Cell Lysis And Disruption Market | Acumen Research and Consulting

Cell Lysis and Disruption Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 – 2030

Published :

Report ID:

Pages :

Format :

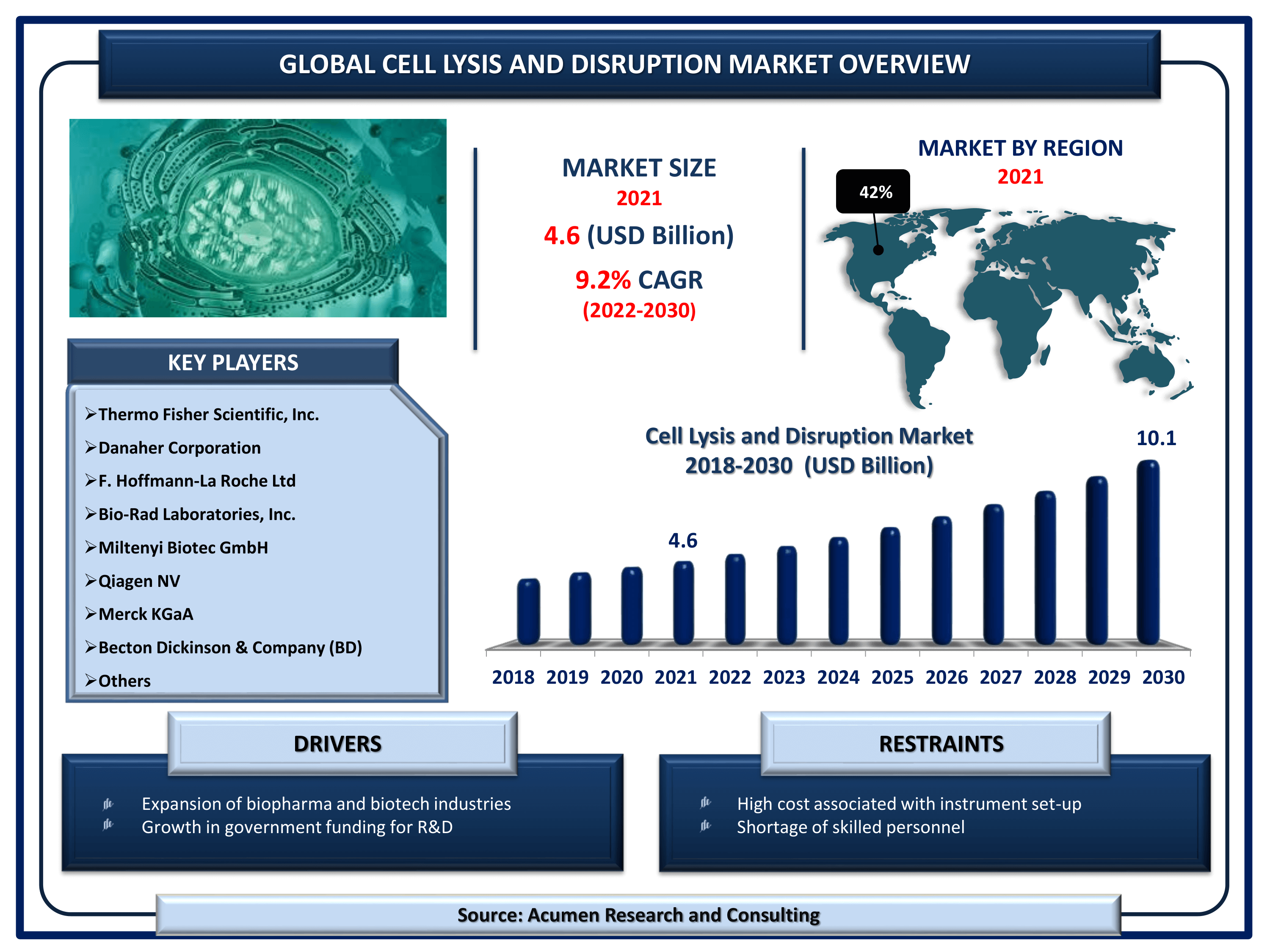

The Global Cell Lysis and Disruption Market Size accounted for USD 4.6 Billion in 2021 and is projected to achieve a market size of USD 10.1 Billion by 2030 rising at a CAGR of 9.2% from 2022 to 2030. The rising application in novel gene expression protocols is the leading aspect that is fueling the cell lysis and disruption market share. Additionally, increasing government funding for research is a popular cell lysis and disruption market trend that is fueling the industry demand from 2022 to 2030.

Cell Lysis and Disruption Market Report Statistics

- Global cell lysis and disruption market revenue is estimated to reach USD 10.1 Billion by 2030 with a CAGR of 9.2% from 2022 to 2030

- North America cell lysis and disruption market share accounted for over 42% shares in 2021

- Based on technique, reagent-based accounted for over 65% of the overall market share in 2021

- On the basis of cell type, mammalian cells generated revenue over USD 2 billion in 2021

- Asia-Pacific cell lysis and disruption market growth will achieve fastest CAGR from 2022 to 2030

- Growing innovation in biopharma and pharma companies fuels the global cell lysis and disruption market value

Cell lysis is one of the important steps in biological studies for removing biological substances and using them to achieve their corresponding study objectives in multiple downstream applications. In many sectors, from pharmaceuticals to food, cosmetics, and biotechnology, cell lysis is used. It is performed to break cells open to bypass shear forces that can denature or degrade cell proteins and DNA. Several methods of effective cell disorders are used to accomplish mechanical homogenization, ultrasound, or chemical disorder with various cell lysis reagents.

Global Cell Lysis and Disruption Market Dynamics

Market Drivers

- Expansion of biopharmaceutical and biotechnology industries

- Growth in government funding for research and development

- Rising application in novel gene expression protocols

- Increasing prevalence of chronic diseases

Market Restraints

- High cost associated with instrument set-up

- Shortage of skilled personnel

Market Opportunities

- Advancements in instruments, homogenizers, and chemical lysis methods

- Growing emphasis on personalized medicine

Cell Lysis and Disruption Market Report Coverage

| Market | Cell Lysis and Disruption Market |

| Cell Lysis and Disruption Market Size 2021 | USD 4.6 Billion |

| Cell Lysis and Disruption Market Forecast 2030 | USD 10.1 Billion |

| Cell Lysis and Disruption Market CAGR During 2022 - 2030 | 9.2% |

| Cell Lysis and Disruption Market Analysis Period | 2018 - 2030 |

| Cell Lysis and Disruption Market Base Year | 2021 |

| Cell Lysis and Disruption Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Technique, By Product, By Cell Type, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Inc., Miltenyi Biotec GmbH, Qiagen NV, Merck KGaA, Becton Dickinson & Company (BD), Microfluidics International Corporation, Claremont BioSolutions, LLC, BioVision, Inc., Parr Instrument Company, Covaris, Inc., and Qsonica LLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Cell Lysis and Disruption Market Dynamics

Engineering advances in cellular organel release processes have paved the way for the increased implementation of cell disruption techniques. Because biopharmaceuticals are collected and purified by cells, increased demand would result in subsequent market growth. Moreover, progress is anticipated to boost progressively in this area in the field of proteomics, metabolomics, and personalized medicine. However, the high price of equipment combined with the lack of qualified experts will in some way limit the generation of income. Increased investments in R&D linked to biotechnology, both by different governments and private organizations, and the market should be considerably further driven by scholars. Furthermore, the increase in the incidence of different illnesses and demand for new treatments is anticipated to stimulate market growth.

Expansion into the biopharmaceutical sector will provide fresh market growth opportunities because cell lysis and disturbance are part of the recovery and purification of biopharmaceuticals. In the course of the bioprocess, it will also be expected that the adoption of biotech processes in the pharmaceutical, agricultural and bio-service sectors will drive the market progress. The increase in demand for effective tumor dissociation machinery has resulted in the growth of new microfluidics products. Ineffective dissociation of tumor tissue in single cells, microfluidic devices are helpful and thereby improve cellular recoach in terms of amount and purity.

High maintenance and costly devices, which could hamper the market growth in developing areas, are connected with cell-based studies. Cell-based research should be correctly sustained because, in any event, contamination could hinder the general test or study. High maintenance and heavy costs of equipment, such as ultrasound and homogenization, could therefore be used as restrictive variables for the development of the industry in cell lysis. Problems in the mechanical method to apply at the microscale stage and regulatory compliance are other factors restricting this market's development.

Cell Lysis and Disruption Market Segmentation

The worldwide cell lysis and disruption market is split based on technique, product, cell type, application, end-use, and geography.

Cell Lysis and Disruption Market By Technique

- Reagent-Based

- Detergent

- Enzymatic

- Physical Disruption

- Mechanical Homogenization

- Temperature Treatments

- Pressure Homogenization

- Ultrasonic Homogenization

According to the cell lysis and disruption industry analysis, the reagent-based sub-segment dominated with 45% of the share in 2021 and is expected to continue its dominance in the coming years from 2022 to 2030. In this market, the main players for extraction of intracellular content traditionally embraced physical disturbance techniques. However, these techniques have now been adopted comparatively less because of the costly and cumbersome equipment necessity. Due to the presence of variability in the device, it is difficult to repeat physical disruptive methods, thereby reducing its penetration into the market. Reagent-based methods, by contrast, don't ruin final products' biological activities, are gentle, and are ideal for laboratory samples.

Cell Lysis and Disruption Market By Product

- Instruments

- Sonicator

- High Pressure Homogenizers

- Microfluidizer

- French Press

- Bead Mill

- Other Instruments

- Reagents & Consumables

- Enzymes

- Ionic Detergent

- Detergent Solutions

- Zwitterionic Detergent

- Nonionic Detergent

- Kits & Reagents

As per the cell lysis and disruption market forecast, the reagents and consumables represented the biggest proportion of revenues. In addition, the enzymes witnessed a strong growth in the cell lysis & disruption industry and are expected to develop more quickly in the coming years. Application for the selective discharge of product and regulated lysis, which are biological specific to the method, are factors that attribute the estimated share. Because of the specificity of the enzyme, bacterial, plant, yeast and mammalian samples have different kits and enzymes. These enzymes can be sold in a number of shapes.

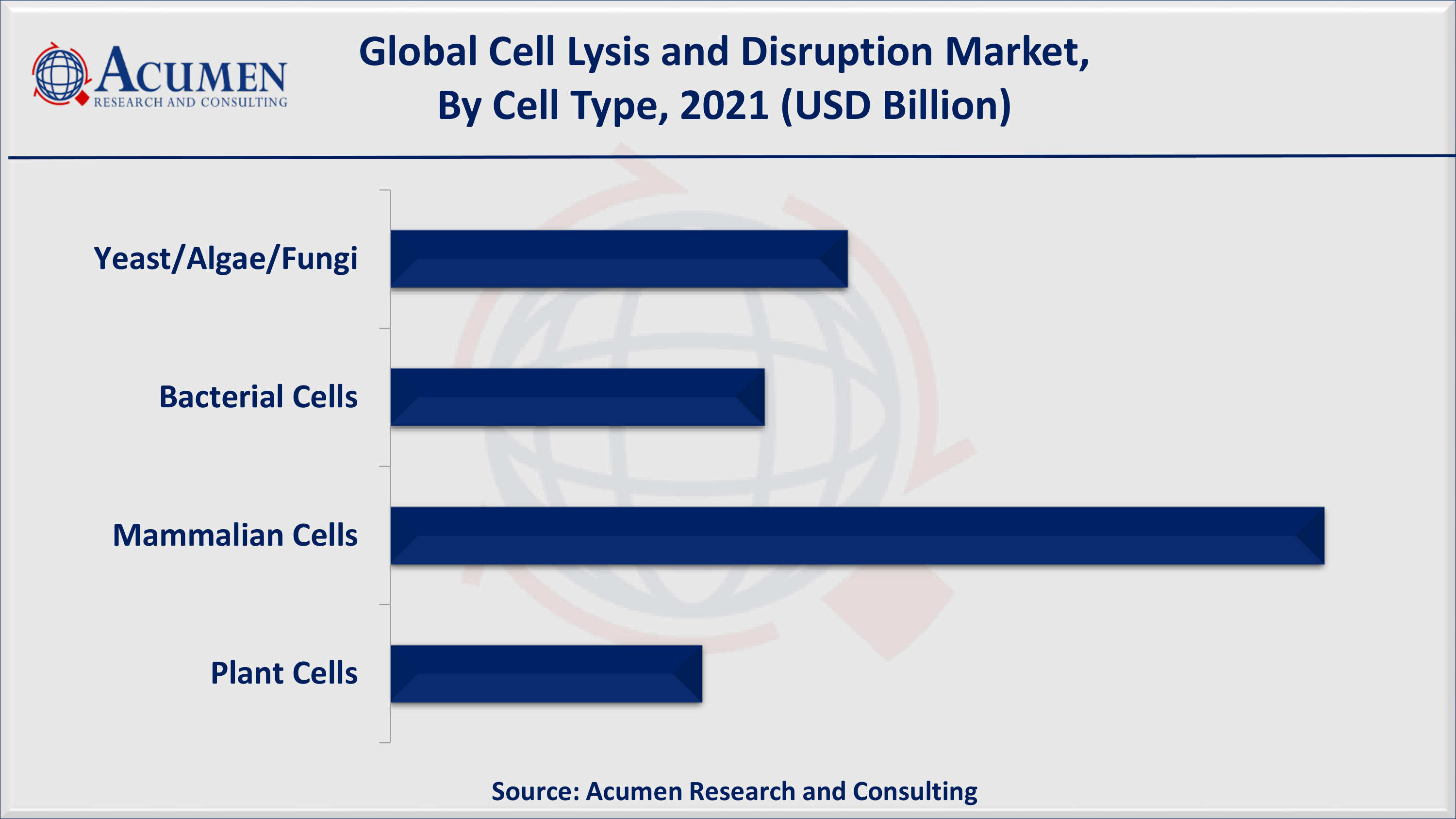

Cell Lysis and Disruption Market By Cell Type

- Yeast/Algae/Fungi

- Bacterial Cells

- Mammalian Cells

- Plant Cells

The most important part in 2021 was the mammalian cell segment which is anticipated to stay dominant in the prediction era. Mammalian cultivation systems are widely used when virals, therapeutic proteins, and other recombinant products are bio-produced. Further, 3D mammalian culture systems are expected to be used for stem cell research and cancer research to increase the development of the sector. Because the efficiency of reagents varies according to the type of cell, major companies have specifically produced reagents for mammalian cells. Merck Millipore offers, for example, a variety of mammalian lysis reagents used for mammalian phosphorylated, cytosolic, and nuclear protein preparations. Some products are the extraction of CytoBuster protein reagent, the extraction kit for NucBuster protein, the phosphoSafe, and the kits for ProteoExtract.

Cell Lysis and Disruption Market By Application

- Downstream Processing

- Protein Isolation

- Nucleic Acid Isolation

- Cell Organelle Isolation

These techniques are widely used to isolate protein and process biopharmaceuticals downstream. Protein isolation includes proteomics, western blotting, and immunoprecipitation as key fields of implementation. The demand is anticipated to fuel the development of the segment for effective and quick lysis methods, which may extract proteins with minimal disintegration or oxidation. Another challenge that has to be resolved by pronouncing studies in this section is the viscosity that results from cell debris and genomic contamination. Advanced bioprocessing reagents and machinery are expected to be developed to facilitate market growth and complement established disturbance processes.

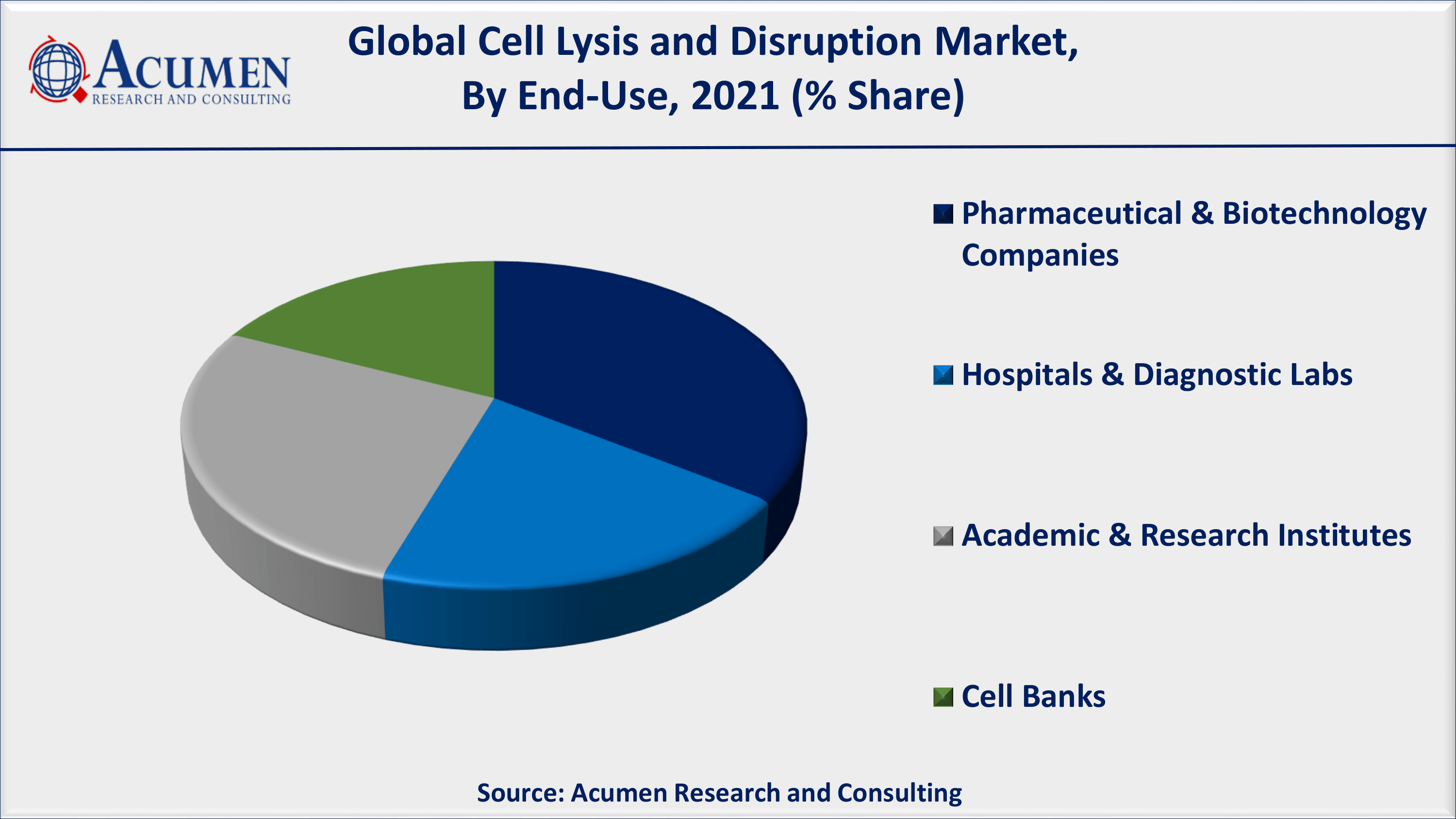

Cell Lysis and Disruption Market By End-Use

- Hospitals & Diagnostic Labs

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Cell Banks

The most important market share of academic and research institutions were in 2021. This is because there is a wide range of biotechnology institutes that examine molecular biology and methods for bioprocesses, using protocols for cell lysis. The protocols for the testing and study of the tumorigenicity resulted in significant demand in banking biospecimen for cell disruption techniques. Clinical drug development study is anticipated to drive growth in the coming years.

Cell Lysis and Disruption Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Latin America

- Mexico

- Brazil

- Rest of Latin America

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

The Middle East & Africa (MEA)

- Gulf Cooperation Council (GCC)

- South Africa

- Rest of the Middle East & Africa

Cell Lysis and Disruption Market Regional Analysis

Geographically, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. The biggest share of income in 2021 was represented in North America. Different public initiatives in the U.S. and Canada that promote research into molecular biology, precision medicine, and cancer will boost cell lysis and the development of the market for disturbance in this region. Both high private and public spending on target therapies and novel discoveries of drugs are expected to boost demand for the therapy of multiple complex and rare diseases. However, Asia Pacific will be the fastest-increasing country in the forecast period, given that important firms in emerging markets are increasingly interested in making greater earnings.

Cell Lysis and Disruption Market Players

Some of the cell lysis and disruption companies are Thermo Fisher Scientific, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Inc., Miltenyi Biotec GmbH, Qiagen NV, Merck KGaA, Becton Dickinson & Company (BD), Microfluidics International Corporation, Claremont BioSolutions, LLC, BioVision, Inc., Parr Instrument Company, Covaris, Inc., and Qsonica LLC. Competitive market dynamics arise through strategic initiatives, which include fusion and acquisitions, partnerships, and joint ventures. These businesses concentrated on new acquisitions/collaborations for product growth in order to strengthen their market position.

These companies offer a broad variety of products and have a large worldwide distribution system. Small players, particularly in Asian emerging markets, also enter the market. However, the market penetration of fresh entrants will be reduced by a strict legislative structure and high-quality standards set by market leaders.

Frequently Asked Questions

What is the size of global cell lysis and disruption market in 2021?

The market size of cell lysis and disruption market in 2021 was accounted to be USD 4.6 Billion.

What is the CAGR of global cell lysis and disruption market during forecast period of 2022 to 2030?

The projected CAGR of cell lysis and disruption market during the analysis period of 2022 to 2030 is 9.2%.

Which are the key players operating in the market?

The prominent players of the global cell lysis and disruption market are Thermo Fisher Scientific, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Inc., Miltenyi Biotec GmbH, Qiagen NV, Merck KGaA, Becton Dickinson & Company (BD), Microfluidics International Corporation, Claremont BioSolutions, LLC, BioVision, Inc., Parr Instrument Company, Covaris, Inc., and Qsonica LLC.

Which region held the dominating position in the global cell lysis and disruption market?

North America held the dominating cell lysis and disruption during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for cell lysis and disruption during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global cell lysis and disruption market?

Expansion of biopharmaceutical and biotechnology industries, growth in government funding for research and development, and rising application in novel gene expression protocols drives the growth of global cell lysis and disruption market.

Which technique held the maximum share in 2021?

Based on technique, reagent-based segment is expected to hold the maximum share cell lysis and disruption market.