Cell Culture Protein Surface Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Cell Culture Protein Surface Coating Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

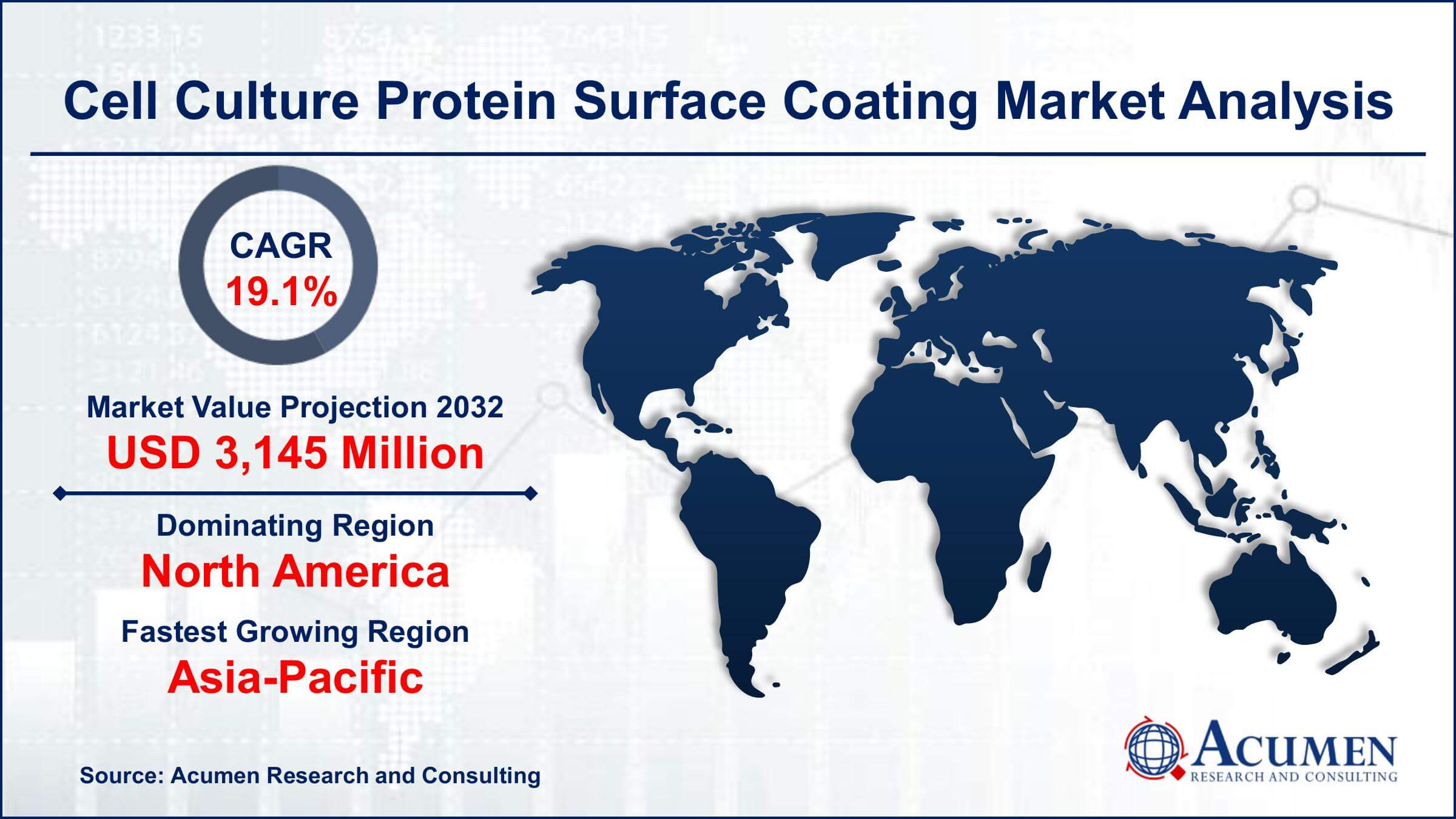

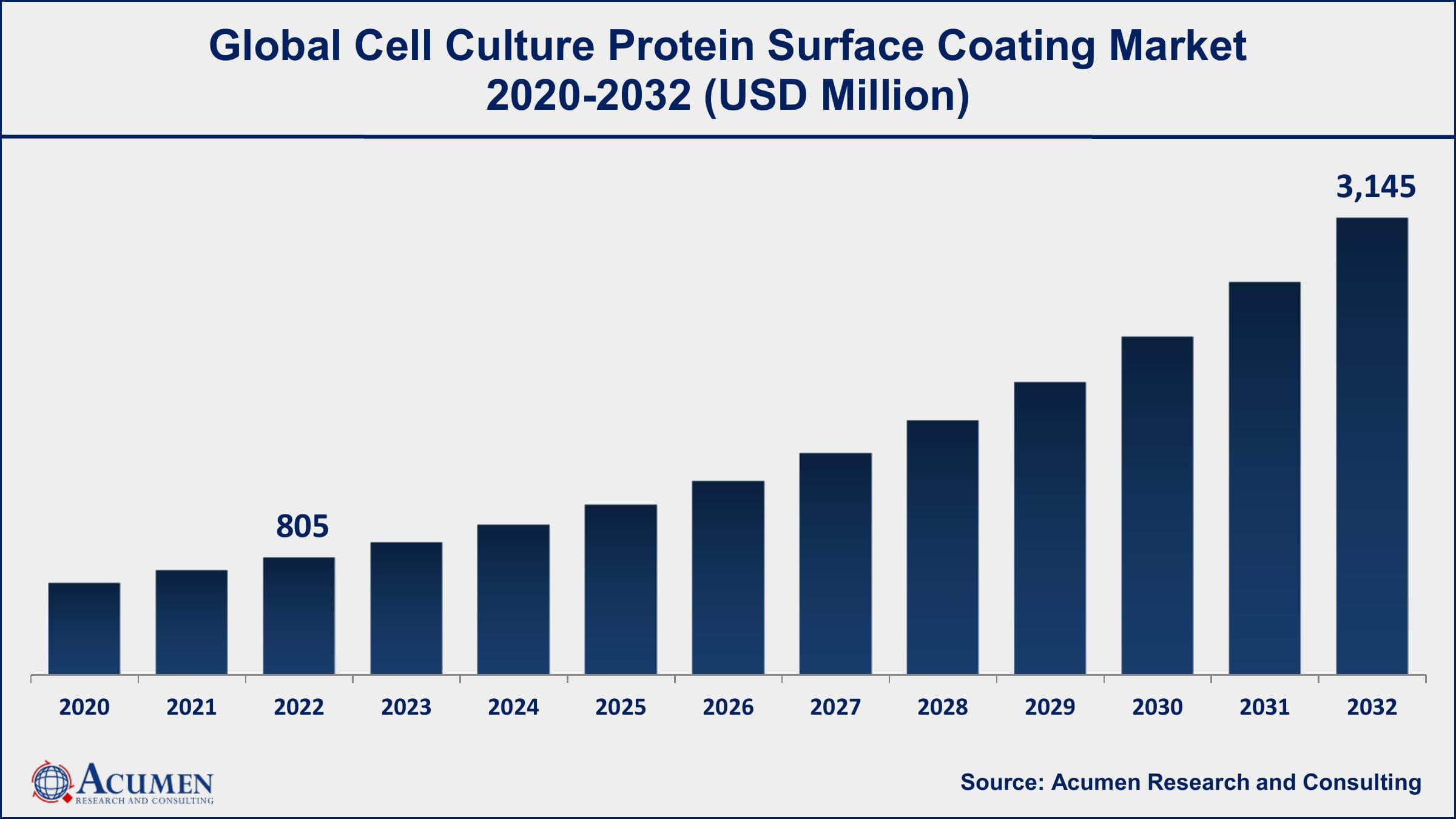

The Global Cell Culture Protein Surface Coating Market Size accounted for USD 805 Million in 2022 and is projected to achieve a market size of USD 3,145 Million by 2032 growing at a CAGR of 14.8% from 2023 to 2032.

Cell Culture Protein Surface Coating Market Highlights

- Global cell culture protein surface coating market revenue is expected to increase by USD 3,145 Million by 2032, with a 14.8% CAGR from 2023 to 2032

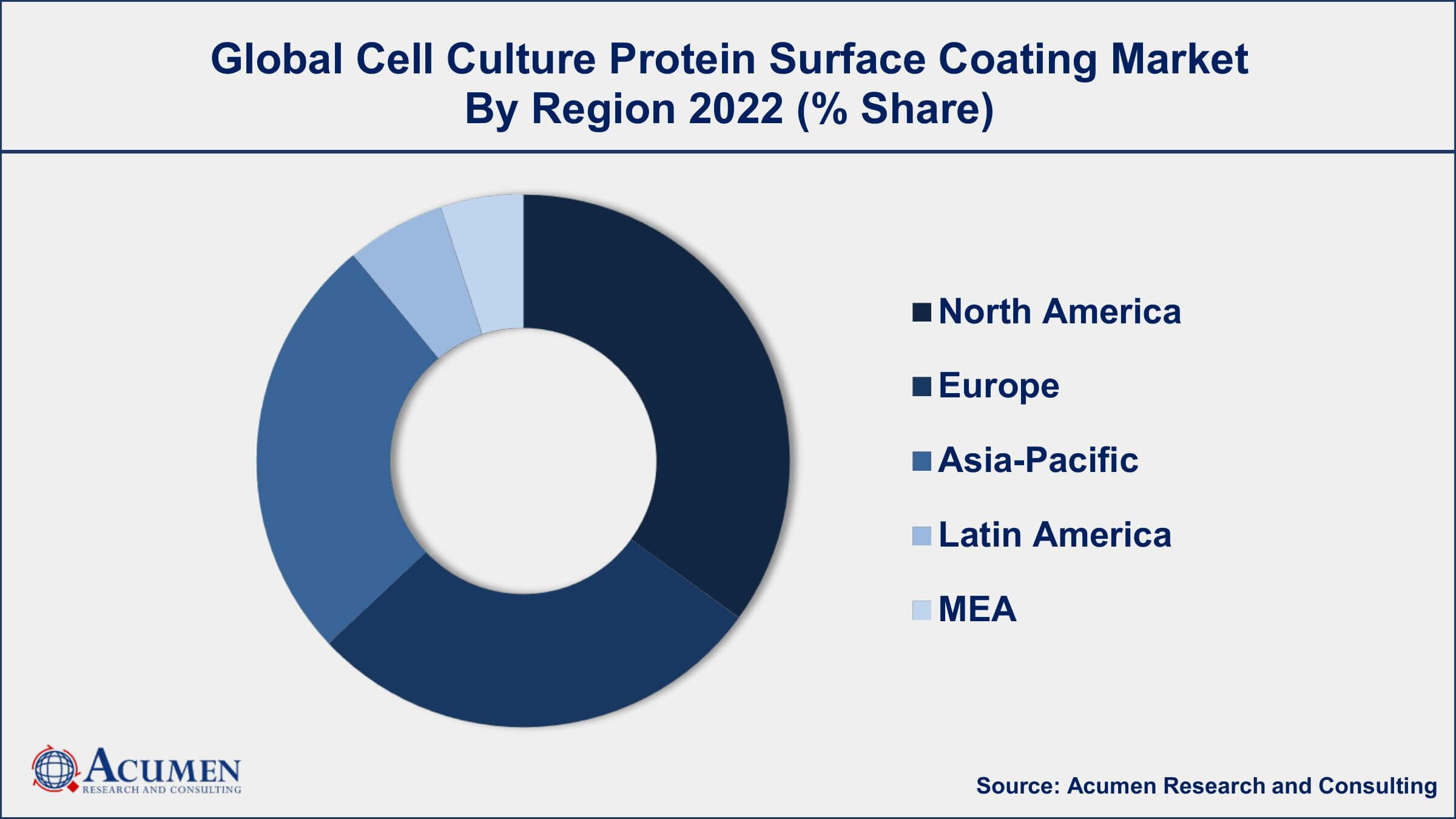

- North America region led with more than 37% of cell culture protein surface coating market share in 2022

- Asia-Pacific cell culture protein surface coating market growth will record a CAGR of around 20% from 2023 to 2032

- By coating types, the self-coating segment has recorded more than 61% of the revenue share in 2022.

- By protein sources, the animal-derived material segment accounted more than 39% of the revenue share in 2022

- Increasing demand for cell-based therapies and biologics, drives the cell culture protein surface coating market value

Cell culture protein surface coatings refer to the application of extracellular matrix (ECM) components, such as fibronectin, laminin, and collagen, onto the surface of cell culture vessels. These coatings mimic the natural environment of cells in vivo, promoting cell attachment, proliferation, and differentiation. The use of protein surface coatings in cell culture has become increasingly popular in the biotechnology and pharmaceutical industries, as they can improve the reproducibility and consistency of cell-based assays and drug discovery.

In recent years, the global cell culture protein surface coatings market has experienced significant growth due to the increasing demand for cell-based therapies and biologics, as well as the rising number of research activities in the fields of regenerative medicine, drug discovery, and tissue engineering. The market growth can also be attributed to the technological advancements in the development of novel protein surface coatings that offer enhanced cell adhesion and proliferation, as well as improved biocompatibility and reproducibility. Additionally, the increasing adoption of 3D cell culture techniques and the growing focus on personalized medicine and precision medicine are expected to create lucrative opportunities for the players operating in the cell culture protein surface coatings market in the coming years.

Global Cell Culture Protein Surface Coating Market Trends

Market Drivers

- Increasing demand for cell-based therapies and biologics

- Growing number of research activities in regenerative medicine, drug discovery, and tissue engineering

- Rising adoption of 3D cell culture techniques

- Focus on personalized medicine and precision medicine

Market Restraints

- High cost of protein surface coatings

- Lack of skilled professionals

Market Opportunities

- Development of synthetic and recombinant protein surface coatings

- Growing demand for stem cell research and cell-based assays

Cell Culture Protein Surface Coating Market Report Coverage

| Market | Cell Culture Protein Surface Coating Market |

| Cell Culture Protein Surface Coating Market Size 2022 | USD 805 Million |

| Cell Culture Protein Surface Coating Market Forecast 2032 | USD 3,145 Million |

| Cell Culture Protein Surface Coating Market CAGR During 2023 - 2032 | 14.8% |

| Cell Culture Protein Surface Coating Market Analysis Period | 2020 - 2032 |

| Cell Culture Protein Surface Coating Market Base Year | 2022 |

| Cell Culture Protein Surface Coating Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Protein Source, By Type of Coating, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Corning Life Sciences, Thermo Fisher Scientific Inc., Merck KGaA, Bio-Techne Corporation, PerkinElmer Inc., Greiner Bio-One International GmbH, Promega Corporation, Sartorius AG, Eppendorf AG, and Lonza Group AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Protein surface coatings play a crucial role in improving the performance and reliability of cell-based assays and drug screening assays. The coatings facilitate the attachment and growth of cells, resulting in increased cell viability, cell density, and cell differentiation, and allowing researchers to obtain more accurate and reproducible results. In tissue engineering and regenerative medicine, protein surface coatings are used to promote cell adhesion and differentiation on scaffolds and other biomaterials. This helps to create tissue constructs that more closely resemble the native tissue, promoting better integration and function after implantation. These coatings mimic the natural environment of cells in vivo, promoting their growth and function in vitro. Protein surface coatings are commonly used in cell-based assays, drug discovery, tissue engineering, and regenerative medicine.

The cell culture protein surface coating market has been growing steadily over the past few years, driven by the increasing demand for cell-based therapies and biologics, as well as the growing number of research activities in regenerative medicine, drug discovery, and tissue engineering. In addition, technological advancements in the development of novel protein surface coatings and the rising adoption of 3D cell culture techniques are expected to further boost market growth in the coming years. In addition, the increasing investments in stem cell research and the growing demand for cell-based assays are expected to create lucrative opportunities for the players operating in the market. However, the high cost of protein surface coatings and the stringent regulatory requirements for their use are some of the key challenges faced by the market players.

Cell Culture Protein Surface Coating Market Segmentation

The global cell culture protein surface coating market segmentation is based on protein source, type of coating, and geography.

Cell Culture Protein Surface Coating Market By Protein Source

- Animal-derived Protein

- Synthetic Protein

- Human-derived Protein

- Plant-derived Protein

According to the cell culture protein surface coating industry analysis, the animal-derived protein segment accounted for the largest market share in 2022. Animal-derived proteins, such as bovine serum albumin (BSA), fibronectin, and laminin, are widely used in cell culture applications due to their ability to promote cell adhesion, proliferation, and differentiation. However, the use of animal-derived proteins in cell culture has been associated with several issues, including ethical concerns, variability in quality, and the risk of contamination with pathogens. In recent years, there has been a growing trend towards the development of synthetic and recombinant protein surface coatings that can mimic the natural ECM environment without the use of animal-derived components. This trend is expected to create a significant impact on the growth of the animal-derived protein segment.

Cell Culture Protein Surface Coating market By Type of Coating

- Self-coating

- Pre-coating

- Petri Dish

- Microwell Plates

- Slides

- Flask

- Others

In terms of type of coatings, the pre-coating segment is expected to witness significant growth in the coming years. This approach offers several advantages, including increased reproducibility, consistency, and ease of use, making it a popular choice among researchers and biopharmaceutical companies. The pre-coating segment is expected to witness significant growth in the coming years, driven by the increasing demand for pre-coated cell culture vessels in various applications, including drug discovery, tissue engineering, and regenerative medicine. Pre-coated cell culture vessels offer several benefits, such as improved cell attachment and proliferation, reduced risk of contamination, and enhanced cell functionality, which are expected to drive their adoption in the coming years.

Cell Culture Protein Surface Coating Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cell Culture Protein Surface Coating Market Regional Analysis

North America dominates the cell culture protein surface coating market due to the presence of a large number of biotechnology and pharmaceutical companies in the region. One of the primary reasons is the presence of a large number of biotechnology and pharmaceutical companies in the region. These companies are actively engaged in research and development activities, which require cell culture techniques and protein surface coatings for various applications. This creates a high demand for protein surface coatings, thereby driving the growth of the market. Another factor contributing to the dominance of North America is the increasing investments in R&D activities. The region has a well-established infrastructure for research and development, with significant funding from the government and private sector. This has led to the development of advanced protein surface coatings and cell culture techniques, further driving the market growth. Furthermore, the presence of key market players in the region has also contributed to the dominance of North America in the cell culture protein surface coating market.

Cell Culture Protein Surface Coating Market Player

Some of the top cell culture protein surface coating market companies offered in the professional report include Corning Life Sciences, Thermo Fisher Scientific Inc., Merck KGaA, Bio-Techne Corporation, PerkinElmer Inc., Greiner Bio-One International GmbH, Promega Corporation, Sartorius AG, Eppendorf AG, and Lonza Group AG.

Frequently Asked Questions

What was the market size of the global cell culture protein surface coating in 2022?

The market size of cell culture protein surface coating was USD 805 Million in 2022.

What is the CAGR of the global cell culture protein surface coating market from 2023 to 2032?

The CAGR of cell culture protein surface coating is 14.8% during the analysis period of 2023 to 2032.

Which are the key players in the cell culture protein surface coating market?

The key players operating in the global market are including Corning Life Sciences, Thermo Fisher Scientific Inc., Merck KGaA, Bio-Techne Corporation, PerkinElmer Inc., Greiner Bio-One International GmbH, Promega Corporation, Sartorius AG, Eppendorf AG, and Lonza Group AG.

Which region dominated the global cell culture protein surface coating market share?

North America held the dominating position in cell culture protein surface coating industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cell culture protein surface coating during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cell culture protein surface coating industry?

The current trends and dynamics in the cell culture protein surface coating industry include increasing demand for cell-based therapies and biologics, and growing number of research activities in regenerative medicine, drug discovery, and tissue engineering.

Which type of coating held the maximum share in 2022?

The self-coating type held the maximum share of the cell culture protein surface coating industry.