Cell Culture Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Cell Culture Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

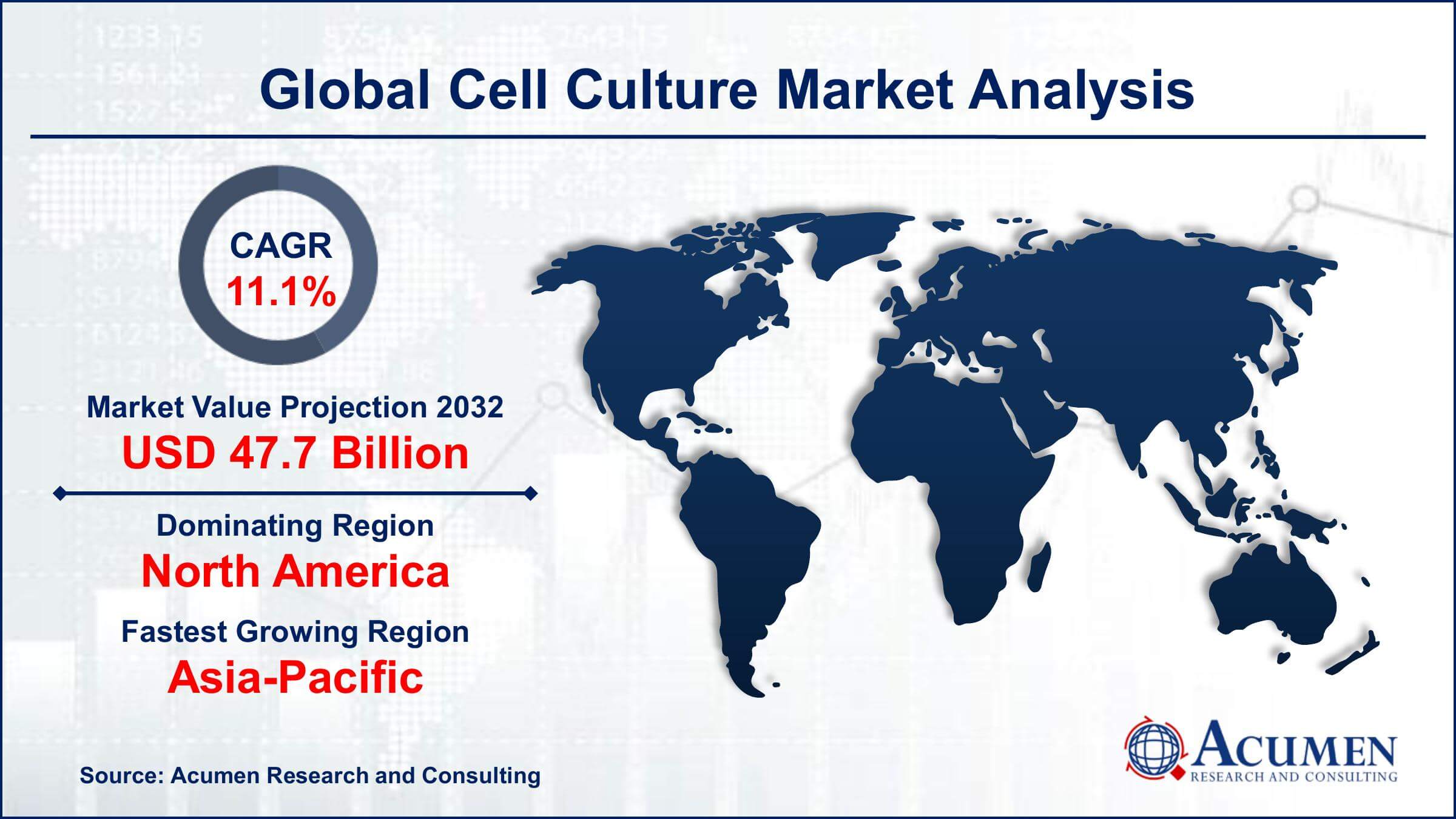

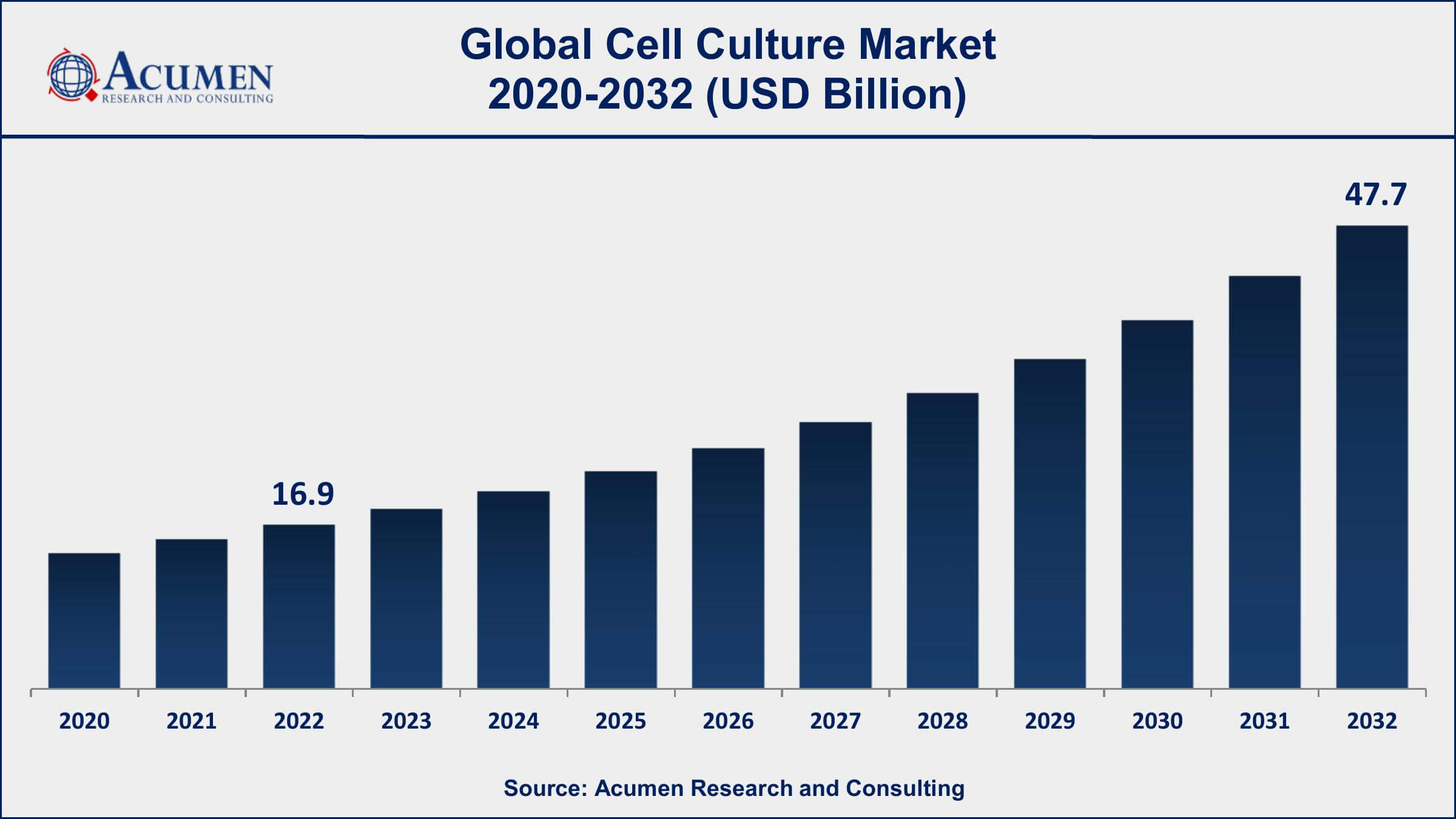

The Global Cell Culture Market Size accounted for USD 16.9 Billion in 2022 and is projected to achieve a market size of USD 47.7 Billion by 2032 growing at a CAGR of 11.1% from 2023 to 2032.

Cell Culture Market Highlights

- Global Cell Culture Market revenue is expected to increase by USD 47.7 Billion by 2032, with an 11.1% CAGR from 2023 to 2032

- North America region led with more than 36% of Cell Culture Market share in 2022

- Asia-Pacific Cell Culture Market growth will record a CAGR of around 11.8% from 2023 to 2032

- By product, the consumables are the largest segment of the market, accounting for over 58% of the global market share

- By application, the biopharmaceutical production is one of the largest and fastest-growing segments of the cell culture industry

- Rise in the demand for vaccines, biopharmaceuticals, and artificial organs, drives the Cell Culture Market value

Cell culture is a fundamental technique in the field of biology and biotechnology that involves the growth and maintenance of cells outside their natural environment, typically in a controlled laboratory setting. This process allows researchers to study and manipulate cells for various purposes, including basic research, drug development, vaccine production, and the creation of cell-based therapies. Cell cultures are often used to investigate cell behavior, function, and response to external stimuli, making them essential tools for advancing our understanding of cellular biology and for developing innovative medical and pharmaceutical solutions.

The cell culture market has experienced significant growth over the past few decades, primarily driven by advancements in biotechnology, increased demand for biopharmaceuticals, and a growing need for personalized medicine. As the pharmaceutical and biotechnology industries continue to expand, so does the demand for cell culture products and services. The market encompasses a wide range of products, including cell culture media, reagents, bioreactors, and cultureware, as well as contract manufacturing and services. Additionally, the emergence of regenerative medicine and the development of cell-based therapies have further propelled the growth of the cell culture market. With ongoing research into cell therapies, tissue engineering, and organ transplantation, the cell culture market is expected to continue its robust expansion in the coming years.

Global Cell Culture Market Trends

Market Drivers

- Increasing demand for biopharmaceuticals

- Advancements in cell culture technologies

- Growing focus on personalized medicine and regenerative therapies

- Rise in stem cell research

- Expansion of the biotechnology and pharmaceutical sectors

Market Restraints

- High cost and complexity of cell culture processes

- Ethical concerns related to cell sourcing

- Regulatory challenges and compliance issues

Market Opportunities

- Adoption of single-use bioreactors

- Expansion of 3D cell culture techniques

- Outsourcing of cell culture services

Cell Culture Market Report Coverage

| Market | Cell Culture Market |

| Cell Culture Market Size 2022 | USD 16.9 Billion |

| Cell Culture Market Forecast 2032 | USD 47.7 Billion |

| Cell Culture Market CAGR During 2023 - 2032 | 11.1% |

| Cell Culture Market Analysis Period | 2020 - 2032 |

| Cell Culture Market Base Year |

2022 |

| Cell Culture Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Thermo Fisher Scientific, Merck KGaA (Sigma-Aldrich), Lonza Group, Corning Incorporated, Sartorius AG, GE Healthcare Life Sciences, BD Biosciences, Eppendorf AG, Promega Corporation, PerkinElmer, Inc., CellGenix GmbH, and HiMedia Laboratories Pvt. Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cell culture is a laboratory technique used in the field of biology and biotechnology to grow and maintain cells outside their natural environment, typically in a controlled setting such as a petri dish or a bioreactor. This technique involves the isolation and cultivation of cells from various sources, including tissues, organs, or cell lines, in a specially designed nutrient-rich medium. Cells are provided with the necessary nutrients, growth factors, and environmental conditions to encourage their proliferation and maintain their viability. Cell culture is a vital tool in scientific research, drug development, vaccine production, and biotechnology applications, as it allows scientists to study cell behavior, perform experiments, and produce specific cell types for various purposes.

The applications of cell culture are diverse and play a crucial role in advancing various fields of science and medicine. In biomedical research, cell culture is used to study cellular processes, gene expression, and signaling pathways. It is also instrumental in drug discovery and development, enabling researchers to test the efficacy and safety of potential drug candidates on cultured cells before advancing to clinical trials. In the field of biotechnology, cell culture is essential for the production of biopharmaceuticals, including monoclonal antibodies, vaccines, and recombinant proteins, which are used in the treatment of various diseases. Additionally, cell culture has applications in regenerative medicine, tissue engineering, and stem cell research, offering the potential to develop therapies for a wide range of medical conditions by growing and manipulating specific cell types in vitro for transplantation or disease modeling.

The cell culture market has been experiencing robust growth in recent years and is poised to continue expanding in the coming years. One of the key drivers of this growth is the increasing demand for biopharmaceuticals, including monoclonal antibodies, vaccines, and cell-based therapies. As the pharmaceutical industry shifts its focus from traditional small molecule drugs to biologics, the need for large-scale cell culture processes for the production of these biopharmaceuticals has surged. This has led to significant investments in cell culture technologies and infrastructure by pharmaceutical and biotechnology companies. Advancements in cell culture technologies have also played a pivotal role in market growth. Innovations in media formulations, bioreactor designs, and automation have improved the efficiency, scalability, and cost-effectiveness of cell culture processes. Additionally, the emergence of 3D cell culture systems and the development of animal-free culture media have expanded the applications of cell culture in drug discovery, tissue engineering, and regenerative medicine.

Cell Culture Market Segmentation

The global cell cultures market segmentation is based on product, application, and geography.

Cell Culture Market By Product

- Consumables

- Reagents

- Albumin

- Others

- Sera

- Fetal Bovine Serum

- Other

- Media

- Serum-free Media

- BHK Medium

- CHO Media

- Vero Medium

- HEK 293 Media

- Other Serum-free Media

- Chemically Defined Media

- Classical Media

- Specialty Media

- Stem Cell Culture Media

- Other Cell Culture Media

- Serum-free Media

- Reagents

- Instruments

- Centrifuges

- Culture Systems

- Biosafety Equipment

- Incubators

- Cryostorage Equipment

- Pipetting Instruments

In terms of products, the consumables segment accounted for the largest market share in 2022. Consumables in cell culture refer to the various supplies and materials used in cell culture processes, including culture media, reagents, sera, and disposable labware like flasks, plates, and tubes. This segment is vital to the entire cell culture industry as it encompasses the essential components required for cell cultivation and maintenance. One of the primary drivers of growth in the consumables segment is the increasing demand for biopharmaceuticals. As the biopharmaceutical industry continues to expand, there is a parallel surge in the requirement for cell culture consumables to support the production of biologics such as monoclonal antibodies and vaccines. This demand has led to a constant need for high-quality culture media, growth factors, and sterile labware. Additionally, the shift towards more advanced cell culture techniques, such as 3D cell culture and perfusion bioreactors, requires specialized consumables, driving further market growth.

Cell Culture Market By Application

- Biopharmaceutical Production

- Vaccines Production

- Monoclonal Antibodies

- Other Therapeutic Proteins

- Diagnostics

- Drug Development

- Cell & Gene Therapy

- Toxicity Testing

- Tissue Culture & Engineering

- Others

According to the cell culture market forecast, the biopharmaceutical production segment is expected to witness significant growth in the coming years. Biopharmaceuticals, which include monoclonal antibodies, vaccines, gene therapies, and cell-based therapies, have become a cornerstone of modern medicine. As a result, the demand for large-scale biopharmaceutical production has skyrocketed, and cell culture plays a pivotal role in meeting this demand. One of the primary drivers of growth in the biopharmaceutical production segment is the increasing prevalence of complex and targeted therapies. Monoclonal antibodies, for instance, have seen remarkable success in treating a variety of diseases, including cancer and autoimmune disorders. The production of these biologics requires advanced cell culture techniques to cultivate the cells that produce the therapeutic proteins. Similarly, the development of cell-based therapies, such as CAR-T cell therapies, relies heavily on cell culture for expanding and modifying patient cells. As research and development efforts in biopharmaceuticals continue to expand, so does the demand for efficient and scalable cell culture processes.

Cell Culture Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cell Culture Market Regional Analysis

North America has emerged as a dominating region in the cell culture market for several compelling reasons. One key factor is the robust presence of leading pharmaceutical and biotechnology companies in the United States and Canada. These companies are major contributors to the global cell culture market, driving significant demand for cell culture products and services. The region is home to a multitude of research and development facilities, production sites, and academic institutions conducting cutting-edge research in the field of cell culture. This concentration of industry and research institutions fosters a highly competitive and innovative environment, propelling North America to the forefront of the market. Additionally, North America benefits from a strong regulatory framework that facilitates the development and commercialization of biopharmaceutical products produced through cell culture. Regulatory agencies like the U.S. Food and Drug Administration (FDA) and Health Canada have established clear guidelines and standards for the approval of biopharmaceuticals, ensuring product safety and efficacy. This regulatory clarity provides a level of confidence to both domestic and international companies operating in the region, further enhancing North America's appeal as a prominent player in the cell culture market.

Cell Culture Market Player

Some of the top cell culture market companies offered in the professional report include Thermo Fisher Scientific, Merck KGaA (Sigma-Aldrich), Lonza Group, Corning Incorporated, Sartorius AG, GE Healthcare Life Sciences, BD Biosciences, Eppendorf AG, Promega Corporation, PerkinElmer, Inc., CellGenix GmbH, and HiMedia Laboratories Pvt. Ltd.

Frequently Asked Questions

What was the market size of the global cell culture in 2022?

The market size of cell culture was USD 16.9 Billion in 2022.

What is the CAGR of the global cell culture market from 2023 to 2032?

The CAGR of cell culture is 11.1% during the analysis period of 2023 to 2032.

Which are the key players in the cell culture market?

The key players operating in the global market are including Thermo Fisher Scientific, Merck KGaA (Sigma-Aldrich), Lonza Group, Corning Incorporated, Sartorius AG, GE Healthcare Life Sciences, BD Biosciences, Eppendorf AG, Promega Corporation, PerkinElmer, Inc., CellGenix GmbH, and HiMedia Laboratories Pvt. Ltd.

Which region dominated the global cell culture market share?

North America held the dominating position in cell culture industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cell culture during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cell culture industry?

The current trends and dynamics in the cell culture market growth include increasing demand for biopharmaceuticals, advancements in cell culture technologies, and growing focus on personalized medicine and regenerative therapies.

Which product held the maximum share in 2022?

The consumables product held the maximum share of the cell culture industry.