Celiac Disease Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Celiac Disease Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

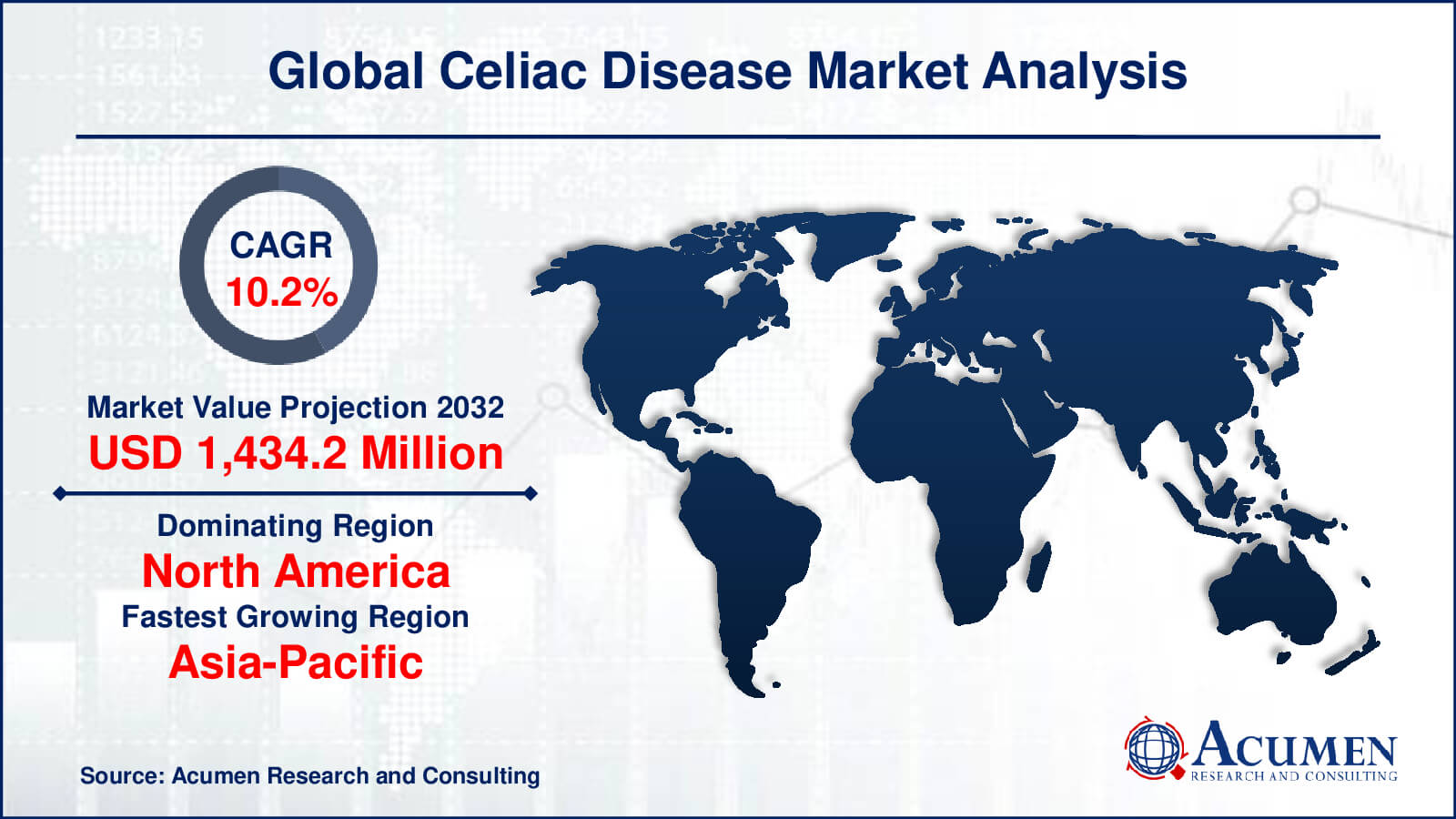

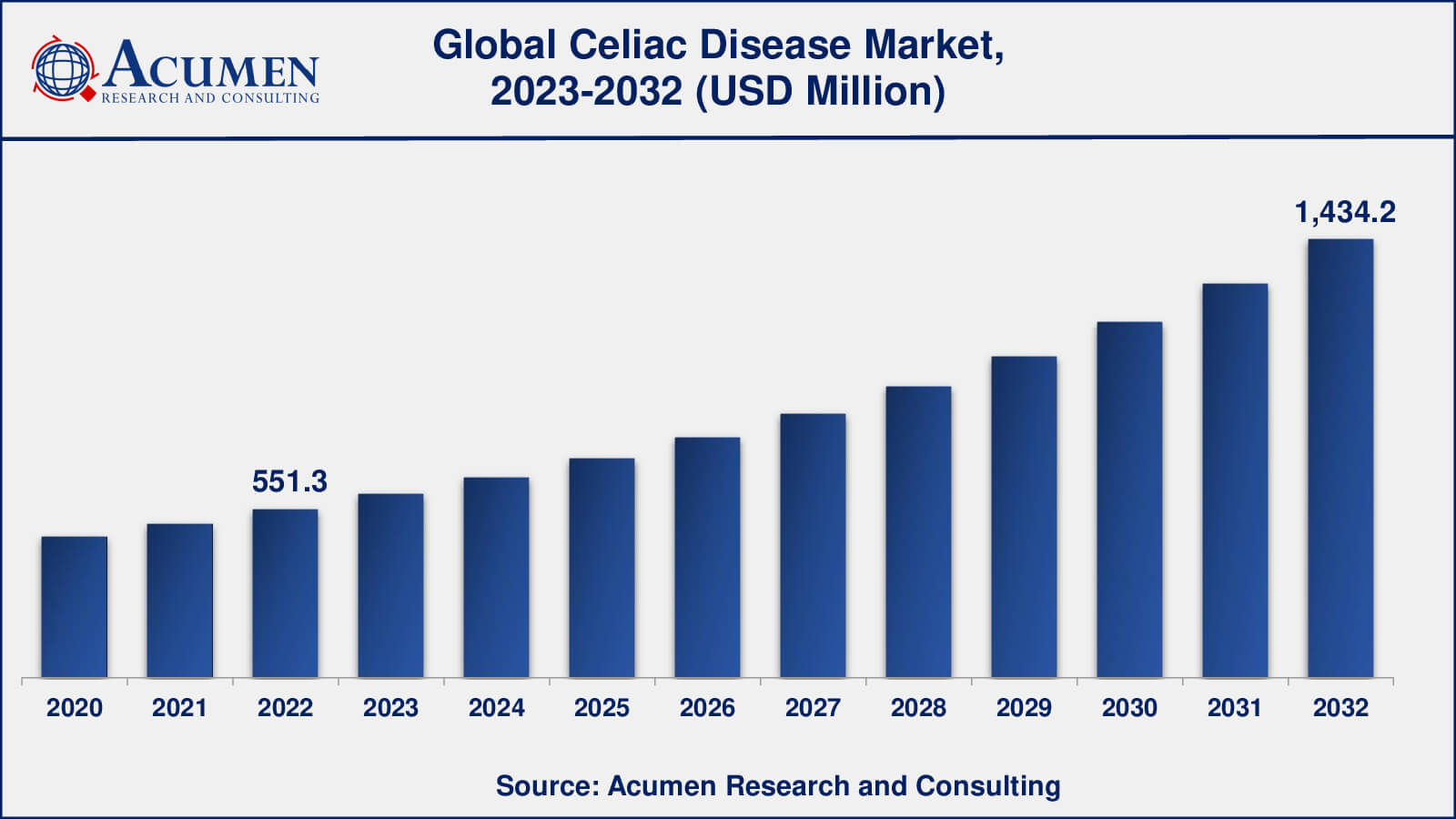

The global Celiac Disease Market size was valued at USD 551.3 Million in 2022 and is projected to reach USD 1,434.2 Million by 2032 mounting at a CAGR of 10.2% from 2023 to 2032.

Celiac Disease Market Highlights

- Global celiac disease market revenue is poised to garner USD 1,434.2 Million by 2032 with a CAGR of 10.2% from 2023 to 2032

- North America celiac disease market value occupied around USD 204 million in 2022

- Asia-Pacific celiac disease market growth will record a CAGR of more than 6% from 2023 to 2032

- Among therapeutic class, the gluten free diet sub-segment generated over US$ 226 million revenue in 2022

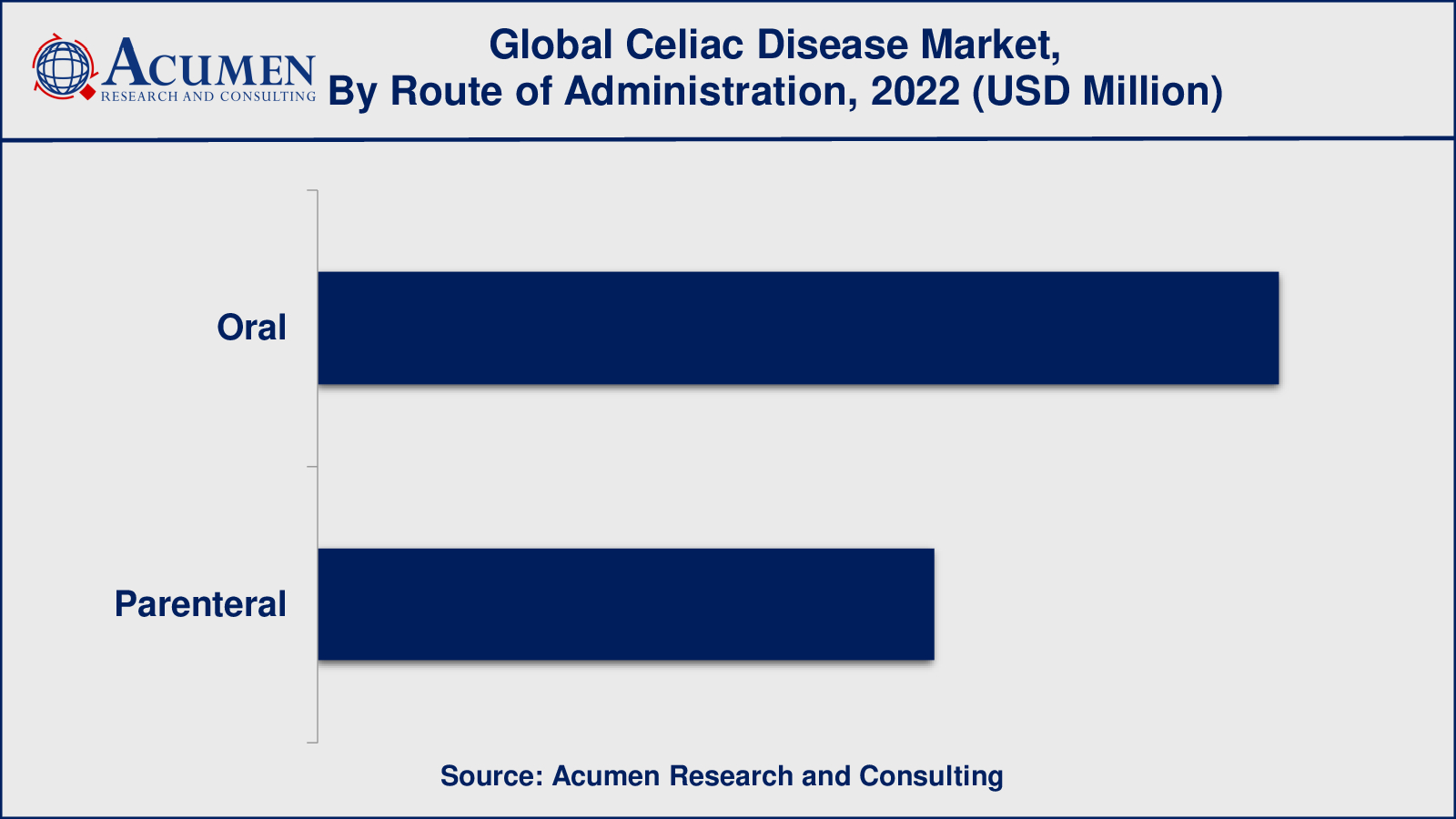

- Based on route of administration, the Oral sub-segment generated around 61% share in 2022

- Focus on patient education and support programs is a popular celiac disease market trend that fuels the industry demand

Celiac disease is an autoimmune illness in which gluten consumption causes an immune response that destroys the small intestinal lining. This damage prevents appropriate nutritional absorption from meals, resulting in a variety of symptoms and possibly long-term health consequences. Celiac disease symptoms include gastrointestinal disorders such as stomach discomfort, diarrhoea, and bloating, as well as non-gastrointestinal symptoms such as lethargy, anaemia, weight loss, and skin rashes. Both children and adults might be affected.

Celiac disease can cause major health complications if left untreated. Chronic inflammation and nutrient malabsorption can lead to nutritional deficiencies, osteoporosis, infertility, neurological problems, and an increased risk of some malignancies. Adherence to a rigorous gluten-free diet is the primary and most effective Route of Administration for celiac disease. This includes avoiding all gluten sources, such as wheat, barley, rye, and their derivatives. A gluten-free diet promotes small intestinal healing and alleviates symptoms. It is crucial to know that even trace levels of gluten might cause a reaction in those with celiac disease.

Individuals with celiac disease may benefit from nutritional counseling in addition to dietary adjustments to address any nutrient deficits. Medication or supplements may be administered in some circumstances to treat particular symptoms or problems. Individuals with celiac disease must collaborate closely with healthcare specialists such as gastroenterologists and qualified dietitians to ensure effective diagnosis, treatment, and follow-up care.

Global Celiac Disease Market Dynamics

Market Drivers

- Increasing awareness and diagnosis of celiac disease

- Growing demand for gluten-free products

- Advancements in diagnostic techniques for celiac disease

- Rising prevalence of celiac disease globally

- Supportive government initiatives and regulations for gluten-free labeling

Market Restraints

- Limited availability and high cost of gluten-free products

- Lack of awareness among healthcare professionals

- Challenges in accurately diagnosing celiac disease

- Social and psychological impact on individuals following a strict gluten-free diet

- Potential for misdiagnosis or underdiagnosis

Market Opportunities

- Development of novel therapies and treatment options

- Expansion of gluten-free food and beverage industry

- Increased research and development for celiac disease management

- Emerging markets with untapped potential for celiac disease management

Celiac Disease Market Report Coverage

| Market | Celiac Disease Market |

| Celiac Disease Market Size 2022 | USD 551.3 Million |

| Celiac Disease Market Forecast 2032 | USD 1,434.2 Million |

| Celiac Disease Market CAGR During 2023 - 2032 | 10.2% |

| Celiac Disease Market Analysis Period | 2020 - 2032 |

| Celiac Disease Market Base Year | 2022 |

| Celiac Disease Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Treatment, By Route of Administration, By End-User, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amgen, Anokion SA, BioLineRx Ltd, ChemoCentryx, Inc, COUR Pharmaceutical, F. Hoffmann-La Roche Ltd, ImmunogenX, LLC, Innovate Biopharmaceuticals, Takeda Pharmaceutical Company Limited, and Teva Pharmaceutical Industries Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Celiac Disease Market Insights

Several variables influence celiac disease market dynamics. Primarily, there has been a considerable rise in celiac disease awareness and diagnosis. Because of a better awareness of the condition and its symptoms, more people are seeking medical treatment and being correctly identified. This has aided the overall expansion of the celiac disease market. Another driving factor is the increasing demand for gluten-free goods. As more people become aware of the negative effects of gluten on celiac disease patients, there has been an increase in demand for gluten-free alternatives in the food and beverage business. This has resulted in the creation of a large range of gluten-free items, including bread, pasta, snacks, and drinks, to meet the demands of celiac disease patients.

Diagnostic advancements have also had a substantial impact on the market dynamics of celiac disease. Diagnostic methods that have been improved, such as serological assays and genetic testing, have increased the accuracy and efficiency of celiac disease detection. These developments have improved early identification and timely intervention, resulting in better illness management. Another aspect propelling the market is the increased frequency of celiac disease worldwide. Several studies have found a rise in the prevalence of celiac disease in both industrialized and developing nations. Because of the growth in prevalence, there is now a bigger patient pool that requires medical treatment, which has raised demand for diagnostic tests, gluten-free food, and other Route of Administration alternatives.

However, there are several constraints affecting the celiac disease industry. Individuals with celiac disease have difficulties due to the scarcity and high cost of gluten-free items. Gluten-free options are frequently more expensive and may be difficult to find, particularly in some locations. This can present financial and logistical difficulties for patients, making it difficult for them to follow a gluten-free diet. Another barrier is a lack of understanding among healthcare providers. Because not all healthcare practitioners have appropriate expertise and awareness of celiac disease, underdiagnosis or misdiagnosis may occur. This highlights the importance of ongoing education and awareness programmes aimed at healthcare workers in order to enhance illness diagnosis and management.

Despite these obstacles, the celiac disease sector offers several prospects. The development of innovative medicines and treatment options for celiac disease, such as possible pharmaceuticals and immunotherapies targeted at lowering the immunological response to gluten, is gaining attention. Furthermore, the growth of the gluten-free food and beverage business provides chances for product development and innovation.

Celiac Disease Market Segmentation

The worldwide market for celiac disease is split based on treatments, route of administration, end-user, distribution channel, and geography.

Celiac Disease Treatments

- Infliximab

- Larazotide Acetate

- Gluten Free Diet

- Others

As per the celiac disease industry analysis, the gluten-free diet is the primary and most prevalent treatment for celiac disease. It is the gold standard and the only treatment that is medically recognised for the illness. A gluten-free diet must be strictly followed in order to reduce symptoms, improve intestinal healing, and prevent long-term consequences associated with celiac disease. While there are continuous attempts to investigate alternative therapies for celiac disease, such as the use of drugs such as Infliximab and Larazotide Acetate, they have not yet been well established or prominent in the market. These drugs are designed to address certain parts of the immunological response caused by gluten consumption.

Infliximab, a TNF inhibitor, has showed promise in several studies for lowering inflammation in the small intestine of people with refractory celiac disease, a rare and severe type of the illness. However, it is only used in select instances and under the supervision of healthcare specialists. Larazotide Acetate is an experimental medication that intends to diminish the immunological response caused by gluten by targeting intestinal permeability. Although clinical trials have been done to assess its efficacy and safety, licensure and broad use have yet to occur.

Celiac Disease Route of Administrations

- Oral

- Parenteral

The most common mode of delivery in celiac disease route of administration is oral. This is mostly due to the fact that the core of celiac disease route of administration is adherence to a rigorous gluten-free diet, which includes avoiding the consumption of gluten-containing foods and drinks. The oral route of administration refers to the consumption of food and oral pharmaceuticals, which includes gluten-free items as well as any prescription medications or supplements.

The gluten-free diet is the foundation of celiac disease care and is critical for symptom control, intestinal healing, and long-term problems avoidance. Individuals with celiac disease should completely adhere to this diet and carefully check food labels to avoid any hidden sources of gluten.

While there are current research efforts to investigate prospective celiac disease treatments, such as Infliximab or Larazotide Acetate, their administration is often parenteral, involving injection or infusion. These drugs, however, are still being studied and have not yet become well established or dominating in the celiac disease market

Celiac Disease End-Users

- Hospitals

- Homecare

- Others

In the celiac disease market, hospitals are the largest end-user. Hospitals are extremely important in the diagnosis, treatment, and management of celiac disease. They serve as primary sites for diagnostic procedures such as serological assays and genetic testing, which help in the confirmation of celiac disease diagnosis. Individuals with celiac disease are cared for in hospitals by gastroenterologists and other healthcare specialists who specialise in digestive diseases. They offer specialist advice on treatment alternatives, such as gluten-free diet implementation, nutritional counselling, and monitoring for any consequences.

Moreover, hospitals frequently have specialist dietetic departments or nutritionists that work closely with celiac disease patients to create personalised gluten-free meal plans and give continuous nutritional care. This partnership assists patients in comprehending the complexities of a gluten-free diet, such as label reading, item identification, and meal preparation.

While hospitals play an important role, it is important to note that homecare also plays an important role in celiac disease management. Many people with celiac disease need ongoing care and assistance in their homes. This may entail regular visits from healthcare specialists, such as dietitians, who give food advice, assess symptom development, and provide nutritional counselling.

Celiac Disease Distribution Channels

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

According to the celiac disease market forecast, retail pharmacy is the dominant distribution channel. Retail pharmacies, both independent and chain pharmacies, play an important role in providing persons with celiac disease with access to drugs, vitamins, and over-the-counter goods.

Retail pharmacies provide a practical and accessible way for people to get gluten-free items, nutritional supplements, and medicines for celiac disease treatment. They frequently stock a variety of gluten-free products, such as specialist gluten-free meals, baking ingredients, and personal care items that cater to the unique needs of gluten-free dieters.

Online pharmacies have grown in popularity, allowing customers to obtain gluten-free food, prescriptions, and vitamins online and have them delivered to their homes. This helps people with celiac disease to get goods without having to go to a pharmacist.

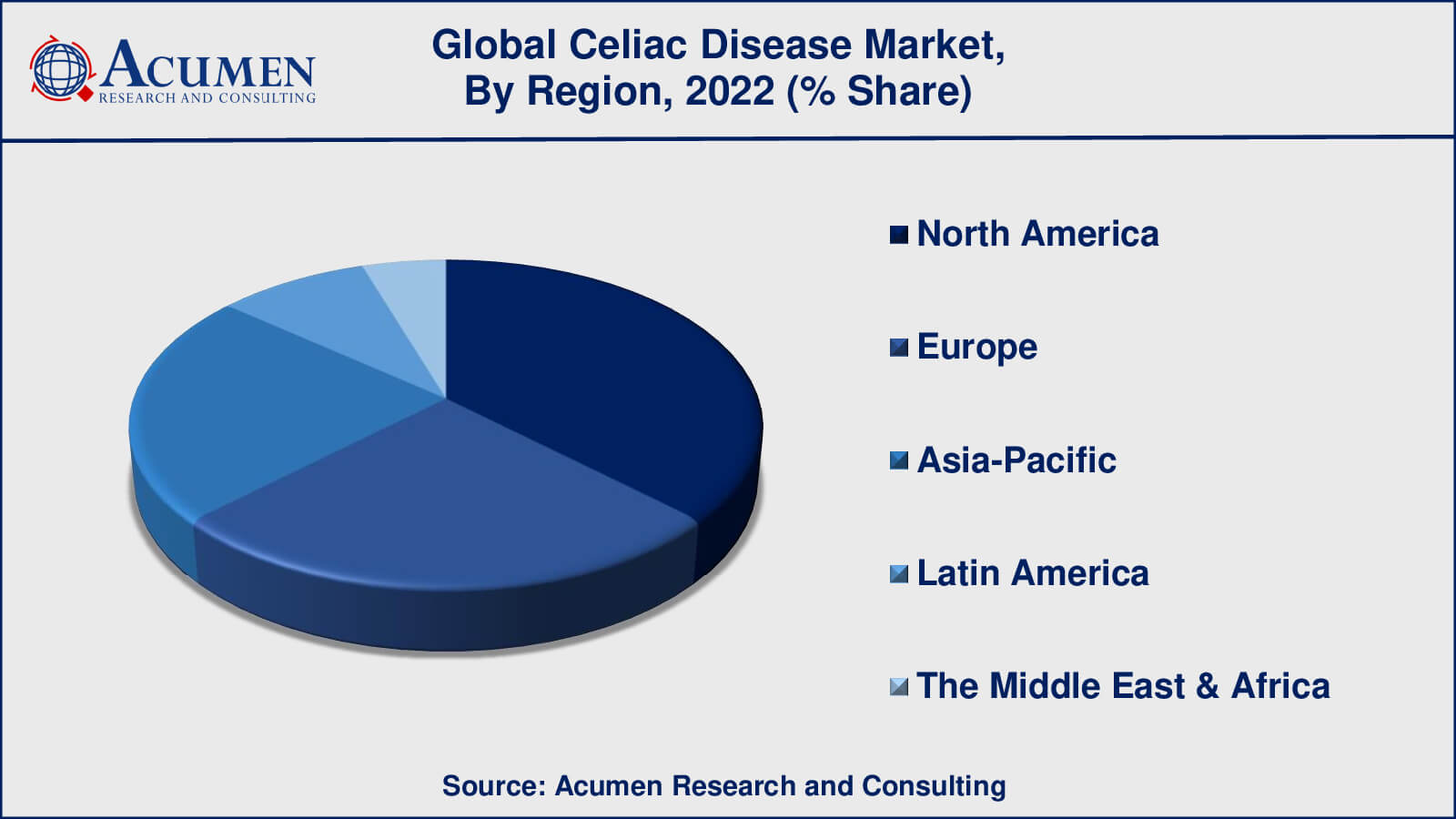

Celiac Disease Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Celiac Disease Market Regional Analysis

North America has a greater diagnostic rate than other regions due to a comparatively high knowledge of celiac disease. The United States, in particular, has a well-developed gluten-free industry and a major emphasis on celiac disease research. The presence of important market players, developments in diagnostic techniques, and supporting government regulations all contribute to the growth of this region's celiac disease industry.

Europe has a high frequency of celiac disease, notably in Italy, Ireland, and Finland. Gluten-free labelling legislation and norms have been established in European nations, facilitating the availability and accessibility of gluten-free products. Growing awareness, increased diagnosis rates, and a growing demand for gluten-free options in the food sector are driving the market in Europe.

The prevalence of celiac disease varies by country in Asia-Pacific. Some countries, like as India, have lower rates of diagnosis and awareness. However, in nations such as China, Japan, and Australia, there is a growing trend of urbanization, changing dietary patterns, and more knowledge of celiac disease. This region's market is predicted to rise as a result of growing diagnosis rates, improved healthcare infrastructure, and more gluten-free product offers.

Celiac Disease Market Players

Some of the top celiac disease companies offered in our report include Amgen, Anokion SA, BioLineRx Ltd, ChemoCentryx, Inc, COUR Pharmaceutical, F. Hoffmann-La Roche Ltd, ImmunogenX, LLC, Innovate Biopharmaceuticals, Takeda Pharmaceutical Company Limited, and Teva Pharmaceutical Industries Ltd.

Celiac Disease Industry Recent Developments

- BioLineRx recently announced the initiation of a Phase 2b clinical trial for its lead compound, BL-7010, as a potential treatment for celiac disease. The trial aims to evaluate the safety and efficacy of BL-7010 in reducing gluten-induced symptoms and gut inflammation in patients with celiac disease.

- ChemoCentryx recently reported positive results from a Phase 2 clinical trial evaluating a novel drug candidate for celiac disease-associated refractory sprue. The study demonstrated promising efficacy in reducing symptoms and improving intestinal health in patients with refractory sprue, a severe form of celiac disease.

Frequently Asked Questions

What was the market size of the global celiac disease in 2022?

The market size of celiac disease was USD 551.3 Million in 2022.

What is the CAGR of the global celiac disease market from 2023 to 2032?

The CAGR of celiac disease is 10.2% during the analysis period of 2023 to 2032.

Which are the key players in the celiac disease market?

The key players operating in the global market are including Abbott Laboratories, AbbVie (Allergan Plc), Astellas Pharma Inc., Boehringer Ingelheim Pharma GmbH & Co. KG, Eli Lilly and Company, GlaxoSmithKline plc., Merck & Co., Inc. (Merck Sharp & Dohme Corp), Pfizer Inc., Sanofi, and Teva Pharmaceutical Industries Limited.

Which region dominated the global celiac disease market share?

North America held the dominating position in celiac disease industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of celiac disease during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global celiac disease industry?

The current trends and dynamics in the celiac disease industry include increasing awareness and diagnosis of celiac disease, growing demand for gluten-free products, and advancements in diagnostic techniques for celiac disease

Which Treatment held the maximum share in 2022?

The gluten free held the maximum share of the celiac disease industry.?