Catecholamines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Catecholamines Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

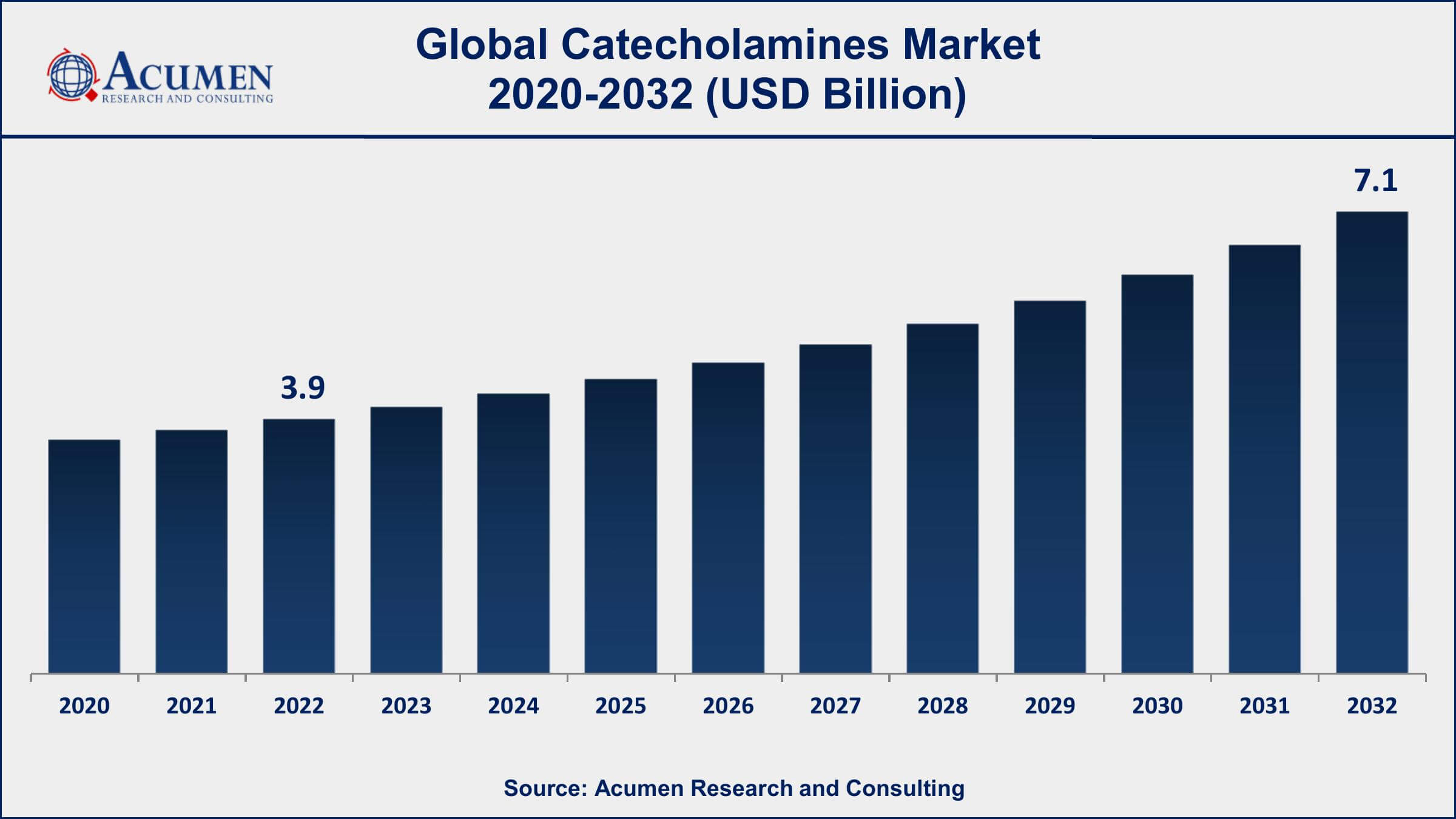

The Global Catecholamines Market Size accounted for USD 3.9 Billion in 2022 and is projected to achieve a market size of USD 7.1 Billion by 2032 growing at a CAGR of 6.3% from 2023 to 2032.

Catecholamines Market Highlights

- Global Catecholamines Market revenue is expected to increase by USD 7.1 Billion by 2032, with a 6.3% CAGR from 2023 to 2032

- North America region led with more than 41% of Catecholamines Market share in 2022

- Asia-Pacific Catecholamines Market growth will record a CAGR of around 6.8% from 2023 to 2032

- By type, the epinephrine (adrenaline) segment dominated the market with a major market share of 49% in 2022

- By route of administration, the intravenous segment captured more than 68% of market share in 2022

- Increasing prevalence of cardiovascular diseases, drives the Catecholamines Market value

Catecholamines are a group of naturally occurring chemicals in the human body that act as neurotransmitters and hormones. The most well-known catecholamines are dopamine, norepinephrine (noradrenaline), and epinephrine (adrenaline). These compounds play crucial roles in regulating various physiological processes, including the "fight or flight" response, mood regulation, and blood pressure control. In the medical field, catecholamines are also used as medications to treat conditions such as low blood pressure, heart rhythm disturbances, and asthma.

The catecholamines market has witnessed steady growth in recent years, driven by increasing healthcare awareness and a rising incidence of diseases that require catecholamine-based therapies. As the global population ages and the prevalence of cardiovascular diseases, neurological disorders, and respiratory conditions continues to rise, the demand for catecholamine drugs and formulations is expected to increase. Additionally, ongoing research and development efforts to improve the efficacy and safety of catecholamine-based treatments are likely to contribute to market expansion. Furthermore, advancements in drug delivery technologies and the availability of generic versions of catecholamines are also influencing the market dynamics, making these essential compounds more accessible to patients worldwide.

Global Catecholamines Market Trends

Market Drivers

- Increasing prevalence of cardiovascular diseases

- Growing aging population

- Rising awareness about catecholamine-based therapies

- Advancements in drug delivery technologies

- Expanding applications in neuroscience research

Market Restraints

- Stringent regulatory requirements

- Pricing pressures and reimbursement challenges

Market Opportunities

- Personalized medicine and precision therapeutics

- Integration of catecholamines in combination therapies

Catecholamines Market Report Coverage

| Market | Catecholamines Market |

| Catecholamines Market Size 2022 | USD 3.9 Billion |

| Catecholamines Market Forecast 2032 | USD 7.1 Billion |

| Catecholamines Market CAGR During 2023 - 2032 | 6.3% |

| Catecholamines Market Analysis Period | 2020 - 2032 |

| Catecholamines Market Base Year |

2022 |

| Catecholamines Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Route of Administration, By Indication, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Pfizer Inc., Novartis International AG, Mylan N.V. (now part of Viatris Inc.), Teva Pharmaceutical Industries Ltd., Sandoz International GmbH, Amneal Pharmaceuticals LLC, Par Pharmaceutical Companies, Inc., Fresenius Kabi USA, Apotex Inc., Sun Pharmaceutical Industries Ltd., and Aurobindo Pharma Limited. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Catecholamines are a class of neurotransmitters and hormones produced in the human body that play vital roles in regulating various physiological processes. The three primary catecholamines are dopamine, norepinephrine (noradrenaline), and epinephrine (adrenaline). These chemicals are synthesized from the amino acid tyrosine and are integral to the functioning of the nervous system and the endocrine system.

Catecholamines have diverse applications in medicine and research. In the medical field, they are used to treat conditions such as low blood pressure (hypotension), heart rhythm disorders, and asthma. For instance, epinephrine is administered in emergencies to counteract severe allergic reactions and to stimulate the heart during cardiac arrest. Additionally, norepinephrine is employed to raise blood pressure in cases of acute hypotension. Beyond clinical use, catecholamines have vital roles in neuroscience research, where they are utilized as neurotransmitters to study the brain's functioning and its impact on behavior, mood, and cognition. Researchers also investigate catecholamines' involvement in various neurological and psychiatric disorders, providing valuable insights into conditions like Parkinson's disease and schizophrenia.

The catecholamines market has experienced significant growth in recent years and is expected to continue on an upward trajectory. Several key factors are contributing to this expansion. One of the primary drivers is the increasing prevalence of cardiovascular diseases, neurodegenerative disorders, and other conditions that require catecholamine-based therapies. With a growing global population and an aging demographic, the demand for these medications, which play a vital role in regulating blood pressure and heart function, is steadily rising. Furthermore, there is a heightened awareness among healthcare professionals and patients about the effectiveness of catecholamine drugs in managing various medical conditions. Advances in drug delivery technologies and formulations are also facilitating their use in a broader range of applications, including neuroscience research. Additionally, ongoing research and development efforts are focused on improving the safety and efficacy of catecholamine-based treatments, creating new growth opportunities in the market.

Catecholamines Market Segmentation

The global Catecholamines Market segmentation is based on type, route of administration, indication, distribution channel, and geography.

Catecholamines Market By Type

- Epinephrine (adrenaline)

- Dopamine

- Norepinephrine (noradrenaline)

According to the catecholamines industry analysis, the epinephrine (adrenaline) segment accounted for the largest market share in 2022. Epinephrine is a crucial catecholamine hormone and neurotransmitter that plays a pivotal role in the body's "fight or flight" response, making it indispensable in various medical applications. One significant driver of growth in the epinephrine segment is its widespread use in emergency medicine. Epinephrine is a lifesaving medication used to treat severe allergic reactions (anaphylaxis) and cardiac arrest. With an increasing number of individuals diagnosed with severe allergies and anaphylactic conditions, there is a rising demand for epinephrine auto-injectors and other formulations, particularly in developed markets. Additionally, the continued emphasis on cardiopulmonary resuscitation (CPR) and advanced life support techniques has led to increased use of epinephrine in cardiac arrest scenarios.

Catecholamines Market By Route of Administration

- Intravenous

- Transdermal

- Inhalation

- Others

In terms of route of administration, the intravenous segment is expected to witness significant growth in the coming years. Intravenous administration of catecholamines is a critical route for delivering these medications, particularly in emergency and critical care settings. One significant driver of growth in the intravenous catecholamines segment is their indispensable role in managing various life-threatening conditions. Epinephrine, for example, is commonly administered intravenously during cardiac arrest or severe allergic reactions when rapid and precise delivery of the medication is essential. The increasing incidence of cardiac emergencies and severe allergic reactions has led to a higher demand for IV catecholamine formulations, particularly in hospital and emergency care settings.

Catecholamines Market By Indication

- Anaphylaxis

- Shock

- Cardiac arrest

- Hypertension

- Acute asthma

- Others

According to the catecholamines market forecast, the cardiac arrest segment is expected to witness significant growth in the coming years. Cardiac arrest is a life-threatening condition where the heart suddenly stops beating, and immediate intervention is required to restore circulation and save a patient's life. Catecholamines, particularly epinephrine (adrenaline), play a vital role in the treatment of cardiac arrest. One of the key drivers of growth in the cardiac arrest segment is the rising incidence of cardiac emergencies. Factors such as lifestyle-related risk factors, an aging population, and an increase in chronic heart diseases have contributed to a higher frequency of cardiac arrests. In such cases, epinephrine is administered intravenously as part of advanced life support protocols to enhance cardiac output and perfusion of vital organs, increasing the chances of successful resuscitation.

Catecholamines Market By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

Based on the distribution channel, the hospital pharmacy segment is expected to continue its growth trajectory in the coming years. Catecholamines, such as epinephrine and norepinephrine, are frequently used in hospital pharmacies for a variety of critical care scenarios. One significant driver of growth in this segment is the increasing demand for catecholamines in the management of acute medical conditions. These medications are essential in treating patients with severe allergic reactions (anaphylaxis), cardiac arrest, septic shock, and other life-threatening situations. Hospital pharmacies need to maintain a ready supply of catecholamines to ensure that healthcare professionals can quickly access and administer these drugs in emergency situations, thereby saving lives. Additionally, advancements in pharmaceutical formulations and drug delivery systems have enhanced the convenience and precision of catecholamine administration in hospitals.

Catecholamines Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Catecholamines Market Regional Analysis

North America has consistently dominated the catecholamines market for several key reasons, making it the leading region in this pharmaceutical sector. North America boasts a well-developed healthcare infrastructure and a strong emphasis on research and development, allowing for the rapid adoption of catecholamine-based therapies. The region has a high prevalence of cardiovascular diseases, neurodegenerative disorders, and severe allergies, which require catecholamines like epinephrine and norepinephrine for treatment. With an aging population and a growing awareness of these health conditions, the demand for catecholamines has been consistently high. Moreover, the region is home to some of the world's largest pharmaceutical companies and research institutions. These organizations are at the forefront of catecholamine research, drug development, and innovation, leading to the introduction of advanced formulations and delivery methods. North American pharmaceutical companies have also been active in strategic collaborations and partnerships, enabling them to expand their market presence globally. The region's regulatory framework and approval processes have further supported the growth of the catecholamines market, ensuring the safety and efficacy of these medications.

Catecholamines Market Player

Some of the top catecholamines market companies offered in the professional report include Pfizer Inc., Novartis International AG, Mylan N.V. (now part of Viatris Inc.), Teva Pharmaceutical Industries Ltd., Sandoz International GmbH, Amneal Pharmaceuticals LLC, Par Pharmaceutical Companies, Inc., Fresenius Kabi USA, Apotex Inc., Sun Pharmaceutical Industries Ltd., and Aurobindo Pharma Limited.

Frequently Asked Questions

What was the market size of the global catecholamines in 2022?

The market size of catecholamines was USD 3.9 Billion in 2022.

What is the CAGR of the global catecholamines market from 2023 to 2032?

The CAGR of catecholamines is 6.3% during the analysis period of 2023 to 2032.

Which are the key players in the catecholamines market?

The key players operating in the global market are including Pfizer Inc., Novartis International AG, Mylan N.V. (now part of Viatris Inc.), Teva Pharmaceutical Industries Ltd., Sandoz International GmbH, Amneal Pharmaceuticals LLC, Par Pharmaceutical Companies, Inc., Fresenius Kabi USA, Apotex Inc., Sun Pharmaceutical Industries Ltd., and Aurobindo Pharma Limited.

Which region dominated the global catecholamines market share?

North America held the dominating position in catecholamines industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of catecholamines during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global catecholamines industry?

The current trends and dynamics in the catecholamines industry include increasing prevalence of cardiovascular diseases, growing aging population, and rising awareness about catecholamine-based therapies.

Which route of administration held the maximum share in 2022?

The intravenous route of administration held the maximum share of the catecholamines industry.