Cast Elastomer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Cast Elastomer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

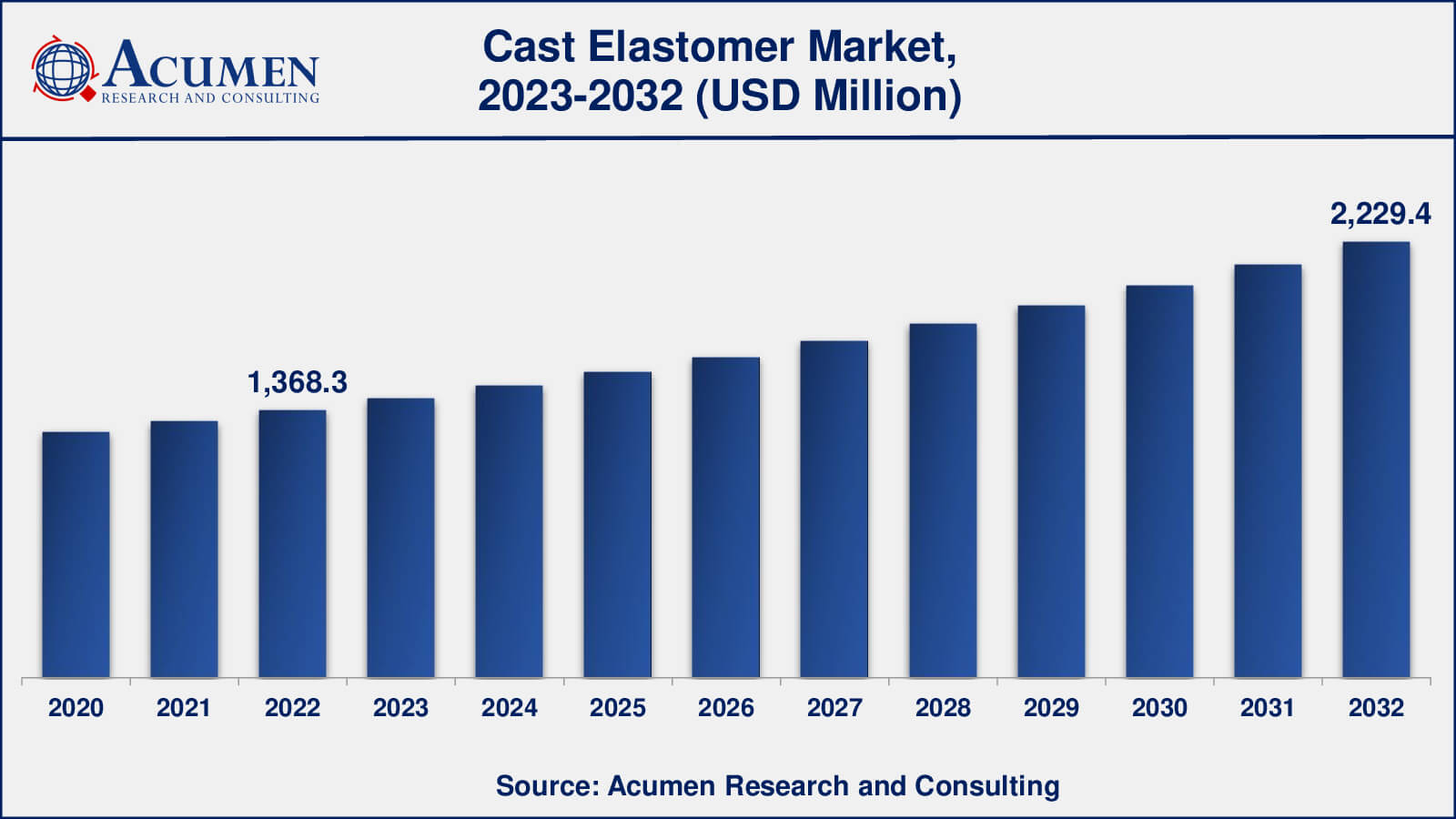

The global Cast Elastomer Market size was valued at USD 1,368.3 Million in 2022 and is projected to attain USD 2,229.4 Million by 2032 mounting at a CAGR of 5.1% from 2023 to 2032.

Cast Elastomer Market Highlights

- Global cast elastomer market revenue is poised to garner USD 2,229.4 million by 2032 with a CAGR of 5.1% from 2023 to 2032

- Asia-Pacific cast elastomer market value occupied around USD 574.7 million in 2022

- Asia-Pacific cast elastomer market growth will record a CAGR of more than 6% from 2023 to 2032

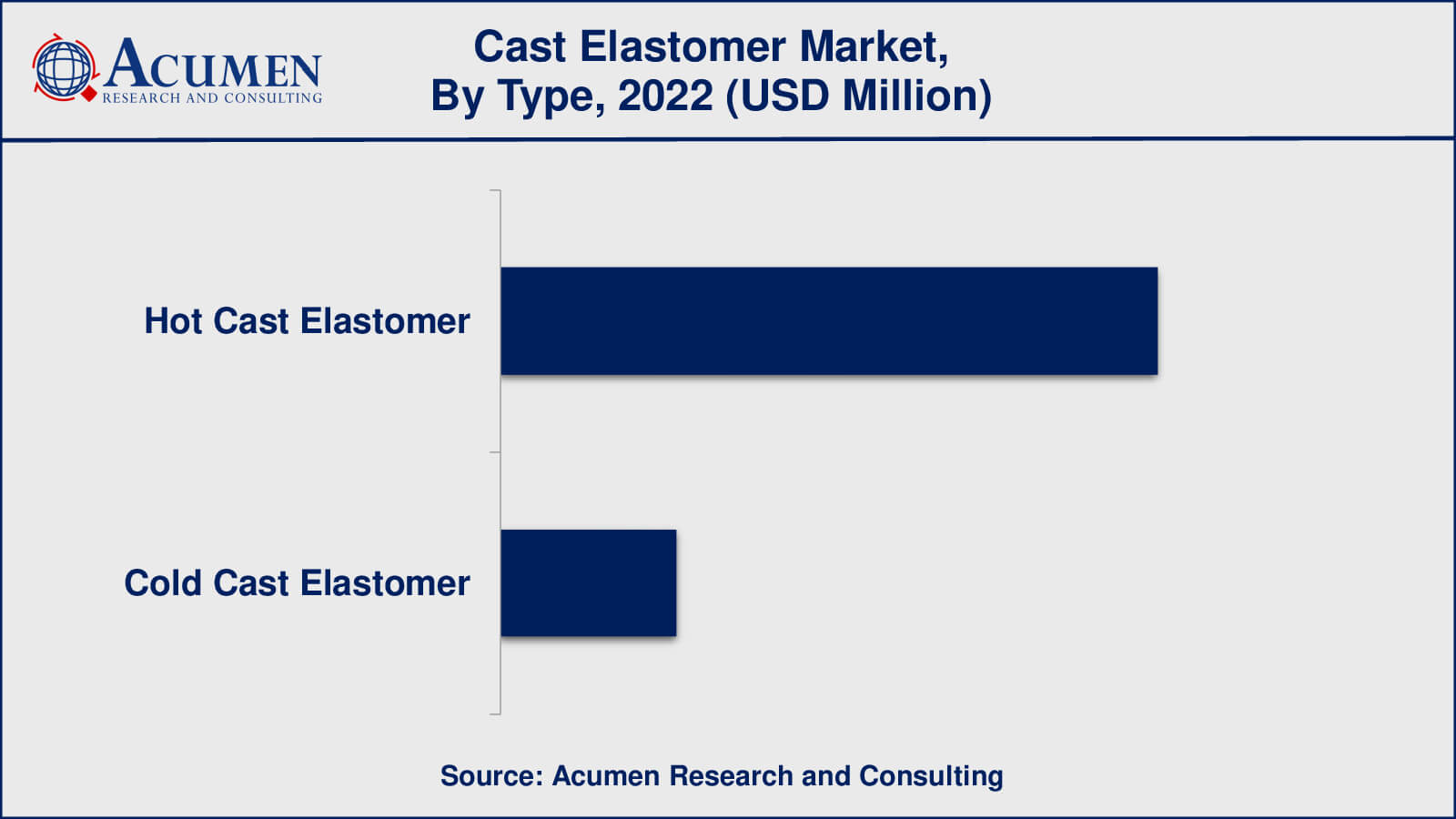

- Among type, the hot cast polymer sub-segment occupied over US$ 1,080.9 million revenue in 2022

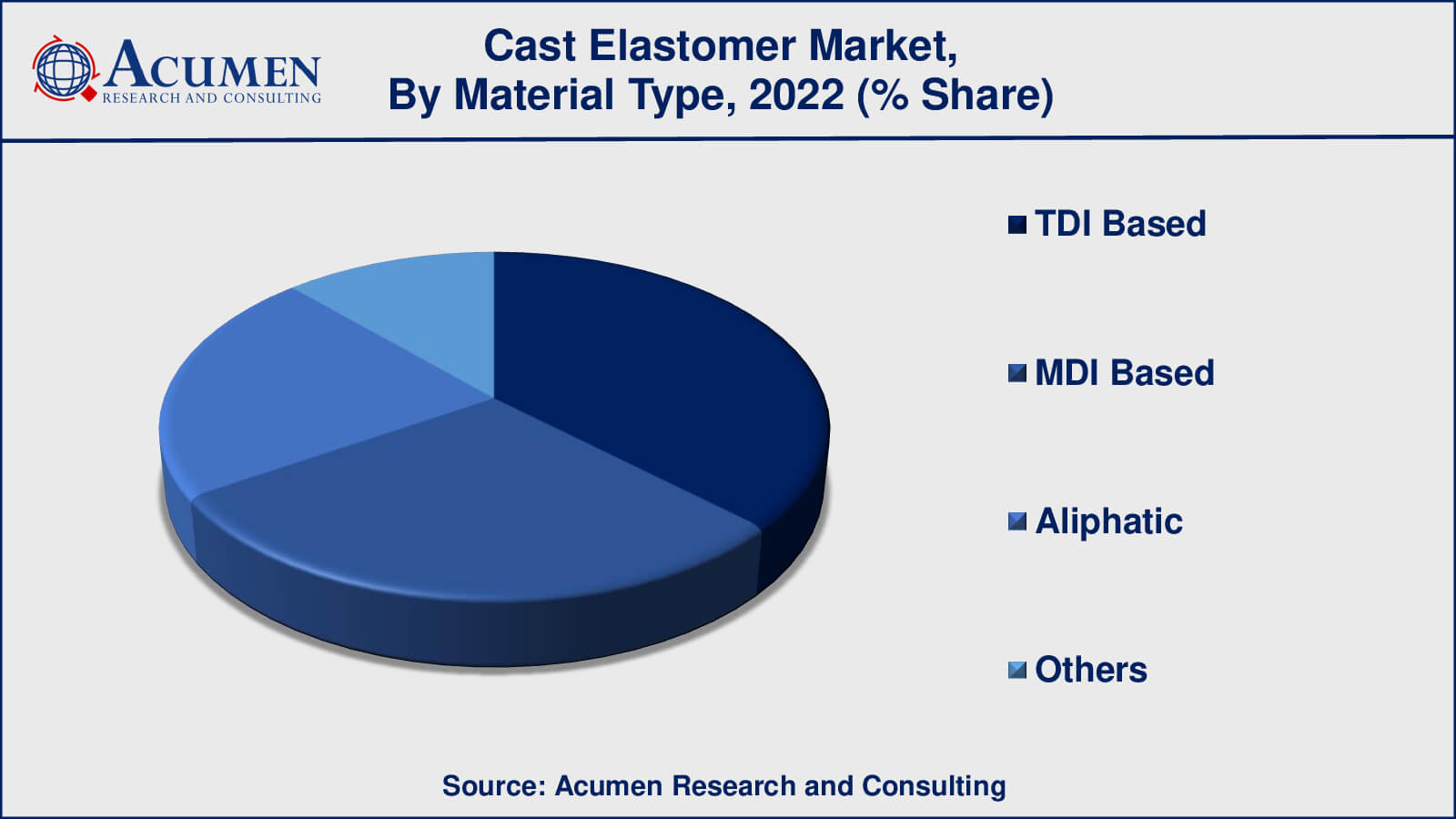

- Based on material type, the TDI-based sub-segment gathered around 37% share in 2022

- Rapidly growing 3D printing applications is a popular cast elastomer market trend that drives the industry demand

Cast elastomers are a form of polymeric material well-known for its flexibility, durability, and resilience. They are made via a specialized manufacturing method that involves pouring liquid prepolymers or monomers into molds, where they react chemically to generate a solid elastomeric structure. This procedure enables the manufacture of a wide variety of goods, including seals, gaskets, rollers, wheels, and numerous industrial components.

Cast elastomers are notable for their ability to tolerate harsh environmental conditions such as high temperatures, chemicals, and abrasion. As a result, they are ideal for demanding applications such as automotive, oil & gas, mining, and manufacturing, where resistance to wear and tear is critical.

Global Cast Elastomer Market Dynamics

Market Drivers

- Growing demand for automotive components

- Increasing use in oil & gas applications

- Advancements in material technology

- Expansion of healthcare sector

Market Restraints

- High production costs

- Limited recycling options

- Environmental concerns

Market Opportunities

- Emerging markets in Asia-Pacific

- Customization for niche applications

- Green and sustainable elastomers

Cast Elastomer Market Report Coverage

| Market | Cast Elastomer Market |

| Cast Elastomer Market Size 2022 | USD 1,368.3 Million |

| Cast Elastomer Market Forecast 2032 | USD 2,229.4 Million |

| Cast Elastomer Market CAGR During 2023 - 2032 | 5.1% |

| Cast Elastomer Market Analysis Period | 2020 - 2032 |

| Cast Elastomer Market Base Year |

2022 |

| Cast Elastomer Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Material Type, By Application, By End-user Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Argonics, Inc., BASF SE, Covestro, Coim Group, Dow, Era Polymers Pty Ltd., Huntsman Corporation, LANXESS, Tosoh Corporation, and Wanhua Chemical Group Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cast Elastomer Market Insights

Cast elastomers provide a number of benefits, including the flexibility to be customized to meet specific performance needs. Cast elastomers' hardness, elasticity, and other mechanical qualities may be tailored to meet the demands of a specific application by manufacturers. Because of their adaptability, they have been used in a wide range of industries, from automotive and aerospace to healthcare and consumer products.

However, there are drawbacks to cast elastomers, such as relatively high production costs and restricted recycling alternatives when compared to other materials. This factor is limiting the cast elastomers market growth. Furthermore, environmental worries about the manufacture and disposal of these elastomers have encouraged the industry to look for more environmentally friendly alternatives. Despite these obstacles, the cast elastomer market continues to expand, owing to its unique mix of performance qualities and capacity to meet the diversified demands of numerous sectors.

Furthermore, cast elastomers have gained popularity in areas where standard rubber materials fail. This is expected to generate significant opportunities for the cast elastomers market growth. They perform well in circumstances requiring high accuracy, low compression set, and great load-bearing capacities. Furthermore, advances in material technology have resulted in the creation of cast elastomers with increased environmental sustainability, which is appealing to enterprises seeking greener solutions.

Cast Elastomer Market Segmentation

The worldwide market for cast elastomer is split based on type, material type, application, end-user industry, and geography.

Cast Elastomer Types

- Hot Cast Elastomer

- Cold Cast Elastomer

As per the cast elastomers industry analysis, hot cast elastomers will have a considerable market share in 2022. Hot Cast Elastomers were often utilised for medications and fluids that required a consistent and continuous infusion rate throughout time. These pumps were frequently used in conditions requiring a constant drug concentration, such as pain management, antibiotic therapy, or specific conveyor scrapers regimens.

Cold cast elastomers, on the other hand, allowed for greater flexibility in adjusting the infusion rate to meet the changing needs of the patient. These pumps were indicated when treatments required periodic modifications or medications needed to be delivered at varied rates over time. By altering the formulation, hot cast elastomers may be customised to fulfil specific performance requirements. Manufacturers may adapt the material's hardness, elasticity, and other mechanical qualities to the demands of a specific application. Because of their adaptability, they are used in a broad variety of items, including heavy-duty industrial components, conveyor belts, automotive parts, and specialised equipment components.

Cast Elastomer Material Types

- TDI-Based

- MDI-Based

- Aliphatic

- Others

As per the material type industry analysis, TDI-based is the market leader. Several significant aspects contribute to the commercial dominance of TDI-based cast elastomers. To begin with, TDI (Toluene Diisocyanate)-based cast elastomers are less expensive to create than MDI (Methylene Diphenyl Diisocyanate) equivalents. This cost benefit is especially tempting to producers that want to balance material performance with economic concerns, making TDI-based elastomers a favoured alternative.

The adaptability provided by TDI-based cast elastomers is another important aspect leading to their supremacy. They provide a wide range of hardness possibilities, from extremely soft to very hard, making them appropriate for a wide range of applications in a variety of sectors. This versatility is a key benefit, since it allows these elastomers to be used in a wide range of applications, from automobile components to industrial gear.

Cast Elastomer Applications

- Separating Screens

- Pipe Linings

- Conveyor Scrapers

- Idler Rolls

- Others

Conveyor scrapers have historically been a prominent application category in the cast elastomers industry. Conveyor scrapers are critical components in sectors such as mining, bulk material handling, and agriculture, where effective material residue and debris removal from conveyor belts is critical. Because of their superior abrasion resistance, durability, and ability to preserve shape and function under demanding operating circumstances, cast elastomers are preferred in this application.

These characteristics make cast elastomers, such as those used in conveyor scrapers, dependable and long-lasting, lowering maintenance costs and downtime. It is crucial to note, however, that the dominance of certain applications in the cast elastomer market may vary over time as industries and technology improve and new uses arise.

Cast Elastomer End-User Industries

- Automotive

- Chemical & Petrochemical

- Energy & Power

- Oil & Gas

- Food & Beverage

- Healthcare

- Others

According to the cast elastomer market forecast, automotive end-user industry is expected to gain significant traction from 2023 to 2032. The automobile sector was a major end-use industry that dominated the cast elastomer market. Cast elastomers, particularly those with high durability and wear resistance, are widely used in automobile components such as seals, gaskets, suspension components, and tyres. These elastomers are appreciated for their ability to endure harsh conditions in the automobile industry, which contributes to their dominance in that sector.

Cast Elastomer Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cast Elastomer Market Regional Analysis

North America has been a major participant in the cast elastomer industry, with industries such as automotive, oil & gas, and healthcare driving demand. The United States, in particular, has a thriving manufacturing industry that makes extensive use of cast elastomers in a variety of applications. Environmental legislation and concerns about sustainability have also fueled the development of eco-friendly elastomers in this region.

The automotive and industrial sectors in Europe are well-established, and they rely on cast elastomers for performance and durability. Germany, in particular, has contributed significantly to the European cast elastomer market. In order to comply with environmental standards, European countries have also been aggressive in adopting greener elastomers.

The Asia-Pacific region has seen substantial expansion in the cast elastomer market, led by nations such as China, India, Japan, and South Korea. Rapid industrialization, infrastructural development, and the rise of the automobile sector have fueled demand for cast elastomers in this region. Because of its economic expansion, Asia-Pacific is anticipated to remain a major market.

Cast Elastomer Market Players

Some of the top cast elastomer companies offered in our report include Argonics, Inc. BASF SE, Covestro, Coim Group, Dow, Era Polymers Pty Ltd., Huntsman Corporation, LANXESS, Tosoh Corporation, and Wanhua Chemical Group Co., Ltd.

Frequently Asked Questions

What was the size of the global cast elastomer market in 2022?

What was the size of the global cast elastomer market in 2022?

What is the cast elastomer market CAGR from 2023 to 2032?

The cast elastomer market CAGR during the analysis period of 2023 to 2032 is 5.1%.

Which are the key players in the cast elastomer market?

The key players operating in the global cast elastomer market are Argonics, Inc. BASF SE, Covestro, Coim Group, Dow, Era Polymers Pty Ltd., Huntsman Corporation, LANXESS, Tosoh Corporation, and Wanhua Chemical Group Co., Ltd.

Which region dominated the global cast elastomer market share?

Asia-Pacific region held the dominating position in cast elastomer industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cast elastomer during the analysis period of 2023 to 2032.

What are the current trends in the global cast elastomer industry?

The current trends and dynamics in the cast elastomer industry include growing demand for automotive components, increasing use in oil & gas applications, and advancements in material technology.

Which type held the maximum share in 2022?

The hot cast elastomer type held the maximum share of the cast elastomer industry.