Carboxymethyl Cellulose Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Carboxymethyl Cellulose Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

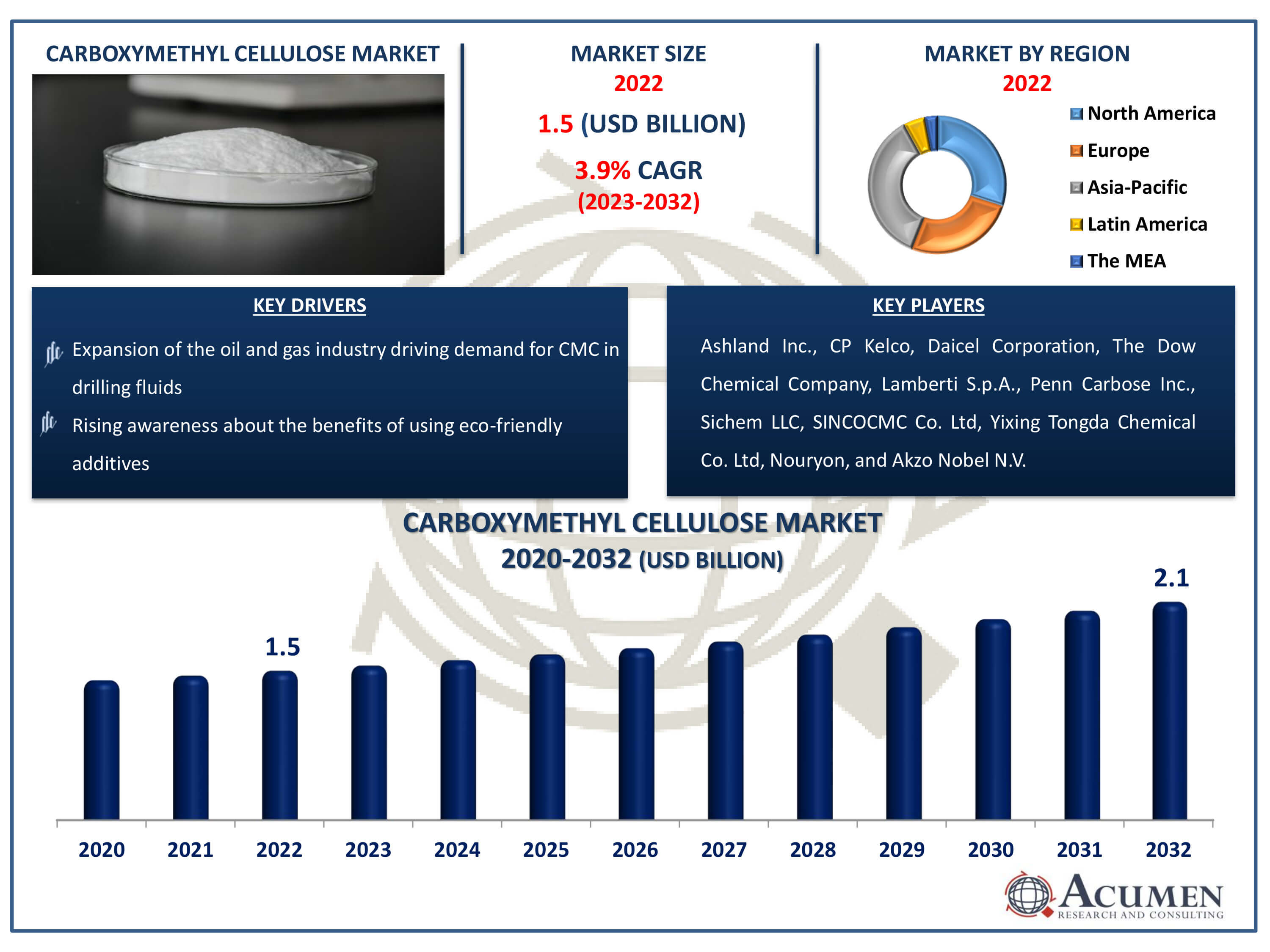

The Carboxymethyl Cellulose Market Size accounted for USD 1.5 Billion in 2022 and is estimated to achieve a market size of USD 2.1 Billion by 2032 growing at a CAGR of 3.9% from 2023 to 2032.

Carboxymethyl Cellulose Market Highlights

- Global carboxymethyl cellulose market revenue is poised to garner USD 2.1 billion by 2032 with a CAGR of 3.9% from 2023 to 2032

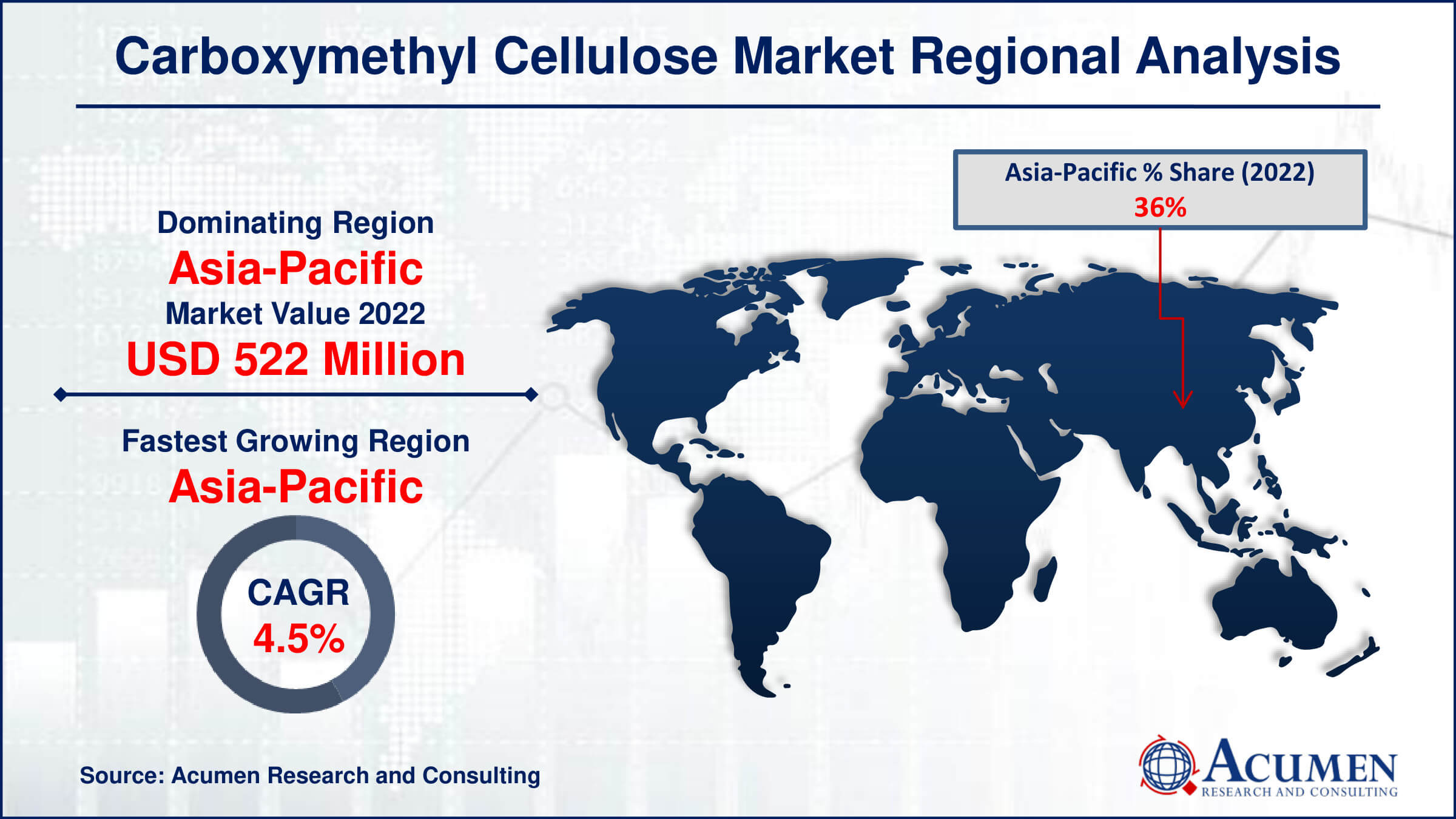

- Asia-Pacific carboxymethyl cellulose market value occupied around USD 522 million in 2022

- Asia-Pacific carboxymethyl cellulose market growth will record a CAGR of more than 4.5% from 2023 to 2032

- Among property, the thickening agent sub-segment generated more than USD 507.5 million revenue in 2022

- Based on application, the food & beverages sub-segment generated around 38% market share in 2022

- Development of novel applications in the textile industry is a popular carboxymethyl cellulose market trend that fuels the industry demand

Carboxymethyl cellulose (CMC), often known as cellulose gum, is water-soluble cellulose ether formed by partially substituting hydroxyl groups on cellulose with ionic hydrophilic moieties. It occurs largely as a sodium salt and is used for thickening, emulsifying, and stabilizing in a variety of sectors, including food, medicines, and cosmetics. It is used in medicine as a bulk laxative because of its capacity to absorb water and increase stool volume, which aids in digestive regularity. Because of its ability to change viscosity and texture, this versatile molecule is used as an ingredient in a broad range of goods, including ice cream and salad dressings, pharmaceutical formulations, and personal care products such as toothpaste and lotion.

Global Carboxymethyl Cellulose Market Dynamics

Market Drivers

- Growing demand for processed foods and beverages

- Increasing applications in pharmaceutical formulations

- Rising awareness about the benefits of using eco-friendly additives

- Expansion of the oil and gas industry driving demand for CMC in drilling fluids

Market Restraints

- Fluctuating prices of raw materials

- Stringent regulations regarding product safety and quality

- Competition from alternative thickening agents

Market Opportunities

- Surge in demand for personal care and cosmetics products

- Technological advancements enhancing CMC properties

- Expansion into emerging markets with increasing industrial activities

Carboxymethyl Cellulose Market Report Coverage

| Market | Carboxymethyl Cellulose Market |

| Carboxymethyl Cellulose Market Size 2022 | USD 1.5 Billion |

| Carboxymethyl Cellulose Market Forecast 2032 |

USD 2.1 Billion |

| Carboxymethyl Cellulose Market CAGR During 2023 - 2032 | 3.9% |

| Carboxymethyl Cellulose Market Analysis Period | 2020 - 2032 |

| Carboxymethyl Cellulose Market Base Year |

2022 |

| Carboxymethyl Cellulose Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Purity Level, By Property, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ashland Inc., CP Kelco, Daicel Corporation, The Dow Chemical Company, Lamberti S.p.A., Penn Carbose Inc., Sichem LLC, SINCOCMC Co. Ltd, Yixing Tongda Chemical Co. Ltd, Nouryon, and Akzo Nobel N.V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Carboxymethyl Cellulose Market Insights

The growing demand for processed food, pharmaceutical, and cosmetics along with the increasing disposable income in emerging economies is driving the market value. The benefits to enhance the aesthetics of the finished product by imparting smooth texture and modifying the viscosity of various personal care products, foods, and pharmaceutical products are supporting the market value. The increasing sales of specialty drugs across the globe and rising number of oil drilling activities are further accelerating the market value. Furthermore, increasing the use of CMC in the flotation process in mining and rapid industrialization in emerging economies is projected to create potential demand during the carboxymethyl cellulose industry forecast period from 2023 to 2032.

The advent of replacements in numerous application areas will offer a significant threat to the carboxymethyl cellulose (CMC) market's growth trajectory over the carboxymethyl cellulose market forecast period. Alternatives to CMC, such as guar gum and xanthan gum, are increasingly being researched and used in areas where CMC has historically dominated. These alternatives frequently provide identical features at competitive rates, enticing both customers and manufacturers alike. Furthermore, advances in research and development have resulted in the discovery of other materials with qualities equivalent to or even superior to those of CMC, hence increasing market rivalry. As a result, CMC producers are under pressure to not only maintain their current market share but also innovate in order to be competitive in an ever-changing field of alternatives. Overcoming these issues requires deliberate expenditures in R&D and marketing efforts to highlight CMC's distinct benefits and uses, ensuring its relevance in the face of increasing competition.

Carboxymethyl Cellulose Market Segmentation

Carboxymethyl Cellulose Market Segmentation

The worldwide market for carboxymethyl cellulose is split based on purity level, property, application, and geography.

Carboxymethyl Cellulose (CMC) Market By Purity Level

- Highly Purified

- Technical Grade

- Industrial Grade

In the carboxymethyl cellulose (CMC) market, the highly purified category is the largest, accounting for a sizable market share and influencing industry dynamics. This segment's popularity stems mostly from the crucial role of high-purity CMC in applications that need tight quality requirements and precise performance characteristics. Pharmaceutical, food, and cosmetic industries value highly purified CMC for its better quality, consistency, and dependability. In pharmaceutical formulations, for example, where product safety and efficacy are critical, highly pure CMC assures compliance with regulatory standards while reducing the danger of contaminants that might jeopardise patient health. Similarly, in food and cosmetic formulations, consumers expect high-quality goods, which drives demand for CMC with excellent purity levels. The dominance of the Highly Purified sector demonstrates the importance of quality assurance and product integrity in a variety of industries, allowing it to maintain its lead in the CMC market.

Carboxymethyl Cellulose (CMC) Market By Property

- Thickening Agent

- Stabilizer

- Binder

- Anti-repository Agent

- Lubricator

- Emulsifier

- Excipient

The thickening agent sector leads the carboxymethyl cellulose (CMC) industry, driving global growth and innovation. This importance stems from CMC's varied position as a thickening agent in a variety of industries. CMC, as a thickening, increases liquid viscosity, giving a variety of goods the required texture and consistency, including food and drinks, medicinal formulations, and personal care items. Its capacity to change viscosity makes it essential in food applications such as sauces, dressings, and dairy products, where texture and stability are critical. On other hand, in medicines, CMC is an important component in formulations needing controlled release or delayed activity. Its efficacy as a thickening agent, along with its flexibility and compatibility with other ingredients, reinforces its market dominance, encouraging continuous adoption and expansion of its uses across a wide range of industries.

Carboxymethyl Cellulose (CMC) Market By Application

- Cosmetics & Pharmaceuticals

- Food & Beverages

- Oil & Gas

- Paper & Board

- Paints & Adhesives

- Detergent

- Others

According to carboxymethyl cellulose industry analysis, the food and beverage segment dominates the market, accounting for the largest share in 2022. This sector's leadership is fueled by a number of causes, most notably the growing global population and evolving consumer lifestyles, which are driving up demand for processed food items. CMC is an important element in this environment, acting as a binder, thickening, bulking agent, and suspending agent in a variety of bakery and culinary products. Its adaptability and functionality greatly improve product quality and customer happiness. Furthermore, as global health consciousness grows, so does the desire for better beverage options, such as energy drinks, in which CMC is widely used. This rising trend towards better lives and dietary choices accelerates the CMC market's growth trajectory in the food and beverage category.

Carboxymethyl Cellulose Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Carboxymethyl Cellulose Market Regional Analysis

In terms of carboxymethyl cellulose market analysis, in 2022, Asia-Pacific registered maximum share (%) in terms of volume, and the region is also projected to maintain its dominance over the forecast timeframe. The high demand from oil & gas, pharmaceuticals, cosmetics, and food & beverage sector in the regional market is driving the market value. The major economies of the region including Japan, China, and India are majorly contributing to the regional market growth. The ongoing industrialization and increasing focus of major manufacturers in the available opportunities in the regional market are additionally bolstering the market value. Moreover, the region is further projected to experience the fastest growth with major CAGR (%) during the forecast timeframe from 2023 to 2032.

Carboxymethyl Cellulose Market Players

Some of the top carboxymethyl cellulose companies offered in our report include Ashland Inc., CP Kelco, Daicel Corporation, The Dow Chemical Company, Lamberti S.p.A., Penn Carbose Inc., Sichem LLC, SINCOCMC Co. Ltd, Yixing Tongda Chemical Co. Ltd, Nouryon, and Akzo Nobel N.V.

Frequently Asked Questions

How big is the carboxymethyl cellulose market?

The carboxymethyl cellulose market size was valued at USD 1.5 billion in 2022.

What is the CAGR of the global carboxymethyl cellulose market from 2023 to 2032?

The CAGR of carboxymethyl cellulose is 3.9% during the analysis period of 2023 to 2032.

Which are the key players in the carboxymethyl cellulose market?

The key players operating in the global market are including Ashland Inc., CP Kelco, Daicel Corporation, The Dow Chemical Company, Lamberti S.p.A., Penn Carbose Inc., Sichem LLC, SINCOCMC Co. Ltd, Yixing Tongda Chemical Co. Ltd, Nouryon, and Akzo Nobel N.V.

Which region dominated the global carboxymethyl cellulose market share?

Asia-Pacific held the dominating position in carboxymethyl cellulose industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of carboxymethyl cellulose during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global carboxymethyl cellulose industry?

The current trends and dynamics in the carboxymethyl cellulose industry include growing demand for processed foods and beverages, increasing applications in pharmaceutical formulations, rising awareness about the benefits of using eco-friendly additives, and expansion of the oil and gas industry driving demand for CMC in drilling fluids.

Which property held the maximum share in 2022?

The thickening agent property held the maximum share of the carboxymethyl cellulose industry.