Carbon Black Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Carbon Black Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

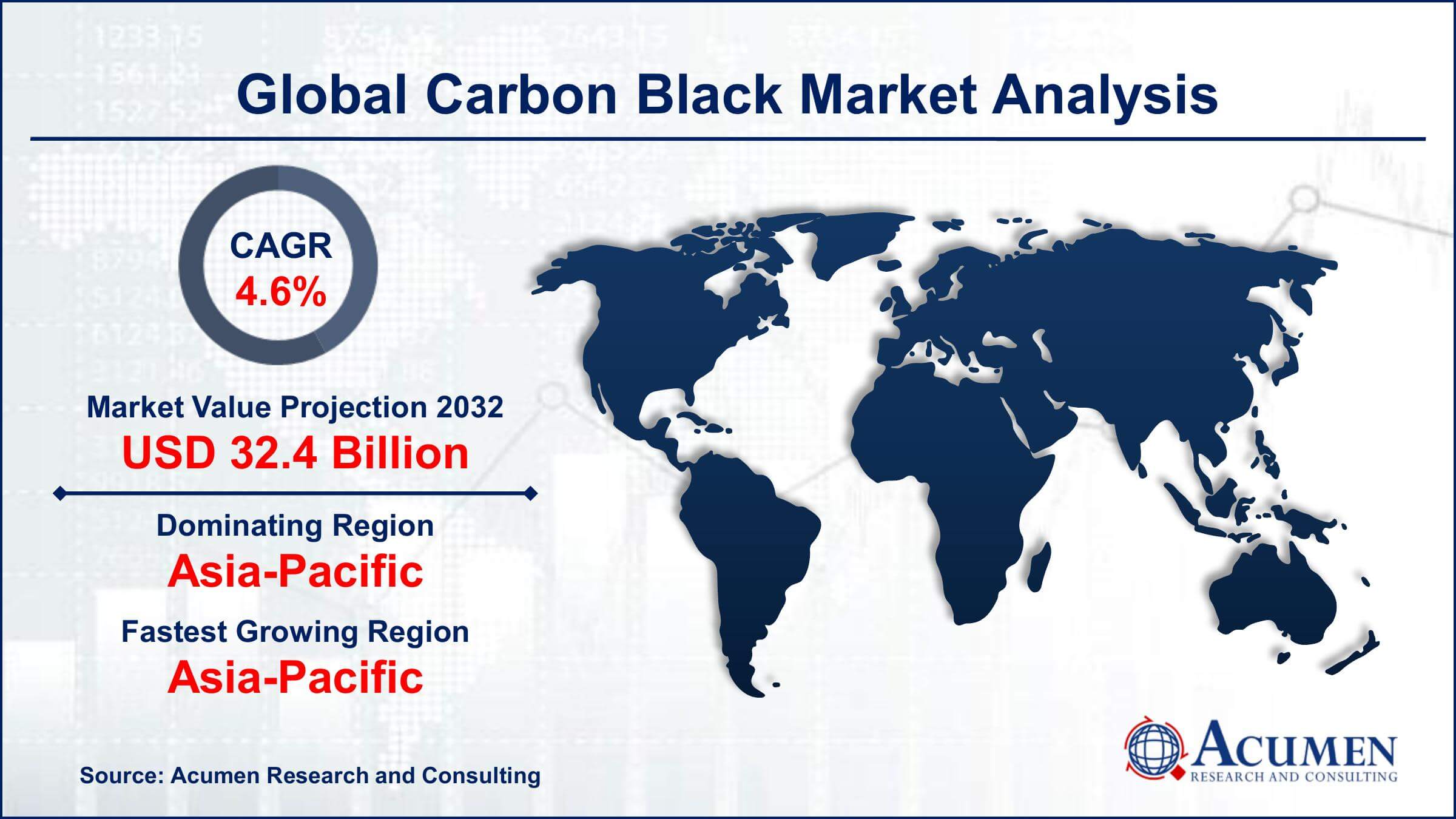

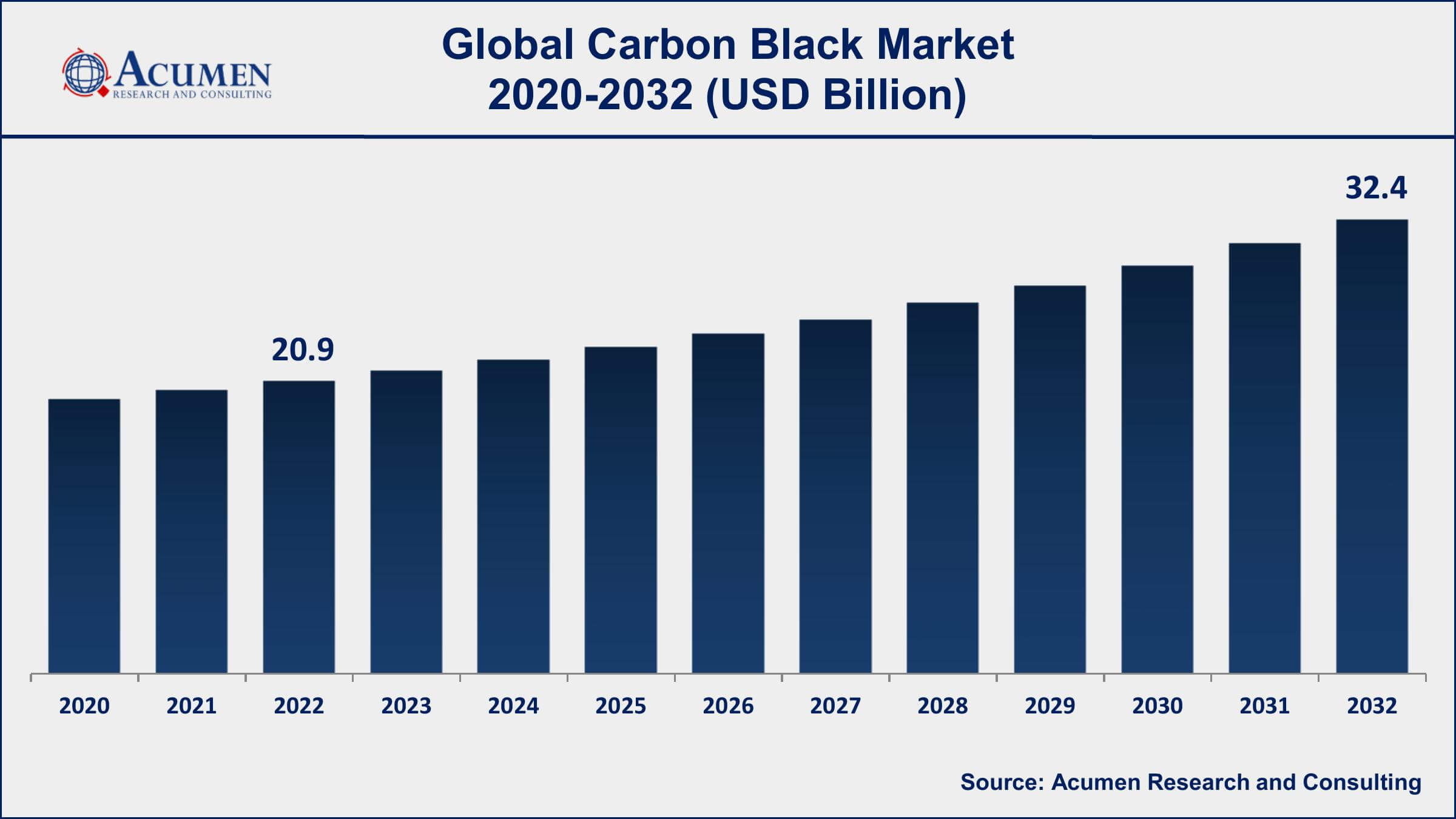

The Global Carbon Black Market Size accounted for USD 20.9 Billion in 2022 and is projected to achieve a market size of USD 32.4 Billion by 2032 growing at a CAGR of 4.6% from 2023 to 2032.

Carbon Black Market Highlights

- Global carbon black market revenue is expected to increase by USD 32.4 Billion by 2032, with a 4.6% CAGR from 2023 to 2032

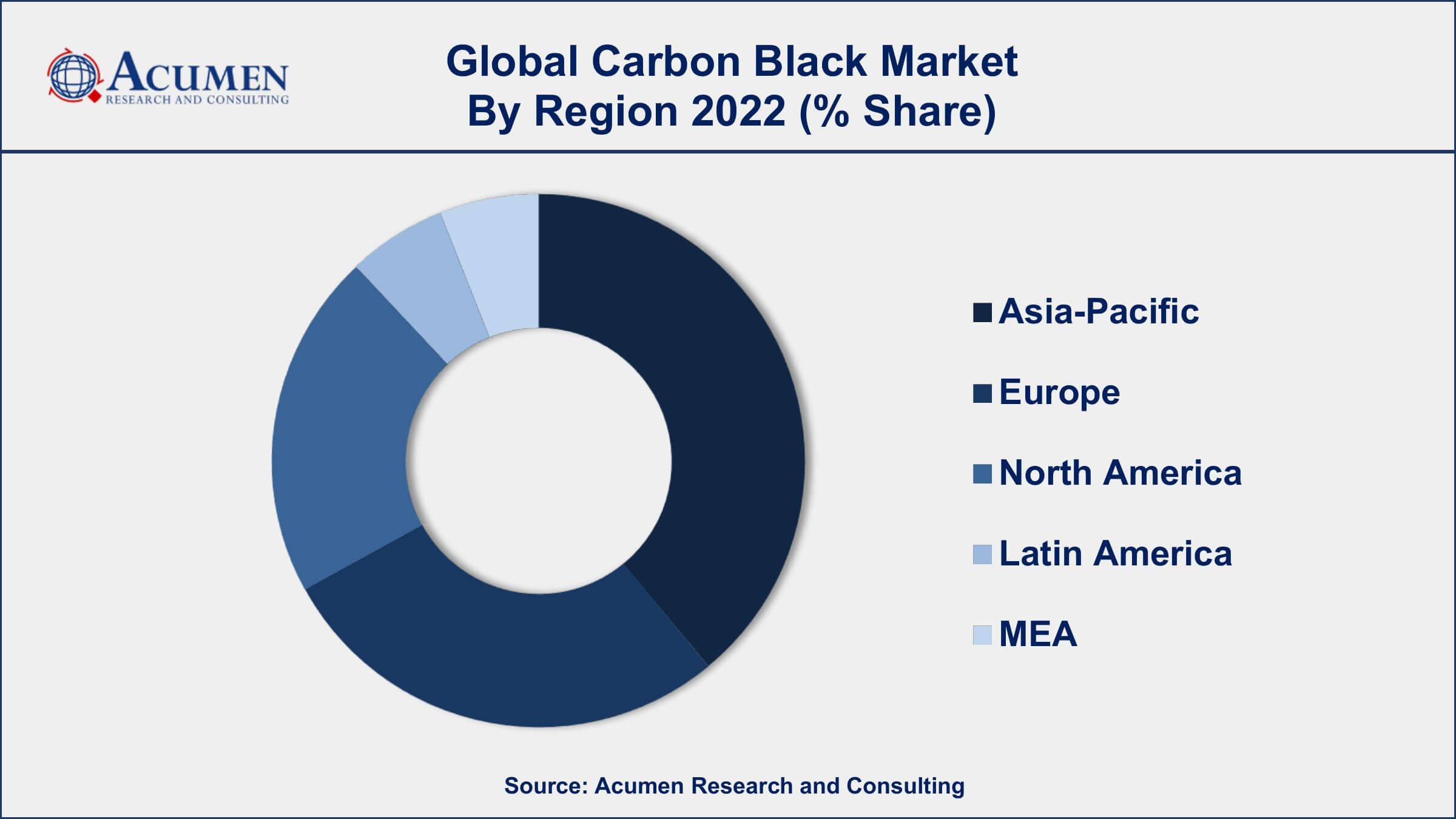

- Asia-Pacific region led with more than 62% of carbon black market share in 2022

- Furnace black is the most widely used type of carbon black, accounting for around 85% of the market share in 2022

- The tire industry is the largest consumer of carbon black, accounting for over 80% of the market share in 2022

- According to research, around 30% of the weight of a tire is composed of rubber, which is usually strengthened with carbon black

- Growing demand for conductive carbon black in batteries and other electronic devices, drives the carbon black market value

Carbon black is a type of finely divided carbon that is produced through the incomplete combustion of hydrocarbons such as oil or gas. It is primarily used as a reinforcing filler in rubber products, such as tires, as well as in other industrial applications, including plastics, inks, coatings, and batteries. Carbon black is valued for its ability to improve the durability, strength, and conductivity of these materials.

The carbon black market has experienced steady growth over the past decade, driven by increasing demand from the tire industry, which is the largest consumer of carbon black. The growth of the automotive industry, particularly in developing countries, has been a major factor driving this demand. In addition, increasing demand for high-performance tires, which require greater amounts of carbon black, has also contributed to market growth. The market is expected to continue to grow over the next several years, driven by the increasing use of carbon black in other applications, such as plastics and batteries, as well as the development of new, high-performance carbon black products.

Global Carbon Black Market Trends

Market Drivers

- Increasing demand from the tire industry, particularly for high-performance tires

- Growing automotive industry, particularly in developing countries

- Rising demand for plastics and other materials containing carbon black

- Growing demand for conductive carbon black in batteries and other electronic devices

- Increasing the use of carbon black as a pigment in inks and coatings

Market Restraints

- Environmental and health concerns related to carbon black production

- Volatility in raw material prices

Market Opportunities

- Development of new, innovative carbon black products for high-tech applications

- Advancements in sustainable and environmentally friendly production methods

Carbon Black Market Report Coverage

| Market | Carbon Black Market |

| Carbon Black Market Size 2022 | USD 20.9 Billion |

| Carbon Black Market Forecast 2032 | USD 32.4 Billion |

| Carbon Black Market CAGR During 2023 - 2032 | 4.6% |

| Carbon Black Market Analysis Period | 2020 - 2032 |

| Carbon Black Market Base Year | 2022 |

| Carbon Black Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Grade, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Tokai Carbon Co, Ltd., Ralson, Birla Carbon, Philips Carbon Black Limited, Orion Engineered Carbons GmbH, International China Oak Investment Holdings Co., Ltd., Omsk Carbon Group, Himadri Speciality Chemical Limited, Atlas Organics Private Limited, Cabot Corporation, and Continental Carbon Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Carbon black is a type of finely divided carbon that is produced through the incomplete combustion of hydrocarbons such as oil or gas. It is composed of tiny, spherical particles that are black in color and have a high surface area-to-volume ratio. Carbon black is primarily used as a reinforcing filler in rubber products, particularly tires, where it helps to improve their durability, strength, and resistance to wear.

In addition to its use in rubber products, carbon black has a wide range of other industrial applications. It is used as a pigment in inks, coatings, and plastics, where it provides a deep black color and high opacity. It is also used as a conductive additive in electronic devices, including batteries, where it helps to improve their electrical conductivity and overall performance. Carbon black is also used in the production of electrodes, carbon brushes, and other electrical components. In the construction industry, it is used as a lightweight filler in concrete and other building materials. Additionally, carbon black is used in the production of various types of carbon black masterbatches, which are used to color plastic products.

The global carbon black market has been experiencing steady growth over the past few years, driven by increasing demand from the tire industry, which is the largest consumer of carbon black. The growth of the automotive industry, particularly in emerging economies, has been a major factor driving this demand. The expansion of industrial activities, infrastructure development, and the increasing use of plastics and other materials containing carbon black are also contributing to the carbon black market growth. The market is expected to continue to grow over the next several years, driven by the development of new and innovative products, growing demand for sustainable production methods, and investments in research and development.

Carbon Black Market Segmentation

The global carbon black market segmentation is based on type, grade, application, and geography.

Carbon Black Market By Type

- Channel Black

- Lamp Black

- Acetylene Black

- Furnace Black

According to the carbon black industry analysis, the furnace black segment accounted for the largest market share in 2022. It is produced through the incomplete combustion of hydrocarbons in a furnace, resulting in a highly pure and finely divided carbon black powder. Furnace black is used primarily as a reinforcing filler in rubber products, such as tires, and is valued for its ability to improve the durability, strength, and conductivity of these materials. The furnace black segment has been experiencing steady growth in recent years, driven by increasing demand from the tire industry. The growth of the automotive industry, particularly in emerging economies, has been a major factor driving this demand. The increasing demand for high-performance tires, which require greater amounts of furnace black, has also contributed to market growth. In addition, advancements in furnace black technology and manufacturing processes are enabling manufacturers to produce high-quality, specialty furnace black products that offer improved performance and sustainability.

Carbon Black Market By Grade

- Speciality Grade

- Standard Grade

In terms of grades, the speciality grade segment is expected to witness significant growth in the coming years. Specialty grade carbon black is a type of high-performance carbon black that is produced using advanced manufacturing processes and is used in a wide range of specialty applications, such as printing inks, coatings, plastics, and electronics. The specialty grade segment has been experiencing significant growth in recent years, driven by the increasing demand for high-performance products and the growing trend towards customization and product differentiation. One of the key drivers of growth in the specialty grade segment is the increasing demand for high-quality, high-performance carbon black products in a variety of industries.

Carbon Black Market By Application

- Coatings & Inks

- Plastics

- Tires

- Non-Tire Rubber

- Others

According to the carbon black market forecast, the tires segment is expected to witness significant growth in the coming years. Carbon black is used as a reinforcing filler in tire compounds to improve the strength, durability, and performance of tires. The growth of the tire segment has been a major factor driving the overall market growth. The tire segment has been experiencing steady growth in recent years, driven by the expansion of the automotive industry, particularly in emerging economies. The increasing demand for passenger cars, commercial vehicles, and off-road vehicles has created new opportunities for the tire industry, which is driving demand for carbon black. The growing demand for high-performance tires, which require greater amounts of carbon black, has also contributed to market growth.

Carbon Black Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Carbon Black Market Regional Analysis

Asia-Pacific is the dominant region in the global carbon black market, accounting for the largest share of the market. This can be attributed to several factors, including the region's large and rapidly growing industrial base, particularly in the automotive and tire industries. The Asia-Pacific region is home to some of the largest automotive and tire manufacturing companies in the world, such as Toyota, Honda, Bridgestone, and Michelin, which are major consumers of carbon black. Moreover, the region has a large population, which has led to the growth of the construction and infrastructure sectors, driving demand for carbon black in applications such as coatings, plastics, and construction materials. Additionally, the increasing demand for consumer electronics and appliances in the region is driving the growth of specialty grade carbon black, which is used in the production of these products.

Carbon Black Market Player

Some of the top carbon black market companies offered in the professional report include Tokai Carbon Co, Ltd., Ralson, Birla Carbon, Philips Carbon Black Limited, Orion Engineered Carbons GmbH, International China Oak Investment Holdings Co., Ltd., Omsk Carbon Group, Himadri Speciality Chemical Limited, Atlas Organics Private Limited, Cabot Corporation, and Continental Carbon Company.

Frequently Asked Questions

What was the market size of the global carbon black in 2022?

The market size of carbon black was USD 20.9 Billion in 2022.

What is the CAGR of the global carbon black market from 2023 to 2032?

The CAGR of carbon black is 4.6% during the analysis period of 2023 to 2032.

Which are the key players in the carbon black market?

The key players operating in the global market are including Tokai Carbon Co, Ltd., Ralson, Birla Carbon, Philips Carbon Black Limited, Orion Engineered Carbons GmbH, International China Oak Investment Holdings Co., Ltd., Omsk Carbon Group, Himadri Speciality Chemical Limited, Atlas Organics Private Limited, Cabot Corporation, and Continental Carbon Company.

Which region dominated the global carbon black market share?

Asia-Pacific held the dominating position in carbon black industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of carbon black during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global carbon black industry?

The current trends and dynamics in the carbon black industry include increasing demand from the tire industry, particularly for high-performance tires, growing automotive industry, particularly in developing countries, and rising demand for plastics and other materials containing carbon black.

Which grade held the maximum share in 2022?

The speciality grade held the maximum share of the carbon black industry.