Cannabis Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Cannabis Packaging Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

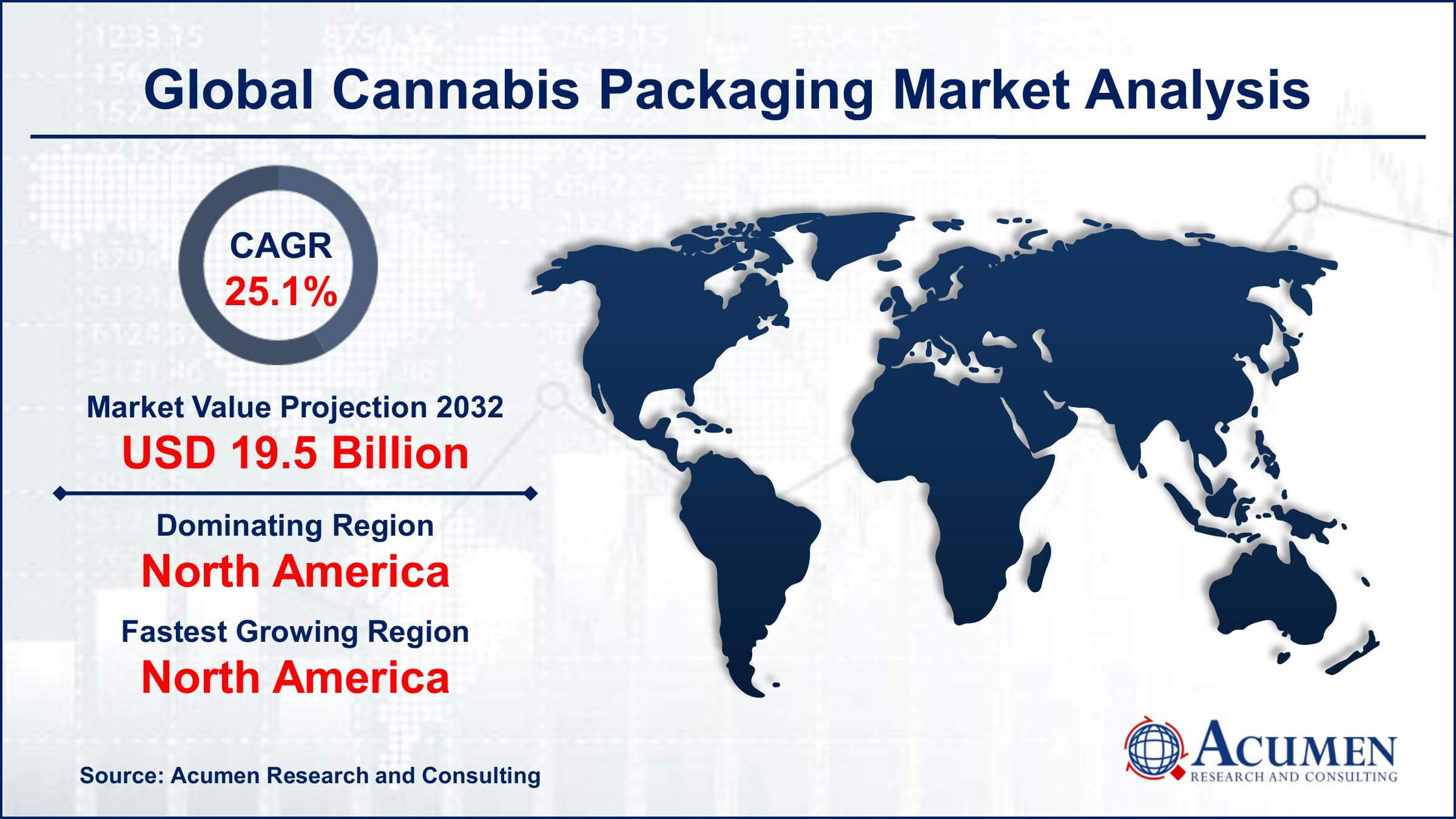

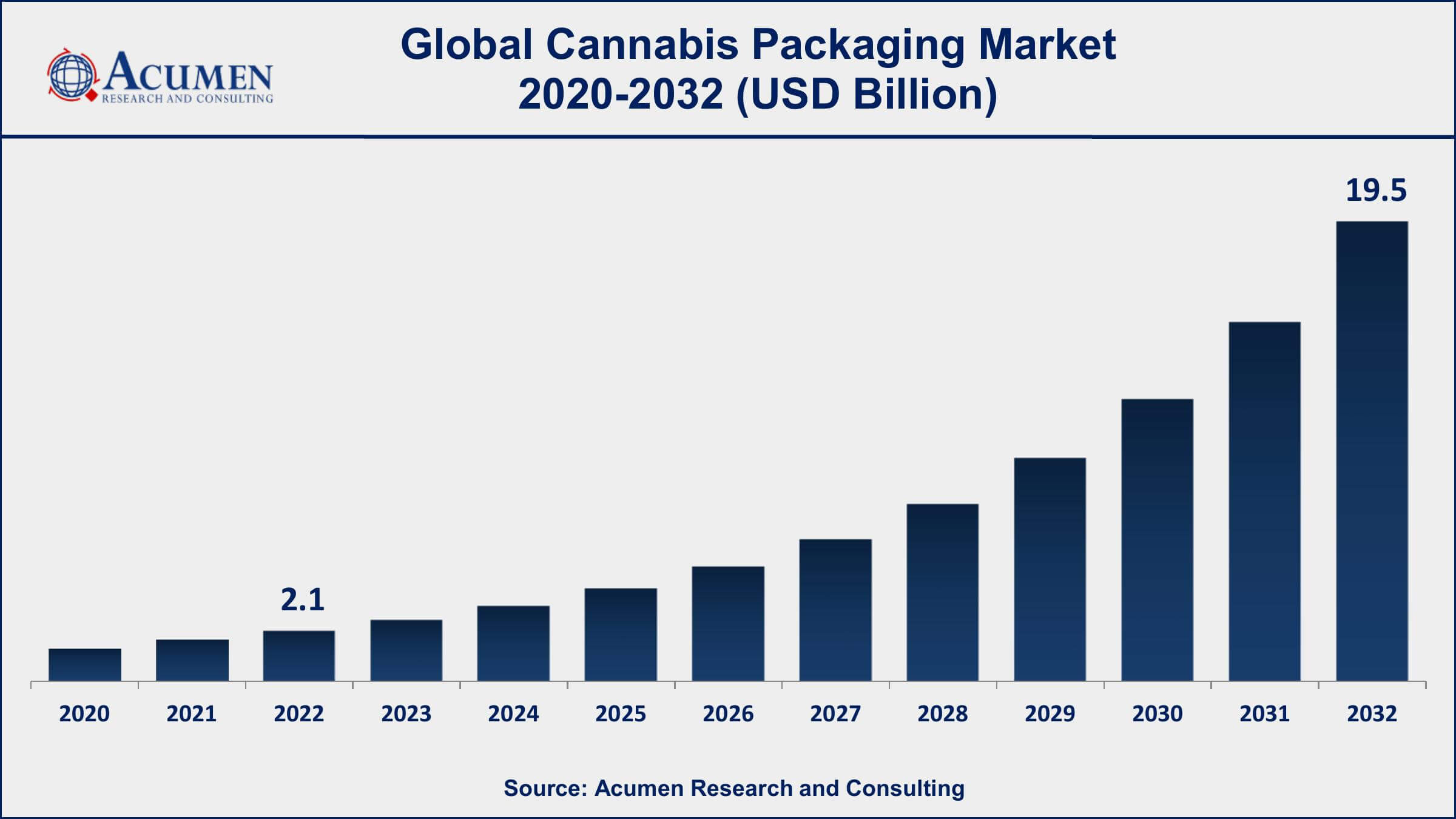

The Global Cannabis Packaging Market Size accounted for USD 2.1 Billion in 2022 and is projected to achieve a market size of USD 19.5 Billion by 2032 growing at a CAGR of 25.1% from 2023 to 2032.

Cannabis Packaging Market Highlights

- Global Cannabis Packaging Market revenue is expected to increase by USD 19.5 Billion by 2032, with a 25.1% CAGR from 2023 to 2032

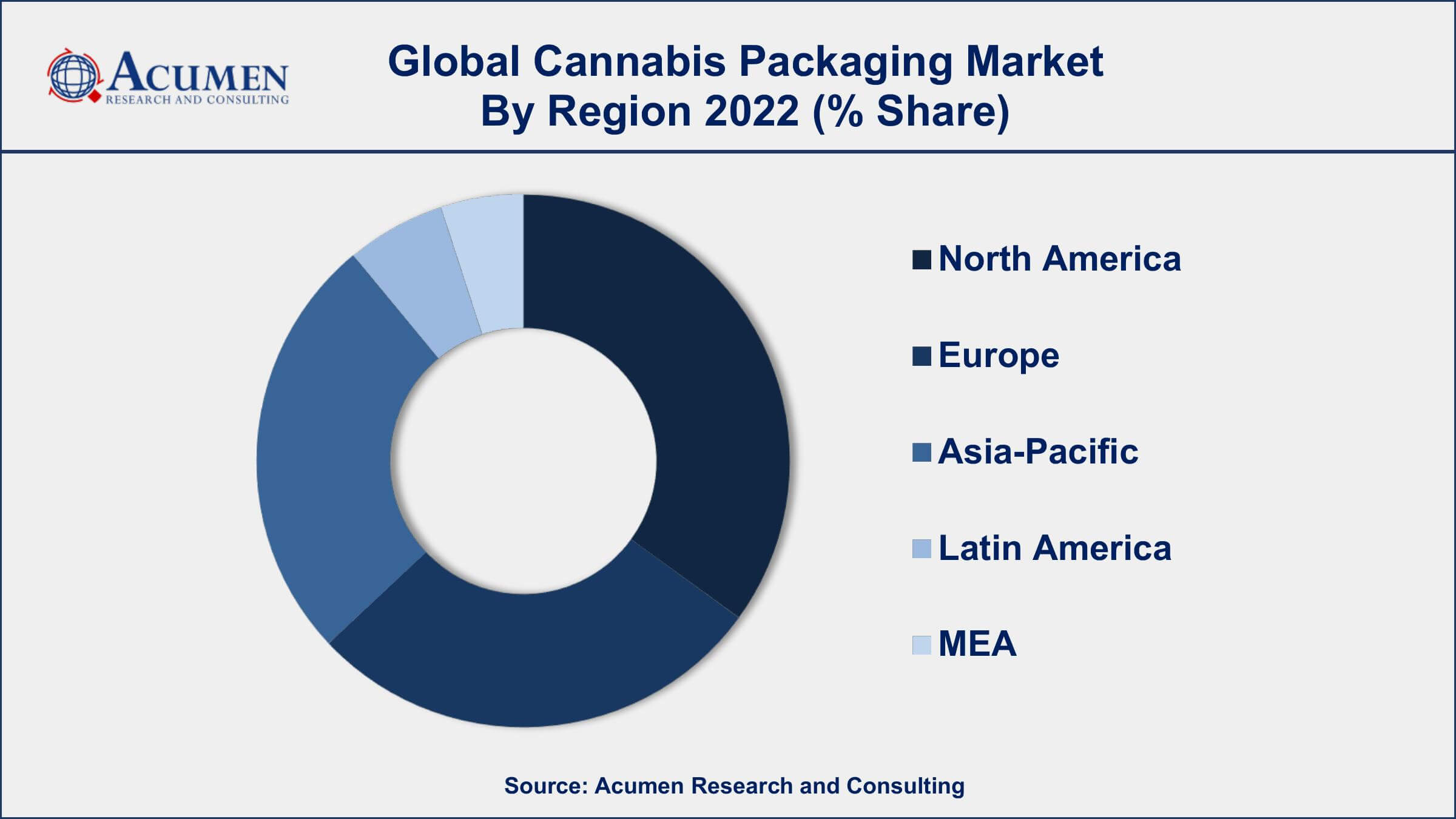

- North America region led with more than 46% of Cannabis Packaging Market share in 2022

- By material, the plastic segment accounted more than 52% of the revenue share in 2022

- By product, the bottles & jars segment has recorded more than 45% of the revenue share in 2022

- By application, the recreational use segment is predicted to grow at the fastest CAGR of 26.4% between 2023 and 2032

- Growing market for CBD-infused products and other cannabis derivatives, drives the Cannabis Packaging Market value

Cannabis packaging refers to the specialized packaging solutions designed for the storage, transport, and display of cannabis products. As the cannabis industry continues to grow and evolve, the need for compliant and innovative packaging has become increasingly important. Cannabis packaging serves several crucial purposes, including product protection, safety, regulatory compliance, and brand differentiation.

The market growth of cannabis packaging has been substantial in recent years, primarily driven by the legalization of cannabis for both medicinal and recreational use in several countries and states. This legalization has led to a surge in the number of cannabis products and brands entering the market, creating a significant demand for packaging solutions. Additionally, the regulatory requirements surrounding cannabis packaging, such as child-resistant packaging and labeling compliance, have further fueled the cannabis packaging market growth. The cannabis packaging market is expected to continue its upward trajectory in the coming years. Factors contributing to its growth include the expansion of legalized cannabis markets, the introduction of new product formats, and the increasing focus on sustainability in packaging solutions. As more regions legalize cannabis and consumer acceptance grows, the demand for innovative and compliant packaging will continue to rise.

Global Cannabis Packaging Market Trends

Market Drivers

- Legalization of cannabis in various regions and countries

- Growing acceptance and changing attitudes towards cannabis

- Increasing demand for medicinal and recreational cannabis products

- Emergence of new cannabis product categories, such as edibles and concentrates

- Stringent regulations regarding child-resistant packaging and product labeling

Market Restraints

- Complex and evolving regulatory landscape surrounding cannabis

- Limited access to banking and financial services for cannabis-related businesses

- Uncertainty regarding federal legalization in some countries

Market Opportunities

- Increasing demand for child-resistant and tamper-evident packaging solutions

- Growing market for CBD-infused products and other cannabis derivatives

- Expansion of e-commerce platforms and online sales channels for cannabis

Cannabis Packaging Market Report Coverage

| Market | Cannabis Packaging Market |

| Cannabis Packaging Market Size 2022 | USD 2.1 Billion |

| Cannabis Packaging Market Forecast 2032 | USD 19.5 Billion |

| Cannabis Packaging Market CAGR During 2023 - 2032 | 25.1% |

| Cannabis Packaging Market Analysis Period | 2020 - 2032 |

| Cannabis Packaging Market Base Year | 2022 |

| Cannabis Packaging Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | KushCo Holdings Inc., Stink Sack, Sana Packaging, Pollen Gear, Collective Supply, CannaPack Solutions, Greenlane Holdings Inc., Dixie Brands Inc., PAX Labs, and Smokus Focus. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cannabis packaging refers to the specialized packaging solutions designed specifically for cannabis products. With the legalization of cannabis for both medicinal and recreational purposes in many regions, the packaging of cannabis has become a crucial aspect of the industry. Cannabis packaging serves multiple purposes, including product protection, safety, regulatory compliance, and branding.

One of the primary functions of cannabis packaging is to protect the product from external factors such as moisture, light, and air. Cannabis is a sensitive plant material that can degrade if exposed to these elements, leading to a loss of potency and quality. Proper packaging helps maintain the freshness, flavor, and potency of the cannabis products, ensuring a positive consumer experience. Moreover, cannabis packaging plays a crucial role in ensuring product safety. Child-resistant packaging is a regulatory requirement in many jurisdictions to prevent accidental consumption by children. Packaging solutions such as child-resistant containers and tamper-evident seals help keep cannabis products out of the hands of unintended users and promote responsible use.

The cannabis packaging market has experienced significant growth in recent years and is expected to continue expanding at a robust rate. The market growth can be attributed to several key factors. First and foremost, the legalization of cannabis for both medicinal and recreational use in numerous countries and states has created a substantial demand for cannabis products. This increased demand has consequently driven the need for compliant and innovative packaging solutions. Furthermore, the rapid expansion of the cannabis industry has led to the emergence of numerous cannabis brands and product variations. Each brand seeks to differentiate itself in the market and establish a unique identity. As a result, there is a growing demand for customized packaging options that not only comply with regulatory requirements but also effectively showcase the brand's image and values.

Cannabis Packaging Market Segmentation

The global Cannabis Packaging Market segmentation is based on material, product, application, and geography.

Cannabis Packaging Market By Material

- Plastic

- Glass

- Metal

- Paper

According to the cannabis packaging industry analysis, the plastic segment accounted for the largest market share in 2022. Plastic packaging materials offer several advantages, including durability, versatility, and cost-effectiveness. These factors have contributed to the increasing adoption of plastic packaging in the cannabis industry. One key factor driving the growth of the plastic segment is the need for child-resistant packaging. Many regulatory bodies require cannabis products to be packaged in child-resistant containers to ensure the safety of children. Plastic packaging materials, such as rigid plastics or specialized child-resistant closures, provide an effective solution to meet these regulatory requirements. Additionally, plastic packaging offers excellent product protection, keeping cannabis products safe from moisture, light, and air exposure. This is particularly important for preserving the potency and quality of cannabis products, including flowers, edibles, and concentrates.

Cannabis Packaging Market By Product

- Bottles & Jars

- Tins

- Tubes

- Blisters & clamshells

- Pouches

- Others

In terms of products, the bottles & jars segment is expected to witness significant growth in the coming years. Bottles and jars are widely used for packaging various cannabis products, including flowers, concentrates, oils, and tinctures, due to their suitability for storage, protection, and regulatory compliance. One of the primary drivers of growth in this segment is the need for child-resistant packaging. Many regulatory frameworks require cannabis products to be packaged in child-resistant containers, and bottles and jars are well-suited for this purpose. They can be designed with child-resistant caps or closures, providing an effective barrier and ensuring the safety of children. Moreover, bottles and jars offer excellent product protection. They are designed to keep cannabis products safe from moisture, air, and light exposure, which can degrade the quality and potency of the products.

Cannabis Packaging Market By Application

- Medical Use

- Recreational Use

According to the cannabis packaging market forecast, the recreational use segment is expected to witness significant growth in the coming years. As more regions and countries legalize cannabis for recreational purposes, the demand for cannabis products and associated packaging has witnessed a substantial increase. The legalization of recreational cannabis has led to a surge in consumer demand for a variety of cannabis products, including flowers, edibles, concentrates, and pre-rolls. Each of these product categories requires specific packaging solutions to ensure proper storage, freshness, and regulatory compliance. The packaging needs of the recreational segment are diverse and cater to different consumer preferences and consumption methods, leading to a wide range of packaging options. Furthermore, the recreational use segment has created opportunities for branding and product differentiation. With the increasing number of cannabis brands entering the market, packaging plays a crucial role in capturing consumer attention and conveying brand identity.

Cannabis Packaging Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cannabis Packaging Market Regional Analysis

Geographically, North America dominates the cannabis packaging market in 2022. North America has been at the forefront of cannabis legalization, with several states in the United States and Canada legalizing cannabis for both medical and recreational use. This early adoption of cannabis legalization has provided a robust and established market for cannabis products, which in turn drives the demand for packaging solutions. The mature and well-regulated cannabis markets in North America have created a favorable environment for packaging companies to thrive and innovate. Moreover, North America boasts a strong manufacturing and packaging infrastructure. The region is home to numerous packaging companies that specialize in providing compliant and customized solutions for the cannabis industry. These companies have the expertise, equipment, and capacity to meet the demands of the growing market. Additionally, North America has a well-established distribution network that enables efficient and timely delivery of cannabis products to various retail locations.

Cannabis Packaging Market Player

Some of the top cannabis packaging market companies offered in the professional report include KushCo Holdings Inc., Stink Sack, Sana Packaging, Pollen Gear, Collective Supply, CannaPack Solutions, Greenlane Holdings Inc., Dixie Brands Inc., PAX Labs, and Smokus Focus.

Frequently Asked Questions

What was the market size of the global cannabis packaging in 2022?

The market size of cannabis packaging was USD 2.1 Billion in 2022.

What is the CAGR of the global cannabis packaging market from 2023 to 2032?

The CAGR of cannabis packaging is 25.1% during the analysis period of 2023 to 2032.

Which are the key players in the cannabis packaging market?

The key players operating in the global market are including KushCo Holdings Inc., Stink Sack, Sana Packaging, Pollen Gear, Collective Supply, CannaPack Solutions, Greenlane Holdings Inc., Dixie Brands Inc., PAX Labs, and Smokus Focus.

Which region dominated the global cannabis packaging market share?

North America held the dominating position in cannabis packaging industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of cannabis packaging during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global cannabis packaging industry?

The current trends and dynamics in the cannabis packaging industry include legalization of cannabis in various regions and countries, growing acceptance and changing attitudes towards cannabis, and increasing demand for medicinal and recreational cannabis products.

Which material held the maximum share in 2022?

The plastic material held the maximum share of the cannabis packaging industry.