Cancer Immunotherapy Drug Discovery Outsourcing Market | Acumen Research and Consulting

Cancer Immunotherapy Drug Discovery Outsourcing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

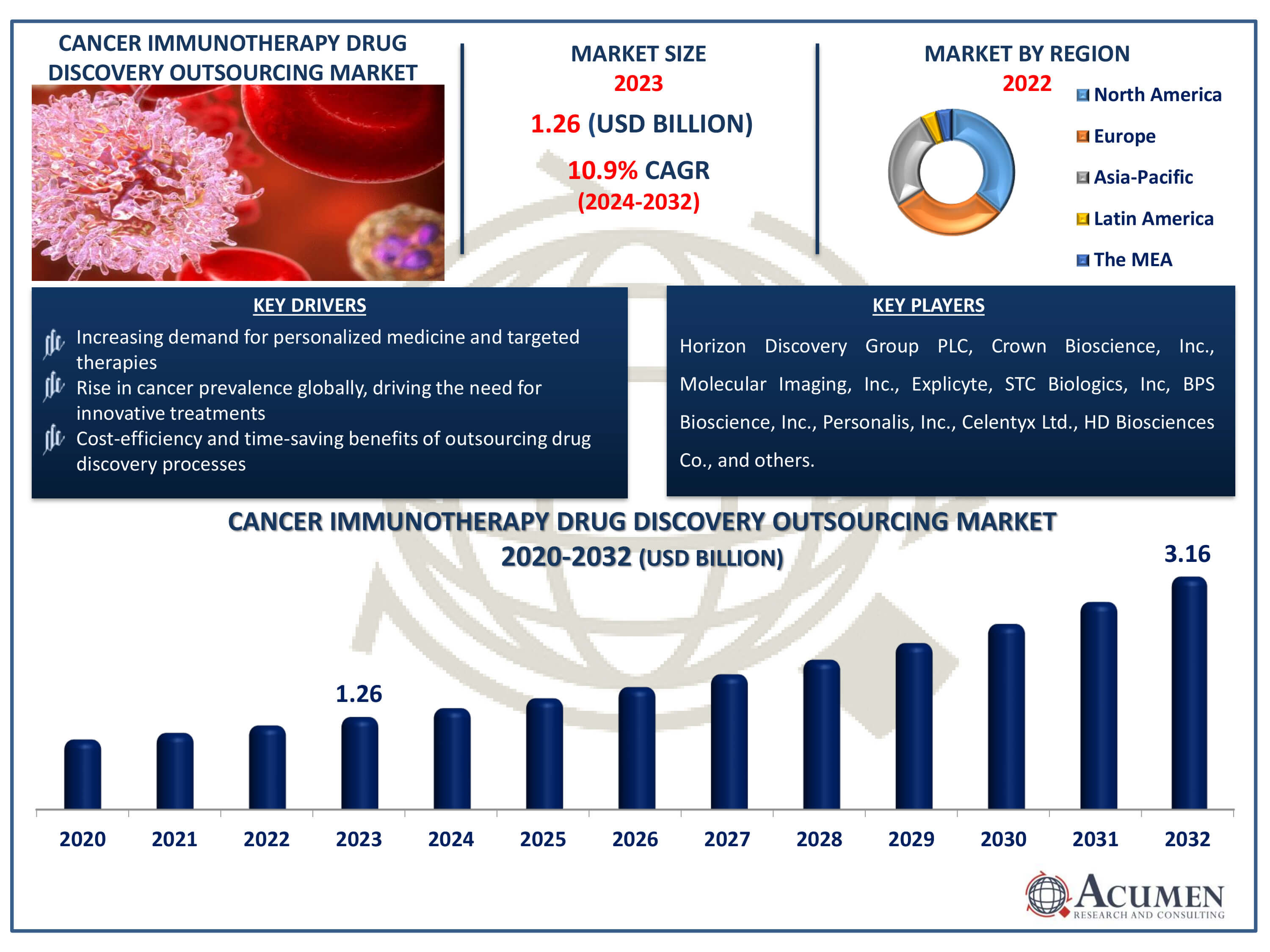

The Cancer Immunotherapy Drug Discovery Outsourcing Market Size accounted for USD 1.26 Billion in 2023 and is estimated to achieve a market size of USD 3.16 Billion by 2032 growing at a CAGR of 10.9% from 2024 to 2032.

Cancer Immunotherapy Drug Discovery Outsourcing Market Highlights

- Global cancer immunotherapy drug discovery outsourcing market revenue is poised to garner USD 3.16 billion by 2032 with a CAGR of 10.9% from 2024 to 2032

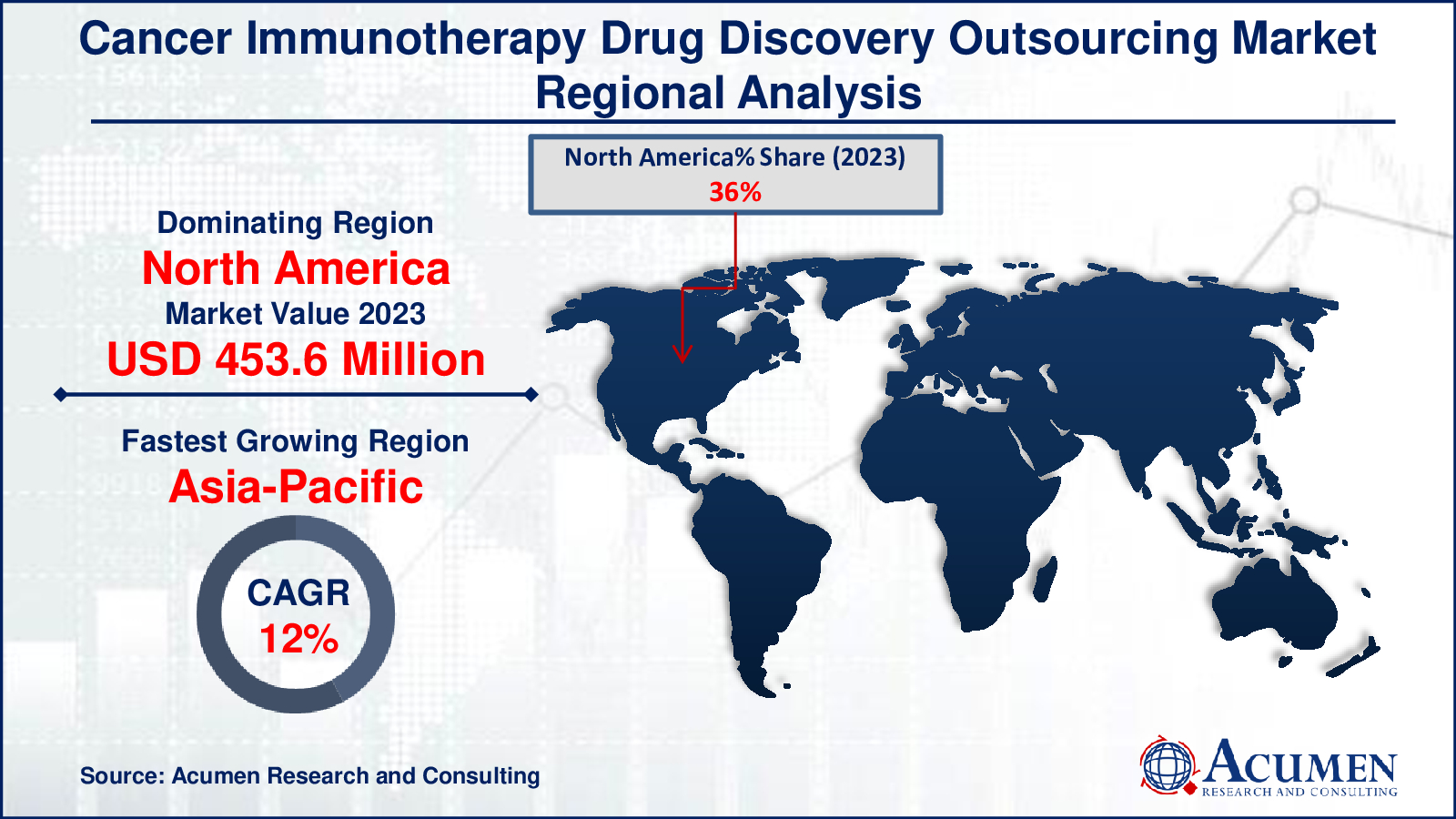

- North America cancer immunotherapy drug discovery outsourcing market value occupied around USD 453.6 million in 2023

- Asia-Pacific cancer immunotherapy drug discovery outsourcing market growth will record a CAGR of more than 12% from 2024 to 2032

- Among drug type, the monoclonal antibodies sub-segment generated 63% of the market share in 2023

- Based on cancer type, the lung sub-segment generated 25% of market share in 2023

- Growing demand for specialized CRO services due to the complexity of immunotherapy drug development and regulatory requirements is the cancer immunotherapy drug discovery outsourcing market trend that fuels the industry demand

Cancer immunotherapy drug discovery outsourcing refers to the practice of leveraging external expertise and resources, typically through contract research organizations (CROs), to accelerate the development of immunotherapy drugs for treating cancer. This outsourcing involves delegating various stages of drug discovery, such as target identification, assay development, screening, and preclinical studies, to specialized firms. By doing so, pharmaceutical companies can access specialized knowledge and technologies that may not be available in-house, thereby speeding up the drug discovery process. This approach aims to harness the power of the immune system to target and destroy cancer cells more effectively than traditional therapies. Outsourcing also allows for cost efficiencies and flexibility in managing research priorities, ultimately aiming to bring new and effective cancer treatments to patients more rapidly.

Global Cancer Immunotherapy Drug Discovery Outsourcing Market Dynamics

Market Drivers

- Increasing demand for personalized medicine and targeted therapies

- Rise in cancer prevalence globally, driving the need for innovative treatments

- Cost-efficiency and time-saving benefits of outsourcing drug discovery processes

Market Restraints

- Stringent regulatory requirements and compliance challenges

- High costs associated with advanced immunotherapy research and development

- Intellectual property concerns and confidentiality issues in outsourcing collaborations

Market Opportunities

- Growing collaborations between pharmaceutical companies and contract research organizations (CROs)

- Advancements in technology such as artificial intelligence and genomics enhancing drug discovery capabilities

- Expansion of immunotherapy research into new therapeutic areas beyond oncology

Cancer Immunotherapy Drug Discovery Outsourcing Market Report Coverage

| Market | Cancer Immunotherapy Drug Discovery Outsourcing Market |

| Cancer Immunotherapy Drug Discovery Outsourcing Market Size 2022 | USD 1.26 Billion |

| Cancer Immunotherapy Drug Discovery Outsourcing Market Forecast 2032 | USD 3.16 Billion |

| Cancer Immunotherapy Drug Discovery Outsourcing Market CAGR During 2023 - 2032 | 10.9% |

| Cancer Immunotherapy Drug Discovery Outsourcing Market Analysis Period | 2020 - 2032 |

| Cancer Immunotherapy Drug Discovery Outsourcing Market Base Year |

2022 |

| Cancer Immunotherapy Drug Discovery Outsourcing Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Drug Type, By Cancer Type, By Service Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Horizon Discovery Group PLC, Crown Bioscience, Inc., Molecular Imaging, Inc., Explicyte, STC Biologics, Inc, BPS Bioscience, Inc., Personalis, Inc., Celentyx Ltd., HD Biosciences Co., Promega Corporation, DiscoveRx Corporation, Genscript Biotech Corporation, and ImmunXperts SA |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cancer Immunotherapy Drug Discovery Outsourcing Market Insights

The increasing global prevalence of cancer has spurred a corresponding demand for innovative treatments, catalyzing growth in the cancer immunotherapy drug discovery outsourcing market. For instance, according to National Institute of Health, in 2023, the United States is expected to see 1,958,310 new cancer cases and 609,820 cancer-related deaths. This sector thrives on outsourcing research and development activities to specialized firms, leveraging their expertise in developing novel immunotherapy. By partnering with these firms, pharmaceutical companies aim to expedite the discovery and development of new cancer treatments, addressing the urgent need for effective therapies. As a result, the market for cancer immunotherapy drug discovery outsourcing is poised for significant expansion, driven by the imperative to improve patient outcomes and healthcare outcomes worldwide.

The high costs linked to advanced immunotherapy research and development presents a significant challenge for the cancer immunotherapy drug discovery outsourcing market. These expenses encompass intricate technological requirements, specialized expertise, and rigorous regulatory compliance, amplifying financial burdens. As a result, pharmaceutical companies often seek outsourcing solutions to mitigate these costs, tapping into specialized service providers for efficient drug discovery processes. Despite these challenges, strategic outsourcing remains a vital strategy to navigate the complexities and costs associated with advancing immunotherapy treatments for cancer.

The growing collaborations between pharmaceutical companies and contract research organizations (CROs) are transforming the landscape of cancer immunotherapy drug discovery outsourcing. For instance, in February 2023, Personalis, Inc. and Moderna, Inc. announced a new collaboration to utilize the Personalis NeXT Platform in upcoming clinical trials for mRNA-4157/V940, an investigational personalized cancer vaccine developed in partnership by Moderna and Merck. These partnerships leverage the specialized expertise of CROs in preclinical and clinical research, accelerating the development of novel immunotherapy’s. By outsourcing drug discovery, pharmaceutical firms can access a broader range of technologies and reduce costs associated with in-house research. This trend fosters innovation and expedites the delivery of promising cancer treatments to patients worldwide.

Cancer Immunotherapy Drug Discovery Outsourcing Market Segmentation

The worldwide market for cancer immunotherapy drug discovery outsourcing is split based on drug type, cancer type, service type, and geography.

Cancer Immunotherapy Drug Discovery Outsourcing by Drug type

- Monoclonal Antibodies

- Immunomodulators

- Oncolytic Viral Therapies and Cancer Vaccines

- Others

According to the cancer immunotherapy drug discovery outsourcing industry analysis, monoclonal antibodies dominate the market due to their specificity and efficacy in targeting cancer cells while sparing healthy tissues. These biologics have shown significant success in clinical trials, leading to a surge in their development and commercialization. Pharmaceutical companies prefer outsourcing to specialized firms to leverage their expertise and advanced technologies, ensuring efficient and cost-effective drug discovery. This trend has driven substantial growth in the market, making monoclonal antibodies a cornerstone in cancer immunotherapy.

Cancer Immunotherapy Drug Discovery Outsourcing by Cancer Type

- Lung

- Breast

- Colorectal

- Melanoma

- Prostate

- Head and Neck

- Ovarian

- Pancreatic

The lung segment is the largest cancer type category in the cancer immunotherapy drug discovery outsourcing market and it is expected to increase over the industry. Lung cancer, being one of the most prevalent and deadly forms of cancer. The high incidence and mortality rates drive extensive research and development efforts, leading to a surge in demand for outsourcing services to accelerate drug discovery. For instance, in 2023, approximately 238,340 individuals (117,550 men and 120,790 women) are expected to receive a lung cancer diagnosis, with 127,070 fatalities anticipated from the disease. This focus ensures the rapid advancement of innovative therapies aimed at improving patient outcomes. Consequently, lung cancer remains a dominant area in cancer immunotherapy drug discovery outsourcing.

Cancer Immunotherapy Drug Discovery Outsourcing by Service Type

- Target Identification and Validation

- Lead Screening and Characterization

- Cell-Based Assays

According to the cancer immunotherapy drug discovery outsourcing industry analysis, target identification and validation are dominates market. These processes involve identifying and confirming biological targets for new therapies, ensuring their relevance in combating cancer. Effective target identification and validation are essential for developing successful immunotherapy, driving significant investment and outsourcing in this area. Consequently, companies specializing in these processes are pivotal in the advancement of novel cancer treatments.

Cancer Immunotherapy Drug Discovery Outsourcing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cancer Immunotherapy Drug Discovery Outsourcing Market Regional Analysis

For several reasons, North America leads the cancer immunotherapy drug discovery outsourcing market due to its advanced healthcare infrastructure and substantial investment in research and development. For instance, in July 2021, LabCorp revealed the acquisition of OmniSeq®, a move aimed at enhancing its cancer drug development and discovery portfolio. The region's strong presence of biopharmaceutical companies and academic institutions accelerates innovation in cancer therapies. Robust regulatory frameworks and a high prevalence of cancer cases further drive demand for cutting-edge treatments. Overall, these factors collectively position North America as the dominant player in this market.

The Asia-Pacific region is experiencing rapid growth in the cancer immunotherapy drug discovery outsourcing market due to increasing investment in healthcare infrastructure, a rising incidence of cancer, and favorable government initiatives. The region's cost-effective research and development capabilities, coupled with a large, diverse patient population, attract global pharmaceutical companies. For instance, in May 2022, JSR Life Sciences businesses Crown Bioscience and Medical & Biological Laboratories (MBL) announced the formation of a joint venture to enhance the availability of Crown Bioscience's preclinical services for Japanese clients. Additionally, advancements in biotechnology and collaboration between academic institutions and industry players bolster this growth. The expansion of clinical trial networks further enhances the region's appeal for outsourcing drug discovery.

Cancer Immunotherapy Drug Discovery Outsourcing Market Players

Some of the top cancer immunotherapy drug discovery outsourcing companies offered in our report include Horizon Discovery Group PLC, Crown Bioscience, Inc., Molecular Imaging, Inc., Explicyte, STC Biologics, Inc, BPS Bioscience, Inc., Personalis, Inc., Celentyx Ltd., HD Biosciences Co., Promega Corporation, DiscoveRx Corporation, Genscript Biotech Corporation, and ImmunXperts SA.

Frequently Asked Questions

How big is the cancer immunotherapy drug discovery outsourcing market?

The cancer immunotherapy drug discovery outsourcing market size was valued at USD 1.26 billion in 2023.

What is the CAGR of the global cancer immunotherapy drug discovery outsourcing market from 2024 to 2032?

The CAGR of cancer immunotherapy drug discovery outsourcing is 10.9% during the analysis period of 2024 to 2032.

Which are the key players in the cancer immunotherapy drug discovery outsourcing market?

The key players operating in the global market are including Horizon Discovery Group PLC, Crown Bioscience, Inc., Molecular Imaging, Inc., Explicyte, STC Biologics, Inc, BPS Bioscience, Inc., Personalis, Inc., Celentyx Ltd., HD Biosciences Co., Promega Corporation, DiscoveRx Corporation, Genscript Biotech Corporation, and ImmunXperts SA

Which region dominated the global cancer immunotherapy drug discovery outsourcing market share?

North America held the dominating position in cancer immunotherapy drug discovery outsourcing industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cancer immunotherapy drug discovery outsourcing during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global cancer immunotherapy drug discovery outsourcing industry?

The current trends and dynamics in the cancer immunotherapy drug discovery outsourcing industry include increasing demand for personalized medicine and targeted therapies, rise in cancer prevalence globally, driving the need for innovative treatments, and cost-efficiency and time-saving benefits of outsourcing drug discovery processes.

Which drug type held the maximum share in 2023?

The monoclonal antibodies drug type held the maximum share of the cancer immunotherapy drug discovery outsourcing industry.?