Cancer Biomarkers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Cancer Biomarkers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

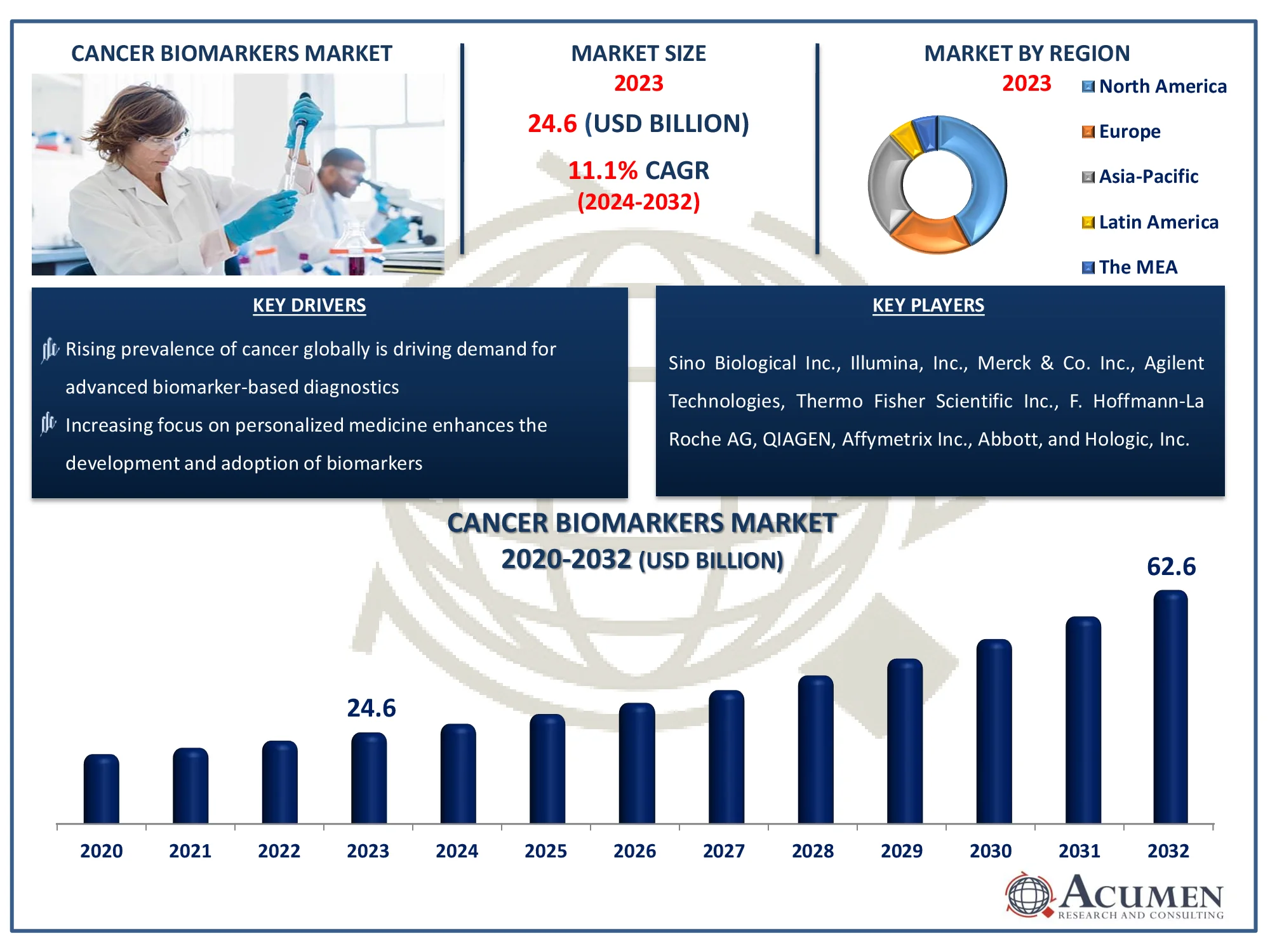

The Global Cancer Biomarkers Market Size accounted for USD 24.6 Billion in 2023 and is estimated to achieve a market size of USD 62.6 Billion by 2032 growing at a CAGR of 11.1% from 2024 to 2032.

Cancer Biomarkers Market Highlights

- Global cancer biomarkers market revenue is poised to garner USD 62.6 billion by 2032 with a CAGR of 11.1% from 2024 to 2032

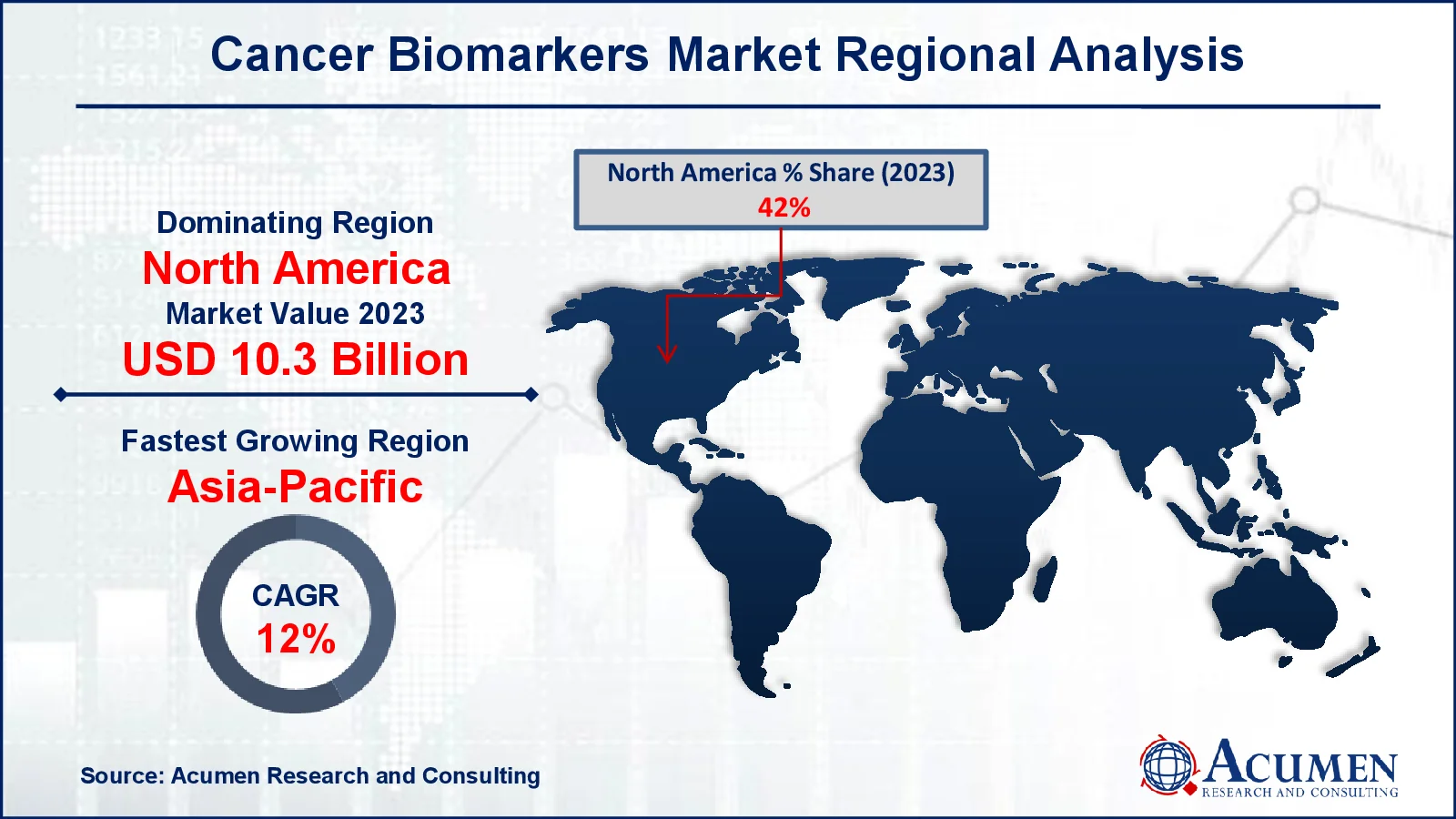

- North America cancer biomarkers market value occupied around USD 10.3 billion in 2023

- Asia-Pacific cancer biomarkers market growth will record a CAGR of more than 12% from 2024 to 2032

- Among cancer type, the breast cancer sub-segment generated more than USD 6.4 billion revenue in 2023

- Based on application, the diagnostics sub-segment generated around significant market share in 2023

- Expanding applications of biomarkers in drug discovery is a popular cancer biomarkers market trend that fuels the industry demand

Cancer biomarker is a substance that helps to indicate the presence of cancer in the body. This substance may be a molecule secreted by a tumor or specific response of the body to a tumor. Genetic, proteomic, and glycomic biomarkers used for various applications such as diagnosis, epidemiology, and prognosis. These are also used in cancer research or drug discovery process field. Biomarkers can be identified in blood, urine, stool, tissue, and other body fluids.

Currently, various biomarkers are using for patient care such as BRCA1/BRCA2 (Breast /Ovarian cancer), EGFR (Non-small cell lung carcinoma), HER-2 (Breast cancer), PSA (Prostate cancer), S100 (Melanoma), and AFP (liver cancer). Based on the specific recognition of intracellular and cancerous cell surface biomarkers, various technologies have been developed to identify a tumor in the body. These technologies include immunoassays, cytogenetic testing, omics technology, and imaging technologies such as CT, Ultrasound, MRI, PET, and mammography.

Global Cancer Biomarkers Market Dynamics

Market Drivers

- Rising prevalence of cancer globally is driving demand for advanced biomarker-based diagnostics

- Increasing focus on personalized medicine enhances the development and adoption of biomarkers

- Advancements in genomics and proteomics technologies boost biomarker research and applications

- Supportive government initiatives and funding for cancer research stimulate market growth

Market Restraints

- High costs of biomarker development and validation limit market accessibility

- Regulatory complexities and stringent approval processes hinder rapid commercialization

- Limited awareness and adoption in developing regions slow down market penetration

Market Opportunities

- Growing adoption of liquid biopsy techniques presents opportunities for non-invasive cancer diagnostics

- Integration of artificial intelligence in biomarker analysis enhances diagnostic precision

- Emerging markets in Asia-Pacific offer significant growth potential due to improving healthcare infrastructure

Cancer Biomarkers Market Report Coverage

|

Market |

Cancer Biomarkers Market |

|

Cancer Biomarkers Market Size 2023 |

USD 24.6 Billion |

|

Cancer Biomarkers Market Forecast 2032 |

USD 62.6 Billion |

|

Cancer Biomarkers Market CAGR During 2024 - 2032 |

11.1% |

|

Cancer Biomarkers Market Analysis Period |

2020 - 2032 |

|

Cancer Biomarkers Market Base Year |

2023 |

|

Cancer Biomarkers Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Cancer Type, By Technology, By Biomolecule, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Sino Biological Inc., Illumina, Inc., Merck & Co. Inc., Agilent Technologies, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche AG, QIAGEN, Affymetrix Inc., Abbott, and Hologic, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cancer Biomarkers Market Insights

Increasing healthcare expenditure, technological advancements which led to high speed and more accuracy, favorable reimbursements in developed countries, and growing awareness about regular health checkups are the major driving factors of the cancer biomarkers market. Additionally, rising number of cancer patients across the world, investment by market players for the development and commercialization of cancer biomarkers, presence of strong pipeline, and increasing affordability of patients for advanced cancer treatment are some of the other factors that propel the market. For instance, according to the World Health Organization (WHO), In 2022, there are expected to be 20 million new cancer diagnoses and 9.7 million fatalities. The expected number of people who survived 5 years after a cancer diagnosis was 53.5 million. Cancer affects around one in every five persons in their lifetime, with one in every nine men and one in every twelve women dying from it.

Increased in cancer cases were observed due to several factors such as ageing, unhealthy lifestyle, and changing social & economic scenario. Rising surgical procedures, such as tumor removal surgery, are likely to drive expansion in the market. According to the American Society of Plastic Surgeons, there are 351,591 procedures for tumor removal, a 2% increase from 2022. High capital investment for research, development, and commercialization, stringent & complex regulatory requirements, and low or no reimbursement in low and middle income countries are key restraining factors of the market. Furthermore, specimen collection and storage, detailed tracking, and retrieval software are necessary for proper management and accurate result. These issues are also anticipated to hinder the overall cancer biomarkers market growth.

Cancer Biomarkers Market Segmentation

The worldwide market for cancer biomarkers is split based on cancer type, technology, biomolecule, application, and geography.

Cancer Biomarkers Market By Cancer Type

- Breast Cancer

- Lung Cancer

- Prostate Cancer

- Colorectal Cancer

- Cervical cancer

- Thyroid gland Cancer

- Kidney Cancer

- Liver cancer

- Others

According to cancer biomarkers industry analysis, breast cancer dominates the market, accounting for the majority of share due to its high global occurrence and increased demand for early detection methods. For instance according to the WHO In 2022, 2.3 million women were diagnosed with breast cancer, with 670,000 fatalities worldwide. Advanced diagnostic technologies and the development of breast cancer-specific biomarkers, such as BRCA1, BRCA2, and HER2, have considerably improved diagnosis and treatment accuracy. Increasing awareness programs, together with government and non-government activities, strengthens early detection efforts. The rise of customized medicine and focused medicines has also increased the demand for biomarkers in breast cancer care. Furthermore, continuing research and technical developments in biomarker discovery are fueling innovation, ensuring that this category continues to lead the cancer biomarkers market.

Cancer Biomarkers Market By Technology

- Omics Technology

- Immunoassay

- Imaging Technology

- Cytogenetic Testing

Imaging technology generates the most revenue in the cancer biomarkers market forecast period due to its broad use in non-invasive cancer screening and monitoring. PET, CT, and MRI scans provide exact visualization of tumor location, size, and progression, which aids in accurate diagnosis and treatment planning. The use of imaging biomarkers such as FDG-PET for metabolic activity improves the ability to detect cancer at an early stage. Advancements in imaging techniques, such as AI integration and high-resolution systems, are increasing their effectiveness and usage. Additionally, imaging technology is widely employed in clinical trials to assess therapy responses, which contributes to its market domination. Its adaptability across cancer types ensures long-term expansion and high demand in the biomarker landscape.

Cancer Biomarkers Market By Biomolecule

- Epigenetic Biomarkers

- Genetic Biomarkers

- Proteomic Biomarkers

- Metabolic Biomarkers

- Others

Genetic biomarkers have emerged as the most significant sector in the cancer biomarkers market, owing to their importance in early detection, risk assessment, and tailored treatment options. These biomarkers, including BRCA1, BRCA2, and KRAS, provide crucial insights into genetic abnormalities and predispositions, allowing for targeted therapy based on an individual's genetic profile. The development of genomic sequencing technology, notably next-generation sequencing (NGS), has dramatically accelerated the discovery and implementation of genetic biomarkers. Their broad usage in predicting treatment responses and tracking disease progression across multiple cancer types emphasizes their significance. Furthermore, increased research funding and advances in molecular biology strengthen the prominence of genetic biomarkers as a cornerstone in cancer management.

Cancer Biomarkers Market By Application

- Diagnostics

- Drug discovery and Development

- Personalized medicine

- Others

The diagnostics sector leads the cancer biomarkers market, owing to the growing demand for early cancer detection and precise diagnostic tools. Biomarkers are critical in early cancer detection, which improves patient outcomes and survival rates. Technologies such as liquid biopsies and improved tests offer non-invasive, precise detection, making diagnostics widely used in clinical settings. The rising global prevalence of cancer increases the demand for effective diagnostic technologies. Furthermore, advances in biomarker research, together with incorporation into imaging and molecular diagnostic platforms, increase their effectiveness and scope. Government and healthcare initiatives promoting early screening also help the diagnostics segment dominate the cancer biomarkers market.

Cancer Biomarkers Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cancer Biomarkers Market Regional Analysis

North America dominates the cancer biomarkers market due to its advanced healthcare infrastructure, high cancer prevalence, and large expenditure in R&D. For instance according to the American Association for Cancer Research On January 1, 2022, there were more than 18 million cancer survivors in the United States. The region benefits from the presence of renowned biotechnology and pharmaceutical companies, which promotes biomarker discovery and application innovation. The widespread use of modern diagnostic techniques and tailored medication reinforces its market leadership. Furthermore, actions in the public and commercial sectors to promote early cancer identification and screening programs are critical. Supportive regulatory frameworks and reimbursement policies for biomarker-based diagnostics are also driving market expansion in North America.

Asia-Pacific is emerging as the fastest-growing region, owing to rising cancer rates, improved healthcare infrastructure, and increased awareness of early detection. For instance according to the National Institutes of Health (NIH) (.gov) in 2022, there were 4,824,703 new cancer cases and 2,574,176 cancer-related deaths in China. Countries such as China, India, and Japan are experiencing significant development as a result of increased medical tourism, biotechnology investments, and the use of modern diagnostic technologies. The region's enormous population and rising healthcare expenditure present significant prospects for cancer biomarker applications. Government-led initiatives and collaborations with international organizations to improve cancer care will further increase the industry. Furthermore, Asia-Pacific is becoming a hub for clinical trials and research, hastening breakthroughs in biomarker technologies and placing the region as a significant growth driver in the global market.

Cancer Biomarkers Market Players

Some of the top cancer biomarkers companies offered in our report includes Sino Biological Inc., Illumina, Inc., Merck & Co. Inc., Agilent Technologies, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche AG, QIAGEN, Affymetrix Inc., Abbott, and Hologic, Inc.

Frequently Asked Questions

How big is the cancer biomarkers market?

The cancer biomarkers market size was valued at USD 24.6 Billion in 2023.

What is the CAGR of the global cancer biomarkers market from 2024 to 2032?

The CAGR of cancer biomarkers is 11.1% during the analysis period of 2024 to 2032.

Which are the key players in the cancer biomarkers market?

The key players operating in the global market are including Sino Biological Inc., Illumina, Inc., Merck & Co. Inc., Agilent Technologies, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche AG, QIAGEN, Affymetrix Inc., Abbott, and Hologic, Inc.

Which region dominated the global cancer biomarkers market share?

North America held the dominating position in cancer biomarkers industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of cancer biomarkers during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global cancer biomarkers industry?

The current trends and dynamics in the cancer biomarkers industry include rising prevalence of cancer globally is driving demand for advanced biomarker-based diagnostics, and increasing focus on personalized medicine enhances the development and adoption of biomarkers.

Which cancer type held the maximum share in 2023?

The breast cancer type segment held the maximum share of the cancer biomarkers industry.