Cables And Accessories Market | Acumen Research and Consulting

Cables and Accessories Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

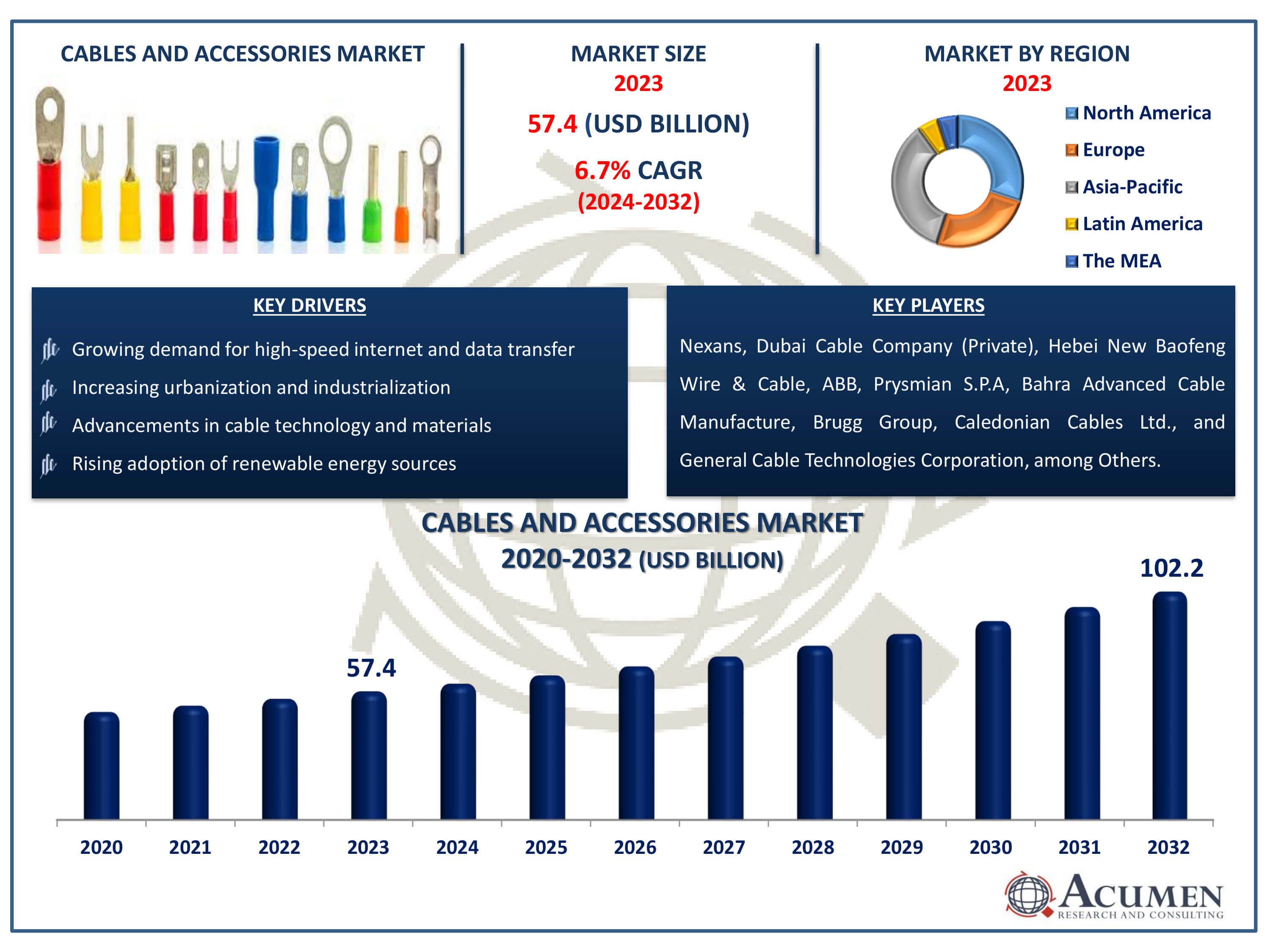

The Cables and Accessories Market Size accounted for USD 57.4 Billion in 2023 and is estimated to achieve a market size of USD 102.2 Billion by 2032 growing at a CAGR of 6.7% from 2024 to 2032.

Cables and Accessories Market Highlights

- Global cables and accessories market revenue is poised to garner USD 102.2 billion by 2032 with a CAGR of 6.7% from 2024 to 2032

- Asia-Pacific cables and accessories market value occupied around USD 20.1 billion in 2023

- North America cables and accessories market growth will record a CAGR of more than 7.5% from 2024 to 2032

- Among voltage, the high voltage sub-segment generated more than USD 24.1 billion revenue in 2023

- Based on installation, the overhead sub-segment generated around 55% market share in 2023

- Development of eco-friendly and recyclable cable materials is a popular cables and accessories market trend that fuels the industry demand

A cable is a group of wires or a single wire inside a rubber or plastic covering, used to carry electricity or electronic signals. Additionally, a cable is also referred to as a very strong, thick rope made up of wires twisted together. These cables are used for the transmission of power or data between devices. Moreover, an accessory is a device added to a computer that performs extra functions but is not required. One of the best examples of an accessory is a computer printer, which gives the computer the capability to print, but the computer can still work without it.

Global Cables and Accessories Market Dynamics

Market Drivers

- Growing demand for high-speed internet and data transfer

- Increasing urbanization and industrialization

- Advancements in cable technology and materials

- Rising adoption of renewable energy sources

Market Restraints

- High installation and maintenance costs

- Stringent regulatory standards and compliance requirements

- Fluctuating raw material prices

Market Opportunities

- Expansion of smart grid and smart city projects

- Increasing demand for electric vehicles and related infrastructure

- Growth in the telecommunications sector in emerging markets

Cables and Accessories Market Report Coverage

| Market | Cables and Accessories Market |

| Cables and Accessories Market Size 2022 | USD 57.4 Million |

| Cables and Accessories Market Forecast 2032 | USD 102.2 Million |

| Cables and Accessories Market CAGR During 2023 - 2032 | 6.7% |

| Cables and Accessories Market Analysis Period | 2020 - 2032 |

| Cables and Accessories Market Base Year |

2022 |

| Cables and Accessories Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Voltage, By Installation, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Nexans, Dubai Cable Company (Private), Hebei New Baofeng Wire & Cable, ABB, Prysmian S.P.A, Bahra Advanced Cable Manufacture, Brugg Group, Caledonian Cables Ltd., General Cable Technologies Corporation, Kabelwerk Eupen Ag, and Nkt Cables. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Cables and Accessories Market Insights

Several main drivers influence the worldwide cable accessories market, which is growing and expanding. For starters, the growing need for renewable energy is a powerful motivator. As the world transitions to more sustainable energy sources, there is an increasing demand for cables and accessories capable of efficiently transmitting power generated by renewable sources such as wind, solar, and hydroelectric power plants. This move is fueled by both environmental concerns and government restrictions aimed at lowering carbon emissions. Second, rapid industrialization and urbanization are driving the market ahead. Rapid industrial growth and urbanization necessitate strong and dependable power transmission and distribution (T&D) infrastructure. As cities grow and new industrial regions emerge, the demand for high-quality cables and accessories to support the electrical system grows dramatically. This trend is particularly obvious in emerging nations, where urbanization is accelerating.

Government assistance and initiatives to enhance and improve existing T&D infrastructure are also important factors. Many governments around the world are making significant investments in updating their electrical networks to improve efficiency, reliability, and capacity. These initiatives frequently include financial incentives, subsidies, and regulatory support, which increases demand for upgraded cables and accessories. In addition, the industry is being driven by global growth in electricity capacity. As global electricity demand rises, there is a need for new power facilities as well as expanded existing ones. This necessitates significant cabling solutions to enable effective power transmission from generation sites to end consumers.

The implementation of offshore wind policies in developing economies is another element driving cables and accessories market expansion. Offshore wind farms require specialized cables for power transmission, resulting in a significant market opportunity. Furthermore, the replacement of traditional grids with 'Smart-Grids' is increasing demand for advanced cables and accessories capable of supporting the sophisticated technology and architecture of smart grids, which provide greater energy management and distribution capabilities. However, the market is not without obstacles. One of the most significant barriers is a shortage of technical competence for high-voltage (HV) projects. To design, implement, and maintain high-voltage systems, specialized knowledge and skills are required. The scarcity of experienced experts can cause project delays, increased costs, and inferior performance, impeding market expansion. This technical competence gap is a substantial hurdle, especially in regions where HV infrastructure development is still in its early stages.

Cables and Accessories Market Segmentation

The worldwide cables and accessories market is split based on voltage, installation, application, end-user, and geography.

Cables and Accessories By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

According to cables and accessories industry analysis, the high voltage sector dominates the market, owing to the growing demand for efficient power transmission across long distances. High voltage cables are required to connect power generation sources, such as power plants and renewable energy projects, to substations and end customers. They are capable of handling higher power loads while reducing energy loss during transmission. The growing growth of infrastructure projects, urbanization, and industry, particularly in emerging economies, drives up the demand for high voltage cables. Furthermore, advances in grid technology, such as the installation of smart grids, necessitate the usage of high voltage cables, which fuels the growth of this market sector.

Cables and Accessories By Installation

- Overhead

- Submarine

- Underground

The overhead category accounts for the biggest part of the market and it is expected to grow over the cables and accessories industry forecast period, owing to its low cost of installation and widespread application. These cables are installed on pylons or utility poles, which makes deployment easier than subterranean or submarine cables, which need more sophisticated installations. This strategy is especially useful in remote and less inhabited areas where logistical issues may impede underground developments. Overhead wires also provide simpler access for maintenance and repairs, reducing downtime and operational expenses over time. Their adaptability to various voltage requirements, as well as their scalability for network expansions, add to their popularity, cementing the overhead segment's dominance in the worldwide cable and accessories market.

Cables and Accessories By Application

- Oil Industry

- Chemical Industry

- Electric Power

- Commercial

- Other

The electric power sector is predicted to be the major segment of the cables and accessories market. This is owing to rising worldwide electricity consumption caused by urbanization, industry, and a shift toward renewable energy sources. Electric power cables and accessories are critical components in the efficient and reliable transmission and distribution of electricity across networks. As countries improve their infrastructure and include renewable energy sources like as wind and solar into their grids, there is an increasing demand for specialized cables and accessories capable of handling greater voltages and changing loads. This sector's growth is accelerated by increasing investments in smart grid technology, which improve grid resilience and efficiency.

Cables and Accessories By End-User

- Industrial

- Renewable

- Others

In terms of cables and accessories market analysis, the renewable energy segment is expected to be the largest end-user category. This projection is based on the global transition towards renewable energy sources such as wind, solar, and hydroelectric power. As governments throughout the world pledge to lowering carbon footprints and meeting renewable energy targets, significant investments are being made in renewable infrastructure. Cables and accessories designed specifically for renewable energy applications are crucial in ensuring the reliable and efficient transmission of electricity from renewable sources to the grid and consumers. These specialized components must survive harsh weather conditions, fluctuating power outputs, and lengthy transmission distances. With continued technical breakthroughs and the expansion of renewable projects, the need for sturdy and high-performance cables and accessories in this area is expected to increase significantly in the coming years.

Cables and Accessories Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Cables and Accessories Market Regional Analysis

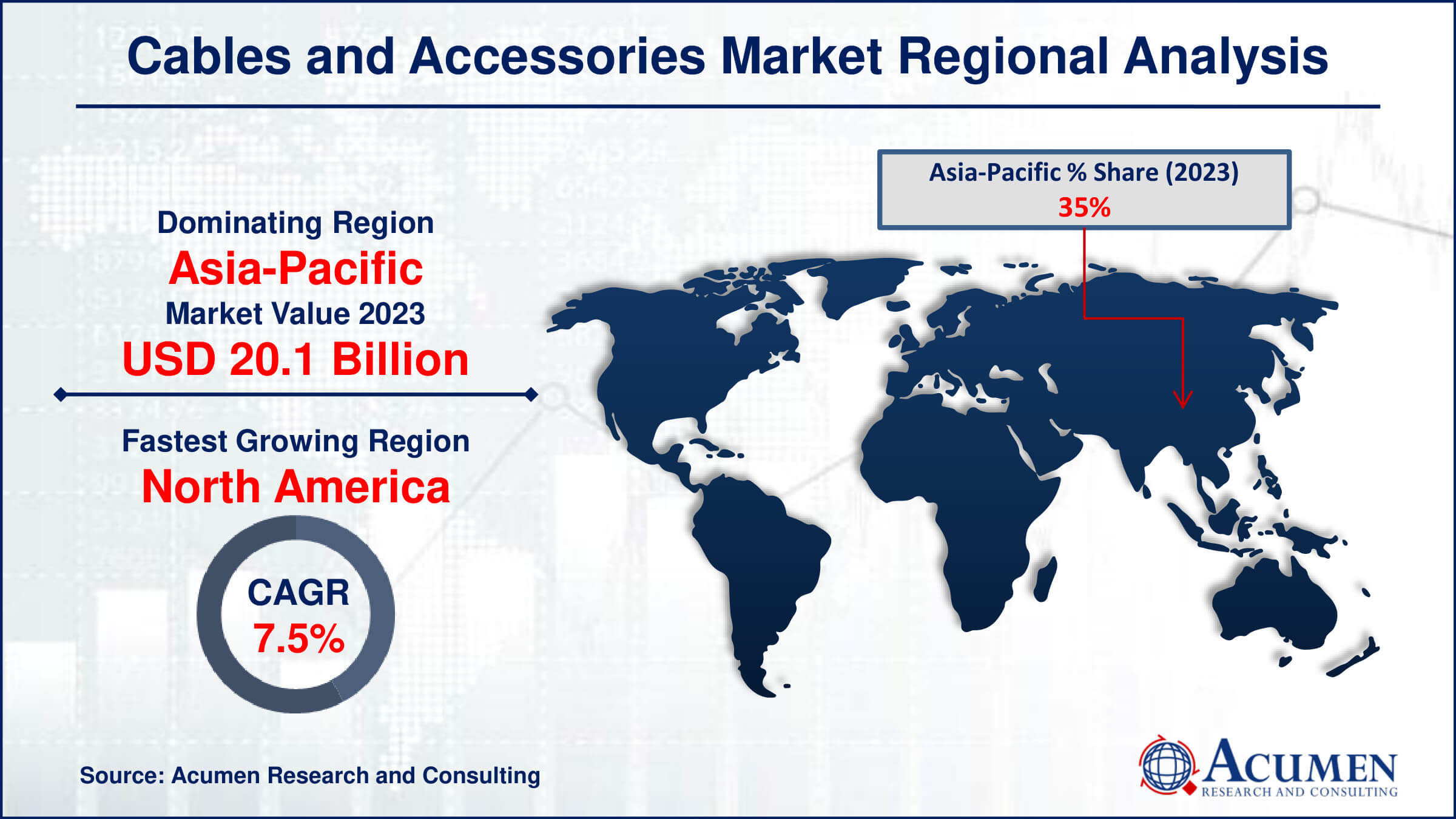

Geographically, the global cables and accessories market is divided into four regions: North America, Europe, Asia Pacific (APAC), and Latin America, Middle East & Africa (LAMEA). Asia Pacific is expected to lead market during the forecast period from 2024 to 2032, driven by increasing demand for electric energy due to urbanization, industrialization, and government mandates. Countries like India, experiencing rising power demand, will require significant additions to installed power generation capacity, boosting market growth in this region.

North America is expected to fastest growing region during the cables and accessories market forecast period, supported by industrialization and growing demand for cables and accessories across various industries. Europe is anticipated to experience strong growth due to the presence of major market players and government support. LAMEA is expected to see steady growth, influenced by slower industrialization and government support.

Cables and Accessories Market Players

Some of the top cables and accessories companies offered in our report includes Nexans, Dubai Cable Company (Private), Hebei New Baofeng Wire & Cable, ABB, Prysmian S.P.A, Bahra Advanced Cable Manufacture, Brugg Group, Caledonian Cables Ltd., General Cable Technologies Corporation, Kabelwerk Eupen Ag, and Nkt Cables.

Frequently Asked Questions

How big is the cables and accessories market?

The cables and accessories market size was valued at USD 57.4 billion in 2023.

What is the CAGR of the global cables and accessories market from 2024 to 2032?

The CAGR of cables and accessories is 6.7% during the analysis period of 2024 to 2032.

Which are the key players in the cables and accessories market?

The key players operating in the global market are including Nexans, Dubai Cable Company (Private), Hebei New Baofeng Wire & Cable, ABB, Prysmian S.P.A, Bahra Advanced Cable Manufacture, Brugg Group, Caledonian Cables Ltd., General Cable Technologies Corporation, Kabelwerk Eupen Ag, and Nkt Cables.

Which region dominated the global cables and accessories market share?

Asia-Pacific held the dominating position in cables and accessories industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of cables and accessories during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global cables and accessories industry?

The current trends and dynamics in the cables and accessories industry include growing demand for high-speed internet and data transfer, increasing urbanization and industrialization, advancements in cable technology and materials, and rising adoption of renewable energy sources.

Which installation held the maximum share in 2023?

The overhead installation held the maximum share of the cables and accessories industry.