Business Process Outsourcing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Business Process Outsourcing Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

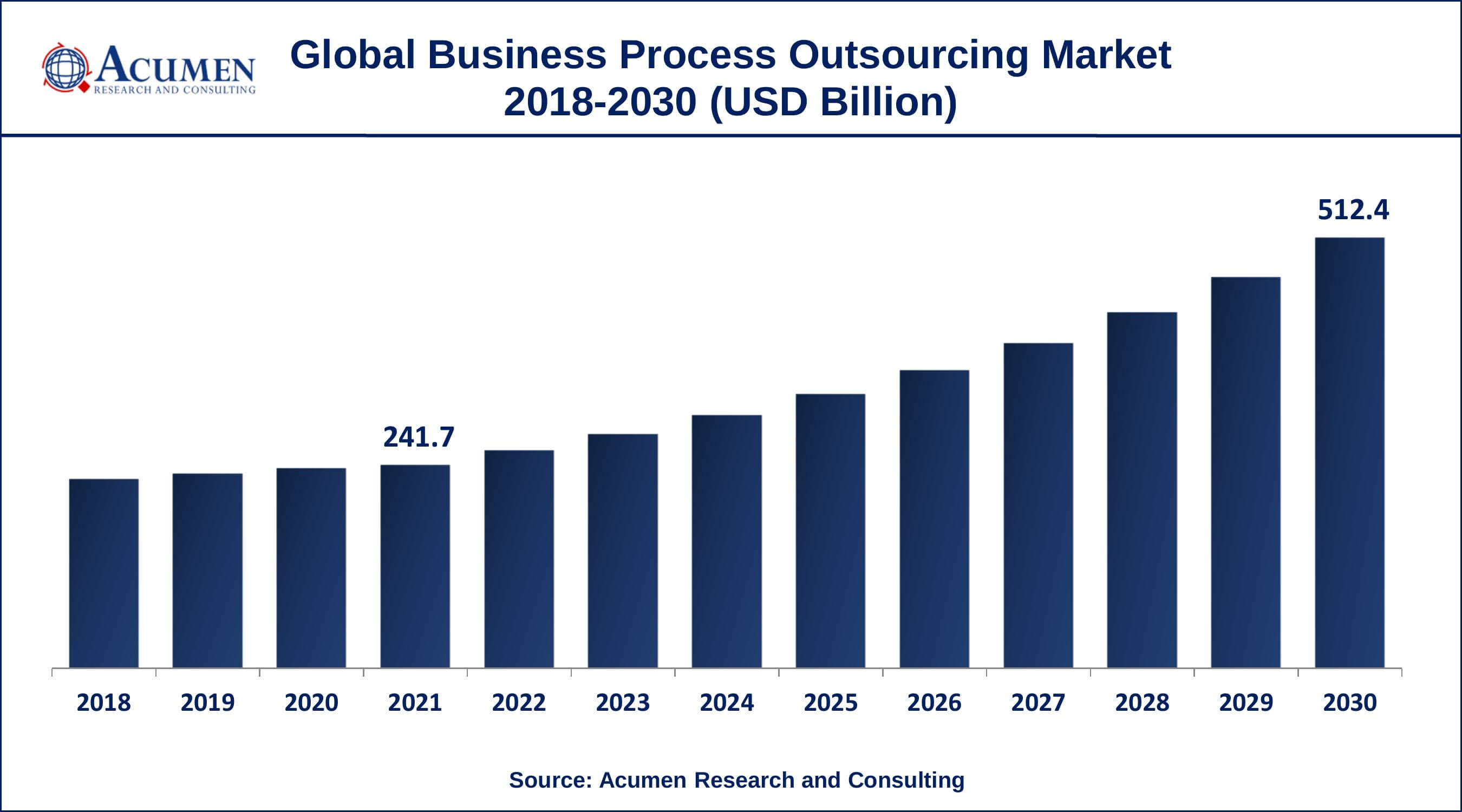

The Global Business Process Outsourcing Market Size accounted for USD 241.7 Billion in 2021 and is estimated to achieve a market size of USD 512.4 Billion by 2030 growing at a CAGR of 8.9% from 2022 to 2030. An increasingly competitive environment from new outsourcing sites, along with the emphasis on firms running more cost-effectively, will fuel the business process outsourcing market growth. Furthermore, the business process outsourcing market value is being propelled by aspects such as businesses' increased attention on enhancing efficiency and business agility, lowering operational costs, and stressing core capabilities in order to withstand the continuously shifting business dynamics.

Business Process Outsourcing Market Report Key Highlights

- Global business process outsourcing market revenue is estimated to expand by USD 512.4 billion by 2030, with a 8.9% CAGR from 2022 to 2030.

- North America business process outsourcing market share accounted for over 35.9% shares in 2021

- Asia-Pacific business process outsourcing market growth will observe fastest CAGR from 2022 to 2030

- Based on service, customer services segment accounted for over 30% of the overall market share in 2021

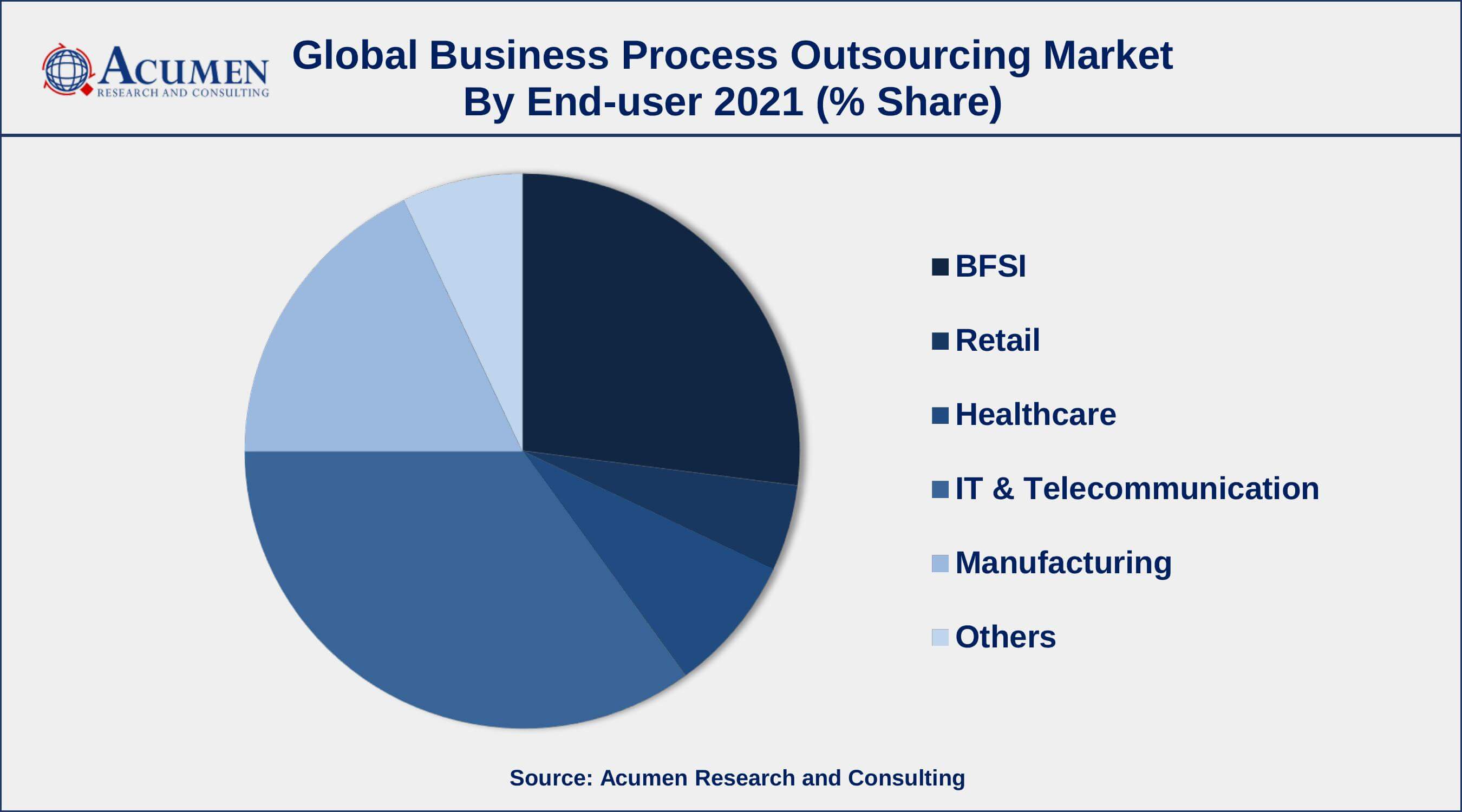

- Among end-user, IT and telecom sector engaged more than 36% of the total market share

- Rising global penetration of new competitors, drives the business process outsourcing market size

Business process outsourcing (BPO) is a way to offer a third-party service provider control over a range of business functions in return for a fixed payment. The fast expansion of the BPO industry's scope and size is linked to multinational firms' greater need to lower costs and deal with issues such as skilled labor scarcity. The multiple benefits offered by BPO, including cost reductions, increased customer satisfaction, better concentration on core markets, competitive capacity, and rapid time to market, have motivated operations to embrace the outsourcing model.

Global Business Process Outsourcing Market Trends

Market Drivers

- Increased emphasis on improving business agility by businesses

- The growing use of cloud computing

- Increased demand for standardized technology platforms

- Focusing attention on the IT and telecommunications industries

Market Restraints

- Increased concerns about confidentiality and intellectual property

- Risks related to cybercrime

Market Opportunities

- Continually changing business dynamics

- Rising global penetration of new competitors

Business Process Outsourcing Market Report Coverage

| Market | Business Process Outsourcing Market |

| Business Process Outsourcing Market Size 2021 | USD 241.7 Billion |

| Business Process Outsourcing Market Forecast 2030 | USD 512.4 Billion |

| Business Process Outsourcing Market CAGR During 2022 - 2030 | 8.9% |

| Business Process Outsourcing Market Analysis Period | 2018 - 2030 |

| Business Process Outsourcing Market Base Year | 2021 |

| Business Process Outsourcing Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Service, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Infosys Limited, CBRE Group Inc., Accenture, NCR Corporation, HCL, Sodexo, Capgemini, TTEC Holdings, Inc., Wipro, and Amdocs. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

BPO is rapidly gaining momentum across an array of verticals such as banking, financial services, and insurance (BFSI), healthcare, manufacturing, IT & telecommunications, retail, and others, which is driving the BPO market value. Demand to decrease operational costs is a main factor expected to boost the BPO market size. Any further expenditure spent on a device or business that is not among the major capabilities of a company is called operational costs. A growing numeral of businesses has been outsourcing these operations, allowing them to emphasize core capabilities and improve their business. This results is shown in cost competence and real-time as well as resource management.

Business activities of any association are characterized into basic, critical, core, and non-core activities. Core exercises are an organization's essential capabilities that give it a key favorable position, while basic tasks require a specific range of abilities. Non-core activities are supporting tasks that to a great extent include relationships with the executives among shoppers and items. Grouping these exercises is essential so as to distribute assets fittingly to guarantee opportune conveyance administrations. These days, organizations have started putting more noteworthy accentuation on core activities with a view to keeping up their market nearness and growing their client base. This has brought about higher redistributing of non-core activities.

Business Process Outsourcing Market Segmentation

The worldwide business process outsourcing market segmentation is based on the service, end-user, and geography.

Business Process Outsourcing Market By Service

- Finance & Accounting

- Knowledge Process Outsourcing

- Human Resources

- Customer Services

- Procurement & Supply Chain

- Others

According to a business process outsourcing industry analysis, the customer services segment can lead the global market in 2021 and is predicted to grow significantly in the coming years. The segment's dominance can be due to the growing number of service centers throughout the world that require both online and offline technical help. Client service-based BPO firms specialize in addressing customer requests and inquiries via email, chatrooms, social media platforms, phone calls, as well as other channels.

Business Process Outsourcing Market By End-User

- Banking, Financial Services, and Insurance (BFSI)

- Retail

- Healthcare

- IT & Telecommunication

- Manufacturing

- Others

According to the business process outsourcing market forecast, the BFSI segment would continue growing in the market over the next few years. Financial organizations have traditionally viewed BPO as a tool for increasing cost efficiency. To improve their customer service, BFSI firms are choosing for outsourcing activities in numerous fields of the BFSI sector, particularly asset management as well as investment management.

Business Process Outsourcing Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

North America Is Expected To Record Dominant Market Share For The Global Business Process Outsourcing Market

North America region held the largest market share in the BPO market in 2021. Development in the regional market is credited to flexibility and customization of service delivery in order to develop the efficient and efficient solutions, paired with the increasing need for cloud computing technology.

The Asia-Pacific BPO market growth is expected to exhibit the highest CAGR during the forecast timeframe. This development is ascribable to the speedy growth of the manufacturing and (CPG) consumer packaged goods industries in this region. Moreover, growing support from the government to promotion of English language learning programs in to gain fascination from global service providers is expected to push business process outsourcing market growth.

Business Process Outsourcing Market Players

Some of the top business process outsourcing market companies offered in the professional report includes Infosys Limited, CBRE Group Inc., Accenture, NCR Corporation, HCL, Sodexo, Capgemini, TTEC Holdings, Inc., Wipro, and Amdocs.

Strategic partnerships and associations are a significant strategy among foremost players to merge their presence in the market. For instance, Capgemini entered into a partnership with NetSuite in October 2014, the company NetSuite delivers cloud computing solutions internationally. The objective of this partnership is to enable Capgemini to launch its new virtual company, which delivers business process outsourcing solutions. The numerous business solutions offered comprise human resources, accounting and finance, and a host of technology solutions.

Frequently Asked Questions

What is the size of global business process outsourcing market in 2021?

The estimated value of global business process outsourcing market in 2021 was accounted to be USD 241.7 Billion.

What is the CAGR of global business process outsourcing market during forecast period of 2022 to 2030?

The projected CAGR business process outsourcing market during the analysis period of 2022 to 2030 is 8.9%.

Which are the key players operating in the market?

The prominent players of the global business process outsourcing market are Infosys Limited, CBRE Group Inc., Accenture, NCR Corporation, HCL, Sodexo, Capgemini, TTEC Holdings, Inc., Wipro, and Amdocs.

Which region held the dominating position in the global business process outsourcing market?

North America held the dominating business process outsourcing during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for business process outsourcing during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global business process outsourcing market?

Increased emphasis on improving business agility by businesses and growing use of cloud computing drives the growth of global business process outsourcing market.

By end-user segment, which sub-segment held the maximum share?

Based on end-user, IT & telecommunication segment is expected to hold the maximum share of the business process outsourcing market.