Building Integrated Photovoltaics Market | Acumen Research and Consulting

Building-Integrated Photovoltaics Market Size - Global Industry Analysis, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

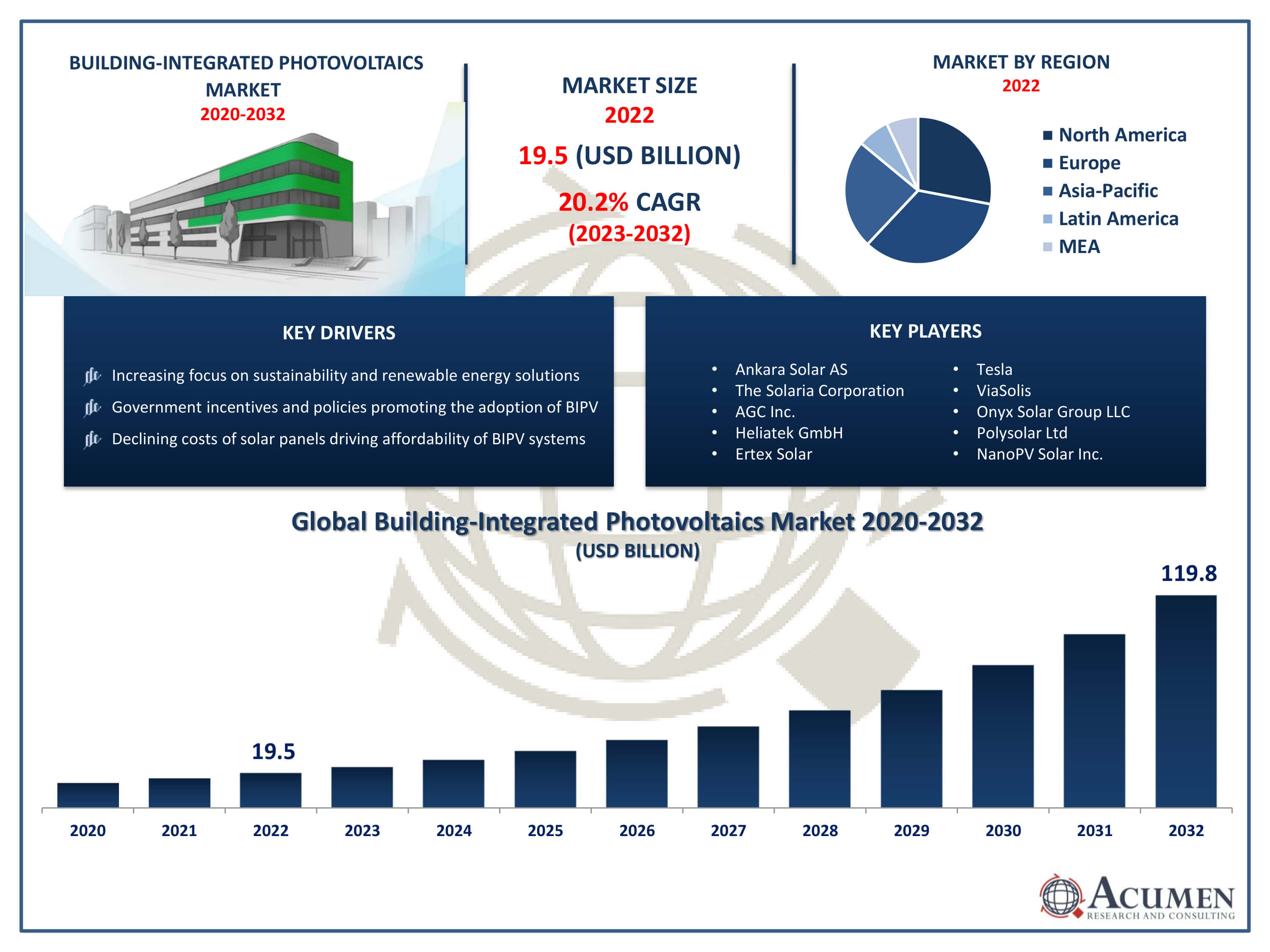

The Building-Integrated Photovoltaics Market Size accounted for USD 19.5 Billion in 2022 and is projected to achieve a market size of USD 119.8 Billion by 2032 growing at a CAGR of 20.2% from 2023 to 2032.

Building-Integrated Photovoltaics Market Highlights

- Global building-integrated photovoltaics market revenue is expected to increase by USD 119.8 billion by 2032, at a 20.2% CAGR from 2023 to 2032

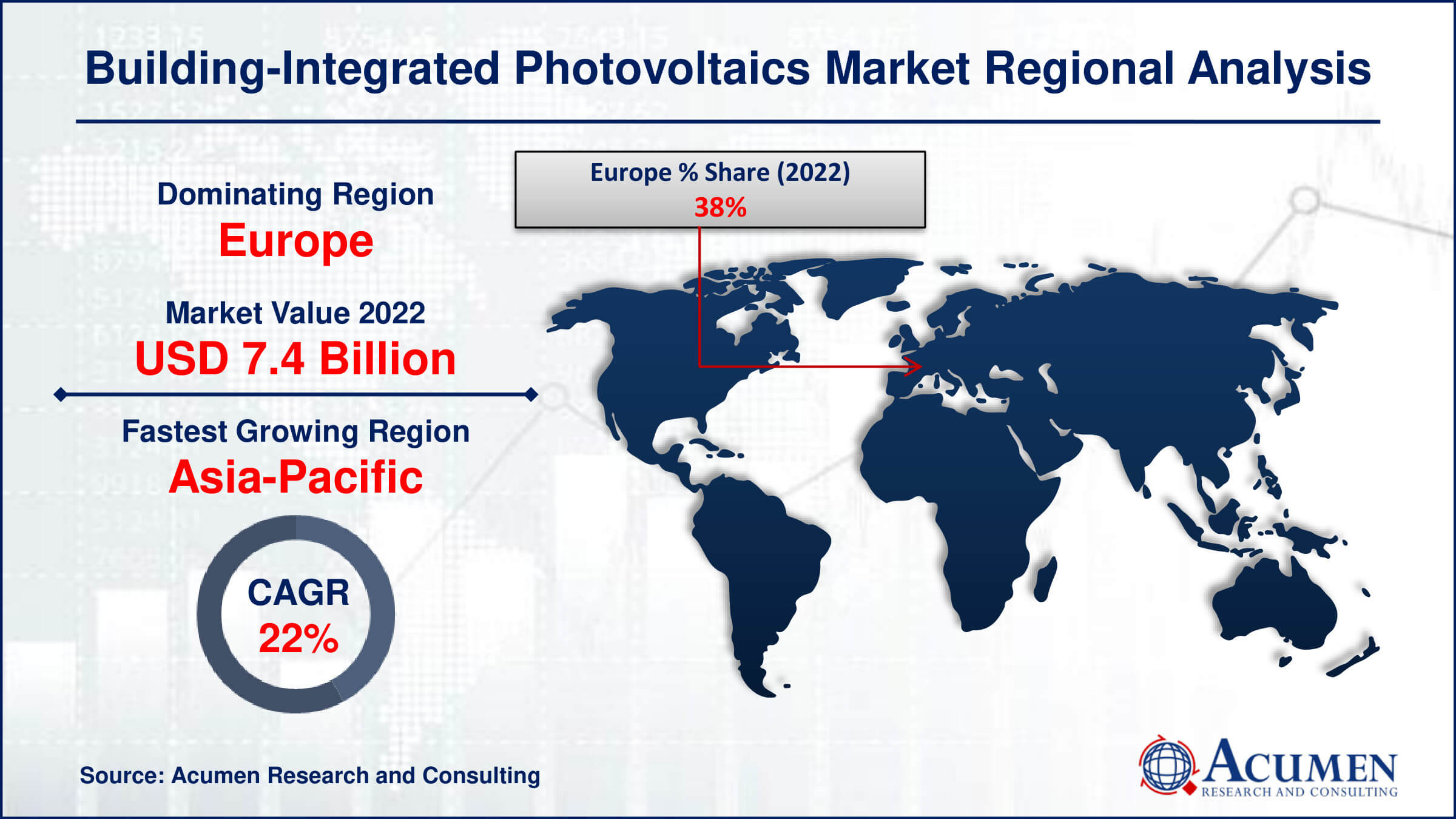

- Europe region led with more than 38% of building-integrated photovoltaics market share in 2022

- Asia-Pacific building-integrated photovoltaics market growth will record a CAGR of more than 22.5% from 2023 to 2032

- By technology, the crystalline silicon (C-Si) segment captured more than 70% of revenue share in 2022

- By application, the roofs segment generated over 58% of the market share in 2022

- Increasing focus on sustainability and renewable energy solutions, drives the building-integrated photovoltaics market value

Building-integrated photovoltaic (BIPV) systems make it simple to integrate solar panels into building materials. BIPV systems serve as both structural elements and power generators. Their seamless integration into walls, windows, roofs, and facades improves both aesthetics and utility. BIPV lowers greenhouse gas emissions, dependence on non-renewable resources, and improves energy efficiency. Growing consumer awareness of sustainability and the need for renewable energy to fend against climate change are the main drivers of BIPV's market expansion. Governments everywhere are passing laws and offering incentives to promote the use of BIPV. The increased durability, efficiency, and design flexibility of BIPV are among the technological innovations that attract developers, builders, and architects. As more buildings include solar energy generation into their design and construction, this trend is anticipated to continue.

Building-integrated photovoltaic (BIPV) systems make it simple to integrate solar panels into building materials. BIPV systems serve as both structural elements and power generators. Their seamless integration into walls, windows, roofs, and facades improves both aesthetics and utility. BIPV lowers greenhouse gas emissions, dependence on non-renewable resources, and improves energy efficiency. Growing consumer awareness of sustainability and the need for renewable energy to fend against climate change are the main drivers of BIPV's market expansion. Governments everywhere are passing laws and offering incentives to promote the use of BIPV. The increased durability, efficiency, and design flexibility of BIPV are among the technological innovations that attract developers, builders, and architects. As more buildings include solar energy generation into their design and construction, this trend is anticipated to continue.

The German glass and building materials manufacturer Grenzebach Group announced in September 2022 that its subsidiary Envelon, located in the Bavaria part of the country, would be opening a building-integrated PV (BIPV) module production factory. The project has an annual capacity of up to 300,000 square meters.

Global Building-Integrated Photovoltaics Market Trends

Market Drivers

- Increasing focus on sustainability and renewable energy solutions

- Government incentives and policies promoting the adoption of BIPV

- Advancements in BIPV technology improving efficiency and design flexibility

- Declining costs of solar panels driving affordability of BIPV systems

- Growing urbanization and demand for sustainable infrastructure solutions

Market Restraints

- Initial high upfront costs of BIPV installations

- Technical challenges related to integration and compatibility with existing building structures

Market Opportunities

- Expansion into new construction and retrofit markets

- Integration of BIPV with emerging smart building technologies

- Development of innovative BIPV products for niche applications

Building-Integrated Photovoltaics (BIPV) Market Report Coverage

| Market | Building-Integrated Photovoltaics Market |

| Building-Integrated Photovoltaics Market Size 2022 | USD 19.5 Billion |

| Building-Integrated Photovoltaics Market Forecast 2032 | USD 119.8 Billion |

| Building-Integrated Photovoltaics Market CAGR During 2023 - 2032 | 20.2% |

| Building-Integrated Photovoltaics Market Analysis Period | 2020 - 2032 |

| Building-Integrated Photovoltaics Market Base Year |

2022 |

| Building-Integrated Photovoltaics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ankara Solar AS, Hanergy Mobile Energy Holding Group Limited, The Solaria Corporation, AGC Inc., Navitas Green Solutions Pvt. Ltd., Heliatek GmbH, Ertex Solar, ViaSolis, Onyx Solar Group LLC, Polysolar Ltd, and NanoPV Solar Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

In contrast to conventional solar panel installations, building-integrated photovoltaics (BIPV) smoothly incorporate solar technology into pre-existing architectural features including walls, windows, roofs, and facades. In addition to using solar energy, this integration improves a building's sustainability and aesthetic appeal. In the home, business, and industrial domains, BIPV has a wide range of uses. It provides sustainable power generation while lowering dependency on the grid. BIPV systems can take the place of traditional roofs or facades in residential situations, giving homeowners an affordable and sustainable source of power. BIPV plays multipurpose functions in commercial buildings as canopies, shading devices, or atriums, reducing cooling loads, increasing visual aesthetics, and generating clean energy. Similarly, BIPV integration gives businesses the chance to reduce energy use and carbon emissions in industrial settings, such as factories, parking buildings, and warehouses.

The BIPV sector is growing rapidly, partly because of international environmental programs and increased consumer awareness of renewable energy sources. By integrating solar panels with building materials in a seamless manner, BIPV supports sustainability objectives and is becoming more and more popular in the residential, commercial, and industrial construction sectors. The adoption of BIPV systems is further accelerated by supportive government policies, such as tax credits, subsidies, and financial incentives, which also promote the shift to cleaner and more sustainable energy sources.

For power produced by solar components which are effectively incorporated into buildings the French government grants the greatest FiTs. A significant portion of the nation's total installed photovoltaic capacity is produced by systems integrated into building envelopes. This type of system generates power. In an attempt to promote the installation of integrated photovoltaics in buildings, the nation provides substantial subsidies and incentives.

Building-Integrated Photovoltaics Market Segmentation

The global building integrated photovoltaics (BIPV) segmentation is based on technology, application, end-user, and geography.

Building-Integrated Photovoltaics Market By Technology

- Thin film

- Crystalline silicon (C-Si)

- Others

According to the building-integrated photovoltaics industry analysis, the market share with the biggest percentage in 2022 belonged to the crystalline silicon (C-Si) sector. Because of its high efficiency, stability, and maturity, crystalline silicon solar cells both monocrystalline and polycrystalline have long dominated the solar industry. The C-Si segment provides a flexible option for BIPV that may be easily included into different architectural elements including windows, facades, and roofs. Because of its versatility, C-Si BIPV systems are now widely used in the industrial, commercial, and residential sectors. In addition, the competitiveness of C-Si BIPV systems has increased because to developments in crystalline silicon technology, including increases in cell efficiency, manufacturing procedures, and material innovations. Because of these developments, C-Si BIPV systems are now more economically appealing to building developers and property owners because to their higher power production and lower prices.

Building-Integrated Photovoltaics Market By Application

- Roofs

- Walls

- Glass

- Facades

- Others

The roof category is anticipated to have substantial expansion in terms of applications in the upcoming years. Roofs are a great place to integrate BIPV since they are one of the most accessible and large spaces for solar panel installation. Interest in using roofs as a renewable energy source is rising as people become more conscious of sustainability and climate change. In addition to producing energy, BIPV systems installed on rooftops also offer insulation, weather protection, and shade, all of which improve a building's overall performance. Furthermore, the range and practicality of rooftop solar installations have increased due to developments in BIPV technology and manufacturing techniques. BIPV modules are becoming more and more appealing to building developers and homeowners wishing to include renewable energy solutions into their homes because of their improved design flexibility, efficiency, and durability.

Building-Integrated Photovoltaics Market By End-User

- Industrial

- Residential

- Commercial

According to the building-integrated photovoltaics market forecast, In the upcoming years, there will likely be a considerable increase in the residential category. With the growing consciousness of climate change and sustainability, more and more homes are looking for methods to lower their energy costs and carbon impact. By allowing homeowners to produce sustainable energy on-site and improving the practical and cosmetic value of their houses, BIPV systems provide an alluring alternative. The seamless integration of solar panels into windows, roofs, or facades enables homeowners to harvest solar electricity without sacrificing the aesthetic appeal of their homes, which promotes the residential sector's adoption of BIPV. On other hand, these systems are now more widely available and reasonably priced for residential use thanks to developments in BIPV technology and manufacturing techniques. Homeowners, builders, and developers are finding BIPV modules more appealing because to their increased efficiency, longevity, and design flexibility.

Building-Integrated Photovoltaics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Building-Integrated Photovoltaics Market Regional Analysis

Building-Integrated Photovoltaics Market Regional Analysis

In terms of building-integrated photovoltaics market analysis, in Europe, the dominant growth of the market can be attributed to several key factors. The region's strong dedication to sustainability and renewable energy, evidenced by proactive laws and policies aimed at reducing carbon emissions, has created a conducive atmosphere for BIPV adoption. Additionally, financial incentives such as subsidies, feed-in tariffs, and tax credits provided by various European nations have significantly boosted the expansion of the BIPV sector. The European Union's ambitious renewable energy objectives further accelerate the development of BIPV technologies.

On the other hand, Asia-Pacific emerges as the fastest-growing region for BIPV and it is expected to grow throughout the building-integrated photovoltaics market forecast period, driven by a unique set of factors. Government support, rising energy demands, and increasing awareness of sustainable practices fuel this growth. Rapid urbanization, infrastructural development, and a shifting focus towards renewable energy sources in Asia-Pacific provide an optimal environment for the proliferation of BIPV technologies. This dynamic region presents a promising and stable market landscape for BIPV expansion.

The Japanese glass, chemical, and high-tech material maker AGC Inc. announced in September 2021 that their BIPV glass has been chosen to be placed at the Singapore Institute of Technology's new Punggol campus, which is expected to open by 2024.

Building-Integrated Photovoltaics Market Player

Some of the top building-integrated photovoltaics market companies offered in the professional report include Ankara Solar AS, Hanergy Mobile Energy Holding Group Limited, The Solaria Corporation, AGC Inc., Navitas Green Solutions Pvt. Ltd., Heliatek GmbH, Ertex Solar, ViaSolis, Onyx Solar Group LLC, Polysolar Ltd, and NanoPV Solar Inc.

Frequently Asked Questions

How big is the building-integrated photovoltaics market?

The building-integrated photovoltaics market size was USD 19.5 Billion in 2022.

What is the CAGR of the global building-integrated photovoltaics market from 2023 to 2032?

The CAGR of building-integrated photovoltaics is 20.2% during the analysis period of 2023 to 2032.

Which are the key players in the building-integrated photovoltaics market?

The key players operating in the global market are including Ankara Solar AS, Hanergy Mobile Energy Holding Group Limited, The Solaria Corporation, AGC Inc., Navitas Green Solutions Pvt. Ltd., Heliatek GmbH, Ertex Solar, ViaSolis, Onyx Solar Group LLC, Polysolar Ltd, and NanoPV Solar Inc.

Which region dominated the global building-integrated photovoltaics market share?

Europe held the dominating position in building-integrated photovoltaics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of building-integrated photovoltaics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global building-integrated photovoltaics industry?

The current trends and dynamics in the building-integrated photovoltaics industry include increasing focus on sustainability and renewable energy solutions, government incentives and policies promoting the adoption of BIPV, and advancements in BIPV technology improving efficiency and design flexibility.

Which application held the maximum share in 2022?

The roofs application held the maximum share of the building-integrated photovoltaics industry.