Bromine Derivatives Market | Acumen Research and Consulting

Bromine Derivatives Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

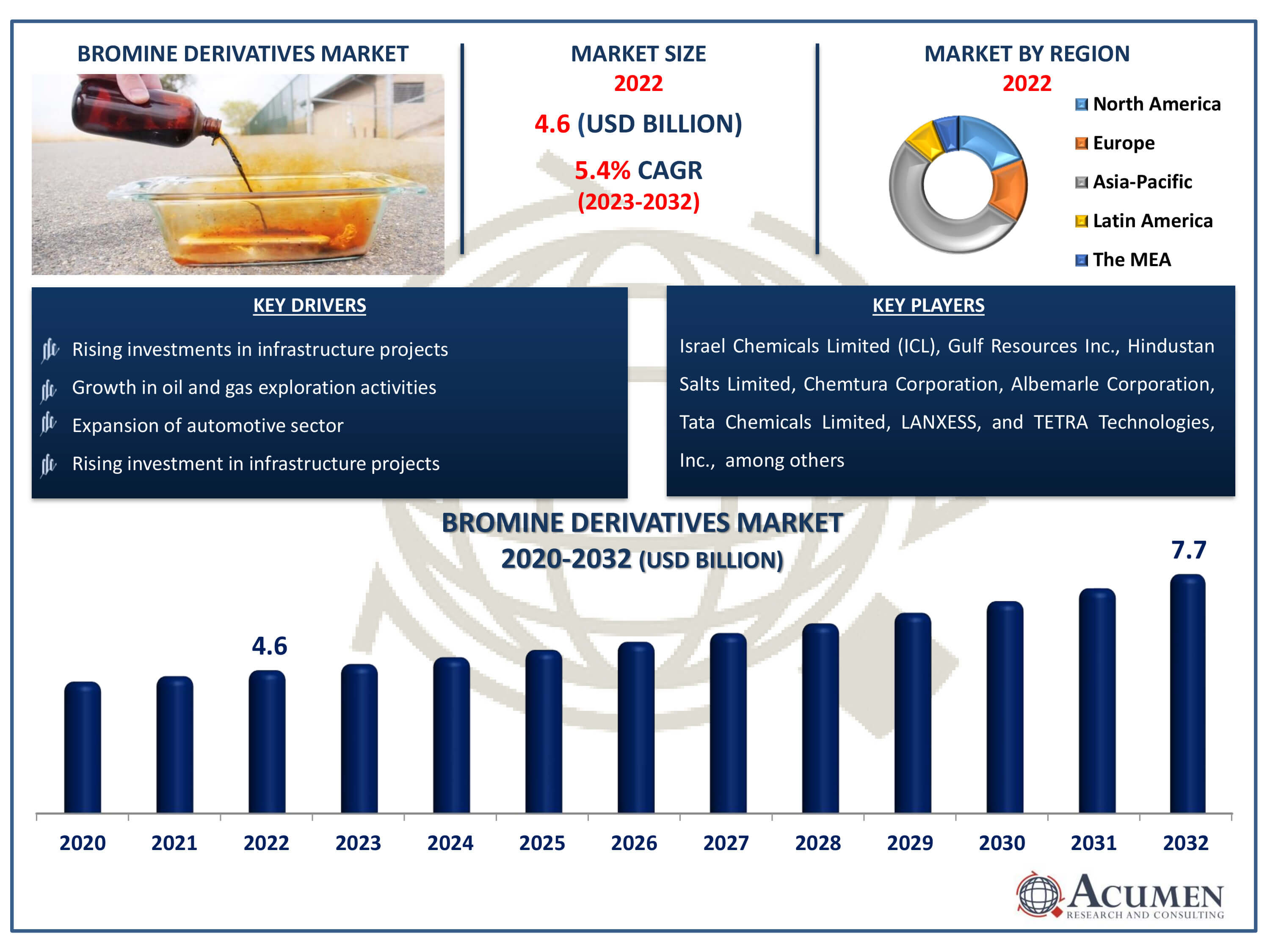

The Bromine Derivatives Market Size accounted for USD 4.6 Billion in 2022 and is estimated to achieve a market size of USD 7.7 Billion by 2032 growing at a CAGR of 5.4% from 2023 to 2032.

Bromine Derivatives Market Highlights

- Global bromine derivatives market revenue is poised to garner USD 7.7 billion by 2032 with a CAGR of 5.4% from 2023 to 2032

- Asia-Pacific bromine derivatives market value occupied around USD 2.4 billion in 2022

- North America bromine derivatives market growth will record a CAGR of more than 6% from 2023 to 2032

- Among derivative, the tetrabromobisphenol A sub-segment generated more than USD 1.3 billion revenue in 2022

- Based on end use, the chemical sub-segment generated around 55% market share in 2022

- Exploration of new applications and formulations for bromine derivatives to cater to evolving market needs is a popular bromine derivatives market trend that fuels the industry demand

Bromine derivatives are chemical compounds made from bromine, a halogen element. These derivatives are used in a variety of industries and applications. Brominates flame retardants, bromine-based biocides, and organ bromine compounds are often employed in the manufacture of medicines, agrochemicals, and fine chemicals. Brominates flame retardants are widely used in electronics, building materials, and fabrics to improve fire resistance. Bromine-based biocides are used as disinfectants and preservatives in water treatment, agriculture, and consumer items. Organ bromine compounds are used as intermediates in pharmaceutical synthesis and specialized reagents in organic chemistry. Bromine derivatives are important in current industrial processes because of their varied features and numerous uses, particularly in areas needing flame retardancy, microbiological control, and chemical synthesis.

Global Bromine Derivatives Market Dynamics

Market Drivers

- Increasing demand for flame retardants and biocides in various industries

- Growth in oil and gas exploration activities, driving demand for drilling fluids

- Expansion of automotive sector, leading to higher usage of fire-resistant hardware

- Rising investments in infrastructure projects, particularly in emerging economies

Market Restraints

- Stringent environmental regulations limiting the use of certain bromine derivatives

- Fluctuations in raw material prices affecting production costs

- Health concerns associated with prolonged exposure to certain bromine derivatives

Market Opportunities

- Growing adoption of bromine derivatives in pharmaceutical and agrochemical sectors

- Expansion of manufacturing facilities in proximity to bromine deposits to reduce supply chain costs

- Increasing demand for bromine derivatives in water treatment and electronics industries

Bromine Derivatives Market Report Coverage

| Market | Bromine Derivatives Market |

| Bromine Derivatives Market Size 2022 | USD 4.6 Billion |

| Bromine Derivatives Market Forecast 2032 |

USD 7.7 Billion |

| Bromine Derivatives Market CAGR During 2023 - 2032 | 5.4% |

| Bromine Derivatives Market Analysis Period | 2020 - 2032 |

| Bromine Derivatives Market Base Year |

2022 |

| Bromine Derivatives Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Derivative, By Application, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Israel Chemicals Limited (ICL), Gulf Resources Inc., Hindustan Salts Limited, Chemtura Corporation, Albemarle Corporation, Tata Chemicals Limited, LANXESS, TETRA Technologies, Inc., Tosoh Corporation, and Jordan Bromine Company. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Bromine Derivatives Market Insights

The rise in the use of bromine for controlling mercury discharges and the increasing demand for halogenated fire retardants have spurred the growth of the market. Thriving end-use industries such as electronics, pharmaceuticals, and agriculture, along with growing construction activities in the Middle East and Asia-Pacific, are expected to boost market growth. Asia Pacific has emerged as one of the largest consumers of bromine derivatives by volume, and demand is projected to grow rapidly over the bromine derivatives industry forecast period. Rising consumption in China and India, along with growing manufacturing activities, is anticipated to drive the market during the forecast period.

The expansion of fire-resistant hardware installations in the automotive sector is providing a boost to the market. Countries such as Brazil, Mexico, the U.S., China, Saudi Arabia, Russia, and Norway have increased their oil and gas exploration activities. In these operations, calcium bromide (CaBr) and sodium bromide (NaBr) are used as drilling fluids for the extraction of oil-based commodities, further stimulating market growth. Raw material suppliers, product manufacturers, and end-users are integral parts of the value chain in the bromine derivatives market. Major manufacturing players in the bromine derivatives market include Lanxess, Albemarle Corporation, Chemtura Corporation, Gulf Resources, Israel Chemicals Ltd., Perekop Bromine, Sanofi S.A., Albemarle Corporation, and Tata Chemicals. To reduce time and costs associated with the supply of materials, manufacturing facilities of raw material providers are located in proximity to bromine deposits.

Hydrobromic acid and calcium bromide are two key derivatives of bromine. Hydrobromic acid is utilized in the manufacturing of inorganic products such as sodium, zinc, and potassium bromides. The diatomic molecule of hydrogen bromide is dissolved in aqueous water to prepare the acid.

Bromine Derivatives Market Segmentation

The worldwide market for bromine derivatives is split based on derivative, application, end use, and geography.

Bromine Derivative Market By Derivatives

- Brominated Polystyrene

- Tetrabromobisphenol A

- Calcium Bromide

- Sodium Bromide

- Zinc Bromide

- Hydrobromic Acid

- Decabromodiphenyl Ethane (DBDPE)

- Others

According to bromine derivatives industry analysis, tetrabromobisphenol A dominates the market due to its wide range of applications and adaptability. Tetrabromobisphenol A (TBBPA) is a widely used flame retardant in a variety of sectors, including electronics, construction, and automotive. Its strong efficacy in lowering material flammability makes it an excellent choice for improving fire safety in electrical gadgets, construction materials, and automotive components. TBBPA also finds use in the manufacture of epoxy resins and polymer additives. The tetrabromobisphenol A segment dominates the bromine derivatives market due to rising demand for flame retardant materials, as well as severe fire safety standards in several sectors.

Bromine Derivative Market By Applications

- Flame Retardants

- Safety Apparel

- Organic Intermediates

- Oil & Gas Drilling

- Biocides

- PTA Synthesis

- Others

The flame retardants category has the highest share of the bromine derivatives market due to its critical function in improving fire safety across numerous sectors. Flame retardants produced from bromine, such as tetrabromobisphenol A (TBBPA) and brominated polystyrene, are widely used in electronics, building materials, textiles, and automotive components to reduce flammability and prevent fire spread. With growing concerns about fire dangers and severe safety standards across the world, the need for flame retardant materials is developing significantly. Industries prioritise the use of bromine derivatives in their goods to fulfil safety regulations and defend against fire. As a consequence, the flame retardants sector continues to dominate throughout the bromine derivatives market forecast period, owing to the continued emphasis on fire safety and the extensive use of flame retardant solutions in a variety of applications.

Bromine Derivative Market By End-Uses

- Chemical

- Construction

- Oil & Gas

- Pharmaceuticals

- Electronics

- Others

Bromine derivatives are frequently employed as intermediates in chemical manufacturing processes, hence the chemical segment accounts for the majority of the market. Hydrobromic acid and tetrabromobisphenol A are important components in the synthesis of many organic molecules, medicines, and specialty chemicals. These compounds are essential in the manufacture of flame retardants, biocides, and pharmaceutical intermediates, among other uses. Furthermore, bromine derivatives are commonly used as polymer additives, water treatment chemicals, and agricultural chemicals. Bromine derivatives are highly used in the chemical industry due to their unique features and versatility across numerous fields.

Bromine Derivatives Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Bromine Derivatives Market Regional Analysis

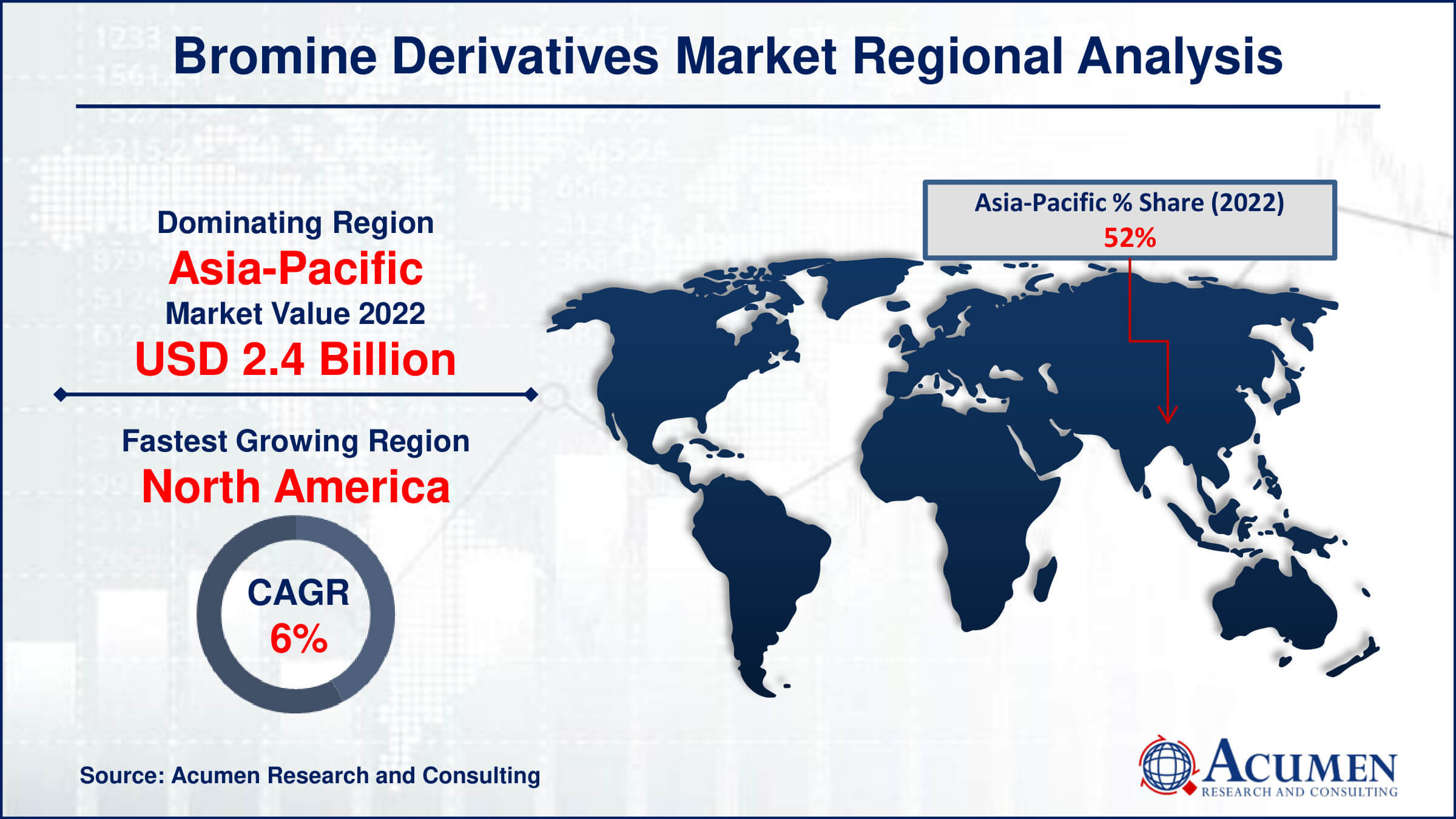

Asia-Pacific is projected to account largest of the total revenue by and is expected to be the fastest-growing region in terms of both value and volume during the forecast period. Many companies have extensive operations in Asia-Pacific, and companies such as Tosoh Corporation and Lanxess have made significant investments in research and development activities, leading to improved product quality in the region.

In 2022, North America represented a significant growth of the market. The region is a producer of natural gas and has been experiencing steady growth in shale gas production, contributing to the market's expansion. Another key factor driving market growth in North America is substantial foreign investments made by global companies. For instance, Lanxess announced several investment expansion plans across the region by, including a substantial investment in the global bromine deposit site.

Bromine Derivatives Market Players

Some of the top bromine derivatives companies offered in our report includes Israel Chemicals Limited (ICL), Gulf Resources Inc., Hindustan Salts Limited, Chemtura Corporation, Albemarle Corporation, Tata Chemicals Limited, LANXESS, TETRA Technologies, Inc., Tosoh Corporation, and Jordan Bromine Company.

Frequently Asked Questions

How big is the bromine derivatives market?

The bromine derivatives market size was valued at USD 4.6 billion in 2022.

What is the CAGR of the global bromine derivatives market from 2023 to 2032?

The CAGR of bromine derivatives is 5.4% during the analysis period of 2023 to 2032.

Which are the key players in the bromine derivatives market?

The key players operating in the global market are including Israel Chemicals Limited (ICL), Gulf Resources Inc., Hindustan Salts Limited, Chemtura Corporation, Albemarle Corporation, Tata Chemicals Limited, LANXESS, TETRA Technologies, Inc., Tosoh Corporation, and Jordan Bromine Company.

Which region dominated the global bromine derivatives market share?

Asia-Pacific held the dominating position in bromine derivatives industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of bromine derivatives during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global bromine derivatives industry?

The current trends and dynamics in the bromine derivatives industry include increasing demand for flame retardants and biocides in various industries, growth in oil and gas exploration activities, expansion of automotive sector, and rising investments in infrastructure projects.

Which end use held the maximum share in 2022?

The chemical end use held the maximum share of the bromine derivatives industry.