Brain Health Supplements Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Brain Health Supplements Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Brain Health Supplements Market Size accounted for USD 8.4 Billion in 2022 and is estimated to achieve a market size of USD 26.2 Billion by 2032 growing at a CAGR of 12.2% from 2023 to 2032.

Brain Health Supplements Market Highlights

- Global brain health supplements market revenue is poised to garner USD 26.2 billion by 2032 with a CAGR of 12.2% from 2023 to 2032

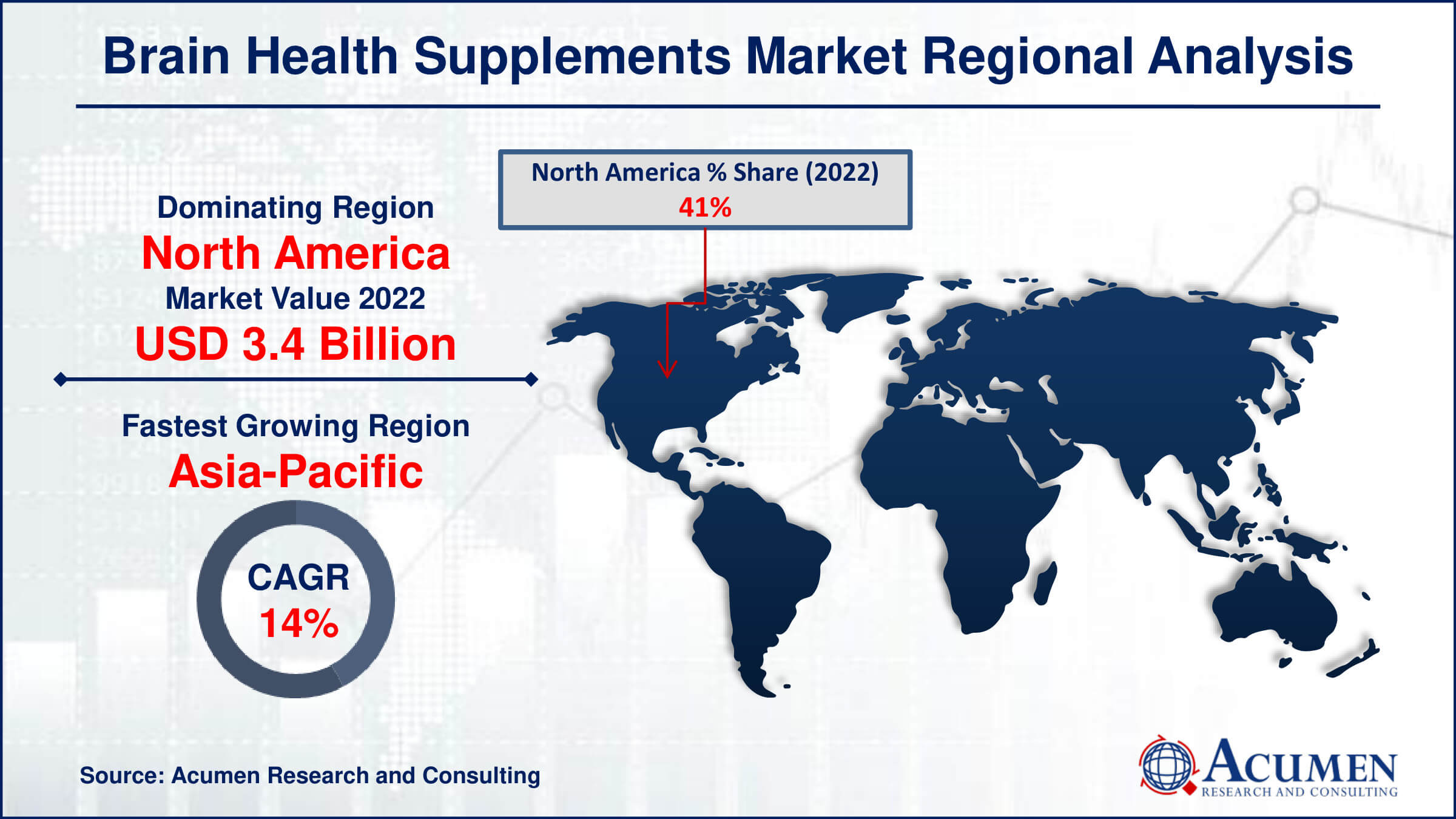

- North America brain health supplements market value occupied around USD 3.4 billion in 2022

- Asia-Pacific brain health supplements market growth will record a CAGR of more than 14% from 2023 to 2032

- Among product, the herbal extract sub-segment generated noteworthy revenue in 2022

- Based on application, the memory enhancement sub-segment generated around 26% share in 2022

- Collaborations for research and development, expanding product portfolios is a popular brain health supplements market trend that fuels the industry demand

Supplements are products used to enhance and improve deficiencies in the human body. They are often consumed in the form of capsules, softgels, powders, or liquids. Over the past few years, the demand for various supplements has significantly increased, owing to the rising prevalence of various diseases. The growth of the brain health supplements market has been driven by increasing awareness about health, a growing population, and changing lifestyles. Many government and private organizations are making efforts to educate people about the various applications and benefits of brain health supplements, which have supported market growth. However, limited penetration of brain health supplements in developing countries in Asia and Africa, as well as high prices, may slow the growth of the brain health supplements sector.

Global Brain Health Supplements Market Dynamics

Market Drivers

- Increasing awareness about mental health and wellness

- Growing aging population seeking cognitive support

- Evolving lifestyles demanding cognitive enhancement

- Research advancements boosting innovative supplement formulations

Market Restraints

- Limited penetration in developing regions like Asia and Africa

- High prices hindering widespread adoption

- Regulatory complexities and stringent approvals

Market Opportunities

- Untapped potential in emerging markets for brain health supplements

- Technological advancements facilitating new product developments

- Rising demand for natural and organic brain health solutions

Brain Health Supplements Market Report Coverage

| Market | Brain Health Supplements Market |

| Brain Health Supplements Market Size 2022 | USD 8.4 Billion |

| Brain Health Supplements Market Forecast 2032 | USD 26.2 Billion |

| Brain Health Supplements Market CAGR During 2023 - 2032 | 12.2% |

| Brain Health Supplements Market Analysis Period | 2020 - 2032 |

| Brain Health Supplements Market Base Year |

2022 |

| Brain Health Supplements Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Age Group, By Supplement Form, By Application, By Sales Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | AlternaScript, LLC, Accelerated Intelligence Inc., Natural Factors Nutritional Products Ltd., Aurobindo Pharma Limited, Onnit Labs, LLC, HVMN Inc., Liquid Health, Inc., Purelife Bioscience Co., Ltd., KeyView Labs, Inc., and Quincy Bioscience. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Brain Health Supplements Market Insights

A number of important factors are driving the brain health supplements industry. Growing cognizance and comprehension of mental health play a major role in encouraging people to give priority to their cognitive health. Demand is further increased by rising stress levels, changing lifestyles, and an ageing population that needs more cognitive help. Market expansion is also fueled by significant research into substances that improve brain function and technological developments. Furthermore, the growth of the fitness and wellness trend encourages customers to take preventative measures for their mental health, which drives the market.

Nonetheless, a noteworthy limitation in the brain health supplements market is the absence of strict standards and standardizations. Concerns regarding product safety, effectiveness, and quality result from this. The swift expansion of the market has led to an abundance of goods with diverse formulations and claims, which has left customers perplexed and skeptical. This uncertainty prevents the market from growing and erodes consumer confidence in these supplements.

Innovation and education present the market's biggest opportunities for brain health supplementation. A better market presence can be achieved by ongoing research and development that focuses on cutting-edge, scientifically verified chemicals and formulations. Building trust and growing the consumer base can be achieved through educating people about the advantages, appropriate usage, and transparency in labeling and manufacturing procedures. Additionally, there is a big chance for market expansion with customized and targeted solutions that address the demands of particular demographic groups like students or the elderly. By incorporating these tactics, the brain health supplements industry may become more stable and reliable, reaching a larger audience of buyers.

Brain Health Supplements Market Segmentation

The worldwide market for brain health supplements is split based on product, age group, supplement form, application, sales channel, and geography.

Brain Health Supplement Products

- Herbal Extract

- Ginseng

- Ginkgo Biloba

- Curcumin

- Lions Mane

- Bacopa Monnieri

- Others

- Vitamins & Minerals

- B Vitamins

- Vitamin C & E

- Others

- Natural Molecules

- Acetyl-L-carnitine

- Alpha GPC

- Citicoline

- Docosahexaenoic Acid (DHA)

- Huperzine-A

- Others

According to brain health supplements industry analysis, the market is expected to dominated by the herbal extract category, which is noteworthy. The growing inclination of consumers towards natural and holistic solutions is the reason behind this segment's success. Because they are thought to be safe and effective, herbal extracts made from plants like turmeric or ginkgo biloba that are said to have cognitive benefits are becoming more and more popular. Their dominance in the market is largely due to their historical use in traditional medicine as well as the rising demand for organic, plant-based alternatives. This particular segment is growing because of their broad appeal and perceived mildness, which appeal to a wide variety of consumers seeking cognitive wellness.

Brain Health Supplement Age Groups

- Children

- Adults

- Elderly

The adult market sector is the largest category in the brain health supplements market. There are multiple reasons for this supremacy. Stressors pertaining to employment, lifestyle, and cognitive function are common among adults, which has led to an increased awareness of and need for cognitive enhancement. Additionally, this market includes a broad spectrum of demographics with different demands, such as professionals looking to increase productivity and students trying to focus. The market's need for brain health supplements is fueled by the size and diversity of the adult segment, which makes up the largest and most important customer group for these goods.

Brain Health Supplement Forms

- Tablets

- Capsules

- Others

Capsules are the brain health supplements industry leader due to a variety of advantages. Easy to take, more absorbent than tablets, and longer shelf life are the reasons behind their appeal. A hassle-free intake alternative, tasteless, portable, and convenient, is what makes capsules appealing to customers. To further improve supplement administration accuracy, the encapsulating technique enables precise dose. Capsules have the largest market share because of their adaptability and convenience, which match the expectations of current consumers. For those who prioritise taking supplements for brain health, their effectiveness, simplicity of use, and dependability keep them at the top of the list.

Brain Health Supplement Applications

- Memory Enhancement

- Mood & Depression

- Attention & Focus

- Longevity & Anti-aging

- Sleep & Recovery

- Anxiety

In terms of brain health supplements market analysis, since memory enhancement is relevant to all demographics and has a wide appeal, it has the biggest market share among supplements for brain health. Improving cognitive function and memory is still a top objective for many people in our fast-paced world. Numerous causes contribute to the demand, such as an ageing population that wants to keep their minds fresh, professionals and students who want to increase productivity, and people who are worried about cognitive loss. Given the importance of memory in day-to-day activities, memory-boosting pills are highly popular and have taken the lead in the brain health industry.

Brain Health Supplement Sales Channels

- Supermarkets & Hyper markets

- Drug Stores

- Online Stores

- Others

Given their extensive reach and convenient location for customers, supermarkets and hypermarkets stand out as the top sales channels in the market for brain health products. Health-conscious consumers who are searching for supplements in addition to their usual consumables are among the varied crowd of customers drawn to these retail establishments. Supplements for brain health are readily visible and accessible on shelves, which makes impulsive purchasing possible. A additional factor in driving sales is the possibility of in-store displays, promotions, and employee recommendations. Supermarkets and hypermarkets are essential in the distribution of brain health supplements because of their strategic locations and capacity to serve a broad client base. They have the largest market share.

Brain Health Supplements Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Brain Health Supplements Market Regional Analysis

North America is expected to hold a major market share during the brain health supplements industry forecast period owing to a high presence of patients suffering from various nutritional diseases, a rising geriatric population, and a well-developed economy. Additionally, the increasing number of surgeries, coupled with high healthcare spending, has supported the growth of the North American brain health supplements market globally. In 2015, according to the Federal Interagency Forum, over 15.1% of the population in North America was aged above 65. Furthermore, according to the Centre for Medicare and Medicaid Services, national health spending in the U.S. is projected to grow at an average rate, reaching USD 5.7 trillion in near future.

Europe is expected to secure the second-leading position in the brain health products market. Adoption of nutritional supplements, heightened awareness among the populace, and a substantial patient pool are the major drivers of this market. Favorable government support and evolving lifestyles have further supported the growth of brain health supplements.

Asia-Pacific is anticipated to be the fastest-growing brain health supplements market owing to the region's large population suffering from nutritional diseases and lifestyle-related ailments like diabetes. According to the International Diabetes Federation (IDF), in 2016, over 114 million cases of diabetes were reported in China alone. The presence of rapidly developing economies, increasing government support, and rising healthcare spending have all contributed to boosting the growth of the Asia-Pacific brain health supplements industry.

The LAMEA (Latin America, Middle East, and Africa) brain health medicine market is mainly driven by an increasing number of children and people suffering from malnutrition, rising nutritional education, and a growing number of premature births. Additionally, the rising geriatric population and increasing government support have also fueled the growth of the brain health supplements market. Many premature babies suffer from undeveloped immunity and low weight, thus requiring brain health supplements to meet their nutritional demands.

Brain Health Supplements Market Players

Some of the top brain health supplements companies offered in our report includes AlternaScript, LLC, Accelerated Intelligence Inc., Natural Factors Nutritional Products Ltd., Aurobindo Pharma Limited, Onnit Labs, LLC, HVMN Inc., Liquid Health, Inc., Purelife Bioscience Co., Ltd., KeyView Labs, Inc., and Quincy Bioscience.

Frequently Asked Questions

How big is the brain health supplements market?

The market size of brain health supplements was USD 8.4 Billion in 2022.

What is the CAGR of the global brain health supplements market from 2023 to 2032?

The CAGR of brain health supplements is 12.2% during the analysis period of 2023 to 2032.

Which are the key players in the brain health supplements market?

The key players operating in the global market are including AlternaScript, LLC, Accelerated Intelligence Inc., Natural Factors Nutritional Products Ltd., Aurobindo Pharma Limited, Onnit Labs, LLC, HVMN Inc., Liquid Health, Inc., Purelife Bioscience Co., Ltd., KeyView Labs, Inc., and Quincy Bioscience.

Which region dominated the global brain health supplements market share?

North America held the dominating Application in brain health supplements industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of brain health supplements during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global brain health supplements industry?

The current trends and dynamics in the brain health supplements industry include increasing awareness about mental health and wellness, growing aging population seeking cognitive support, evolving lifestyles demanding cognitive enhancement, and research advancements boosting innovative supplement formulations.

Which product held the maximum share in 2022?

The herbal extract product held the maximum share of the brain health supplements industry.