Botulinum Toxin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Botulinum Toxin Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

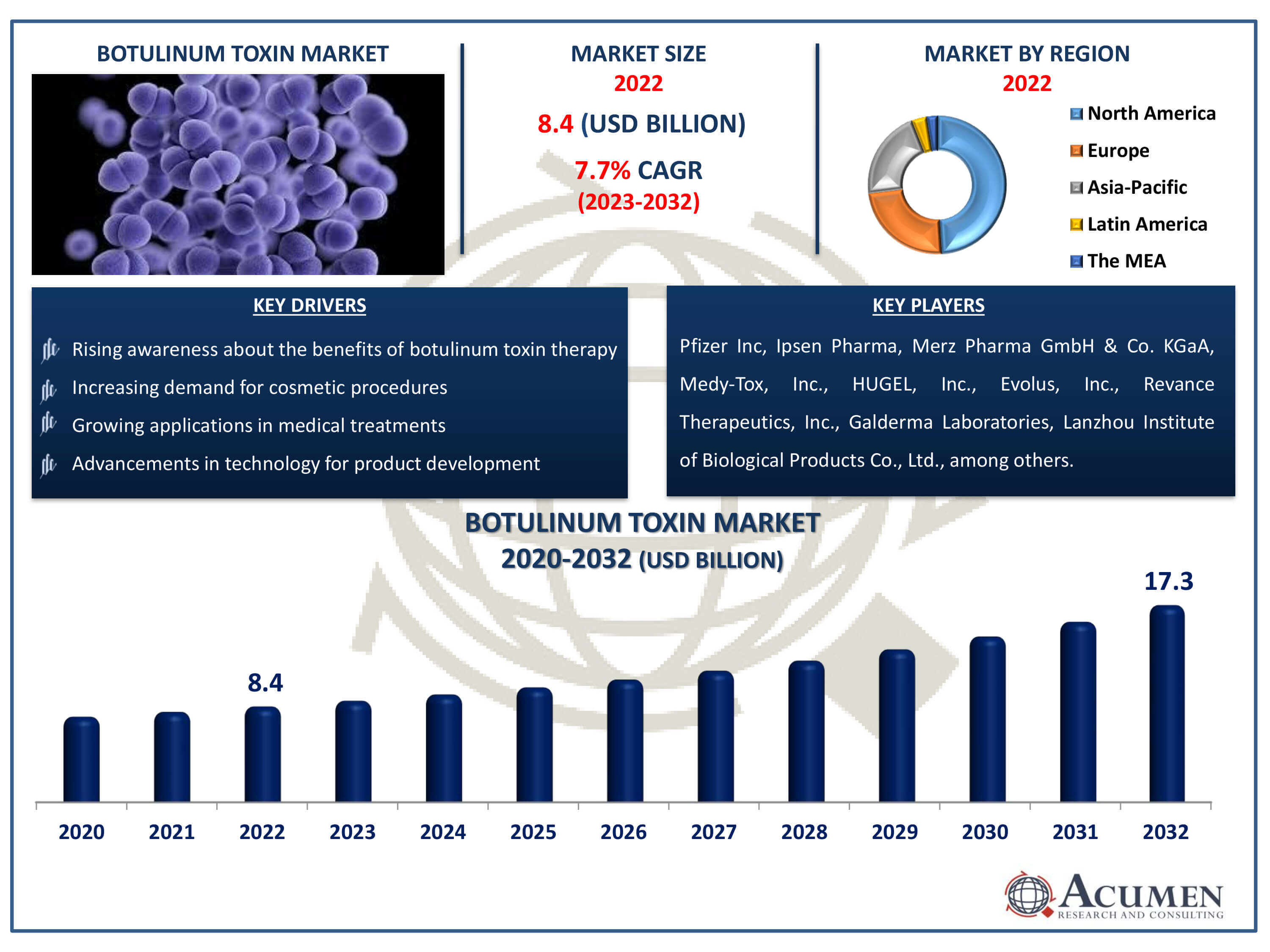

The Botulinum Toxin Market Size accounted for USD 8.4 Billion in 2022 and is estimated to achieve a market size of USD 17.3 Billion by 2032 growing at a CAGR of 7.7% from 2023 to 2032.

Botulinum Toxin Market Highlights

- Global botulinum toxin market revenue is poised to garner USD 17.3 billion by 2032 with a CAGR of 7.7% from 2023 to 2032

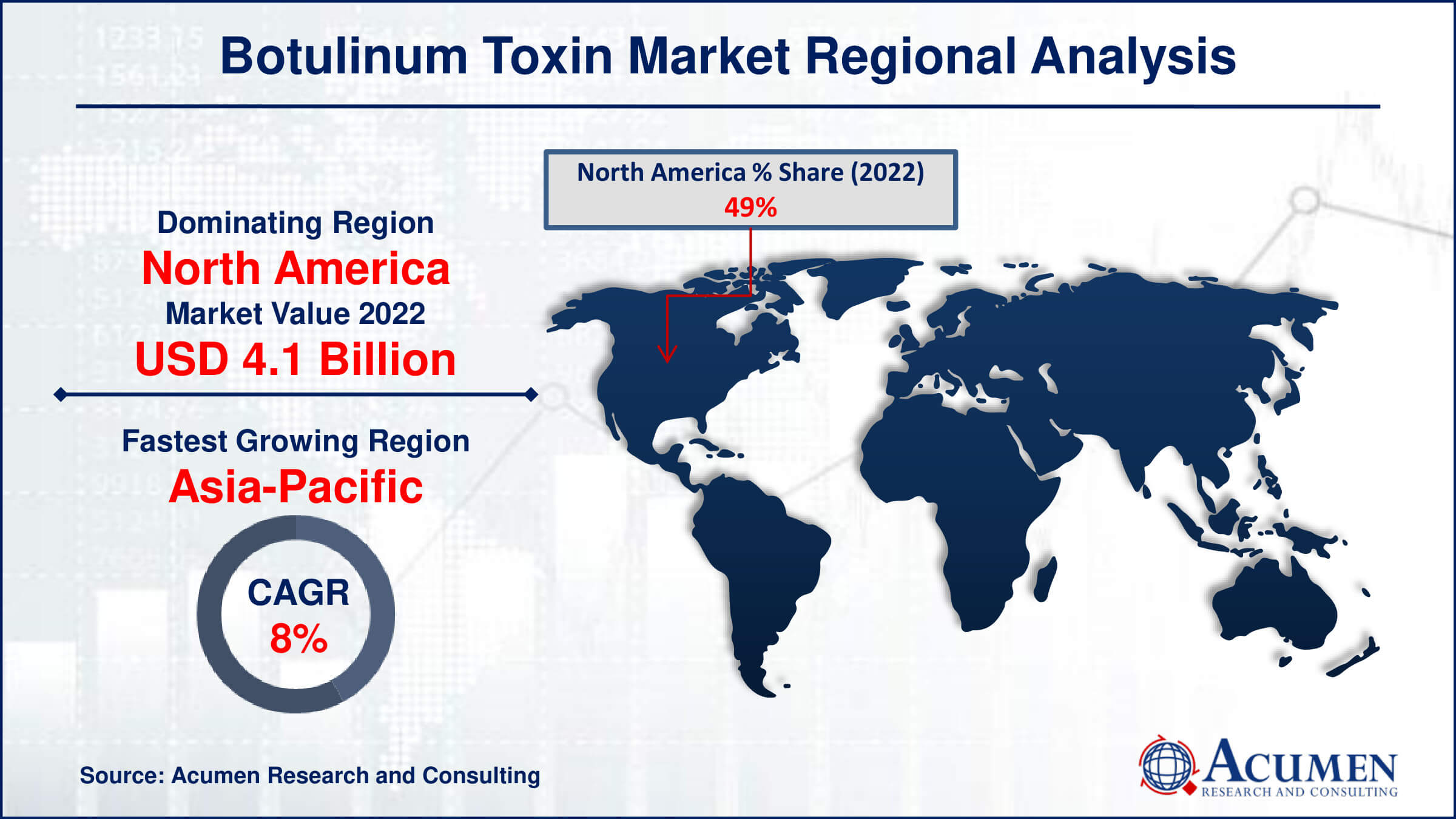

- North America botulinum toxin market value occupied around USD 4.1 billion in 2022

- Asia-Pacific botulinum toxin market growth will record a CAGR of more than 8% from 2023 to 2032

- Among product, the botulinum toxin type A sub-segment generated more than USD 8.2 billion revenue in 2022

- Based on end-use, the cosmetic centers and medspas sub-segment generated significant market share in 2022

- Collaborations for research and development initiatives is a popular botulinum toxin market trend that fuels the industry demand

The critical quality requirements and new uses are keeping the botulinum toxin business competitive on a global scale. Many organizations are investing in research to develop new uses that will allow them to get a greater market share and profit from the worldwide market for botulinum toxins. Furthermore, the need for excellent quality requires organizations to develop stringent quality control procedures in order to fulfill the criteria for current product applications. This emphasis on quality assurance not only assures regulatory compliance, but it also increases consumer pleasure and faith in the goods' efficacy and safety. As the market evolves and expands, firms must stay diligent in their pursuit of innovation and quality in order to preserve a competitive advantage and capitalize on new possibilities.

Global Botulinum Toxin Market Dynamics

Market Drivers

- Increasing demand for cosmetic procedures

- Growing applications in medical treatments

- Advancements in technology for product development

- Rising awareness about the benefits of botulinum toxin therapy

Market Restraints

- Stringent regulatory approvals for new formulations

- High treatment costs limiting accessibility

- Concerns regarding potential side effects and safety

Market Opportunities

- Expansion into emerging markets

- Development of novel delivery methods

- Diversification of product portfolio for varied applications

Botulinum Toxin Market Report Coverage

| Market | Botulinum Toxin Market |

| Botulinum Toxin Market Size 2022 | USD 8.4 Billion |

| Botulinum Toxin Market Forecast 2032 |

USD 17.3 Billion |

| Botulinum Toxin Market CAGR During 2023 - 2032 | 7.7% |

| Botulinum Toxin Market Analysis Period | 2020 - 2032 |

| Botulinum Toxin Market Base Year |

2022 |

| Botulinum Toxin Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Pfizer Inc, Ipsen Pharma, Merz Pharma GmbH & Co. KGaA, Medy-Tox, Inc., HUGEL, Inc., Evolus, Inc., Revance Therapeutics, Inc., Galderma Laboratories, Lanzhou Institute of Biological Products Co., Ltd., Hugh Source (International) Ltd., Metabiologics, Inc., and Eisai Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Botulinum Toxin Market Insights

The expanding population aged 25 to 65, along with an increased desire for minimally invasive or non-invasive operations, is a primary driver of worldwide market growth. Botulinum Neurotoxin (BNT) is a neurotoxin produced by the anaerobic bacteria Clostridium botulinum. There are seven different antigenic types: BNT-A, B, C, D, E, F, and G. BNT is extensively used in aesthetic applications. Currently, just a few BNT-A and one BNT-B items are accessible on the market. However, significant expenditures in research and development are expected to broaden the breadth of botulinum toxin therapeutic applications over the botulinum toxin industry forecast period.

The combination of telemedicine and digital health platforms for remote consultations and treatment monitoring represents a big potential opportunity in the botulinum toxin market. With the advent of telehealth services, patients may now get consultations and follow-ups from the comfort of their own homes, removing the need for in-person visits and lowering healthcare expenditures. This shift towards telemedicine not only improves patient comfort, but it also widens the accessibility of botulinum toxin treatments to underdeveloped communities with limited access to specialised medical care. Furthermore, digital health systems with AI-powered algorithms can help healthcare practitioners with treatment planning, dose optimisation, and patient monitoring, resulting in better treatment results and patient satisfaction.

Furthermore, advances in biotechnology and genetic engineering present exciting opportunities for developing next-generation botulinum toxin treatments with higher effectiveness and safety profiles. Researchers can use cutting-edge biotechnological technologies to create innovative formulations with improved targeting capabilities and reduced immunogenicity, lowering the likelihood of adverse effects while boosting therapeutic efficacy. Furthermore, advances in gene therapy techniques may allow for the creation of gene-based medicines that give long-term and tailored relief for neurological and musculoskeletal problems, boosting botulinum toxin's therapeutic potential in medicine.

Botulinum Toxin Market Segmentation

The worldwide market for botulinum toxin is split based on product, application, end-use, and geography.

Botulinum Toxin Products

- Botulinum Toxin Type B

- Botulinum Toxin Type A

According to botulinum toxin industry analysis, the botulinum toxin type A segment held the largest share, positioning it as the leader in the global market. This segment is expected to continue its dominance during the forecast period. Various BNTA products, including well-known brands such as Botox and Dysport, are commercially available worldwide. Botox is commonly used for aesthetic purposes, including the treatment of severe axillary primary hyperhidrosis, blepharospasm, cervical dystonia, as well as mild and severe glabellar lines. Xeomin is also utilized in certain regions for the treatment of glabellar lines, cervical dystonia, and blepharospasm. However, adverse effects such as allergic reactions, nausea, rash, neck, and back pain have been reported with BNTA products. Additionally, the high cost associated with these products and procedures poses a significant challenge to market growth. Therefore, these factors hinder the expansion of the market.

Botulinum Toxin Applications

- Therapeutic

- Chronic Migraine

- Overactive Bladder

- Cervical Dystonia

- Spasticity

- Others

- Aesthetic

- Glabellar Lines

- Crow’s Feet

- Forehead Lines

- Others

The botulinum toxin is primarily used to enhance facial appearance and reduce signs of aging in cosmetic (esthetic) applications. Common areas for treatment include frown lines, crow's feet, and glabellar lines, leading to a greater market share of the esthetic segment in 2022.

Allergan received FDA approval for Botox in the United States in 2004 for hyperhidrosis, in 2009 for cervical dystonia, in 2010 for post-stroke spasticity in the upper limb, and in 2011 for overactive bladder and urinary incontinence. It is evident that the use of Botox has expanded across multiple indications through consistent R&D efforts.

Furthermore, other products such as Dysport and Xeomin are used to treat conditions like blepharospasm and hyperhidrosis. Myobloc, a botulinum toxin Type B (BNTB), is also used for the treatment of cervical dystonia and is commercially available under its brand name. With the increasing utilization of botulinum toxin in therapeutic applications, a significant increase in therapeutic applications is expected during the botulinum toxin market forecaste period.

Botulinum Toxin End-uses

- Hospitals

- Dermatology Clinics

- Cosmetic Centers and Medspas

In the botulinum toxin market, dermatology clinics are the largest end-user sector. Dermatology clinics, with their specialized knowledge of skincare and cosmetic procedures, play an important role in giving botulinum toxin treatments. These clinics provide a wide range of treatments, including as skin diagnostics and treatment, as well as cosmetic modifications. Dermatology clinics, which have trained dermatologists and cutting-edge equipment, attract a large number of botulinum toxin patients looking for cosmetic operations including wrinkle removal and face rejuvenation. Their emphasis on providing bespoke treatments and personalized care adds to the segment's market dominance, demonstrating a rising desire for specialized medical facilities for aesthetic operations.

Botulinum Toxin Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Botulinum Toxin Market Regional Analysis

North America is the largest market for botulinum toxin due to a variety of variables. First, North America has a strong healthcare infrastructure and a high degree of consumer knowledge about cosmetic operations, which drives demand for botulinum toxin treatments. Furthermore, the region is home to a big number of dermatological clinics, cosmetic centers, and medspas, providing several chances for the use of botulinum toxin products. Furthermore, regulatory approvals and reimbursement policies in North America are favorable to the use of botulinum toxin medicines, driving market expansion.

The Asia-Pacific area is the fastest expanding market for botulinum toxin. This expansion can be ascribed to rising disposable income levels, increased acceptance of Western beauty ideals, and an ageing population in nations such as China, Japan, and South Korea. Furthermore, improvements in healthcare infrastructure and increased access to medical aesthetics operations in emerging nations contribute to the rapid growth of the botulinum toxin market in Asia-Pacific.

Botulinum Toxin Market Players

Some of the top botulinum toxin companies offered in our report includes Pfizer Inc, Ipsen Pharma, Merz Pharma GmbH & Co. KGaA, Medy-Tox, Inc., HUGEL, Inc., Evolus, Inc., Revance Therapeutics, Inc., Galderma Laboratories, Lanzhou Institute of Biological Products Co., Ltd., Hugh Source (International) Ltd., Metabiologics, Inc., and Eisai Co., Ltd.

Frequently Asked Questions

How big is the botulinum toxin market?

The botulinum toxin market size was valued at USD 8.4 billion in 2022.

What is the CAGR of the global botulinum toxin market from 2023 to 2032?

The CAGR of botulinum toxin is 7.7% during the analysis period of 2023 to 2032.

Which are the key players in the botulinum toxin market?

The key players operating in the global market are including Pfizer Inc, Ipsen Pharma, Merz Pharma GmbH & Co. KGaA, Medy-Tox, Inc., HUGEL, Inc., Evolus, Inc., Revance Therapeutics, Inc., Galderma Laboratories, Lanzhou Institute of Biological Products Co., Ltd., Hugh Source (International) Ltd., Metabiologics, Inc., and Eisai Co., Ltd.

Which region dominated the global botulinum toxin market share?

North America held the dominating position in botulinum toxin industry during the analysis period of 2023 to 2032.North America held the dominating position in botulinum toxin industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of botulinum toxin during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global botulinum toxin industry?

The current trends and dynamics in the botulinum toxin industry include increasing demand for cosmetic procedures, growing applications in medical treatments, advancements in technology for product development, and rising awareness about the benefits of botulinum toxin therapy.

Which application held the maximum share in 2022?

The aesthetic application held the maximum share of the botulinum toxin industry.