Blow Molded Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Blow Molded Plastics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

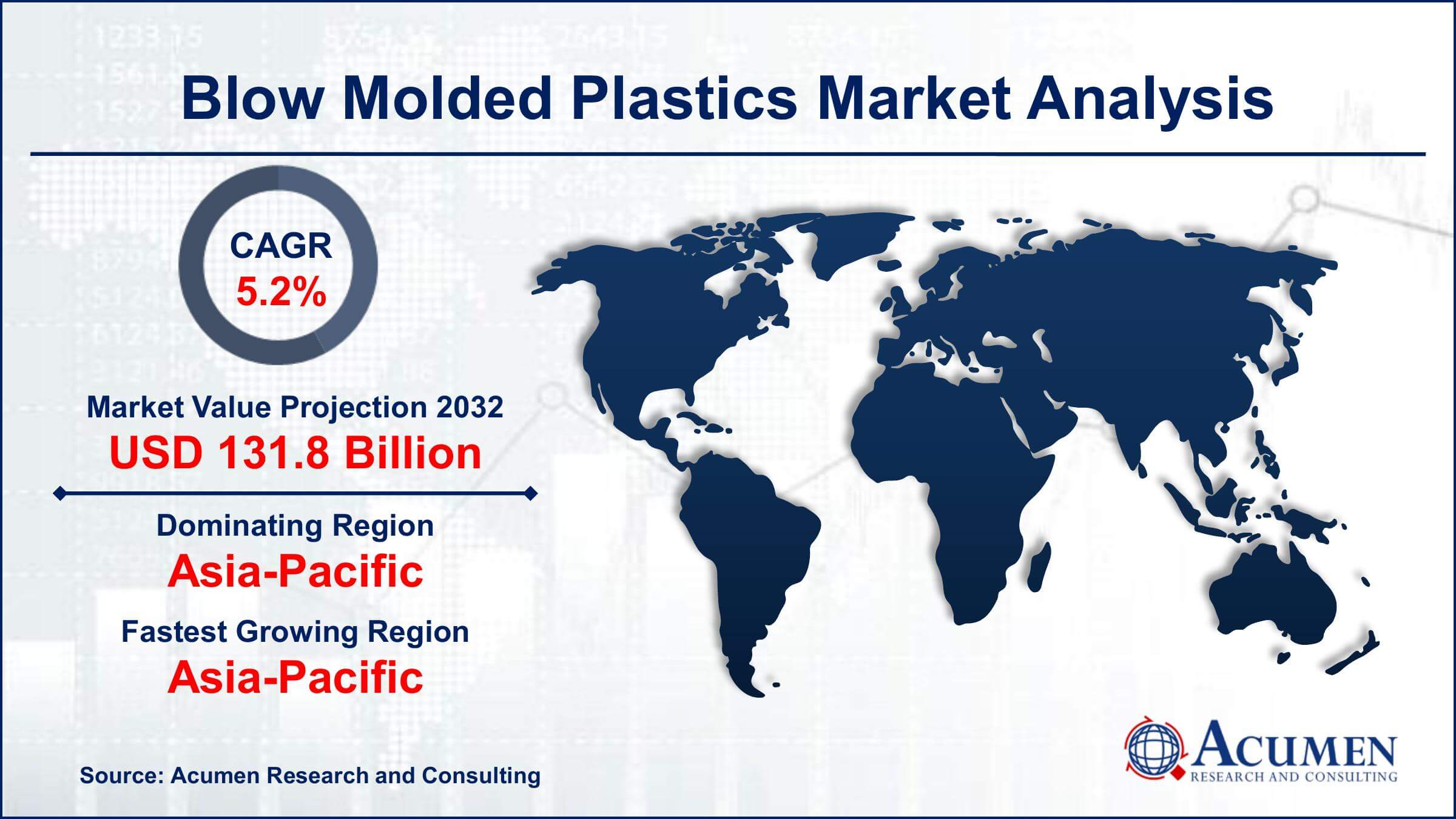

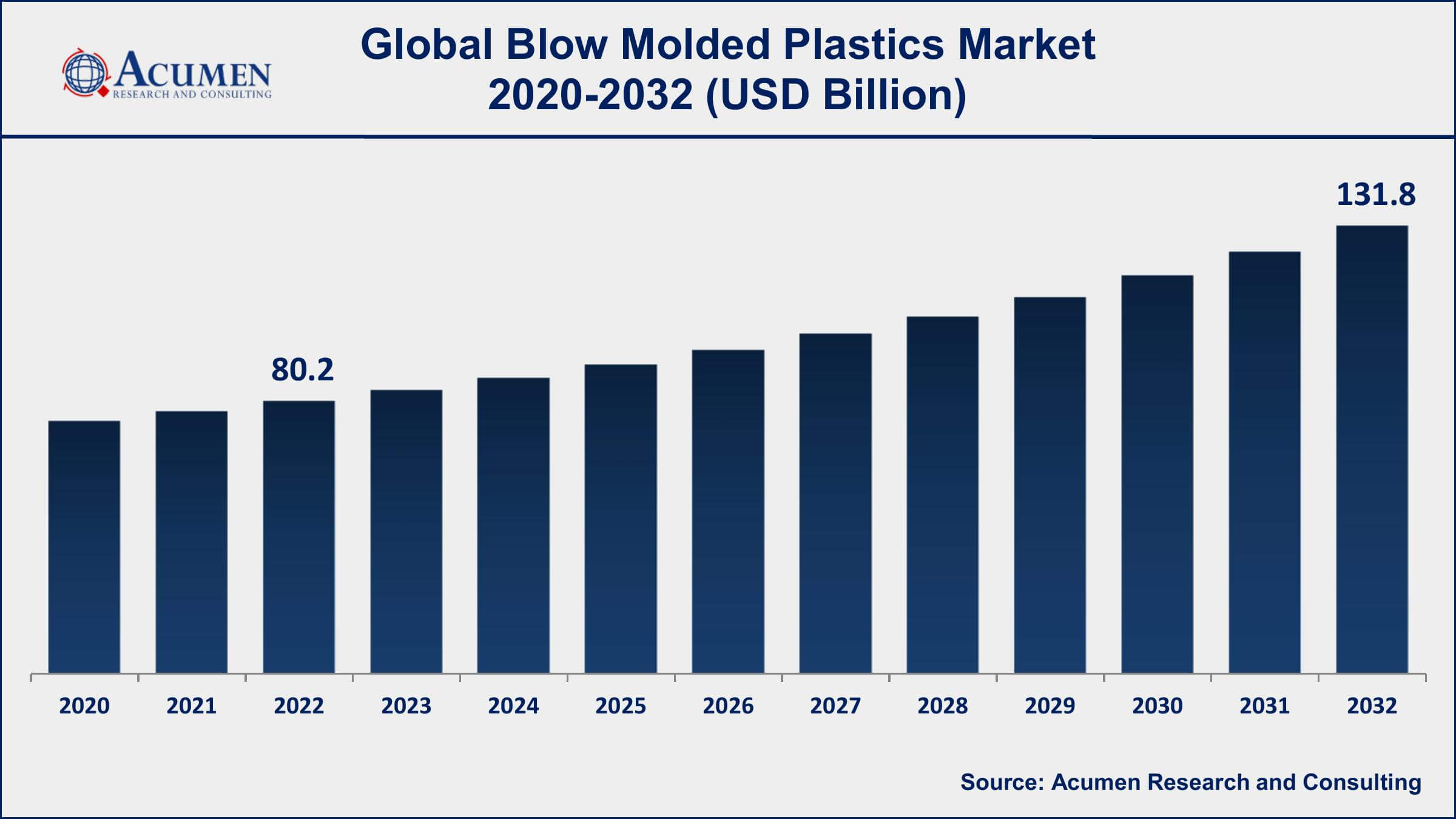

Request Sample Report

The Global Blow Molded Plastics Market Size accounted for USD 80.2 Billion in 2022 and is projected to achieve a market size of USD 131.8 Billion by 2032 growing at a CAGR of 5.2% from 2023 to 2032.

Blow Molded Plastics Market Highlights

- Global blow molded plastics market revenue is expected to increase by USD 131.8 Billion by 2032, with a 5.2% CAGR from 2023 to 2032

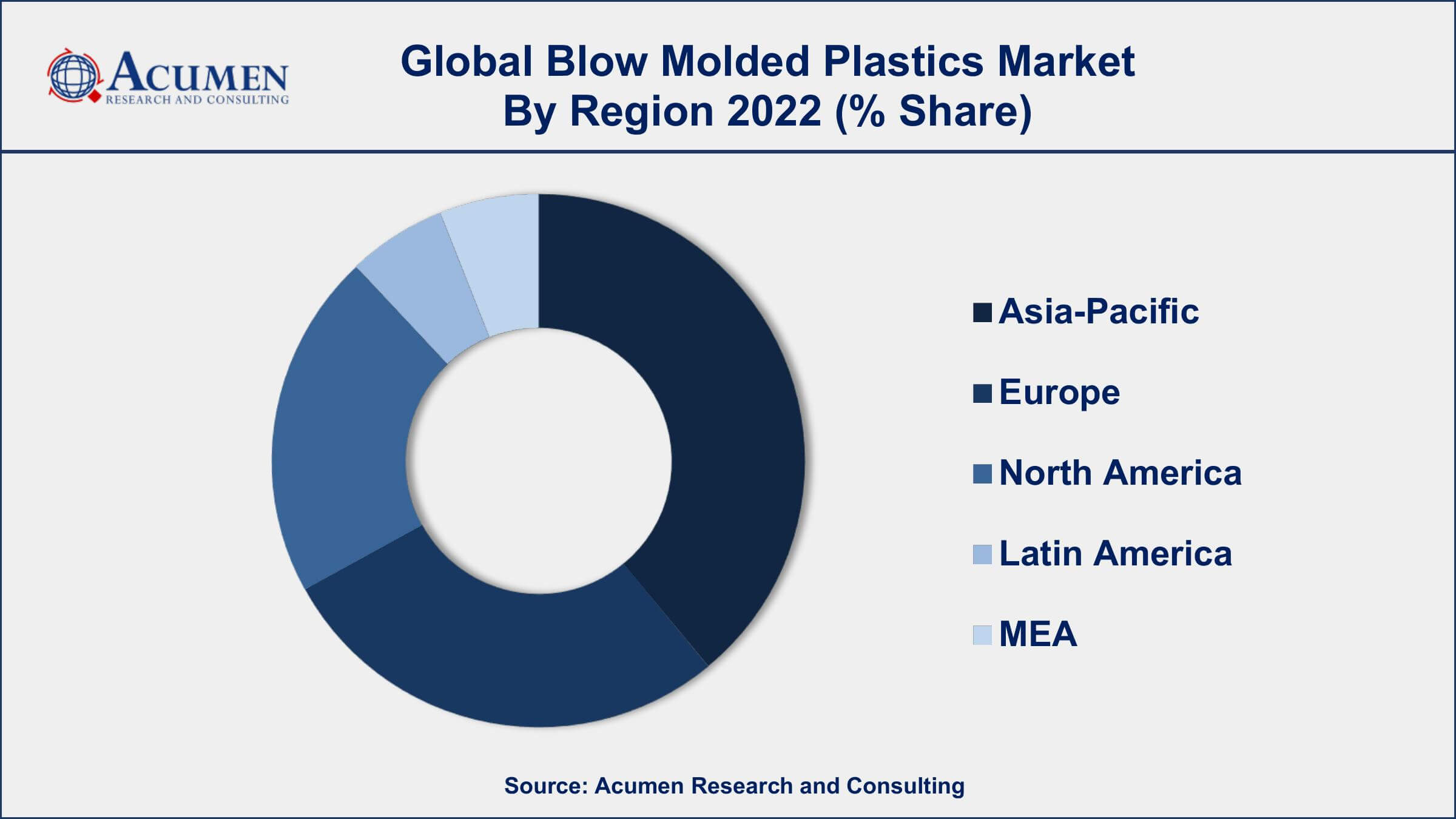

- Asia-Pacific region led with more than 38% of blow molded plastics market share in 2022

- Polyethylene (PE) is the most commonly used material in the market, accounting for more than 21% of the global market share in 2022

- The packaging segment is the largest end-use industry for blow molded plastics, accounting for more than 40% of the global market share in 2022

- The automotive and transport segment is expected to be the fastest-growing end-use industry for blow molded plastics, with a CAGR of 5.9% during the forecast period

- Increasing demand for lightweight and durable packaging materials, drives the blow molded plastics market value

Blow molded plastics are a type of plastic manufacturing process used to create hollow plastic parts. The process involves melting plastic pellets and then blowing air into a mold to create the desired shape. This process is commonly used to create bottles, containers, and other hollow objects. Blow molded plastics are used in a variety of industries, including packaging, automotive, aerospace, and construction.

The market growth for blow molded plastics has been significant in recent years. The growth of the market can be attributed to the increasing demand for lightweight and durable packaging materials, the growing use of blow molded plastics in the automotive industry, and the rising demand for blow molded plastic products in emerging economies. The packaging industry is the largest end-use market for blow molded plastics, with applications ranging from food and beverage packaging to pharmaceuticals and personal care products. The demand for blow molded plastics in the automotive industry is also growing, as automakers look for lightweight and durable materials to improve fuel efficiency and reduce emissions. Additionally, the increasing use of blow molded plastics in emerging economies such as India and China is expected to drive the blow molded plastics market growth in the coming years.

Global Blow Molded Plastics Market Trends

Market Drivers

- Increasing demand for lightweight and durable packaging materials

- Growing use of blow molded plastics in the automotive industry

- Rising demand for blow molded plastic products in emerging economies

- Advancements in technology and machinery used in the blow molding process

- Cost-effectiveness of blow molded plastics compared to other materials

Market Restraints

- Environmental concerns over plastic waste and pollution

- Limited availability of raw materials

Market Opportunities

- Development of bio-based and eco-friendly blow molded plastics

- Increased adoption of blow molded plastics in the construction industry

Blow Molded Plastics Market Report Coverage

| Market | Blow Molded Plastics Market |

| Blow Molded Plastics Market Size 2022 | USD 80.2 Billion |

| Blow Molded Plastics Market Forecast 2032 | USD 131.8 Billion |

| Blow Molded Plastics Market CAGR During 2023 - 2032 | 5.2% |

| Blow Molded Plastics Market Analysis Period | 2020 - 2032 |

| Blow Molded Plastics Market Base Year | 2022 |

| Blow Molded Plastics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Product, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Berry Global, Inc., Amcor plc, The Dow Chemical Company, Exxon Mobil Corporation, LyondellBasell Industries Holdings B.V., SABIC, INEOS Group Holdings S.A., Chevron Phillips Chemical Company LLC, Eastman Chemical Company, RPC Group PLC, ALPLA Werke Alwin Lehner GmbH & Co KG, and Plastipak Holdings, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Blow molded plastics are a type of plastic manufacturing process used to create hollow plastic parts. The process involves melting plastic pellets and then blowing air into a mold to create the desired shape. This process is commonly used to create bottles, containers, and other hollow objects. Blow molded plastics are used in a variety of industries, including packaging, automotive, aerospace, and construction.

One of the primary applications of blow molded plastics is in the packaging industry. Plastic bottles, containers, and jars are commonly made using this process due to their lightweight, durability, and cost-effectiveness. Blow molded plastics are also commonly used in the automotive industry for making fuel tanks, air ducts, and other parts. The hollow nature of blow molded plastics makes them ideal for creating lightweight parts that are strong and durable.

The growth of the market can be attributed to several factors. First, the increasing demand for lightweight and durable packaging materials is driving the use of blow molded plastics in the packaging industry. Additionally, the automotive industry is using blow molded plastics to reduce vehicle weight and improve fuel efficiency. Furthermore, the growth of e-commerce and online shopping is driving the demand for packaging materials, which is expected to further increase the demand for blow molded plastics.

Blow Molded Plastics Market Segmentation

The global blow molded plastics market segmentation is based on technology, product, application, and geography.

Blow Molded Plastics Market By Technology

- Extrusion Blow Molding

- Stretch Blow Molding

- Injection Blow Molding

- Compound Blow Molding

According to the blow molded plastics industry analysis, the injection blow molding segment accounted for the largest market share in 2022. This segment growth can be attributed to the increasing demand for small and complex plastic parts in the healthcare, personal care, and food and beverage industries. The injection blow molding segment is a type of blow molding process that combines the injection molding and blow molding processes into one. This technique is commonly used to create small, complex parts with high precision and accuracy. The process involves injecting molten plastic into a mold cavity to form a preform, which is then transferred to a second mold where the air is blown into the preform to create the final shape. The healthcare industry is expected to be a major driver of growth in the injection blow molding segment, due to the increasing demand for plastic components used in medical devices and pharmaceutical packaging.

Blow Molded Plastics Market By Product

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

- Polystyrene (PS)

- Polyamide (PA)

- Others

In terms of products, the polyethylene (PE) segment is expected to witness significant growth in the coming years. The growth of the PE segment is attributed to the increasing demand for sustainable and eco-friendly packaging materials and the growing need for lightweight and durable materials in the automotive and construction industries. PE is a thermoplastic polymer that can be easily molded into various shapes and sizes using the blow molding process. It offers several benefits such as high impact strength, chemical resistance, and lightweight, making it suitable for a wide range of applications in industries such as packaging, automotive, and construction. Moreover, the development of new grades of PE with improved properties such as higher tensile strength and lower density is expected to further drive the PE segment growth.

Blow Molded Plastics Market By Application

- Packaging

- Building & Construction

- Consumables & Electronics

- Medical

- Automotive & Transport

- Others

According to the blow molded plastics market forecast, the automotive & transport segment is expected to witness significant growth in the coming years. The growth of the automotive and transport segment is attributed to the increasing demand for lightweight and fuel-efficient vehicles, as well as the growing use of electric vehicles. Blow molded plastics are widely used in the automotive and transport industry to create lightweight and durable parts such as air ducts, fuel tanks, and bumper systems. The use of blow molded plastics in the automotive industry has increased in recent years due to the need to reduce vehicle weight and improve fuel efficiency. Additionally, the adoption of advanced manufacturing technologies such as 3D printing and robotics is expected to further drive the automotive and transport segment growth.

Blow Molded Plastics Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Blow Molded Plastics Market Regional Analysis

The Asia-Pacific region dominates the blow molded plastics market, accounting for a significant share of the global market. The region's dominance can be attributed to several factors, including the growing demand for blow molded plastics in various end-use industries such as packaging, automotive, and construction. Additionally, the region has a large and rapidly growing population, which is driving the demand for consumer goods and packaging materials. Moreover, the Asia-Pacific region is home to some of the world's largest manufacturing economies, including China, Japan, and South Korea. These countries have well-established manufacturing industries and are major exporters of blow molded plastics to other regions. The region's low labor costs and favorable government policies have also contributed to the growth of the manufacturing sector, leading to increased production of blow molded plastics.

Blow Molded Plastics Market Player

Some of the top blow molded plastics market companies offered in the professional report include Berry Global, Inc., Amcor plc, The Dow Chemical Company, Exxon Mobil Corporation, LyondellBasell Industries Holdings B.V., SABIC, INEOS Group Holdings S.A., Chevron Phillips Chemical Company LLC, Eastman Chemical Company, RPC Group PLC, ALPLA Werke Alwin Lehner GmbH & Co KG, and Plastipak Holdings, Inc.

Frequently Asked Questions

What was the market size of the global blow molded plastics in 2022?

The market size of blow molded plastics was USD 80.2 Billion in 2022.

What is the CAGR of the global blow molded plastics market from 2023 to 2032?

The CAGR of blow molded plastics is 5.2% during the analysis period of 2023 to 2032.

Which are the key players in the blow molded plastics market?

The key players operating in the global market are including Berry Global, Inc., Amcor plc, The Dow Chemical Company, Exxon Mobil Corporation, LyondellBasell Industries Holdings B.V., SABIC, INEOS Group Holdings S.A., Chevron Phillips Chemical Company LLC, Eastman Chemical Company, RPC Group PLC, ALPLA Werke Alwin Lehner GmbH & Co KG, and Plastipak Holdings, Inc.

Which region dominated the global blow molded plastics market share?

Asia-Pacific held the dominating position in blow molded plastics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of blow molded plastics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global blow molded plastics industry?

The current trends and dynamics in the blow molded plastics industry include increasing demand for lightweight and durable packaging materials, growing use of blow molded plastics in the automotive industry, and advancements in technology and machinery used in the blow molding process.

Which product held the maximum share in 2022?

The polyethylene (PE) product held the maximum share of the blow molded plastics industry.