Blood Warmer Devices/Sample Warmer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Blood Warmer Devices/Sample Warmer Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

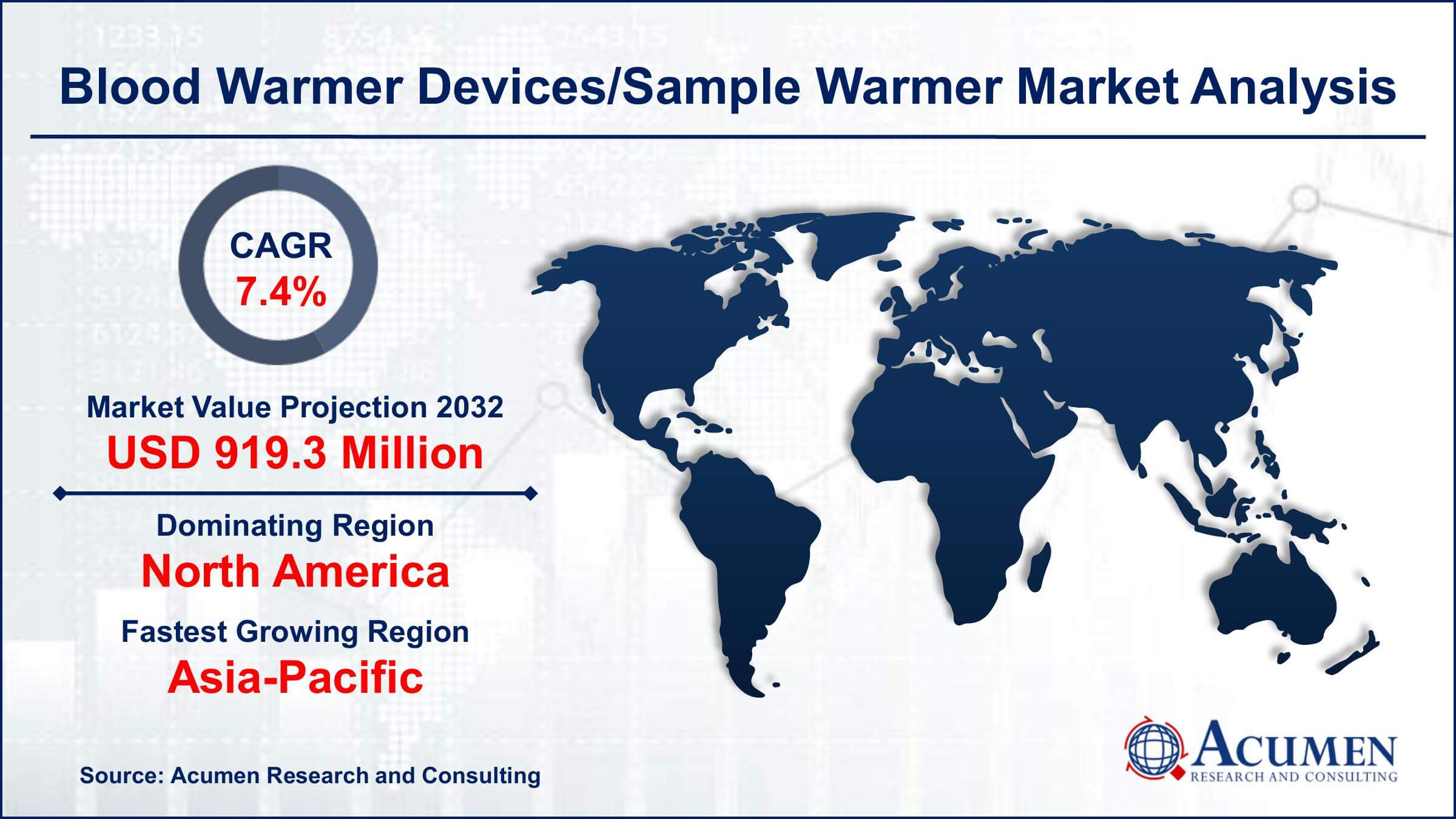

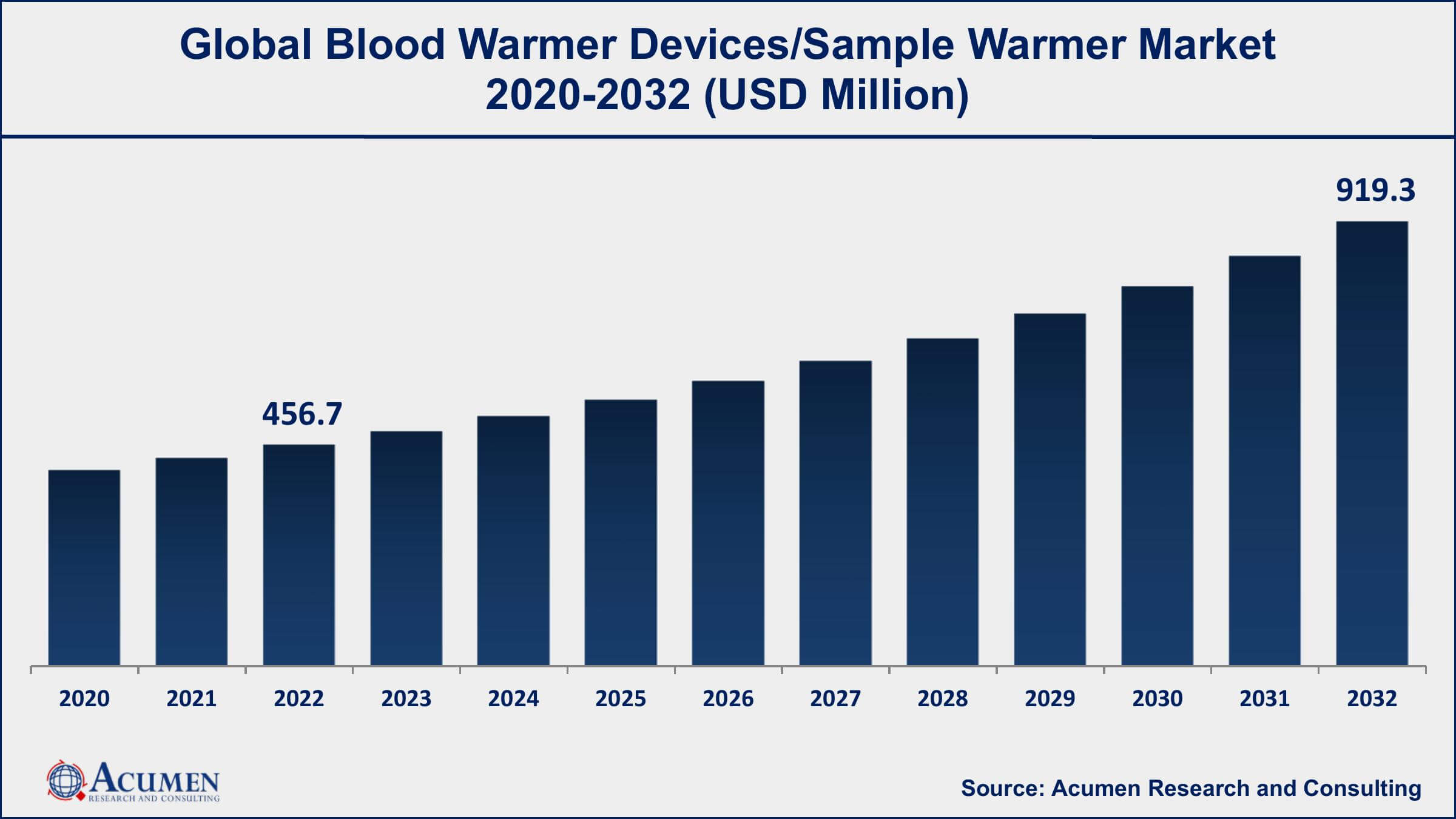

The Global Blood Warmer Devices/Sample Warmer Market Size accounted for USD 456.7 Million in 2022 and is projected to achieve a market size of USD 919.3 Million by 2032 growing at a CAGR of 7.4% from 2023 to 2032.

Blood Warmer Devices/Sample Warmer Market Highlights

- Global blood warmer devices/sample warmer market revenue is expected to increase by USD 919.3 Million by 2032, with a 7.4% CAGR from 2023 to 2032

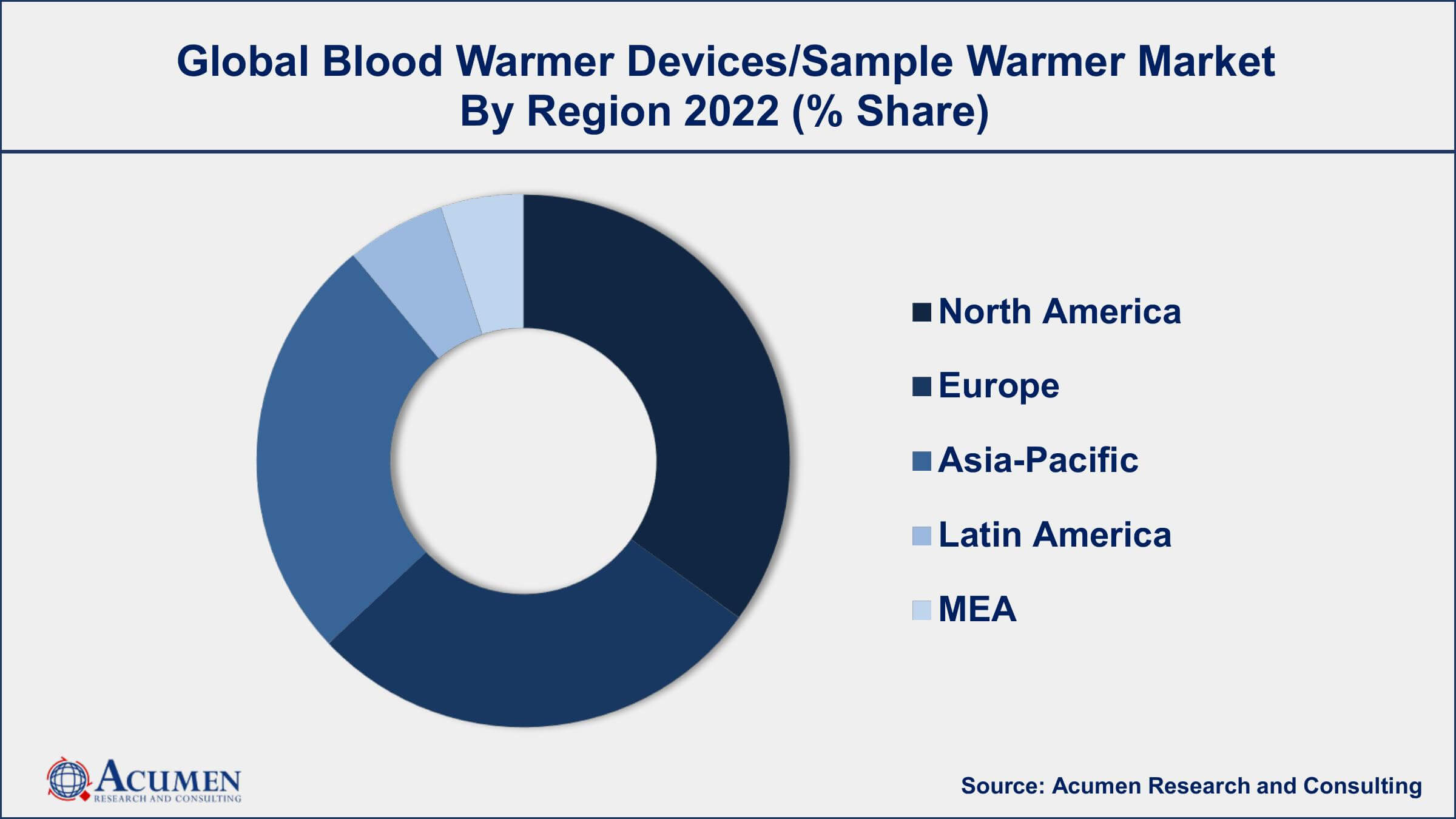

- North America region led with more than 37% of blood warmer devices/sample warmer market share in 2022

- According to the World Health Organization (WHO), around 117.4 million blood donations are collected globally every year

- In the United States, the American Red Cross supplies about 40% of the country's blood and blood components

- Asia-Pacific blood warmer devices/sample warmer market growth will record a CAGR of around 8% from 2023 to 2032

- Increasing number of surgical procedures worldwide, drives the blood warmer devices/sample warmer market value

Blood warmer devices and sample warmers are medical devices used to maintain the temperature of blood and other fluids that are administered to patients during surgery or in emergency situations. Blood and fluid temperature play a crucial role in patient safety and treatment outcomes, as hypothermia can cause a number of complications, including increased risk of infection, cardiac arrhythmias, and impaired coagulation. These devices are designed to quickly warm fluids to a safe temperature before they are administered to the patient.

The market for blood warmer devices and sample warmers has seen steady growth in recent years, primarily due to an increase in surgical procedures and the growing demand for advanced medical technologies. One of the key drivers of growth in this market is the increasing number of surgeries being performed worldwide. According to the World Health Organization, an estimated 313 million surgeries are performed globally every year, and this number is expected to continue growing as the global population ages and demand for healthcare services increases. Additionally, advances in medical technology and an increased focus on patient safety are also driving demand for blood warmer devices and sample warmers, as hospitals and healthcare providers seek to improve patient outcomes and reduce the risk of complications during surgical procedures.

Global Blood Warmer Devices/Sample Warmer Market Trends

Market Drivers

- Increasing number of surgical procedures worldwide

- Growing demand for advanced medical technologies

- Focus on patient safety and improved outcomes

- Rising prevalence of chronic diseases requiring blood transfusions

- Increase in demand for portable blood warmer devices

Market Restraints

- High cost of blood warmer devices/sample warmers

- Limited availability of skilled professionals to operate the devices

Market Opportunities

- Increasing focus on home healthcare and self-administration of medications

- Development of new technologies for blood warmer devices/sample warmers

Blood Warmer Devices/Sample Warmer Market Report Coverage

| Market | Blood Warmer Devices/Sample Warmer Market |

| Blood Warmer Devices/Sample Warmer Market Size 2022 | USD 456.7 Million |

| Blood Warmer Devices/Sample Warmer Market Forecast 2032 | USD 919.3 Million |

| Blood Warmer Devices/Sample Warmer Market CAGR During 2023 - 2032 | 7.4% |

| Blood Warmer Devices/Sample Warmer Market Analysis Period | 2020 - 2032 |

| Blood Warmer Devices/Sample Warmer Market Base Year | 2022 |

| Blood Warmer Devices/Sample Warmer Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3M Health Care, Barkey GmbH & Co. KG, Belmont Instrument Corporation, EMIT Corporation, GE Healthcare, Geratherm Medical AG, Stihler Electronic GmbH, Sarstedt AG & Co. KG, Smiths Medical, The 37Company, Vyaire Medical, Inc., and Biegler GmbH. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

A fluid warmer or blood warmer is a therapeutic device used for healthcare services for warming fluids, colloids, blood products, or crystalloids; before transferring blood to a person. This would help to prevent hypothermia or growing cases of trauma.

The growing burden of hypothermia cases, the rising number of surgeries, and escalating number of trauma cases are some of the factors driving the growth of this market. In addition, the high requirement for blood in surgical treatments across clinics and the substantial number of blood transfusions are also contributing to the growth of this market. The availability of alternative methods for blood and fluid warming can affect growth worldwide. The increasing number of surgeries and more cases of trauma are expected to boost the growth of this market in the forecast period.

Blood Warmer Devices/Sample Warmer Market Segmentation

The global blood warmer devices/sample warmer market segmentation is based on product, end user, and geography.

Blood Warmer Devices/Sample Warmer Market By Product

- Surface Warming System

- Patient Warming Accessories

- Intravenous Warming System

In terms of products, the intravenous (IV) warming system segment has seen significant growth in the blood warmer devices market in recent years. These systems are designed to quickly and efficiently warm intravenous fluids, blood, and other medical fluids to a safe temperature for infusion into the patient's body. IV warming systems play a critical role in maintaining the temperature of fluids during surgical procedures, trauma situations, and emergency care. The IV warming system segment is expected to grow significantly in the coming years due to the increasing adoption of these devices by hospitals, clinics, and other healthcare facilities. The market for IV warming systems is also being driven by technological advancements in the devices, such as the development of portable and disposable systems that are easier to use and more cost-effective.

Blood Warmer Devices/Sample Warmer Market By End User

- Hospitals

- Blood Banks

- Others

According to the blood warmer devices/sample warmer market forecast, the blood banks segment is expected to witness significant growth in the coming years. Blood banks are responsible for collecting, testing, and storing blood and blood products for transfusion to patients. To ensure the safety and efficacy of these blood products, it is crucial to maintain their temperature during storage and transportation. Blood warmers are used to bring blood and blood products to a safe temperature before transfusion, and they play an important role in ensuring the quality of transfused blood. The blood bank segment is expected to see significant growth in the coming years, driven by an increasing number of blood transfusions and the need to maintain the temperature of blood products during storage and transportation. Additionally, technological advancements in blood warmer devices/sample warmers are also expected to drive growth in the blood banks segment.

Blood Warmer Devices/Sample Warmer Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Blood Warmer Devices/Sample Warmer Market Regional Analysis

North America dominates the blood warmer devices/sample warmer market due to several factors. One of the key factors is the high prevalence of chronic diseases and the subsequent need for blood transfusions. According to the American Red Cross, over 36,000 units of red blood cells are needed every day in the United States alone, highlighting the significant demand for blood transfusions. Additionally, the region has a well-developed healthcare infrastructure and high healthcare spending, which drives the adoption of advanced medical technologies such as blood warmer devices/sample warmers. Moreover, the presence of key market players in North America has also contributed to the region's dominance in the market. Leading manufacturers such as 3M, Smiths Medical, and Stryker Corporation are headquartered in North America, and they have a strong presence in the region. These companies have a wide range of product offerings, and they invest heavily in research and development to introduce new and innovative blood warmer devices/sample warmers in the market. Furthermore, favorable government policies and regulations in North America have also supported the growth of the blood-warmer devices/sample warmer market in the region.

Blood Warmer Devices/Sample Warmer Market Player

Some of the top blood warmer devices/sample warmer market companies offered in the professional report include 3M Health Care, Barkey GmbH & Co. KG, Belmont Instrument Corporation, EMIT Corporation, GE Healthcare, Geratherm Medical AG, Stihler Electronic GmbH, Sarstedt AG & Co. KG, Smiths Medical, The 37Company, Vyaire Medical, Inc., and Biegler GmbH.

Frequently Asked Questions

What was the market size of the global blood warmer devices/sample warmer in 2022?

The market size of blood warmer devices/sample warmer was USD 456.7 Million in 2022.

What is the CAGR of the global blood warmer devices/sample warmer market from 2023 to 2032?

The CAGR of blood warmer devices/sample warmer is 7.4% during the analysis period of 2023 to 2032.

Which are the key players in the blood warmer devices/sample warmer market?

The key players operating in the global market are including 3M Health Care, Barkey GmbH & Co. KG, Belmont Instrument Corporation, EMIT Corporation, GE Healthcare, Geratherm Medical AG, Stihler Electronic GmbH, Sarstedt AG & Co. KG, Smiths Medical, The 37Company, Vyaire Medical, Inc., and Biegler GmbH.

Which region dominated the global blood warmer devices/sample warmer market share?

North America held the dominating position in blood warmer devices/sample warmer industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of blood warmer devices/sample warmer during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global blood warmer devices/sample warmer industry?

The current trends and dynamics in the blood warmer devices/sample warmer industry include increasing number of surgical procedures worldwide, growing demand for advanced medical technologies, focus on patient safety and improved outcomes, and rising prevalence of chronic diseases requiring blood transfusions.

Which product held the maximum share in 2022?

The intravenous warming system product held the maximum share of the blood warmer devices/sample warmer industry.