Blood Purification Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Published :

Report ID:

Pages :

Format :

Blood Purification Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

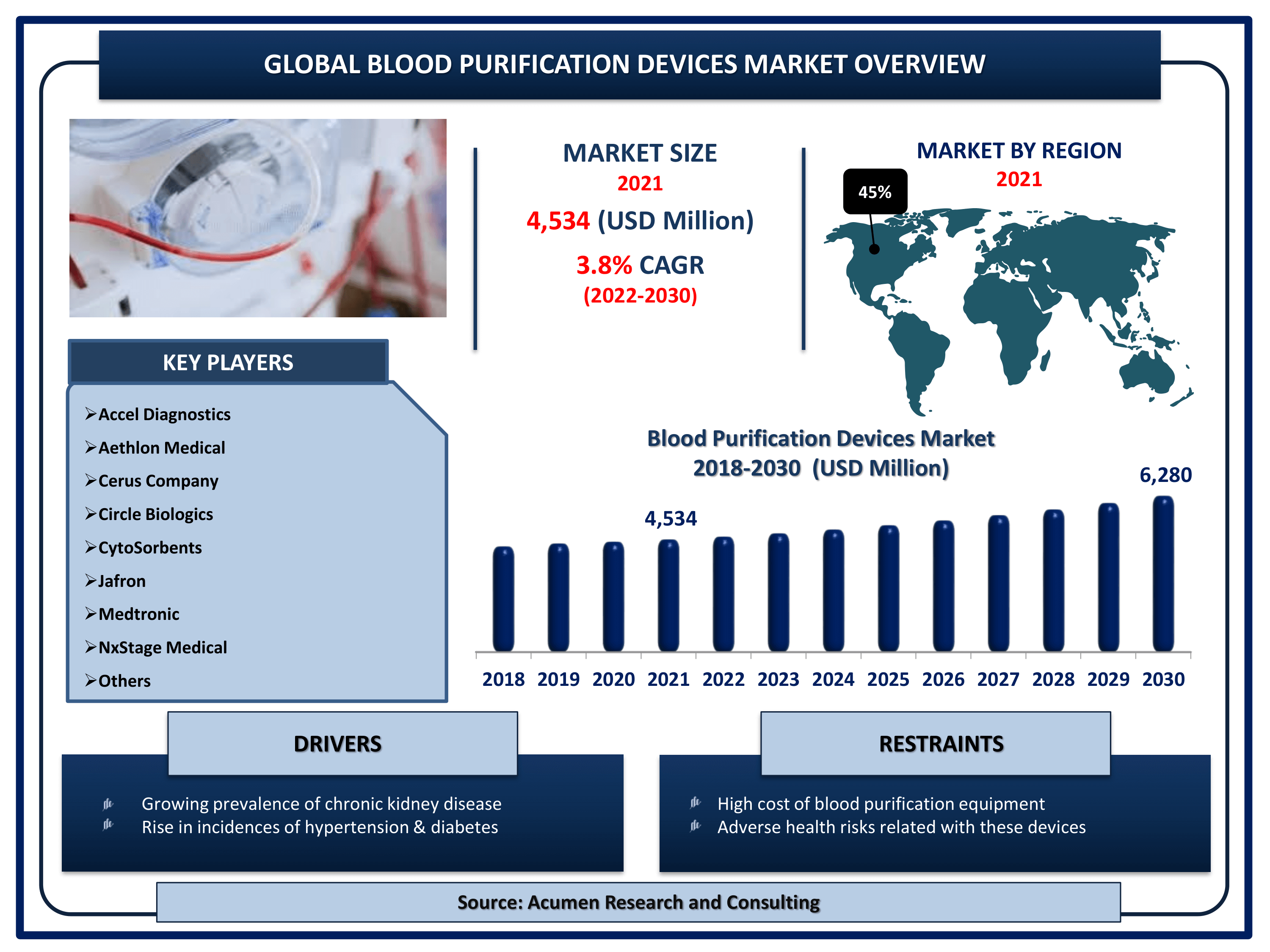

The Global Blood Purification Devices Market Size accounted for USD 4,534 Million in 2021 and is projected to achieve a market size of USD 6,280 Million by 2030 rising at a CAGR of 3.8% from 2022 to 2030. Blood purification devices are effective in treating certain patients by reducing various pathogens, cytokines, and other inflammatory mediators. Blood purification devices involve filtration process that controls cells immune response by reducing various pathogens, cytokines, and other inflammatory mediators that are small active proteins in the bloodstream by filtering the blood and returning the filtered blood to the patient's body.

Blood Purification Devices Market Report Statistics

- Global blood purification devices market revenue is estimated to reach USD 6,280 Million by 2030 with a CAGR of 3.8% from 2022 to 2030

- North America blood purification devices market share accounted for over 45% shares in 2021

- According to World Health Organization (WHO), chronic kidney disease (CKD) affects more than 10% of the population in the world

- Asia-Pacific blood purification devices market growth will register swift CAGR from 2022 to 2030

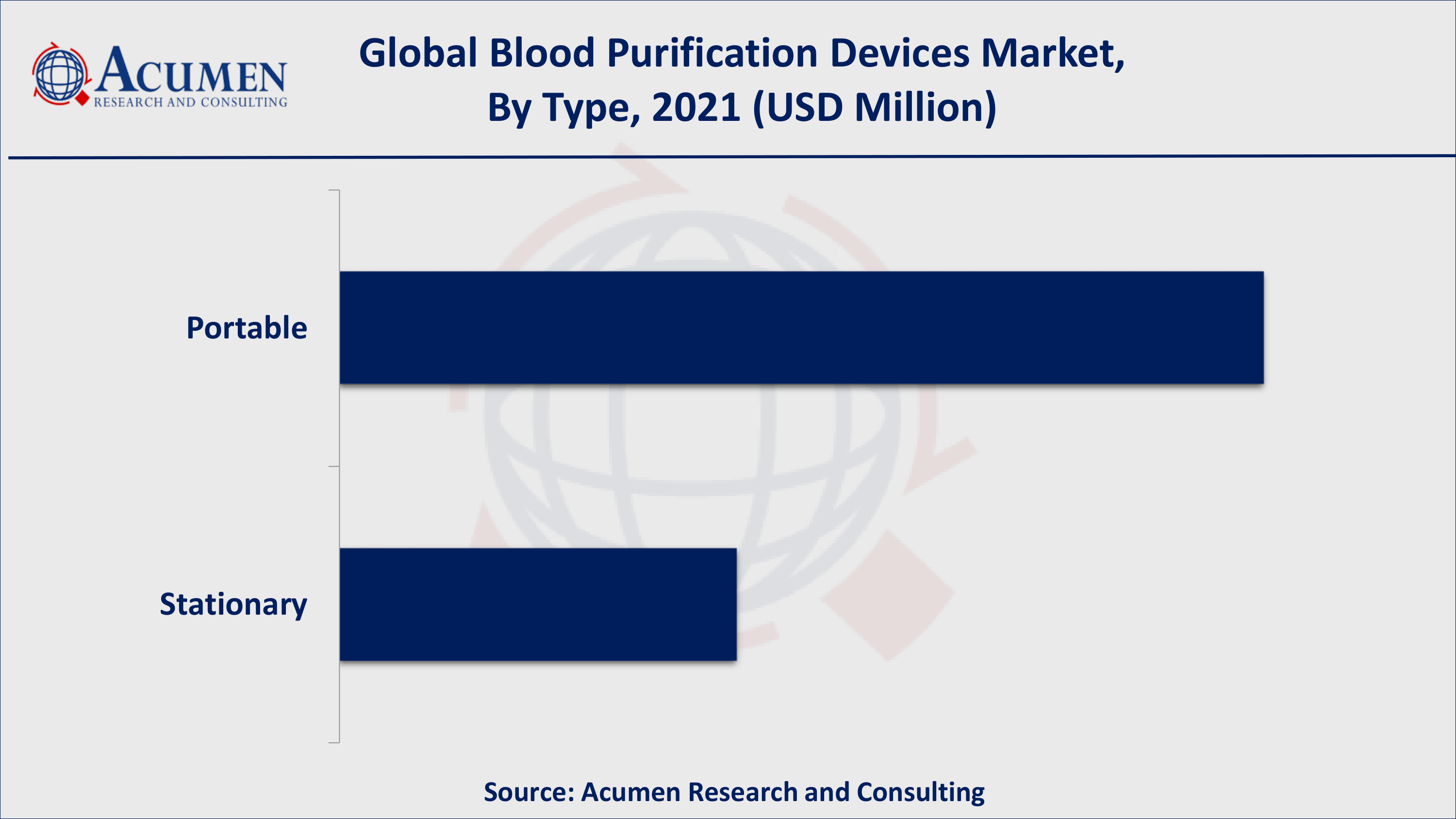

- Based on types, portable devices acquired over 70% of the overall market share in 2021

- Growing incidence of metabolic disorders will fuel the global blood purification devices market value

- Advancement in blood purification techniques is a popular blood purification devices market trend that is fueling the industry demand

Rising support from the FDA regarding Application approvals, the global blood purification devices is anticipated to surpass a notable market revenue growth. Significant rise in prevalence of diabetes and high blood pressure leading to chronic kidney diseases are the prominent factors that fuel the market growth of blood purification devices market globally.

Global Blood Purification Devices Market Dynamics

Market Drivers

- Growing prevalence of chronic kidney disease

- Rise in incidences of hypertension & diabetes

- Increasing advancements in blood purification devices

Market Restraints

- High cost of blood purification equipment

- Adverse health risks related with these devices

Market Opportunities

- Growing demand for home hemodialysis (HDD)

- Technological advancements coupled with innovations

Blood Purification Devices Market Report Coverage

| Market | Blood Purification Devices Market |

| Blood Purification Devices Market Size 2021 | USD 4,534 Million |

| Blood Purification Devices Market Forecast 2030 | USD 6,280 Million |

| Blood Purification Devices Market CAGR During 2022 - 2030 | 3.8% |

| Blood Purification Devices Market Analysis Period | 2018 - 2030 |

| Blood Purification Devices Market Base Year | 2021 |

| Blood Purification Devices Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Type, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Accel Diagnostics, Aethlon Medical, Cerus Company, Circle Biologics, CytoSorbents, Jafron, Medtronic, NxStage Medical, Spectral Medical, Stellarray, Toray Medicall, and others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Blood Purification Equipment Market Growth Factors

High Prevalence of Chronic Kidney Disease (CKD) Will Boost Demand for Blood Purification Equipment Market

With chronic kidney disease (CKD) becoming damage over time they cannot clean the blood when compared with healthy kidneys. Therefore, people with CKD suffer from health problems that include heart disease and high blood pressure. According to the Center for Disease Control and Prevention (CDC), 15% of US adults that is 37 million people suffer from CKD. CKD is more prevalent in people aged 65 years or older (38%) than people with age group 45-64 years (13%) and 18-44 years (7%).

Therapeutic Advancements in Technology Is a Trend

In April 2020, the USFDA issued an Emergency Use Authorization (EUA) to cytosorbents for its cytosorb technology to be used with COVID-19 patients. Such rigorous approvals are led to treat the disease by various product offerings by the market players. In COVID1-19, a new blood filtration technology has successfully treated hyper-vigilant immune syndrome for people who underwent surgery and are critically ill. This proves as an effective therapy for some severe COVID-19 cases. Moreover, in July 2020, Baxter India, a subsidiary of the American Healthcare company Baxter International, announced that the Central Drug Standard Control Organization (CDSCO) has given approval to its blood purification filter oxiris for the treatment of COVID-19 patients. The new product is designed such that it can remove three different things from blood. These includes cytokines, endotoxins (toxins produced by some kinds of bacteria), and uremic toxins (toxins that stay in the body due to improper functioning of kidneys). The product is specialized such that it helps both sepsis patients and patients requiring continuous renal replacement therapy.

Rigorous Product Approvals in COVID-19 by FDA Witness Stupendous Growth Opportunities for Blood Purification Devices Market

In April 2020, the USFDA grant its first emergency use authorization (EUA) for a blood purification system to treat patients at risk for respiratory failure owing to COVID-19. The EUA was granted to Terumo BCT Inc. and Marker Therapeutics authorized for the use of their Spectra Optia Apheresis System and Depuro D2000 Adsorption Cartridge devices that are involved in filtration of cytokines and other inflammatory proteins from patient’s blood. Further, EUA restricts the use of device to patients less than 18 years that are admitted to an intensive care unit (ICU) with confirmed or imminent respiratory failure. Moreover, it specifies that the devices should only be utilized for patients with early acute lung injury, early acute respiratory distress syndrome, and other specific severe or life-threatening symptoms or conditions.

Blood Purification Devices Market Segmentation

The global blood purification devices market is segmented based on type, application, end-use, and geography.

Blood Purification Devices Market By Type

- Portable

- Stationary

Portable Blood Purification Equipment Will Record Significant Share in the Forthcoming Years

Portable equipments are majorly preferred by the professionals that are actively involved in continuous blood purification process. Portability equipment allows efficient treatment in emergency cases. Moreover, portable equipments are sort of compact and occupy minimum space that leads to high adoption during the blood purification process. The device removes dirty blood from the body, separates harmful agents, and returns clean blood to the body in a similar fashion to dialysis in treatment of kidney failure.

Blood Purification Devices Market By Application

- Continuous Blood Purification

- Hemoperfusion

- Hemodialysis

Hemodialysis Segment Will Offer Lucrative Growth Opportunities for the Market Growth of Blood Purification Devices in the Forthcoming Years

Substantial segmental growth is witnessed owing to surge in cases of diabetes that affects kidney functioning. Currently available blood purification devices are highly efficient and assist in recovering the kidney functions. Such growth factors coupled with growing awareness regarding blood purification in developing economies bolster the growth of the blood purification equipment market worldwide.

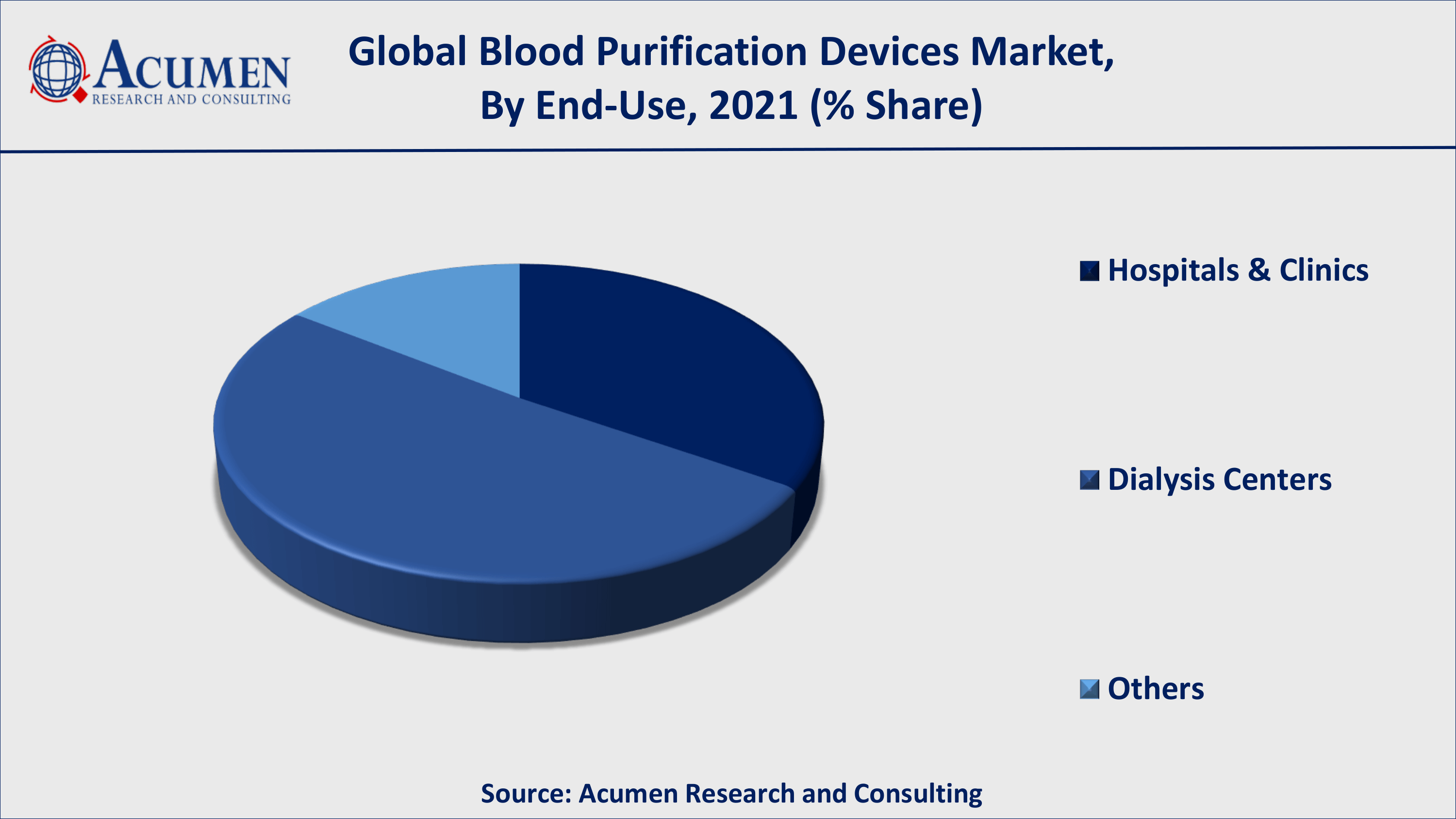

Blood Purification Devices Market By End-Use

- Hospitals & Clinics

- Dialysis Centers

- Others

Hospitals & Clinics Segment Will Achieve Notable Growth for the Blood Purification Devices Market Worldwide

Hospitals & Clinics witness immense growth opportunities during the analysis timeframe. Hospitals & clinics are well-equipped with medical devices and equipment. Blood purification devices services delivered at hospitals & clinics assure fast recovery as these are attached to international standards. Therefore, people suffering from renal failure usually prefer blood purification from hospitals & clinics resulting for the business growth.

Blood Purification Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Blood Purification Devices Market Regional Analysis

North America is projected to dominate the blood purification devices market globally followed by Asia Pacific. Fast product approvals by the USFDA, government involvement to tackle situation of COVID-19 by product offerings in the global market enhance the growth of blood purification device market. Additionally, favorable demographic trend such as ever growing geriatric population led to high demand for blood purification device market that has a positive influence for the growth of overall market. Positive regulatory scenario for blood purification devices triggers the regional market growth.

Asia-Pacific Will Record Significant Growth in the Coming Years

Asia-Pacific is also gaining fast pace in the blood purification device regional market. Growth of this region involves high adoption of the several products in various medical diagnostic and treatment procedures. Moreover, rising number of disease related to kidney disorders and lifestyle disorders like diabetes and cardiac dysfunction, technological advancements in blood collection tubes coupled with filtration techniques are the factors that are impacted positively for the growth of blood purification devices market. Also, WHO and Japanese Society for Dialysis Therapy, National Blood Authority (NBA), and Red Cross Society are the few authorized body are impacted strongly for the regional growth of Asia Pacific blood purification devices market.

Blood Purification Devices Market Players

Key companies profiled in this report involve Accel Diagnostics, Cerus Company, Aethlon Medical, Circle Biologics, CytoSorbents, Jafron, NxStage Medical, Medtronic, Spectral Medical, Stellarray, and Toray Medical among others

Frequently Asked Questions

What is the size of global blood purification devices market in 2021?

The market size of blood purification devices market in 2021 was accounted to be USD 4,534 Million.

What is the CAGR of global blood purification devices market during forecast period of 2022 to 2030?

The projected CAGR of blood purification devices market during the analysis period of 2022 to 2030 is 3.8%.

Which are the key players operating in the market?

The prominent players of the global blood purification devices market include Accel Diagnostics, Cerus Company, Aethlon Medical, Circle Biologics, CytoSorbents, Jafron, NxStage Medical, Medtronic, Spectral Medical, Stellarray, and Toray Medical.

Which region held the dominating position in the global blood purification devices market?

North America held the dominating blood purification devices during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for blood purification devices during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global blood purification devices market?

Growing prevalence of chronic kidney disease, rise in incidences of hypertension & diabetes, and increasing advancements in blood purification devices drives the growth of global blood purification devices market.

Which type held the maximum share in 2021?

Based on type, portable segment is expected to hold the maximum share blood purification devices market.