Blood Drawing Chairs Market | Acumen Research and Consulting

Blood Drawing Chairs Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

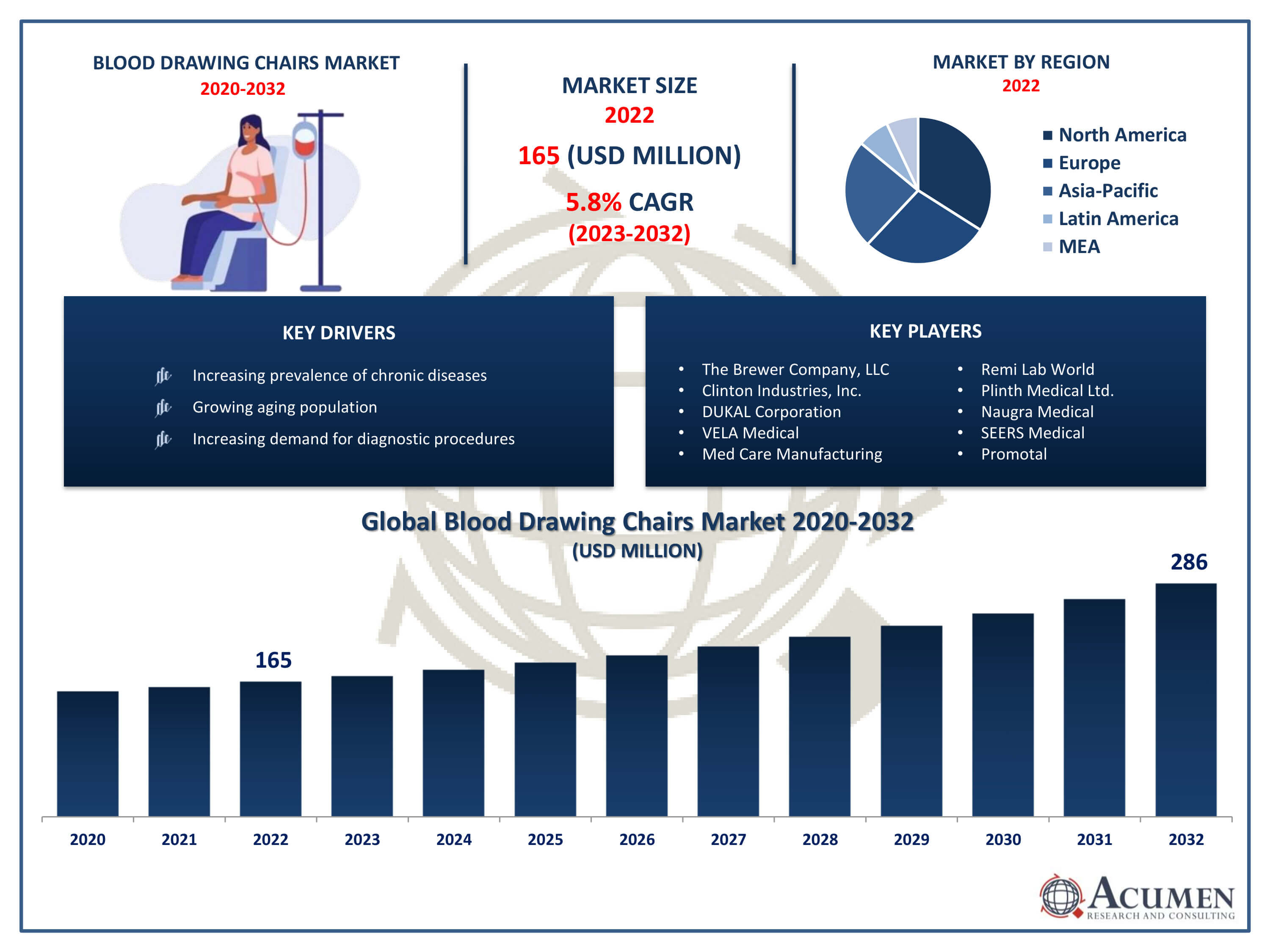

The Blood Drawing Chairs Market Size accounted for USD 165 Million in 2022 and is projected to achieve a market size of USD 286 Million by 2032 growing at a CAGR of 5.8% from 2023 to 2032.

Blood Drawing Chairs Market Highlights

- Global Blood Drawing Chairs Market revenue is expected to increase by USD 286 Million by 2032, with a 5.8% CAGR from 2023 to 2032

- North America region led with more than 33% of Blood Drawing Chairs Market share in 2022

- Asia-Pacific Blood Drawing Chairs Market growth will record a CAGR of more than 6.4% from 2023 to 2032

- By type, the standard chairs segment captured more than 85% of revenue share in 2022.

- By end-use, the hospitals segment has held the largest market share of 79% in 2022

- Increasing demand for diagnostic procedures, drives the Blood Drawing Chairs Market value

Blood drawing chairs, also known as phlebotomy chairs or blood collection chairs, are specialized seating designed for the purpose of drawing blood from patients. These chairs are commonly used in healthcare settings such as hospitals, clinics, and blood donation centers. They provide a comfortable and stable platform for patients to sit while their blood is being drawn, allowing healthcare professionals easy access to the arm for venipuncture. Blood drawing chairs are typically equipped with features such as armrests, adjustable height, and sometimes a reclining option to enhance patient comfort and facilitate the blood collection process.

In terms of market growth, the demand for blood drawing chairs has been influenced by several factors. The increasing prevalence of chronic diseases and the growing aging population have led to a higher demand for diagnostic procedures, including blood tests. Additionally, advancements in healthcare infrastructure and the expansion of healthcare services and blood bank devicesin developing regions contribute to the rising need for blood drawing chairs. The market has also seen innovations in chair designs, incorporating features that prioritize patient comfort and safety.

Global Blood Drawing Chairs Market Trends

Market Drivers

- Increasing prevalence of chronic diseases

- Growing aging population

- Increasing demand for diagnostic procedures

- Expansion of healthcare services in developing regions

- Continuous innovation in chair designs for improved patient comfort

Market Restraints

- High cost associated with advanced blood drawing chair models

- Limited awareness and adoption in certain healthcare settings

Market Opportunities

- Technological advancements in chair features and materials

- Increasing focus on outpatient care and ambulatory services

Blood Drawing Chairs Market Report Coverage

| Market | Blood Drawing Chairs Market |

| Blood Drawing Chairs Market Size 2022 | USD 165 Million |

| Blood Drawing Chairs Market Forecast 2032 | USD 286 Million |

| Blood Drawing Chairs Market CAGR During 2023 - 2032 | 5.8% |

| Blood Drawing Chairs Market Analysis Period | 2020 - 2032 |

| Blood Drawing Chairs Market Base Year |

2022 |

| Blood Drawing Chairs Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Product, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | The Brewer Company, LLC, Clinton Industries, Inc., DUKAL Corporation, VELA Medical, Med Care Manufacturing, Remi Lab World, Zhangjiagang Medi Medical Equipment, Naugra Medical, SEERS Medical, Promotal, and Plinth Medical Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Blood drawing chairs are specifically designed with features that enhance the ease of access to the patient's arm, allowing for a seamless blood collection experience. These features often include adjustable height to accommodate different healthcare providers and patients, padded armrests for added comfort, and sometimes a reclining option to optimize the angle for venipuncture. The ergonomic design of these chairs not only benefits the patient by minimizing discomfort during the procedure but also supports healthcare professionals in performing efficient and accurate blood draws. In healthcare settings, the application of blood drawing chairs is integral to the broader process of diagnostic testing and medical treatment. These chairs play a crucial role in creating a conducive and controlled environment for blood collection, ensuring the safety and well-being of patients while facilitating the work of healthcare practitioners.

The blood drawing chairs market has witnessed steady growth in recent years, driven by factors such as the increasing prevalence of chronic diseases, the aging population, and advancements in healthcare infrastructure. The rising demand for diagnostic procedures, including blood tests, has contributed to the need for specialized equipment like blood drawing chairs in various healthcare settings. The market has also experienced innovation in chair designs, with a focus on improving patient comfort and safety during blood collection procedures. Furthermore, the global expansion of healthcare services, especially in developing regions, has created new opportunities for the adoption of blood drawing chairs. As healthcare facilities continue to modernize and prioritize patient experience, the demand for ergonomic and efficient blood drawing chairs is expected to persist. However, challenges such as high initial costs, regulatory compliance, and competition from alternative technologies may influence market dynamics.

Blood Drawing Chairs Market Segmentation

The global Blood Drawing Chairs Market segmentation is based on type, product, end-use, and geography.

Blood Drawing Chairs Market By Type

- Standard chairs

- Non-adjustable

- Adjustable

- Recliner chairs

According to the blood drawing chairs industry analysis, the standard chairs segment accounted for the largest market share in 2022. These chairs are designed to meet standard requirements for patient comfort and ease of use during blood draws. While they may lack some of the advanced features found in more specialized models, standard blood drawing chairs remain a cost-effective and widely adopted option in various healthcare settings. The growth of the standard chairs segment is often influenced by factors such as the overall expansion of healthcare services, the establishment of new healthcare facilities, and the demand for essential medical equipment. Additionally, as healthcare providers in different regions seek cost-efficient solutions without compromising on quality, standard blood drawing chairs continue to be a preferred choice.

Blood Drawing Chairs Market By Product

- Powered chairs

- Manual chairs

In terms of products, the powered chairs segment is expected to witness significant growth in the coming years. This growth is driven by advancements in technology and a growing emphasis on patient comfort and efficiency in healthcare procedures. These chairs are equipped with motorized features that allow for easy adjustment of height, recline, and other settings, providing healthcare professionals with greater flexibility during blood collection processes. The powered chairs segment is particularly appealing for facilities that prioritize ergonomic design and seek to enhance the overall patient experience. The growth of powered chairs is often tied to the broader trend of healthcare modernization, with facilities increasingly investing in state-of-the-art equipment. The motorized functionality of these chairs not only streamlines blood drawing procedures but also contributes to the optimization of healthcare workflows.

Blood Drawing Chairs Market By End-use

- Hospitals

- Ambulatory surgical centers

- Diagnostic laboratories

- Blood donation centers

- Others

According to the blood drawing chairs market forecast, the hospital segment is expected to witness significant growth in the coming years. Hospitals, being primary centers for patient care and diagnostics, consistently invest in upgrading their facilities to enhance the overall patient experience. Blood drawing chairs play a crucial role in this context, providing a comfortable and efficient platform for phlebotomy procedures within hospital settings. As hospitals continually strive to improve patient satisfaction and optimize clinical workflows, the demand for ergonomic and technologically advanced blood drawing chairs is on the rise. The expansion of healthcare infrastructure, coupled with the rising prevalence of chronic diseases and the aging population, further contributes to the growth of the hospitals segment in the blood drawing chairs market. The need for regular blood tests and diagnostic procedures in hospitals has led to a steady demand for specialized equipment like blood drawing chairs.

Blood Drawing Chairs Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

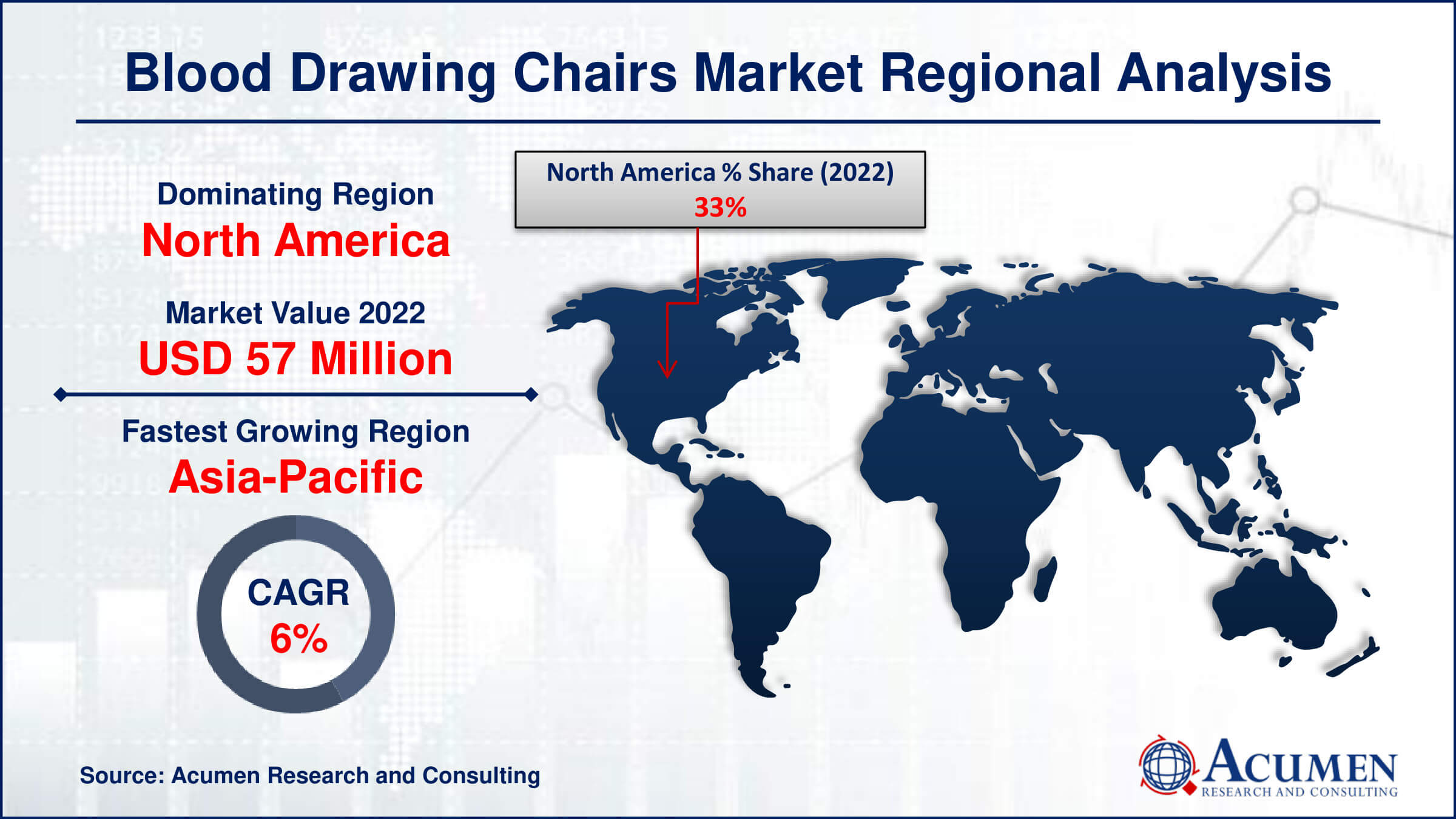

Blood Drawing Chairs Market Regional Analysis

North America dominates the blood drawing chairs market due to several key factors that collectively contribute to the region's prominent position in this industry. One primary driver is the well-established and advanced healthcare infrastructure in North America. The region boasts a network of modern hospitals, clinics, and diagnostic centers that prioritize the integration of cutting-edge medical equipment, including specialized chairs for blood collection. This emphasis on healthcare modernization and technological innovation positions North America as a leader in the adoption of advanced blood drawing chairs. Additionally, the high prevalence of chronic diseases and the aging population in North America contribute significantly to the demand for diagnostic procedures, including blood tests. As a result, there is a sustained and growing need for efficient and patient-friendly blood drawing solutions. The region's strong emphasis on patient care and satisfaction further fuels the adoption of ergonomic and comfortable blood drawing chairs that enhance the overall healthcare experience. Furthermore, regulatory frameworks and standards in North America play a crucial role in ensuring the quality and safety of medical equipment, instilling confidence among healthcare providers and driving the market for blood drawing chairs in the region.

Blood Drawing Chairs Market Player

Some of the top blood drawing chairs market companies offered in the professional report include The Brewer Company, LLC, Clinton Industries, Inc., DUKAL Corporation, VELA Medical, Med Care Manufacturing, Remi Lab World, Zhangjiagang Medi Medical Equipment, Naugra Medical, SEERS Medical, Promotal, and Plinth Medical Ltd.

Frequently Asked Questions

How big is the blood drawing chairs market?

The blood drawing chairs market size was USD 165 Million in 2022.

What is the CAGR of the global blood drawing chairs market from 2023 to 2032?

The CAGR of blood drawing chairs is 5.8% during the analysis period of 2023 to 2032.

Which are the key players in the blood drawing chairs market?

The key players operating in the global market are including The Brewer Company, LLC, Clinton Industries, Inc., DUKAL Corporation, VELA Medical, Med Care Manufacturing, Remi Lab World, Zhangjiagang Medi Medical Equipment, Naugra Medical, SEERS Medical, Promotal, and Plinth Medical Ltd.

Which region dominated the global blood drawing chairs market share?

North America held the dominating position in blood drawing chairs industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of blood drawing chairs during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global blood drawing chairs industry?

The current trends and dynamics in the blood drawing chairs industry include increasing prevalence of chronic diseases, growing aging population, and increasing demand for diagnostic procedures.

Which type held the maximum share in 2022?

The standard chairs type held the maximum share of the blood drawing chairs industry.