Blood Collection Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Blood Collection Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

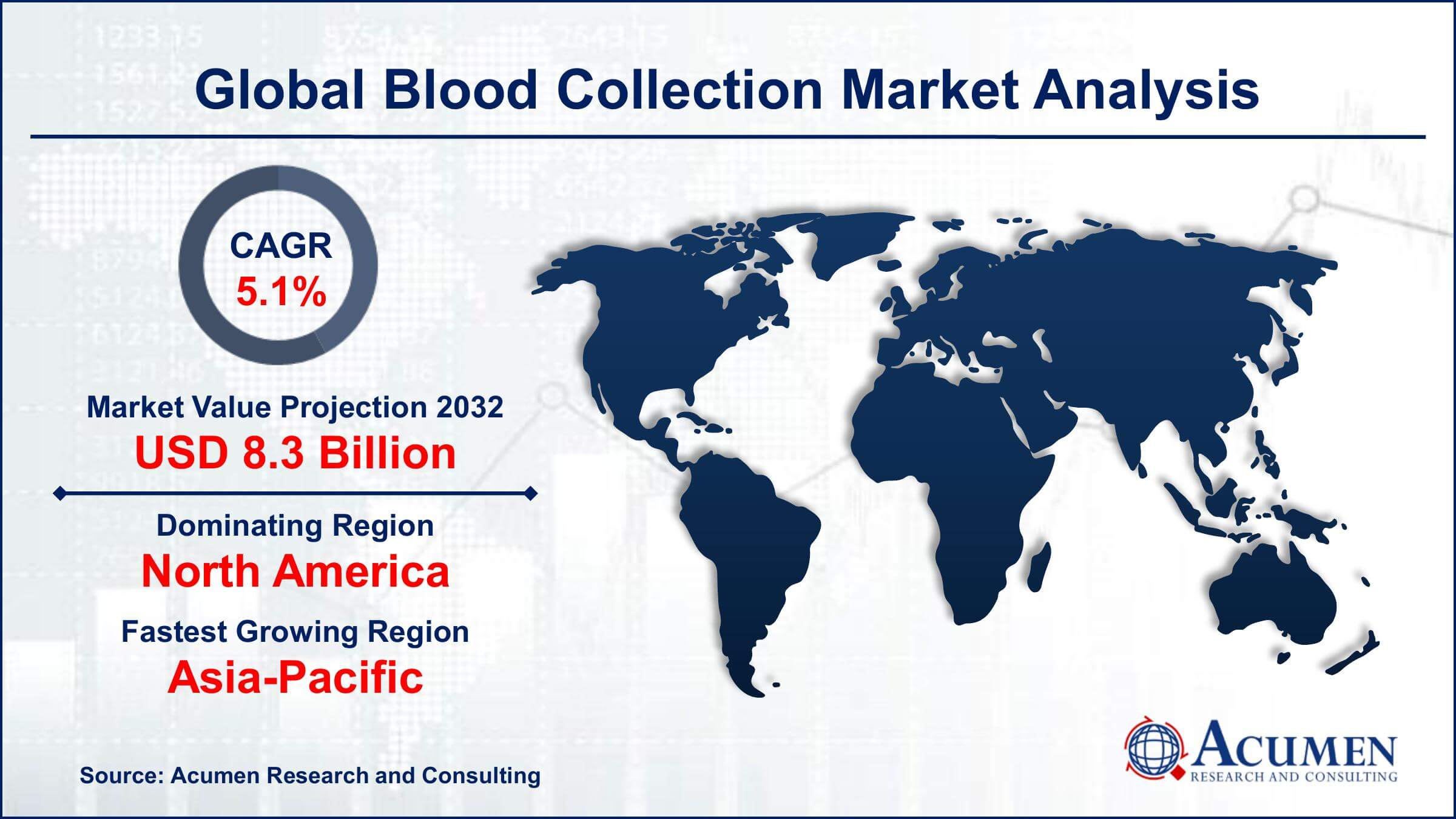

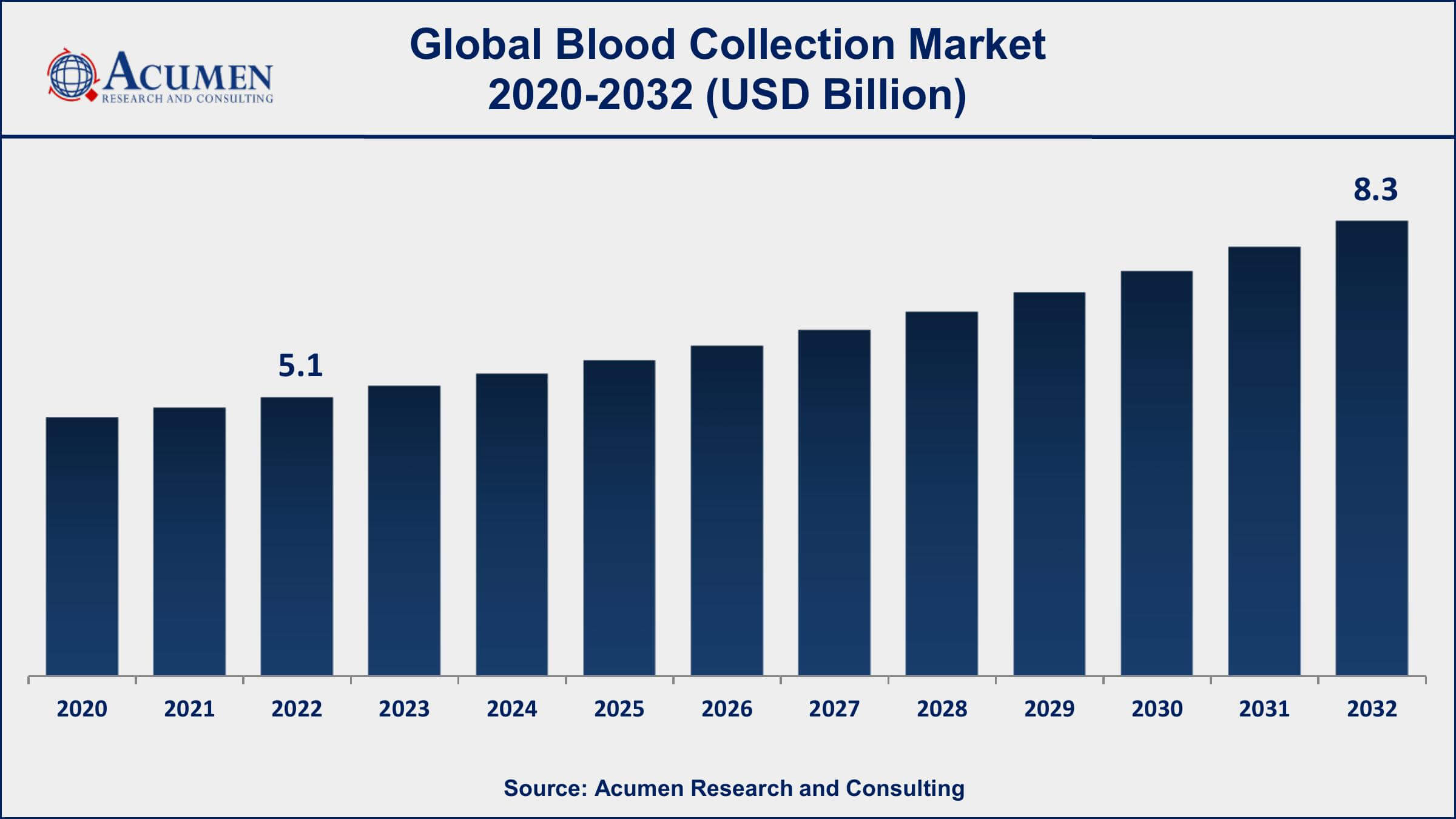

The Global Blood Collection Market Size accounted for USD 5.1 Billion in 2022 and is projected to achieve a market size of USD 8.3 Billion by 2032 growing at a CAGR of 5.1% from 2023 to 2032.

Blood Collection Market Highlights

- Global blood collection market revenue is expected to increase by USD 8.3 Billion by 2032, with a 5.1% CAGR from 2023 to 2032

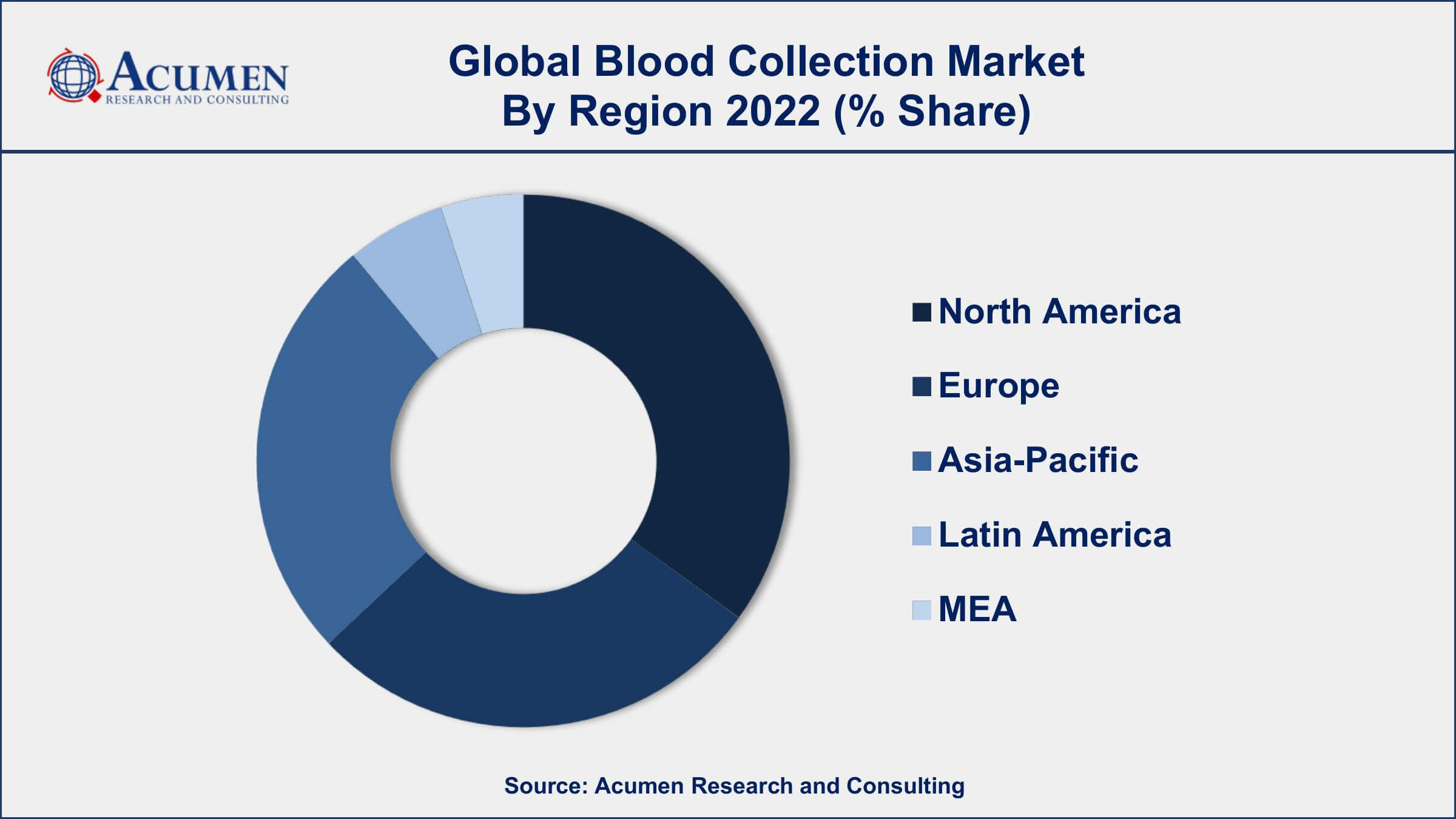

- North America region led with more than 36% of blood collection market share in 2022

- Asia-Pacific blood collection market growth will record a CAGR of around 6% from 2023 to 2032

- According to the World Health Organization (WHO), approximately 118.4 million blood donations are collected globally every year

- According to the research study, approximately 36,000 units of red blood cells are required every day in the United States

- Rising prevalence of chronic diseases and blood-related disorders, drives the blood collection market value

Blood collection is a medical procedure in which blood is withdrawn from a patient's veins using various devices such as needles, tubes, and syringes. The collected blood can then be used for diagnostic, therapeutic, or research purposes. The procedure is commonly performed in hospitals, clinics, and laboratories, and is a crucial component of many medical procedures.

The global blood collection market has experienced significant growth in recent years, driven by increasing demand for blood transfusions and the rising prevalence of blood-related disorders. The market growth is also attributed to the increasing number of blood banks and rising awareness about blood donation. Furthermore, the market is also witnessing a shift towards automation and technological advancements in blood collection devices. Automated blood collection devices offer several benefits such as the reduced risk of contamination, increased efficiency, and improved accuracy. The use of these devices has also helped in reducing the risk of infections and blood transfusion errors. Overall, the blood collection industry is expected to continue its growth trajectory in the coming years, driven by technological advancements and increasing demand for blood transfusions.

Global Blood Collection Market Trends

Market Drivers

- Increasing demand for blood and blood products

- Rising prevalence of chronic diseases and blood-related disorders

- Growing number of blood banks and blood collection centers

- Increasing awareness about blood donation and blood transfusions

Market Restraints

- Risk of infections and transfusion errors

- Stringent regulatory framework for blood collection and storage

Market Opportunities

- Growing demand for customized blood collection devices

- Increasing focus on personalized medicine and genomics research

Blood Collection Market Report Coverage

| Market | Blood Collection Market |

| Blood Collection Market Size 2022 | USD 5.1 Billion |

| Blood Collection Market Forecast 2032 | USD 8.3 Billion |

| Blood Collection Market CAGR During 2023 - 2032 | 5.1% |

| Blood Collection Market Analysis Period | 2020 - 2032 |

| Blood Collection Market Base Year | 2022 |

| Blood Collection Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Application, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Becton, Dickinson and Company, Terumo Corporation, Fresenius SE & Co. KGaA, Haemonetics Corporation, Grifols S.A., Greiner Holding AG, Macopharma SA, Medline Industries, Inc., Sarstedt AG & Co. KG, Nipro Medical Corporation, F.L. Medical SRL, and Improve Medical Technology Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Blood is collected with all its associated components i.e. as whole blood (WB) by blood donation procedures. Later by the process of apheresis, all the components are separated. The amount of blood drawn from the donor’s body varies accordingly and the blood drawn should be in a minimal amount or not more than 1% of the weight of the donor’s body. Blood can also be collected manually, or by using some automated technology. Blood can be drawn with respect to specific components of the body by using automated equipment.

The increasing incidences of numerous diseases, growing number of surgeries, increasing number of accidental cases, and rising trauma cases are driving the growth of this market. However, the high cost related to automated blood collection devices is restraining the growth of this market. The mandates for blood collection products for diagnostic applications are some factors expected to fuel the growth of the blood collection market in the next few years.

Blood Collection Market Segmentation

The global blood collection market segmentation is based on product, application, end-use, and geography.

Blood Collection Market By Product

- Needles and Syringes

- Blood Collection Tubes

- Serum-separating

- Heparin

- EDTA

- Plasma-separating

- Blood Bags

- Others

According to the blood collection industry analysis, the needles and syringes segment accounted for the largest market share in 2022. These devices are available in different sizes and types and are used for venipuncture or capillary blood sampling. The global needles and syringes segment is expected to witness steady growth in the coming years, driven by increasing demand for blood collection procedures. One of the key factors driving the growth of the needles and syringes segment is the rising incidence of chronic diseases and blood-related disorders, which has led to increasing demand for blood transfusions. Additionally, technological advancements in needles and syringes have also helped in reducing the risk of contamination and improving the accuracy of blood collection procedures. The use of safety-engineered needles and syringes has also helped in reducing the risk of needlestick injuries and infections.

Blood Collection Market By Application

- Treatment

- Diagnostics

In terms of applications, the diagnostics segment is expected to witness significant growth in the coming years. The diagnostics segment refers to the use of collected blood samples for diagnostic purposes. These blood samples are used to diagnose various medical conditions such as infectious diseases, cancer, and genetic disorders. The global diagnostics segment is expected to witness significant growth in the coming years, driven by increasing demand for diagnostic testing and personalized medicine. One of the key factors driving the growth of the diagnostics segment is the rising prevalence of chronic diseases and infections, which has led to increasing demand for diagnostic testing. Additionally, technological advancements in diagnostic testing such as point-of-care testing (POCT) and molecular diagnostics have helped in improving the accuracy and speed of diagnostic testing. The increasing focus on personalized medicine and genomics research has also led to a growing demand for diagnostic testing using blood samples.

Blood Collection Market By End-Use

- Hospitals

- Blood Banks

- Diagnostics Centers

- Others

According to the blood collection market forecast, the blood banks segment is expected to witness significant growth in the coming years. The blood banks segment refers to the collection, processing, and storage of donated blood and blood products. The growth of this segment is driven by increasing demand for blood and blood products and the growing number of blood banks and collection centers. One of the key factors driving the growth of the blood bank segment is the rising incidence of chronic diseases and blood-related disorders, which has led to increasing demand for blood transfusions. Additionally, the increasing awareness about blood donation and the growing number of blood donation campaigns have led to a steady supply of donated blood. Moreover, the adoption of automated and digital technologies in blood banking has further enhanced the growth of the blood banks segment. Furthermore, the increasing focus on personalized medicine and regenerative therapies has also led to a growing demand for cord blood banking and stem cell therapies.

Blood Collection Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Blood Collection Market Regional Analysis

North America dominates the blood collection market due to various factors such as the presence of a well-established healthcare system, increasing demand for blood transfusions, and the rising prevalence of chronic diseases. The region is home to some of the largest blood collection companies and has a robust infrastructure for blood collection and storage. Additionally, the rising numbers of blood collection centers and the increasing awareness about blood donation have further contributed to the growth of the blood collection market in North America. The region has a high rate of blood donation, with a significant proportion of the population donating blood regularly. The increasing adoption of automated and digital technologies in blood collection and banking has also helped in improving the efficiency and safety of blood collection procedures in the region. Moreover, the presence of key market players and a favorable regulatory environment has also contributed to the dominance of North America in the blood collection market.

Blood Collection Market Player

Some of the top blood collection market companies offered in the professional report include Becton, Dickinson and Company, Terumo Corporation, Fresenius SE & Co. KGaA, Haemonetics Corporation, Grifols S.A., Greiner Holding AG, Macopharma SA, Medline Industries, Inc., Sarstedt AG & Co. KG, Nipro Medical Corporation, F.L. Medical SRL, and Improve Medical Technology Co., Ltd.

Frequently Asked Questions

What was the market size of the global blood collection in 2022?

The market size of blood collection was USD 5.1 Billion in 2022.

What is the CAGR of the global blood collection market from 2023 to 2032?

The CAGR of blood collection is 5.1% during the analysis period of 2023 to 2032.

Which are the key players in the blood collection market?

The key players operating in the global market are including Becton, Dickinson and Company, Terumo Corporation, Fresenius SE & Co. KGaA, Haemonetics Corporation, Grifols S.A., Greiner Holding AG, Macopharma SA, Medline Industries, Inc., Sarstedt AG & Co. KG, Nipro Medical Corporation, F.L. Medical SRL, and Improve Medical Technology Co., Ltd.

Which region dominated the global blood collection market share?

North America held the dominating position in blood collection industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of blood collection during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global blood collection industry?

The current trends and dynamics in the blood collection industry include increasing demand for blood and blood products, rising prevalence of chronic diseases and blood-related disorders, and growing number of blood banks and blood collection centers.

Which application held the maximum share in 2022?

The diagnostics application held the maximum share of the blood collection industry.