Blood Clot Retrieval Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Blood Clot Retrieval Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

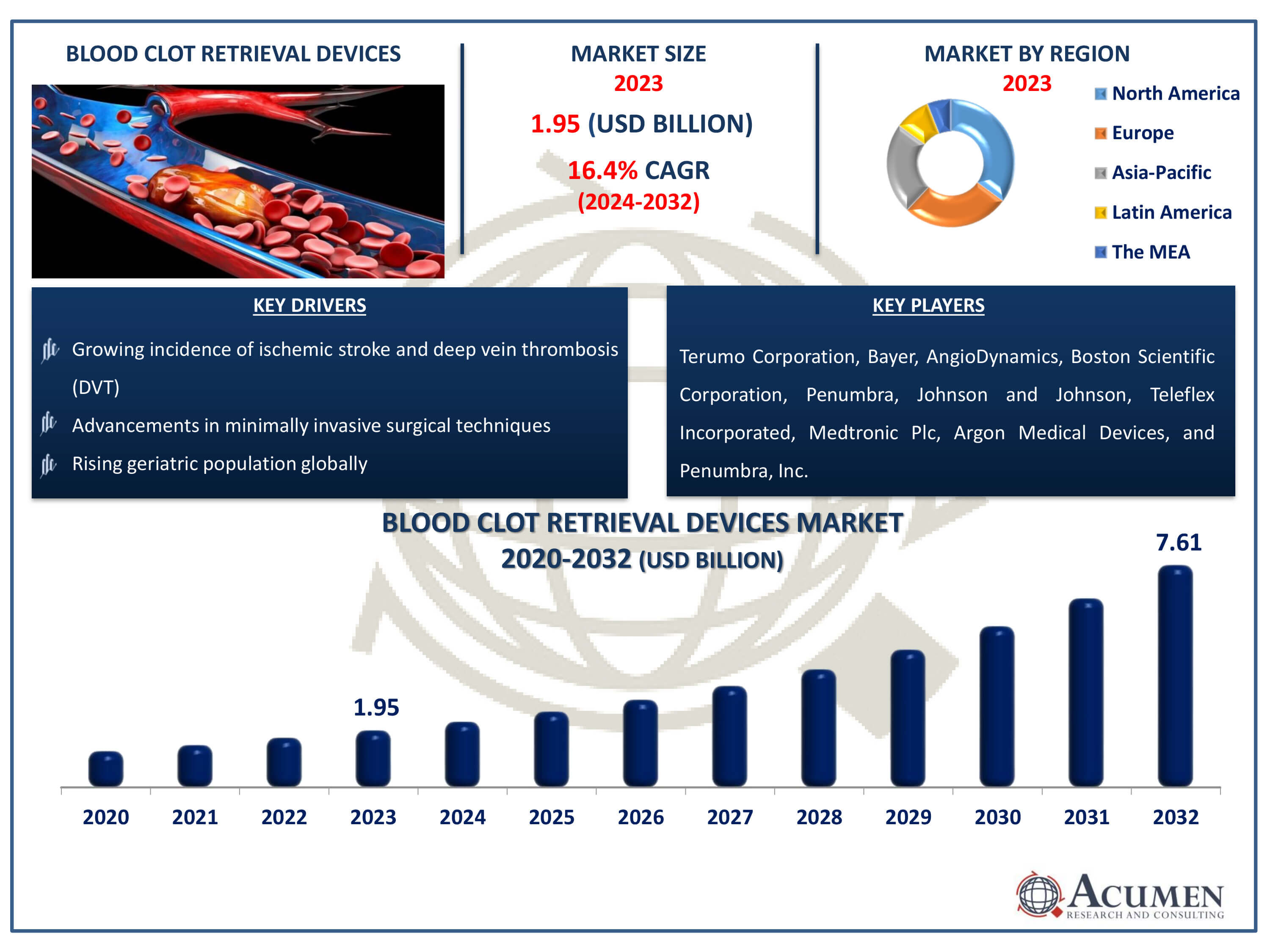

The Blood Clot Retrieval Devices Market Size accounted for USD 1.95 Billion in 2023 and is estimated to achieve a market size of USD 7.61 Billion by 2032 growing at a CAGR of 16.4% from 2024 to 2032.

Blood Clot Retrieval Devices Market Highlights

- Global blood clot retrieval devices market revenue is poised to garner USD 7.61 billion by 2032 with a CAGR of 16.4% from 2024 to 2032

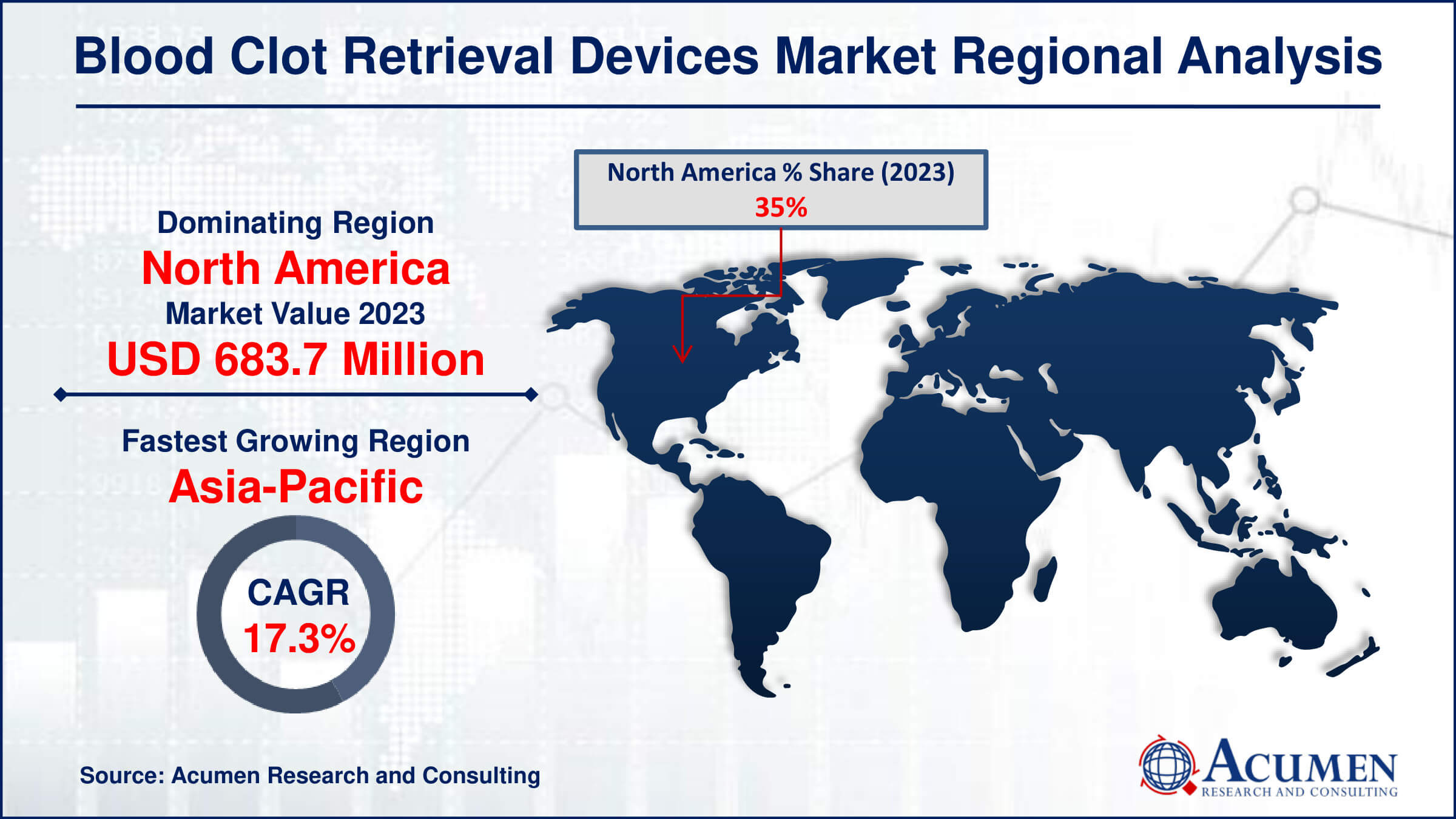

- North America blood clot retrieval devices market value occupied around USD 683.7 million in 2023

- Asia-Pacific blood clot retrieval devices market growth will record a CAGR of more than 17.3% from 2024 to 2032

- Among stroke type, the ischemic stroke sub-segment generated significant revenue in 2023

- Based on end user, the hospital pharmacies sub-segment generated noteworthy blood clot retrieval devices market share in 2023

- Expansion of the market in emerging economies is a popular blood clot retrieval devices market trend that fuels the industry demand

Blood clot retrieval devices are specialized medical instruments used to remove blood clots from blood vessels, especially in the case of an ischemic stroke or deep vein thrombosis (DVT). These devices use a variety of processes to mechanically extract or dissolve blood clots, including aspiration, stent retrievers, and catheter-based procedures. They play an important role in restoring blood flow to injured organs and tissues, preventing further damage and potentially reducing long-term impairment or mortality caused by clot-related disorders. Blood clot retrieval devices are frequently employed in conjunction with other therapies, such as thrombolytic medicines, and are regarded as an essential component of interventional procedures aimed at efficiently treating thrombotic illnesses.

Global Blood Clot Retrieval Devices Market Dynamics

Market Drivers

- Growing incidence of ischemic stroke and deep vein thrombosis (DVT)

- Advancements in minimally invasive surgical techniques

- Increasing adoption of endovascular procedures

- Rising geriatric population globally

Market Restraints

- High cost associated with blood clot retrieval devices

- Stringent regulatory approval processes

- Limited accessibility to advanced healthcare infrastructure in developing regions

Market Opportunities

- Technological innovations leading to improved device efficacy and safety

- Rising awareness about the importance of timely thrombectomy procedures

- Collaborations between medical device manufacturers and healthcare providers to enhance product distribution and patient access

Blood Clot Retrieval Devices Market Report Coverage

| Market | Blood Clot Retrieval Devices Market |

| Blood Clot Retrieval Devices Market Size 2022 | USD 1.95 Billion |

| Blood Clot Retrieval Devices Market Forecast 2032 | USD 7.61 Billion |

| Blood Clot Retrieval Devices Market CAGR During 2023 - 2032 | 16.4% |

| Blood Clot Retrieval Devices Market Analysis Period | 2020 - 2032 |

| Blood Clot Retrieval Devices Market Base Year |

2022 |

| Blood Clot Retrieval Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Stroke Type, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Terumo Corporation, Bayer, AngioDynamics, Boston Scientific Corporation, Penumbra, Johnson and Johnson, Teleflex Incorporated, Medtronic Plc, Argon Medical Devices, and Penumbra, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Blood Clot Retrieval Devices Market Insights

The global blood clot retrieval devices market is expanding rapidly, driven by a number of factors. The most significant of them is the rising global incidence of strokes, which is driving need for effective therapies to reduce their effects. Furthermore, significant investments by governments in healthcare infrastructure, particularly in India and Singapore, are creating a climate conducive to industry growth. These investments not only improve treatment accessibility, but also encourage global players to construct manufacturing plants, utilizing abundant raw materials and low-cost labor.

Considering the positive outlook, the market has intrinsic hurdles. Stringent regulatory approval processes, as well as the possibility of product recalls due to safety concerns, present substantial challenges to market expansion. Nonetheless, amidst these problems, there are several potential for innovation and progress within the sector. One such possibility is the growing use of 3D technology in healthcare, which has the potential to transform treatment methods and improve patient outcomes. Furthermore, ongoing government spending on healthcare initiatives, combined with the emergence of cost-effective product alternatives, opens significant opportunities for market expansion and diversification.

In addition, the blood clot retrieval devices market is experiencing a noticeable trend of increased merger and acquisition activity among major industry competitors. These strategic agreements help businesses strengthen market presence, stimulate collaborative innovation, and generate revenue development by expanding product ranges and improving distribution networks.

Blood Clot Retrieval Devices Market Segmentation

The worldwide market for blood clot retrieval devices is split based on type, stroke type, application, end user, and geography.

Blood Clot Retrieval Device Market By Type

- Penumbra Blood Clot Retrieval Devices

- Mechanical Embolus Removal Devices

- Ultrasound Assisted Devices

- Stent Retrievers

According to blood clot retrieval devices industry analysis, mechanical embolus removal devices dominate the market because to their efficacy and versatility in treating various forms of clots. These technologies, including as catheters and thrombectomy systems, provide accurate mechanical extraction of clots from blood vessels while causing minimal injury to surrounding tissues. They are commonly used to treat disorders such as ischemic stroke and deep vein thrombosis, where early clot removal is critical to avoiding serious consequences.

Moreover, technological improvements have resulted in the development of extremely efficient and minimally intrusive mechanical devices, which has accelerated their acceptance. With a strong focus on improving patient outcomes and lowering procedure risks, healthcare professionals are increasingly relying on Mechanical Embolus Removal Devices, making this sector the key driver of the blood clot retrieval devices market's growth and innovation.

Blood Clot Retrieval Device Market By Stroke Type

- Ischemic Stroke (Blood Clot)

- Transient Ischemic Attack

- Hemorrhagic Stroke (Rupturing Of Arteries)

The ischemic stroke (blood clot) segment holds the largest share and it is expected to grow over the In the blood clot retrieval devices market forecast period due to several factors. Ischemic strokes, caused by blood clots obstructing arteries supplying blood to the brain, account for the majority of stroke cases worldwide. Prompt intervention is critical to restore blood flow and minimize brain damage. Blood clot retrieval devices, particularly mechanical thrombectomy systems and stent retrievers, have revolutionized the treatment landscape for ischemic strokes. These devices allow for rapid and precise removal of clots from affected blood vessels, significantly improving patient outcomes and reducing long-term disabilities. With a growing emphasis on timely intervention and advancements in technology enhancing the efficacy of clot retrieval procedures, the Ischemic Stroke segment continues to dominate the blood clot retrieval devices market, addressing a critical unmet need in stroke care.

Blood Clot Retrieval Device Market By Application

- Coronary Arteries

- Peripheral Arteries

- Cerebral Arteries

The cerebral arteries section is expected to emerge as the market leader in the application category. This assumption is based on the critical function of cerebral arteries in supporting brain health, demanding effective treatments for clot-related blockages. The increase in neuro-interventional operations has significantly accelerated the development of clot retrieval devices, particularly for treating strokes and cerebrovascular diseases. Also, the rising prevalence of ischemic strokes, together with advances in healthcare infrastructure, increases the demand for these devices in cerebral artery applications. This category is poised to maintain its dominance in the foreseeable future, bolstered further by ongoing research and development efforts targeted at enhancing device efficacy and safety for cerebral arteries.

Blood Clot Retrieval Device Market By End User

- Diagnostic Centers

- Hospitals

- Ambulatory Surgical Centers

- Clinics

Several significant factors contribute to hospitals dominance in the blood clot retrieval devices market as the largest end user group. For starters, hospitals frequently provide extensive resources for detecting and treating a wide range of medical disorders, including those needing blood clot retrieval techniques. Furthermore, hospitals deal with a wide spectrum of patient conditions, from ordinary to critical, making them regular users of such equipment. Furthermore, hospitals typically have specialized departments and competent medical workers capable of executing complex procedures such as clot retrieval successfully. This combination of resources, experience, and patient volume establishes hospitals as the key end-user segment, resulting in high demand for blood clot retrieval devices on their grounds.

Blood Clot Retrieval Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Blood Clot Retrieval Devices Market Regional Analysis

In terms of blood clot retrieval devices market analysis, North America stands out as the largest region for a variety of reasons. One important aspect is the advanced healthcare infrastructure in nations such as the United States and Canada, which includes modern hospitals and diagnostic centers outfitted with cutting-edge medical technology. Furthermore, the region's high frequency of cardiovascular disorders drives up demand for blood clot retrieval equipment. Furthermore, advantageous reimbursement policies and a strong emphasis on R&D drive market expansion in North America throughout the blood clot retrieval devices industry forecast period.

Asia-Pacific emerges as the fastest-growing market for blood clot retrieval devices, due to a variety of factors. Rising healthcare spending in nations such as China, India, and Japan is increasing access to modern medical treatments, such as clot retrieval. Furthermore, the region's healthcare infrastructure is expanding, fuelling demand for such gadgets. Furthermore, the presence of a large patient pool, as well as ongoing efforts by governments and healthcare organizations to improve healthcare services, contributes to the rapid expansion of the blood clot retrieval devices market in Asia-Pacific. Overall, while North America dominates the industry, Asia-Pacific shows strong development potential.

Blood Clot Retrieval Devices Market Players

Some of the top blood clot retrieval devices companies offered in our report include Terumo Corporation, Bayer, AngioDynamics, Boston Scientific Corporation, Penumbra, Johnson and Johnson, Teleflex Incorporated, Medtronic Plc, Argon Medical Devices, and Penumbra, Inc.

Frequently Asked Questions

How big is the blood clot retrieval devices market?

The blood clot retrieval devices market size was valued at USD 1.95 billion in 2023.

What is the CAGR of the global blood clot retrieval devices market from 2024 to 2032?

The CAGR of blood clot retrieval devices is 16.4% during the analysis period of 2024 to 2032.

Which are the key players in the blood clot retrieval devices market?

The key players operating in the global market are including Terumo Corporation, Bayer, AngioDynamics, Boston Scientific Corporation, Penumbra, Johnson and Johnson, Teleflex Incorporated, Medtronic Plc, Argon Medical Devices, and Penumbra, Inc.

Which region dominated the global blood clot retrieval devices market share?

North America held the dominating position in blood clot retrieval devices industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of blood clot retrieval devices during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global blood clot retrieval devices industry?

The current trends and dynamics in the blood clot retrieval devices industry include growing incidence of ischemic stroke and deep vein thrombosis (DVT), advancements in minimally invasive surgical techniques, increasing adoption of endovascular procedures, and rising geriatric population globally.

Which stroke type held the maximum share in 2023?

The ischemic stroke (blood clot) stroke type the maximum share of the blood clot retrieval devices industry.