Blind Spot Monitoring System Market | Acumen Research and Consulting

Blind Spot Monitoring System Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

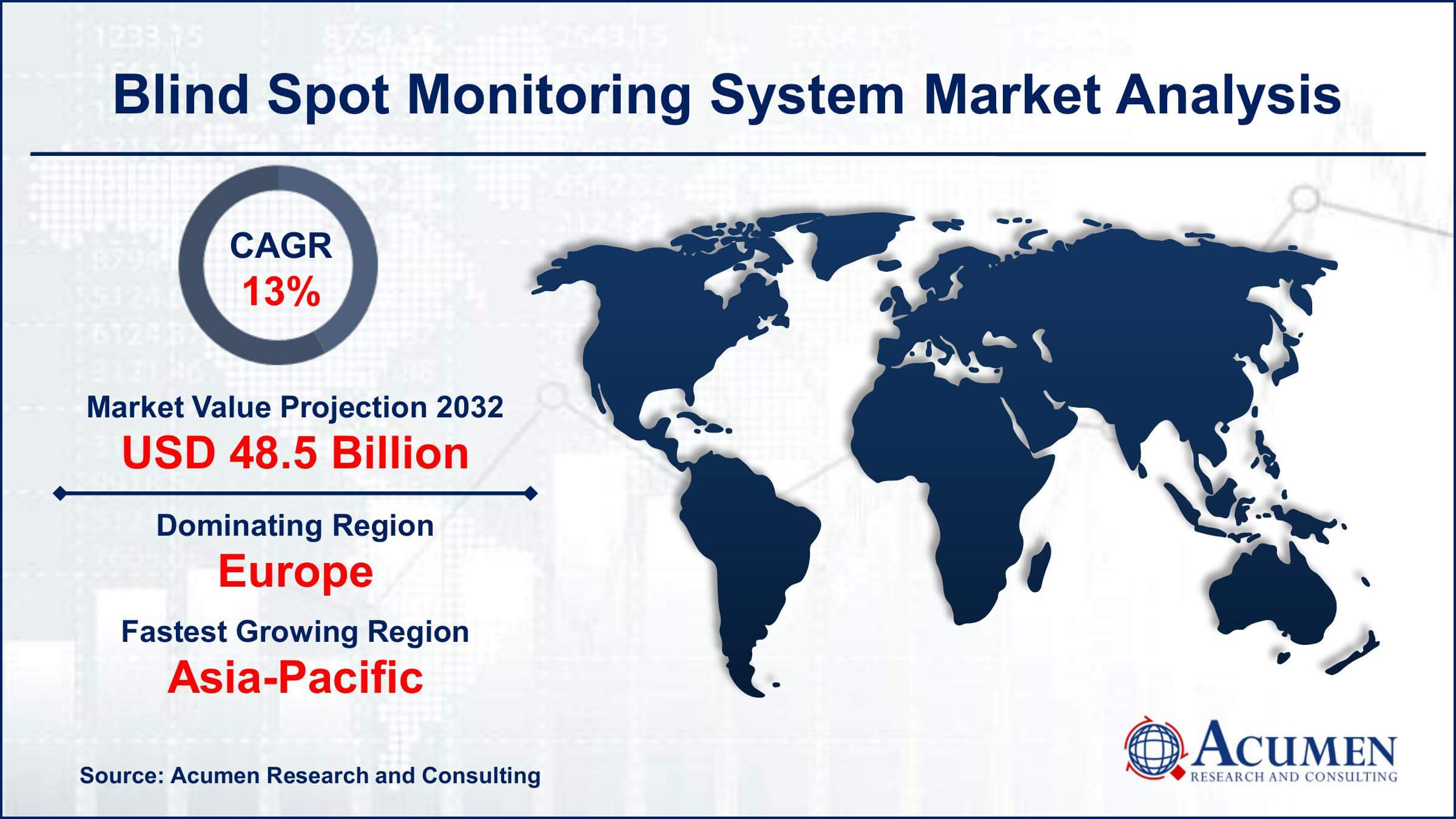

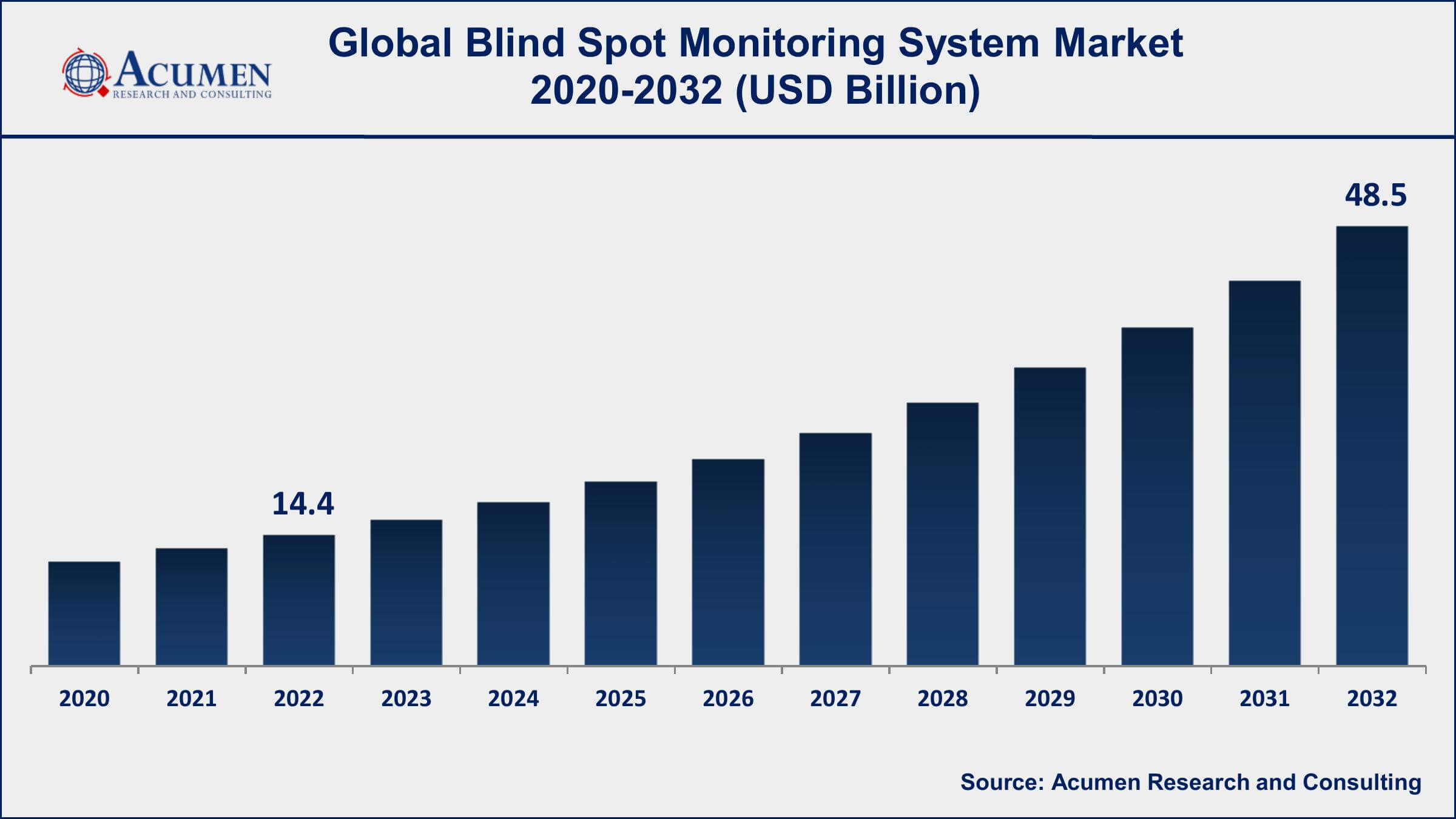

The Global Blind Spot Monitoring (BSM) System Market Size accounted for USD 14.4 Billion in 2022 and is projected to achieve a market size of USD 48.5 Billion by 2032 growing at a CAGR of 13% from 2023 to 2032.

Blind Spot Monitoring System market Highlights

- Global blind spot monitoring system market revenue is expected to increase by USD 48.5 Billion by 2032, with a 13% CAGR from 2023 to 2032

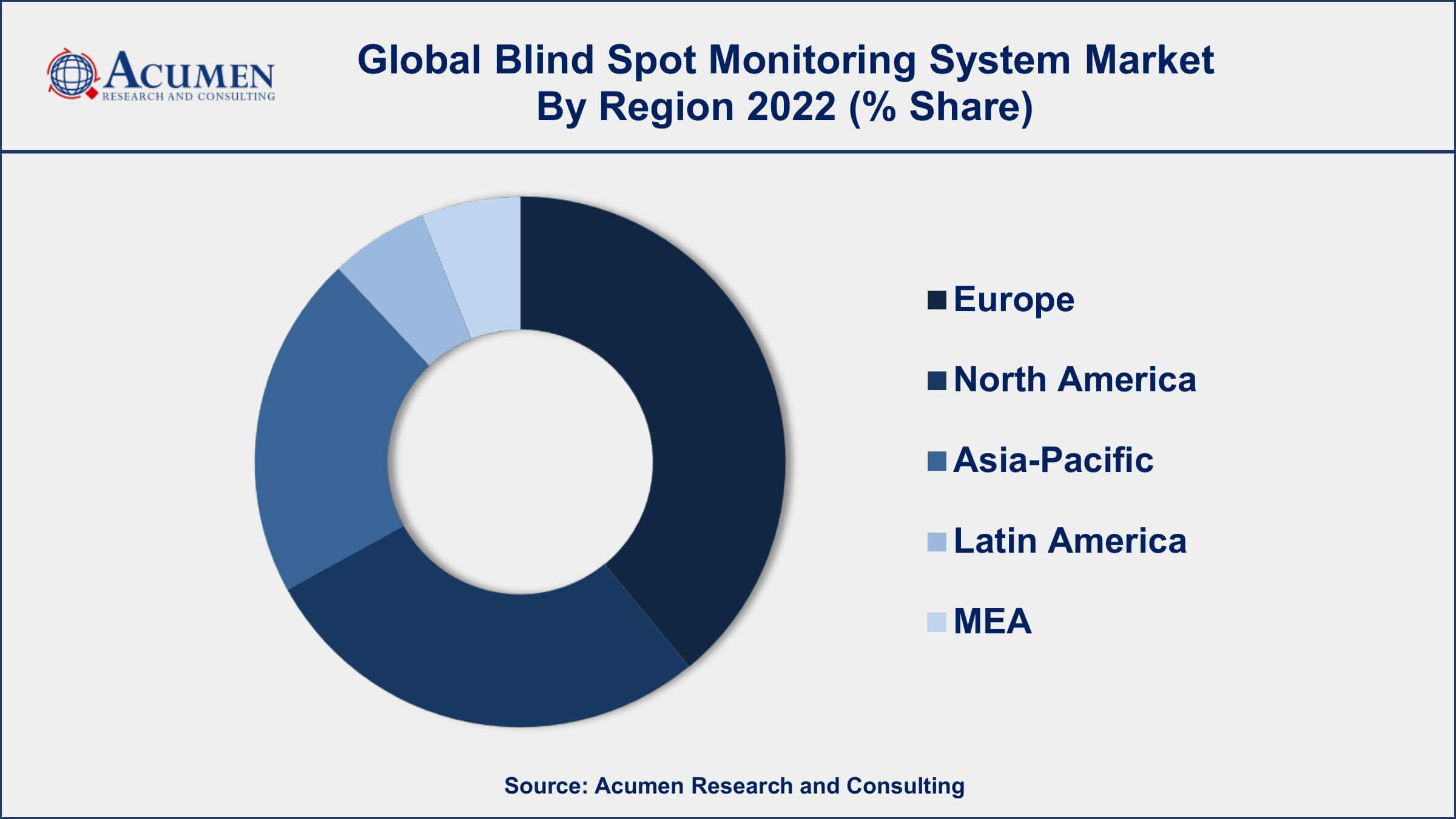

- Europe region led with more than 39% of blind spot monitoring system market share in 2022

- Asia-Pacific blind spot monitoring system market growth will record a CAGR of around 13.8% from 2023 to 2032

- According to a report by AAA, blind spot monitoring systems can reduce the likelihood of crashes by up to 14%

- The radar sensor technology segment accounted for the largest market share in 2022

- Increasing demand for advanced driver assistance systems (ADAS), drives the blind spot monitoring system market value

Blind-spot monitoring (BSM) system is an advanced driver assistance system that uses radar, sensors, and cameras to detect objects or vehicles that are located outside the driver's line of sight. The system provides an alert to the driver when a vehicle is detected in the blind spot, reducing the risk of accidents caused by lane-changing or merging maneuvers. BSM systems are commonly found in cars, trucks, and buses and have become increasingly popular due to their ability to enhance driver safety and reduce accidents on the road.

The global blind spot monitoring system market has experienced significant growth in recent years due to the increasing demand for advanced driver assistance systems (ADAS) and the growing focus on road safety. The growth of the market can be attributed to several factors, such as the increasing number of vehicles on the road, rising demand for luxury and premium vehicles, and the growing awareness of driver safety. The adoption of BSM systems is driven by government regulations mandating the installation of ADAS systems in vehicles to improve road safety. For instance, the European Union has made it mandatory for all new cars to have BSM systems by 2022. Additionally, technological advancements in sensors, cameras, and radar technology have significantly improved the accuracy and reliability of BSM systems, further driving their adoption.

Global Blind Spot Monitoring System Market Trends

Market Drivers

- Increasing demand for advanced driver assistance systems (ADAS)

- Growing focus on road safety

- Government regulations mandating installation of ADAS systems in vehicles

- Technological advancements in sensors, cameras, and radar technology

- Rising demand for luxury and premium vehicles

Market Restraints

- High cost of blind spot monitoring system installation and maintenance

- Limited awareness and understanding of the benefits of BSM systems

Market Opportunities

- Growing demand for electric and autonomous vehicles

- Increasing adoption of connected vehicle technology

Blind Spot Monitoring System Market Report Coverage

| Market | Blind Spot Monitoring System Market |

| Blind Spot Monitoring System Market Size 2022 | USD 14.4 Billion |

| Blind Spot Monitoring System Market Forecast 2032 | USD 48.5 Billion |

| Blind Spot Monitoring System Market CAGR During 2023 - 2032 | 13% |

| Blind Spot Monitoring System Market Analysis Period | 2020 - 2032 |

| Blind Spot Monitoring System Market Base Year | 2022 |

| Blind Spot Monitoring System Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Technology, By Vehicle Type, By Vehicle Propulsion, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Continental AG, Denso Corporation, Robert Bosch GmbH, Aptiv PLC, Valeo SA, Autoliv Inc., ZF Friedrichshafen AG, Magna International Inc., Infineon Technologies AG, Panasonic Corporation, Texas Instruments Incorporated, and NXP Semiconductors N.V. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The blind spot monitor is an automobile-based sensor device that senses other vehicles located on the driver’s side. Warnings from the system are generated and can be in forms such as audible, tactile, visual, or vibrating. However, blind spot monitors may do more than monitoring from the sides and rear of the automobile. They may also incorporate Cross Traffic Alert, which warns a person backing out of a parking area when traffic is reaching from the sides.

The factors expected to boost the growth of this market comprise growing industrialization in the emerging regions with increasing government investments, advanced technologies, low-cost labor, and growing disposable incomes. In addition, the government policies which favor the BSM (blind spot monitoring) system market, substitute sources for automobile production, and growing demand for automated automobiles are expected to provide future opportunities for the growth of this market.

Blind Spot Monitoring System Market Segmentation

The global blind spot monitoring system market segmentation is based on technology, vehicle type, vehicle propulsion, and geography.

Blind Spot Monitoring System Market By Technology

- Ultrasound

- Camera

- Radar

According to the blind spot monitoring system industry analysis, the radar segment accounted for the largest market share in 2022. Radar is a key component of blind spot monitoring systems, as it is used to detect objects or vehicles in the driver's blind spot. Radar-based BSM systems use electromagnetic waves to detect and track objects, providing accurate information about their distance, speed, and direction. Radar technology is preferred over other sensor technologies due to its ability to function in adverse weather conditions and low visibility. The radar segment is expected to witness significant growth in the coming years due to the increasing demand for advanced driver assistance systems and the growing focus on road safety. Moreover, the growth of the radar segment can be attributed to several factors, such as the increasing number of vehicles on the road, rising demand for luxury and premium vehicles, and the growing awareness of driver safety.

Blind Spot Monitoring System Market By Vehicle Type

- Passenger Cars

- Heavy Commercial Vehicles

- Light Commercial Vehicles

In terms of vehicle types, the passenger cars segment is expected to witness significant growth in the coming years. Blind spot monitoring systems are becoming increasingly popular in passenger cars, particularly in luxury and premium vehicles, due to their ability to enhance driver safety and improve the overall driving experience. According to a report by MarketsandMarkets, the passenger car segment is expected to dominate the BSM system market during the forecast period, accounting for the largest market share. The growth of the passenger car segment can be attributed to several factors, such as the increasing demand for advanced driver assistance systems (ADAS), the rising disposable income of consumers, and the growing awareness of driver safety. The adoption of blind spot monitoring systems in passenger cars is also driven by government regulations mandating the installation of ADAS systems in vehicles.

Blind Spot Monitoring System Market By Vehicle Propulsion

- ICE

- Electric

According to the blind spot monitoring system market forecast, the electric segment is expected to witness significant growth in the coming years. With the growing demand for electric vehicles (EVs), there is an increasing focus on enhancing the safety features of these vehicles, including blind spot monitoring systems. EVs often have unique blind spots due to their design, which can be mitigated by the use of advanced sensor technologies. Furthermore, the increasing adoption of connected vehicle technology in EVs is expected to provide new opportunities for the growth of the BSM system market. The development of advanced sensor technologies, such as radar and cameras, is also expected to drive the growth of the electric segment in the BSM system market. These technologies provide accurate and reliable information about objects or vehicles in the driver's blind spot, improving the safety of EVs.

Blind Spot Monitoring System Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Blind Spot Monitoring System Market Regional Analysis

Europe is dominating the blind spot monitoring system market due to several factors, such as the high penetration of advanced driver assistance systems (ADAS) in vehicles, stringent safety regulations, and the presence of leading automotive manufacturers in the region. The European Union has mandated the installation of advanced safety features, including blind spot monitoring systems, in all new vehicles. This has driven the adoption of ADAS technologies in vehicles in the region, creating a favorable environment for the growth of the blind spot monitoring system market. Additionally, the presence of leading automotive manufacturers in Europe, such as BMW, Audi, and Mercedes-Benz, has further driven the demand for advanced safety features in vehicles. Furthermore, the increasing awareness of driver safety in Europe has led to the development of advanced safety technologies, such as radar and cameras, which are used in blind spot monitoring systems. These technologies provide accurate and reliable information about objects or vehicles in the driver's blind spot, improving the safety of vehicles on the road.

Blind Spot Monitoring System Market Player

Some of the top blind spot monitoring system market companies offered in the professional report include Continental AG, Denso Corporation, Robert Bosch GmbH, Aptiv PLC, Valeo SA, Autoliv Inc., ZF Friedrichshafen AG, Magna International Inc., Infineon Technologies AG, Panasonic Corporation, Texas Instruments Incorporated, and NXP Semiconductors N.V.

Frequently Asked Questions

What was the market size of the global blind spot monitoring system in 2022?

The market size of blind spot monitoring system was USD 14.4 Billion in 2022.

What is the CAGR of the global blind spot monitoring system market from 2023 to 2032?

The CAGR of blind spot monitoring system is 13% during the analysis period of 2023 to 2032.

Which are the key players in the blind spot monitoring system market?

The key players operating in the global market are including Continental AG, Denso Corporation, Robert Bosch GmbH, Aptiv PLC, Valeo SA, Autoliv Inc., ZF Friedrichshafen AG, Magna International Inc., Infineon Technologies AG, Panasonic Corporation, Texas Instruments Incorporated, and NXP Semiconductors N.V.

Which region dominated the global blind spot monitoring system market share?

Europe held the dominating position in blind spot monitoring system industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of blind spot monitoring system during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global blind spot monitoring system industry?

The current trends and dynamics in the blind spot monitoring system industry include increasing demand for advanced driver assistance systems (ADAS), growing focus on road safety, and government regulations mandating installation of ADAS systems in vehicles.

Which vehicle type held the maximum share in 2022?

The passenger cars vehicle type held the maximum share of the blind spot monitoring system industry.