Bitcoin Payment Ecosystem Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Bitcoin Payment Ecosystem Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

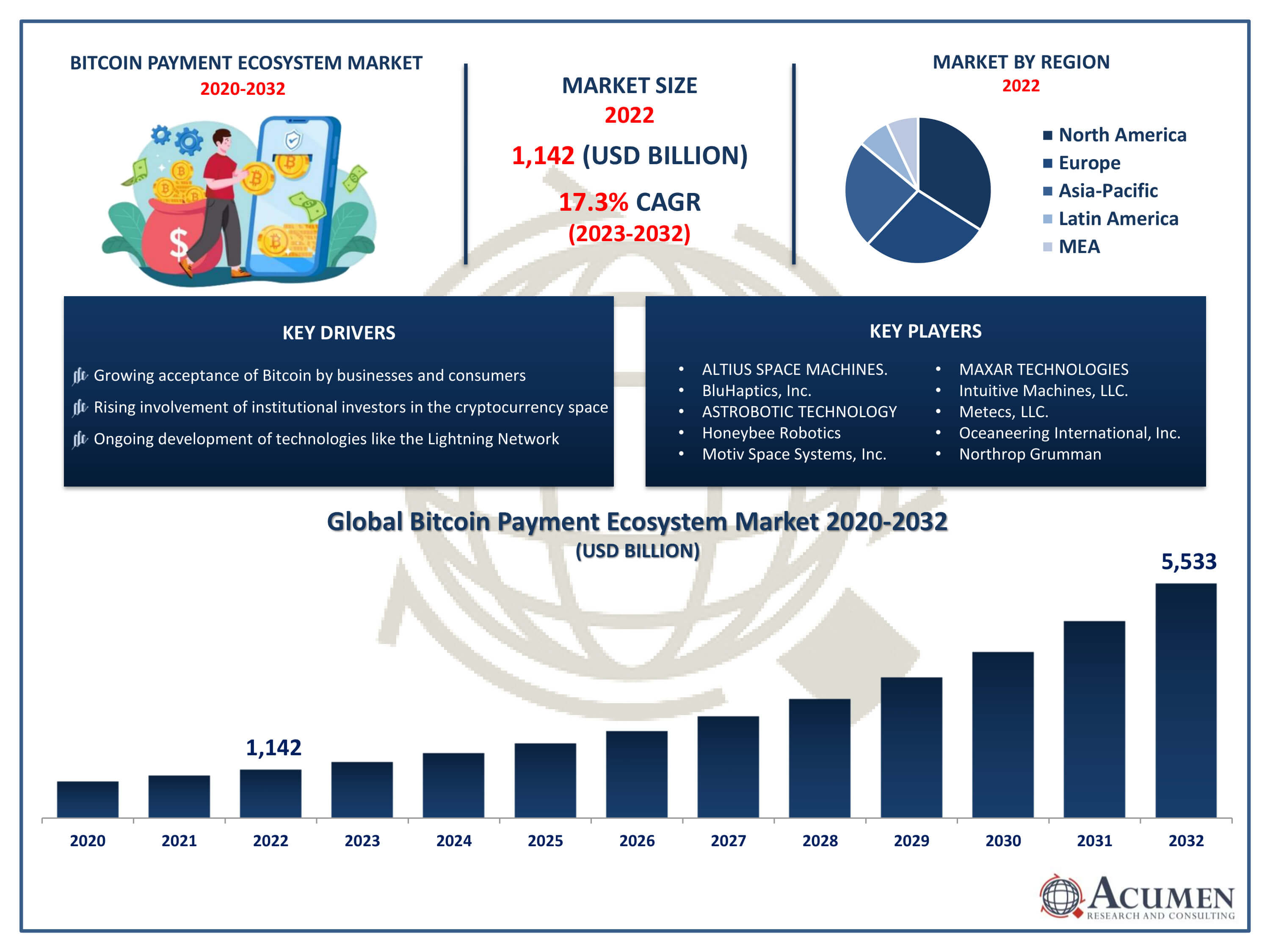

Request Sample Report

The Bitcoin Payment Ecosystem Market Size accounted for USD 1,142 Billion in 2022 and is projected to achieve a market size of USD 5,533 Billion by 2032 growing at a CAGR of 17.3% from 2023 to 2032.

Bitcoin Payment Ecosystem Market Highlights

- Global Bitcoin Payment Ecosystem Market revenue is expected to increase by USD 5,533 Billion by 2032, with a 17.3% CAGR from 2023 to 2032

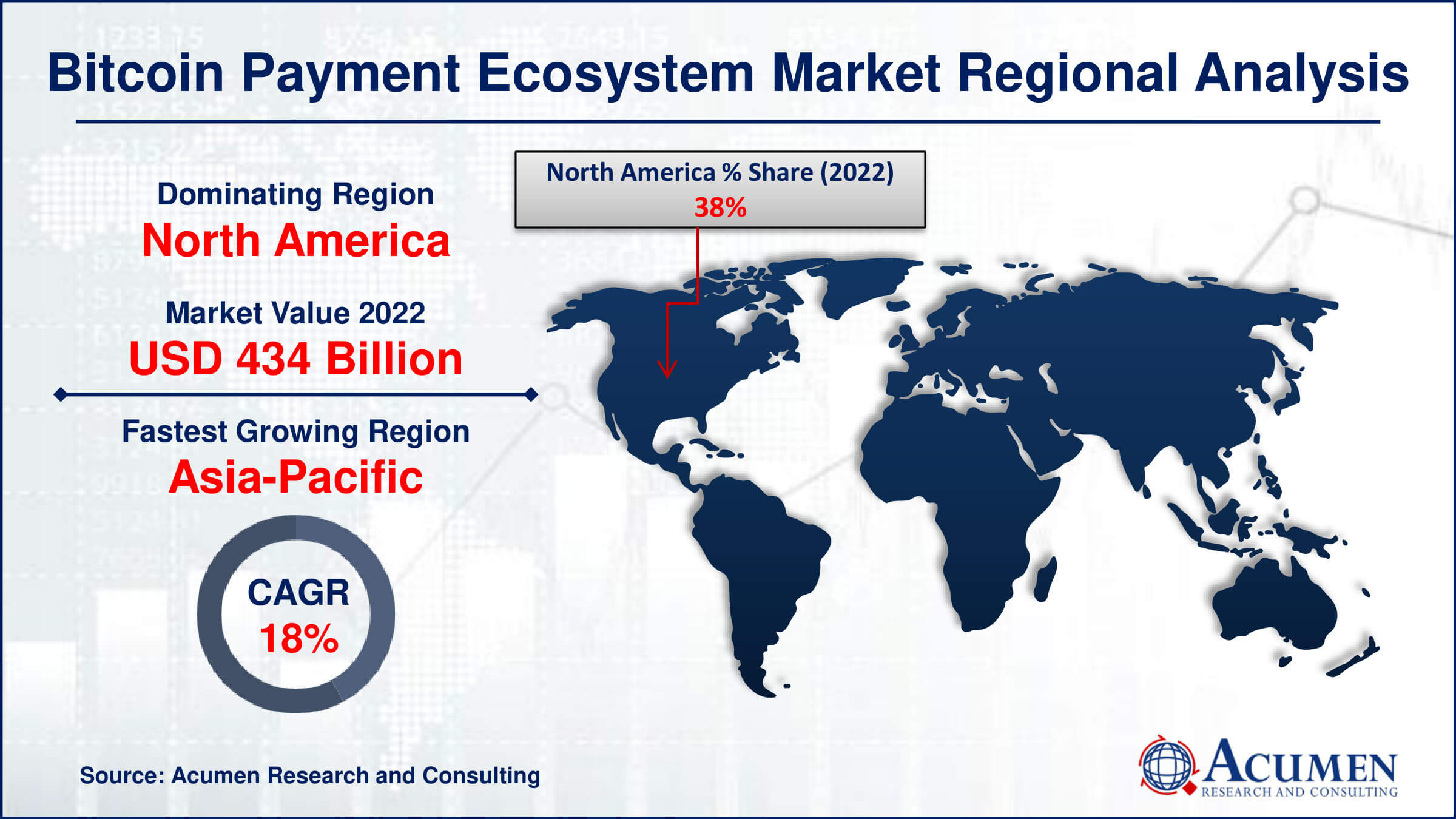

- North America region led with more than 38% of Bitcoin Payment Ecosystem Market share in 2022

- Asia-Pacific Bitcoin Payment Ecosystem Market growth will record a CAGR of more than 18% from 2023 to 2032

- By component, the hardware segment captured more than 46% of revenue share in 2022.

- By application, the trading marketplace segment had the largest market share of 24% in 2022

- Growing acceptance of Bitcoin by businesses and consumers, drives the Bitcoin Payment Ecosystem Market value

The Bitcoin payment ecosystem refers to the network of merchants, consumers, and service providers that facilitate transactions using Bitcoin as a digital currency. Bitcoin, created in 2009, introduced a decentralized and peer-to-peer system that allows users to transact directly without the need for intermediaries like banks. The ecosystem includes various components such as digital wallets, payment processors, and merchant services that enable the seamless exchange of value in the form of bitcoins.

Over the years, the market for Bitcoin payments has experienced significant growth. Bitcoin's increasing popularity as a store of value and a hedge against traditional financial uncertainties has contributed to the expansion of its payment ecosystem. Major companies and retailers have begun to accept Bitcoin payments, providing users with more options to spend their digital assets. Additionally, the development of innovative technologies, such as the Lightning Network, has addressed scalability issues, making Bitcoin transactions faster and more cost-effective. The market growth is also fueled by the growing interest of institutional investors and the broader acceptance of cryptocurrencies in mainstream finance. As regulatory frameworks become clearer and more businesses adopt Bitcoin payments, the ecosystem is likely to continue evolving and expanding.

Global Bitcoin Payment Ecosystem Market Trend

Market Drivers

- Growing acceptance of Bitcoin by businesses and consumers

- Rising involvement of institutional investors in the cryptocurrency space

- Ongoing development of technologies like the Lightning Network for improved scalability

- Bitcoin's role as a hedge against traditional financial uncertainties

- Clearer regulatory frameworks fostering confidence and adoption

Market Restraints

- Lack of clear and consistent regulations hindering widespread adoption

- Bitcoin's price volatility impacting its mainstream adoption for everyday transactions

Market Opportunities

- Continued advancements in blockchain and cryptocurrency technologies

- Integration of Bitcoin in the expanding ecosystem of decentralized financial services

Bitcoin Payment Ecosystem Market Report Coverage

| Market | Bitcoin Payment Ecosystem Market |

| Bitcoin Payment Ecosystem Market Size 2022 | USD 1,142 Billion |

| Bitcoin Payment Ecosystem Market Forecast 2032 | USD 5,533 Billion |

| Bitcoin Payment Ecosystem Market CAGR During 2023 - 2032 | 17.3% |

| Bitcoin Payment Ecosystem Market Analysis Period | 2020 - 2032 |

| Bitcoin Payment Ecosystem Market Base Year |

2022 |

| Bitcoin Payment Ecosystem Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Component, By Application, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BitPay, Binance, Blockchain.com, Inc., MoonPay USA LLC, Coinbase Global, Inc., OpenNode, CoinGateMoonPay USA LLC, RUSbit, PayPal Holdings, Inc., VeriFone, Inc., and BTCPay Server. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

The Bitcoin payment ecosystem is a decentralized network that facilitates financial transactions using Bitcoin as a digital currency. At its core, it comprises various components such as digital wallets, payment processors, and merchant services that enable users to send and receive payments in the form of bitcoins. Unlike traditional payment systems, Bitcoin transactions operate on a peer-to-peer basis, eliminating the need for intermediaries like banks. This ecosystem has gained momentum due to the increasing acceptance of Bitcoin as a legitimate form of currency and store of value. The applications of the Bitcoin payment ecosystem are diverse and continue to evolve. One primary application is online and in-store retail transactions, where merchants accept Bitcoin as a form of payment for goods and services. Additionally, Bitcoin facilitates cross-border transactions, enabling users to transfer value globally with reduced fees and faster processing times compared to traditional banking systems.

The Bitcoin payment ecosystem has experienced robust growth, driven by a combination of increasing adoption, institutional interest, and technological advancements. As Bitcoin gained mainstream recognition as a store of value and a viable form of digital currency, more businesses and merchants have begun to accept it as a means of payment. This growing acceptance has expanded the use cases for Bitcoin beyond a speculative asset, contributing to the overall growth of the payment ecosystem. Institutional involvement has been a significant catalyst for market growth. Institutional investors, including hedge funds and corporations, have shown a heightened interest in Bitcoin as an asset class. Their participation not only brings legitimacy to the cryptocurrency space but also increases the liquidity and accessibility of Bitcoin, making it more attractive for everyday transactions. Moreover, the development of technologies like the Lightning Network has addressed scalability concerns, enabling faster and more cost-effective Bitcoin transactions, further supporting the expansion of the payment ecosystem.

Bitcoin Payment Ecosystem Market Segmentation

The global Bitcoin Payment Ecosystem Market segmentation is based on component, application, end user, and geography.

Bitcoin Payment Ecosystem Market By Component

- Hardware

- Services

- Software

According to the bitcoin payment ecosystem industry analysis, the hardware segment accounted for the largest market share in 2022. This growth is primarily driven by the demand for secure and efficient solutions to store and transact with cryptocurrencies. Hardware wallets, a form of physical device designed to securely store private keys offline, have gained popularity among cryptocurrency users seeking enhanced security measures. The rise in awareness about the importance of securing digital assets and protecting against online threats has fueled the adoption of hardware wallets, contributing significantly to the growth of the hardware segment. Additionally, the increasing institutional interest in Bitcoin has led to a demand for robust and scalable infrastructure, including hardware solutions for managing cryptocurrency holdings.

Bitcoin Payment Ecosystem Market By Application

- Decentralize Identity

- Smart contracts

- Decentralize Organization

- Trading Marketplace

- ATM’s

- Consumer Wallets

- Analytics and Big data

- Others

In terms of applications, the trading marketplace segment is expected to witness significant growth in the coming years. This growth is driven by the increasing interest and participation of retail and institutional traders in the cryptocurrency market. Bitcoin's recognition as a legitimate asset class has led to the establishment and expansion of numerous cryptocurrency exchanges, providing platforms for users to buy, sell, and trade Bitcoin and other digital assets. These trading marketplaces offer a range of features, including spot trading, derivatives, and margin trading, catering to the diverse preferences of market participants. The rise of decentralized finance (DeFi) platforms and the introduction of Bitcoin trading pairs on various exchanges have further fueled the growth of the trading marketplace segment. DeFi protocols, built on blockchain technology, enable users to engage in decentralized trading and lending without relying on traditional financial intermediaries.

Bitcoin Payment Ecosystem Market By End User

- Enterprises

- Government

- Others

According to the bitcoin payment ecosystem market forecast, the government segment is expected to witness significant growth in the coming years. The growth of the government segment is closely tied to the broader regulatory environment, and ongoing efforts by governments to establish clear guidelines for the use of Bitcoin and other cryptocurrencies will likely impact the trajectory of this segment. Governments that adopt progressive and supportive regulatory approaches may contribute to a more robust and inclusive Bitcoin payment ecosystem, providing a framework for businesses and consumers to engage with digital assets securely and legally. Several countries have taken steps to provide regulatory clarity and establish frameworks for the legal use of Bitcoin, fostering a more conducive environment for its growth. Governments are increasingly exploring the potential benefits of issuing central bank digital currencies (CBDCs) or leveraging blockchain technology for more efficient payment systems.

Bitcoin Payment Ecosystem Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Bitcoin Payment Ecosystem Market Regional Analysis

North America has emerged as a dominating region in the Bitcoin payment ecosystem market due to a combination of factors that have fostered widespread adoption and acceptance of cryptocurrencies. The region is home to a vibrant and innovative financial technology (FinTech) sector, which has played a pivotal role in developing user-friendly platforms, wallets, and payment solutions that facilitate Bitcoin transactions. Major financial hubs such as Silicon Valley have been at the forefront of blockchain and cryptocurrency innovation, attracting significant investment and talent to the industry. Regulatory clarity has been a crucial driver of North America's dominance in the Bitcoin payment ecosystem. Compared to some other regions, North American countries, particularly the United States and Canada, have made strides in establishing clearer regulatory frameworks for cryptocurrencies. This regulatory certainty has instilled confidence among businesses, investors, and consumers, encouraging the development of a robust Bitcoin payment infrastructure. Furthermore, the presence of well-established financial institutions and a tech-savvy population has created a favorable environment for the integration of Bitcoin into mainstream financial services, contributing to the region's leadership in the global Bitcoin payment ecosystem.

Bitcoin Payment Ecosystem Market Player

Some of the top bitcoin payment ecosystem market companies offered in the professional report include BitPay, Binance, Blockchain.com, Inc., MoonPay USA LLC, Coinbase Global, Inc., OpenNode, CoinGateMoonPay USA LLC, RUSbit, PayPal Holdings, Inc., VeriFone, Inc., and BTCPay Server.

Frequently Asked Questions

How big is the bitcoin payment ecosystem market?

The bitcoin payment ecosystem market size was USD 1,142 Billion in 2022.

What is the CAGR of the global bitcoin payment ecosystem market from 2023 to 2032?

The CAGR of bitcoin payment ecosystem is 17.3% during the analysis period of 2023 to 2032.

Which are the key players in the bitcoin payment ecosystem market?

The key players operating in the global market are including BitPay, Binance, Blockchain.com, Inc., MoonPay USA LLC, Coinbase Global, Inc., OpenNode, CoinGateMoonPay USA LLC, RUSbit, PayPal Holdings, Inc., VeriFone, Inc., and BTCPay Server.

Which region dominated the global bitcoin payment ecosystem market share?

North America held the dominating position in bitcoin payment ecosystem industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of bitcoin payment ecosystem during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global bitcoin payment ecosystem industry?

The current trends and dynamics in the bitcoin payment ecosystem industry include growing acceptance of Bitcoin by businesses and consumers, rising involvement of institutional investors in the cryptocurrency space, and ongoing development of technologies like the Lightning Network for improved scalability.

Which application held the maximum share in 2022?

The trading market place application held the maximum share of the bitcoin payment ecosystem industry.