Biosensors Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Biosensors Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

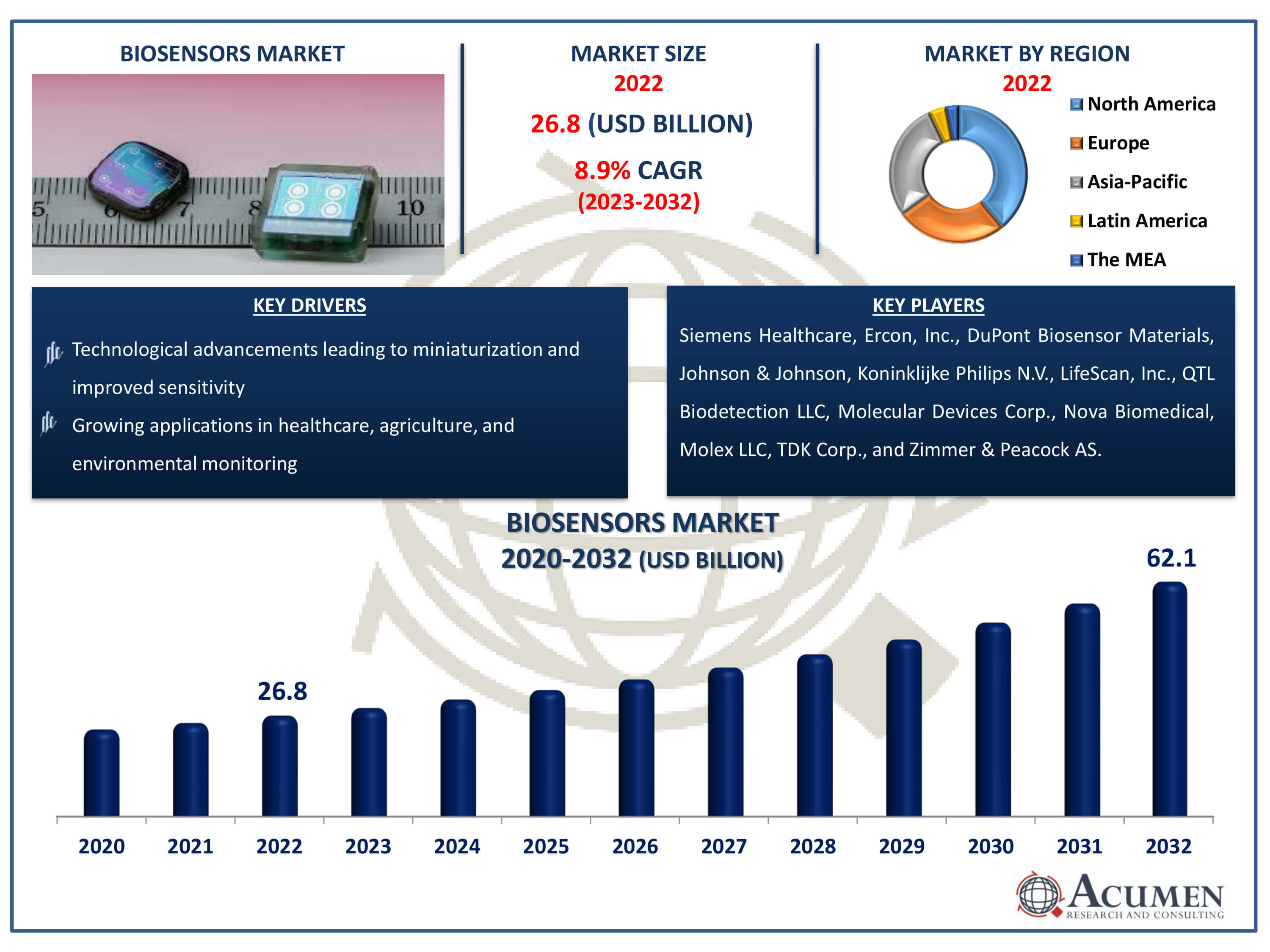

The Biosensors Market Size accounted for USD 26.8 Billion in 2022 and is estimated to achieve a market size of USD 62.1 Billion by 2032 growing at a CAGR of 8.9% from 2023 to 2032.

Biosensors Market Highlights

- Global biosensors market revenue is poised to garner USD 62.1 billion by 2032 with a CAGR of 8.9% from 2023 to 2032

- North America biosensors market value occupied around USD 10.4 billion in 2022

- Asia-Pacific biosensors market growth will record a CAGR of more than 10.5% from 2023 to 2032

- Among technology, the electrochemical sub-segment generated more than USD 19 billion revenue in 2022

- Based on application, the medical sub-segment generated around 66% market share in 2022

- Collaborations and partnerships for research and development initiatives is a popular biosensors market trend that fuels the industry demand

Biosensors are analytical systems utilized to acquire information through biological samples. They consist of a biological recognition unit (BIU) and a transducer. The BIU interacts with biological elements such as enzymes and antibodies, while the transducer converts the biological input events (BIE) into an electrical signal (ES). Biosensors find applications in various fields including medicine, food toxicity detection, agriculture, and biodefense. Low-cost biosensors offer fast results, ease of use, and portability. These innovative devices serve as indispensable tools in scientific research, medical diagnostics, environmental monitoring, and quality control across industries.

Global Biosensors Market Dynamics

Market Drivers

- Increasing demand for point-of-care diagnostics

- Technological advancements leading to miniaturization and improved sensitivity

- Growing applications in healthcare, agriculture, and environmental monitoring

- Rising focus on personalized medicine and preventive healthcare

Market Restraints

- Regulatory challenges and stringent approval processes

- Concerns regarding accuracy and reliability of biosensor technologies

- High initial costs of development and implementation

Market Opportunities

- Expansion of biosensor applications in wearable health monitoring devices

- Integration of biosensors in smartphones and other consumer electronics

- Emerging markets offering untapped growth potential

Biosensors Market Report Coverage

| Market | Biosensors Market |

| Biosensors Market Size 2022 | USD 26.8 Billion |

| Biosensors Market Forecast 2032 | USD 62.1 Billion |

| Biosensors Market CAGR During 2023 - 2032 | 8.9% |

| Biosensors Market Analysis Period | 2020 - 2032 |

| Biosensors Market Base Year |

2022 |

| Biosensors Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Technology, By Application, By End-use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Siemens Healthcare, Ercon, Inc., DuPont Biosensor Materials, Johnson & Johnson, Koninklijke Philips N.V., LifeScan, Inc., QTL Biodetection LLC, Molecular Devices Corp., Nova Biomedical, Molex LLC, TDK Corp., and Zimmer & Peacock AS. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Biosensors Market Insights

In the growth of the global biosensor market, various factors significantly influence its dynamics. Recent research highlights the increased demand for point-of-care test methods efficiently meeting the need for advanced biosensors. Moreover, the rising prevalence of chronic and lifestyle-related disorders drives consumers to adopt biosensors for timely detection of pathogenic diseases. Additionally, the emergence of nanotechnologies and the growing global geriatric population further fortify the application of biosensors across industries. These include not only traditional sectors like healthcare but also expanding into novel domains such as food analysis and microbial activity surveillance, particularly when integrated with nanotechnology.

Furthermore, the market's expansion is propelled by the escalating popularity of personalized medicines and equipment, alongside a growing preference for non-invasive biosensors. Nevertheless, challenges persist due to regulatory constraints and complex reimbursement strategies in the global health sector, hindering biosensor acceptance and market growth. However, the biosensors market holds immense promise in untapped emerging regions. These regions, characterized by rapid economic development and increasing healthcare expenditures, present lucrative opportunities for biosensor technology. Their unmet healthcare needs and growing demand for diagnostic tools create a fertile ground for biosensor adoption, fostering improved disease identification and patient management. Additionally, the relatively lower market saturation and competition in these regions offer ample chances for biosensor companies to establish a robust presence and expand their market share, ultimately driving substantial growth and revenue expansion.

Biosensors Market Segmentation

The worldwide market for biosensors is split based on type, technology, application, end-use, and geography.

Biosensor Types

- Non-wearable

- Wearable

Wearable biosensors are expected to experience robust growth in the biosensors industry forecast period, with a largest CAGR percent. This growth can be attributed to increased awareness of healthy lifestyles driving market demand. Both developed and developing countries are witnessing greater adoption rates of portable biosensors due to the sedentary lifestyles of adults, leading to health issues such as weight gain and hormone disorders. Additionally, the expanding population of baby boomers, who are more susceptible to chronic diseases, will further boost demand for wearable biosensors. The ease of use and convenience offered by wearable biosensors will contribute to business growth in this segment.

In contrast, the market for non-wearable biosensors saw a noteworthy increase in 2022. The rising prevalence of chronic conditions such as diabetes, cancer, and other disorders is driving demand for traditional diagnosis and detection methods. These conventional systems include biosensors used for blood sugar level detection or analysis in hospitals and laboratories. The high accuracy, efficiency, and ongoing product development of non-wearable biosensors will significantly impact segment growth in the biosensors market forecast period.

Biosensor Technologies

- Optical

- Thermal

- Electrochemical

- Piezoelectric

In terms of biosensors industry analysis, in the technology market for electrochemical biosensors, significant growth is anticipated in the forecasted period. This growth will drive the increasing adoption of electrochemical biosensors in various applications such as food analysis and disease diagnostics. The rising incidence of diabetes is driving the adoption of electrochemical biosensor-based glucometers, further fueling business development. Additionally, the increasing prevalence of chronic conditions is boosting the demand for electrochemical biosensors, thereby contributing to segmental growth.

Similarly, the segment of optical biosensors is expected to advance steadily in the projected period. This growth can be attributed to advancements in optical biosensor technology. Optical biosensors find applications in surgical monitoring and critical treatments due to their advantages such as specificity, real-time measurements, high speed, compact design, and remote sensing capabilities. The industry of optical biosensors is poised for continued growth with ongoing innovations in optical biosensing technology.

Biosensor Applications

- Environment

- Medical

- Cholesterol

- Blood Glucose

- Blood Gas Analyzer

- Pregnancy Testing

- Drug Discovery

- Infectious Disease

- Agriculture

- Bioreactor

- Food Toxicity

- Others

The medical segment leads the biosensor market mainly due to its extensive application in healthcare and diagnostics. Biosensors are very important in the medical environment, helping to quickly and accurately detect various biomarkers, pathogens and analytes that are essential for the diagnosis, monitoring and treatment of diseases. They are often used to monitor blood sugar in diabetes, detect infectious diseases, screen medications and perform maintenance tests. As chronic diseases increase and people seek personalized health solutions, the demand for biosensors in the medical field will continue to grow. With the continuous development and integration of biosensors into medical devices, this segment is expected to remain at the forefront of the biosensor market.

Biosensors End-Uses

- Security and Bio-Defense

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

The POC (Point-of-Care) testing segment is the biggest in the biosensors market because it's really important. POC testing biosensors are used a lot in healthcare. They help quickly analyze patient samples right where the patient is, without needing to send samples to a lab. These biosensors give fast and accurate results for diagnosing diseases and monitoring conditions. They're super handy in places like emergency rooms and clinics. People like them because they're easy to use and give results in real-time. As more people want healthcare that's closer to where they are, and with more diseases around, the POC Testing segment is expected to keep growing in the biosensors market.

Biosensors Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

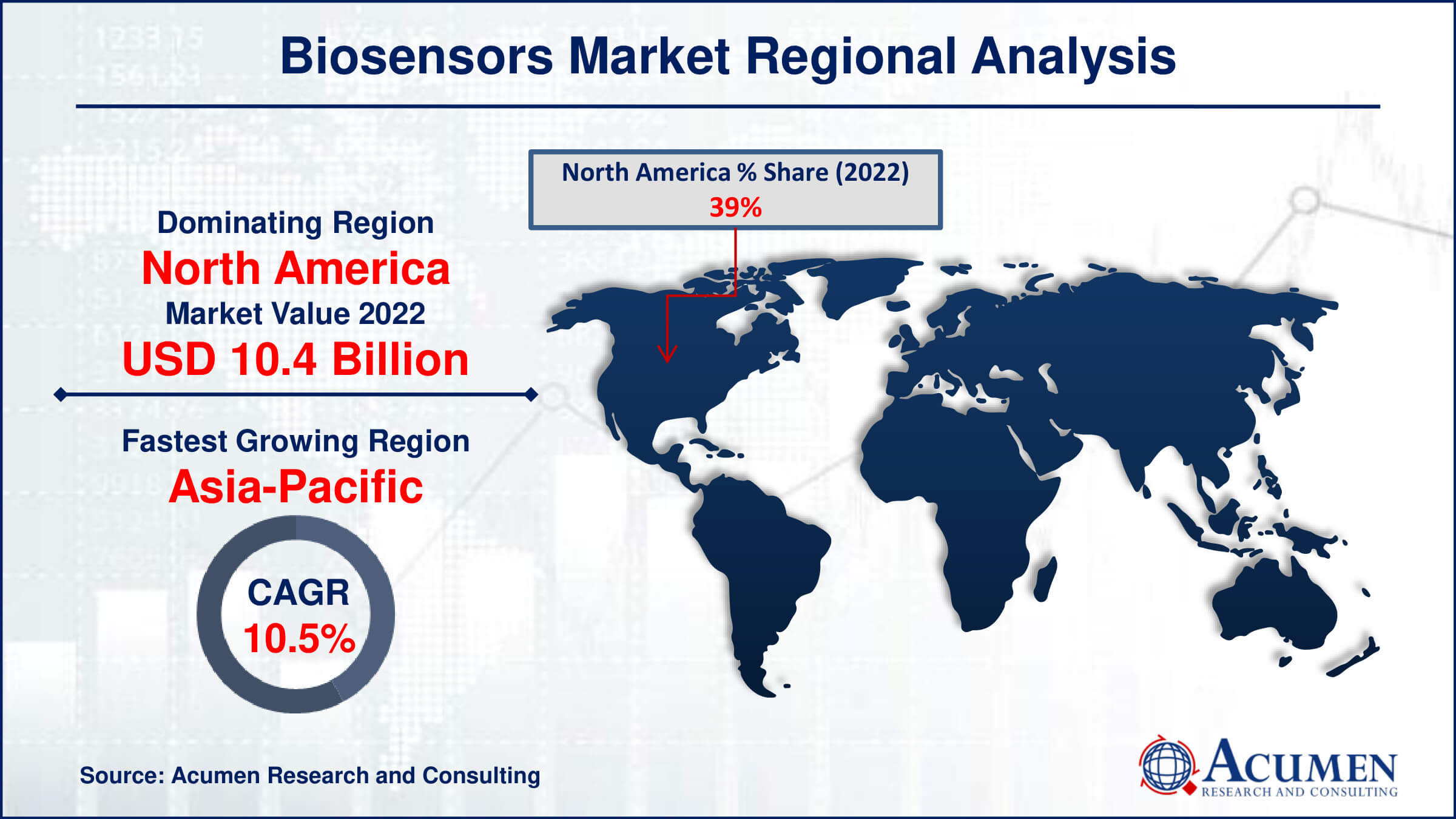

Biosensors Market Regional Analysis

The United States market dominated the biosensor industry in North America. A significant growth in the biosensors industry will lead to increased preference for wearable biosensors due to the rising incidence of chronic disorders such as diabetes, cancer, and excess-weight disorder. The demand for biosensors in the country is expected to increase with enhanced investment in research and development activities to meet evolving customer demand. Furthermore, the growing population base will significantly impact the development of the American biosensor industry in the coming years.

In terms of biosensors market analysis, Asia-Pacific is the fastest growing region in the industry. Similarly, Germany accounted for a significant portion of the European biosensors market. Innovations in biosensors, such as electrochemical biosensors enabling the detection of antioxidant levels, will drive business growth. Several research institutes in Germany are collaborating to accelerate biosensor research and development, thereby fostering industry growth in the coming years.

Biosensors Market Players

Some of the top biosensors companies offered in our report include Siemens Healthcare, Ercon, Inc., DuPont Biosensor Materials, Johnson & Johnson, Koninklijke Philips N.V., LifeScan, Inc., QTL Biodetection LLC, Molecular Devices Corp., Nova Biomedical, Molex LLC, TDK Corp., and Zimmer & Peacock AS.

Frequently Asked Questions

How big is the biosensors market?

The biosensors market size was valued at USD 26.8 billion in 2022.

What is the CAGR of the global biosensors market from 2023 to 2032?

The CAGR of biosensors is 8.9% during the analysis period of 2023 to 2032.

Which are the key players in the biosensors market?

The key players operating in the global market are including Siemens Healthcare, Ercon, Inc., DuPont Biosensor Materials, Johnson & Johnson, Koninklijke Philips N.V., LifeScan, Inc., QTL Biodetection LLC, Molecular Devices Corp., Nova Biomedical, Molex LLC, TDK Corp., and Zimmer & Peacock AS.

Which region dominated the global biosensors market share?

North America held the dominating position in biosensors industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of biosensors during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global biosensors industry?

The current trends and dynamics in the biosensors industry include increasing demand for point-of-care diagnostics, technological advancements leading to miniaturization and improved sensitivity, growing applications in healthcare, agriculture, and environmental monitoring, and rising focus on personalized medicine and preventive healthcare.

Which technology held the maximum share in 2022?

The electrochemical technology held the maximum share of the biosensors industry.