Biopharmaceutical Logistics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Biopharmaceutical Logistics Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

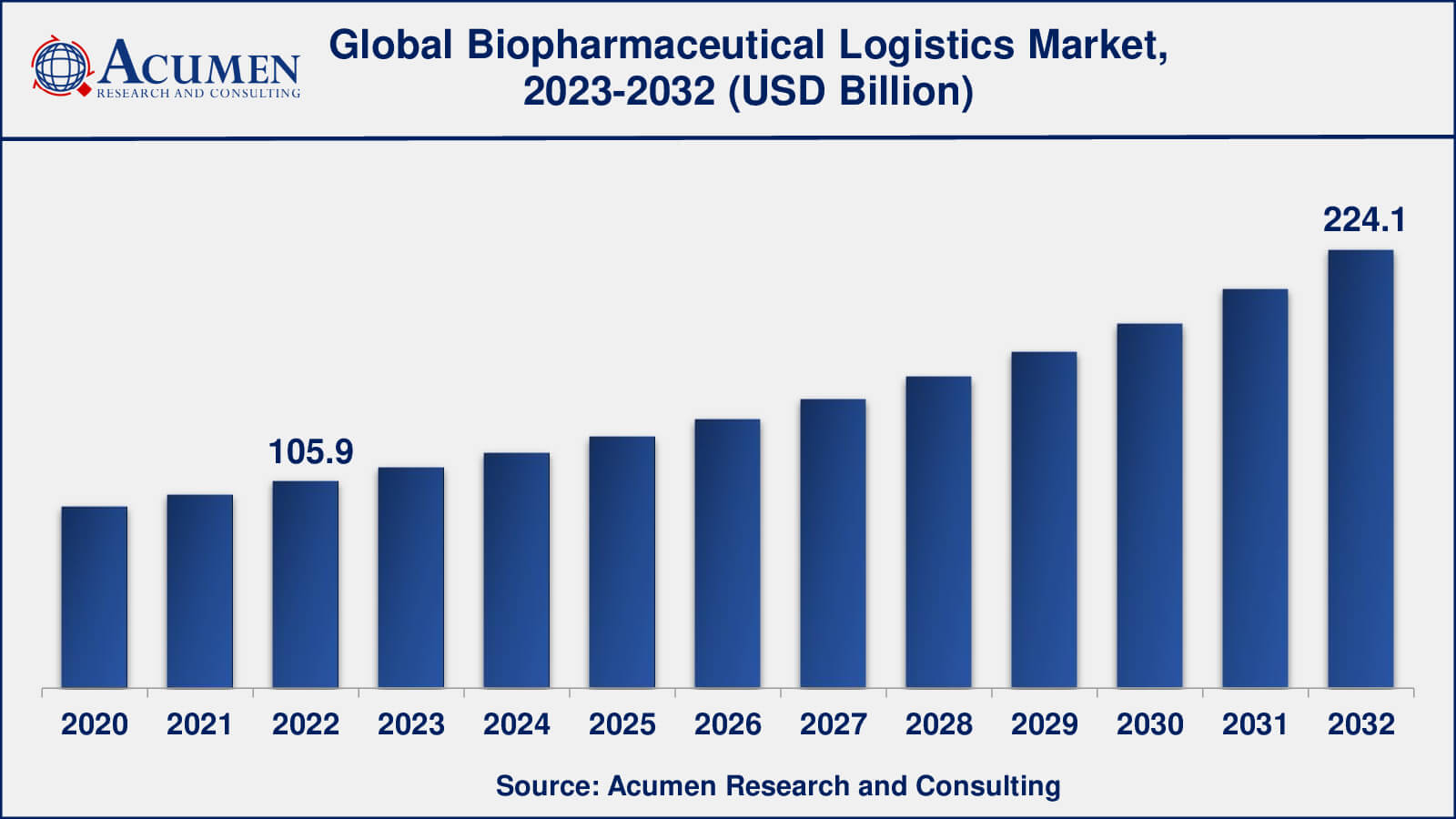

The Global Biopharmaceutical Logistics Market Size accounted for USD 105.9 Billion in 2022 and is estimated to achieve a market size of USD 224.1 Billion by 2032 growing at a CAGR of 7.9% from 2023 to 2032.

Biopharmaceutical Logistics Market Highlights

- Global biopharmaceutical logistics market revenue is poised to garner USD 224.1 billion by 2032 with a CAGR of 7.9% from 2023 to 2032

- North America biopharmaceutical logistics market value occupied more than USD 44.5 billion in 2022

- Asia-Pacific biopharmaceutical logistics market growth will record a CAGR of more than 8% from 2023 to 2032

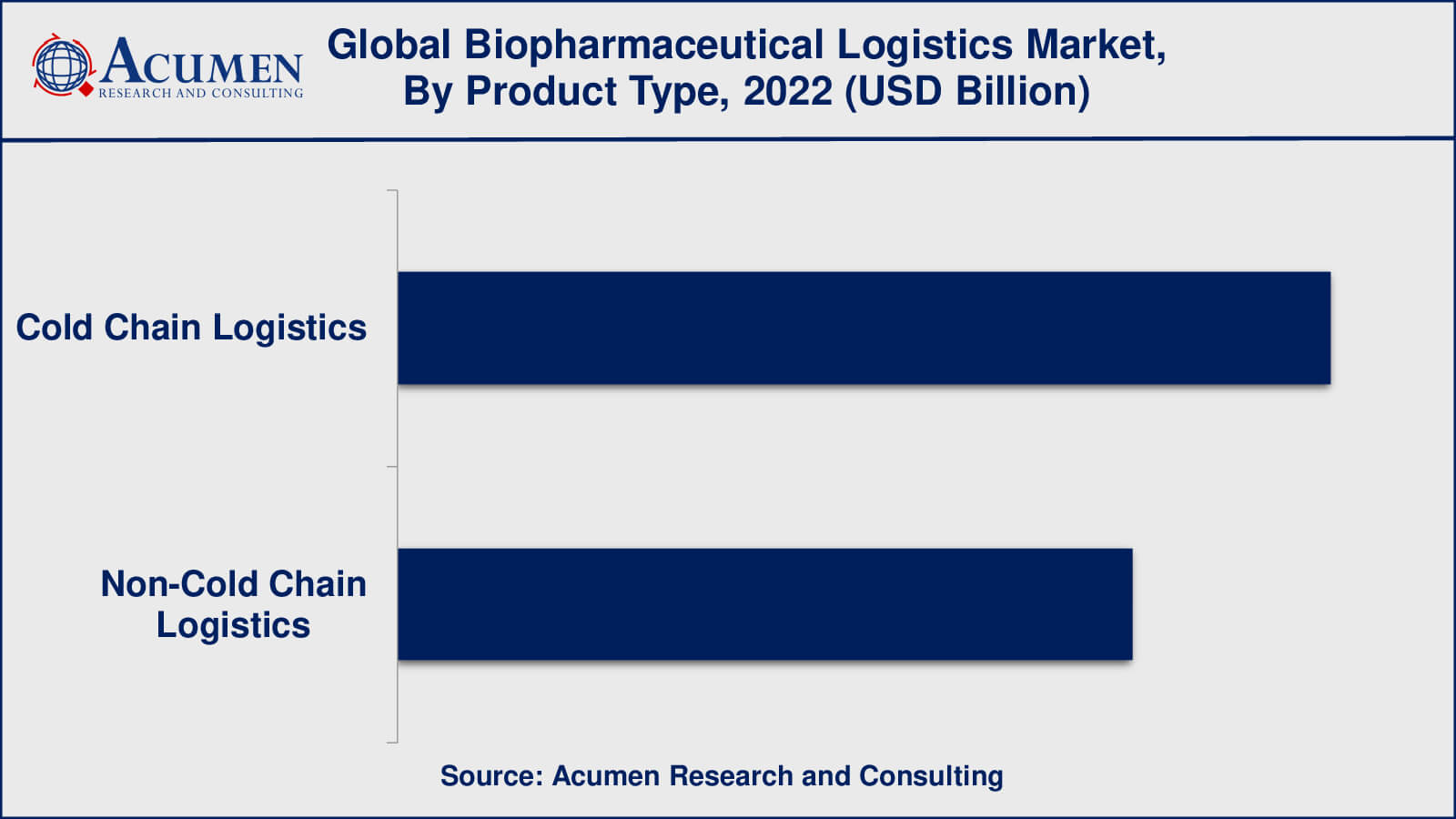

- Among product type, the non-cold chain logistics sub-segment generated over US$ 83.7 billion revenue in 2022

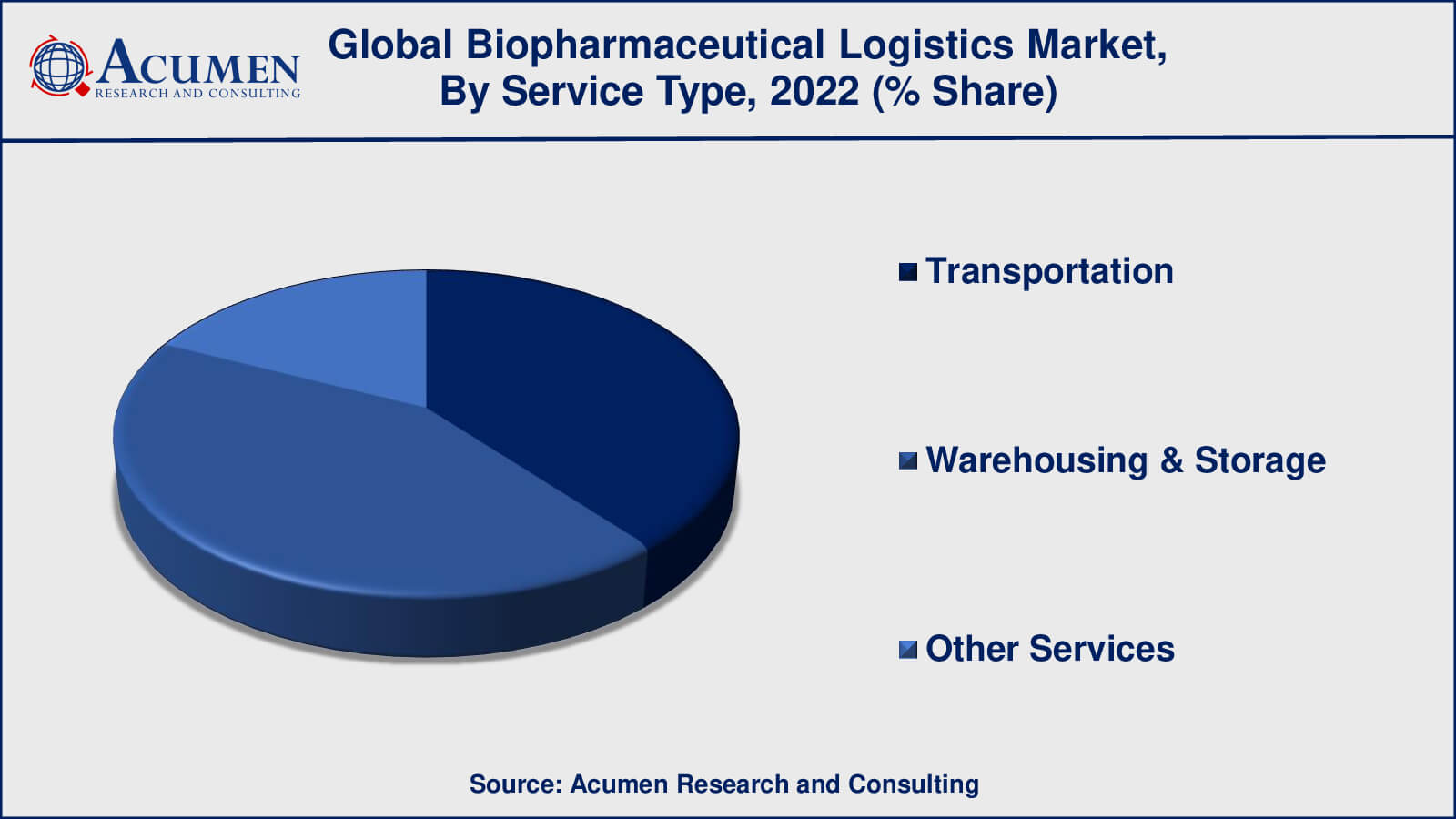

- Based service type, the warehousing and storage sub-segment generated around 43% share in 2022

- Expansion of biopharmaceutical manufacturing and research activities in emerging markets is a popular biopharmaceutical logistics market trend that fuels the industry demand

Biopharmaceutical logistics refers to the transportation, storage, and distribution of biopharmaceutical products such as vaccines, biologics, and biosimilars. Biopharmaceutical products need special handling during transportation and storage because they are sensitive to environmental factors like temperature, humidity, and light exposure. The logistics process for biopharmaceutical products involves temperature-controlled transportation and storage, environmental monitoring, proper handling and documentation, and compliance with regulatory requirements. The timely, safe, and effective delivery of these products to patients, healthcare professionals, and research institutions is crucially dependent on biopharmaceutical logistics.

Global Biopharmaceutical Logistics Market Dynamics

Market Drivers

- Increasing demand for biopharmaceutical products globally

- Growing importance of specialized logistics services to ensure product safety and efficacy

- Advancements in technology for temperature-controlled transportation and storage

- Rising number of clinical trials and research activities for biopharmaceutical product

- Increasing investment in biopharmaceutical research and development by pharmaceutical manufacturers

Market Restraints

- High costs associated with temperature-controlled transportation and storage of biopharmaceutical product

- Complex regulatory environment for biopharmaceutical product

- Lack of proper infrastructure and transportation networks in certain regions

- Short shelf life of biopharmaceutical product

- Stringent storage and handling requirements for biopharmaceutical products

Market Opportunities

- Growing demand for temperature-controlled packaging solutions for biopharmaceutical products

- Development of innovative logistics solutions to improve supply chain efficiency and reduce costs

- Increasing adoption of blockchain technology for enhanced supply chain transparency and security

- Growing trend towards outsourcing logistics services by biopharmaceutical manufacturers

Biopharmaceutical Logistics Market Report Coverage

| Market | Biopharmaceutical Logistics Market |

| Biopharmaceutical Logistics Market Size 2022 | USD 105.9 Billion |

| Biopharmaceutical Logistics Market Forecast 2032 | USD 224.1 Billion |

| Biopharmaceutical Logistics Market CAGR During 2023 - 2032 | 7.9% |

| Biopharmaceutical Logistics Market Analysis Period | 2020 - 2032 |

| Biopharmaceutical Logistics Market Base Year | 2022 |

| Biopharmaceutical Logistics Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product Type, By Service Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Agility, AmerisourceBergen Corporation, DB Schenker, DHL International GmbH, Fedex Corporation, Kerry Logistics Network Ltd, Kuehne and Nagel, Panalpina World Transport Ltd., SF Express, and United Parcel Service of America, Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Biopharmaceutical Logistics Market Insights

Global demand for biopharmaceutical products is increasing as a result of factors such as ageing populations, rising chronic disease incidence, and the growing importance of personalized medicine. This is propelling the biopharmaceutical logistics market forward, as the transportation and storage of these products necessitate specialized handling to ensure their safety and efficacy. Furthermore, technological advancements in temperature-controlled transportation and storage, such as the development of smart packaging solutions, are expected to drive market growth.

The growth of biopharmaceutical manufacturing and research activities in emerging markets such as Asia-Pacific and Latin America is opening up new opportunities for logistics providers in these regions. However, the biopharmaceutical logistics market faces several challenges, including high expenses associated with temperature-controlled transportation and storage, a complex regulatory environment, and a lack of proper infrastructure and transportation networks in certain regions. Nonetheless, the increasing adoption of blockchain technology for improved supply chain transparency and security, as well as the development of innovative logistics methods that enhance supply chain efficiency and reduce costs, are expected to propel the biopharmaceutical logistics market forward in the coming years.

Several factors could stifle the growth of the biopharmaceutical product market. The high costs associated with biopharmaceutical research, development, and production is a major impediment. Biopharmaceutical products are frequently complex and difficult to manufacture, making the manufacturing process costly. Furthermore, the regulatory requirements for these products are strict, which raises the costs. Another significant impediment is the short shelf life of biopharmaceutical products. Many of these products necessitate specialized storage and transportation, such as refrigeration or freezing, which can be expensive and time-consuming to manage. The short shelf life also poses difficulties for logistics providers, who must ensure that products are delivered on time before they expire. Another impediment to the biopharmaceutical logistics market is the complex regulatory environment. Regulations differ by country and region, which can make it difficult for businesses to navigate the regulatory landscape. Regulation compliance can also raise the cost of producing and distributing biopharmaceutical products.

Biopharmaceutical Logistics Market Segmentation

The worldwide market for biopharmaceutical logistics is split based on product type, service type, and geography.

Biopharmaceutical Logistic Product Types

- Cold Chain Logistics

- Non-Cold Chain Logistics

According to biopharmaceutical logistics industry analysis, the the cold chain logistics subs-segment dominated the industry in 2022. To maintain their safety and efficacy, biopharmaceutical products such as vaccines, biologics, and other temperature-sensitive pharmaceuticals require temperature-controlled transportation and storage throughout the supply chain. As a result, cold chain logistics is critical for biopharmaceutical product transportation and distribution. The growing number of biopharmaceutical goods that need temperature-controlled transportation and storage, as well as the increasing demands for these products in emerging markets, are driving demand for cold chain logistics. Non-cold chain logistics is also important in the biopharmaceutical logistics market, especially for products that can be stored at room temperature. However, demand for non-cold chain logistics is significantly lower than demand for cold chain logistics.

Biopharmaceutical Logistic Service Types

- Transportation

- Air Freight

- Sea Freight

- Overland

- Warehousing & Storage

- Other Services

According to the biopharmaceutical logistics market forecast, warehousing and storage services will dominate the biopharmaceutical logistics market, as many biopharmaceutical products require specialised storage conditions, such as refrigeration or freezing. To ensure the safety and integrity of the products, logistics providers provide specialised warehousing and storage solutions, such as cold storage facilities. Other services, such as packaging, labelling, and regulatory compliance, are essential for the biopharmaceutical logistics market, but they have a smaller share than transportation and warehousing.

Transportation services are also crucial in the biopharmaceutical logistics market. Transporting biopharmaceutical products requires specialised handling and temperature control to ensure their safety and efficacy. To ensure the safe and timely delivery of biopharmaceutical products, logistics providers offer a variety of transportation services, including air freight, sea freight, and road transportation. Furthermore, logistics providers frequently use advanced technologies, such as real-time monitoring and tracking systems, to ensure product visibility and security during transportation.

Biopharmaceutical Logistics Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Biopharmaceutical Logistics Market Regional Analysis

North America is a major market for biopharmaceutical logistics because of the region's large number of biopharmaceutical companies and research institutions. The United States is the largest market in North America, owing to rising demand for biopharmaceutical products and the increasing use of advanced logistics technologies.

The Asia-Pacific region is expected to see significant growth in the biopharmaceutical logistics market because of the region's increasing demand for biopharmaceutical products. The region's large population and growing middle class are driving demand for healthcare services and product types. The Asia-Pacific market is also benefiting from increased investments in healthcare infrastructure and logistics technologies.

Biopharmaceutical Logistics Market Players

Some of the top biopharmaceutical logistics companies offered in the professional report include Agility, AmerisourceBergen Corporation, DB Schenker, DHL International GmbH, Fedex Corporation, Kerry Logistics Network Ltd, Kuehne and Nagel, Panalpina World Transport Ltd., SF Express, and United Parcel Service of America, Inc.

Frequently Asked Questions

What was the market size of the global biopharmaceutical logistics in 2022?

The market size of biopharmaceutical logistics was USD 105.9 billion in 2022.

What is the CAGR of the global biopharmaceutical logistics market from 2023 to 2032?

The CAGR of biopharmaceutical logistics is 7.9% during the analysis period of 2023 to 2032.

Which are the key players in the biopharmaceutical logistics market?

The key players operating in the global market are including Agility, AmerisourceBergen Corporation, DB Schenker, DHL International GmbH, Fedex Corporation, Kerry Logistics Network Ltd, Kuehne and Nagel, Panalpina World Transport Ltd., SF Express, and United Parcel Service of America, Inc.

Which region dominated the global biopharmaceutical logistics market share?

North America held the dominating position in biopharmaceutical logistics industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of Biopharmaceutical Logistics during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global biopharmaceutical logistics industry?

The current trends and dynamics in the biopharmaceutical logistics industry include increasing demand for biopharmaceutical products globally, growing importance of specialized logistics services to ensure product type safety and efficacy, and advancements in technology for temperature-controlled transportation and storage.

Which product type held the maximum share in 2022?

The cold chain logistics product type held the maximum share of the biopharmaceutical logistics industry.