Biomedical Refrigerators and Freezers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2022 - 2030

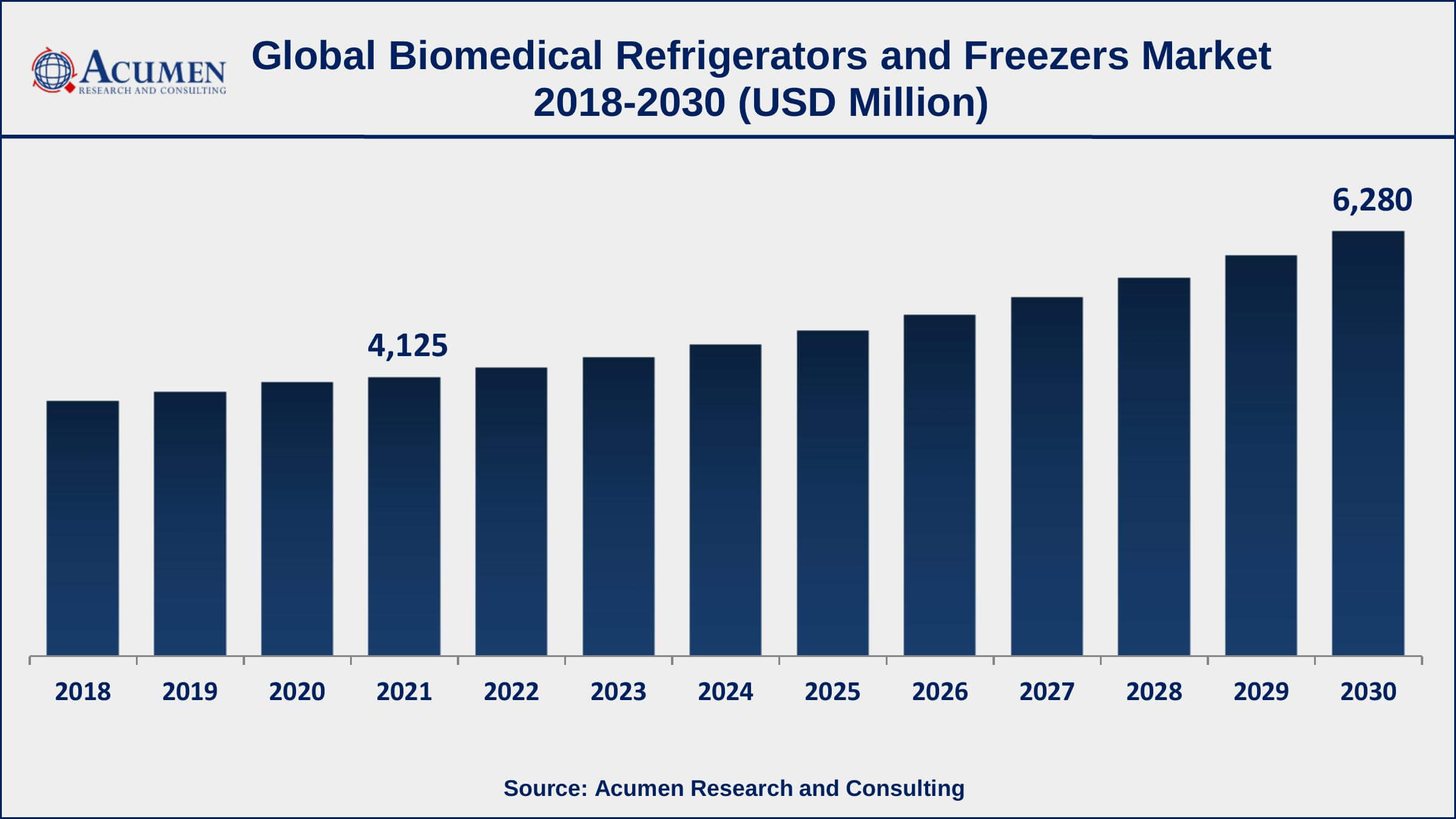

The Global Biomedical Refrigerators and Freezers Market Size accounted for USD 4,125 Million in 2021 and is estimated to achieve a market size of USD 6,280 Million by 2030 growing at a CAGR of 5% from 2022 to 2030. The increased frequency of chronic illnesses, as well as the growing preference for storing blood samples, biological products, blood reagents, DNA samples, vaccines, and other chemicals, are key factors driving the biomedical refrigerators and freezers market growth. Moreover, increasing government support for R&D activities and clinical studies in emerging markets would boost the biomedical refrigerators and freezers market value.

Biomedical Refrigerators and Freezers Market Report Key Highlights

- Global biomedical refrigerators and freezers market revenue is estimated to expand by USD 6,280 million by 2030, with a 5% CAGR from 2022 to 2030.

- North America biomedical refrigerators and freezers market share accounted for over 41.8% of total market in 2021

- Asia-Pacific Biomedical refrigerators and freezers market growth will observe highest CAGR from 2022 to 2030

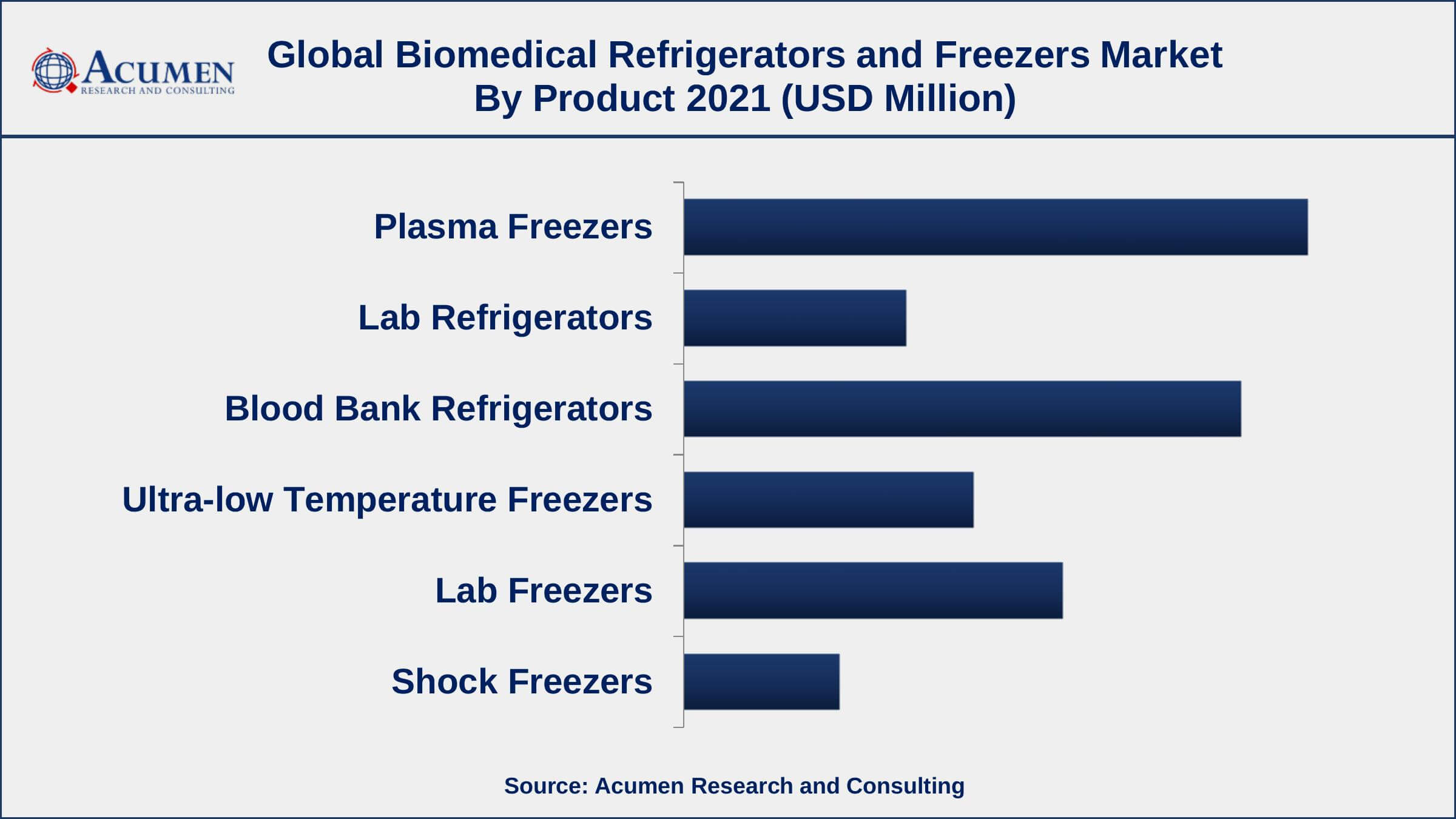

- Based on product, plasma freezers segment accounted for over 28% of the overall market share in 2021

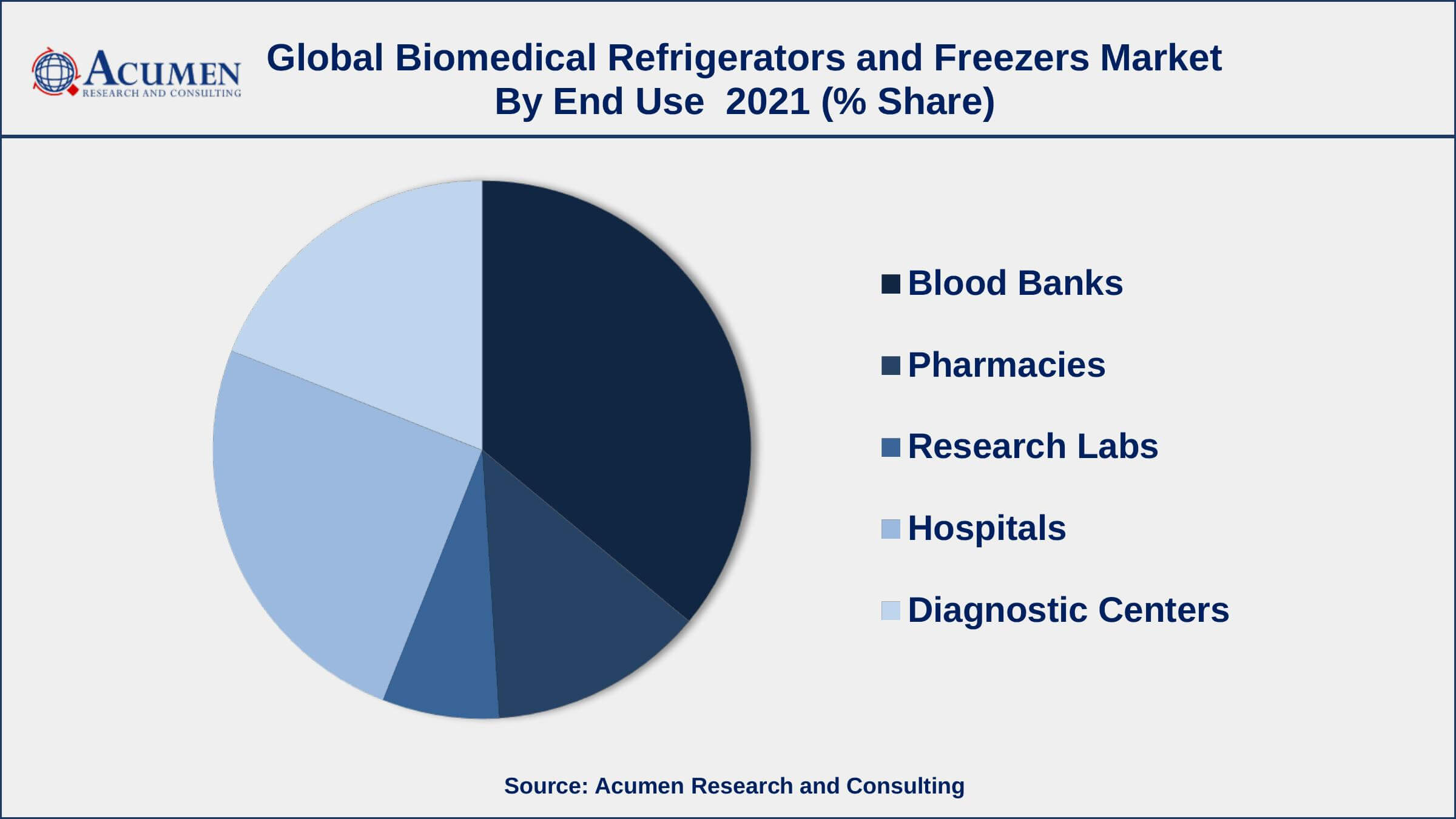

- Among end-use, blood bank segment engaged more than 36% of the total market share

- Rising adoption of biopharma and organ transplantation, drives the biomedical refrigerators and freezers market size

Biomedical freezers and refrigerators are medical devices that are specially used to store various medical samples such as vaccines, blood products, medicines, flammable chemicals, and enzymes. Biomedical freezers and refrigerators are used in research laboratories, hospitals, pharmacies, diagnostic centers, and blood banks. Biomedical freezers and refrigerators offer optimal storage of medical products conditions as compared with domestic biomedical freezers and refrigerators. Biomedical freezers and refrigerators are of different types based on their application in diverse fields. Biomedical refrigerators are widely used in biomedical engineering facilities and research laboratories. Moreover, blood bank refrigerators are medicinal apparatuses principally used in blood banks.

Global Biomedical Refrigerators and Freezers Market Trends

Market Drivers

- Growing rates of chronic diseases

- Increased geriatric population in developed economies

- Rising adoption of biopharma and organ transplantation worldwide

- Increasing government funding for research and clinical trials

Market Restraints

- Technological breakthroughs in biomedical refrigerators and freezers

- Rising demand for biomedical storage

Market Opportunities

- Growth of new applications by key players

- Increased CCSR operations and less reliance on petroleum resources

Biomedical Refrigerators and Freezers Market Report Coverage

| Market | Biomedical Refrigerators and Freezers Market |

| Biomedical Refrigerators and Freezers Market Size 2021 | USD 4,125 Million |

| Biomedical Refrigerators and Freezers Market Forecast 2030 | USD 6,280 Million |

| Biomedical Refrigerators and Freezers Market CAGR During 2022 - 2030 | 5% |

| Biomedical Refrigerators and Freezers Market Analysis Period | 2018 - 2030 |

| Biomedical Refrigerators and Freezers Market Base Year | 2021 |

| Biomedical Refrigerators and Freezers Market Forecast Data | 2022 - 2030 |

| Segments Covered | By Product, By End-Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Migali Scientific, Follett, Aegis Scientific, Azbil Corporation, Panasonic Healthcare Corporation, Binder, Helmer Scientific, Eppendorf, Haier Biomedical, B Medical Systems, Arctiko, Thermo Fisher Scientific, Powers Scientific, and Liebherr-International. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Regulation Analysis |

Escalating demand for biopharmaceuticals and organ transplants, and an increase in demand for organ transplants owing to the rise in the occurrence of organ failure are some of the primary factors that are boosting the biomedical freezers and refrigerators market growth globally. Increasing incidences of chronic diseases such as cancer, cardiac diseases, and infectious diseases are an important factor in boosting the growth of the global biomedical freezers and refrigerators market. Technological advancements in healthcare-grade refrigerators and freezers are also anticipated to drive the growth of the biomedical freezers and refrigerators market during the forecast period. Mounting demand for biomedical refrigerators among pharmaceutical companies and research labs is projected to foster the biomedical freezers and refrigerators market throughout the forecast time frame. Additionally, the growing need for trustworthy blood storage for maintaining donated blood through the transportation of blood samples and donor sessions is boosting the overall market growth. Growing spending on healthcare infrastructure and high-quality standards are some of the key factors driving the growth of the global market. The increasing occurrences of chronic diseases with the growth in the old population are considerably increasing the consumption of various pharmaceutical products and the number of procedures of blood transfusion. This factor is propelling the demand for biomedical refrigerators across all the end-use segments. However, the rising inclination towards refurbished equipment and the high cost of medical-grade freezers and refrigerators are some of the factors that may restrict the growth of the global biomedical freezers and refrigerators market.

Biomedical Refrigerators and Freezers Market Segmentation

The worldwide biomedical refrigerators and freezers market segmentation is based on the product, end-use, and geography.

Biomedical Refrigerators and Freezers Market By Product

- Plasma Freezers

- Lab Refrigerators

- Blood Bank Refrigerators

- Ultra-low Temperature Freezers

- Lab Freezers

- Shock Freezers

According to a biomedical refrigerators and freezers industry analysis, the plasma freezers segment held a significant market share in 2021. This growth is due to an increase in demand for plasma freezers, which are used to safely store platelet concentrates, fresh frozen plasma, as well as red cells. These are compression freezers that use CFC-free refrigerant gas.

Biomedical Refrigerators and Freezers Market By End-use

- Blood Banks

- Pharmacies

- Research Labs

- Hospitals

- Diagnostic Centers

According to the biomedical refrigerators and freezers market forecast, the blood bank segment leads the market, and this growth is projected to continue in the coming years. This is due to the increased demand for a reliable blood cold chain for donated blood, plasma storage, including blood sample transportation.

Biomedical Refrigerators and Freezers Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

North America Holds The Major Share Of The Global Biomedical Refrigerators and Freezers Market

Geographically, North America is leading the market and will continue to dominate the industry in the coming years. Increased R&D expenditure, as well as improvements in the biotechnology and pharmaceutical sectors, are ascribed to the region's rapid growth. Furthermore, the increasing cancer prevalence in the United States, together with the growing usage of biomedical refrigerators and freezers, will fuel market expansion. The United States is the most crucial component, controlling the majority of North America. The rising incidence of numerous chronic diseases in both the pediatric and geriatric populations is one of the factors indicating a rise in the number of individuals admitted, putting further strain on the drug manufacturing system.

Biomedical Refrigerators and Freezers Market Players

Some of the top biomedical refrigerators and freezers market companies offered in the professional report include Migali Scientific, Follett, Aegis Scientific, Azbil Corporation, Panasonic Healthcare Corporation, Binder, Helmer Scientific, Eppendorf, Haier Biomedical, B Medical Systems, Arctiko, Thermo Fisher Scientific, Powers Scientific, and Liebherr-International.

Frequently Asked Questions

What is the size of global biomedical refrigerators and freezers market in 2021?

The estimated value of global biomedical refrigerators and freezers market in 2021 was accounted to be USD 4,125 Million.

What is the CAGR of global biomedical refrigerators and freezers market during forecast period of 2022 to 2030?

The projected CAGR biomedical refrigerators and freezers market during the analysis period of 2022 to 2030 is 5%.

Which are the key players operating in the market?

The prominent players of the global biomedical refrigerators and freezers market are Migali Scientific, Follett, Aegis Scientific, Azbil Corporation, Panasonic Healthcare Corporation, Binder, Helmer Scientific, Eppendorf, Haier Biomedical, B Medical Systems, Arctiko, Thermo Fisher Scientific, Powers Scientific, and Liebherr-International.

Which region held the dominating position in the global biomedical refrigerators and freezers market?

North America held the dominating biomedical refrigerators and freezers during the analysis period of 2022 to 2030.

Which region registered the fastest growing CAGR for the forecast period of 2022 to 2030?

Asia-Pacific region exhibited fastest growing CAGR for biomedical refrigerators and freezers during the analysis period of 2022 to 2030.

What are the current trends and dynamics in the global biomedical refrigerators and freezers market?

Rising adoption of biopharma and organ transplantation worldwide and increasing government funding for research and clinical trials drives the growth of global biomedical refrigerators and freezers market.

By product segment, which sub-segment held the maximum share?

Based on product, plasma freezers segment is expected to hold the maximum share of the biomedical refrigerators and freezers market.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date