Biomarkers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

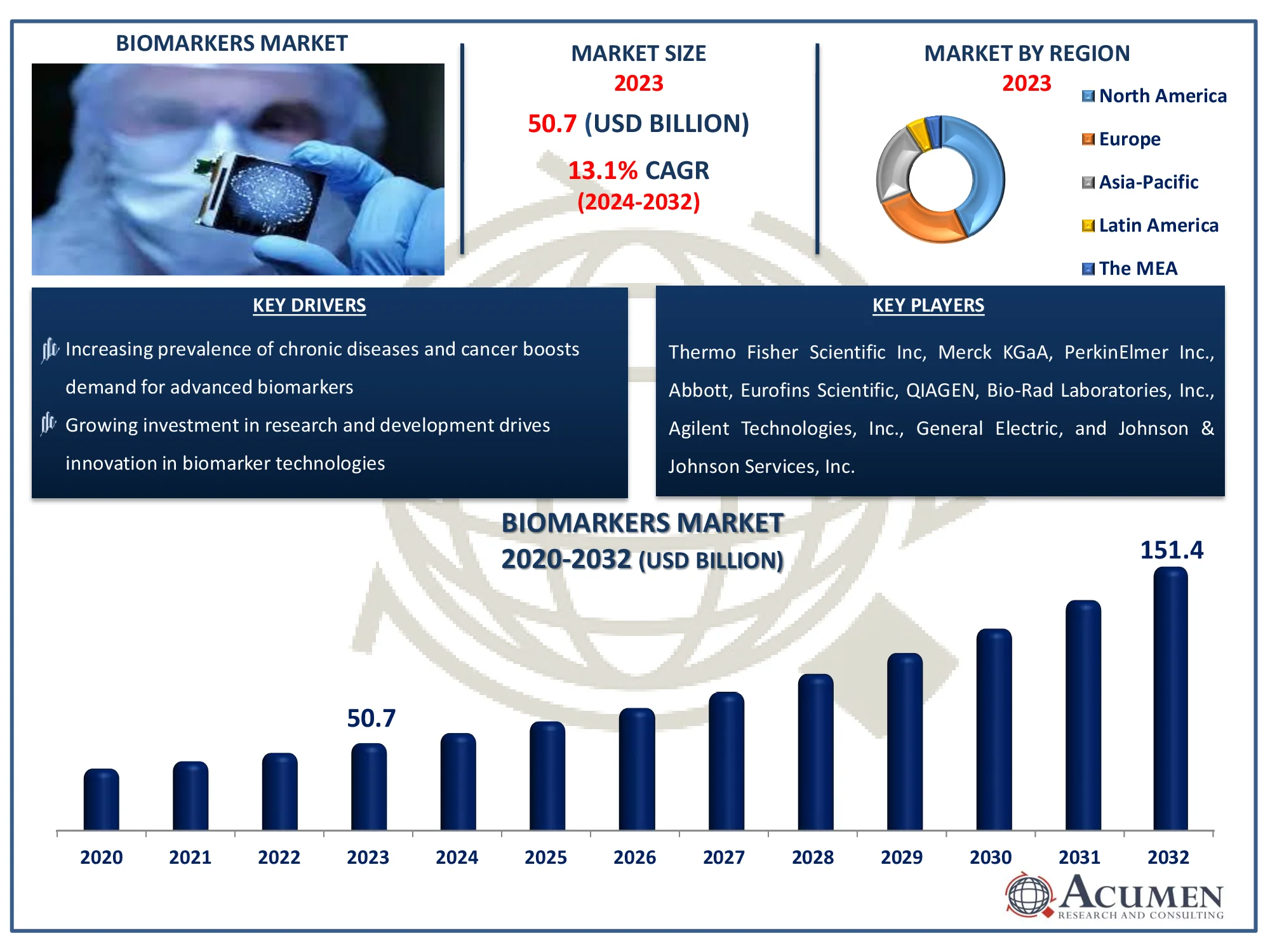

The Global Biomarkers Market Size accounted for USD 50.7 Billion in 2023 and is estimated to achieve a market size of USD 151.4 Billion by 2032 growing at a CAGR of 13.1% from 2024 to 2032.

Biomarkers Market Highlights

- Global biomarkers market revenue is poised to garner USD 151.4 billion by 2032 with a CAGR of 13.1% from 2024 to 2032

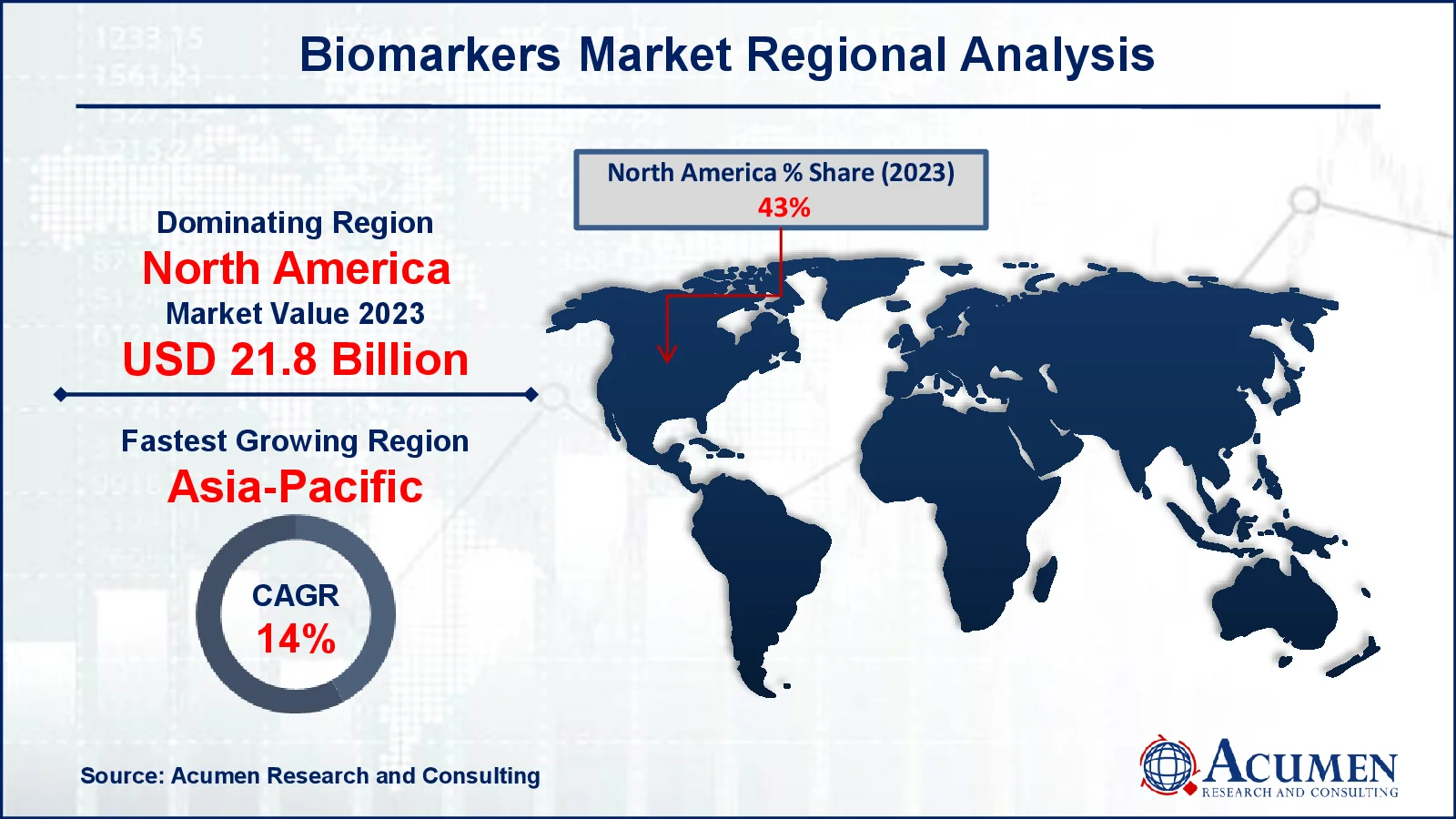

- North America biomarkers market value occupied around USD 21.8 billion in 2023

- Asia-Pacific biomarkers market growth will record a CAGR of more than 14% from 2024 to 2032

- Among type, the safety biomarkers sub-segment generated more than USD 18.8 billion revenue in 2023

- Based on disease, the cancer sub-segment generated around 38% market share in 2023

- Development of non-invasive biomarkers gains traction for early disease detection is a popular biomarkers market trend that fuels the industry demand

Biomarkers are the molecular diagnostic tools that are needed for measurement in biological samples like blood, urine and saliva. It is useful as a tool to measure and assess biological and pathogenic procedures as well as pharmacological responses. Few major biomarkers include prognostic, pharmacodynamics, efficacy and predictive response biomarkers. Multiple biomarkers are available which are associated with biological systems such as cardiovascular system, immune system and metabolic system. Biomarkers help to identify, predict susceptibility of disease and observe disease growth for cancer, infectious diseases, metabolic diseases, autoimmune diseases and central nervous system diseases.

Biomarker technologies are applied in prognostic and diagnosis treatment in order to detect harmful chemicals and formulation and development of drug. Metabolism, absorption and toxicity leads to failure of numerous drugs in clinical trials. Biomarkers are designed as special tools to help in clinical studies in order to assess the results and effects of drug in the initial stages of development. Biomarkers are cost effective diagnostic tools, which aim at development, monitoring and predictability of drugs.

Global Biomarkers Market Dynamics

Market Drivers

- Increasing prevalence of chronic diseases and cancer boosts demand for advanced biomarkers

- Growing investment in research and development drives innovation in biomarker technologies

- Rising adoption of precision medicine enhances the utilization of biomarkers

- Expanding applications of biomarkers in drug discovery and clinical trials accelerate market growth

Market Restraints

- High costs associated with biomarker discovery and validation limit adoption

- Complex regulatory frameworks hinder the rapid commercialization of biomarkers

- Limited availability of skilled professionals poses challenges in biomarker research

Market Opportunities

- Advances in omics technologies create new avenues for biomarker discovery and applications

- Growing focus on companion diagnostics presents lucrative opportunities for biomarker-based tests

- Increasing healthcare infrastructure in emerging economies fosters biomarker market expansion

Biomarkers Market Report Coverage

|

Market |

Biomarkers Market |

|

Biomarkers Market Size 2023 |

USD 50.7 Billion |

|

Biomarkers Market Forecast 2032 |

USD 151.4 Billion |

|

Biomarkers Market CAGR During 2024 - 2032 |

13.1% |

|

Biomarkers Market Analysis Period |

2020 - 2032 |

|

Biomarkers Market Base Year |

2023 |

|

Biomarkers Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Product, By Type, By Disease, By Application, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Thermo Fisher Scientific Inc, Merck KGaA, PerkinElmer Inc., Siemens Healthineers AG, Abbott, Eurofins Scientific, QIAGEN, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., General Electric, and Johnson & Johnson Services, Inc. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Biomarkers Market Insights

Increasing prevalence of target diseases is expected to boost the usage of biomarkers in coming years. FDA support associated with the development of biomarkers and rising demand for personalized medicine are some of the attributes supporting the growth of biomarkers market. Pharmaceutical manufacturers are using biomarkers extensively in order to overcome the failure rates of drugs in clinical trial phases II and III. This is analyzed to bolster the growth of biomarkers market over the forecast period. In addition, increasing drug development cost is also expected to foster the market growth. However, heightened cost of validation and capital investment needed for discovery, application and development of biomarkers contribute towards the obstruction of biomarkers market.

The expansion of healthcare infrastructure in emerging economies is a substantial opportunity for the biomarkers market. These regions are becoming potential markets for biomarker adoption as healthcare facility investments increase, medical technology advances, and diagnostic tools become more accessible. Governments and commercial sectors in India, China, and Brazil are working to improve healthcare services, including the implementation of new diagnostic systems. Furthermore, the rising prevalence of chronic and infectious diseases in these areas necessitates the development of more effective diagnostic and prognostic techniques, such as biomarkers. This innovation enhances research capabilities and clinical trial procedures, promoting biomarker application in drug discovery, disease management, and personalised medicine.

Biomarkers Market Segmentation

Biomarkers Market Segmentation

The worldwide market for biomarkers is split based on product, type, disease, application, and geography.

Biomarker Market By Product

- Services

- Consumable

- Software

According to biomarkers industry analysis, the consumables segment appears as the most important due to its widespread and frequent use in biomarker-related research and clinical applications. Consumables include the reagents, tests, kits, and other lab supplies needed for biomarker detection, quantification, and analysis. These products are essential components of diagnostic procedures, therapeutic monitoring, and drug discovery processes. Consumables have a consistent demand due to their single-use nature, ensuring a consistent cash flow for manufacturers. Furthermore, advancements in biomarker technologies, such as liquid biopsy and high-throughput screening, have raised the need for specialized consumables. The segment's dominance is also attributed to the rising prevalence of chronic diseases and the expanding use of tailored medication, which is driving up global biomarker testing.

Biomarker Market By Type

- Efficacy Biomarkers

- Safety Biomarkers

- Predictive Biomarkers

- Pharmacodynamic Biomarkers

- Surrogate Biomarkers

- Validation Biomarkers

- Prognostics Biomarkers

Safety biomarkers are in high demand in the biomarker market due to their vital function in assessing drug toxicity and patient safety. These indicators are used to track biological responses and detect potential drug side effects during preclinical and clinical trials. Their importance lies in the early detection of drug-induced organ damage, such as liver or kidney toxicity, hence minimizing risks and improving patient outcomes. Safety biomarkers are significant in regulatory decision-making because they provide data that supports the approval process for new medications. The expanding emphasis on pharmaceutical safety, combined with rising expenses for late-stage trial failures, has increased demand for safety biomarkers, proving their commercial value.

Biomarker Market By Disease

- Cancer

- Neurological Diseases

- Cardiovascular Diseases

- Immunological Diseases

- Others

Cancer is the largest section of the biomarker market due to its widespread use in early identification, prognosis, and therapy monitoring. Cancer biomarkers, such as genetic, epigenetic, and proteomic indicators, are critical for early disease detection, which improves survival rates. Their use in guiding targeted medicines and providing personalized treatment procedures has significantly raised demand. The rising global cancer burden has encouraged more investment in advanced diagnostic technology, bolstering this business further. Liquid biopsy, a non-invasive process that uses biomarkers, has emerged as a game changer in cancer treatment. Furthermore, ongoing research and development in oncology biomarkers, together with increased healthcare spending, is propelling this segment's dominance in the overall market.

Biomarker Market By Application

- Drug Discovery & Development

- Diagnostics

- Disease Risk Assessment

- Personalized Medicine

- Others

The drug discovery and development industry dominates the biomarkers market due to its critical role in speeding up pharmaceutical research and lowering medication attrition rates. Biomarkers are essential for identifying biological targets, optimizing medication selection, and monitoring therapeutic responses during clinical trials. They provide critical insights into a drug's mechanism of action and safety profile, enabling better decision-making and cost-effectiveness. Biomarkers have become increasingly important in promoting precision medicine as R&D funding rises and demand for innovative therapies develops. Their uses include anticipating patient reactions, improving trial success rates, and accelerating regulatory clearances. This growing reliance on biomarkers to optimize medication pipelines ensures that the industry retains its market leadership position.

Biomarkers Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Biomarkers Market Regional Analysis

Biomarkers Market Regional Analysis

North America dominates the biomarkers market, earning the most revenue, because to superior healthcare infrastructure, large investment in R&D, and early adoption of novel diagnostic technologies. The region benefits from the presence of major pharmaceutical and biotechnology businesses that are actively involved in biomarker-driven drug research and development. In addition, the increasing prevalence of chronic diseases such as cancer, cardiovascular problems, and neurological conditions necessitates the use of biomarkers in diagnosis and treatment monitoring. North America's market dominance is supported by regulatory frameworks such as FDA biomarker development initiatives and widespread use of customized medicine.

In contrast, the Asia-Pacific region is experiencing the fastest development in the market, driven by increased healthcare investments, expanded research capacity, and a growing emphasis on precision medicine. Countries such as China, India, and Japan are driving this growth because to their enormous patient populations, rising prevalence of chronic diseases, and improved access to healthcare. Furthermore, government actions to improve healthcare infrastructure and support clinical research are accelerating biomarker use in the region. The low cost of biomarker-based tests, combined with increased pharmaceutical outsourcing to Asia-Pacific, boosts its growth potential, positioning it as a key developing market in the worldwide biomarker business.

Biomarkers Market Players

Some of the top biomarkers companies offered in our report include Thermo Fisher Scientific Inc, Merck KGaA, PerkinElmer Inc., Siemens Healthineers AG, Abbott, Eurofins Scientific, QIAGEN, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., General Electric, and Johnson & Johnson Services, Inc.

Frequently Asked Questions

How big is the biomarkers market?

The biomarkers market size was valued at USD 50.7 billion in 2023.

What is the CAGR of the global biomarkers market from 2024 to 2032?

The CAGR of biomarkers is 13.1% during the analysis period of 2024 to 2032.

Which are the key players in the biomarkers market?

The key players operating in the global market are including Thermo Fisher Scientific Inc, Merck KGaA, PerkinElmer Inc., Siemens Healthineers AG, Abbott, Eurofins Scientific, QIAGEN, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., General Electric, and Johnson & Johnson Services, Inc.

Which region dominated the global biomarkers market share?

North America held the dominating position in biomarkers industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of biomarkers during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global biomarkers industry?

The current trends and dynamics in the biomarkers industry include rising adoption of precision medicine enhance the utilization of biomarker, and expanding applications of biomarkers in drug discovery and clinical trials accelerate market growth.

Which product held the maximum share in 2023?

The consumable product held the maximum share of the biomarkers industry.