Biomarker Technologies Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Biomarker Technologies Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Biomarker Technologies Market Size accounted for USD 38.4 Billion in 2022 and is estimated to achieve a market size of USD 150.9 Billion by 2032 growing at a CAGR of 14.9% from 2023 to 2032.

Biomarker Technologies Market Highlights

- Global biomarker technologies market revenue is poised to garner USD 150.9 billion by 2032 with a CAGR of 14.9% from 2023 to 2032

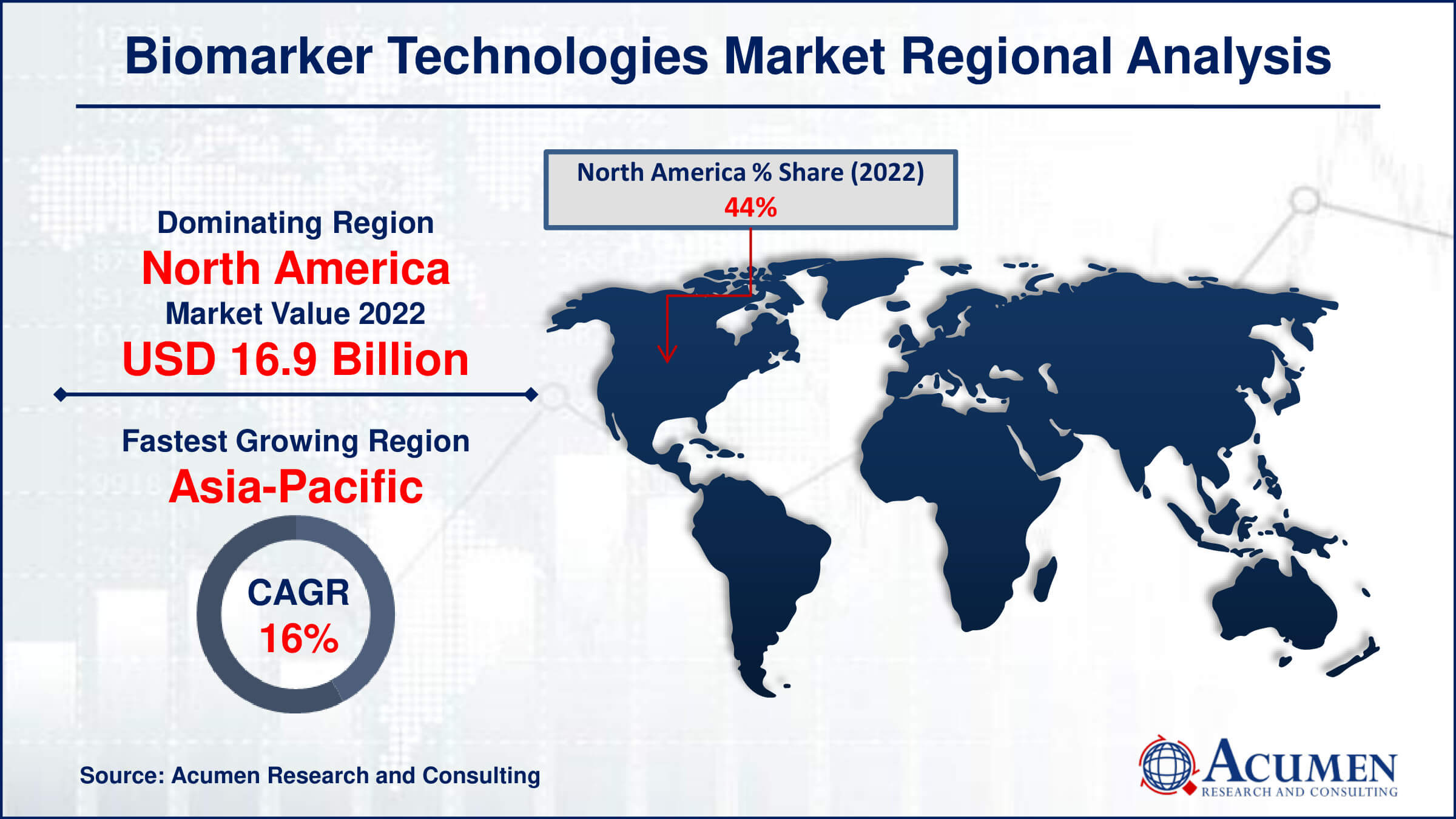

- North America biomarker technologies market value occupied around USD 16.9 billion in 2022

- Asia-Pacific biomarker technologies market growth will record a CAGR of more than 16% from 2023 to 2032

- Among product, the consumables sub-segment generated USD 15.4 billion revenue in 2022

- Based on indication, the cancer sub-segment generated around 32% market share in 2022

- Collaboration between pharmaceutical companies and diagnostic firms to develop companion diagnostics is a popular biomarker technologies market trend that fuels the industry demand

The biomarker is a measurable indicator that is used to indicate exposure, effect, susceptibility, or clinical disease in a biological system. This technology provides a dynamic and powerful approach to understanding neurological disease, along with the applications in observational and analytic epidemiology, screening and diagnosis, randomized clinical trials, and prognosis. Moreover, it defines and measures the alterations in the constituents of tissues or body fluids, as well as helps in exploring information about the underlying pathogenesis of the disease.

Global Biomarker Technologies Market Dynamics

Market Drivers

- Advancements in precision medicine and personalized healthcare

- Increasing prevalence of chronic diseases necessitating early detection

- Rising investments in biomarker research and development

- Growing demand for non-invasive diagnostic techniques

Market Restraints

- Regulatory hurdles and approval processes for biomarker-based diagnostics

- Challenges associated with standardization and validation of biomarker assays

- Limited reimbursement policies for biomarker testing in healthcare systems

Market Opportunities

- Expansion of biomarker applications in oncology, neurology, and infectious diseases

- Integration of artificial intelligence and machine learning for biomarker discovery

- Emergence of point-of-care biomarker testing platforms

Biomarker Technologies Market Report Coverage

| Market | Biomarker Technologies Market |

| Biomarker Technologies Market Size 2022 | USD 38.4 Billion |

| Biomarker Technologies Market Forecast 2032 | USD 150.9 Billion |

| Biomarker Technologies Market CAGR During 2023 - 2032 | 14.9% |

| Biomarker Technologies Market Analysis Period | 2020 - 2032 |

| Biomarker Technologies Market Base Year |

2022 |

| Biomarker Technologies Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Test Type, By Product, By Technology, By Application, By Indication, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Agilent Technologies, Bio-Rad Laboratories, Danaher Corporation, F. Hoffmann-La Roche AG, Illumina, Inc., LI-COR, Inc., Merck KGAA, PerkinElmer Inc., QIAGEN, Roche, Shimadzu Corporation, Thermo Fisher Scientific, and Waters Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Biomarker Technologies Market Insights

The increasing healthcare expenditure and R&D funding in pharma and biotech companies are primarily driving the biomarker market value. The rising number of Clinical Research Organizations (CROs) and the low cost of clinical trials in developing economies further support market growth. Additionally, the high prevalence of chronic diseases like cancer, increasing utility of biomarkers in diagnostics, and applications in personalized medicine accelerate market expansion over the biomarker technologies market forecast period. Furthermore, the potential opportunities in emerging economies are projected to drive biomarket market growth.

On the other hand, factors such as high capital investments, unfavorable reimbursement policies, and technical issues related to sample collection and storage are expected to hamper market growth. The challenges in standardizing and validating biomarker tests hinder market progress. It is essential for biomarker assessments to be accurate, dependable, and repeatable across platforms and labs. However, differences in sample collection, processing methods, and data interpretation can make achieving consistent results difficult. Additionally, the absence of regulatory frameworks and standardized protocols for biomarker validation further complicates the creation of reliable assays and may hinder biomarket market expansion.

The integration of machine learning (ML) and artificial intelligence (AI) methods for biomarker discovery presents one solution. These technologies can rapidly process large amounts of multi-omic data to find new biomarkers, forecast illness outcomes, and improve treatment plans. Moreover, advancements in proteomics, genome sequencing, and other omics technologies enable personalized treatment plans based on unique biomarker signatures, improving patient outcomes and healthcare efficiency. Anticipated growth in biomarker-driven precision medicine techniques is expected to drive demand for advanced biomarker technologies and further market expansion.

Biomarker Technologies Market Segmentation

The worldwide market for biomarker technologies is split based on test type, product, technology, application, indications, and geography.

Biomarker Technologies Market by Test Types

- Solid Biopsy

- Liquid Biopsy

According to biomarker technologies industry analysis, solid biopsy is the largest section in the test type category of the market. Solid biopsies entail the removal and examination of tissue samples from tumors or organs in order to provide comprehensive data regarding biomarkers such as protein expression and genetic abnormalities. The diagnosis, prognosis, and choice of treatment for a number of malignancies and other disorders are greatly aided by these biopsies. Solid biopsies are the method of choice for pathologists and oncologists due to their excellent specificity and accuracy. Solid biopsies continue to be in high demand in the biomarker technologies market due in part to developments in minimally invasive biopsy techniques and imaging technologies.

Biomarker Technologies Market by Products

- Consumables

- Instruments

- Services

- Software/Informatics

Consumables are the largest section in the product category of the biomarker technologies market. Products that are necessary for biomarker analysis fall under the broad category of consumables and include chemicals, assay kits, antibodies, and sample collection equipment. These consumables are essential parts of many lab processes that include the identification, measurement, and validation of biomarkers. The consumption of these items keeps rising due to the growing need for biomarker research and diagnostic applications in areas including infectious illnesses, cardiovascular diseases, and oncology. Furthermore, the consumables category is the largest of all product categories because to the recurring nature of consumable purchases and the requirement for a steady supply, which contribute to its dominance in the biomarker technologies Market.

Biomarker Technologies Market by Technology

- DdPCR

- NGS

- Immunoassay

- Mass Spectrometry

- DHPLC

- Other Technologies

Next-Generation Sequencing (NGS) is the leading section in the biomarker technologies market's technology category. By enabling high-throughput sequencing of DNA and RNA and offering thorough insights into genetic variants, gene expression, and biochemical pathways, next-generation sequencing (NGS) transformed biomarker analysis. Its great sensitivity and accuracy in sequencing numerous indicators at once makes it indispensable for a wide range of applications, such as personalised medicine, infectious disease diagnostics, and cancer genomics. Researchers and physicians can discover complicated biomarker signatures and biomarker-driven therapeutics thanks to NGS's unmatched depth and breadth of data. NGS continues to spur innovation and growth in the biomarker market, solidifying its position as the leading technological platform, thanks to continuous improvements in sequencing technologies and declining sequencing prices.

Biomarker Technologies Market by Applications

- Drug Discovery

- Diagnostics

- Personalized Medicine

Diagnostics is the most popular application category in the biomarker technologies market. In order to diagnose illnesses, track their course, and forecast how well a treatment will work, biomarkers are essential. Early disease identification, precise prediction, and well-informed treatment choices are made possible by diagnostic biomarkers, which enhance patient outcomes and streamline healthcare. The use of biomarkers in diagnostics is quickly spreading across a variety of medical specialties, including neurology, cardiology, and oncology, thanks to developments in biomarker discovery techniques and an increasing understanding of disease causes. The adoption of biomarker-based diagnostics is further fueled by the growing need for non-invasive diagnostic tools and the focus on precision medicine, which further solidifies its dominance in the biomarker technologies market.

Biomarker Technologies Market by Indications

- Cancer

- Infectious Diseases

- Autoimmune Disorders

- Cardiovascular Disorders

- Others

In the biomarker market's indication category, Cancer is the most dominant segment. Because they offer information on tumour biology, therapeutic response, and patient outcomes, biomarkers are essential for cancer diagnosis, prognosis, and therapy decision-making. The need for biomarker-based cancer diagnostics and treatments is only going to increase due to the increased global prevalence of cancer and the growing emphasis on individualized oncology care. The use of biomarkers in cancer treatment has been shown to increase patient survival and quality of life by facilitating early cancer detection, precise staging, and focused therapy. The dominance of the Cancer segment in the Biomarker methods Market is further supported by continuous improvements in biomarker discovery methods and the creation of new cancer biomarkers.

Biomarker Technologies Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Biomarker Technologies Market Regional Analysis

In 2022, North America dominated the global market with a significant share, and it is projected to maintain this dominance through the estimated period from 2023 to 2032. The well-established healthcare infrastructure and easy accessibility of advanced technologies to consumers further support the market value in the region. Additionally, the rising prevalence of chronic diseases, coupled with the increasing geriatric population, accelerates the regional market value. The presence of a large number of major players in the US region further accelerates market growth. Furthermore, the Asia Pacific region is projected to exhibit the fastest growth over the biomarker technologies industry forecast timeframe from 2023 to 2032. The emerging economies of the region, including China and India, primarily support this growth over the estimated period.

Biomarker Technologies Market Players

Some of the top biomarker technologies companies offered in our report includes Agilent Technologies, Bio-Rad Laboratories, Danaher Corporation, F. Hoffmann-La Roche AG, Illumina, Inc., LI-COR, Inc., Merck KGAA, PerkinElmer Inc., QIAGEN, Roche, Shimadzu Corporation, Thermo Fisher Scientific, and Waters Corporation.

Frequently Asked Questions

How big is the biomarker technologies market?

The biomarker technologies market size was valued at USD 38.4 billion in 2022.

What is the CAGR of the global biomarker technologies market from 2023 to 2032?

The CAGR of biomarker technologies is 14.9% during the analysis period of 2023 to 2032.

Which are the key players in the biomarker technologies market?

The key players operating in the global market are including Agilent Technologies, Bio-Rad Laboratories, Danaher Corporation, F. Hoffmann-La Roche AG, Illumina, Inc., LI-COR, Inc., Merck KGAA, PerkinElmer Inc., QIAGEN, Roche, Shimadzu Corporation, Thermo Fisher Scientific, and Waters Corporation.

Which region dominated the global biomarker technologies market share?

North America held the dominating position in biomarker technologies industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of biomarker technologies during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global biomarker technologies industry?

The current trends and dynamics in the biomarker technologies industry include advancements in precision medicine and personalized healthcare, increasing prevalence of chronic diseases necessitating early detection, rising investments in biomarker research and development, and growing demand for non-invasive diagnostic techniques.

Which indication held the maximum share in 2022?

The cancer indication held the maximum share of the biomarker technologies industry.