Biolubricants Market | Acumen Research and Consulting

Biolubricants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

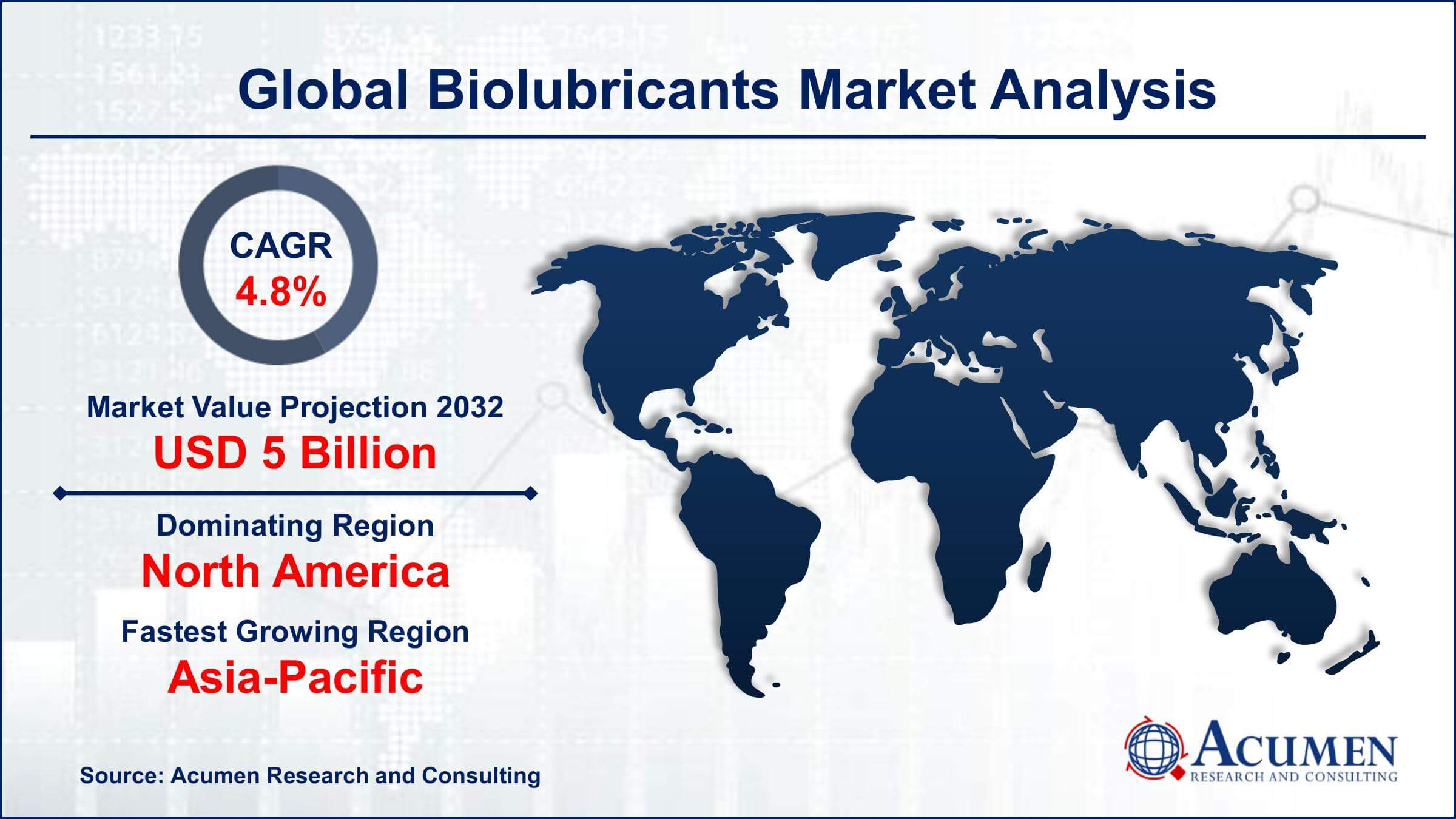

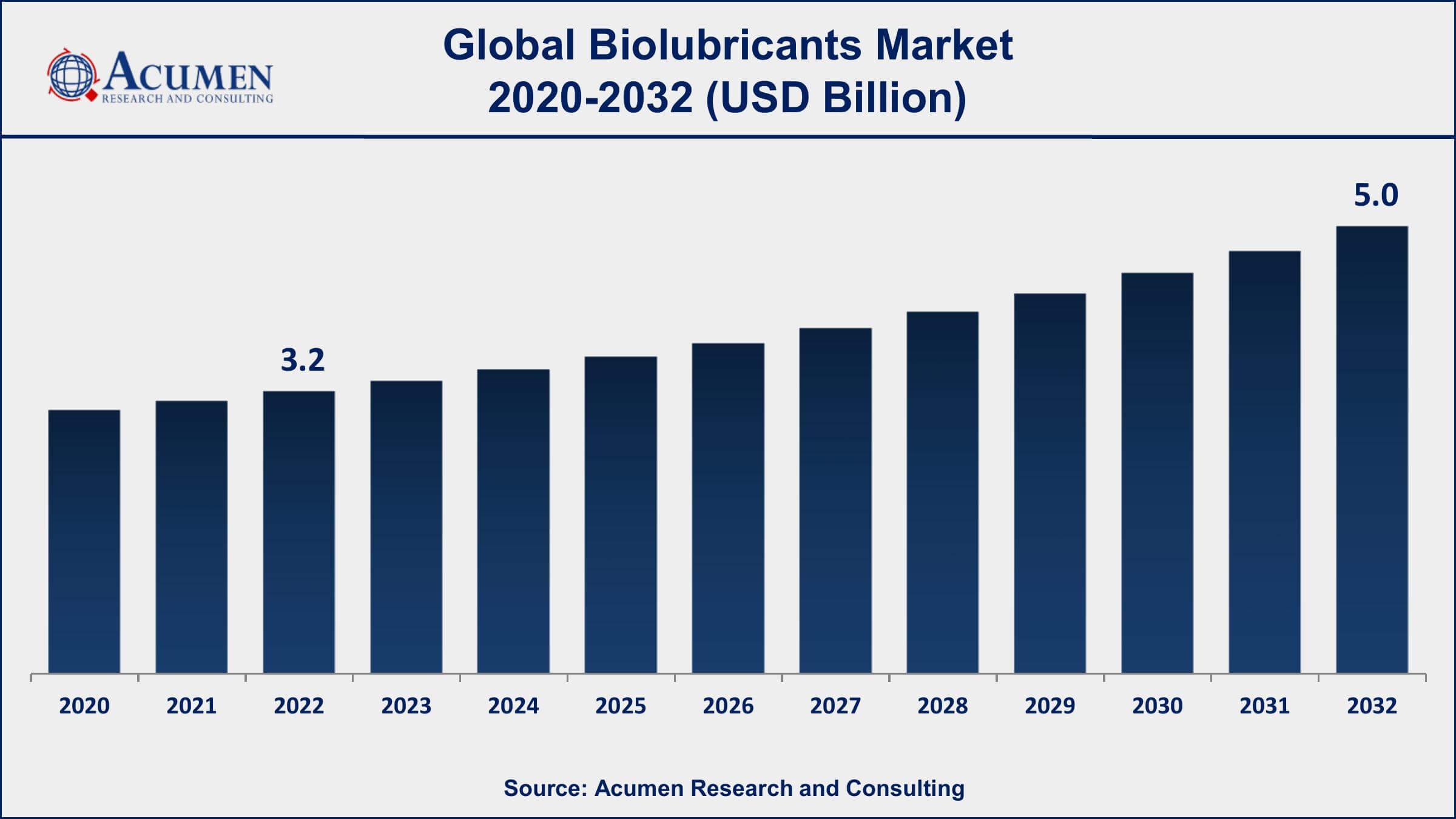

The Global Biolubricants Market Size accounted for USD 3.2 Billion in 2022 and is projected to achieve a market size of USD 5.0 Billion by 2032 growing at a CAGR of 4.8% from 2023 to 2032.

Biolubricants Market Highlights

- Global biolubricants market revenue is expected to increase by USD 5.0 Billion by 2032, with a 4.8% CAGR from 2023 to 2032

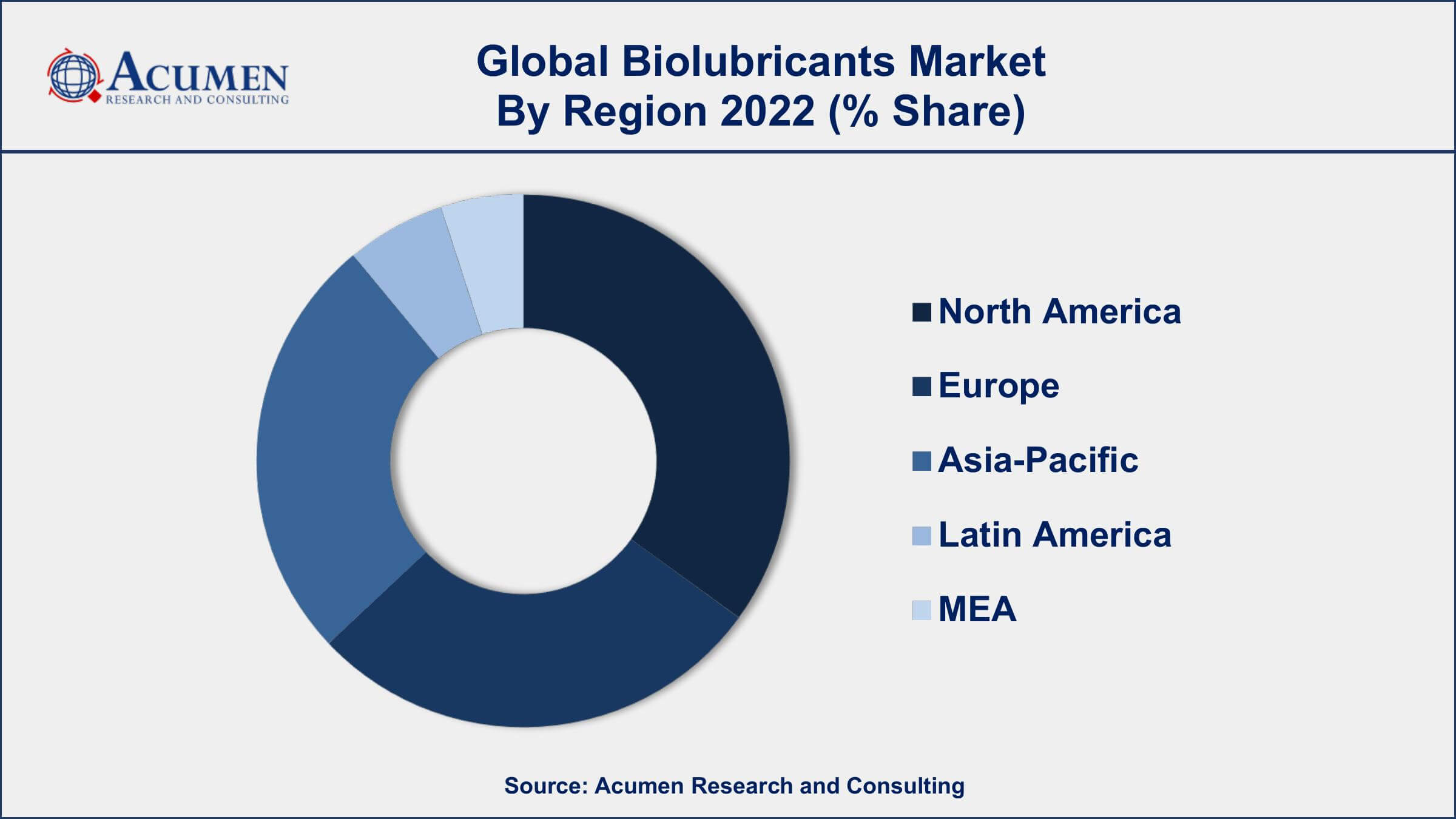

- North America region led with more than 35% of biolubricants market share in 2022

- Asia-Pacific biolubricants market growth will record a CAGR of around 5.7% from 2023 to 2032

- By type, the vegetable oil segment is the largest segment of the market, accounting for more than 60% of the total market share in 2022

- By applications, the engine oil segment is the fastest-growing segment of the market, with a CAGR of 5.3% from 2023 to 2032

- Growing demand for sustainable and biodegradable lubricants, drives the biolubricants market value

Biolubricants are lubricants made from renewable resources such as vegetable oils, animal fats, and synthetic esters. They are biodegradable, non-toxic, and have a lower environmental impact compared to traditional petroleum-based lubricants. Biolubricants are widely used in various applications such as automotive, industrial, marine, and aviation industries. They offer superior performance, extended equipment life, reduced maintenance costs, and improved energy efficiency. The use of biolubricants has become increasingly popular due to the growing concerns about environmental sustainability and the need to reduce carbon emissions.

The global biolubricants market has been growing steadily in recent years and is expected to continue its growth trajectory in the coming years. The market growth is driven by the increasing demand for biodegradable and sustainable lubricants, stringent government regulations regarding environmental sustainability, and rising awareness among consumers about the benefits of using biolubricants. The market is also driven by the growing adoption of biolubricants in various industries, including automotive, construction, marine, and aerospace. The Asia-Pacific region is expected to witness the highest growth rate during the forecast period, driven by the increasing industrialization and infrastructure development in emerging economies such as India and China.

Global Biolubricants Market Trends

Market Drivers

- Growing demand for sustainable and biodegradable lubricants

- Stringent government regulations on environmental sustainability

- Increasing awareness among consumers regarding environmental impact

- Improved performance and extended equipment life

Market Restraints

- Higher cost compared to traditional petroleum-based lubricants

- Limited availability and production capacity

Market Opportunities

- Rising demand from emerging economies

- Development of new and innovative biolubricants

Biolubricants Market Report Coverage

| Market | Biolubricants Market |

| Biolubricants Market Size 2022 | USD 3.2 Billion |

| Biolubricants Market Forecast 2032 | USD 5.0 Billion |

| Biolubricants Market CAGR During 2023 - 2032 | 4.8% |

| Biolubricants Market Analysis Period | 2020 - 2032 |

| Biolubricants Market Base Year | 2022 |

| Biolubricants Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, By End-user Industry, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Royal Dutch Shell, Total S.A., ExxonMobil Corporation, Chevron Corporation, BP p.l.c., Fuchs Petrolub SE, Klüber Lubrication, Emery Oleochemicals, Cargill, Incorporated, Renewable Lubricants Inc., Panolin AG, and Lubrizol Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Bio-lubes also known as biolubricants are biodegradable and nonhazardous lubricants. This is generally produced by using raw materials/feedstock like coconut oil, sunflower oil, rapeseed oil, palm oil, and animal fats. Lubricants are materials used for the lubrication of power-driven components. Traditional lubricants are usually produced using petroleum-based feedstock. R Demand and significance of biolubricant are increasing due to rising concern for the use of petroleum-based lubricants having a hazardous impact on the environment and to moderate reliance on petroleum feedstock.

Increasing passenger car sales in developing economies is driving the growth of this market. Complex processing technologies and the upsurge in the initial cost of production are majorly hampering the growth of this market. Increasing environmental regulations such as eco-labels and vessel general permits (VGP) in the developed regions, new and upcoming organizations involved in research and developments (R&D) are projected to drive the biolubricants market in the next years.

Biolubricants Market Segmentation

The global biolubricants market segmentation is based on type, application, end-user industry, and geography.

Biolubricants Market By Type

- Vegetable Oils

- Animal Fats

- Others

According to the biolubricants industry analysis, the vegetable oils segment accounted for the largest market share in 2022. Vegetable oils such as canola, soybean, palm, and sunflower oil are used as base oil in the production of biolubricants. Vegetable oils are renewable resources and offer several benefits over traditional petroleum-based lubricants. They are biodegradable, non-toxic, and have a lower environmental impact. The use of vegetable oils in biolubricants helps to reduce carbon emissions and improve the overall sustainability of lubricants. The vegetable oils segment is expected to witness significant growth in the coming years. The increasing demand for sustainable and biodegradable lubricants, stringent government regulations on environmental sustainability, and rising awareness among consumers about the benefits of biolubricants are some of the major factors driving the growth of the vegetable oils segment.

Biolubricants Market By Application

- Engine Oil

- Transmission and Hydraulic Fluid

- Gear Oil

- General Industrial Oil

- Process Oil

- Grease

- Metalworking Fluid

- Other

In terms of applications, the engine oil segment is expected to witness significant growth in the coming years. Engine oils are used to reduce friction and wear between moving parts in internal combustion engines. They are widely used in various applications such as automotive, marine, and aviation industries. The engine oil segment is expected to witness significant growth in the coming years. The growing demand for sustainable and biodegradable lubricants, stringent government regulations on environmental sustainability, and rising awareness among consumers about the benefits of biolubricants are some of the major factors driving the growth of the engine oil segment. The engine oil segment is also witnessing significant innovation and development. Several key players in the market are investing in research and development to develop new and innovative biolubricants for engine oil applications.

Biolubricants Market By End-user Industry

- Power Generation

- Heavy Equipment

- Automotive and Transportation

- Metallurgy & Metalworking

- Food & Beverage

- Chemical Manufacturing

- Others

According to the biolubricants market forecast, the automotive and transportation segment is expected to witness significant growth in the coming years. The automotive industry is one of the largest consumers of lubricants, and the growing demand for sustainable and biodegradable lubricants is driving the automotive and transportation segment growth. The use of biolubricants in the automotive and transportation sector helps to reduce carbon emissions and improve the overall sustainability of the industry. The segment includes applications such as engine oils, transmission fluids, and greases, which are widely used in various automotive and transportation applications. The automotive and transportation segment is expected to witness significant growth in the coming years. The growing adoption of electric vehicles, increasing awareness among consumers about the benefits of biolubricants, and stringent government regulations on environmental sustainability are some of the major factors driving the growth of the automotive and transportation segment.

Biolubricants Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Biolubricants Market Regional Analysis

North America is one of the largest and most significant regions in the biolubricants market. The region is dominated by the United States, which is one of the largest consumers and producers of biolubricants globally. The dominance of North America can be attributed to several factors such as stringent government regulations on environmental sustainability, increasing demand for sustainable and biodegradable lubricants, and the presence of a well-established manufacturing industry. The United States is home to several key players in the biolubricants industry, which have a significant presence and strong distribution networks in the region. The presence of key players such as Chevron, ExxonMobil, and Royal Dutch Shell has further strengthened the position of North America in the biolubricant market. The growing adoption of biolubricants in various applications such as automotive, marine, and aviation industries, and the increasing awareness among consumers about the benefits of biolubricants are also driving the regional market growth.

Biolubricants Market Player

Some of the top biolubricant market companies offered in the professional report include Royal Dutch Shell, Total S.A., ExxonMobil Corporation, Chevron Corporation, BP p.l.c., Fuchs Petrolub SE, Klüber Lubrication, Emery Oleochemicals, Cargill, Incorporated, Renewable Lubricants Inc., Panolin AG, and Lubrizol Corporation.

Frequently Asked Questions

What was the market size of the global biolubricants in 2022?

The market size of biolubricants was USD 3.2 Billion in 2022.

What is the CAGR of the global biolubricants market from 2023 to 2032?

The CAGR of biolubricants is 4.8% during the analysis period of 2023 to 2032.

Which are the key players in the biolubricants market?

The key players operating in the global market are including Royal Dutch Shell, Total S.A., ExxonMobil Corporation, Chevron Corporation, BP p.l.c., Fuchs Petrolub SE, Klüber Lubrication, Emery Oleochemicals, Cargill, Incorporated, Renewable Lubricants Inc., Panolin AG, and Lubrizol Corporation.

Which region dominated the global biolubricants market share?

North America held the dominating position in biolubricants industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of biolubricants during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global biolubricants industry?

The current trends and dynamics in the biolubricants industry include growing demand for sustainable and biodegradable lubricants, stringent government regulations on environmental sustainability, and increasing awareness among consumers regarding environmental impact.

Which type held the maximum share in 2022?

The vegetable oils type held the maximum share of the biolubricants industry.