Biological Seed Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Biological Seed Treatment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

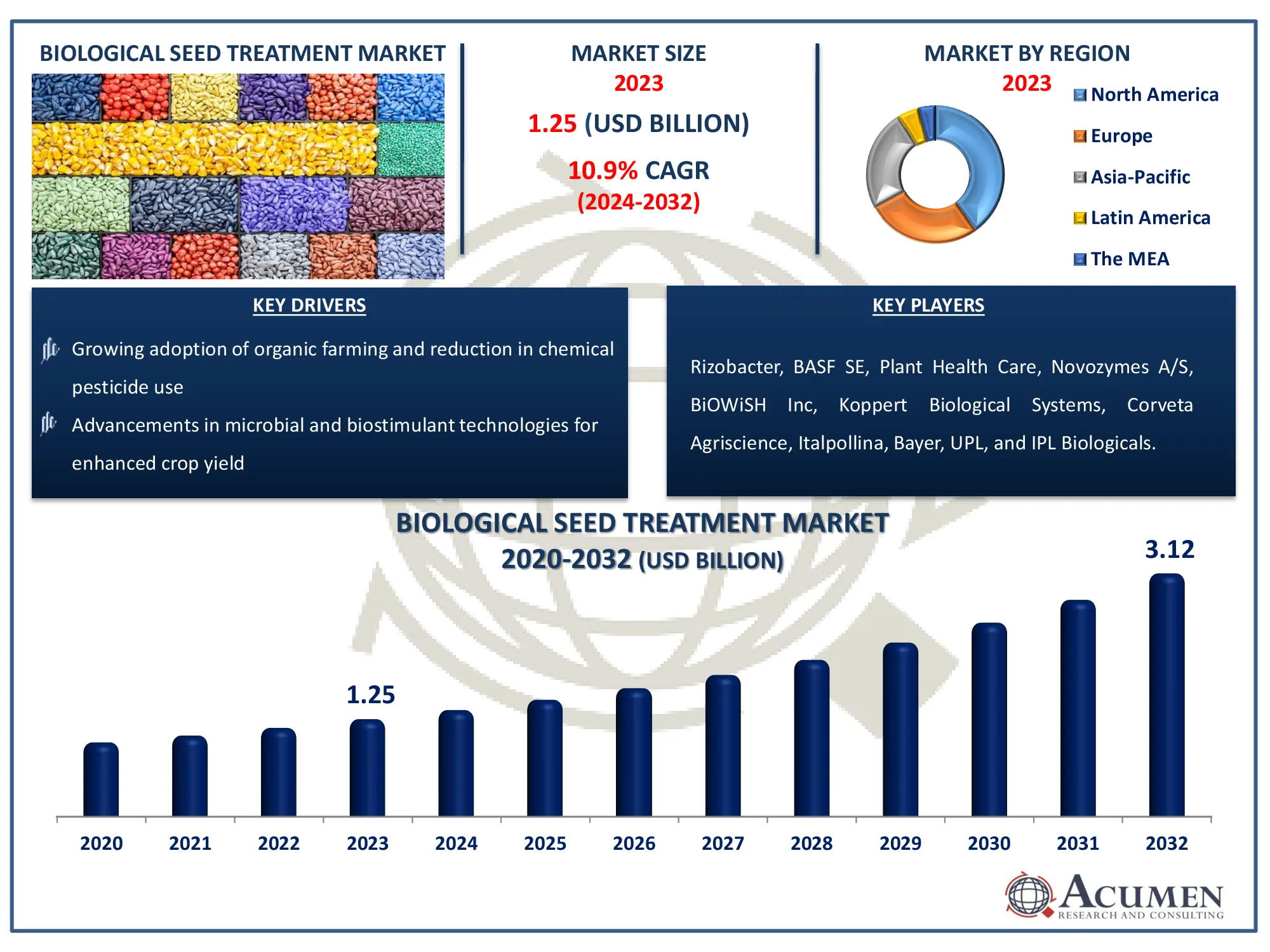

The Global Biological Seed Treatment Market Size accounted for USD 1.25 Billion in 2023 and is estimated to achieve a market size of USD 3.12 Billion by 2032 growing at a CAGR of 10.9% from 2024 to 2032.

Biological Seed Treatment Market Highlights

- Global biological seed treatment market revenue is poised to garner USD 3.12 billion by 2032 with a CAGR of 10.9% from 2024 to 2032

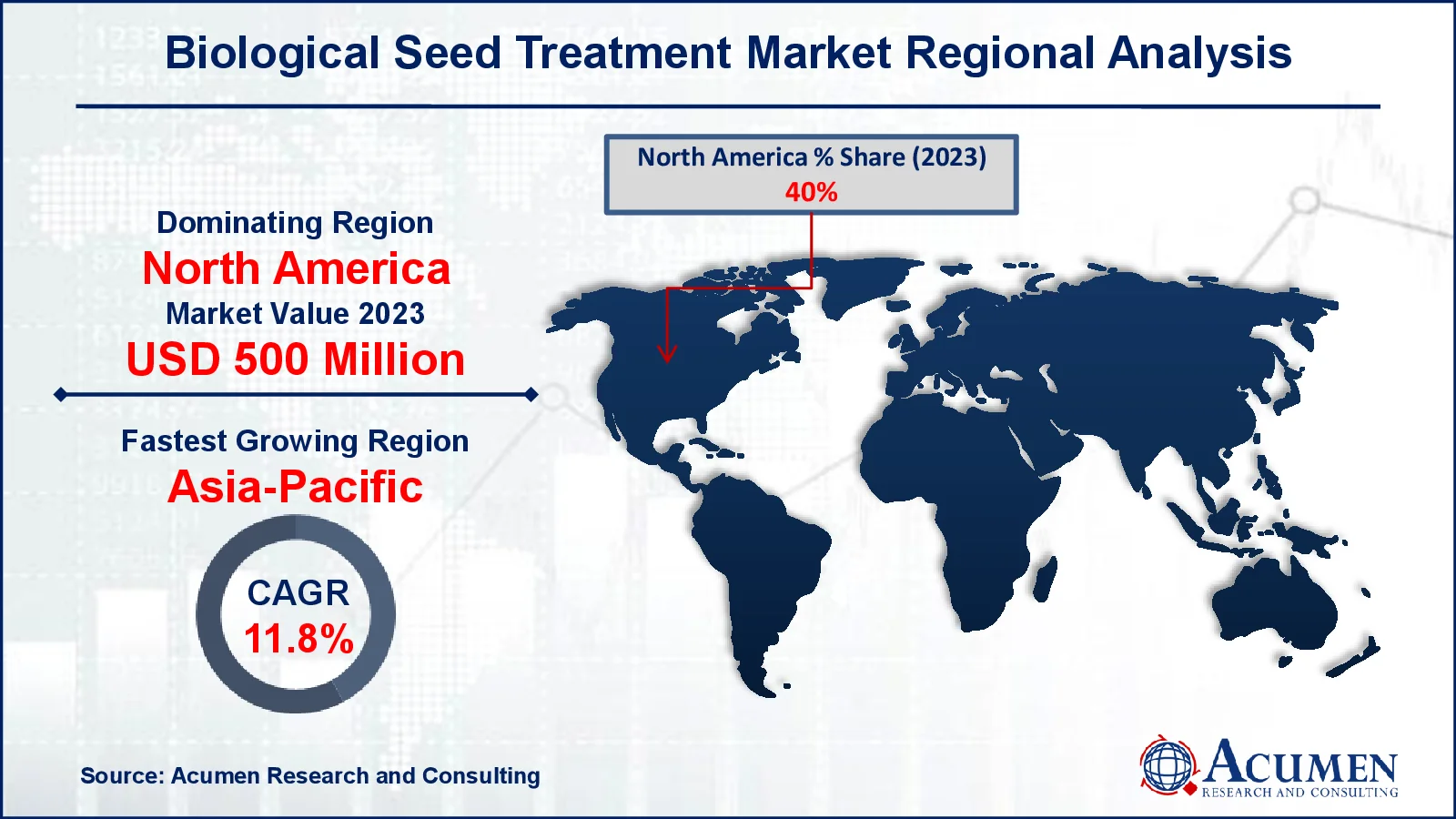

- North America biological seed treatment market value occupied around USD 500 million in 2023

- Asia-Pacific biological seed treatment market growth will record a CAGR of more than 11.8% from 2024 to 2032

- Among function, the seed protection sub-segment generated more than USD 837.5 billion revenue in 2023

- Based on crop type, the vegetable crops sub-segment generated around 25% biological seed treatment market share in 2023

- Potential to tap into the rising interest in regenerative and climate-smart agriculture is a popular biological seed treatment market trend that fuels the industry demand

Before planting, biological seeds are treated with natural substances or living creatures like beneficial bacteria. This treatment promotes plant health by stimulating growth, enhancing nutrient uptake, and protecting against soil-borne diseases and pests. Biological treatments, as opposed to chemical treatments, use bacteria, fungi, and other natural elements to improve root health and plant resistance.

These treatments can provide long-term environmental benefits by reducing the need for chemical pesticides and fertilizers. Trichoderma, Rhizobium, and mycorrhizal fungi are common microorganisms employed to promote favorable plant-soil interactions. Biological seed treatment also helps plants tolerate environmental stressors such as drought and poor soil conditions, resulting in higher yields. This technique is consistent with current agricultural tendencies towards environmentally friendly and sustainable farming practices.

Global Biological Seed Treatment Market Dynamics

Market Drivers

- Increasing demand for eco-friendly and sustainable agricultural practices

- Rising awareness of soil health and biodiversity preservation

- Growing adoption of organic farming and reduction in chemical pesticide use

- Advancements in microbial and biostimulant technologies for enhanced crop yield

Market Restraints

- Limited effectiveness in certain climates and against specific pathogens

- High initial costs for research, development, and application

- Lack of awareness and technical knowledge among farmers in emerging regions

Market Opportunities

- Expanding demand for organic produce globally

- Government initiatives and subsidies promoting biological seed treatments

- Development of advanced microbial strains for diverse crop applications

Biological Seed Treatment Market Report Coverage

| Market | Biological Seed Treatment Market |

| Biological Seed Treatment Market Size 2022 |

USD 1.25 Billion |

| Biological Seed Treatment Market Forecast 2032 | USD 3.12 Billion |

| Biological Seed Treatment Market CAGR During 2023 - 2032 | 10.9% |

| Biological Seed Treatment Market Analysis Period | 2020 - 2032 |

| Biological Seed Treatment Market Base Year |

2022 |

| Biological Seed Treatment Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Product, By Function, By Crop Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Rizobacter, BASF SE, Plant Health Care, Novozymes A/S, BiOWiSH Inc, Koppert Biological Systems, Corveta Agriscience, Italpollina, Bayer, UPL, and IPL Biologicals. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Biological Seed Treatment Market Insights

The increased demand for non-chemical plants is anticipated to fuel sector development over the forecast period. A change in customer attitudes towards private hygiene and good food consumption is probable to boost product supply. product demand. Moreover, the growing population of older people is expected to further boost demand.

The use of the item in agricultural practices has increased significantly as it helps to avoid seed-borne and soil-borne infections and illnesses. Due to a reduced danger of surpassing residue boundaries and growing demand for sustainable agriculture, the item began gaining significance with respect to chemical therapy. In addition, a increasing organic farming trend is anticipated to have a direct effect on the product's market penetration.

According to the National Statistics Office, UK, the U.K. agriculture sector, It accounts for approximately 0.7% of the complete GDP. The item consists of naturally occurring active components, which protect against abiotic stress and soil-borne pathogens, and thus increase plant growth. Sustainable farming methods in emerging countries are probable to be an important constraint to business development. Limited shelf-life, particularly for seeds such as soybeans, is expected to have negative effects on product demand over the forecast period compared to other treated crop seeds.

Biotherapy is essential to viable farming, because it decreases fertilizer needs, improves immunity, and enhances the ability to absorb nutrients and to resist illnesses and pesticides. Reduced use of chemical fertilizers improves crop health and allow them to recover rapidly from abiotic stress like drought and salinity.

In order to improve business availability, industrial competitors have incorporated their manufacturing and distribution channels. Key market players operate through their manufacturing plants near raw material sources, which ultimately leads to low procurement costs for raw materials. In addition, businesses involved in the manufacturing and delivery of biologic seeds through a wide network of retailers distributed across main consumer areas in North Americas, Asia-Pacific and Europe are engaged in the sale and delivery of the item.

Biological Seed Treatment Market Segmentation

The worldwide market for biological seed treatment is split based on product, function, crop type, and geography.

Biological Seed Treatment Market By Product

- Microbials

- Fungi

- Bacteria

- Botanicals & Others

According to biological seed treatment industry analysis, the section of microbials is anticipated to expand over market forecast period. In microbial therapy, the eradications and improvement in seeds are effected by bacteria such as Rhizobia, Bacillus, Pseudomonas and Streptomyces, and by fungi, like mycorrhizae, Penicillium bilaii, and Trichoderma harzianum. These products protect plants against drought, insects, pests and plant diseases extremely effectively.

Plants benefit from the bacteria discovered in the soil and many of them are biocontrol species damaging to pathogens. The pathogens are eradicated and many useful tasks are performed by bacteria to improve the physiological efficiency of the plant.

Some organisms such as rhizobacteria fix nitrogen, take antibiotics to destroy pathogenic substances, improve phosphorous accessibility, cause systemic opposition to plant pathogenic substances and are vital to the well being of a crop. Bacteria like Streptomyces Bacillus and Pseudomonas produce soluble phosphorus and reduce plant dependence on phosphate fertilizers.

Seeds are handled with crop extracts in botanical therapy to remove pathogen, decrease disease and boost germination speed. The technique is generally chosen because plant extracts are low price and easily available.

Biological Seed Treatment Market By Function

- Seed Enhancement

- Biostimulants

- Biofertilizers

- Seed Protection

- Biofungicides

- Bioinsecticides

- Others

The seed protection section retained the biggest share of the biological seed treatment market with about 67% of its income. Increased plant damage is projected to boost sector development in the coming years because of variables such as infected plants and biotic and abiotic stress. In addition, the increasing consumer inclination towards organic food is expected to increase the popularity of biological proteins.

The seed enhancement sector is expected to see significant development in the biological seed treatment market. The growing use of biotreatment, which increases the development of seedling and germination, is stimulating development. It includes the use of multiple methods to enhance seed efficiency by enhancing its capacity to withstand illnesses and improving seed vigor, which in turn improves both harvest outcomes and crop quality.

For seed covering, biofungicides are crucial, as most pathogens are fungi. Various fungi trigger red seedling and black rot, reducing the germination rate, and affecting the strength of the seedling. The most prevalent fungal pathogens are Fusarium, Pythium, Phytophthora and Rhizoctonia. Biofungicides are used for coating to defeat these fungal pathogens and guarantee plant vitality.

Biological Seed Treatment Market By Crop Type

- Vegetable Crops

- Wheat

- Corn

- Soybean

- Sunflower

- Cotton

- Others

The biological seed treatment market was divided into soybean, wheat, cotton, maize, sunflower, vegetable plants and others. The vegetable crop type accounted for the largest income share of more than 25% in 2023 and is projected to expand during the biological seed treatment market forecast period. Increased use of biopesticides to treat vegetable plants, increased consumer inclination towards a healthy lifestyle, and increased demand for non-chemical food products are anticipated, over the anticipated era, to boost biological seed treatment market growth.

At a significant CAGR, the wheat sector is anticipated to expand in biological seed treatment market from 2024 to 2032. Sowing wheat plants are prone to illnesses such as pythium and fusarium (pungus) plant grain and Erwinia rhapontici (bacteria) purple plant infection. Biological treatment is vital to prevent these pathogens from infestation. Seedborne pathogens in soybeans are one of the major hazards to the formation of seedlings. Different illnesses of plants, such as stem blight, violet seed stain and a decrease in germination rates, are attributable to fungal pathogenic agents such as Phomopsis, Cercospora, Fusarium and Aspergillus. To prevent plants from these illnesses, Bacillus pumilus and Coniothyrium minitans are handled.

Biological Seed Treatment Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Biological Seed Treatment Market Regional Analysis

North America dominated the sector in biological seed treatment market on a regional basis with a share of 40% in revenues. The region is anticipated to develop from 2024 to 2032 at a significant CAGR. The increasing use of organic farming in nations such as the United States, Mexico and Canada is expected to lead the sector in the future. Canada and Mexico are the world's largest grain exporters. Farmers use biological seed treatments to safeguard the plants and plants from pathogens, pests and nematodes in order to produce significant plants.

Asia-Pacific is the fastest growing area, and over the prediction era, a CAGR of 11.8% is anticipated to accelerate in the biological seed treatment market. In nations like India, China, Bangladesh and Sri Lanka, powerful development in the farm industry is anticipated to boost consumer supply in the future. In addition, increasing population and increased revenue are anticipated to remain driving demand for meat and goods from agriculture.

Biological Seed Treatment Market Players

Some of the top biological seed treatment market companies offered in our report includes Rizobacter, BASF SE, Plant Health Care, Novozymes A/S, BiOWiSH Inc, Koppert Biological Systems, Corveta Agriscience, Italpollina, Bayer, UPL, and IPL Biologicals.

Frequently Asked Questions

How big is the biological seed treatment market?

The biological seed treatment market size was valued at USD 1.25 billion in 2023.

What is the CAGR of the global biological seed treatment market from 2024 to 2032?

The CAGR of Biological Seed Treatment is 10.9% during the analysis period of 2024 to 2032.

Which are the key players in the biological seed treatment market?

The key players operating in the global market are including Rizobacter, BASF SE, Plant Health Care, Novozymes A/S, BiOWiSH Inc, Koppert Biological Systems, Corveta Agriscience, Italpollina, Bayer, UPL, and IPL Biologicals.

Which region dominated the global biological seed treatment market share?

North America held the dominating position in biological seed treatment industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of biological seed treatment during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global biological seed treatment industry?

The current trends and dynamics in the biological seed treatment industry include increasing demand for eco-friendly and sustainable agricultural practices, rising awareness of soil health and biodiversity preservation, growing adoption of organic farming and reduction in chemical pesticide use, and advancements in microbial and biostimulant technologies for enhanced crop yield.

Which product held the maximum share in 2023?

The microbials product held the maximum share of the biological seed treatment industry.