Biodiesel Catalyst Market | Acumen Research and Consulting

Biodiesel Catalyst Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

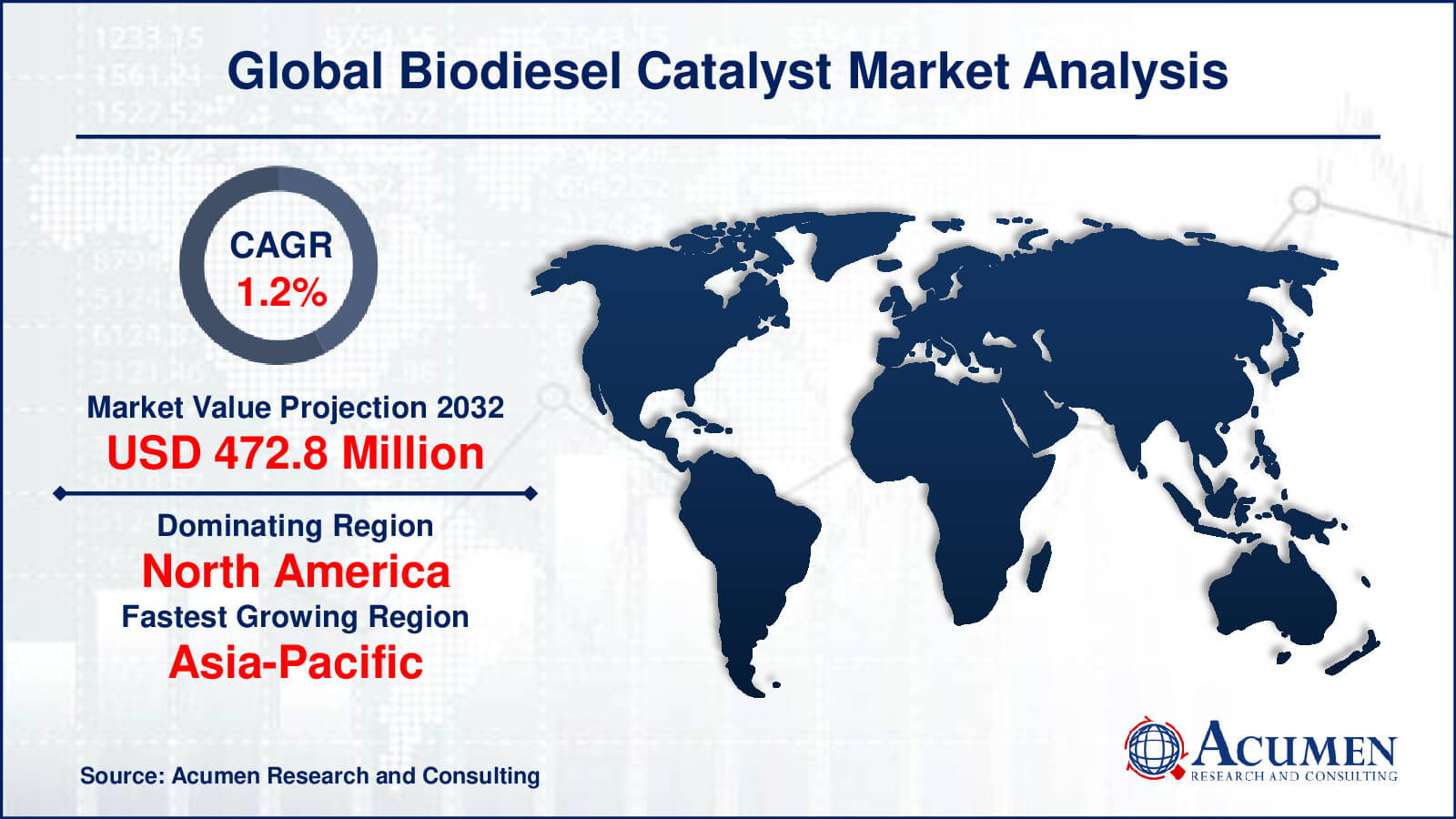

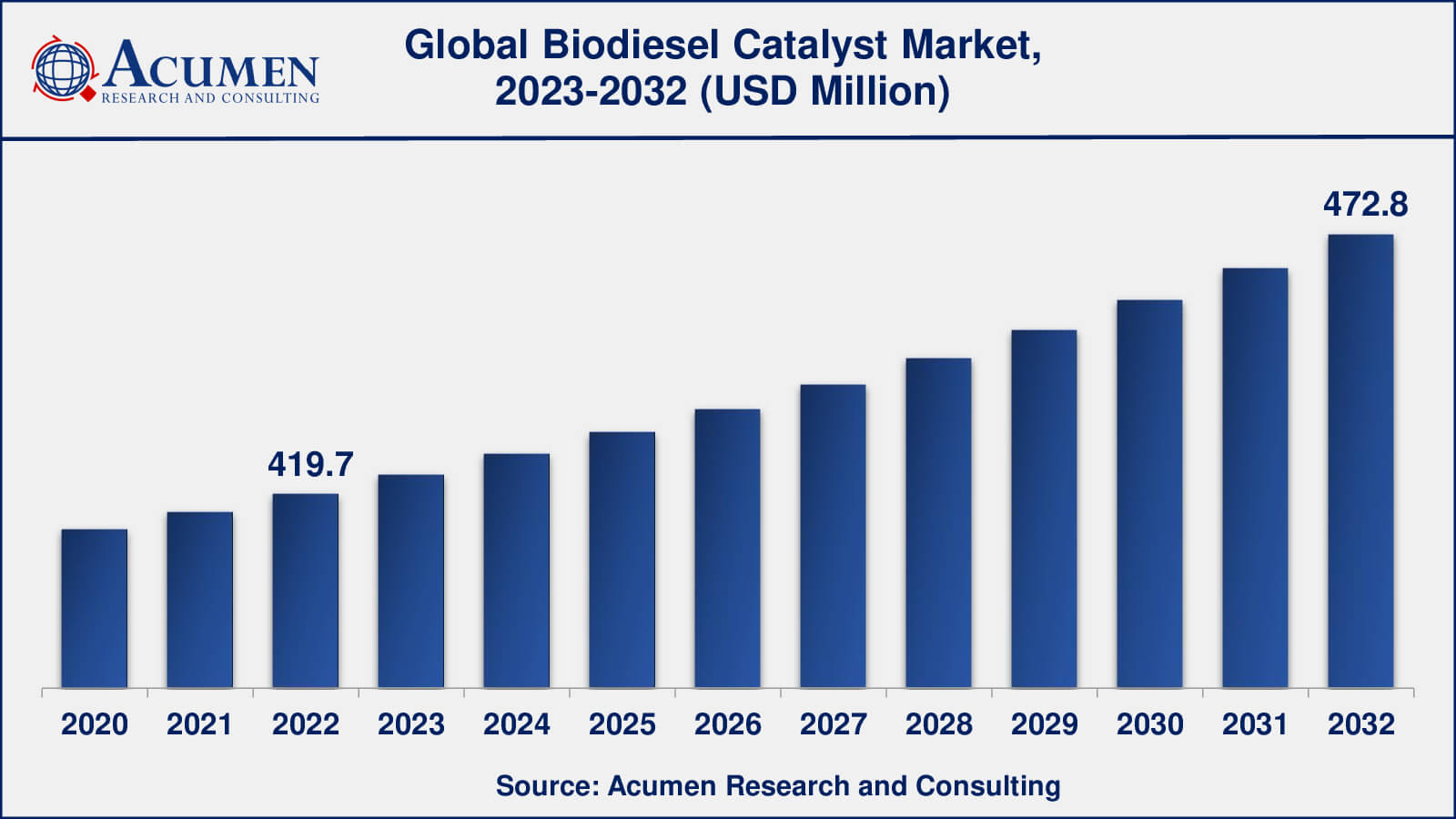

The Global Biodiesel Catalyst Market Size accounted for USD 419.7 Million in 2022 and is estimated to achieve a market size of USD 472.8 Million by 2032 growing at a CAGR of 1.2% from 2023 to 2032.

Biodiesel Catalyst Market Highlights

- Global biodiesel catalyst market revenue is poised to garner USD 472.8 million by 2032 with a CAGR of 1.2% from 2023 to 2032

- North America biodiesel catalyst market value occupied almost USD 160 million in 2022

- Asia-Pacific biodiesel catalyst market growth will record a CAGR of around 2% from 2023 to 2032

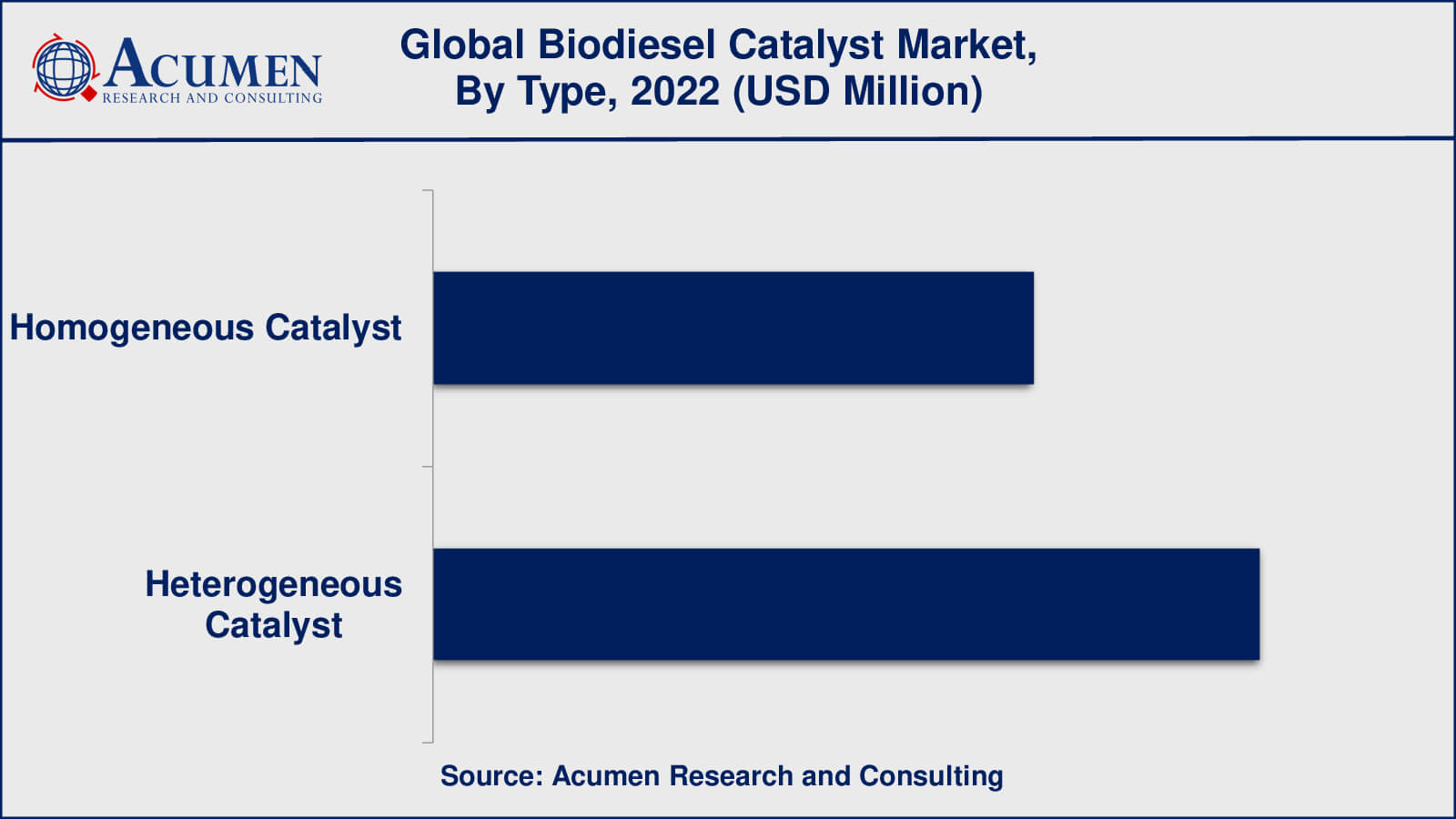

- Among type, the heterogeneous catalyst sub-segment generated over US$ 244 million revenue in 2022

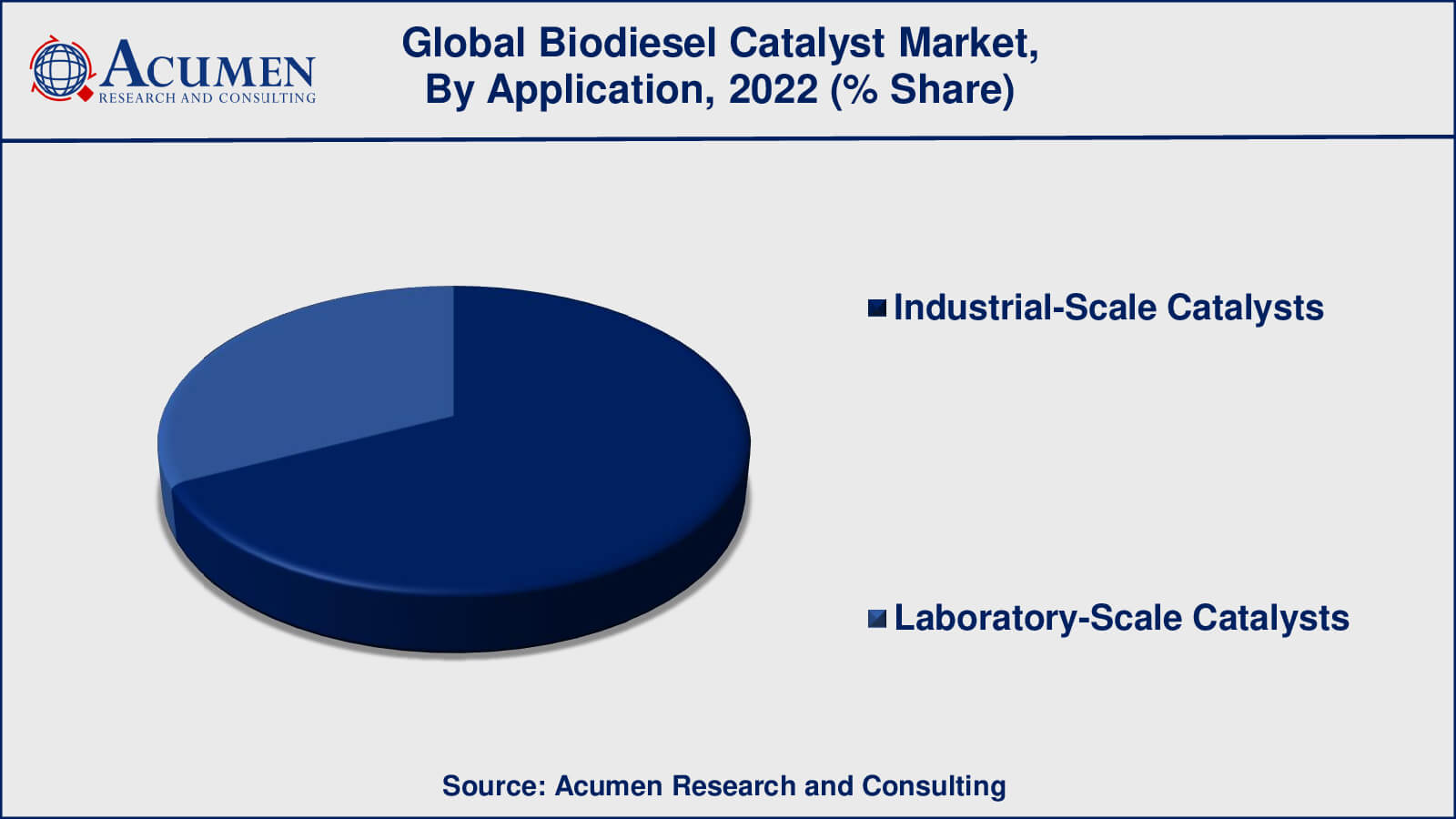

- Based on application, the industrial-scale catalyst sub-segment generated over 68% share in 2022

- Advancements in nanocatalysts is a popular biodiesel catalyst market trend that fuels the industry demand

Biofuel catalysts are the catalysts consumed to produce biofuels by transesterification reactions. Oils and fats used in transesterification reactions in the presence of a catalyst are edible and non-edible vegetable oils or animal fats. Advanced biofuels need technologies that are capable to convert renewable feedstocks more efficiently and economically. Catalysts for biofuels are used in the hydrotreating of natural oils & fats for upgrading and stabilization of pyrolysis oils to produce gasoline, diesel, and jet fuel.

Global Biodiesel Catalyst Market Dynamics

Market Drivers

- Growing demand for renewable and sustainable energy

- Focus on enzyme catalysts

- Increasing use of solid catalysts

Market Restraints

- Feedstock availability and quality

- Cost and scalability

Market Opportunities

- Rising need for customized catalyst formulations

- Rapidly growing research and development activities

- Circular economy and waste utilization

Biodiesel Catalyst Market Report Coverage

| Market | Biodiesel Catalyst Market |

| Biodiesel Catalyst Market Size 2022 | USD 419.7 Million |

| Biodiesel Catalyst Market Forecast 2032 | USD 472.8 Million |

| Biodiesel Catalyst Market CAGR During 2023 - 2032 | 1.2% |

| Biodiesel Catalyst Market Analysis Period | 2020 - 2032 |

| Biodiesel Catalyst Market Base Year | 2022 |

| Biodiesel Catalyst Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Dupont, W.R. Grace & Co.-Conn, Sud-Chemie, Evonik, BASF, BHR Biofuels Ltd, TSS Group, Camera Agricultura, DOW, Albemarle, Clariant AG, Arkema Group, Axens, Johnson Matthey, Novozymes A/S, and Honeywell UOP. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Biodiesel Catalyst Market Insights

The growing threat of fossil fuel depletion is anticipated to propel the expansion of the biofuel catalyst market. Extensive use of fossil fuels has increased the emission of carbon dioxide into the atmosphere and it is considered a primary contributor to global warming. The choice of catalyst for biofuel production depends upon the amount of free fatty acids and raw materials. In order to reduce costs, some researchers have developed new biocatalysts in recent years. No purification necessary for using biocatalysts is an advantage offered by biocatalysts.

Biodiesel Catalyst Market, By Segmentation

The worldwide market for biodiesel catalyst is split based on type, application, and geography.

Biodiesel Catalyst Types

- Homogeneous Catalyst

- Heterogeneous Catalyst

According to our biodiesel catalyst industry analysis, heterogeneous catalysts currently dominate the biodiesel catalyst market. Heterogeneous catalysts are catalysts that are in a different phase than the reactants in a chemical reaction (solid, liquid, or gas). Solid heterogeneous catalysts are commonly used in the Production of biodiesel. They are typically added to the reaction mixture as powders, pellets, or supported catalysts and can be easily separated from the biodiesel Type once the reaction is complete. Because heterogeneous catalysts have higher stability, reusability, and ease of separation, they are widely used in the biodiesel production process.

In contrast, homogeneous catalysts are catalysts that are in the same phase as the reactants. They are typically liquids that are completely dissolved in the reaction mixture. Although homogeneous catalysts have been used in the Production of biodiesel, they are less commonly used due to challenges such as separation difficulty, potential environmental concerns, and higher costs associated with catalyst recovery and recycling.

Biodiesel Catalyst Applications

- Industrial-Scale Catalysts

- Laboratory-Scale Catalysts

As per the biodiesel catalyst market forecast, the idustrial-scale catalysts are expected to gain significant share from 2023 to 2032. Biodiesel is primarily produced at industrial-scale facilities, where large quantities of feedstock are processed to produce commercial-scale biodiesel. Large-scale biodiesel production processes require high volumes of feedstock, continuous operation, and efficient catalyst recovery and reuse, so industrial-scale catalysts are specifically designed and optimised for large-scale biodiesel production processes. Because they are produced in larger quantities and are designed to meet the demands of industrial-scale biodiesel production, these catalysts are typically more robust, efficient, and cost-effective.

In contrast, laboratory-scale catalysts are used in smaller-scale biodiesel production for research and development, pilot-scale production, or small-scale production in niche applications. Laboratory-scale catalysts are frequently used for testing and validation in academic research, process optimisation, and small-scale biodiesel production. While laboratory-scale catalysts contribute significantly to the advancement of catalyst technology and process development, their overall market share in terms of volume and value is significantly lower than that of industrial-scale catalysts.

Biodiesel Catalyst Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Biodiesel Catalyst Market Regional Analysis

North America is a key region for biodiesel production, with the United States being the largest producer. Government regulations and policies promoting renewable energy, rising environmental concerns, and the need to reduce greenhouse gas emissions are driving demand for biodiesel in North America. The presence of established catalyst manufacturers, research and development activities, and technological developments in catalyst technologies characterize the North American biodiesel catalyst market.

In terms of biodiesel production, Asia-Pacific is a rapidly growing region, with Indonesia and Malaysia being major producers of palm oil-based biodiesel. Due to rising energy demand and environmental concerns, other countries in the region, such as India and China, are emerging as significant biodiesel markets. Growing biodiesel production capacities, technological advancements, and increased awareness about sustainable energy sources characterize the Asia-Pacific biodiesel catalyst market.

Biodiesel Catalyst Market Players

Some of the top biodiesel catalyst companies offered in the professional report Dupont, W.R. Grace & Co.-Conn, Sud-Chemie, Evonik, BASF, BHR Biofuels Ltd, TSS Group, Camera Agricultura, DOW, Albemarle, Clariant AG, Arkema Group, Axens, Johnson Matthey, Novozymes A/S, and Honeywell UOP.

Frequently Asked Questions

What was the market size of the global biodiesel catalyst in 2022?

The market size of biodiesel catalyst was USD 419.7 million in 2022.

What is the CAGR of the global biodiesel catalyst market from 2023 to 2032?

The CAGR of biodiesel catalyst is 1.2% during the analysis period of 2023 to 2032.

Which are the key players in the biodiesel catalyst market?

The key players operating in the global biodiesel catalyst market is includes Dupont, W.R. Grace & Co.-Conn, Sud-Chemie, Evonik, BASF, BHR Biofuels Ltd, TSS Group, Camera Agricultura, DOW, Albemarle, Clariant AG, Arkema Group, Axens, Johnson Matthey, Novozymes A/S, and Honeywell UOP.

Which region dominated the global biodiesel catalyst market share?

North America held the dominating position in biodiesel catalyst industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of biodiesel catalyst during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global biodiesel catalyst industry?

The current trends and dynamics in the biodiesel catalyst industry include growing demand for renewable and sustainable energy, focus on enzyme catalysts, and increasing use of solid catalysts.

Which type held the maximum share in 2022?

The heterogeneous catalysts type held the maximum share of the biodiesel catalyst industry.