Biochips Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Biochips Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

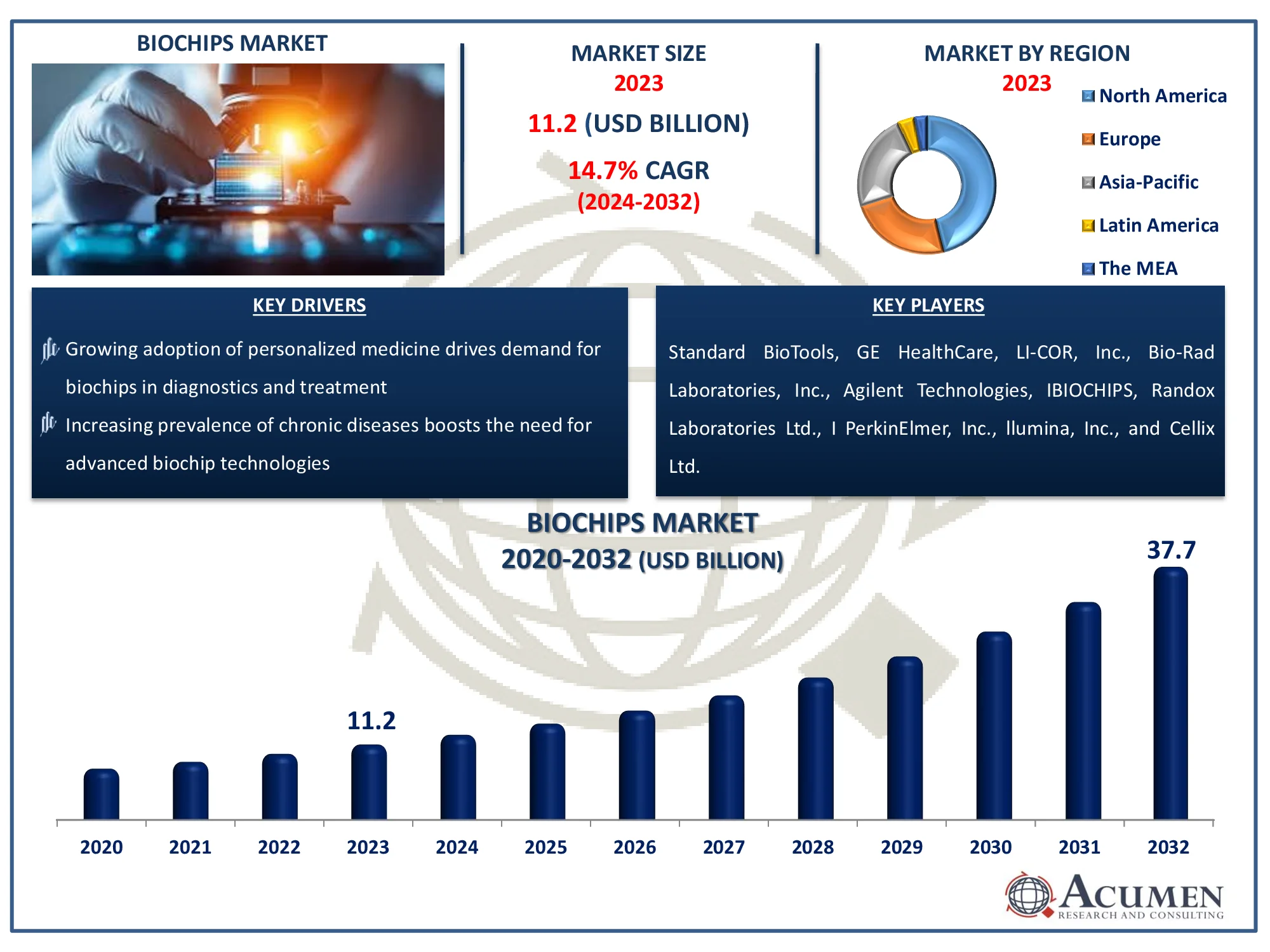

The Global Biochips Market Size accounted for USD 11.2 Billion in 2023 and is estimated to achieve a market size of USD 37.7 Billion by 2032 growing at a CAGR of 14.7% from 2024 to 2032.

Biochips Market Highlights

- Global biochips market revenue is poised to garner USD 37.7 billion by 2032 with a CAGR of 14.7% from 2024 to 2032

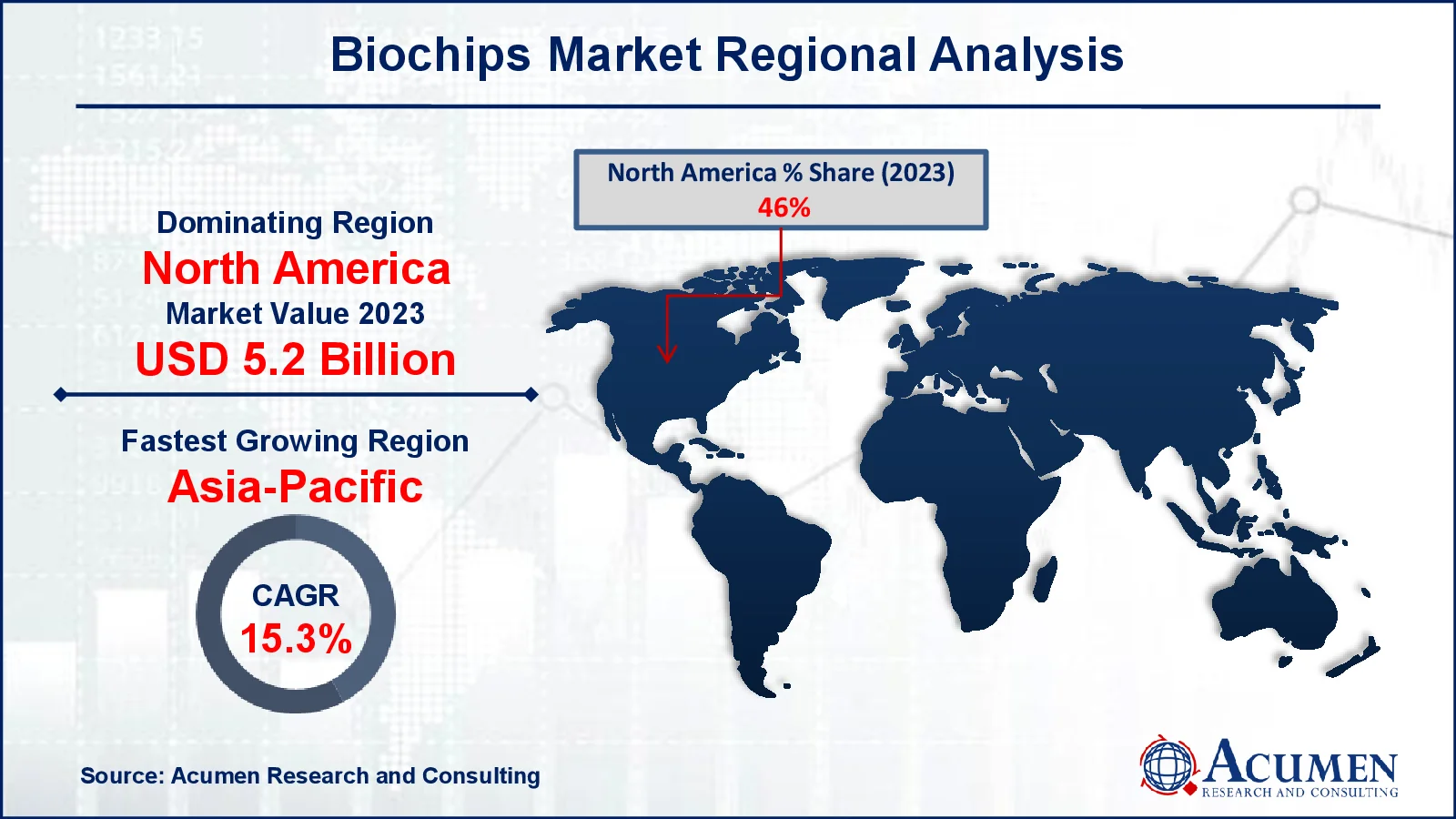

- North America biochips market value occupied around USD 5.2 billion in 2023

- Asia-Pacific biochips market growth will record a CAGR of more than 15.3% from 2024 to 2032

- Among type, the DNA chips generator sub-segment generated more than USD 4.3 billion revenue in 2023

- Based on end-user, the biotechnology & pharmaceutical sub-segment generated around 55% biochips market share in 2023

- Government initiatives promoting precision healthcare is a popular biochips market trend that fuels the industry demand

Biochips have a wide range of diversified applications ranging from accelerated drug development to disease marker identification and include a large number of applications related to research, especially in the fields of genotyping, genomics, and proteomics. Moreover, bio microsystem is considered as a group of integrated and miniaturized devices generally used for biochemical and biological reactions in monitoring, diagnostics, research and development, and therapy. Some of the key advantages of bio microsystems include integrated intelligence, parallelism, speed, low cost, redundancy, and complexity.

Biochips have a wide range of diversified applications ranging from accelerated drug development to disease marker identification and include a large number of applications related to research, especially in the fields of genotyping, genomics, and proteomics. Moreover, bio microsystem is considered as a group of integrated and miniaturized devices generally used for biochemical and biological reactions in monitoring, diagnostics, research and development, and therapy. Some of the key advantages of bio microsystems include integrated intelligence, parallelism, speed, low cost, redundancy, and complexity.

Additionally, a biochip is considered to be one of the most proficient examples of development in bio microsystems technologies. It is a vast collection of rearranged microarrays, especially on a solid substrate, that allows thousands of difficult and complex biochemical reactions. Biochips are widely used in a variety of major applications, such as research in biotechnology as well as proteomics and genomics, and the development and drug screening of molecular diagnostics.

Global Biochips Market Dynamics

Market Drivers

- Growing adoption of personalized medicine drives demand for biochips in diagnostics and treatment

- Increasing prevalence of chronic diseases boosts the need for advanced biochip technologies

- Technological advancements enhance biochip performance, expanding their applications

- Rising investments in genomics research accelerates biochip development and innovation

Market Restraints

- High initial costs of biochip systems limit adoption in low-resource settings

- Complex manufacturing processes pose challenges in scalability and affordability

- Limited awareness in emerging markets hinders the penetration of biochip technologies

Market Opportunities

- Expansion of point-of-care testing creates new avenues for biochip applications

- Integration of biochips with AI and IoT paves the way for smart diagnostic platforms

- Growing interest in non-invasive diagnostics fosters demand for biochip-based solutions

Biochips Market Report Coverage

|

Market |

Biochips Market |

|

Biochips Market Size 2023 |

USD 11.2 Billion |

|

Biochips Market Forecast 2032 |

USD 37.7 Billion |

|

Biochips Market CAGR During 2024 - 2032 |

14.7% |

|

Biochips Market Analysis Period |

2020 - 2032 |

|

Biochips Market Base Year |

2023 |

|

Biochips Market Forecast Data |

2024 - 2032 |

|

Segments Covered |

By Type, By Fabrication Technology, By End-user, and By Geography |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies Profiled |

Standard BioTools, GE HealthCare, LI-COR, Inc., Bio-Rad Laboratories, Inc., PerkinElmer, Inc., Agilent Technologies, IBIOCHIPS, Randox Laboratories Ltd., Illumina, Inc., and Cellix Ltd. |

|

Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Biochips Market Insights

An increasing need for the reduction of overall turnaround time as well as miniaturization of clinical and biological tests deployed for diagnosis and research has bolstered the overall demand for biochips and bio-array procedures, thus driving the global biochips market. Moreover, the rapid increase in spending, especially on clinical research and allocation of substantial resources for proteomic and genomic research, is anticipated to fuel market growth over the forecast period. Rapid technical developments associated with the aforementioned techniques, along with a wide portfolio of product offerings due to new product innovations, are providing researchers with a broad range of choices tailored to their specific requirements.

However, since biochip systems consist of formatted probes in micro scales, especially on glass surfaces, they require automatic robotic tools for scanning and handling the micro scale samples. Additionally, bioinformatics tools are essential for the analysis of data. The demand for such specific techniques and tools for implementing biochip technology positions biochips as a sophisticated and relatively more expensive technology.

Biochips Market Segmentation

The worldwide market for biochips is split based on type, fabrication technology, end-user, and geography.

Biochip Market By Type

- Cell Arrays

- Lab-on-Chip

- Protein Chips

- DNA Chips

- Tissue Arrays

According to biochips industry analysis, DNA chips dominate the market, accounting for the biggest proportion due to their adaptability and wide variety of applications in genomics and diagnostics. These chips, also known as microarrays, enable high-throughput investigation of gene expression, mutation detection, and genetic variation profiling. They are commonly used in research and clinical diagnostics for personalized medicine, drug development, and disease detection. DNA chips' commercial attractiveness originates from its ability to manage massive volumes of data, identify genetic markers, and aid in illness detection. As global demand for precision medicine and genetic testing rises, so does their adoption.

Biochip Market By Fabrication Technology

- Microarrays

- Microfluidics

Microfluidics is expected to become an important segment in the biochips market forecast period due to its capacity to combine small-scale fluid handling devices onto a chip. This technology allows for precise fluid management, resulting in miniaturized and cost-effective diagnostic tests and biological research. Microfluidic biochips are gaining popularity due to their exceptional efficiency in carrying out complex biochemical reactions that previously required larger laboratory equipment. They enable speedier and more reliable results, reducing the time and cost of clinical trials. Microfluidic biochips are gaining popularity in research and healthcare settings, with uses spanning from diagnostics to drug development and environmental monitoring. Their increased use in point-of-care diagnostics is driving market growth.

Biochip Market By End-user

- Hospitals & Diagnostics Centers

- Academic & Research Institutes

- Biotechnology & Pharmaceutical

- Others

The biotechnology and pharmaceutical industries account for 55% of the biochips market, which is driven by its broad use in drug development, disease diagnostics, and personalized medicine. Biochips, particularly DNA and protein chips, play an essential role in detecting genetic markers, monitoring gene expression, and testing new medications. Pharmaceutical companies use biochips for high-throughput compound screening, which speeds up drug discovery and lowers expenses. Biochips help biotechnology researchers develop new medicines, diagnostics, and bioprocessing procedures. With an increased emphasis on precision medicine, which tailors therapies to individual genetic profiles, the biotechnology and pharmaceutical industries are projected to continue to dominate the biochip industry in the future years.

Biochips Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of LATAM

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Biochips Market Regional Analysis

Biochips Market Regional Analysis

North America now dominates the biochips market. The region has advanced healthcare infrastructure, a well-established biotechnology sector, and significant investments in research and development. The presence of significant market participants, as well as frequent cooperation between academic institutions and industry leaders, strengthens the region's supremacy. Furthermore, North America's leading position is fueled by high healthcare spending, the expanding use of precision medicine, and increased government support for medical advancements.

The Asia-Pacific biochip market is expanding at a rapid pace. Countries such as China, Japan, and India are seeing rapid technological developments and greater investment in biotechnology and healthcare. This region's expansion can be linked to increased demand for low-cost healthcare solutions, improved healthcare infrastructure, and government measures to promote the biotechnology industry. Furthermore, advances in customized medicine and molecular diagnostics are hastening biochip implementation throughout Asia.

Asia-Pacific countries' focus on innovation and healthcare modernization is expected to increase demand for biochips, resulting in significant market growth over the forecast period. The availability of low-cost solutions, as well as enhanced regulatory frameworks, are fueling this expanding trend.

Biochips Market Players

Some of the top biochips companies offered in our report includes Standard BioTools, GE HealthCare, LI-COR, Inc., Bio-Rad Laboratories, Inc., PerkinElmer, Inc., Agilent Technologies, IBIOCHIPS, Randox Laboratories Ltd., Illumina, Inc., and Cellix Ltd.

Frequently Asked Questions

How big is the biochips market?

The biochips market size was valued at USD 11.2 billion in 2023.

What is the CAGR of the global biochips market from 2024 to 2032?

The CAGR of biochips is 14.7% during the analysis period of 2024 to 2032.

Which are the key players in the biochips market?

The key players operating in the global market are including Standard BioTools, GE HealthCare, LI-COR, Inc., Bio-Rad Laboratories, Inc., PerkinElmer, Inc., Agilent Technologies, IBIOCHIPS, Randox Laboratories Ltd., Illumina, Inc., and Cellix Ltd.

Which region dominated the global biochips market share?

North America held the dominating position in biochips industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of biochips during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global biochips industry?

The current trends and dynamics in the biochips industry include growing adoption of personalized medicine drives demand for biochips in diagnostics and treatment, and increasing prevalence of chronic diseases boosts the need for advanced biochip technologies.

Which technology held the maximum share in 2023?

The microfluidics technology held the notable share of the biochips industry.