Bioanalytical Testing Services Market | Acumen Research and Consulting

Bioanalytical Testing Services Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

The Bioanalytical Testing Services Market Size accounted for USD 4.2 Billion in 2022 and is estimated to achieve a market size of USD 11.4 Billion by 2032 growing at a CAGR of 10.7% from 2023 to 2032.

Bioanalytical Testing Services Market Highlights

- Global bioanalytical testing services market revenue is poised to garner USD 11.4 billion by 2032 with a CAGR of 10.7% from 2023 to 2032

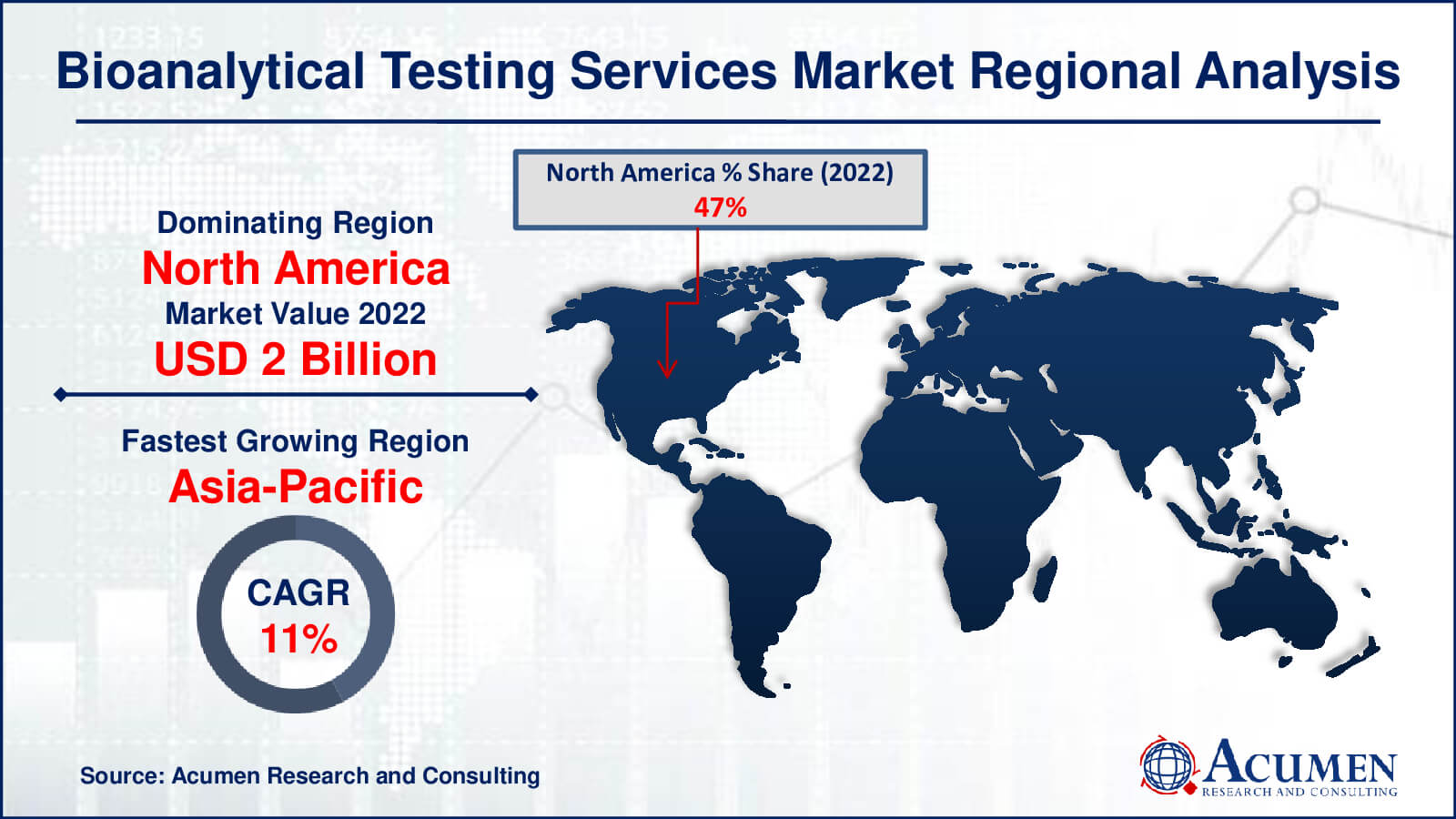

- North America bioanalytical testing services market value occupied around USD 2 billion in 2022

- Asia-Pacific bioanalytical testing services market growth will record a CAGR of more than 11% from 2023 to 2032

- Among molecule type, the small molecule sub-segment generated over US$ 2.3 billion revenue in 2022

- Based on workflow, the sample analysis sub-segment generated around 46% share in 2022

- Increasing partnerships and collaborations between pharmaceutical companies and testing service providers is a popular bioanalytical testing services market trend that fuels the industry demand

A variety of procedures are used in bioanalytical testing services to quantify pharmaceuticals and their metabolites in biological samples. Through accurate characterization of drug concentrations in biological matrices, these procedures are critical in pharmaceutical development, assuring drug efficacy, safety, and conformance to regulatory criteria. Bioanalytical testing services encompass various methods to quantify active drugs and their metabolites within the human body. This testing is pivotal in drug development, ensuring the efficacy and success of medications. Forecasts suggest a rising demand for fast-acting medications addressing chronic diseases, driving the need for bioanalytical testing services. Ongoing advancements in research and development (R&D) support this trend, facilitating rapid biologic development for quicker clinical trials, notably impacting treatment options for severe illnesses like cancer. Additionally, the outsourcing of R&D to contract research organizations is expected to significantly increase demand for bioanalytical testing services.

Global Bioanalytical Testing Services Market Dynamics

Market Drivers

- Increasing demand for personalized medicine and targeted therapies

- Growth in pharmaceutical R&D activities and drug development

- Stringent regulatory requirements driving the need for accurate testing

- Advancements in technology enhancing analytical capabilities in testing methodologies

Market Restraints

- High costs associated with sophisticated testing equipment and methodologies

- Challenges in standardization and harmonization of testing protocols

- Limited skilled workforce and expertise in specialized bioanalytical techniques

Market Opportunities

- Expansion in biopharmaceuticals and biosimilar development

- Rising demand for bioanalytical services in emerging markets

- Integration of automation and robotics in testing processes

Bioanalytical Testing Services Market Report Coverage

| Market | Bioanalytical Testing Services Market |

| Bioanalytical Testing Services Market Size 2022 | USD 4.2 Billion |

| Bioanalytical Testing Services Market Forecast 2032 | USD 11.4 Billion |

| Bioanalytical Testing Services Market CAGR During 2023 - 2032 | 10.7% |

| Bioanalytical Testing Services Market Analysis Period | 2020 - 2032 |

| Bioanalytical Testing Services Market Base Year |

2022 |

| Bioanalytical Testing Services Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Molecule Type, By Test Type, By Workflow, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | PSC, SGS SA, Toxikon, Inc., The Intertech group, Pace Analytical Services, SLC, PPD, ICON plc, Covance Inc., LabCorp, Charles River Laboratories International, Inc., Syneos Health, Toxikon, and IQVIA. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Bioanalytical Testing Services Market Insights

Anticipated advancements in biological development during the forecast period are poised to stimulate market demand. Patent expirations and essential clinical trials for diverse medications are expected to positively impact the bioanalytic testing services market. The outsourcing of testing services to contract research organizations in developing economies is likely to propel market growth. Additionally, the increasing prevalence of cancer and other chronic diseases necessitating blockbuster medications is anticipated to drive market demand in the forthcoming years. Nevertheless, the high costs of drugs may present a challenge to market growth.

The increasing trend of major pharmaceutical companies outsourcing R&D activities to focus on core competencies is a key driver. The economic efficiency offered by outsourcing, rather than conducting internal studies, continues to fuel demand. Patent expirations among large sellers are prompting drug manufacturers to invest in replenishing their pipelines, a significant factor driving growth in the bioanalytical testing services market. Contract Research Organizations (CROs) are witnessing growing demand from the pharmaceutical sector due to their diversified expertise, particularly in clinical trials across different regions and drug development within specific therapeutic sectors compared to pharmaceutical companies.

In the pharmaceutical analytical testing services market, outsourcing significantly amplifies the complexity and standards that individual molecules must adhere to. Alongside evolving standards, companies must vigilantly track regulatory updates and harness expertise and advisory services. International organizations like the International Council on Harmonization (ICH) routinely update harmonized guidelines.

The rise of biosimilars, combination molecules, and other innovative drugs has spurred heightened demand for specific types of tests. Additionally, when businesses expand to new locations, adherence to local standards becomes imperative, often necessitating specific types of testing.

Bioanalytical Testing Services Market Segmentation

The worldwide market for bioanalytical testing services is split based on molecule type, test type, workflow, end-user, and geography.

Bioanalytical Testing Services Molecule Types

- Large Molecule

- Immunoassays

- LC-MS Studies

- Others

- Small Molecule

The bioanalytical testing services market segments molecules into small and large categories. In recent years, the small molecular sector held a significant market share, housing the majority of both generic and branded drug compounds. As many blockbuster medicines patents expired, generic manufacturers had to conduct bioanalytical tests, driving growth in this segment for the subsequent years.

Conversely, a robust growth trajectory is anticipated for the large molecular sector during this market forecast period. This growth is attributed to a rich pipeline of biofuel or amino acid-based molecules, necessitating technical expertise and advanced analytical instruments for testing. Service providers in bioanalytical services possess the necessary infrastructure, making externalization of these molecules a prevalent trend in the forecast period.

Large molecules, known as biologics, are protein-based with therapeutic effects, comprising several thousand amino acids and weighing up to 150kDa. The entire development process necessitates bioanalytical testing for these large molecular drugs. The biological pipeline is burgeoning, leading to exponential growth in biological sales over the years.

Bioanalytical Testing Services Test Types

- ADME

- In-Vitro

- In-Vivo

- PD

- PK

- Bioequivalence

- Bioavailability

- Others

The market segments are based on test types such as MTS Excretion (ADME), pH, Pharmacokinetics (PD), bioavailability, bioequivalence, and others. According to the bioanalytical testing services industry analysis the bioavailablity subsegment is the largest. High demands for bioavailability (BA) and bioequivalence (BE) studies, particularly in generic drug production, led to significant market shares.

Pharmacokinetics (PK) pertains to the post-administration phase of pharmacology, governing drug fate. Essential PK parameters, frequently measured, include dosage interval, peak plasma concentration (Cmax), time to peak plasma concentration (tmax), and volume of distribution. Companies employ advanced methods for determining PK parameters. For instance, SGS technology using Dry Blood Spot (DBS) offers numerous advantages over traditional methods. DBS methods require minimal samples, eliminate post-collection processing, facilitate convenient sample delivery and storage, and entail low biohazard risks.

Bioanalytical Testing Services Workflows

- Sample Analysis

- Sample Preparation

- Others

Sample analysis dominates the workflow sector of the bioanalytical testing services market due to its vital function in analysing drug concentration levels and metabolites in biological samples. It is a critical stage in guaranteeing drug safety and efficacy, as well as affecting regulatory approvals and clinical decisions. As pharmaceutical R&D becomes more intense, there is a greater demand for precise and thorough sample analysis to meet tight regulatory standards. Furthermore, advances in analytical techniques and technology increase demand for robust sample analysis services, reinforcing its market leadership.

Bioanalytical Testing Services End-Users

- Pharmaceutical and Biotechnology Companies

- Contract Development and Manufacturing Organization

- Contract Research Organization

- Others

According to the bioanalytical testing services market forecast, the pharmaceutical and biotechnology companies lead the industry because they undergo considerable research and development, needing thorough testing to assure drug efficacy, safety, and regulatory compliance. These companies are involved in various drug development phases, from discovery to commercialization, and they require extensive bioanalytical services. With a focus on novel therapeutics and high regulatory standards, these companies primarily rely on robust testing services to progress their pipelines, securing their significant position of the bioanalytical testing market.

Bioanalytical Testing Services Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Bioanalytical Testing Services Market Regional Analysis

In 2022, North America led the global market for bioanalytical testing services due to its status as a highly reliable and sophisticated pharmaceutical manufacturing hub. Consequently, Original Equipment Manufacturers (OEMs) swiftly partnered with electronic service providers to efficiently manage the increasing electronic components within pharmaceutical products.

The market's growth in North America is primarily driven by the rapid expansion of pharmaceutical production to meet the escalating healthcare demand. Anticipated increments in state support for healthcare costs further fuel the region's pharmaceutical outsourcing market. In addition to its supremacy in bioanalytical testing services, North America's pharmaceutical manufacturing sector is propelled by the region's concentration on innovation and cutting-edge technologies. This innovative methodology promotes relationships between academic institutions and industry participants, promoting breakthroughs in drug development and analytical testing procedures. Simultaneously, Asia Pacific's outsourcing growth is driven by its rising talent pool and cost-effective solutions, which are attracting global attention and fostering partnerships, ultimately transforming the area into a significant pharmaceutical outsourcing destination and propelling its rapid market rise.

In the Asia-Pacific region, the most rapid growth in outsourcing services is expected, particularly in relatively untapped markets. Supply centers in China, Manila, and India typically support outsourcing services in this region. China, increasingly popular as an onshore and offshore outlet, attracts customers from Japan and other regions.

Bioanalytical Testing Services Market Players

Some of the top bioanalytical testing services companies offered in our report includes PSC, SGS SA, Toxikon, Inc., The Intertech group, Pace Analytical Services, SLC, PPD, ICON plc, Covance Inc., LabCorp, Charles River Laboratories International, Inc., Syneos Health, Toxikon, and IQVIA

Frequently Asked Questions

How big is the bioanalytical testing services market?

The market size of bioanalytical testing services was USD 4.2 billion in 2022.

What is the CAGR of the global bioanalytical testing services market from 2023 to 2032?

The CAGR of bioanalytical testing services is 10.7% during the analysis period of 2023 to 2032.

Which are the key players in the bioanalytical testing services market?

The key players operating in the global market are including PSC, SGS SA, Toxikon, Inc., The Intertech group, Pace Analytical Services, SLC, PPD, ICON plc, Covance Inc., LabCorp, Charles River Laboratories International, Inc., Syneos Health, Toxikon, and IQVIA.

Which region dominated the global bioanalytical testing services market share?

North America held the dominating position in bioanalytical testing services industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of bioanalytical testing services during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global bioanalytical testing services industry?

The current trends and dynamics in the bioanalytical testing services industry include increasing demand for personalized medicine and targeted therapies, growth in pharmaceutical R&D activities and drug development, stringent regulatory requirements driving the need for accurate testing, and advancements in technology enhancing analytical capabilities in testing methodologies.

Which molecule type held the maximum share in 2022?

The small molecule molecule type held the maximum share of the bioanalytical testing services industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date