Bioadhesive Market | Acumen Research and Consulting

Bioadhesive Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format : ![]()

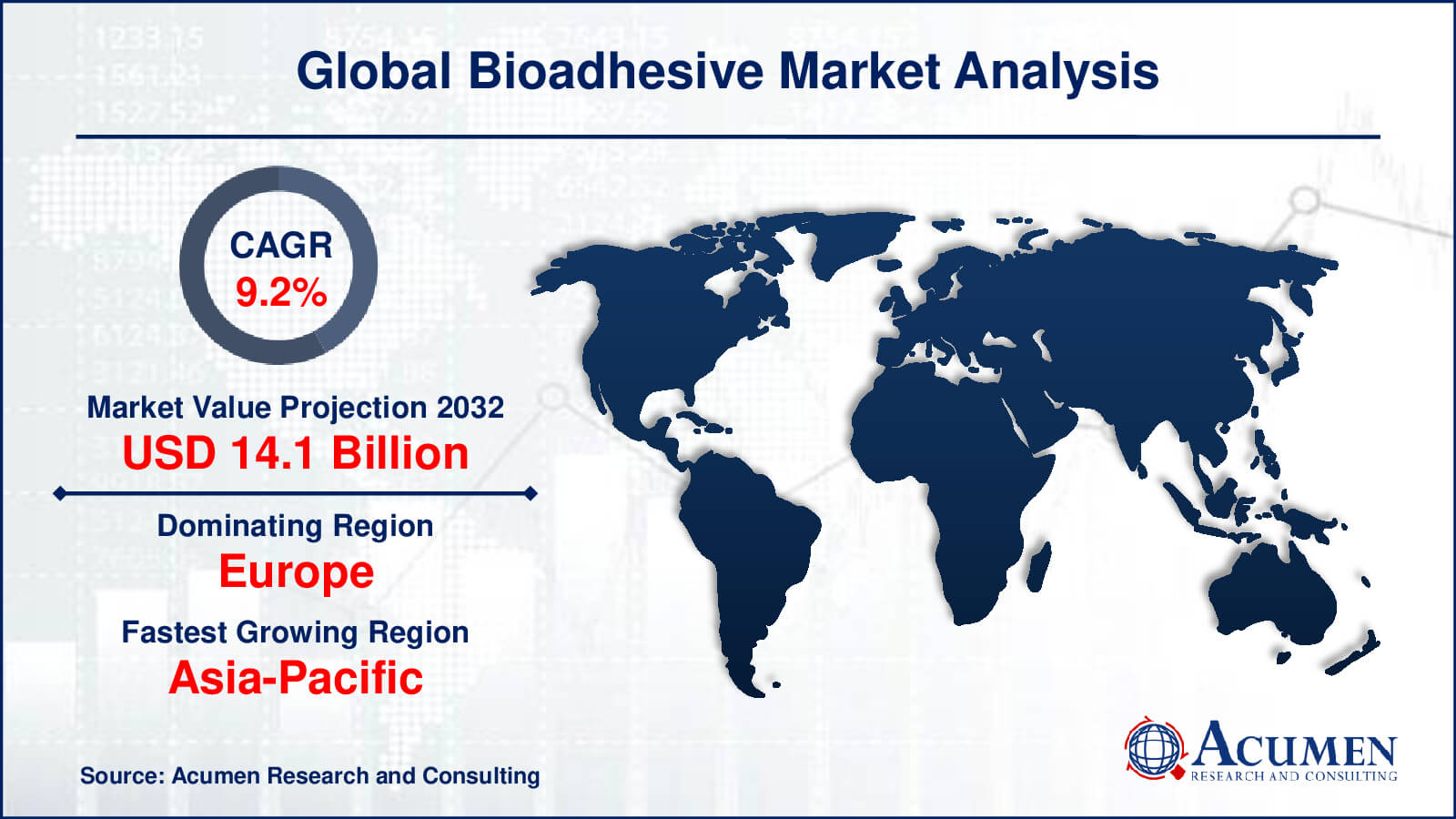

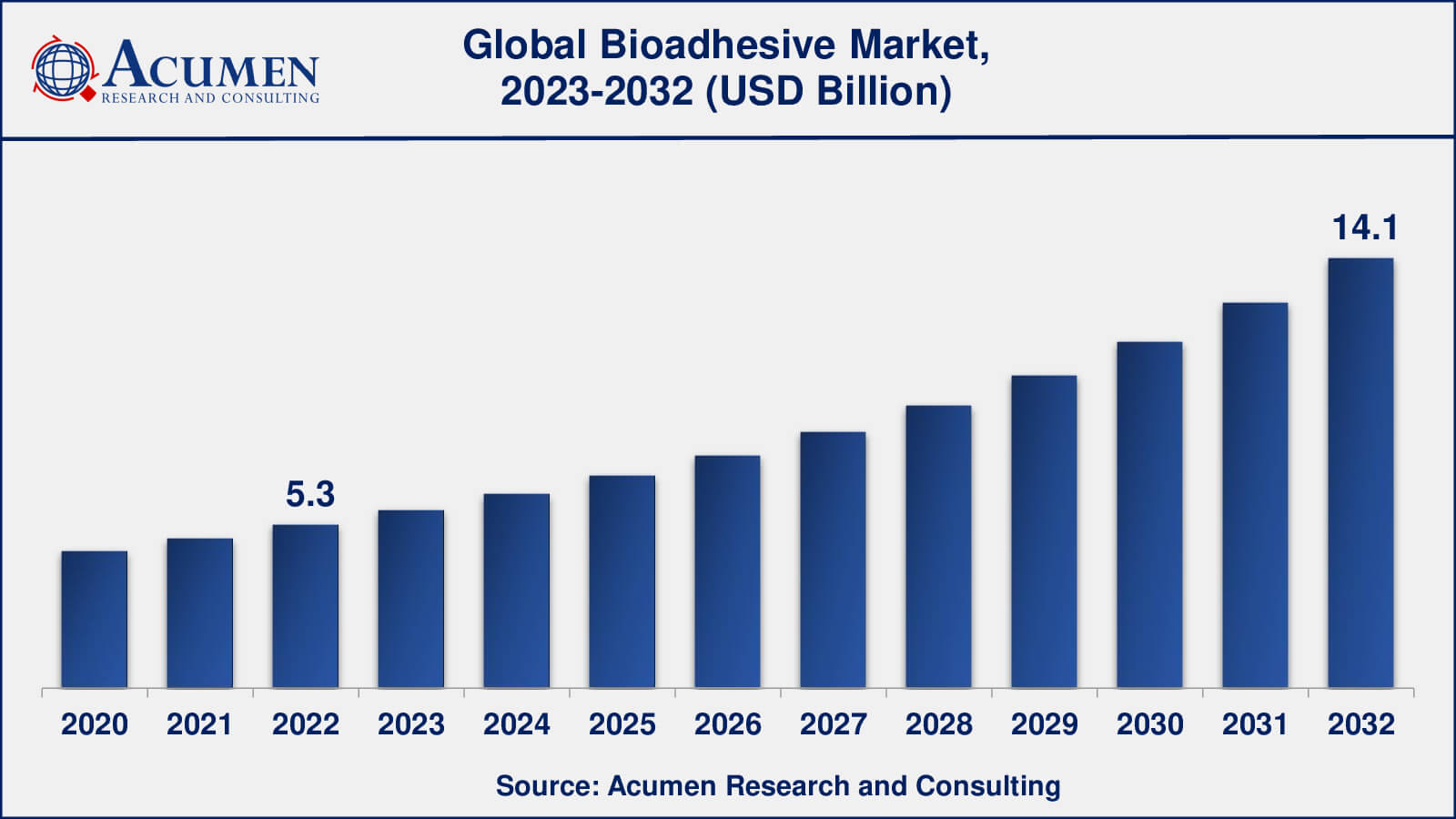

The Global Bioadhesive Market Size collected USD 5.3 Billion in 2022 and is set to achieve a market size of USD 14.1 Billion in 2032 growing at a CAGR of 9.2% from 2023 to 2032.

Bioadhesives are natural polymeric materials that act as a glue between two surfaces. The term "bioadhesives" refers to an adhesive that is used to bind a substance and repel separation between two materials. Bioadhesives have the ability to form a long-lasting interface between two various materials and have distinct properties that distinguish them from synthetic glues. Glue is synthesized from biological monomers such as sugars or from any synthetic material designed to adhere to organic tissue. Protein and carbohydrates are the primary components of bioadhesives. People have been using these as general-purpose adhesives for centuries.

Bioadhesive Market Report Statistics

- Global bioadhesive market revenue is estimated to reach USD 14.1 billion by 2032 with a CAGR of 9.2% from 2023 to 2032

- Europe bioadhesive market value occupied more than USD 2.2 billion in 2022

- Asia-Pacific bioadhesive market growth will record a CAGR of over 9% from 2023 to 2032

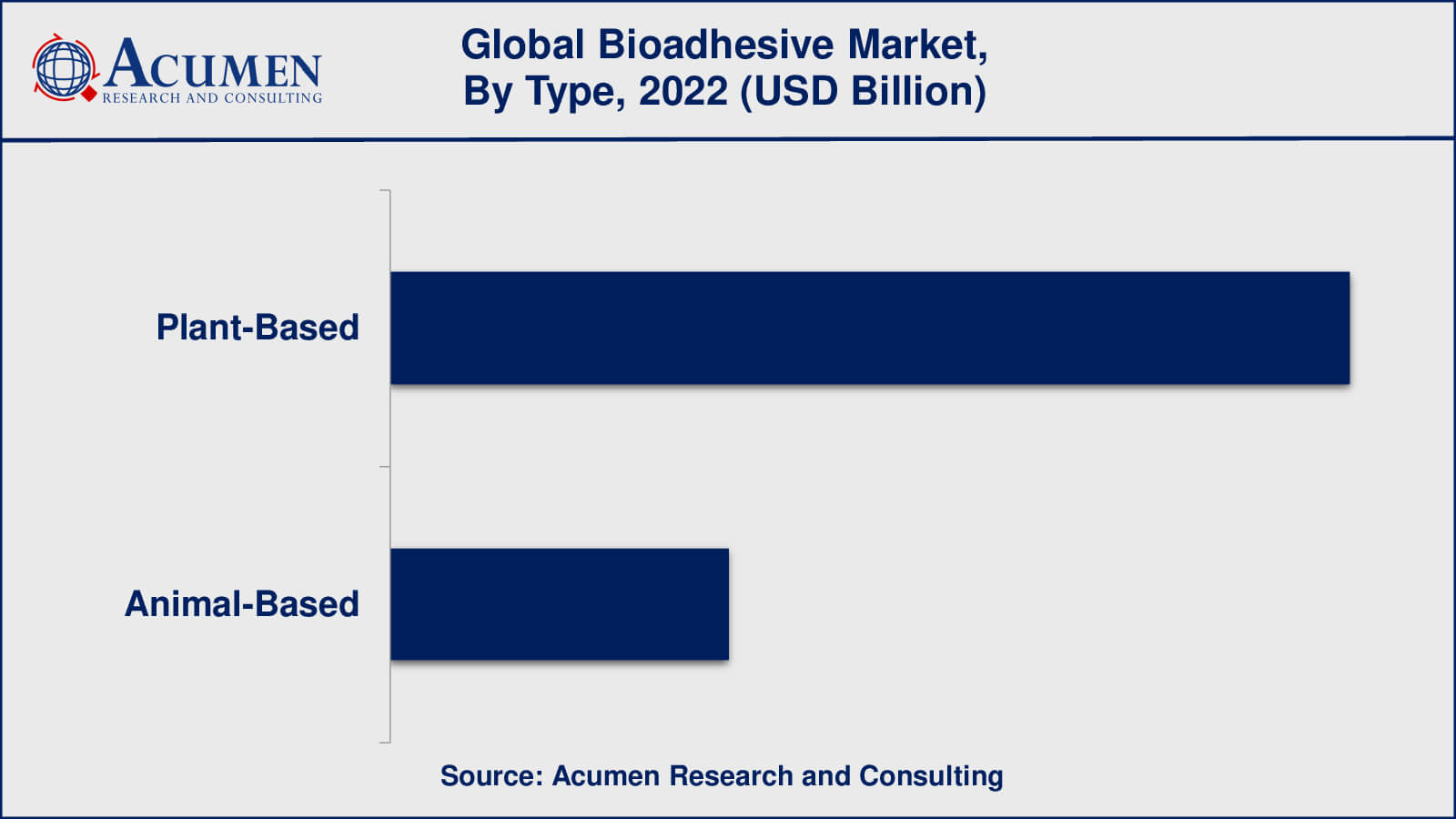

- Among type, the plant-based sub-segment generated around 74% share in 2022

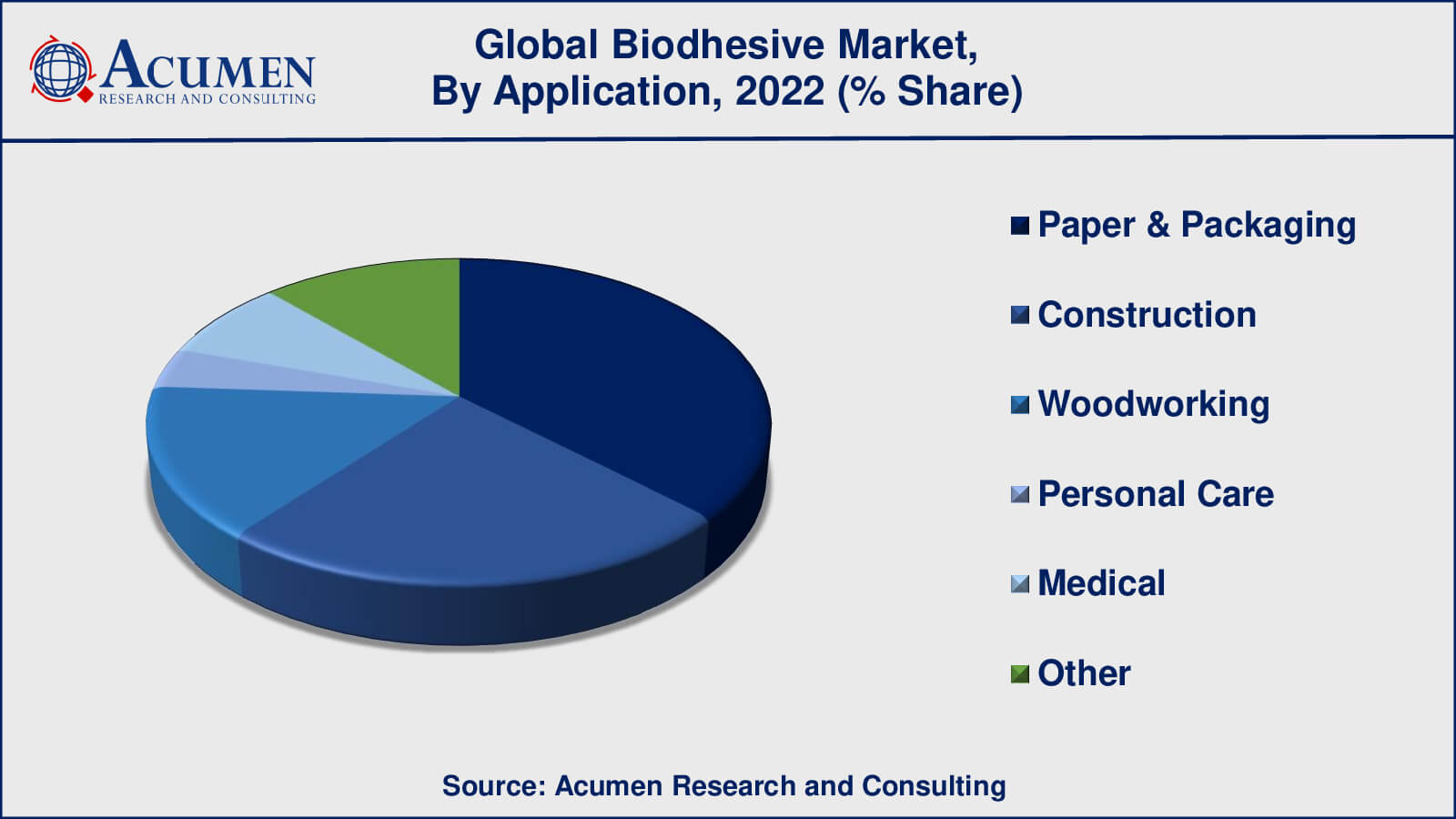

- Based on application, the paper and packaging generated US $ 2 billion revenue in 2022

- Increasing demand for eco-friendly and sustainable adhesives is a popular bioadhesive market trend that fuels the industry demand

Global Bioadhesive Market Dynamics

Market Drivers

- Increasing demand for eco-friendly products

- Growing demand from the healthcare industry

- Rising investment in research and development

Market Restraints

- Limited availability of raw materials

- High cost

Market Opportunities

- Government regulations

- Advancements in technology

Bioadhesive Market Report Coverage

| Market | Bioadhesive Market |

| Bioadhesive Market Size 2022 | USD 5.3 Billion |

| Bioadhesive Market Forecast 2032 | USD 14.1 Billion |

| Bioadhesive Market CAGR During 2023 - 2032 | 9.2% |

| Bioadhesive Market Analysis Period | 2020 - 2032 |

| Bioadhesive Market Base Year | 2022 |

| Bioadhesive Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ashland Global Holdings Inc., 3M Company, Bioadhesive Alliance Inc., Cryolife Inc., Henkel AG & Company, Ecosynthetix Inc., Arkema S.A., Dupont De Nemours, Inc, Danimer Scientific LLC, Tate & Lyle. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Bioadhesive Market Growth Factors

Bioadhesives are used in biomedical applications that involve body skin and other body tissues as these have biocompatible properties. Some of the bioadhesives also work underwater or in wet environments condition, whereas others are only capable of operating in low surface energy. Rising demand for biomedical applications is analyzed to bolster the global bioadhesives market. In addition, stringent environmental regulations and increasing consumer awareness with regard to the adverse effects of synthetic materials are further propelling the global bioadhesives market. In addition, individuals' and industrial inclination towards the usage of bio-based products in order to keep the environment eco-friendly or green is further analyzed to boost the global bioadhesives market. Governments across the globe are coming up with regulations for chemical industries to reduce the usage of fossil products, thereby further augmenting the demand for bio-based adhesives in the world market.

Bioadhesives are generally useful in the healthcare segment in biomedical applications because they can interface with biological fluids and living tissues within the human body. Bioadhesives also find numerous applications in paper & pulp and the personal care sector. The healthcare sector is analyzed to dominate the market during the forecast period. Rising government initiatives to use more ecological products have inclined bioadhesive manufacturing firms to come out with more progressive bioadhesive materials in the market. The rising demand for biomedical application of adhesives from the healthcare sector is analyzed to bolster the global bioadhesives market.

Bioadhesive Market Segmentation

The worldwide bioadhesive market is categorized based on type, application, and geography.

Bioadhesive Market By Type

- Plant-Based

- Animal-Based

As per the bioadhesive industry analysis, plant-based bioadhesives dominate the bioadhesive market. This is due primarily to the eco-friendliness and biodegradability of plant-based bioadhesives, which are preferred over synthetic or animal-based adhesives in a variety of industries. Plant-based bioadhesives are made from renewable resources like starch, cellulose, lignin, and proteins and are thought to be a more sustainable alternative to traditional adhesives. They are widely used in a variety of industries, including packaging, construction, and woodworking.

While animal-based bioadhesives, such as collagen and gelatin, are used in certain applications, such as wound care and tissue engineering in the medical industry, their use is limited in comparison to plant-based bioadhesives. Furthermore, there are ethical concerns about the use of animal-based adhesives, which may limit their use in certain industries.

Bioadhesive Market By Application

- Paper & Packaging

- Construction

- Woodworking

- Personal Care

- Medical

- Other

According to the bioadhesive market forecast, the paper & packaging application is expected to generate the maximum revenue throughout 2023 to 2032. The paper and packaging industry is the largest application segment in the bioadhesive market at the moment. Bioadhesives are commonly used in the production of paper and paperboard products like paper bags, boxes, and cartons. They have several advantages over traditional synthetic adhesives, including improved adhesion, increased strength, and improved biodegradability. Furthermore, the use of bioadhesives in the paper and packaging industries helps to reduce product carbon footprint, which is becoming an increasingly important factor for consumers.

Bioadhesives are also used extensively in the construction and woodworking industries. Bioadhesives are used in the manufacture of wood composites such as particleboard and fiberboard, as well as wood products such as furniture, doors, and windows. They have benefits such as increased bonding strength, lower toxicity, and better water resistance.

Bioadhesive Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Bioadhesive Market Regional Analysis

In terms of geography, the global bioadhesives market is bifurcated into North America, Europe, Asia-Pacific, Latin America, Middle East and Africa. North America dominates the market for global bioadhesives, followed by Europe and Asia-Pacific. The United States is the largest consumer of bioadhesives due to technological development and consumer inclination towards using ecological products. North America is analyzed to maintain its leading share throughout the forecast period; Europe is likely to display average growth. However, Asia-Pacific is projected to witness highest growth during the forecast period due to technological improvements in the developing countries such as China and India.

Bioadhesive Market Players

Some of the leading bioadhesive companies include Arkema S.A., 3M Company, Ashland Global Holdings Inc., Bioadhesive Alliance Inc., Cryolife Inc., Danimer Scientific LLC, Dupont De Nemours, Inc, Ecosynthetix Inc., Henkel AG & Company, Tate & Lyle.

Frequently Asked Questions

What was the market size of the global bioadhesive in 2022?

The market size of bioadhesive was USD 5.3 Billion in 2022.

What is the CAGR of the global bioadhesive market during forecast period of 2023 to 2032?

The CAGR of bioadhesive market is 9.2% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global market are Arkema S.A., 3M Company, Ashland Global Holdings Inc., Bioadhesive Alliance Inc., Cryolife Inc., Danimer Scientific LLC, Dupont De Nemours, Inc, Ecosynthetix Inc., Henkel AG & Company, Tate & Lyle.

Which region held the dominating position in the global bioadhesive market?

Europe held the dominating position in bioadhesive market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for bioadhesive market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global bioadhesive market?

The current trends and dynamics in the bioadhesive industry include increasing demand for eco-friendly products, growing demand from the healthcare industry, and rising investment in research and development.

Which type held the maximum share in 2022?

The plant-based type held the maximum share of the bioadhesive market.