Bio-Decontamination Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Bio-Decontamination Equipment Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

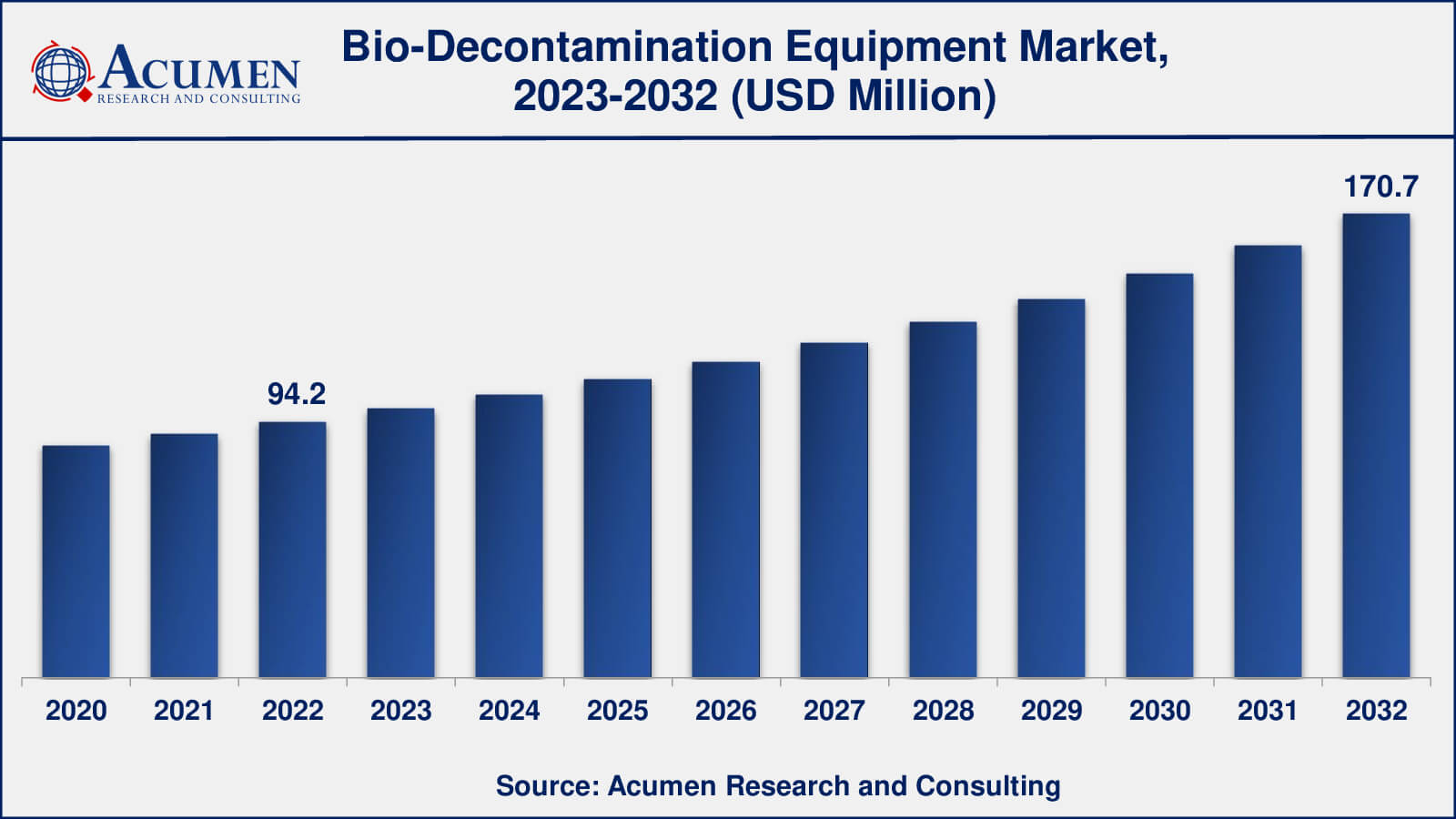

The global Bio-Decontamination Equipment Market gathered USD 94.2 Million in 2022 and is expected to reach USD 170.7 Million by 2032, growing at a CAGR of 6.2% from 2023 to 2032.

Bio-Decontamination Equipment Market Highlights

- The global bio-decontamination equipment market is poised to achieve a revenue of USD 170.7 million by 2032, experiencing a CAGR of 6.2% from 2023 to 2032

- In 2022, the North America bio-decontamination equipment market held a value of approximately USD 42.3 million

- The Asia-Pacific bio-decontamination equipment market is expected to witness substantial growth, with a projected CAGR of over 6.5% from 2023 to 2032

- Among types, the chamber decontamination sub-segment accounted for revenue exceeding USD 57.4 million in 2022

- In terms of application, the pharmaceutical manufacturing sub-segment claimed a significant share, surpassing 40% in 2022

- Collaborations between healthcare facilities and equipment providers is one of the notable bio-decontamination equipment market trends

Bio-decontamination refers to the process of neutralizing or removing chemical agents, infectious microorganisms, and radioactive materials. This is achieved through physical means, chemicals, or biology-based methods. Bio-decontamination using physical means involves techniques such as thermal and high-pressure methods, among others. Decontamination by chemicals involves the use of surfactants to neutralize chemical waste, oxidizing agents, and more. Decontamination methods based on biology involve the use of artificial bacteria, enzymatic systems, and others.

Bio-decontamination equipment refers to equipment such as an isolated box or chamber in which the decontamination procedure is performed. The bio-decontamination equipment market has been rising at a fast rate due to an increase in awareness of such processes and governments of various countries taking initiatives in this field. According to regional analysis, North America held the prime share in the global market and continues to showcase its growth throughout the forecasting timeframe.

Global Bio-Decontamination Equipment Market Dynamics

Market Drivers

- Increasing awareness of healthcare-associated infections (HAIs)

- Growing pharmaceutical and biotechnology industries drive the need for sterile environments

- COVID-19 pandemic highlights the importance of effective decontamination solutions

- Regulatory pressure for stringent hygiene standards promotes bio-decontamination equipment adoption

Market Restraints

- High initial costs and maintenance expenses hinder widespread adoption

- Limited accessibility and affordability in developing regions restrict market growth

- Concerns about the environmental impact of decontamination chemicals pose challenges

Market Opportunities

- Development of eco-friendly decontamination solutions addresses environmental concerns

- Expansion of healthcare infrastructure in emerging markets creates growth opportunities

- Research and development efforts for novel decontamination technologies offer innovation prospects

Bio-Decontamination Equipment Market Report Coverage

| Market | Bio-Decontamination Equipment Market |

| Bio-Decontamination Equipment Market Size 2022 | USD 94.2 Million |

| Bio-Decontamination Equipment Market Forecast 2032 | USD 170.7 Million |

| Bio-Decontamination Equipment Market CAGR During 2023 - 2032 | 6.2% |

| Bio-Decontamination Equipment Market Analysis Period | 2020 - 2032 |

| Bio-Decontamination Equipment Market Base Year |

2022 |

| Bio-Decontamination Equipment Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Amira Srl, ClorDiSys Solutions, Inc., Ecolab, Inc., Fedegari Autoclavi S.p.A., Howorth Air Technology Limited, JCE Biotechnology SAS, Solidfog Technologies SPRL, STERIS PLC, TOMI Environmental Solutions, Inc., and Zhejiang TAILIN Bioengineering Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Bio-Decontamination Equipment Market Insights

The global bio-decontamination equipment market has been experiencing robust growth in recent years. As concerns over contamination and infection control continue to rise, the demand for advanced bio-decontamination solutions has surged. This demand is driven by various sectors, including healthcare, pharmaceuticals, research facilities, and more. Bio-decontamination equipment, which includes chamber and room decontamination systems, plays a pivotal role in ensuring the safety and sterility of environments, equipment, and materials.

The bio decontamination equipment market is characterized by rapid technological advancements, with innovative methods such as chemical sterilization and gas-based decontamination gaining prominence. These methods are not only effective in neutralizing pathogens but also offer material compatibility and reduced equipment damage, setting them apart from traditional decontamination approaches.

Moreover, the aging population, stringent regulatory standards, and a heightened focus on infection control have fueled the growth of the bio-decontamination market globally. As countries invest in healthcare infrastructure and research and development, the bio-decontamination equipment market is expected to continue its upward trajectory, addressing the ever-increasing threat from infectious sources.

Key factors driving the global bio decontamination equipment market include the rise in the prevalence of contamination cases, government initiatives in the field, technological advancements, and increasing awareness of various bio-decontamination procedures. However, stringent government regulations in certain countries, the high cost of equipment, and economic slowdowns are significant factors restraining the growth of the bio decontamination market. Additionally, the long lifecycles of bio-decontamination equipment pose a challenge for the decontamination equipment market.

Developing nations hold great potential for the growth of the bio-decontamination market. The innovation of bio-decontamination equipment with higher contamination standards is expected to offer promising opportunities for global bio-decontamination equipment market players. Long processing times for complete decontamination and the large size of equipment are some of the major challenges faced by bio decontamination market players. Furthermore, the increasing concern about hospital-acquired infections and the growing elderly population, which is more susceptible to diseases, are expected to be the primary drivers for the growth of the bio-decontamination equipment market.

Bio-Decontamination Equipment Market Segmentation

The worldwide market for bio-decontamination equipment is split based on type, application, and geography.

Bio-Decontamination Equipment Types

- Chamber Decontamination

- Room Decontamination

According to a bio-decontamination equipment market analysis, chamber decontamination holds the major market share. This is due to the fact that chambers provide a completely sealed environment for the decontamination of materials and equipment entering or leaving a containment facility. Chamber decontamination requires less equipment and has a smaller footprint compared to room decontamination. For instance, a decontamination room with an interior chamber size of around 300 ft² has a footprint of 120-130 ft², whereas decontamination chambers of the same 300 ft² interior have a footprint of around 45 ft². Chamber decontamination also consumes less energy than room decontamination. Pharmaceutical manufacturing is a major application of bio-decontamination equipment, as pharmaceutical companies invest more in advanced decontamination equipment due to the aging population and the increasing prevalence of chronic and infectious diseases. Value-added services such as microbial testing and equipment sterilization are offered to pharmaceutical companies.

Bio-Decontamination Equipment Applications

- Pharmaceutical Manufacturing

- Bioscience Research

- Hospital & Healthcare

As per the bio-decontamination equipment market forecast, pharmaceutical manufacturing typically dominates the bio-decontamination equipment market. This is because pharmaceutical manufacturing facilities require highly controlled and sterile environments to produce drugs and other pharmaceutical products. Bio-decontamination equipment is crucial in ensuring that these facilities meet stringent cleanliness and contamination control standards, making it a primary application for such equipment. Additionally, the pharmaceutical industry invests significantly in advanced bio-decontamination equipment due to its critical role in drug manufacturing and regulatory compliance.

Bio-Decontamination Equipment Market Regional Segmentation

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Bio-Decontamination Equipment Market Regional Analysis

North America, notably the United States, accounts for a sizable portion of the worldwide bio-decontamination equipment market. A solid healthcare system, high regulatory requirements, and improved awareness of pollution management are factors driving growth. Pharmaceutical and biotechnology sectors are also present, which helps to market expansion. Technological improvements and government efforts bolster the industry even more.

Europe is another important market for bio-decontamination equipment, with Germany, the United Kingdom, and France leading the way. Strict hygiene and healthcare-associated infection (HAI) requirements boost demand for bio-decontamination solutions. The pharmaceutical and healthcare industries in the region are significant users of such equipment.

The bio-decontamination equipment market is expanding rapidly in the Asia-Pacific region. Growing healthcare spending, a growing population, and more infection control knowledge fuel market growth. Emerging economies such as China and India are important contributors to market growth. To satisfy worldwide quality requirements, pharmaceutical production and research institutes in the region are implementing bio-decontamination technology.

Bio-Decontamination Equipment Market Players

Some of the top bio-decontamination equipment companies offered in our report includes Amira Srl, ClorDiSys Solutions, Inc., Ecolab, Inc., Fedegari Autoclavi S.p.A., Howorth Air Technology Limited, JCE Biotechnology SAS, Solidfog Technologies SPRL, STERIS PLC, TOMI Environmental Solutions, Inc., and Zhejiang TAILIN Bioengineering Co., Ltd.

Frequently Asked Questions

What was the size of the global bio-decontamination equipment market in 2022?

The size of bio-decontamination equipment market was USD 94.2 million in 2022.

What is the bio-decontamination equipment market CAGR from 2023 to 2032?

The bio-decontamination equipment market CAGR during the analysis period of 2023 to 2032 is 6.2%.

Which are the key players in the bio-decontamination equipment market?

The key players operating in the global bio-decontamination equipment market are Amira Srl, ClorDiSys Solutions, Inc., Ecolab, Inc., Fedegari Autoclavi S.p.A., Howorth Air Technology Limited, JCE Biotechnology SAS, Solidfog Technologies SPRL, STERIS PLC, TOMI Environmental Solutions, Inc., and Zhejiang TAILIN Bioengineering Co., Ltd.

Which region dominated the global bio-decontamination equipment market share?

North America region held the dominating position in bio-decontamination equipment industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of bio-decontamination equipment during the analysis period of 2023 to 2032.

What are the current trends in the global bio-decontamination equipment industry?

The current trends and dynamics in the bio-decontamination equipment industry include growing demand for energy-efficient solutions, expanding industrial and commercial sectors, and stringent safety and hygiene regulations.

Which type held the maximum share in 2022?

The chamber decontamination held the maximum share of the bio-decontamination equipment industry.