Bio Based Polypropylene Market | Acumen Research and Consulting

Bio-Based Polypropylene Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

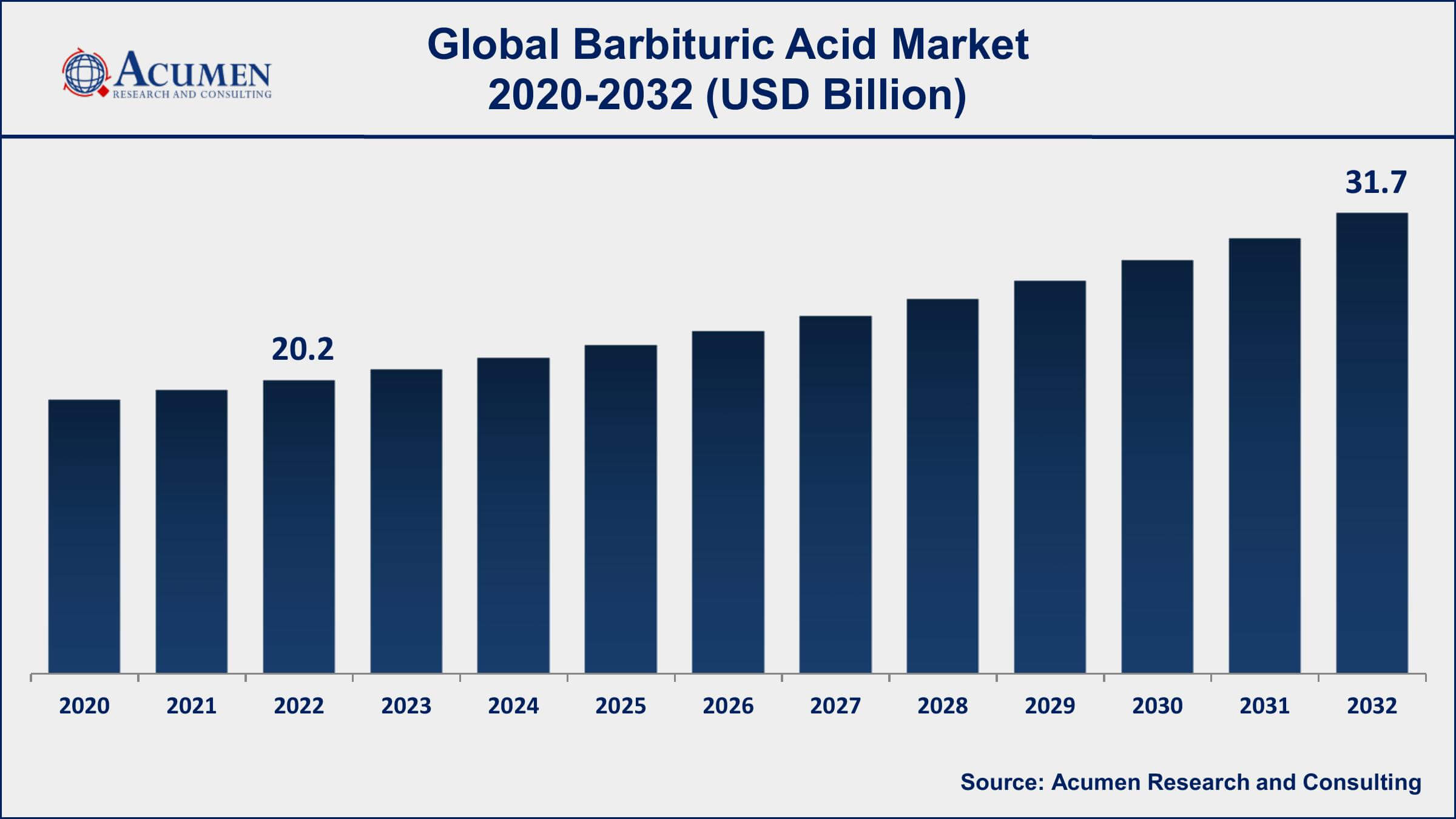

The Global Bio-Based Polypropylene (PP) Market Size accounted for USD 45.9 Million in 2022 and is projected to achieve a market size of USD 91.6 Million by 2032 growing at a CAGR of 7.3% from 2023 to 2032.

Bio-Based Polypropylene Market Highlights

- Global bio-based polypropylene market revenue is expected to increase by USD 91.6 Million by 2032, with a 7.3% CAGR from 2023 to 2032

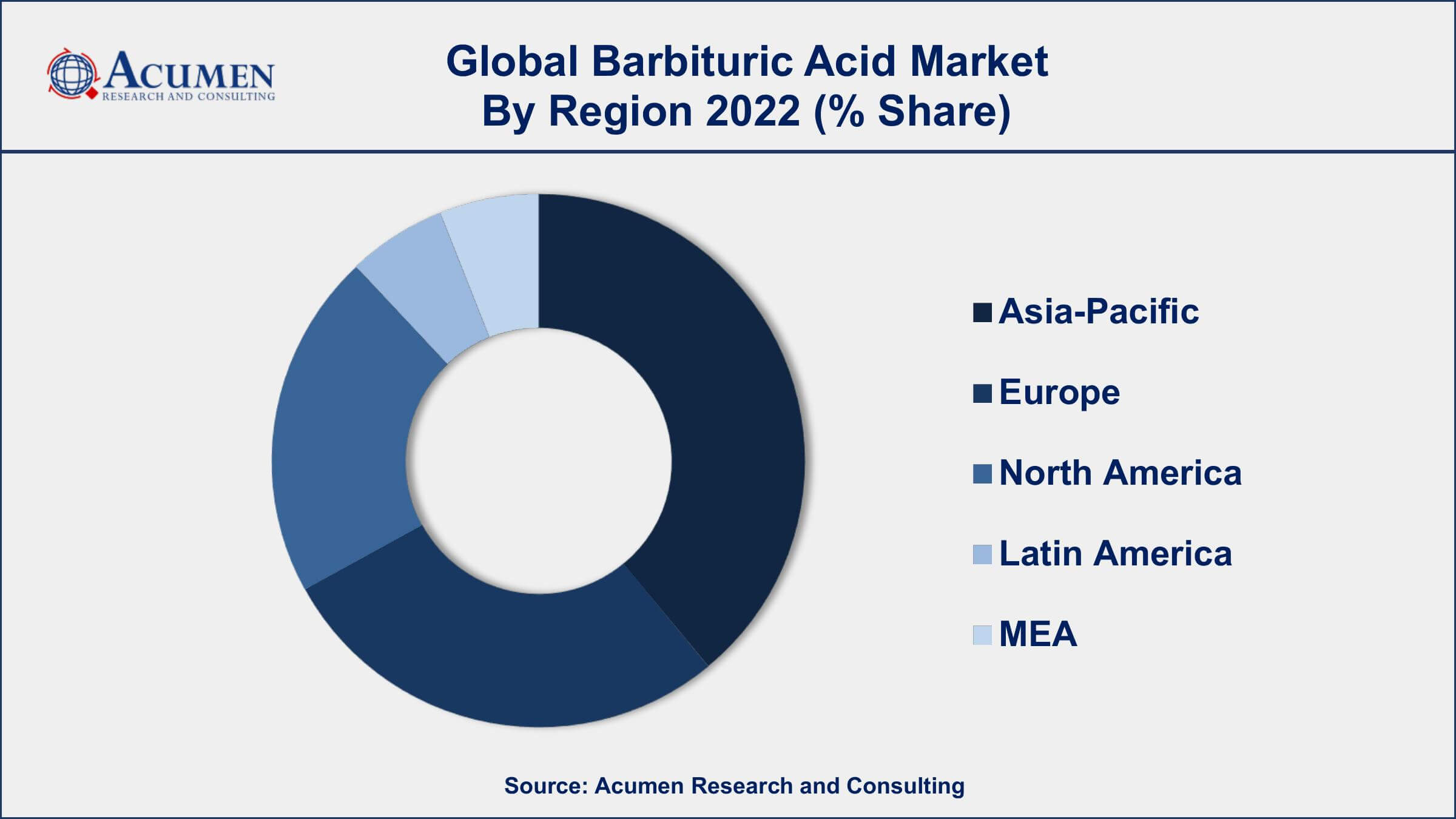

- Europe region led with more than 40% of bio-based polypropylene market share in 2022

- Asia-Pacific bio-based polypropylene market growth will record a CAGR of around 8% from 2023 to 2032

- By source, corn is the largest segment for bio-based polypropylene, accounting for over 42% of the global market share in 2022

- By end-user, the automotive segment is one of the fastest-growing application segments in the market, with a CAGR of 8.2% from 2023 to 2032

- Increasing demand for sustainable packaging solutions, drives the bio-based polypropylene market value

Bio-based polypropylene is a type of polymer that is derived from renewable and sustainable biomass sources such as sugarcane, corn, and other biomass feedstocks. It is a more sustainable and eco-friendly alternative to traditional petroleum-based polypropylene, which is a non-renewable resource and contributes to environmental degradation. Bio-based polypropylene has similar properties to traditional polypropylene and is used in a variety of applications such as packaging, automotive parts, and consumer goods.

The market for bio-based polypropylene has been growing steadily over the past few years due to increased awareness and demand for sustainable and eco-friendly products. The increasing demand for sustainable packaging solutions, the growing automotive industry, and stringent environmental regulations are some of the key factors driving the growth of the market. Furthermore, initiatives by various governments and organizations to promote the use of bio-based materials are also contributing to the growth of the market. For example, the European Union has set a target of achieving 25% of its plastics demand from recycled and bio-based materials by 2030, which is expected to drive the demand for bio-based polypropylene in the region. Overall, the bio-based polypropylene market is expected to continue growing in the coming years as more companies and industries adopt sustainable and eco-friendly practices.

Global Bio-Based Polypropylene Market Trends

Market Drivers

- Increasing demand for sustainable packaging solutions

- Growing automotive industry

- Stringent environmental regulations

- Rising awareness about the harmful impact of plastic waste on the environment

- Government initiatives to promote the use of bio-based materials

Market Restraints

- High production costs compared to traditional polypropylene

- Limited availability of raw materials for bio-based polypropylene

Market Opportunities

- Advancements in technology and manufacturing processes

- Development of new and innovative applications for bio-based polypropylene

Bio-Based Polypropylene Market Report Coverage

| Market | Bio-Based Polypropylene Market |

| Bio-Based Polypropylene Market Size 2022 | USD 45.9 Billion |

| Bio-Based Polypropylene Market Forecast 2032 | USD 91.6 Billion |

| Bio-Based Polypropylene Market CAGR During 2023 - 2032 | 7.3% |

| Bio-Based Polypropylene Market Analysis Period | 2020 - 2032 |

| Bio-Based Polypropylene Market Base Year | 2022 |

| Bio-Based Polypropylene Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Source, By Application, By End-user, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Braskem, Total Corbion PLA, Biobent Polymers, Trellis Bioplastics, NatureWorks LLC, FKuR Kunststoff GmbH, Danimer Scientific, BioLogiQ Inc., API SpA, Corbion, Novamont, and Bio-On S.p.A. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Increasing demand for bio-based polymers from the manufacturers of various end-use industries in order to lower the carbon footprints, coupled with stringent government regulation related to the use of synthetic polymers are major factors expected to drive the growth of the global market. In addition, high investment by major players for R&D activities and innovative product offerings are among other factors expected to further support the growth of the target market.

The developing food & beverage industry, an increasing number of manufacturers in the US, coupled with high adoption of bio-based PP for various processes such as coating, printing, and laminating is another major factor expected to support the growth of the target market

Major players are focused on increasing their business presence in developing economies due to the easy availability of raw materials and low-cost labor. They are focused on collaborative work in order strategic partnerships in order to increase the business presence and enhance the profit ratio this is another important factor expected to augment the growth of the target market.

- In 2019, Borealis and Neste signed a strategic agreement for the production of renewable polypropylene (PP). This is expected to help the company to enhance its customer base and increase its profit ratio.

- In 2019, Mitsui Chemicals is undertaking a project in order to develop and deliver bio-polypropylene in an effort to achieve its sustainable development goals. This is expected to help the company to enhance its customer base.

- In 2019, LyondellBasel the largest plastics, chemicals, and refining company signed a collaborative contract with Neste in order to produce bio-based polypropylene and bio-based low-density polyethylene at a commercial scale.

However, factors such as the high cost of operation and fluctuation in raw material supply are expected to hamper the growth of the global bio-based polypropylene market. In addition, the availability of other alternatives is another factor expected to further challenge the growth of the target market.

Rapid technological advancements in cost-effective production techniques and high investment in R&D activities in order to deliver innovative products are factors expected to create new opportunities for players operating in the target market over the forecast period. In addition, increasing partnership and agreement activities for business development is another factor expected to revenue support the growth of the target market.

Bio-Based Polypropylene Market Segmentation

The global bio-based polypropylene market segmentation is based on source, application, end-user, and geography.

Bio-Based Polypropylene Market By Source

- Corn

- Beet

- Sugarcane

- Others

According to the bio-based polypropylene industry analysis, the corn segment accounted for the largest market share in 2022. Corn-based bio-based polypropylene is derived from cornstarch and is a more sustainable and eco-friendly alternative to traditional petroleum-based polypropylene. The corn segment is expected to grow significantly in the coming years due to increasing demand for sustainable packaging solutions and the growing automotive industry. The increasing demand for corn-based bio-based polypropylene is mainly driven by the availability of corn as a low-cost and renewable feedstock, as well as the high adoption of corn-based bio-based polypropylene in the packaging industry.

Bio-Based Polypropylene Market By Application

- Injection

- Textile

- Films

- Others

In terms of applications, the injection segment is expected to witness significant growth in the coming years. Injection molding is a process used to manufacture plastic products by injecting molten material into a mold. Bio-based polypropylene is increasingly being used in injection molding applications due to its similar properties to traditional polypropylene, as well as its sustainable and eco-friendly nature. The injection segment is expected to grow at a significant rate in the coming years due to increasing demand for sustainable and eco-friendly products, especially in the packaging industry. The growth of the injection segment is mainly driven by the increasing use of bio-based polypropylene in the production of sustainable packaging solutions, such as food packaging, cosmetics packaging, and medical packaging, as well as in the automotive industry for interior and exterior parts.

Bio-Based Polypropylene Market By End-user

- Automotive

- Construction

- Electronics

- Industrial applications

- Others

According to the bio-based polypropylene market forecast, the automotive segment is expected to witness significant growth in the coming years. The automotive industry is one of the major end-use industries for bio-based polypropylene, with the material being used in various applications such as interior parts, exterior trims, and under-the-hood components. Bio-based polypropylene is a sustainable and eco-friendly alternative to traditional petroleum-based polypropylene, offering advantages such as a lower carbon footprint, higher biodegradability, and reduced dependence on non-renewable resources. The automotive segment is expected to grow at a significant rate in the coming years, driven by the increasing demand for sustainable and eco-friendly automotive components. Moreover, bio-based polypropylene is being increasingly used in the production of lightweight automotive components, which can help improve fuel efficiency and reduce emissions.

Bio-Based Polypropylene Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Bio-Based Polypropylene Market Regional Analysis

Europe is currently dominating the bio-based polypropylene market due to various factors such as favorable government regulations, high demand for sustainable products, and increasing investments in research and development. The European Union has set ambitious targets for reducing greenhouse gas emissions and promoting sustainable practices, which has led to the adoption of policies and regulations promoting the use of bio-based materials. This has created a favorable environment for the growth of the bio-based polypropylene market in the region. Moreover, Europe is home to many leading players in the bio-based polypropylene market, who are investing heavily in research and development to improve the properties of bio-based polypropylene and reduce its production costs. This has led to the development of new and innovative bio-based polypropylene products that are suitable for a wide range of applications, including packaging, automotive, and construction.

Bio-Based Polypropylene Market Player

Some of the top bio-based polypropylene market companies offered in the professional report include Braskem, Total Corbion PLA, Biobent Polymers, Trellis Bioplastics, NatureWorks LLC, FKuR Kunststoff GmbH, Danimer Scientific, BioLogiQ Inc., API SpA, Corbion, Novamont, and Bio-On S.p.A.

Frequently Asked Questions

What was the market size of the global bio-based polypropylene in 2022?

The market size of bio-based polypropylene was USD 45.9 Million in 2022.

What is the CAGR of the global bio-based polypropylene market from 2023 to 2032?

The CAGR of bio-based polypropylene is 7.3% during the analysis period of 2023 to 2032.

Which are the key players in the bio-based polypropylene market?

The key players operating in the global market are including Braskem, Total Corbion PLA, Biobent Polymers, Trellis Bioplastics, NatureWorks LLC, FKuR Kunststoff GmbH, Danimer Scientific, BioLogiQ Inc., API SpA, Corbion, Novamont, and Bio-On S.p.A.

Which region dominated the global bio-based polypropylene market share?

Europe held the dominating position in bio-based polypropylene industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of bio-based polypropylene during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global bio-based polypropylene industry?

The current trends and dynamics in the bio-based polypropylene industry include increasing demand for sustainable packaging solutions, growing automotive industry, stringent environmental regulations, and rising awareness about the harmful impact of plastic waste on the environment.

Which application held the maximum share in 2022?

The injection application held the maximum share of the bio-based polypropylene industry.