Bio-Based Lubricants Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

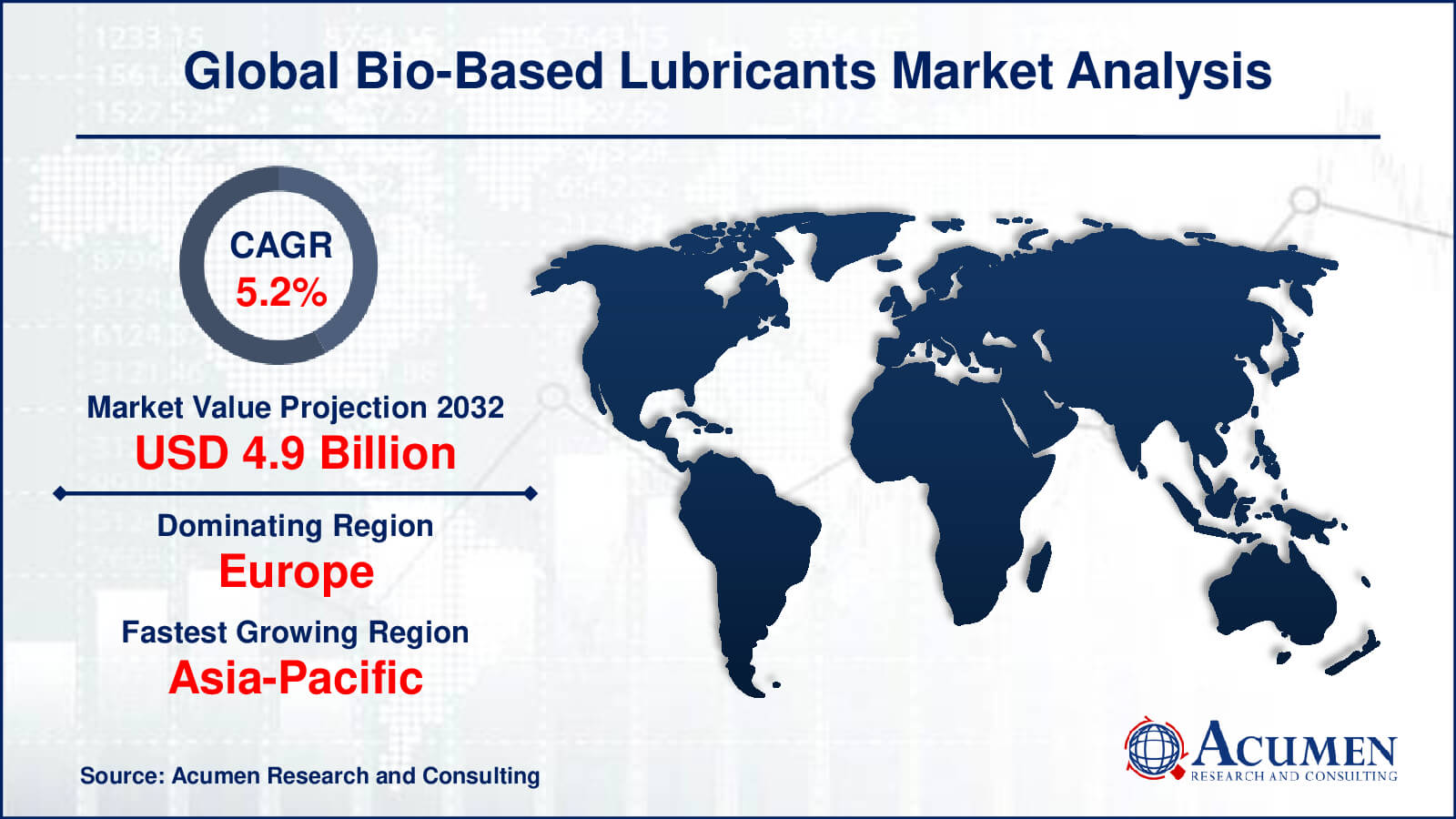

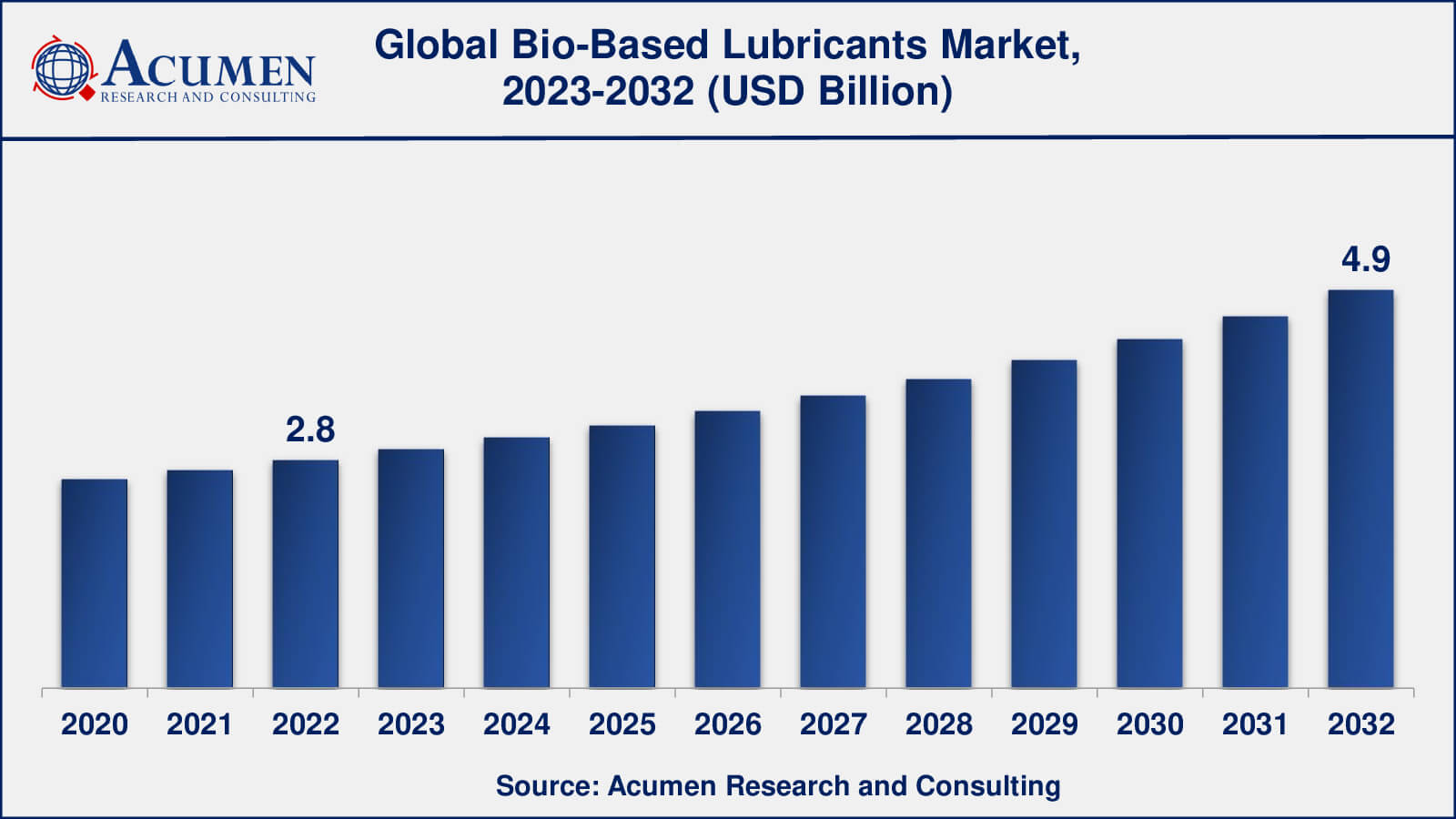

The Global Bio-Based Lubricants Market Size collected USD 2.8 Billion in 2022 and is set to achieve a market size of USD 4.9 Billion in 2032 growing at a CAGR of 5.2% from 2023 to 2032.

Over the past decades, the rising concern and awareness towards the usage of products derived from petroleum and their harmful environmental impact have generated a huge opportunity to produce environment-friendly lubricants. The benefits of environmentally suitable products include negligible health and safety risks along with less amount of pollution. The environmental effect of lubricants is observed at all stages of usage, production, and disposal. However, it should be harmless to humans through inhalation and contact during both use and production. Ecological disasters can be caused by accidental losses that occur during spills to environmentally sensitive areas such as waterways, forestry, construction, agriculture, harbors, and mining. Therefore, owing to these reasons and in return to public awareness, there are desirable rules that designate the usage of environmentally friendly lubricating fluids. Therefore, it has created a huge opportunity to produce environmentally acceptable lubricants that are obtained from natural esters such as vegetable oils.

Owing to their low toxicity, high biodegradability, and environment-friendly nature, there is a large interest in bio-based lubricants obtained from renewable resources such as vegetable oils. Various pathways are being created into various lubrication productions such as fuels, hydraulic fluids, petroleum fuel additives, engine oils, and metalworking fluids owing to the natural abundance and high lubricity of vegetable oils, especially monoesters. Also, there is an increasing demand for vegetable oils every year. For instance, in 1980, the annual production of vegetable oil across the world was 55 million metric tons (MMT) and it rose to 100 MMT by 2000. It has been projected that by 2020 it will be around 200 MMT.

Bio-Based Lubricants Market Report Statistics

- Global bio-based lubricants market revenue is estimated to reach USD 4.9 Billion by 2032 with a CAGR of 5.2% from 2023 to 2032

- Europe bio-based lubricants market value occupied more than USD 1.4 billion in 2022

- Asia-Pacific bio-based lubricants market growth will register a CAGR of around 5% from 2023 to 2032

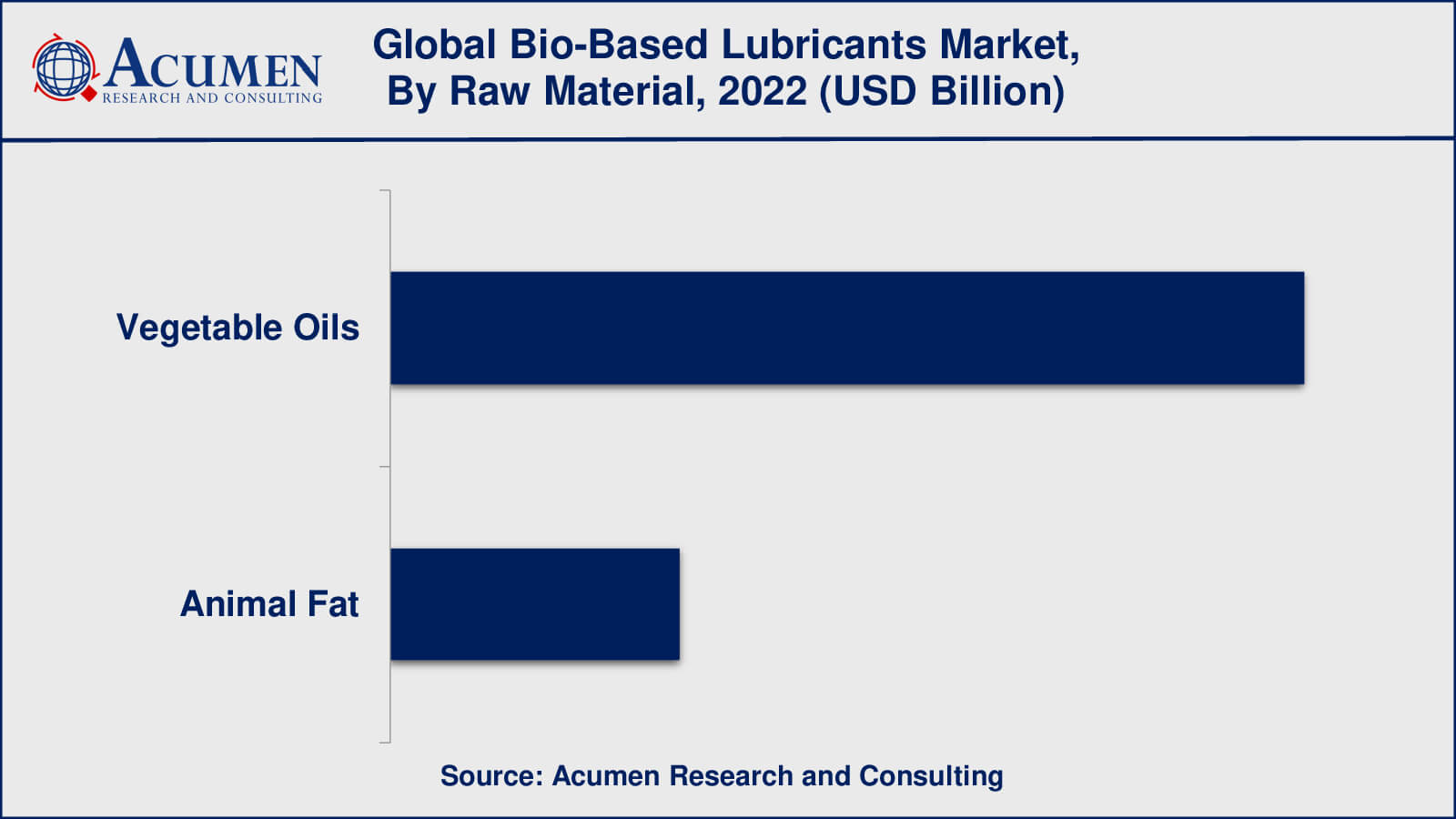

- Among raw material, the vegetable oils sub-segment generated around 75% share in 2022

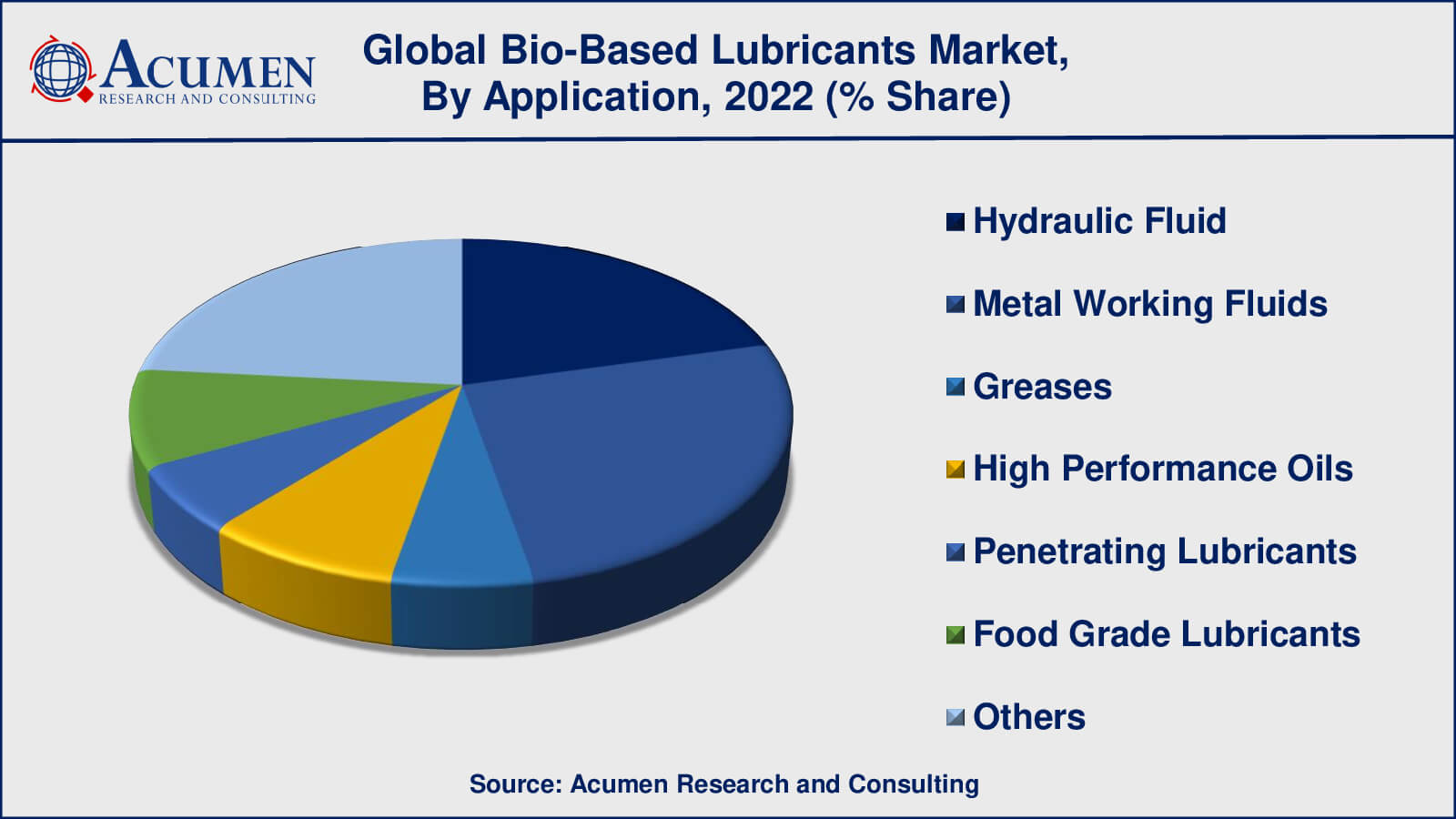

- Based on application, the metal working fluids bio-based lubricants generated US $ 728 million revenue in 2022

- Increasing adoption in automotive industry is a popular bio-based lubricants market trend that fuels the industry demand

Global Bio-Based Lubricants Market Dynamics

Market Drivers

- Increasing demand for environmentally friendly lubricants

- Growing demand from end-use industries

- Rising popularity for sustainable products

Market Restraints

- High cost

- Limited availability of raw materials

Market Opportunities

- Increase in research and development

- Advancements in technology

Bio-Based Lubricants Market Report Coverage

| Market | Bio-Based Lubricants Market |

| Bio-Based Lubricants Market Size 2022 | USD 2.8 Billion |

| Bio-Based Lubricants Market Forecast 2032 | USD 4.9 Billion |

| Bio-Based Lubricants Market CAGR During 2023 - 2032 | 5.2% |

| Bio-Based Lubricants Market Analysis Period | 2020 - 2032 |

| Bio-Based Lubricants Market Base Year | 2022 |

| Bio-Based Lubricants Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Raw Material, By Application, By End-User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | BioBlend Renewable Resources, LLC, BP p.l.c., Chevron Corporation, Environmental Lubricants Manufacturing, Inc., Exxon Mobil Corporation, Houghton International, Inc., Panolin AG, Royal Dutch Shell plc, Renewable Lubricants, Inc., and Total S.A. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Bio-Based Lubricants Market Growth Factors

A large part of bio based lubricant market mainly comprises from vegetable oil and oilseeds. Also, majority of the bio lubricants are made from esters. Firstly, there are natural esters which are triglycerides of vegetable oils. Also, oleo chemical esters of fatty acids like di-esters, polyol esters, and complex esters are present. A number of these kind of lubricating materials are obtained from numerous cultures, typically either sunflower or rapeseed. However, they can also be produced from exotic oils. Depending upon the usage, fatty acids can also be obtained from palm and coconut oil. These oils possess different properties as compared to those that are more commonly used, specifically in terms of oxidation stability. Therefore, owing to these reasons and in return to public awareness, there are desirable rules that designate the usage of environment friendly lubricating fluids. Therefore, it has created huge opportunity to produce environmentally acceptable lubricants that are obtained from natural esters such as vegetable oils.

Bio-Based Lubricants are mostly for the lubrication of chain saws. While it is being used, the oil has to deal with the centrifugal force and is spread over the entire floor. In order to optimize the equipment operation like harvesters, tractors, load carriers or cranes, these Raw Materials of lubricants play the role of hydraulic fluids. In order to lubricate components that cannot be constantly covered with oil, they are also used in greases. Bio-Based Lubricants are also utilized for lubricating engines. In fact, the motor oils produced from plant based oils have been developed to deal with high thermal stresses.

The major factors boosting the growth of bio-based lubricants market include legislations supporting the use of bio-lubricants and the growth in end user industries such as transportation. But, price volatility in mineral oil prices and high amount of production cost can impede the growth of this market. Huge opportunities are present for bio based lubricant manufacturers owing to the accelerated industrialization taking place in emerging countries.

Bio-Based Lubricants Market Segmentation

The worldwide bio-based lubricants market is categorized based on raw material, application, end-user, and geography.

Bio-Based Lubricants Market By Raw Material

- Vegetable Oils

- Animal Fat

According to a bio-based lubricants industry analysis, vegetable oils have the largest market share in the bio-based lubricants market. This is due to vegetable oils are more widely available and have several advantages as a raw material over animal fat. Vegetable oils are derived from a variety of plants such as rapeseed, soybean, palm, sunflower, and coconut, which are abundant and renewable resources. Furthermore, vegetable oils have good oxidative stability and excellent lubricity, making them suitable for a variety of industrial applications. Animal fat, on the other hand, is less commonly used as a raw material due to its scarcity, higher cost, and potential for quality variation. While some animal fat-based bio-based lubricants are employed in niche applications, they have a small market share in comparison to vegetable oil-based bio-based lubricants.

Bio-Based Lubricants Market By Application

- Hydraulic Fluid

- Metal Working Fluids

- Greases

- High Performance Oils

- Penetrating Lubricants

- Food Grade Lubricants

- Others

The largest application segment in the bio-based lubricants market varies by region, but hydraulic fluid and metalworking fluids are two of the most widely used globally. Hydraulic fluids are used in hydraulic machinery and equipment such as earthmoving equipment, cranes, and hydraulic presses to transmit power. Because of their biodegradability and improved environmental performance, bio-based hydraulic fluids are becoming more popular. Furthermore, bio-based hydraulic fluids outperform traditional petroleum-based hydraulic fluids in terms of thermal and oxidative stability. During machining and metal forming operations, metalworking fluids are used to cool, lubricate, and protect metalworking equipment. Bio-based metalworking fluids outperform petroleum-based fluids in terms of biodegradability, toxicity, and performance.

Bio-Based Lubricants Market By End-User

- Transportation

- Industrial

The transportation end-user accounts for a larger share of the market than the industrial sector, according to the bio-based lubricants market forecast, from 2023 to 2032. The transportation sector includes, among other things, the automotive, marine, and aviation industries. Because of their superior environmental performance and regulatory compliance, bio-based lubricants are increasingly being used in the transportation sector. They are found in a variety of products, including engine oils, gear oils, and transmission fluids. In particular, the automotive industry is a major user of bio-based lubricants, as automakers are looking increasingly to reduce their carbon footprint and meet extremely strict emissions regulations. Manufacturing, mining, construction, and agriculture are just a few of the applications in the industrial sector. Bio-based lubricants are used in a variety of industrial applications, including metalworking fluids, hydraulic fluids, and greases.

Bio-Based Lubricants Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Bio-Based Lubricants Market Regional Analysis

Due to the region's strict environmental rules and rising demand for environmentally friendly products, Europe is a sizable market for bio-based lubricants. The biggest European markets for bio-based lubricants are in Germany, France, and the UK. The market for bio-based lubricants in the Asia-Pacific area is anticipated to grow at the fastest rate thanks to the region's booming industrial sector, rising demand for eco-friendly products, and favorable governmental regulations. The biggest markets in the region for bio-based lubricants are China, India, and Japan.

Bio-Based Lubricants Market Players

Some of the leading bio-based lubricants companies include BioBlend Renewable Resources, LLC, BP p.l.c., Chevron Corporation, Environmental Lubricants Manufacturing, Inc., Exxon Mobil Corporation, Houghton International, Inc., Panolin AG, Royal Dutch Shell plc, Renewable Lubricants, Inc., and Total S.A.

Frequently Asked Questions

What was the market size of the global bio-based lubricants in 2022?

The market size of bio-based lubricants was USD 2.8 Billion in 2022.

What is the CAGR of the global bio-based lubricants market during forecast period of 2023 to 2032?

The CAGR of bio-based lubricants market is 5.2% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global market are BioBlend Renewable Resources, LLC, BP p.l.c., Chevron Corporation, Environmental Lubricants Manufacturing, Inc., Exxon Mobil Corporation, Houghton International, Inc., Panolin AG, Royal Dutch Shell plc, Renewable Lubricants, Inc., and Total S.A.

Which region held the dominating position in the global bio-based lubricants market?

Europe held the dominating position in bio-based lubricants market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for bio-based lubricants market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global bio-based lubricants market?

The current trends and dynamics in the bio-based lubricants industry include increasing demand for environmentally friendly lubricants, growing demand from end-use industries, and rising popularity for sustainable products.

Which raw material held the maximum share in 2022?

The vegetable oils raw material held the maximum share of the bio-based lubricants market.