Beverage Flavoring Systems Market | Acumen Research and Consulting

Beverage Flavoring Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

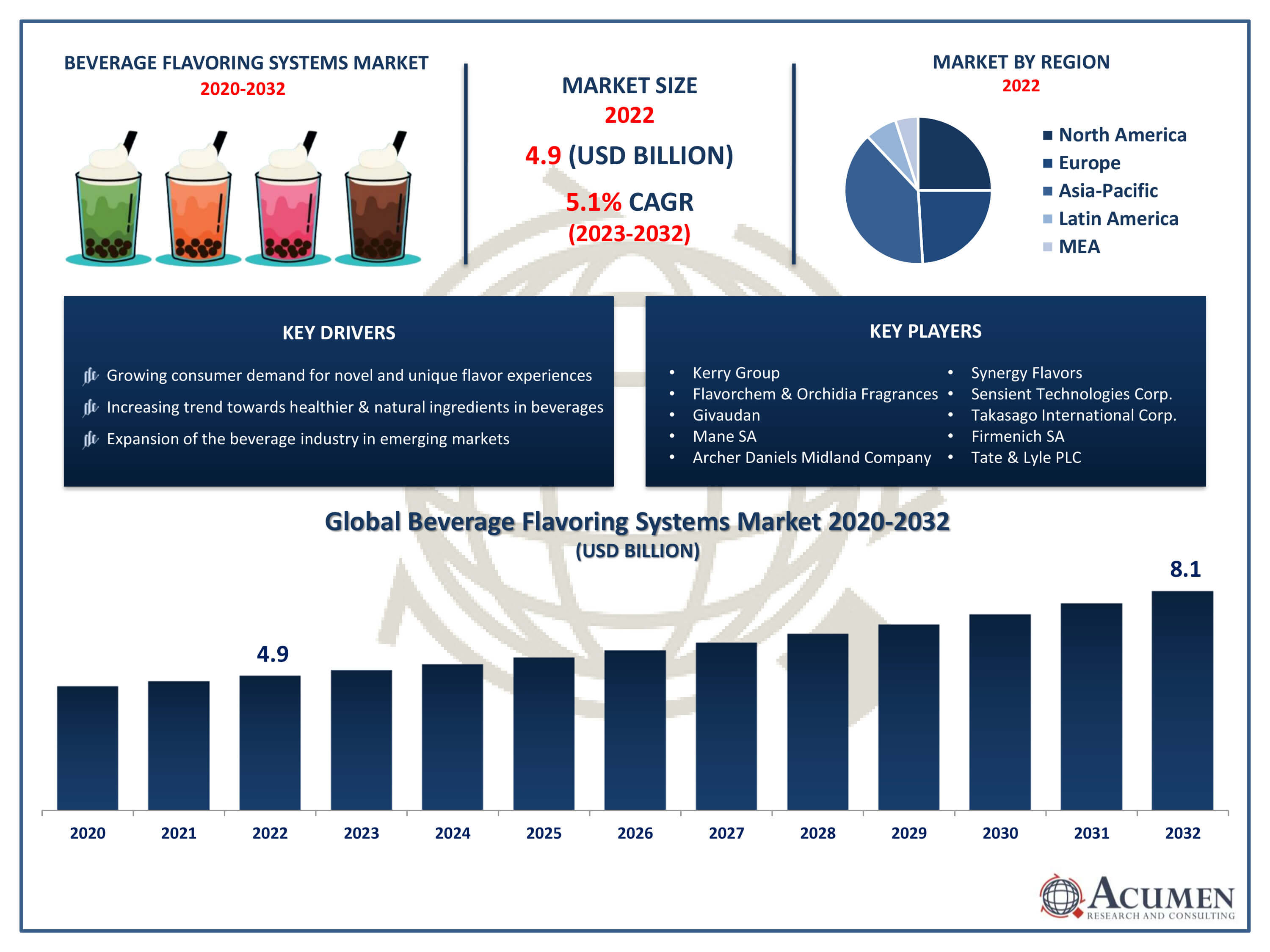

The Beverage Flavoring Systems Market Size accounted for USD 4.9 Billion in 2022 and is projected to achieve a market size of USD 8.1 Billion by 2032 growing at a CAGR of 5.1% from 2023 to 2032.

Beverage Flavoring Systems Market Highlights

- Global beverage flavoring systems market revenue is expected to increase by USD 8.1 Billion by 2032, with a 5.1% CAGR from 2023 to 2032

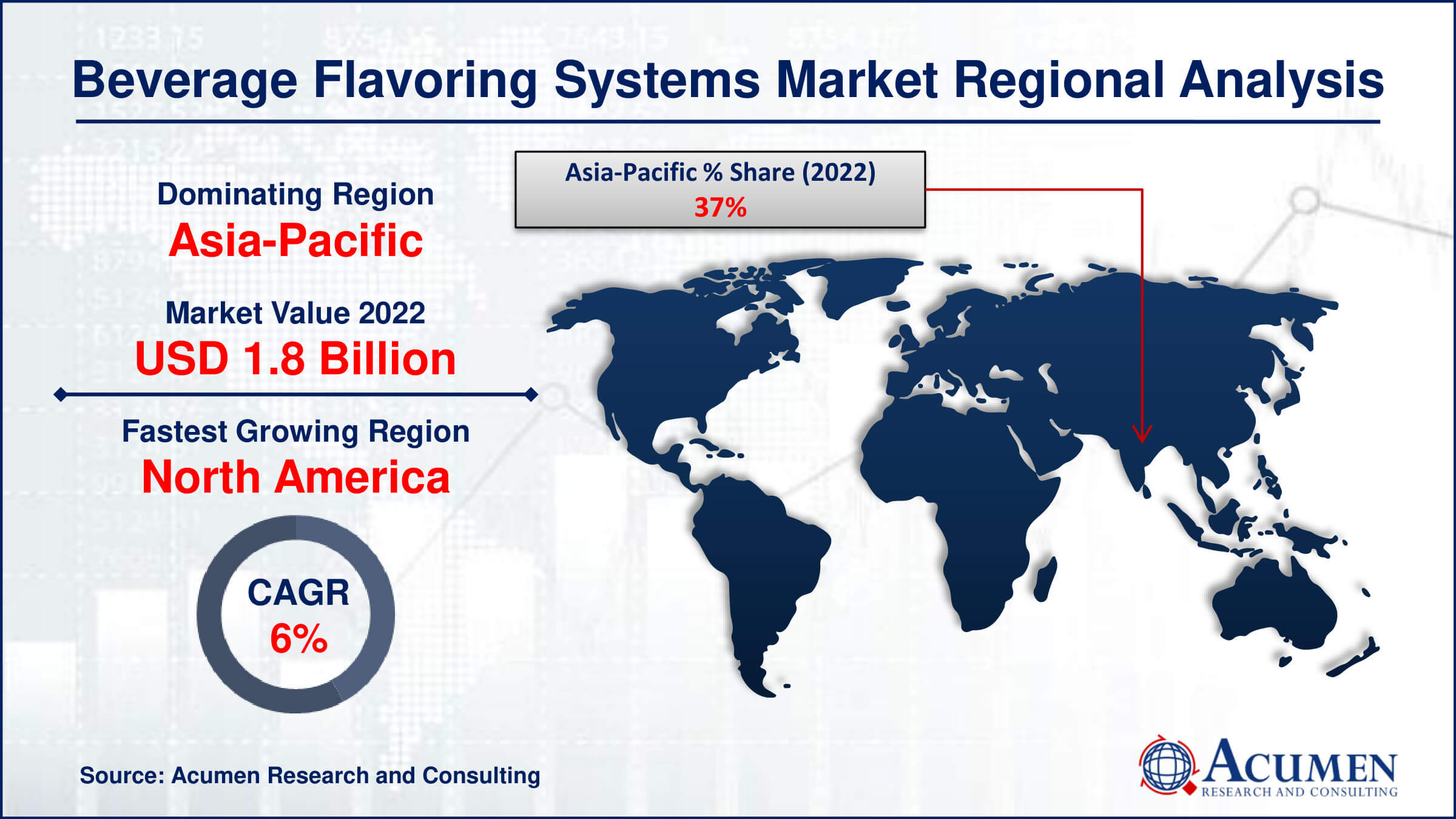

- Asia-Pacific region led with more than 37% of beverage flavoring systems market share in 2022

- North America beverage flavoring systems market growth will record a CAGR of more than 5.7% from 2023 to 2032

- By ingredients, the flavoring agents segment captured more than 70% of revenue share in 2022.

- By beverage type, the non-alcoholic segment is projected to expand at the fastest CAGR over the projected period

- Growing consumer demand for novel and unique flavor experiences, drives the beverage flavoring systems market value

Beverage flavoring systems are complex formulations designed to enhance and modify the taste, aroma, and overall sensory experience of beverages. These systems typically consist of various ingredients such as natural and artificial flavors, sweeteners, acids, colors, and masking agents. They are used by beverage manufacturers to create a wide range of products including carbonated soft drinks, juices, energy drinks, flavored water, sports drinks, and alcoholic beverages. The goal of beverage flavoring systems is to meet consumer preferences for unique and appealing flavor profiles while also addressing factors such as cost, stability, and regulatory compliance.

The market for beverage flavoring systems has experienced significant growth in recent years, driven by several factors. One key driver is the increasing demand for innovative and differentiated beverage products in both developed and emerging markets. Consumers are seeking novel flavor experiences and are willing to experiment with new and exotic flavors. Additionally, the growing trend towards healthier and natural ingredients has led to the development of flavoring systems using more natural and clean label ingredients, such as plant-derived flavors and natural sweeteners. Furthermore, the expansion of the beverage industry, particularly in regions like Asia-Pacific and Latin America, has provided opportunities for flavoring system manufacturers to tap into new markets and diversify their product offerings.

Global Beverage Flavoring Systems Market Trends

Market Drivers

- Growing consumer demand for novel and unique flavor experiences

- Increasing trend towards healthier and natural ingredients in beverages

- Expansion of the beverage industry in emerging markets

- Technological advancements in flavor encapsulation and delivery systems

- Rising demand for personalized and customizable beverage options

Market Restraints

- Stringent regulations and safety standards governing food additives

- Fluctuating prices of raw materials such as natural flavors and sweeteners

Market Opportunities

- Growing popularity of functional beverages with added health benefits

- Expansion of e-commerce platforms for direct-to-consumer sales

Beverage Flavoring Systems Market Report Coverage

| Market | Beverage Flavoring Systems Market |

| Beverage Flavoring Systems Market Size 2022 | USD 4.9 Billion |

| Beverage Flavoring Systems Market Forecast 2032 | USD 8.1 Billion |

| Beverage Flavoring Systems Market CAGR During 2023 - 2032 | 5.1% |

| Beverage Flavoring Systems Market Analysis Period | 2020 - 2032 |

| Beverage Flavoring Systems Market Base Year |

2022 |

| Beverage Flavoring Systems Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Ingredients, By Beverage Type, By Flavor Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Kerry Group, Flavorchem&Orchidia Fragrances, Givaudan, International Flavors & Fragrances Inc., Mane SA, Archer Daniels Midland Company, Synergy Flavors, Sensient Technologies Corporation, Takasago International Corporation, Firmenich SA, and Tate & Lyle PLC. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Beverage flavoring systems are sophisticated formulations crafted to enhance and diversify the taste, aroma, and overall sensory experience of various beverages. These systems typically comprise a blend of natural and artificial flavors, sweeteners, acids, colors, and other additives, meticulously calibrated to achieve desired flavor profiles. Beverage manufacturers utilize flavoring systems across a broad spectrum of products, ranging from carbonated soft drinks and juices to energy drinks, flavored water, sports beverages, and alcoholic drinks. The primary objective behind employing such systems is to cater to evolving consumer preferences for distinctive and enticing flavor combinations while also addressing considerations such as cost-effectiveness, stability, and regulatory compliance. The applications of beverage flavoring systems are manifold and versatile, spanning across different beverage categories and consumer segments. In the realm of carbonated soft drinks, flavoring systems play a crucial role in creating iconic tastes like cola, lemon-lime, and orange, while also facilitating the development of innovative and seasonal flavors to capture consumer interest.

The beverage flavoring systems market has witnessed robust growth in recent years, fueled by evolving consumer preferences and the constant drive for innovation within the beverage industry. With consumers increasingly seeking novel taste experiences, beverage manufacturers are turning to flavoring systems to differentiate their products and cater to diverse palates. This trend has led to a surge in demand for flavoring systems across various beverage categories, including carbonated soft drinks, juices, flavored water, energy drinks, and alcoholic beverages. Additionally, the growing awareness of health and wellness among consumers has spurred the demand for natural and clean label ingredients in beverage flavoring systems, further driving market growth. Moreover, the globalization of taste preferences and the expanding middle-class population in emerging economies have opened up new avenues for market expansion. Regions such as Asia-Pacific and Latin America have emerged as key growth markets for beverage flavoring systems, presenting manufacturers with lucrative opportunities for market penetration and product diversification.

Beverage Flavoring Systems Market Segmentation

The global beverage flavoring systems market segmentation is based on ingredients, beverage type, flavor type, and geography.

Beverage Flavoring Systems Market By Ingredients

- Flavoring agents

- Flavor enhancers

- Flavoring carriers

- Others

According to the beverage flavoring systems industry analysis, the flavoring agents segment accounted for the largest market share in 2022. One key driver is the increasing consumer demand for diverse and unique taste experiences across a wide range of beverages. This demand has led to a surge in the development and utilization of various flavoring agents, including natural and artificial flavors, to create innovative and appealing beverage products. Moreover, the rising preference for healthier and natural ingredients has spurred the adoption of flavoring agents derived from sources such as fruits, herbs, and botanicals, driving further growth in this segment. Additionally, advancements in food science and technology have enabled manufacturers to enhance the performance and versatility of flavoring agents, leading to their widespread application in different beverage categories.

Beverage Flavoring Systems Market By Beverage Type

- Alcoholic

- Non-alcoholic

- Juices

- Dairy

- Functional Drinks

- Carbonated soft drinks

- Others

In terms of beverage types, the non-alcoholic segment is expected to witness significant growth in the coming years. This growth is driven by shifting consumer preferences towards healthier lifestyles and the increasing availability of non-alcoholic beverage options. As health-conscious consumers seek alternatives to traditional sugary drinks and alcoholic beverages, there has been a surge in demand for flavored non-alcoholic beverages such as flavored water, functional drinks, and ready-to-drink teas and coffees. This trend has propelled beverage manufacturers to invest in innovative flavoring systems to develop a wide array of non-alcoholic beverages that offer refreshing flavors and added health benefits. Furthermore, the growing trend of premiumization within the non-alcoholic beverage sector has created opportunities for flavoring systems manufacturers to cater to discerning consumers seeking high-quality and indulgent beverage experiences.

Beverage Flavoring Systems Market By Flavor Type

- Chocolate and browns

- Fruits & vegetables

- Herbs & botanicals

- Dairy

- Others

According to the beverage flavoring systems market forecast, the fruits & vegetables segment is expected to witness significant growth in the coming years. With consumers increasingly prioritizing health and wellness, there has been a surge in demand for beverages featuring natural and nutritious ingredients. Fruits and vegetables offer a plethora of flavors, colors, and nutritional benefits, making them highly sought-after ingredients in beverage formulations. As a result, beverage manufacturers are leveraging fruit and vegetable-based flavoring systems to create a wide range of refreshing and health-conscious beverages such as fruit juices, smoothies, vegetable-infused waters, and plant-based dairy alternatives. Moreover, the growing consumer preference for clean label products has fueled the adoption of fruit and vegetable-based flavoring systems as they are perceived as natural and minimally processed ingredients. This trend aligns with the increasing awareness of the health benefits associated with consuming whole fruits and vegetables, driving further growth in this segment.

Beverage Flavoring Systems Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Beverage Flavoring Systems Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the beverage flavoring systems market due to several factors contributing to its rapid growth and dominance. One of the primary drivers is the region's burgeoning population coupled with rising disposable incomes and urbanization trends. As a result, there has been a significant increase in the consumption of a wide variety of beverages, ranging from carbonated soft drinks to functional beverages, driving demand for flavoring systems. Moreover, the diverse and dynamic culinary landscape across Asia-Pacific nations has led to a rich tapestry of flavors and taste preferences, creating a fertile ground for innovation in beverage flavoring systems. Manufacturers are capitalizing on this diversity by developing customized flavor profiles tailored to meet the specific tastes of different demographics within the region. Additionally, the increasing awareness of health and wellness among consumers in Asia-Pacific has fueled demand for natural and clean label ingredients in beverage formulations. Flavoring systems derived from fruits, herbs, and botanicals are particularly popular as consumers seek healthier alternatives to traditional sugary beverages.

Beverage Flavoring Systems Market Player

Some of the top beverage flavoring systems market companies offered in the professional report include Kerry Group, Flavorchem&Orchidia Fragrances, Givaudan, International Flavors & Fragrances Inc., Mane SA, Archer Daniels Midland Company, Synergy Flavors, Sensient Technologies Corporation, Takasago International Corporation, Firmenich SA, and Tate & Lyle PLC.

Frequently Asked Questions

How big is the beverage flavoring systems market?

The beverage flavoring systems market size was USD 4.9 Billion in 2022.

What is the CAGR of the global beverage flavoring systems market from 2023 to 2032?

What is the CAGR of the global beverage flavoring systems market from 2023 to 2032?

Which are the key players in the beverage flavoring systems market?

The key players operating in the global market are including Kerry Group, Flavorchem&Orchidia Fragrances, Givaudan, International Flavors & Fragrances Inc., Mane SA, Archer Daniels Midland Company, Synergy Flavors, Sensient Technologies Corporation, Takasago International Corporation, Firmenich SA, and Tate & Lyle PLC.

Which region dominated the global beverage flavoring systems market share?

Asia-Pacific held the dominating position in beverage flavoring systems industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of beverage flavoring systems during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global beverage flavoring systems industry?

The current trends and dynamics in the beverage flavoring systems industry include growing consumer demand for novel and unique flavor experiences, increasing trend towards healthier and natural ingredients in beverages, and technological advancements in flavor encapsulation and delivery systems.

Which beverage type held the maximum share in 2022?

The non-alcoholic beverage type held the maximum share of the beverage flavoring systems industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date