Battery Electrolyte Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Battery Electrolyte Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

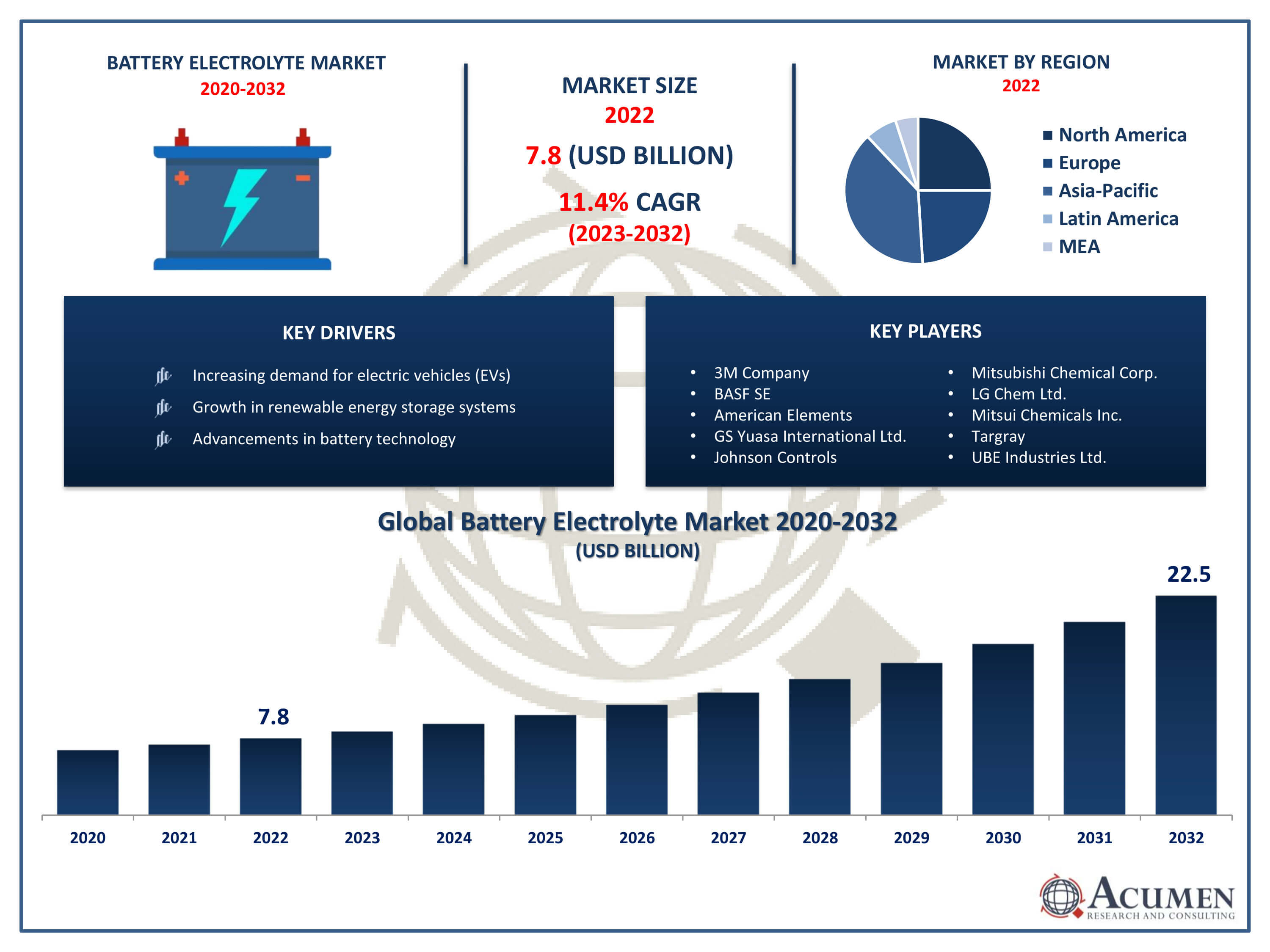

The Battery Electrolyte Market Size accounted for USD 7.8 Billion in 2022 and is projected to achieve a market size of USD 22.5 Billion by 2032 growing at a CAGR of 11.4% from 2023 to 2032.

Battery Electrolyte Market Highlights

- Global battery electrolyte market revenue is expected to increase by USD 22.5 Billion by 2032, with a 11.4% CAGR from 2023 to 2032

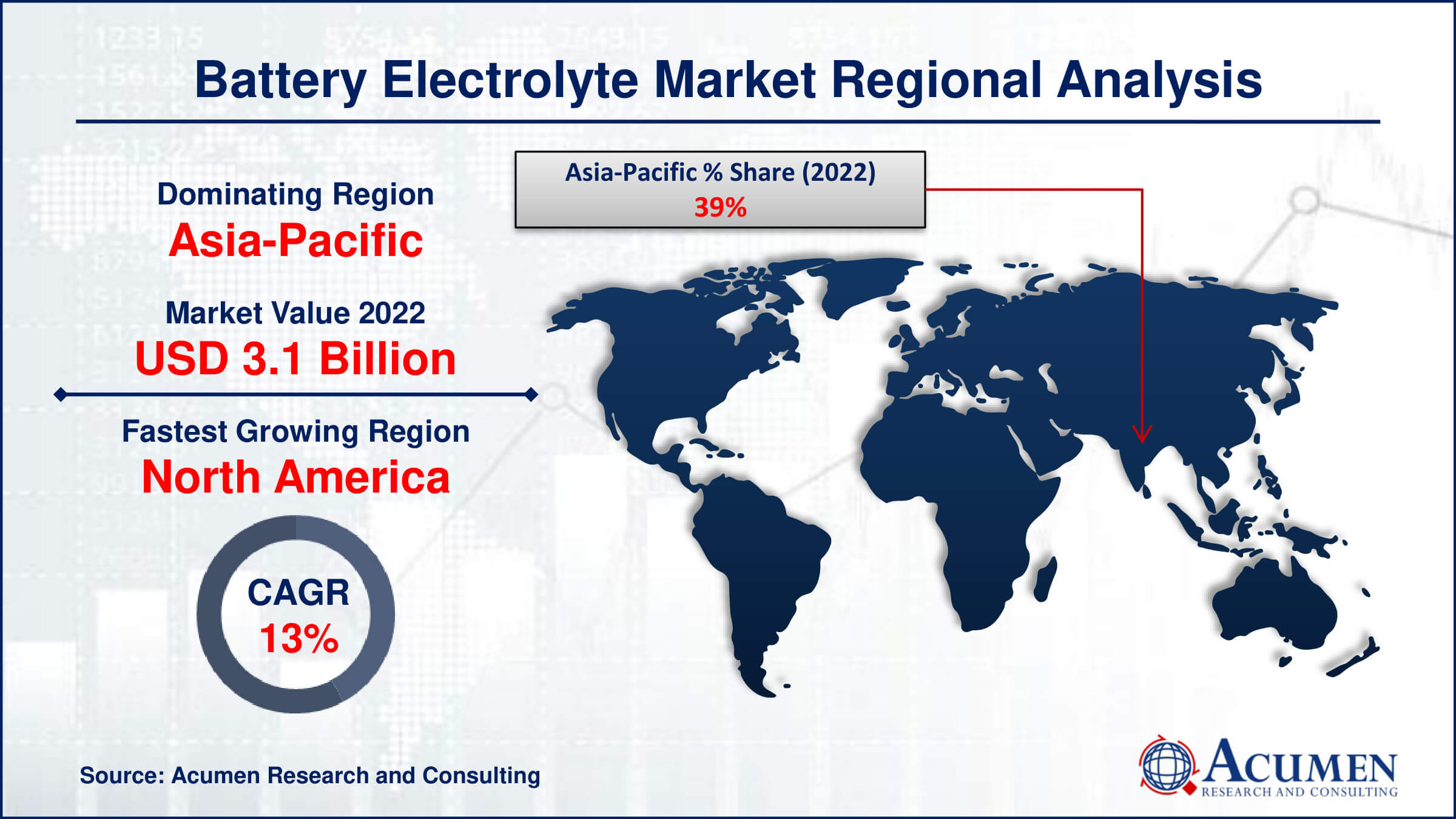

- Asia-Pacific region led with more than 39% of battery electrolyte market share in 2022

- North America battery electrolyte market growth will record a CAGR of more than 13.1% from 2023 to 2032

- By battery type, the lithium-ionsegment captured more than 37% of revenue share in 2022.

- By end user, the electric vehicle segment is projected to expand at the fastest CAGR over the projected period

- Increasing demand for electric vehicles (EVs) and energy storage systems, drives the battery electrolyte market value

Battery electrolyte is a crucial component in various types of batteries, including lithium-ion batteries, lead-acid batteries, and others. It acts as a medium for the flow of ions between the cathode and anode, facilitating the electrochemical reactions that generate electric energy. Typically, battery electrolytes consist of a solvent and dissolved salts, with additives often included to enhance performance and safety. In lithium-ion batteries, for instance, the electrolyte commonly comprises a lithium salt dissolved in an organic solvent.

The market for battery electrolytes has experienced significant growth in recent years, primarily driven by the increasing demand for rechargeable batteries in various applications such as consumer electronics, electric vehicles (EVs), and energy storage systems. With the global shift towards sustainable energy solutions and the rapid adoption of EVs, there has been a surge in the production and deployment of lithium-ion batteries, thus boosting the demand for electrolytes. Additionally, advancements in battery technology, such as the development of high-energy-density batteries and solid-state electrolytes, are further fueling market growth as manufacturers seek to improve battery performance, safety, and longevity.

Global Battery Electrolyte Market Trends

Market Drivers

- Increasing demand for electric vehicles (EVs) and energy storage systems

- Advancements in battery technology, including high-energy-density batteries and solid-state electrolytes

- Government initiatives promoting renewable energy sources and reducing greenhouse gas emissions

- Growing investment in battery manufacturing and research and development activities

- Electrification trend across industries driving demand for battery electrolyte materials

Market Restraints

- Supply chain disruptions and raw material shortages

- Safety concerns associated with lithium-ion battery electrolytes

Market Opportunities

- Development of novel electrolyte formulations for improved performance and safety

- Expansion of energy storage applications beyond automotive sector

Battery Electrolyte Market Report Coverage

| Market | Battery Electrolyte Market |

| Battery Electrolyte Market Size 2022 | USD 7.8 Billion |

| Battery Electrolyte Market Forecast 2032 | USD 22.5 Billion |

| Battery Electrolyte Market CAGR During 2023 - 2032 | 11.4% |

| Battery Electrolyte Market Analysis Period | 2020 - 2032 |

| Battery Electrolyte Market Base Year |

2022 |

| Battery Electrolyte Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Battery Type, By Electrolyte Type, By End User, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | 3M Company, BASF SE, American Elements, Guangzhou Tinci Materials Technology Co. Ltd., GS Yuasa International Ltd., Johnson Controls, Mitsubishi Chemical Corporation, LG Chem Ltd., Mitsui Chemicals Inc., Targray, Shenzhen Capchem Technology Co. Ltd., and UBE Industries Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Battery electrolyte is a critical component in various types of batteries, serving as a medium for the transport of ions between the electrodes, facilitating the electrochemical reactions that generate electricity. It typically consists of a solvent, such as a liquid or polymer gel, and dissolved salts, which dissociate into ions to enable the flow of electric current. The choice of electrolyte varies depending on the type of battery and its intended application. For instance, lithium-ion batteries commonly use organic electrolytes containing lithium salts, while lead-acid batteries employ aqueous sulfuric acid solutions. The applications of battery electrolytes span across numerous industries, driven by the increasing demand for portable power sources, energy storage solutions, and electric transportation. In consumer electronics, such as smartphones, laptops, and tablets, lithium-ion batteries with advanced electrolyte formulations provide high energy density and long-lasting performance.

The battery electrolyte market has been experiencing robust growth in recent years, primarily fueled by the increasing demand for rechargeable batteries in a wide range of applications, including electric vehicles (EVs), consumer electronics, and energy storage systems. The global push towards sustainable energy solutions and the electrification of transportation are significant drivers propelling this growth. As governments worldwide implement stricter regulations to curb emissions and promote renewable energy adoption, the demand for batteries, and consequently electrolytes, continues to soar. Advancements in battery technology further amplify the growth trajectory of the electrolyte market. Innovations such as high-energy-density batteries and solid-state electrolytes promise improved performance, safety, and longevity. Manufacturers are continually investing in research and development to enhance battery capabilities, driving the need for advanced electrolyte formulations. Moreover, as the cost of lithium-ion batteries declines and energy density increases, the market for battery-powered devices expands, generating additional opportunities for electrolyte suppliers.

Battery Electrolyte Market Segmentation

The global battery electrolyte market segmentation is based on battery type, electrolyte type, end user, and geography.

Battery Electrolyte Market By Battery Type

- Lead Acid

- Flow Battery

- Lithium-ion

- Others

According to the battery electrolyte industry analysis, the lithium-ion segment accounted for the largest market share in 2022. Lithium-ion batteries have become the preferred choice for electric vehicles (EVs), consumer electronics, and energy storage systems due to their high energy density, longer cycle life, and faster charging capabilities. As the demand for these end-use applications continues to surge, so does the demand for lithium-ion battery electrolytes. One of the key drivers fueling the growth of the lithium-ion segment is the rapid electrification of transportation. With governments worldwide implementing stringent emission regulations and consumers increasingly embracing electric vehicles, the automotive industry is experiencing a significant shift towards electrification. Lithium-ion batteries power the majority of electric vehicles on the market, driving the demand for electrolytes. Additionally, advancements in battery technology, such as the development of solid-state electrolytes and silicon anodes, are further boosting the performance and efficiency of lithium-ion batteries, driving their adoption across various sectors.

Battery Electrolyte Market By Electrolyte Type

- Liquid Electrolyte

- Gel Electrolyte

- Solid Electrolyte

- Others

In terms of electrolyte types, the liquid electrolyte segment is expected to witness significant growth in the coming years. Liquid electrolytes, typically composed of lithium salts dissolved in organic solvents, facilitate the flow of ions between the cathode and anode, enabling the electrochemical reactions that generate electricity. With the increasing demand for lithium-ion batteries across applications such as electric vehicles, consumer electronics, and grid-scale energy storage, the demand for liquid electrolytes has surged. One of the primary drivers of growth in the liquid electrolyte segment is the rapid adoption of electric vehicles (EVs) worldwide. As governments implement stricter regulations to reduce greenhouse gas emissions and combat climate change, automotive manufacturers are accelerating their transition towards electric mobility. Liquid electrolytes play a critical role in powering lithium-ion batteries used in EVs, driving the demand for these electrolytes.

Battery Electrolyte Market By End User

- Electric Vehicle

- Consumer Electronics

- Energy Storage

- Others

According to the battery electrolyte market forecast, the electric vehicle segment is expected to witness significant growth in the coming years. Battery electrolytes play a crucial role in powering the lithium-ion batteries which are the primary energy storage technology used in EVs. As governments worldwide implement stringent emissions regulations and provide incentives to promote electric mobility, automotive manufacturers are ramping up production of EVs, leading to a surge in demand for battery electrolytes. One of the key drivers propelling the growth of the EV segment in the battery electrolyte market is the continuous improvement in battery technology. Advancements such as higher energy density, faster charging capabilities, and increased longevity are enhancing the performance of lithium-ion batteries, making EVs more attractive to consumers. Additionally, ongoing research and development efforts aimed at reducing battery costs and enhancing safety are further driving the adoption of EVs, consequently increasing the demand for battery electrolytes.

Battery Electrolyte Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Battery Electrolyte Market Regional Analysis

The Asia-Pacific region has emerged as a dominating force in the battery electrolyte market, primarily due to several key factors driving growth in this region. One significant factor is the rapid expansion of the electric vehicle (EV) market, particularly in countries like China, Japan, and South Korea. These nations have aggressively pursued policies and incentives to encourage EV adoption, leading to a surge in demand for lithium-ion batteries and, consequently, battery electrolytes. Additionally, the presence of major battery and automotive manufacturers in the Asia-Pacific region further strengthens its position as a hub for battery production, driving the demand for electrolyte materials. Moreover, Asia-Pacific countries are investing heavily in renewable energy and energy storage projects to address growing energy needs while reducing carbon emissions. This has led to significant deployments of grid-scale energy storage systems using lithium-ion batteries, creating a substantial demand for electrolytes. China, in particular, has been at the forefront of renewable energy adoption and has ambitious targets for energy storage capacity, driving substantial growth in the battery electrolyte market. Furthermore, the region benefits from a well-established supply chain for battery materials and components, including electrolytes, which supports the thriving battery industry in Asia-Pacific.

Battery Electrolyte Market Player

Some of the top battery electrolyte market companies offered in the professional report include 3M Company, BASF SE, American Elements, Guangzhou Tinci Materials Technology Co. Ltd., GS Yuasa International Ltd., Johnson Controls, Mitsubishi Chemical Corporation, LG Chem Ltd., Mitsui Chemicals Inc., Targray, Shenzhen Capchem Technology Co. Ltd., and UBE Industries Ltd.

Frequently Asked Questions

How big is the battery electrolyte market?

The battery electrolyte market size was USD 7.8 Billion in 2022.

What is the CAGR of the global battery electrolyte market from 2023 to 2032?

The CAGR of battery electrolyte is 11.4% during the analysis period of 2023 to 2032.

Which are the key players in the battery electrolyte market?

The key players operating in the global market are including 3M Company, BASF SE, American Elements, Guangzhou Tinci Materials Technology Co. Ltd., GS Yuasa International Ltd., Johnson Controls, Mitsubishi Chemical Corporation, LG Chem Ltd., Mitsui Chemicals Inc., Targray, Shenzhen Capchem Technology Co. Ltd., and UBE Industries Ltd.

Which region dominated the global battery electrolyte market share?

Asia-Pacific held the dominating position in battery electrolyte industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of battery electrolyte during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global battery electrolyte industry?

The current trends and dynamics in the battery electrolyte industry include increasing demand for electric vehicles (EVs) and energy storage systems, and advancements in battery technology, including high-energy-density batteries and solid-state electrolytes.

Which electrolyte type held the maximum share in 2022?

The liquid electrolyte type held the maximum share of the battery electrolyte industry.