Bariatric Surgery Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Bariatric Surgery Devices Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

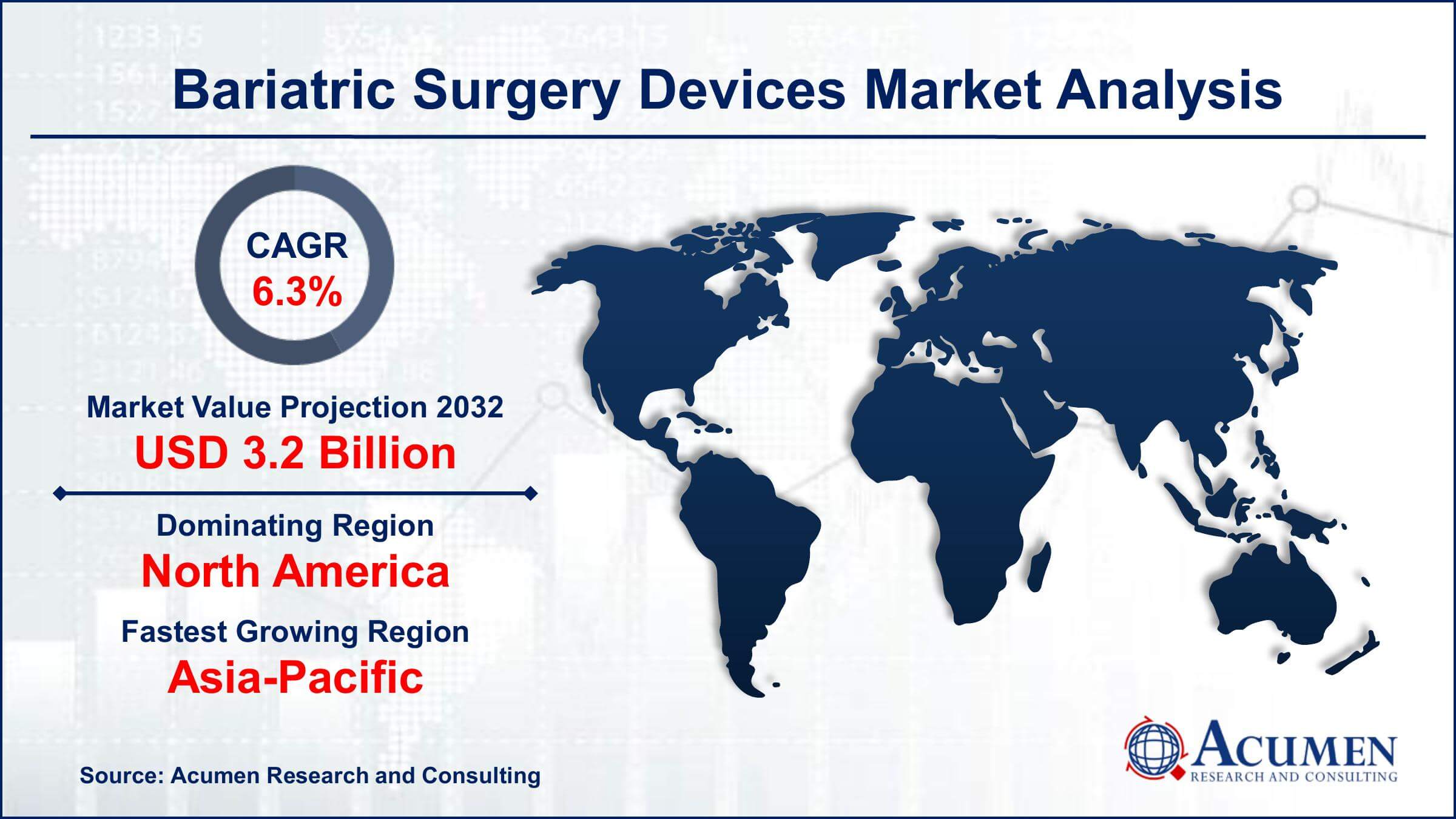

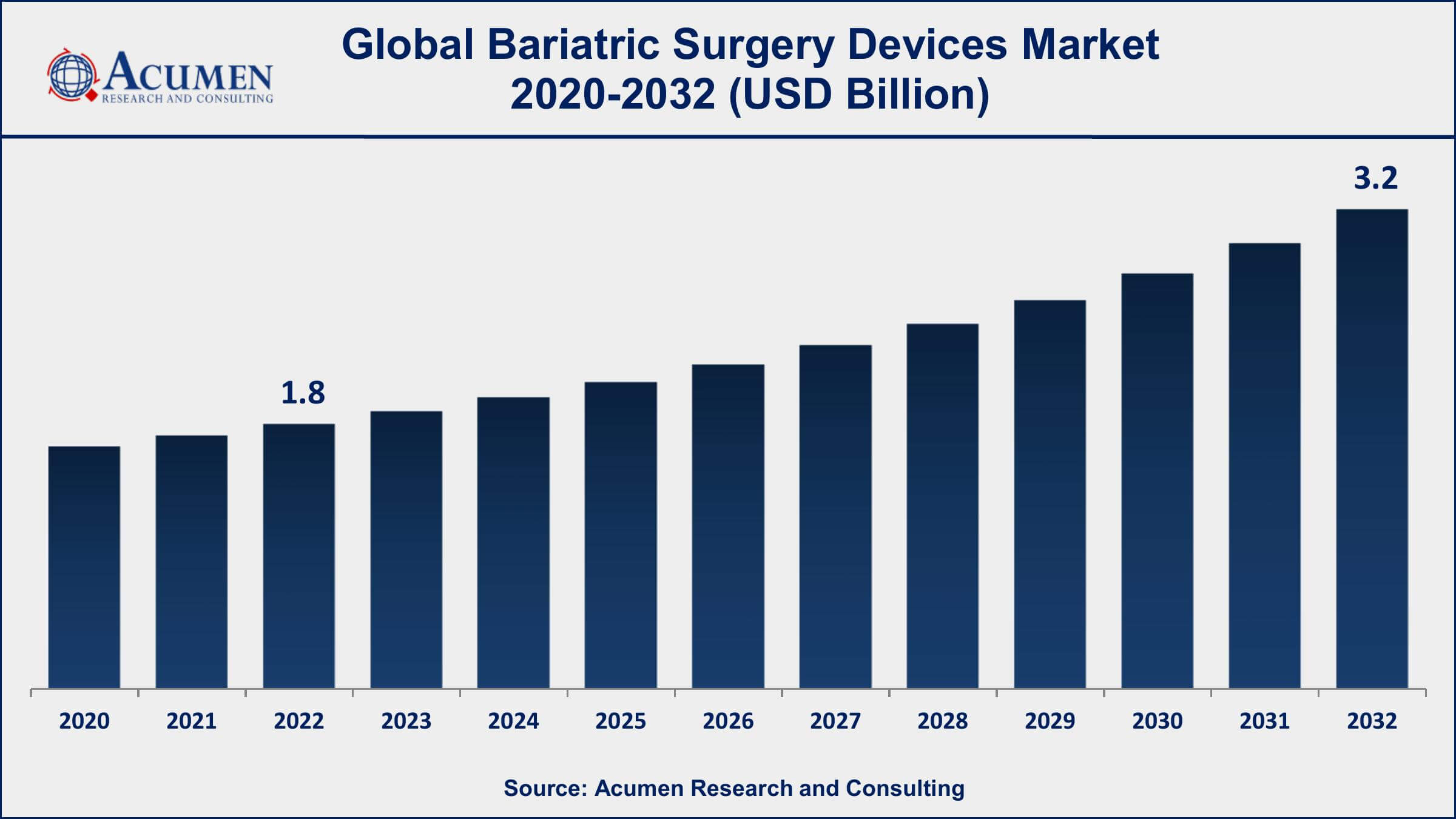

The Global Bariatric Surgery Devices Market Size accounted for USD 1.8 Billion in 2022 and is projected to achieve a market size of USD 3.2 Billion by 2032 growing at a CAGR of 6.3% from 2023 to 2032.

Bariatric Surgery Devices Market Highlights

- Global Bariatric Surgery Devices Market revenue is expected to increase by USD 3.2 Billion by 2032, with a 6.3% CAGR from 2023 to 2032

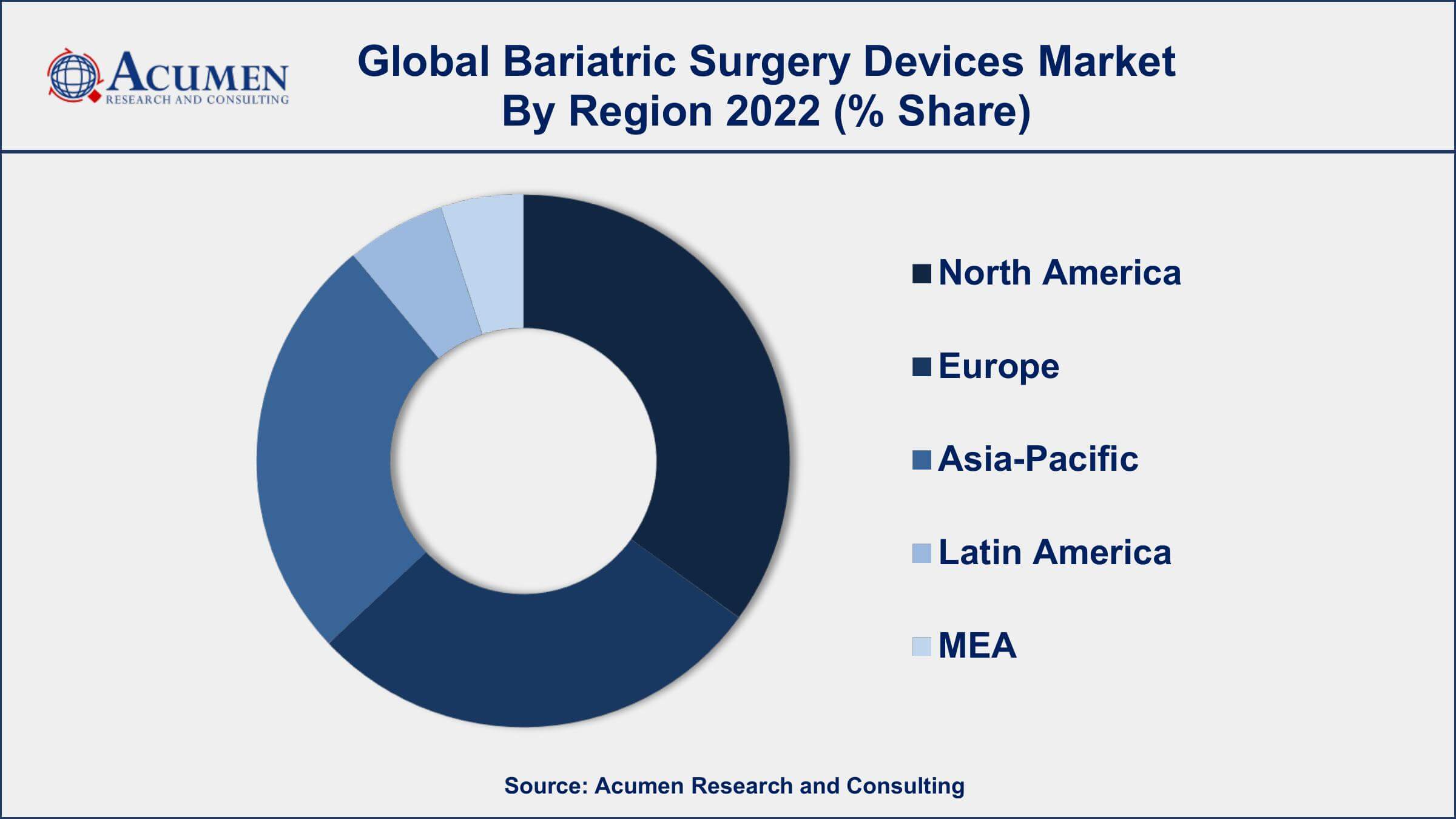

- North America region led with more than 37% of Bariatric Surgery Devices Market share in 2022

- Asia-Pacific Bariatric Surgery Devices Market growth will record a CAGR of more than 7.1% from 2023 to 2032

- By product, the minimally invasive surgical devices segment has accounted more than 89% of the revenue share in 2022

- By procedure, the sleeve gastrectomy segment has recorded more than 45% of the revenue share in 2022

- Increasing awareness about the health risks associated with obesity, drives the Bariatric Surgery Devices Market value

Bariatric surgery devices refer to the medical instruments and equipment used in surgical procedures that aim to treat obesity and its associated health conditions. These devices are specifically designed to assist surgeons in performing various types of weight loss surgeries, such as gastric bypass, gastric sleeve, and gastric banding procedures. Bariatric surgery is considered a highly effective treatment option for individuals with severe obesity who have been unable to achieve sustainable weight loss through non-surgical methods.

The market for bariatric surgery devices has experienced significant growth in recent years. This growth can be attributed to several factors, including the increasing prevalence of obesity worldwide and the rising awareness about the long-term health risks associated with obesity. Additionally, advancements in surgical techniques and the development of innovative and minimally invasive devices have further fueled the demand for bariatric surgery devices. The market growth of bariatric surgery devices is expected to continue in the coming years. Factors such as the growing adoption of surgical treatments for obesity, rising healthcare expenditure, and favorable reimbursement policies in some regions are likely to contribute to market expansion.

Global Bariatric Surgery Devices Market Trends

Market Drivers

- Rising prevalence of obesity worldwide

- Increasing awareness about the health risks associated with obesity

- Growing adoption of surgical interventions for weight loss

- Technological advancements in bariatric surgery devices

Market Restraints

- High cost of bariatric surgery procedures and devices

- Stringent regulatory requirements for device approval

Market Opportunities

- Emerging markets with a high prevalence of obesity and growing healthcare infrastructure

- Development of minimally invasive and non-invasive bariatric procedures

Bariatric Surgery Devices Market Report Coverage

| Market | Bariatric Surgery Devices Market |

| Bariatric Surgery Devices Market Size 2022 | USD 1.8 Billion |

| Bariatric Surgery Devices Market Forecast 2032 | USD 3.2 Billion |

| Bariatric Surgery Devices Market CAGR During 2023 - 2032 | 6.3% |

| Bariatric Surgery Devices Market Analysis Period | 2020 - 2032 |

| Bariatric Surgery Devices Market Base Year | 2022 |

| Bariatric Surgery Devices Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Product, By Procedure, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Medtronic, Johnson & Johnson, Apollo Endosurgery, Allergan (acquired by AbbVie), ReShape Lifesciences, Intuitive Surgical, GI Dynamics, Mediflex Surgical Products, Cousin Biotech, and Silimed. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Bariatric surgery devices are specialized medical instruments and equipment used in surgical procedures to treat obesity and its related health conditions. These devices are specifically designed to assist surgeons in performing various types of weight loss surgeries, such as gastric bypass, gastric sleeve, and gastric banding procedures. They play a crucial role in enhancing the safety, effectiveness, and precision of bariatric surgeries.

The applications of bariatric surgery devices revolve around addressing the complex health challenges associated with obesity. Bariatric surgery is primarily performed to achieve significant and sustained weight loss in individuals with severe obesity, typically with a body mass index (BMI) greater than 40. These devices help in reducing the size of the stomach or altering the way it functions, thereby restricting food intake or inducing malabsorption to promote weight loss. Bariatric surgery devices also serve various therapeutic purposes beyond weight loss. They can help improve or resolve obesity-related health conditions such as type 2 diabetes, hypertension, sleep apnea, and metabolic syndrome. Additionally, these devices can contribute to enhancing patients' quality of life, as significant weight loss can lead to improved mobility, reduced joint pain, and increased overall well-being. The applications of bariatric surgery devices extend beyond the surgical procedure itself and have a profound impact on patients' long-term health outcomes and quality of life.

The bariatric surgery devices market has been experiencing significant growth in recent years and is expected to continue its upward trajectory. The market growth can be attributed to several factors, including the increasing prevalence of obesity worldwide has created a substantial demand for effective treatment options. Bariatric surgery has emerged as a highly effective method for weight loss and the management of obesity-related health conditions, which has fueled the demand for bariatric surgery devices. Additionally, there is a growing awareness among individuals about the long-term health risks associated with obesity, leading to an increased willingness to undergo surgical interventions. Technological advancements have also played a crucial role in driving market growth.

Bariatric Surgery Devices Market Segmentation

The global Bariatric Surgery Devices Market segmentation is based on product, procedure, and geography.

Bariatric Surgery Devices Market By Product

- Minimally invasive surgical devices

- Energy/vessel-sealing devices

- Suturing devices

- Stapling devices

- Others

- Non-invasive surgical devices

In terms of products, the minimally invasive surgical devices segment has seen significant growth in the recent years. Minimally invasive surgical procedures have gained significant popularity due to their advantages over traditional open surgeries, such as smaller incisions, reduced trauma, faster recovery, and lower complication rates. These benefits have driven the demand for minimally invasive devices in bariatric surgery. One of the key factors contributing to the growth of the minimally invasive surgical devices segment is the continuous development and refinement of surgical technologies. Advancements in laparoscopic instruments, including specialized trocars, surgical staplers, and energy devices, have made it possible to perform complex bariatric procedures with minimal invasiveness. These devices enable surgeons to navigate and operate through small incisions, reducing postoperative pain, scarring, and recovery time. Additionally, the rising preference for minimally invasive procedures among patients and healthcare providers has also fueled the market growth.

Bariatric Surgery Devices Market By Procedure

- Sleeve gastrectomy

- Non-invasive bariatric surgery

- Gastric bypass

- Mini-gastric bypass

- Revision bariatric surgery

- Adjustable gastric banding

- Others

According to the bariatric surgery devices market forecast, the sleeve gastrectomy segment is expected to witness significant growth in the coming years. Sleeve gastrectomy is a popular bariatric procedure that involves the removal of a portion of the stomach, resulting in a reduced stomach size and appetite control. This procedure has gained prominence due to its effectiveness in achieving substantial weight loss and improving obesity-related health conditions. One of the key factors driving the growth of the sleeve gastrectomy segment is the increasing prevalence of obesity worldwide. With the rising incidence of obesity, there is a growing demand for effective weight loss solutions. Sleeve gastrectomy has emerged as a highly effective surgical option, leading to a surge in the number of procedures performed and driving the demand for associated surgical devices. Furthermore, advancements in surgical techniques and devices have contributed to the growth of the sleeve gastrectomy segment.

Bariatric Surgery Devices Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Bariatric Surgery Devices Market Regional Analysis

Geographically, North America has been dominating the bariatric surgery devices market in 2022. North America has a high prevalence of obesity, which has contributed to the demand for bariatric surgeries and associated devices. The United States, in particular, has one of the highest obesity rates globally, driving the need for effective treatment options. The awareness of the long-term health risks associated with obesity has also been on the rise, prompting individuals to seek surgical interventions, thereby increasing the market demand for bariatric surgery devices. Moreover, North America has a well-established healthcare infrastructure and a robust reimbursement system. The availability of advanced medical facilities and specialized healthcare professionals has contributed to the growth of the bariatric surgery devices market in the region. Additionally, the presence of favorable reimbursement policies and insurance coverage for bariatric surgeries has made these procedures more accessible and affordable for patients. This has played a significant role in driving the market expansion and attracting investments in bariatric surgery devices.

Bariatric Surgery Devices Market Player

Some of the top bariatric surgery devices market companies offered in the professional report include Medtronic, Johnson & Johnson, Apollo Endosurgery, Allergan (acquired by AbbVie), ReShape Lifesciences, Intuitive Surgical, GI Dynamics, Mediflex Surgical Products, Cousin Biotech, and Silimed.

Frequently Asked Questions

What was the market size of the global bariatric surgery devices in 2022?

The market size of bariatric surgery devices was USD 1.8 Billion in 2022.

What is the CAGR of the global bariatric surgery devices market from 2023 to 2032?

The CAGR of bariatric surgery devices is 6.3% during the analysis period of 2023 to 2032.

Which are the key players in the bariatric surgery devices market?

The key players operating in the global market are including Medtronic, Johnson & Johnson, Apollo Endosurgery, Allergan (acquired by AbbVie), ReShape Lifesciences, Intuitive Surgical, GI Dynamics, Mediflex Surgical Products, Cousin Biotech, and Silimed.

Which region dominated the global bariatric surgery devices market share?

North America held the dominating position in bariatric surgery devices industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of bariatric surgery devices during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global bariatric surgery devices industry?

The current trends and dynamics in the bariatric surgery devices market growth include rising prevalence of obesity worldwide, increasing awareness about the health risks associated with obesity, and growing adoption of surgical interventions for weight loss.

Which procedure held the maximum share in 2022?

The sleeve gastrectomy procedure held the maximum share of the bariatric surgery devices industry.