Barge Transportation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Barge Transportation Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

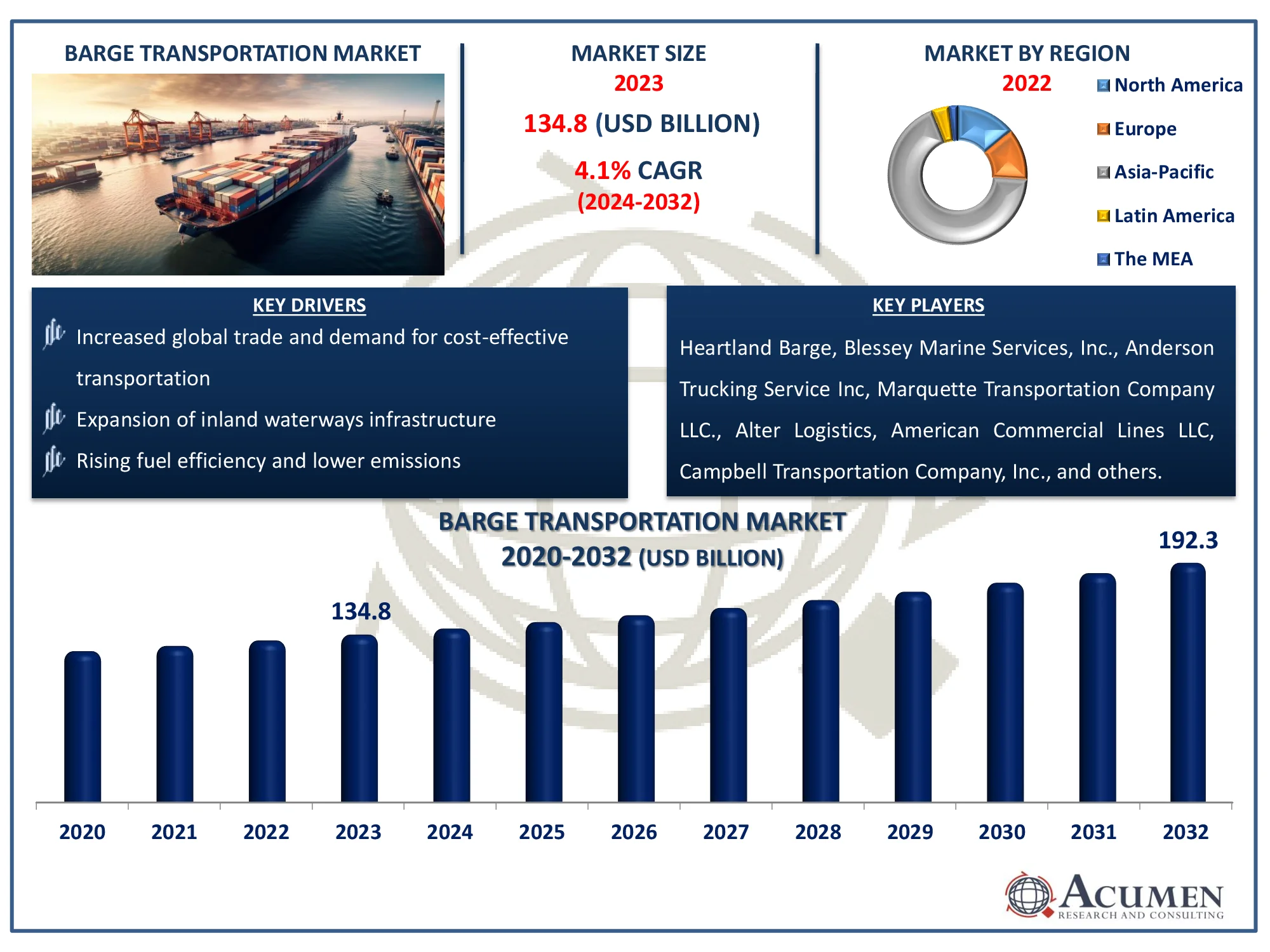

The Global Barge Transportation Market Size accounted for USD 134.8 Billion in 2023 and is estimated to achieve a market size of USD 192.3 Billion by 2032 growing at a CAGR of 4.1% from 2024 to 2032.

Barge Transportation Market Highlights

- Global barge transportation market revenue is poised to garner USD 192.3 billion by 2032 with a CAGR of 4.1% from 2024 to 2032

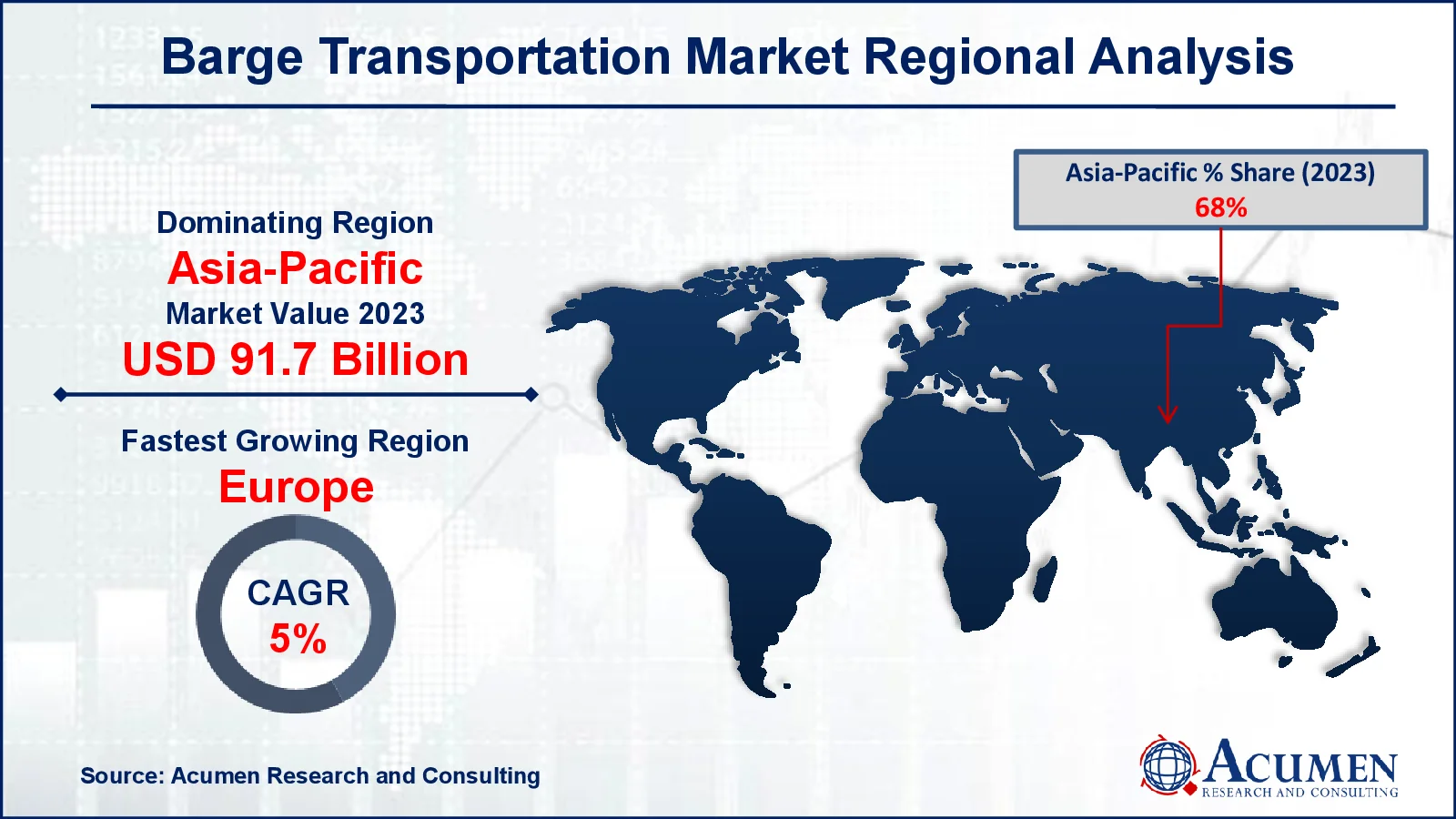

- Asia-Pacific barge transportation market value occupied around USD 91.7 billion in 2023

- Europe barge transportation market growth will record a CAGR of more than 5% from 2024 to 2032

- Among cargo, the dry cargo sub-segment generated 40% of the market share in 2023

- Based on fleet, the covered barge sub-segment generated 44% market share in 2023

- Cost-effectiveness drives preference for barge over other transportation modes is the barge transportation market trend that fuels the industry demand

Barge transportation involves the use of flat-bottomed boats, known as barges, to move goods and materials across waterways. This method is particularly effective for transporting bulk commodities like coal, grain, and oil, as barges can carry large volumes at relatively low costs. Barges are often used on rivers, canals, and lakes, taking advantage of their shallow drafts and large cargo capacities. They are an environmentally friendly option, reducing road and rail congestion. Additionally, barges can be used for specialized purposes, such as transporting heavy equipment or construction materials. Their efficiency and ability to navigate inland waterways make them a vital component of the logistics and shipping industries.

Global Barge Transportation Market Dynamics

Market Drivers

- Increased global trade and demand for cost-effective transportation

- Expansion of inland waterways infrastructure

- Rising fuel efficiency and lower emissions compared to other transport modes

Market Restraints

- Seasonal limitations due to weather conditions

- High initial capital investment for infrastructure development

- Limited access to remote areas not connected by waterways

Market Opportunities

- Integration of advanced technologies for navigation and logistics

- Development of multimodal transport networks

- Growing focus on environmental sustainability and reduction of carbon footprint

Barge Transportation Market Report Coverage

| Market | Barge Transportation Market |

| Barge Transportation Market Size 2022 |

USD 134.8 Billion |

| Barge Transportation Market Forecast 2032 | USD 192.3 Billion |

| Barge Transportation Market CAGR During 2023 - 2032 | 4.1% |

| Barge Transportation Market Analysis Period | 2020 - 2032 |

| Barge Transportation Market Base Year |

2022 |

| Barge Transportation Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Cargo, By Fleet, By Activities, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Heartland Barge, Blessey Marine Services, Inc., Anderson Trucking Service Inc, Marquette Transportation Company LLC., Alter Logistics, American Commercial Lines LLC, Campbell Transportation Company, Inc., Kirby Corporation, SEACOR Marine Holdings Inc., Bouchard Transportation Co. Inc., and among others. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Barge Transportation Market Insights

The growth of the barge transportation market is largely fueled by increased global trade and the need for cost-effective logistics solutions. Barges offer a more economical means of transporting large volumes of goods, especially in regions with extensive inland waterways. Key manufacturers further promote waterways transportation by innovations. For instance, in June 2022, KSINC introduced a 300 metric ton acid barge to encourage the use of waterways for transporting goods, aiming to minimize the risks linked to transporting acid via roadways. As international trade expand, the demand for efficient and low-cost transportation methods rises, boosting the use of barges. Their ability to carry substantial cargo at lower operational costs compared to other modes of transport further drives market growth.

Limited access to remote areas not connected by waterways presents significant logistical challenges. Transportation options are restricted to land-based methods, which can be hindered by poor road conditions and geographic obstacles. This lack of connectivity often leads to higher costs and delays in delivering goods and services. Consequently, development and emergency response efforts in these regions face considerable hurdles.

The integration of advanced technologies like GPS, AI, and IoT in navigation and logistics is revolutionizing the barge transportation market. These technologies enhance route optimization, reduce operational costs, and improve safety by providing real-time data and predictive analytics. Additionally, they enable better coordination and management of cargo, leading to increased efficiency and reliability in barge operations. Overall, these advancements are poised to boost the market's growth and operational capabilities.

Barge Transportation Market Segmentation

The worldwide market for barge transportation is split based on cargo, fleet, activities, application, and geography.

Barge Transportation Cargos

- Liquid Cargo

- Gaseous Cargo

- Dry Cargo

According to the barge transportation industry analysis, dry cargo dominates the market due to its versatility and the ability to transport a wide range of goods, including grains, coal, and building materials. Barges offer cost-effective and fuel-efficient transportation for bulk commodities, making them a preferred choice for shippers. The extensive network of inland waterways facilitates the movement of large volumes of dry cargo across regions. This dominance is further supported by the rising demand for bulk transport driven by economic growth and industrial activities.

Barge Transportation Fleets

- Covered Barge

- Open Barge

- Tank Barge

According to the barge transportation industry analysis, covered barges dominate the market due to their ability to protect cargo from weather conditions, ensuring goods remain dry and secure. They are versatile, capable of transporting a wide range of products including agricultural goods, industrial materials, and packaged items. This versatility and protection reduce the risk of damage and spoilage, making covered barges a preferred choice for shippers. Tank barge anticipated to witness notable growth due to their specialized design for transporting liquid cargoes, such as chemicals, oil, and petroleum products. Additionally, acquisition by key manufacturers for tank barge market expansion further solidifies their leading role in the industry. For instance, In April 2022, Campbell Transportation Company, Inc. acquired all the marine assets of E Squared Marine Service, LLC, and a tank barge shipping company based in Houston.

Barge Transportation Activities

- Intracoastal Transportation

- Inland Water Transportation

According to the barge transportation industry forecast, inland water transportation is expected to dominate the market due to its cost-effectiveness and environmental benefits. Barges can efficiently transport large volumes of goods over rivers and canals, reducing road congestion and lowering fuel consumption. Additionally, the expansion of inland waterways infrastructure and increased emphasis on sustainable logistics bolster the sector's growth. As industries seek more eco-friendly transportation solutions, inland water transportation with barges is becoming a preferred choice.

Barge Transportation Applications

- Coal

- Crude And Petroleum Products

- Liquid Chemicals

- Food Pulp And Other Liquids

- Agricultural Products

- Metal Ores And Fabricated Metal Products

- Pharmaceuticals

- Dry And Gaseous Chemicals

- LPG, CNG, and Other Gaseous Products

- Electronics And Digital Equipment

- Others

According to the barge transportation industry forecast, crude oil and petroleum products are expected to dominate the barge transportation market due to their significant volume and the cost-effective, efficient transport solutions provided by barges. Barges offer a key advantage in moving large quantities of these products, particularly along inland waterways and coastal routes. Additionally, barges are integral in reducing congestion on road and rail networks, further supporting their widespread use in the petroleum sector.

Barge Transportation Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Barge Transportation Market Regional Analysis

For several reasons, the Asia-Pacific dominates barge transportation market due to its expanding industrial base, increasing trade volumes, and extensive river and coastal networks. Economic growth and infrastructure development in countries like China and India further drive demand for efficient and cost-effective transport solutions. For instance, in November 2022, Fertilisers and Chemicals Travancore Limited (FACT) introduced a new ammonia transportation barge called Pearl of Periyar in India. The region's strategic location also enhances its role in global trade routes.

Europe shows notable growth in barge transportation market due to its extensive network of rivers and canals, which provides efficient and cost-effective inland shipping routes. The region's advanced port infrastructure and well-established logistics systems further enhance its competitive advantage. For instance, in May 2023, Archer-Daniels-Midland (ADM) signed a landmark charter agreement with HGK Dry Shipping from Germany. This deal involves an innovative low-emission ship that navigates European waters, primarily the Rhine River. According to the shipowner, this new dry cargo inland waterway vessel is designed to cut CO2 emissions by around 30%. Moreover, the solar panels installed on the hatchways generate up to 90 MWh of electricity, leading to an additional reduction of 70 tons of CO2 emissions annually. Additionally, Government policies and investments in waterway maintenance and modernization also support the sector's growth.

Barge Transportation Market Players

Some of the top barge transportation companies offered in our report include Heartland Barge, Blessey Marine Services, Inc., Anderson Trucking Service Inc, Marquette Transportation Company LLC., Alter Logistics, American Commercial Lines LLC, Campbell Transportation Company, Inc., Kirby Corporation, SEACOR Marine Holdings Inc., Bouchard Transportation Co. Inc., and among others.

Frequently Asked Questions

How big is the barge transportation market?

The barge transportation market size was valued at USD 134.8 billion in 2023.

What is the CAGR of the global barge transportation market from 2024 to 2032?

The CAGR of barge transportation is 4.1% during the analysis period of 2024 to 2032.

Which are the key players in the barge transportation market?

The key players operating in the global market are including Heartland Barge, Blessey Marine Services, Inc., Anderson Trucking Service Inc, Marquette Transportation Company LLC., Alter Logistics, American Commercial Lines LLC, Campbell Transportation Company, Inc., Kirby Corporation, SEACOR Marine Holdings Inc., Bouchard Transportation Co. Inc., and among others.

Which region dominated the global barge transportation market share?

North America held the dominating position in barge transportation industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Europe region exhibited fastest growing CAGR for market of barge transportation during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global barge transportation industry?

The current trends and dynamics in the barge transportation industry include increased global trade and demand for cost-effective transportation, expansion of inland waterways infrastructure, and rising fuel efficiency and lower emissions compared to other transport modes.

Which cargo held the maximum share in 2023?

The dry cargo held the maximum share of the barge transportation industry.