Baby Food and Infant Formula Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Baby Food and Infant Formula Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

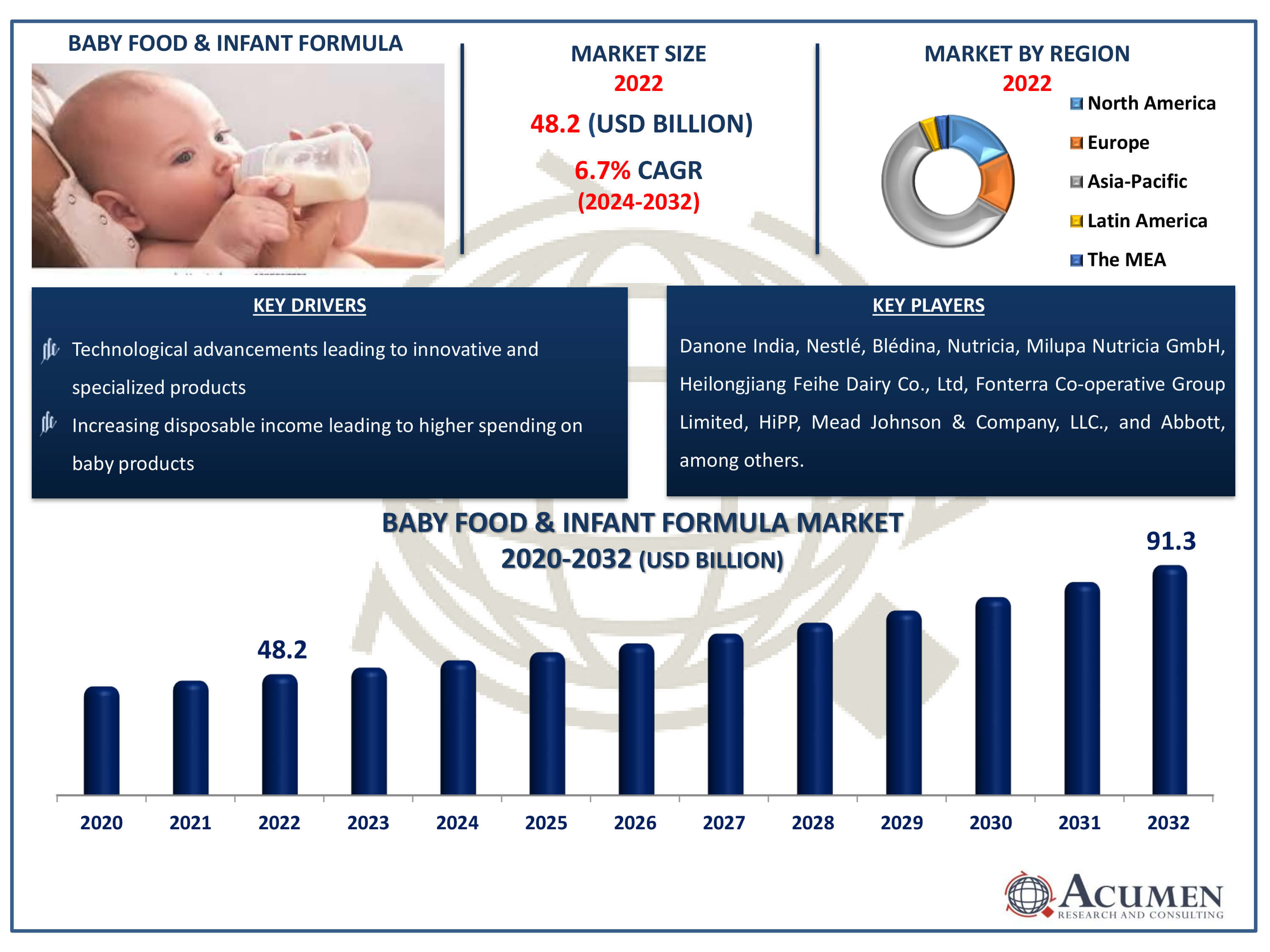

The Baby Food and Infant Formula Market Size accounted for USD 48.2 Billion in 2022 and is estimated to achieve a market size of USD 91.3 Billion by 2032 growing at a CAGR of 6.7% from 2024 to 2032.

Baby Food and Infant Formula Market Highlights

- Global baby food and infant formula market revenue is poised to garner USD 91.3 billion by 2032 with a CAGR of 6.7% from 2024 to 2032

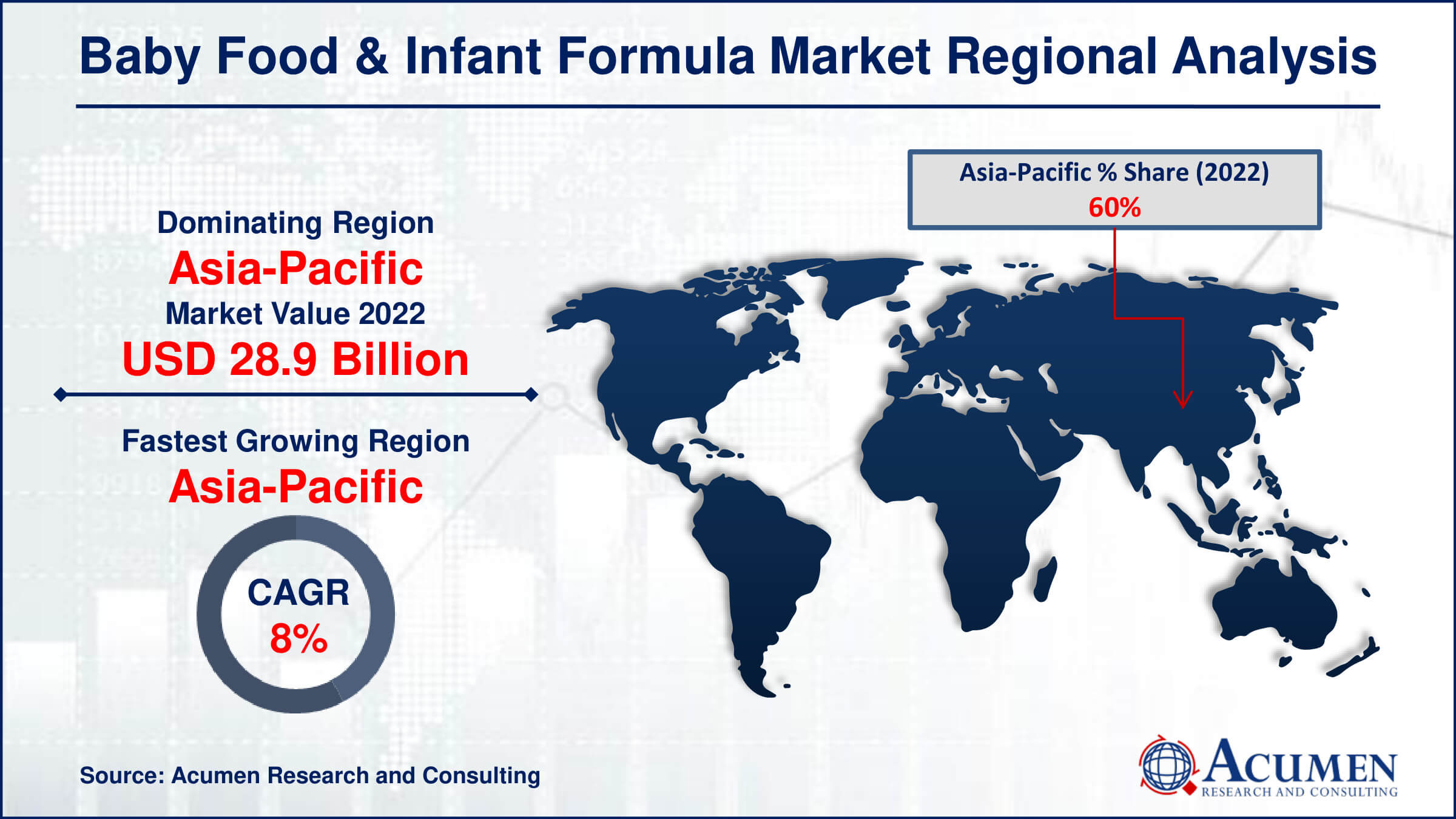

- Asia-Pacific baby food and infant formula market value occupied around USD 28.9 billion in 2022

- Asia-Pacific baby food and infant formula market growth will record a CAGR of more than 8% from 2024 to 2032

- Among type, the infant milk formula sub-segment generated USD 19.3 billion revenue noteworthy revenue in 2022

- Based on distribution channel, the supermarkets sub-segment generated significant baby food and infant formula market share in 2022

- Customization and personalization of baby food and infant formula products is a popular baby food and infant formula market trend that fuels the industry demand

For infants under the age of two, baby food can be used to replace or supplement breast milk, supplying the vital nutrients required for growth and development. It is designed to precisely mirror the composition of breast milk and contains a well-balanced combination of proteins, lipids, carbs, vitamins, and minerals. Baby food is defined by the FDA as a food meant specifically for the unique nutritional needs of newborns. The baby food and infant formula sector has expanded significantly in recent years as a result of a variety of causes. These include increased baby malnutrition rates, particularly in emerging nations, changing lifestyle patterns, and a growing understanding of the necessity of good child nutrition. As a result, parents and carers are increasingly focused on giving their children with high-quality, nutrient-dense foods that promote healthy growth.

Global Baby Food and Infant Formula Market Dynamics

Market Drivers

- Rising awareness about infant nutrition and health

- Increasing disposable income leading to higher spending on baby products

- Growing urbanization and changing lifestyles

- Technological advancements leading to innovative and specialized products

Market Restraints

- Lack of awareness and access in developing regions

- Cultural preferences for traditional foods over commercial products

- Regulatory hurdles and stringent food safety standards

Market Opportunities

- Expansion into emerging markets with high birth rates

- Development of organic and natural baby food and formulas

- Growth in e-commerce and online sales channels

Baby Food and Infant Formula Market Report Coverage

| Market | Baby Food and Infant Formula Market |

| Baby Food and Infant Formula Market Size 2022 | USD 48.2 Billion |

| Baby Food and Infant Formula Market Forecast 2032 |

USD 91.3 Billion |

| Baby Food and Infant Formula Market CAGR During 2024 - 2032 | 6.7% |

| Baby Food and Infant Formula Market Analysis Period | 2020 - 2032 |

| Baby Food and Infant Formula Market Base Year |

2022 |

| Baby Food and Infant Formula Market Forecast Data | 2024 - 2032 |

| Segments Covered | By Type, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Danone India, Blédina, Nutricia, Milupa Nutricia GmbH, Heilongjiang Feihe Dairy Co., Ltd, Fonterra Co-operative Group Limited, HiPP, Mead Johnson and Company, LLC., Nestlé, Abbott, Arla Foods amba, and CSC Brand LP. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Baby Food and Infant Formula Market Insights

The global market for baby food and infant formula is expected to increase rapidly, with a CAGR of more than 6.7%. Several reasons contribute to this growing trend, including rising per capita income across regions, which has increased customers' purchasing power and desire to invest in high-quality newborn items. This tendency is especially visible in emerging nations, where the middle class is growing, driving up demand for premium and niche items. One of the key drivers of market expansion is parents' increasing knowledge of the need of giving their infants with sufficient nutrition. Healthcare experts, public health initiatives, and educational tools for parents frequently help to raise awareness. Furthermore, changing lifestyles and hectic work schedules have boosted the need for handy and simple-to-prepare infant food and formula products. Parents want high-quality solutions that deliver the nutrition their newborns need to grow and thrive while remaining convenient.

The growing need for newborn nutritional supplements has also helped to drive market expansion. Infant formula producers are constantly innovating and improving their formulas to better resemble breast milk composition, including critical nutrients like DHA, ARA, and prebiotics. These additions target specific nutritional demands and health problems, such as lactose intolerance, allergies, and digestive disorders, giving parents a variety of alternatives to meet their children's unique requirements. Despite the generally good prognosis for the business, difficulties exist that might stymie expansion, particularly in developing and undeveloped countries. A lack of understanding about the benefits of high-quality baby food and infant formula, along with restricted availability to these items, can create substantial hurdles. Furthermore, cultural beliefs and customs may impact dietary habits, with some people preferring home-cooked or traditional cuisine over commercially manufactured alternatives.

To overcome these issues, players in the baby food and infant formula markets must prioritise educational programmes that promote knowledge about the need of good newborn nutrition. This involves working with local healthcare practitioners and community organisations to raise awareness about the benefits of high-quality goods. By improving access to and awareness of these goods in disadvantaged areas, the sector may continue to expand and address the nutritional needs of newborns globally.

Baby Food and Infant Formula Market Segmentation

The worldwide market for baby food and infant formula is split based on product, distribution channel, and geography.

Baby Food and Infant Formula Types

- Dried Baby Food

- Infant Milk Formula

- Prepared Baby Food

- Others

According to baby food and infant formula industry analysis, the infant milk formula category is often the largest. This category leads the market because of its critical function in supplying newborns with the nutrients they require throughout critical growth and development periods. Infant milk formula is a replacement for breast milk, especially for parents who are unable to breastfeed or need a supplemental choice. It is meant to closely resemble the composition of breast milk, providing a well-balanced combination of proteins, lipids, carbs, vitamins, and minerals required for an infant's healthy development. Infant milk formula's popularity is spurred by its ease and diversity, with producers creating specialised formulations designed to satisfy certain health concerns such as lactose intolerance, food allergies, and sensitive stomachs. Furthermore, changing lifestyles and demanding work schedules have strengthened modern parents' dependence on formula as a practical alternative, cementing its position as the market's largest sector.

Baby Food and Infant Formula Distribution Channels

- Health and Beauty Retailers

- Online Sales

- Supermarkets

- Others

Supermarkets are often the biggest distribution route for baby food and infant formula. Supermarkets provide a simple one-stop shopping experience for parents and carers, making them a popular place to buy baby food and infant formula. These retail establishments sell a large range of items from many manufacturers, allowing customers to compare and choose the finest products for their infants' requirements. Supermarkets also have easy access to both basic and specialised baby food and infant formula goods, allowing parents to select the exact sorts and formulae they need. Furthermore, these retailers frequently provide low pricing and special promotions, making them an appealing choice for budget-conscious shoppers. Supermarkets' physical presence in many communities, whether urban and rural, adds to their position as the primary distribution channel in the Baby Food and Infant Formula business.

Baby Food and Infant Formula Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Baby Food and Infant Formula Market Regional Analysis

In terms of baby food and infant formula market analysis, The Asia Pacific region commands the largest share of the industry due to its large population, increasing prevalence of malnutrition among children, and rising birth rates. China and India are the major contributors to the market in this region.

North America holds the second-largest share in the market. High spending power among North America consumers and government support has contributed to the growth of the market, placing North America in the second position. North America is expected to see significant growth in the market in the coming years. Over 1 million babies and children in the U.S. consume baby food and infant formula after birth. The U.S. dominates the majority share of the North American market.

The Africa region holds the smallest share in the market due to the prevalence of poor economies and a lack of awareness among the population. However, the region presents significant growth opportunities for the market in the baby food and infant formula market forecast period.

Baby Food and Infant Formula Market Players

Some of the top baby food and infant formula companies offered in our report includes Danone India, Blédina, Nutricia, Milupa Nutricia GmbH, Heilongjiang Feihe Dairy Co., Ltd, Fonterra Co-operative Group Limited, HiPP, Mead Johnson and Company, LLC., Nestlé, Abbott, Arla Foods amba, and CSC Brand LP.

Frequently Asked Questions

How big is the baby food and infant formula market?

The baby food and infant formula market size was valued at USD 48.2 billion in 2022.

What is the CAGR of the global baby food and infant formula market from 2024 to 2032?

The CAGR of baby food and infant formula is 6.7% during the analysis period of 2024 to 2032.

Which are the key players in the baby food and infant formula market?

The key players operating in the global market are including Danone India, Bl�dina, Nutricia, Milupa Nutricia GmbH, Heilongjiang Feihe Dairy Co., Ltd, Fonterra Co-operative Group Limited, HiPP, Mead Johnson and Company, LLC., Nestl�, Abbott, Arla Foods amba, and CSC Brand LP.

Which region dominated the global baby food and infant formula market share?

Asia-Pacific held the dominating position in baby food and infant formula industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of baby food and infant formula during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global baby food and infant formula industry?

The current trends and dynamics in the baby food and infant formula industry include rising awareness about infant nutrition and health, increasing disposable income leading to higher spending on baby products, growing urbanization and changing lifestyles, and technological advancements leading to innovative and specialized products.

Which distribution channel held the maximum share in 2022?

The commercial distribution channel held the maximum share of the baby food and infant formula industry.