Autonomous Ships Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Autonomous Ships Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

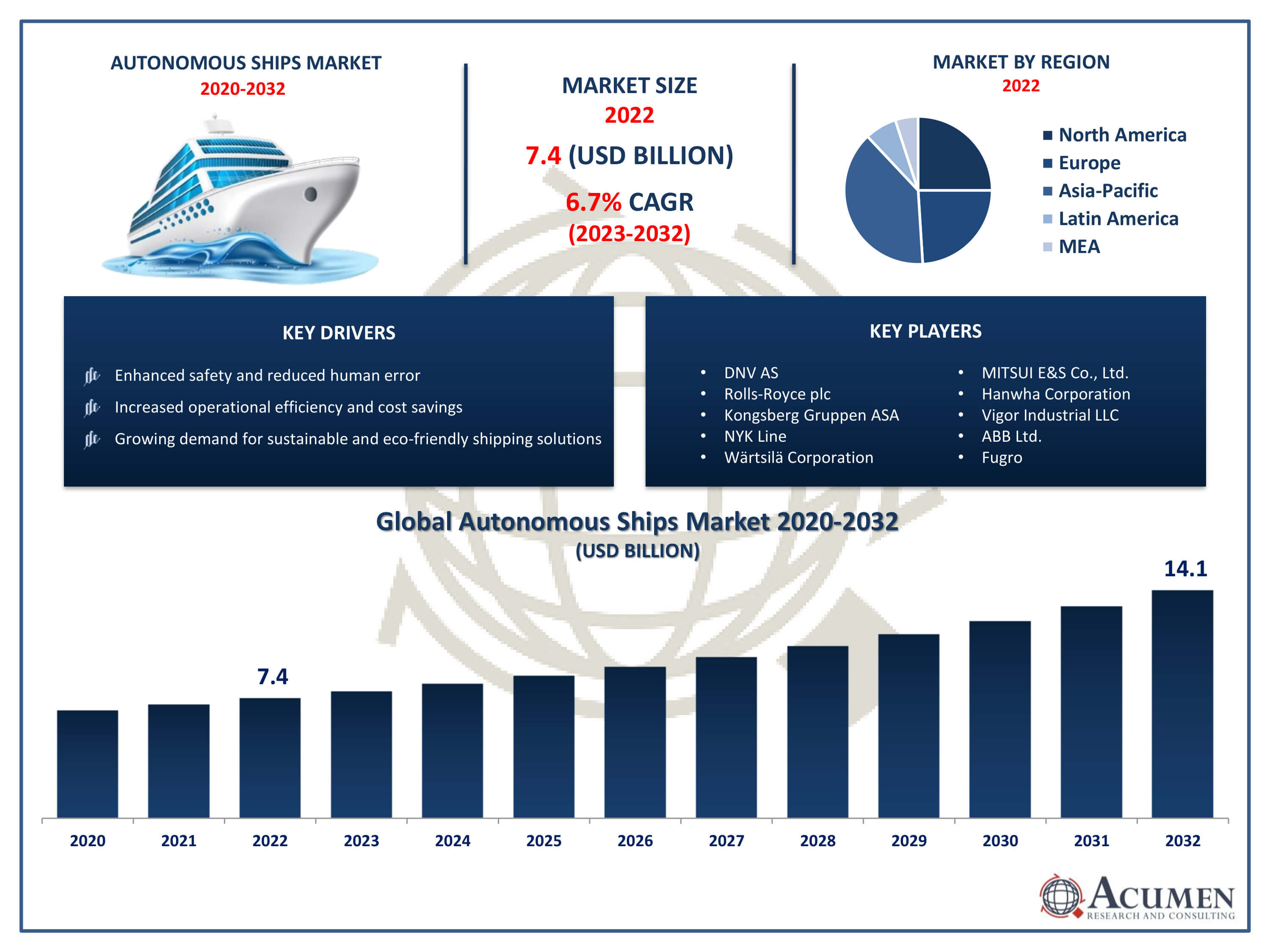

The Autonomous Ships Market Size accounted for USD 7.4 Billion in 2022 and is projected to achieve a market size of USD 14.1 Billion by 2032 growing at a CAGR of 6.7% from 2023 to 2032.

Autonomous Ships Market Highlights

- Global autonomous ships market revenue is expected to increase by USD 14.1 billion by 2032, with a 6.7% CAGR from 2023 to 2032

- Asia-Pacific region led with more than 40% of autonomous ships market share in 2022

- Europe autonomous ships market growth will record a CAGR of more than 8.1% from 2023 to 2032

- By type, the partially autonomous are the largest segment of the market, accounting for over 78% of the global market share

- By application, the commercial segment generated over 64% of market share in 2022

- Growing demand for sustainable and eco-friendly shipping solutions, drives the autonomous ships market value

Autonomous ships are maritime vessels that operate without human intervention for navigation and control. These ships utilize various advanced technologies such as artificial intelligence (AI), sensors, cameras, radar, and satellite communication to autonomously navigate, detect obstacles, make decisions, and perform tasks typically conducted by onboard crew members. The development of autonomous ships is aimed at improving safety, efficiency, and sustainability in the maritime industry by reducing the risk of human error, optimizing route planning, and enhancing fuel efficiency.

Autonomous ships are maritime vessels that operate without human intervention for navigation and control. These ships utilize various advanced technologies such as artificial intelligence (AI), sensors, cameras, radar, and satellite communication to autonomously navigate, detect obstacles, make decisions, and perform tasks typically conducted by onboard crew members. The development of autonomous ships is aimed at improving safety, efficiency, and sustainability in the maritime industry by reducing the risk of human error, optimizing route planning, and enhancing fuel efficiency.

The market for autonomous ships has been steadily growing in recent years as technological advancements continue to mature and regulations evolve to accommodate unmanned vessels. The potential benefits of autonomous ships, including lower operating costs, reduced environmental impact, and increased operational efficiency, have attracted significant interest from shipping companies, technology firms, and governments worldwide. Additionally, the global demand for maritime transportation continues to rise, further driving the need for innovative solutions to enhance the efficiency and safety of shipping operations. Furthermore, the adoption of autonomous ships is expected to bring about a paradigm shift in the maritime sector, leading to enhanced safety, efficiency, and sustainability.

Global Autonomous Ships Market Trends

Market Drivers

- Enhanced safety and reduced human error

- Increased operational efficiency and cost savings

- Growing demand for sustainable and eco-friendly shipping solutions

- Advancements in technology, including AI and sensor systems

- Supportive government regulations promoting autonomous shipping

Market Restraints

- Concerns regarding regulatory framework and legal liabilities

- Initial high capital investment required for development and implementation

Market Opportunities

- Expansion of autonomous shipping in defense and military applications

- Integration of autonomous ships with smart port infrastructure

- Development of hybrid autonomous systems combining manned and unmanned operations

Autonomous Ships Market Report Coverage

| Market | Autonomous Ships Market |

| Autonomous Ships Market Size 2022 | USD 7.4 Billion |

| Autonomous Ships Market Forecast 2032 | USD 14.1 Billion |

| Autonomous Ships Market CAGR During 2023 - 2032 | 6.7% |

| Autonomous Ships Market Analysis Period | 2020 - 2032 |

| Autonomous Ships Market Base Year |

2022 |

| Autonomous Ships Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | DNV AS, Rolls-Royce plc, Kongsberg Gruppen ASA, Nippon Yusen Kabushiki Kaisha (NYK Line), Wärtsilä Corporation, MITSUI E&S Co., Ltd., Hanwha Corporation, Praxis Automation Technology B.V., Vigor Industrial LLC, ABB Ltd., Fugro, and HD Hyundai Heavy Industries Co., Ltd. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Autonomous ships represent a transformative shift in maritime transportation, leveraging cutting-edge technologies to operate without direct human intervention. These vessels are equipped with sophisticated sensors, artificial intelligence (AI) systems, and advanced communication networks, enabling them to navigate, detect obstacles, and make decisions autonomously. Unlike traditional manned ships, autonomous vessels offer a range of potential benefits including increased operational efficiency, enhanced safety, and reduced environmental impact. They have the capability to revolutionize various sectors within the maritime industry, from cargo shipping and offshore operations to maritime surveillance and research. The applications of autonomous ships span across a diverse range of sectors within the maritime domain. In cargo shipping, autonomous vessels promise to streamline logistics operations by optimizing route planning, reducing fuel consumption, and enhancing cargo security.

The market growth for autonomous ships is on a trajectory fueled by technological advancements, increasing industry acceptance, and the urgent need for more efficient and sustainable maritime transportation solutions. With the continuous development and refinement of autonomous technologies such as AI, sensors, and communication systems, the capabilities of unmanned vessels are rapidly expanding, enabling safer and more reliable operations. This technological progress is driving market growth as shipping companies seek to capitalize on the benefits of autonomous ships, including reduced operational costs, improved efficiency, and enhanced safety. Moreover, supportive government regulations and initiatives are further propelling the market forward by providing a conducive environment for the development and adoption of autonomous ships. For instance, DNV GL, a company based in Norway, is engaged in numerous autonomous ship projects. One notable project is the Norwegian Forum for Autonomous Ships (NFAS), which receives support from the Norwegian government. Governments and regulatory bodies recognize the potential of unmanned vessels to revolutionize the maritime industry, leading to the establishment of frameworks that encourage innovation while ensuring safety and compliance.

Autonomous Ships Market Segmentation

The global autonomous ships market segmentation is based on type, application, and geography.

Autonomous Ships Market By Type

- Partially Autonomous

- Remotely Controlled Ship

- Fully Autonomous

In terms of types, the fully autonomous segment is the fastest growing in the autonomous ships market due to advancements in AI and sensor technologies, which enhance navigation and operational efficiency. These ships offer significant cost savings by reducing crew requirements and operational errors. Additionally, regulatory support and increased investments in maritime automation drive market expansion. Moreover, the partially autonomous is further significant growing segment in market. This growth is driven by the gradual adoption of semi-autonomous technologies and systems by shipping companies. Partially autonomous vessels incorporate a combination of automated features and human intervention, allowing for increased efficiency and safety while retaining human oversight for critical decision-making. This segment is witnessing expansion as shipping operators seek to leverage the benefits of automation without completely eliminating the human element from maritime operations. One significant factor contributing to the growth of the partially autonomous segment is the development of advanced navigation and collision avoidance systems. These systems enable ships to autonomously perform routine tasks such as course correction, collision avoidance, and docking maneuvers, reducing the workload on human crew members and enhancing operational efficiency. Additionally, advancements in remote monitoring and control technologies allow for real-time supervision and intervention by onshore operators, further improving the safety and reliability of partially autonomous vessels.

Autonomous Ships Market By Application

- Commercial

- Military

According to the autonomous ships market forecast, the commercial segment is showcasing the highest growth. This growth is driven by increasing demand for cost-efficient and safe shipping operations, as well as advancements in maritime technology. Autonomous ships offer significant advantages, such as reduced human error, optimized fuel consumption, and lower operational costs, making them highly attractive for commercial shipping companies.

Several companies are partnering with technology providers to accelerate the advancement of autonomous ships. For instance, in September 2022, DNV (Norway) signed a Memorandum of Understanding (MOU) with Hyundai Heavy Industries Co., Ltd., Avikus, and the Liberian International Ship & Corporate Registry (LISCR). This MOU involves a joint study aimed at deploying autonomous navigation systems on ships to enhance technology adoption within the industry and among flag states.

Moreover, the military segment is expected to witness significant growth in the coming years. This growth is driven by the increasing adoption of unmanned surface vessels (USVs) for various defense and security applications. Military organizations worldwide recognize the potential of autonomous ships to enhance their capabilities across a range of missions, including maritime surveillance, reconnaissance, mine countermeasures, and anti-submarine warfare. Consequently, there is growing investment in developing and deploying USVs equipped with advanced sensors, communication systems, and weaponry to bolster naval operations and strengthen maritime security.

One significant factor driving the growth of the military segment is the need for enhanced situational awareness and operational flexibility in complex and contested maritime environments. Autonomous ships offer military forces the ability to gather real-time intelligence, conduct covert surveillance, and monitor strategic waterways without putting human lives at risk. Additionally, unmanned vessels can be deployed in swarm formations, working collaboratively to achieve mission objectives while minimizing exposure to threats

Autonomous Ships Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

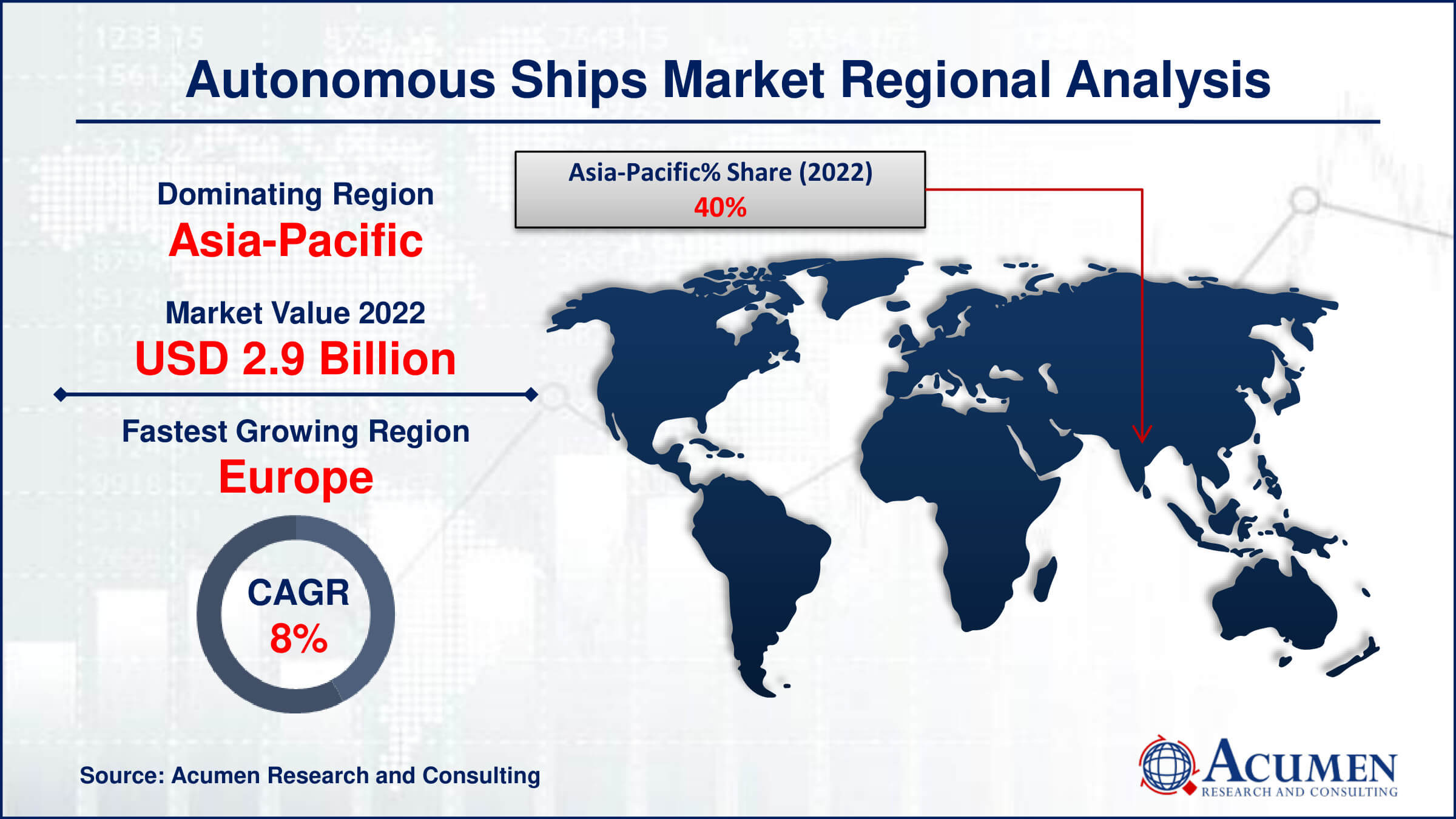

Autonomous Ships Market Regional Analysis

The Asia-Pacific region is emerging as a significant growth area in the autonomous ships market, driven by rapid technological advancements, increasing maritime trade, and supportive government initiatives. With approximately 80 percent of global trade conducted via sea routes, maritime shipping networks are a cornerstone of China’s export-driven economic strategy. To facilitate the smooth movement of goods, China has established some of the largest and busiest ports in the world. Countries in the Asia-Pacific region, including China, Japan, South Korea, and Singapore, are investing heavily in research and development to bolster their capabilities in autonomous ship technology. For example, in 2023, China’s R&D expenditure surpassed 3.3 trillion yuan (approximately 458.5 billion U.S. dollars), marking an 8.1 percent increase from the previous year.

The strategic location of the Asia-Pacific region as a major hub for maritime trade makes it an ideal environment for the adoption of autonomous ships. The increasing demand for efficient and cost-effective transportation solutions is prompting shipping companies in the region to explore the potential of autonomous vessels to optimize their operations and gain a competitive edge. Supportive government policies and initiatives aimed at promoting innovation and sustainability in the maritime sector further drive the growth of the autonomous ships market in the Asia-Pacific region. For instance, China’s 14th Five-Year Plan, adopted on March 12, 2021, aims to advance key technologies related to marine engineering and strengthen the industry producing equipment for marine engineering projects.

In contrast, Europe is the fastest-growing region in the autonomous ships market due to significant investments in technology, infrastructure, and innovative product development. For instance, in 2022, Sea Machines Robotics unveiled a novel marine computer-vision navigation sensor designed to improve safety and performance while vessels are underway. European countries are embracing automation to enhance maritime efficiency, safety, and sustainability. Strategic partnerships between industry players and research institutions are driving innovation and accelerating the adoption of autonomous vessel technologies. For example, in 2022, Sea Machines Robotics, Inc., in collaboration with Rolls-Royce, introduced three innovative products under the mtu NautIQ ship automation systems range: mtu NautIQ CoPilot, mtu NautIQ CoOperate, and mtu NautIQ CoDirect. Consequently, Europe is emerging as a frontrunner in the global autonomous ships market.

Autonomous Ships Market Player

Some of the top autonomous ships market companies offered in the professional report include DNV AS, Rolls-Royce plc, Kongsberg Gruppen ASA, Nippon Yusen Kabushiki Kaisha (NYK Line), Wärtsilä Corporation, MITSUI E&S Co., Ltd., Hanwha Corporation, Praxis Automation Technology B.V., Vigor Industrial LLC, ABB Ltd., Fugro, and HD Hyundai Heavy Industries Co., Ltd.

Frequently Asked Questions

How big is the autonomous ships market?

The autonomous ships market size was USD 7.4 Billion in 2022.

What is the CAGR of the global autonomous ships market from 2023 to 2032?

The CAGR of autonomous ships is 6.7% during the analysis period of 2023 to 2032.

Which are the key players in the autonomous ships market?

The key players operating in the global market are including DNV AS, Rolls-Royce plc, Kongsberg Gruppen ASA, Nippon Yusen Kabushiki Kaisha (NYK Line), W�rtsil� Corporation, MITSUI E&S Co., Ltd., Hanwha Corporation, Praxis Automation Technology B.V., Vigor Industrial LLC, ABB Ltd., Fugro, and HD Hyundai Heavy Industries Co., Ltd.

Which region dominated the global autonomous ships market share?

Asia-Pacific held the dominating position in autonomous ships industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Europe region exhibited fastest growing CAGR for market of autonomous ships during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global autonomous ships industry?

The current trends and dynamics in the autonomous ships market growth include enhanced safety and reduced human error, and increased operational efficiency and cost savings, and growing demand for sustainable and eco-friendly shipping solutions.

Which type held the maximum share in 2022?

The partially autonomous type held the maximum share of the autonomous ships industry.