Automotive Windshield Market | Acumen Research and Consulting

Automotive Windshield Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

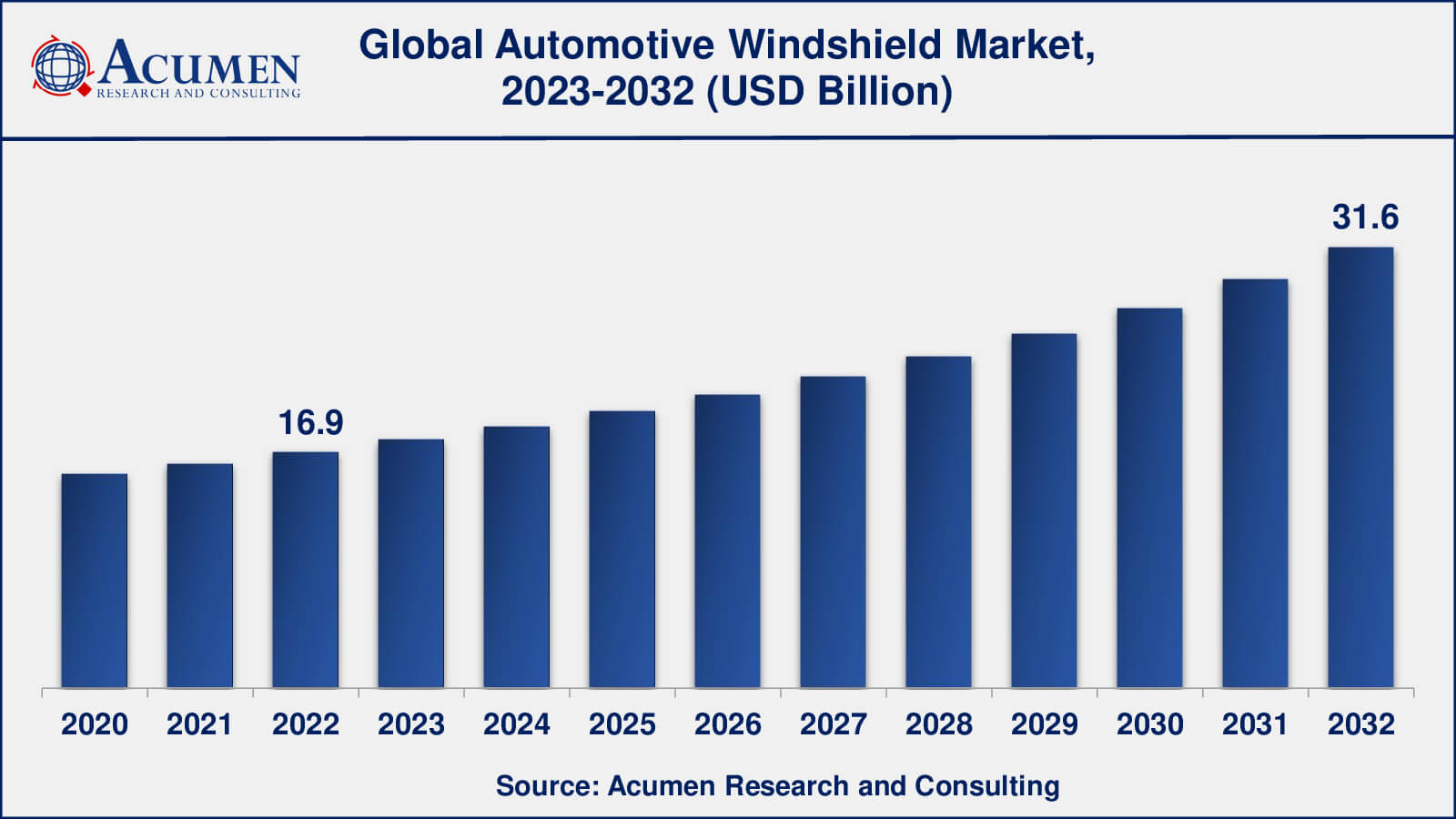

The Global Automotive Windshield Market Size accounted for USD 16.9 Billion in 2022 and is estimated to achieve a market size of USD 31.6 Billion by 2032 growing at a CAGR of 6.6% from 2023 to 2032.

Automotive Windshield Market Highlights

- Global automotive windshield market revenue is poised to garner USD 31.6 Billion by 2032 with a CAGR of 6.6% from 2023 to 2032

- North America automotive windshield market value occupied more than USD 9.3 billion in 2022

- Asia-Pacific automotive windshield market growth will record a CAGR of around 7% from 2023 to 2032

- Among glass type, the tempered glass sub-segment generated over US$ 15 billion revenue in 2022

- Based windshield position, the front windshield sub-segment generated around 80% share in 2022

- Rising demand for customized windshields is a popular automotive windshield market trend that fuels the industry demand

The automotive industry is one of the key supporters of global GDP and is significantly growing altogether across the years. Likewise, new vehicle models and expanding interest in the premium and extravagance segment of vehicles have expanded the interest in vehicle parts and accessories, for instance, a windshield. The car windshield gives a proficient, clear perceivability and assurance from dust, bright (UV) beams, undesirable particles as well as hurtful radiations. Windshields are utilized to shield the driver and travelers from UV rays, dust, wind, pollution, and other remote particles from entering the lodge of the vehicle. Windshields are also intended to support the vehicle structure and are affixed to the vehicle structure by utilizing polyurethane adhesives. Car windshields are manufactured by utilizing security glass which opposes any shattering and limits the danger of destructive wounds. In the car, laminated or covered glasses are significantly utilized for assembling windshields.

Global Automotive Windshield Market Dynamics

Market Drivers

- Increasing demand for automobiles

- Growing awareness of safety

- Growth of the aftermarket industry

- Rising popularity of electric vehicles

Market Restraints

- Volatility of raw material prices

- Stringent safety regulations

- Increasing popularity of autonomous vehicles

Market Opportunities

- Increasing use of advanced materials

- Growth of the electric vehicle market

- Rising adoption of advanced driver assistance systems (ADAS)

Automotive Windshield Market Report Coverage

| Market | Automotive Windshield Market |

| Automotive Windshield Market Size 2022 | USD 16.9 Billion |

| Automotive Windshield Market Forecast 2032 | USD 31.6 Billion |

| Automotive Windshield Market CAGR During 2023 - 2032 | 6.6% |

| Automotive Windshield Market Analysis Period | 2020 - 2032 |

| Automotive Windshield Market Base Year | 2022 |

| Automotive Windshield Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Glass Type, By Windshield Position, By Material Type, By Vehicle Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Asahi Glass Co., Ltd., Saint-Gobain SA, Nippon Sheet Glass Co. Ltd., Fuyao Glass Industry Group Co., Ltd., ECAM Group, Guardian Industries, Xinyi Glass Group and Safelite Auto Glass. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Windshield Market Insights

Some of the significant drivers supporting the growth of the global automotive windshield market include increasing vehicle demand and expanding utilization of windshields in the recent in-car display applications. The development in the global automotive industry is directly proportional to the development in the automotive windshield market. Advancements in technology, for example, smart displays and driver assistance features, are currently getting fused into the budget. The market for display advancements on windshields such as head-up displays is driven by the growing awareness of street and vehicle safety. The global automotive windshield market is basically determined by expanding vehicle production, vehicle sales as well as vehicle usage. The rising demand for automotive windshields is likewise prominent in the automotive aftermarket. The post-retail or aftermarket automotive windshield depends on breakage due to vehicle accidents and inefficient maintenance among others.

Automotive Windshield Market, By Segmentation

The worldwide market for automotive windshield is split based on glass type, windshield position, material type, vehicle type, and geography.

Automotive Windshield Market, By Glass Type

- Tempered Glass

- Laminated Glass

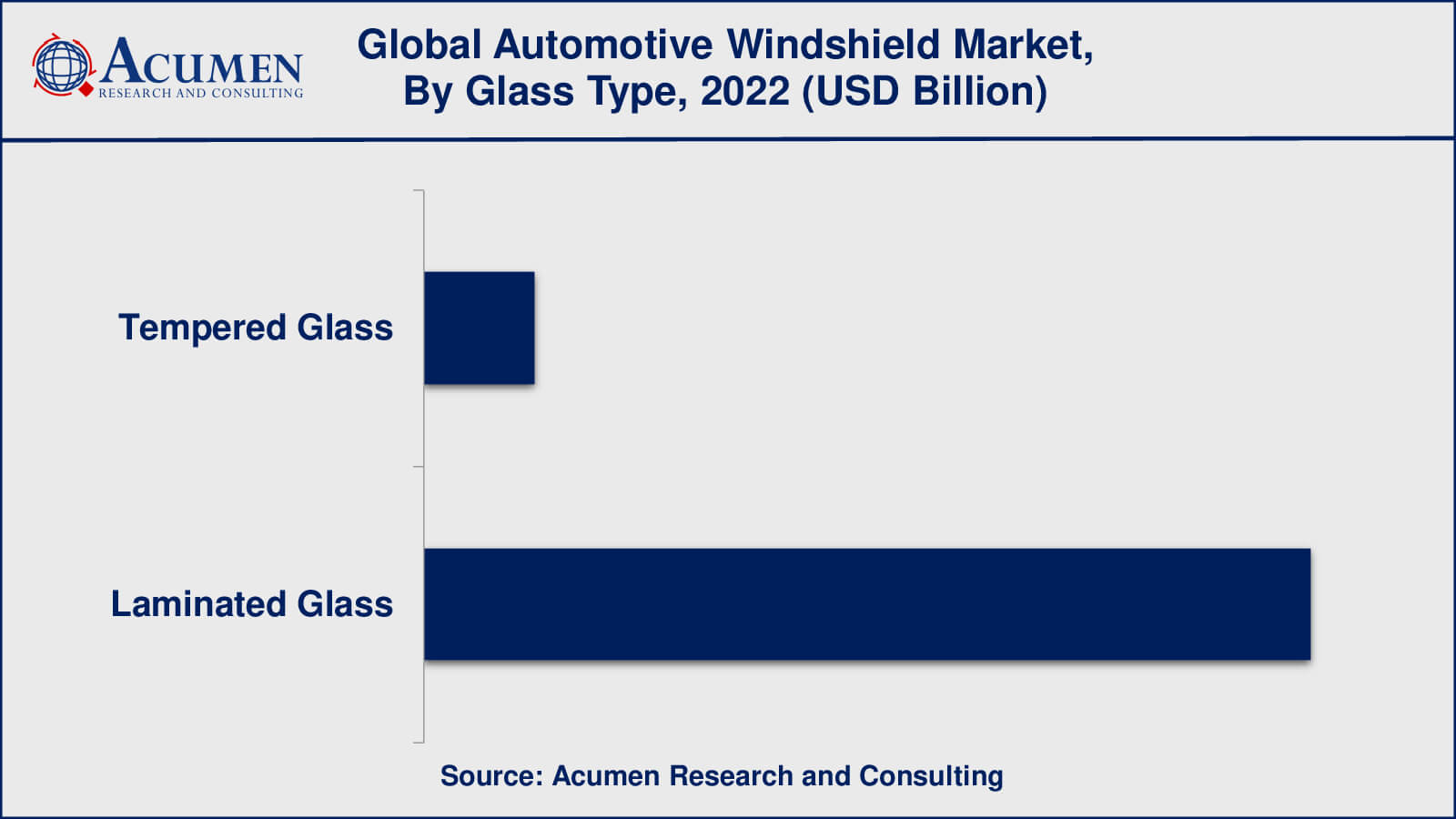

According to automotive windscreen industry analysis, laminated glass windscreens provide better impact protection and are required in most regions due to safety regulations. Tempered glass is used in side and rear windows, but it is not suitable for windscreens because it shatters into small pieces on impact, which can be dangerous. As a result, laminated glass is the preferred choice for automotive windscreens, and its market dominance is expected to continue in the coming years.

Tempered glass became the market's second-largest sub-segment in 2022. Tempered glass is commonly used in automobiles for side and rear windows, as well as sunroofs. Tempered glass is created by heating the glass to a high temperature and then rapidly cooling it, creating a state of compression in the glass that makes it stronger and more impact resistant.

Automotive Windshield Market, By Windshield Position

- Rear Windshield

- Front Windshield

- Top Windshield

The front windshield dominates the automotive windshield market. It is the largest and most critical windshield on a vehicle, and it is required by law in almost all regions. The front windshield provides a clear view of the road ahead and protects the driver and passengers from wind, dust, and other elements. In addition, it is also an important component of the vehicle's safety system, as it helps to prevent occupants from being ejected from the vehicle in the event of an accident. The rear windshield is also an important component, but it is smaller and typically made of tempered glass. The top windshield, also known as the sunroof or moonroof, is a smaller component and is optional on most vehicles.

Automotive Windshield Market, By Material Type

- Thermoset

- Thermoplastic

Thermoset materials, such as polyvinyl butyral (PVB), are the most common material used for laminated glass windshields. PVB is a type of resin that is placed between two or more layers of glass and then fused together through a process of heat and pressure. The PVB layer provides several benefits, including improved structural strength, better sound insulation, and greater resistance to impact, making it a popular choice for automotive windshields. While thermoplastic materials, such as polycarbonate, are also used in some applications, such as side windows or sunroofs, laminated glass made with thermoset materials dominates the market due to its superior performance and safety characteristics.

Automotive Windshield Market, By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

As per the automotive windshield market forecast, the passenger cars is expected to dominate the automotive windshield market. This is due to the fact that passenger cars are the most common type of vehicle on the road and have larger windscreens than light or heavy commercial vehicles. Passenger car windscreens are also subject to stricter safety regulations than commercial vehicle windscreens, which has increased demand for high-quality laminated glass windscreens. Although light commercial vehicles such as vans and pickup trucks use laminated glass windscreens, their market share is lower than that of passenger cars. Tempered glass is typically used for the windscreens of heavy commercial vehicles such as buses and trucks because they are subject to different safety regulations and have different performance requirements than laminated glass windscreens.

Automotive Windshield Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Windshield Market Regional Analysis

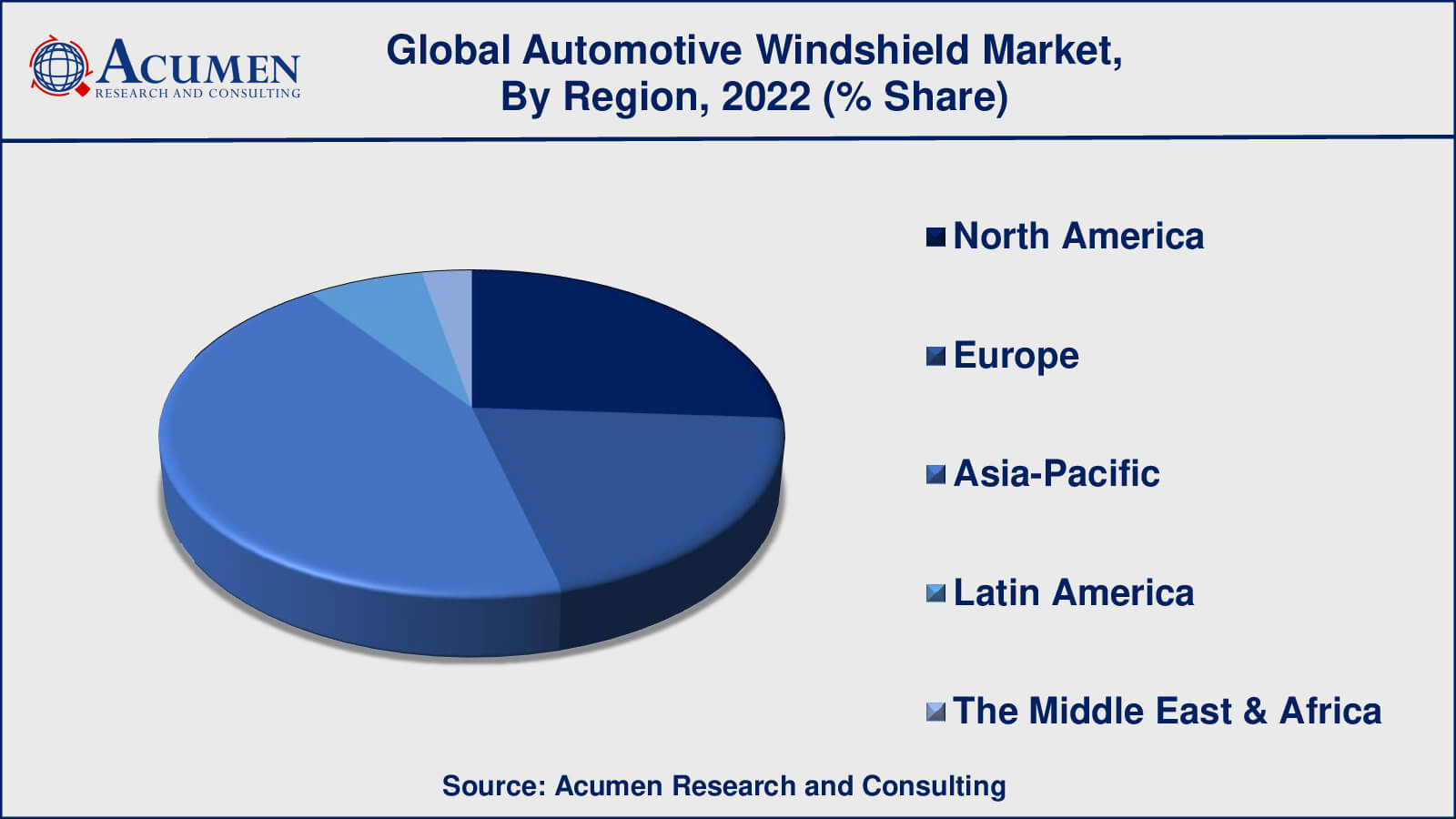

With strong demand from countries such as China, Japan, India, and South Korea, the Asia Pacific region is the largest market for automotive windscreens. Increased vehicle production, rising demand for electric vehicles, and a growing middle class with disposable income to buy cars are driving the market.

The automotive windscreen market in North America is mature and fiercely competitive. The United States is the region's largest market, with high demand for laminated glass windscreens due to strict safety regulations. Both Canada and Mexico have a sizable market for laminated and tempered glass windscreens.

The European automotive windscreen market is also mature and highly competitive. Germany is the region's largest market, followed by France, Italy, and the United Kingdom. Given strict safety regulations and a growing demand for electric vehicles, the region has a high demand for laminated glass windscreens.

Automotive Windshield Market Players

Some of the top automotive windshield companies offered in the professional report include Asahi Glass Co., Ltd., ECAM Group, Fuyao Glass Industry Group Co., Ltd., Guardian Industries, Nippon Sheet Glass Co. Ltd., Safelite Auto Glass, Saint-Gobain SA, and Xinyi Glass Group.

Frequently Asked Questions

What was the market size of the global automotive windshield in 2022?

The market size of automotive windshield was USD 16.9 billion in 2022.

What is the CAGR of the global automotive windshield market from 2023 to 2032?

The CAGR of automotive windshield is 6.6% during the analysis period of 2023 to 2032.

Which are the key players in the automotive windshield market?

The key players operating in the global market are including Asahi Glass Co., Ltd., ECAM Group, Fuyao Glass Industry Group Co., Ltd., Guardian Industries, Nippon Sheet Glass Co. Ltd., Safelite Auto Glass, Saint-Gobain SA, and Xinyi Glass Group.

Which region dominated the global automotive windshield market share?

North America held the dominating position in automotive windshield industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive windshield during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive windshield industry?

The current trends and dynamics in the automotive windshield industry include increasing demand for automobiles, growing awareness of safety, growth of the aftermarket industry, and rising popularity of electric vehicles.

Which glass type held the maximum share in 2022?

The laminated glass type held the maximum share of the automotive windshield industry.?