Automotive Wheel Market | Acumen Research and Consulting

Automotive Wheel Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

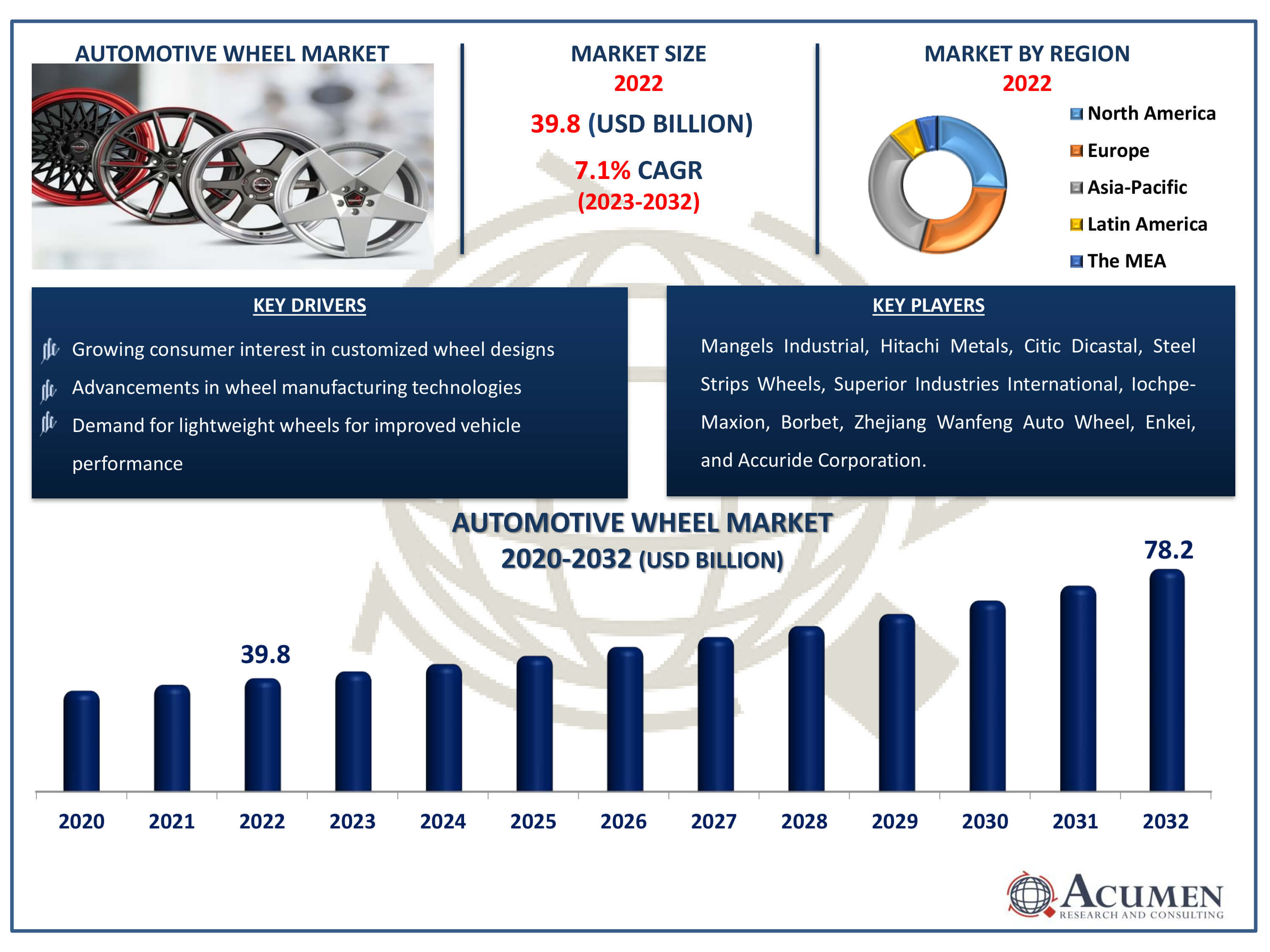

The Global Automotive Wheel Market Size accounted for USD 39.8 Billion in 2022 and is estimated to achieve a market size of USD 78.2 Billion by 2032 growing at a CAGR of 7.1% from 2023 to 2032.

Automotive Wheel Market Highlights

- Global automotive wheel market revenue is poised to garner USD 78.2 billion by 2032 with a CAGR of 7.1% from 2023 to 2032

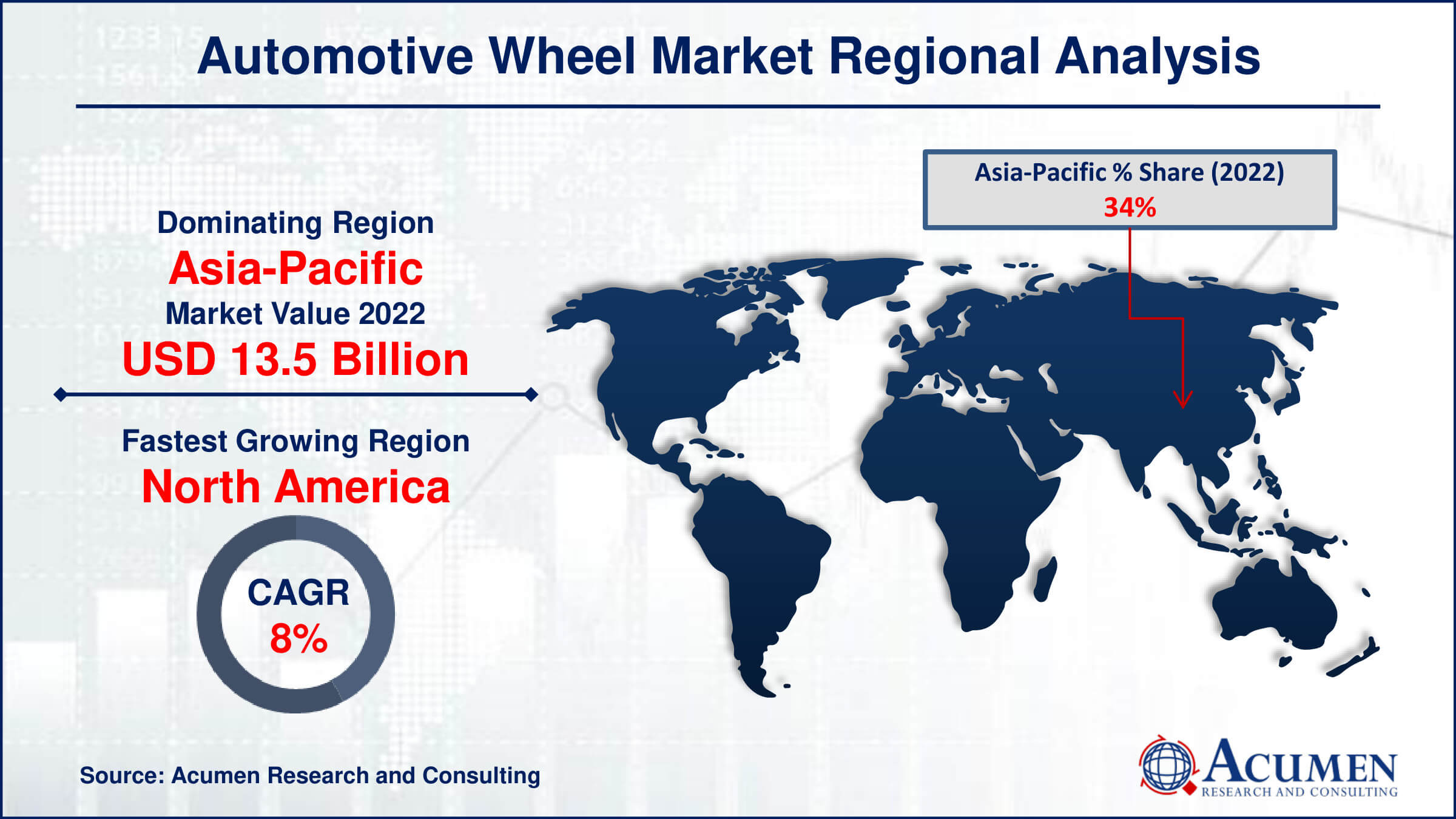

- Asia-Pacific automotive wheel market value occupied around USD 13.5 billion in 2022

- North America automotive wheel market growth will record a CAGR of more than 8% from 2023 to 2032

- Among vehicle, the passenger cars sub-segment generated more than USD 19.1 billion revenue in 2022

- Based on material, the alloy (aluminum & magnesium) sub-segment generated around 40% market share in 2022

- Collaborations for developing advanced wheel technologies is a popular automotive wheel market trend that fuels the industry demand

The wheel is an integral component of an engine, with its demand directly tied to the automotive industry. It must be sufficiently robust to support the vehicle's weight and withstand operational forces. Serving as a rotating component, the car wheel transfers drive from the axle to the road and provide a means to attach tires. Consisting of a rim, spokes, and a hub, car wheels have become popular due to their aesthetic appeal. Alloy wheels, in particular, have gained popularity for being lighter and more durable than steel wheels, facilitating better heat dissipation from pipes and brakes. Moreover, increased investments in infrastructure and research and development, particularly in commercial vehicles, drive industry growth. The automotive sector is witnessing a trend toward sleek, aesthetically pleasing cars, resulting in robust growth in both developed and emerging regions. Additionally, in response to mounting environmental concerns, automotive giants are increasingly focusing on producing smaller vehicles.

Global Automotive Wheel Market Dynamics

Market Drivers

- Demand for lightweight wheels for improved vehicle performance

- Increasing vehicle production in emerging markets

- Growing consumer interest in customized wheel designs

- Advancements in wheel manufacturing technologies

Market Restraints

- Fluctuating raw material costs impacting profitability

- Stringent regulatory standards increasing production expenses

- Economic instability affecting consumer purchasing power

Market Opportunities

- Expansion of aftermarket sales with innovative designs

- Rising demand for specialized wheels for electric and autonomous vehicles

- Growth in premium vehicle sales driving demand for high-end wheels

Automotive Wheel Market Report Coverage

| Market | Automotive Wheel Market |

| Automotive Wheel Market Size 2022 | USD 39.8 Billion |

| Automotive Wheel Market Forecast 2032 |

USD 78.2 Billion |

| Automotive Wheel Market CAGR During 2023 - 2032 | 7.1% |

| Automotive Wheel Market Analysis Period | 2020 - 2032 |

| Automotive Wheel Market Base Year |

2022 |

| Automotive Wheel Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Material, By Vehicle, By End Use, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Mangels Industrial, Hitachi Metals, Citic Dicastal, Steel Strips Wheels, Superior Industries International, Iochpe-Maxion, Borbet, Zhejiang Wanfeng Auto Wheel, Enkei, and Accuride Corporation. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Wheel Market Insights

Consumers are increasingly prioritizing the aesthetic appeal of cars to enhance vehicle sales, prompting car manufacturers to develop superior vehicle designs. Consequently, the market for aesthetic enhancements is expected to grow, thus boosting the motorcycle market. Due to high demand among young consumers, numerous aftermarket operators offer customized wheels, as they are visually appealing. This surge in demand is driving growth in the automobile wheel market.

Moreover, increased sales of commercial motor vehicles in Asia-Pacific and Latin America are expanding the automotive spokes market. Globally, the rising sales of SUVs have intensified competition for larger rim-sized wheels, with the trend for larger wheels driving demand for 18-inch wheels. This trend is further fueled by the vehicle tire market.

Original equipment manufacturers (OEMs) are also focusing on increasing the rolling resistance of wheels. High-performance two-piece wheels made of cast aluminum and carbon fiber, such as those designed by Emergent Carbon Wheels and Forgeline Motorsports, are gaining prominence. These wheels are valued for their weight advantages, combining the strength of aluminum with the benefits of carbon fiber. Additionally, due to the automotive industry's emphasis on carbon reduction, demand for two-piece wheels is expected to rise in the automotive wheel industry forecast period. However, the high price of carbon fiber remains a key limiting factor for this segment.

Automotive Wheel Market Segmentation

The worldwide market for automotive wheel is split based on material, vehicle end use, and geography.

Automotive Wheel Materials

- Alloy (Aluminum & Magnesium)

- Steel

- Carbon Fiber

- Aluminum

According to automotive wheel industry analysis, The alloy (aluminium & magnesium) category leads market for a variety of reasons. To begin, alloy wheels combine lightweight construction with great strength, resulting in increased vehicle performance and fuel efficiency. Second, aluminium and magnesium alloys are very resistant to corrosion, making them appropriate for usage in a variety of environments. Additionally, alloy wheels are recognised for their visual appeal, which improves the overall look of automobiles and attracts customers. Furthermore, developments in alloy manufacturing technology have resulted in cost-effective production processes, which have boosted affordability and acceptance. Overall, the alloy (aluminium & magnesium) segment dominates the market because to its superior performance features, aesthetic advantages, and technical developments in alloy manufacturing.

Automotive Wheel Vehicles

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

- Passenger Cars

The passenger cars sector has the largest share of the automotive wheel market due to a number of compelling considerations. To begin, passenger automobiles account for a sizable share of the global vehicle population, resulting in increased demand for wheels in this sector. Second, passenger car buyers frequently choose aesthetics and customisation possibilities, which drives the need for a diverse range of wheel designs and materials. Furthermore, the passenger car category benefits from periodic replacements and upgrades, which contribute to consistent demand for wheels throughout the vehicle's lifespan. Furthermore, the passenger vehicle industry is characterised by fierce rivalry among manufacturers, resulting in ongoing innovation and technical breakthroughs in wheel design and production methods, which reinforces the segment's dominance in the automotive wheel market.

Automotive Wheel End Uses

- Aftermarket

- OEM

The OEM (original equipment manufacturer) segment dominates the automobile wheel industry for a variety of reasons. First, OEMs offer wheels directly to car makers, meeting the automotive industry's high demand for new automobiles. Because car manufacturing numbers are often higher than aftermarket demand, OEMs have a greater market share. Second, OEM wheels are frequently included as standard equipment in new automobiles, so strengthening their market domination. Furthermore, OEMs profit from long-term contracts with automakers, which ensure stability and steady sales volumes. Furthermore, OEMs benefit from the seamless integration of wheel design and production into the vehicle manufacturing process, assuring compatibility and quality assurance. Overall, these factors lead to the OEM segment's large proportion of the car wheel market.

Automotive Wheel Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Wheel Market Regional Analysis

Asia-Pacific is expected to lead the automobile wheel market, with North America and Europe closely following. This estimate is driven by a number of reasons, most notably growing industrialization and an increase in production and sales of passenger cars and utility vehicles in important countries such as China, Japan, and Indonesia, which is fueling regional development. Furthermore, North America is expected to have considerable growth throughout the projection period. This development may be ascribed to the greater availability of external design options and wheel customizations, as well as the growing usage of alloy wheels in buses, pickup trucks, and recreational vehicles in the United States and Canada. On other hand, the European industry is expected to increase significantly over the automotive wheel market forecast period, driven by rising demand for environmentally friendly vehicles and the region's continued trend of rapid industrialization.

Automotive Wheel Market Players

Some of the top automotive wheel companies offered in our report includes Mangels Industrial, Hitachi Metals, Citic Dicastal, Steel Strips Wheels, Superior Industries International, Iochpe-Maxion, Borbet, Zhejiang Wanfeng Auto Wheel, Enkei, and Accuride Corporation.

Frequently Asked Questions

How big is the automotive wheel market?

The automotive wheel market size was valued at USD 39.8 billion in 2022.

What is the CAGR of the global automotive wheel market from 2023 to 2032?

The CAGR of Automotive Wheel is 7.1% during the analysis period of 2023 to 2032.

Which are the key players in the automotive wheel market?

The key players operating in the global market are including Mangels Industrial, Hitachi Metals, Citic Dicastal, Steel Strips Wheels, Superior Industries International, Iochpe-Maxion, Borbet, Zhejiang Wanfeng Auto Wheel, Enkei, and Accuride Corporation.

Which region dominated the global automotive wheel market share?

Asia-Pacific held the dominating position in automotive wheel industry during the analysis period of 2023 to 2032.

Which region registered fastest CAGR from 2023 to 2032?

North America region exhibited fastest growing CAGR for market of automotive wheel during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive wheel industry?

The current trends and dynamics in the automotive wheel industry include demand for lightweight wheels for improved vehicle performance, increasing vehicle production in emerging markets, growing consumer interest in customized wheel designs, and advancements in wheel manufacturing technologies.

Which vehicle held the maximum share in 2022?

The passenger cars vehicle held the maximum share of the automotive wheel industry.

Select Licence Type

Connect with our sales team

Why Acumen Research And Consulting

100%

Customer Satisfaction

24x7

Availability - we are always there when you need us

200+

Fortune 50 Companies trust Acumen Research and Consulting

80%

of our reports are exclusive and first in the industry

100%

more data and analysis

1000+

reports published till date