Automotive Turbocharger Market | Acumen Research and Consulting

Automotive Turbocharger Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

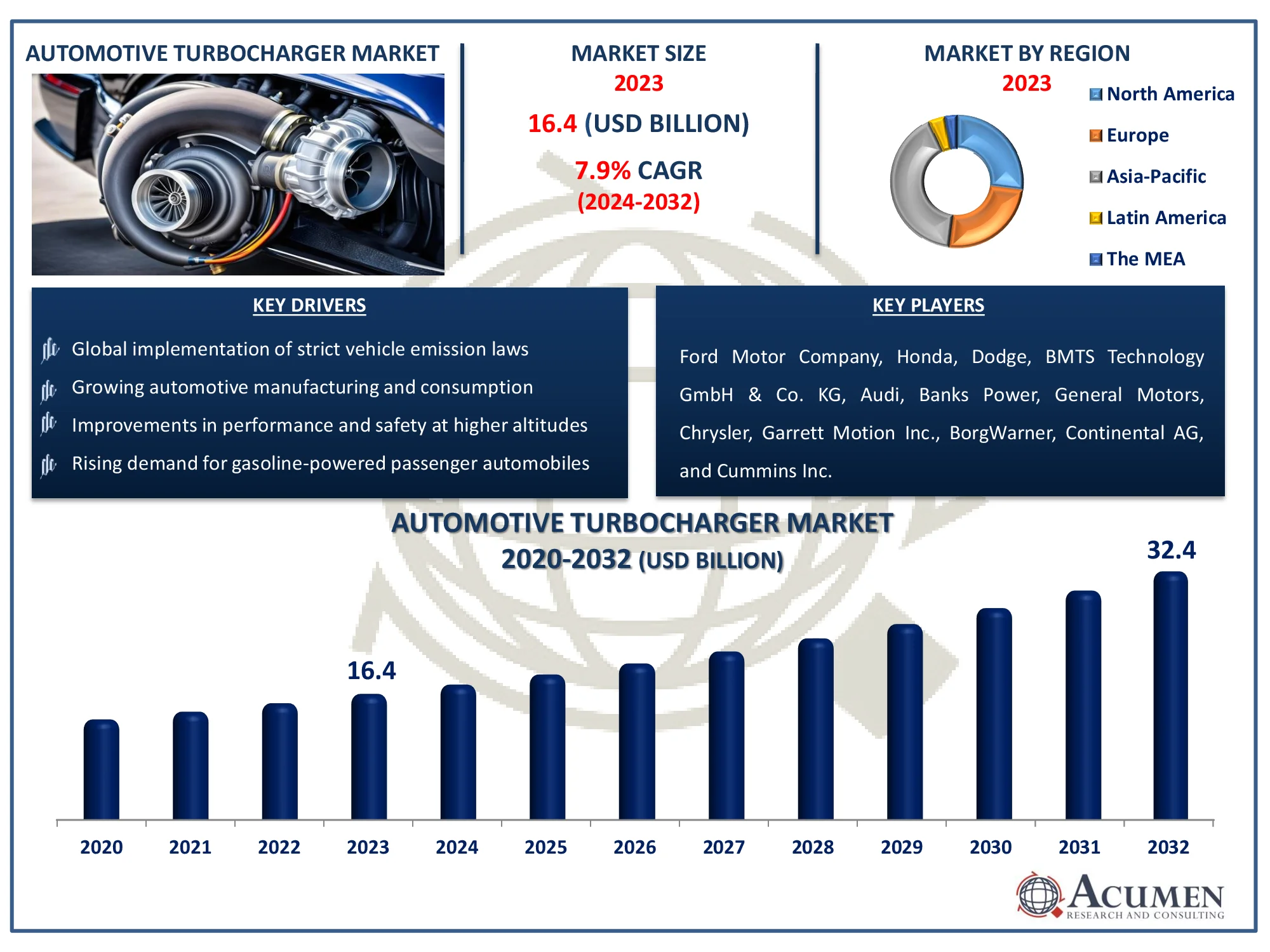

The Global Automotive Turbocharger Market Size accounted for USD 16.4 Billion in 2023 and is estimated to achieve a market size of USD 32.4 Billion by 2032 growing at a CAGR of 7.9% from 2024 to 2032

Automotive Turbocharger Market Highlights

- Global automotive turbocharger market revenue is poised to garner USD 32.4 billion by 2032 with a CAGR of 7.9% from 2024 to 2032

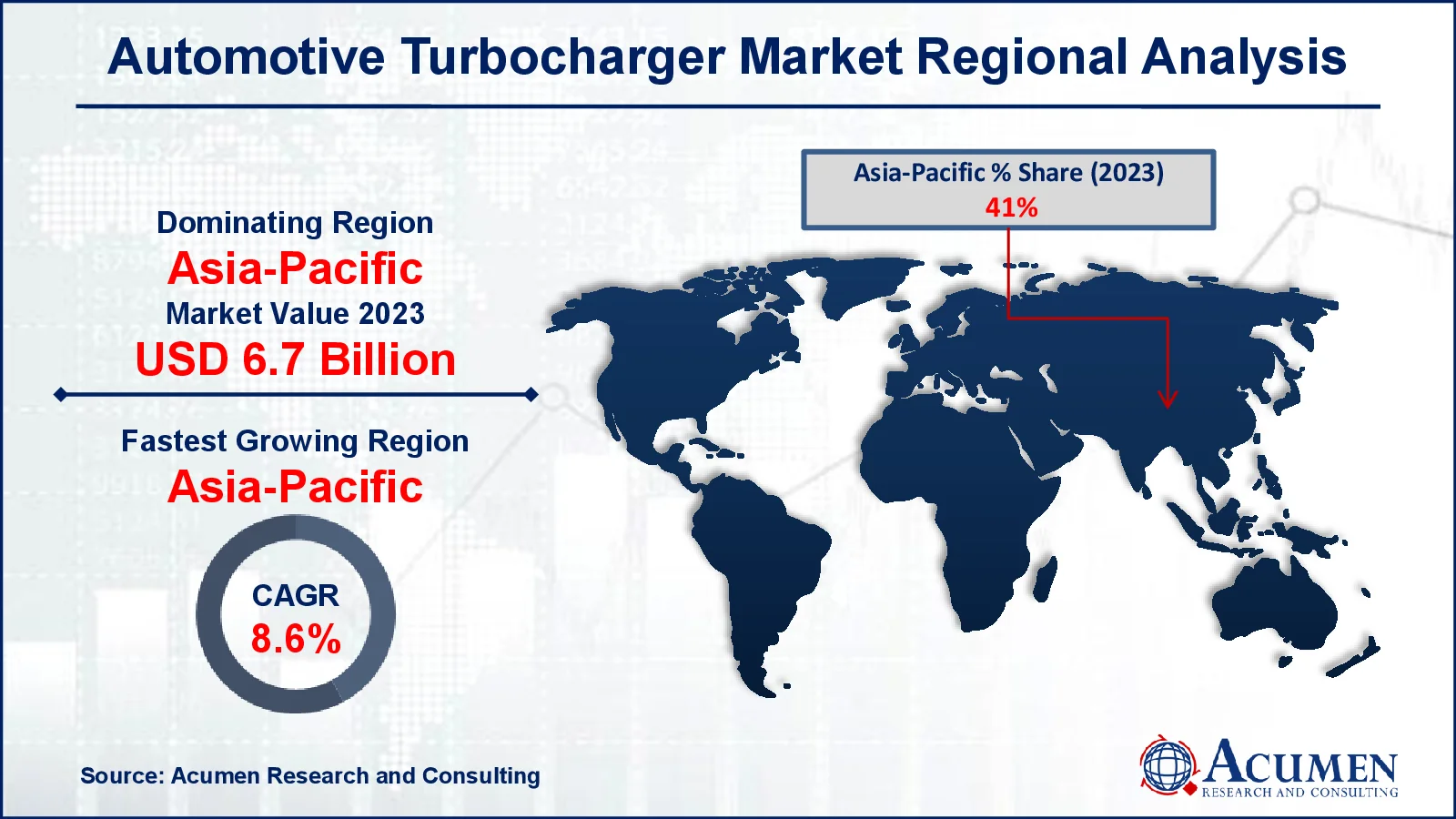

- Asia-Pacific automotive turbocharger market value occupied around USD 6.7 billion in 2023

- Asia-Pacific automotive turbocharger market growth will record a CAGR of more than 8.6% from 2024 to 2032

- Based on vehicle, the passenger vehicle sub-segment generated around 75% automotive turbocharger market share in 2023

- Among technology, the VGT/VNT sub-segment generated more than USD 6.9 billion revenue in 2023

- Development of lightweight materials for turbocharger components is a popular automotive turbocharger market trend that fuels the industry demand

A turbocharger is a device that improves the overall economy and performance of an automobile engine. This is one of the reasons why many automakers choose to turbocharge their automobiles. Radial flow turbine turbochargers are the most often utilized turbocharger in automobiles. The turbine, on the other hand, utilized compressed exhaust energy to power a compressor that increased intake air pressure. Although there is a prevalent misconception concerning turbocharged automobiles and fuel economy, turbochargers increase an engine's fuel efficiency. However, manufacturers employ turbocharging to improve fuel efficiency by downsizing engines and afterward turbocharging them. The global market is estimated to grow at a substantial CAGR of more than 10% during the automotive turbocharger industry forecast period. Furthermore, industry participants are focusing their efforts on the development of groundbreaking new technologies that will aid in the growth of the worldwide automotive turbocharger market revenue.

Global Automotive Turbocharger Market Dynamics

Market Drivers

- Global implementation of strict vehicle emission laws

- Growing automotive manufacturing and consumption

- Improvements in performance and safety at higher altitudes

- Rising demand for gasoline-powered passenger automobiles

Market Restraints

- Increasing interest in electric vehicles

- Higher cost of maintenance

- Potential shortage of raw materials

Market Opportunities

- The introduction of electric turbochargers

- Advancements in turbocharger technology for hybrid vehicles

- Expansion into emerging markets with increasing vehicle ownership

Automotive Turbocharger Market Report Coverage

| Market | Automotive Turbocharger Market |

| Automotive Turbocharger Market Size 2022 |

USD 16.4 Billion |

| Automotive Turbocharger Market Forecast 2032 | USD 32.4 Billion |

| Automotive Turbocharger Market CAGR During 2023 - 2032 | 7.9% |

| Automotive Turbocharger Market Analysis Period | 2020 - 2032 |

| Automotive Turbocharger Market Base Year |

2022 |

| Automotive Turbocharger Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Vehicle, By Technology, By Fuel, By Distribution Channel, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Ford Motor Company, Honda, Dodge, BMTS Technology GmbH & Co. KG, Audi, Banks Power, General Motors, Chrysler, Garrett Motion Inc., BorgWarner, Continental AG, and Cummins Inc. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Turbocharger Market Insights

The growing popularity of compact engines in passenger cars is pushing a gradual shift from straight gasoline engines, which is fueling the expansion of automotive turbochargers. Furthermore, as harsh automobile pollution laws across the world become more stringent, original equipment manufacturers (OEMs) are utilizing drive system strategies to boost vehicle fuel economy. This development is helpful to promote the growth of automotive turbochargers, which aid in lowering vehicle emissions and enhancing fuel economy. Growing engine downsizing requirements, greater use of zero-emission vehicles, increased electrical turbocharger penetration, and favorable stringent regulations are some of the key drivers of global automotive turbocharger market growth. The adoption of vehicle emission norms is constantly rising in order to increase engine efficiency and productivity, hence promoting the growth of the global automotive turbocharger market size.

Furthermore, the growing usage of electric vehicles as a result of tougher pollution regulations around the world is likely to reduce the use of ICE engines in vehicles. Furthermore, the high market price of these items may limit their acceptance.

Automotive Turbocharger Market Segmentation

The worldwide market for automotive turbocharger is split based on vehicle, technology, fuel, distribution channel, and geography.

Automotive Turbocharger Vehicles

- Passenger Vehicle

- LCV

- HCV

According to automotive turbocharger industry analysis, based on the vehicle, the passenger vehicle segment is predicted to rise with significant market shares in the coming years. This expansion can be attributable to consumers' increased preference for high-performance, fuel-efficient vehicles. Furthermore, the growth in disposable income finally enhanced global passenger automobile production and sales. In passenger vehicles, the two main benefits of a turbocharged engine are enhanced power density and fuel efficiency. Furthermore, the government's introduction of tough pollution rules has spurred automobile manufacturers to use automotive superchargers in passenger vehicles and heavy-duty trucks.

Automotive Turbocharger Technologies

- VGT/VNT

- Wastegate

- Twin turbo

In terms of technology, the VGT/VNT segment held a major market share in 2023. The variable geometry turbine (VGT) allows for precise control of the compression ratio throughout the turbine. This adaptability can be used to improve low-speed torque characteristics, minimize turbocharger delay, and drive EGR flow in diesel engines. The moving wall and pivoting vane turbocharger models are the most prevalent variable geometry turbocharger variants. Furthermore, these turbochargers create maximum torque as well as maximum engine power and are far less expensive than other turbochargers. As a result, the global industry will be driven by this segment in the automotive turbocharger market forecast period.

Automotive Turbocharger Fuels

- Gasoline

- Diesel

Based on the fuel, the gasoline segment is predicted to increase at the fastest rate in the market over the forecasted timeframe. The growing popularity of compact gasoline-powered passenger automobiles worldwide is driving the surge in the popularity of gasoline automobile turbochargers. These vehicles' engines have become more fuel-efficient and powerful. Build-in gasoline auto turbochargers that use engine exhaust turbocharging technology to improve engine performance by assisting inefficient combustion of engine fuel. On the other hand, the pandemic effect is expected to favor gasoline turbochargers over diesel engines because diesel engines are becoming more expensive, and the enforcement of new pollution laws raises the cost of diesel engines, particularly in light-duty vehicles.

Automotive Turbocharger Distribution Channels

- OEM

- Aftermarket

In terms of distribution channels, the OEM sector will lead the market in 2023. OEM auto parts are similar to parts used in car production because the OEM is the original manufacturer of a vehicle's components. However, OEM parts are typically guaranteed by the manufacturer to work with the vehicle; in some cases, the assembly may also be guaranteed. As a result, consumers demand the best, and the OMEs category will drive the market.

Automotive Turbocharger Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Turbocharger Market Regional Analysis

In terms of automotive turbocharger market analysis, the Asia-Pacific region is predicted to be the largest industry. The expansion can be attributed to improvements in socioeconomic aspects in developing markets such as China, Japan, India, and Thailand. Increased vehicle production and looming tighter pollution regulations in India and China will propel the automotive turbocharger industry in the region. Furthermore, due to the country's huge production rates in automotive, China dominated the overall demand for turbochargers across the region. China was also one of the first economies to recover from COVID-19 and recommence production. As a result, demand for turbochargers is expected to increase during the automotive turbocharger market forecast period. Besides that, the region's turbocharger growth is influenced by stringent government regulations and pollution standards.

Automotive Turbocharger Market Players

Some of the top automotive turbocharger companies offered in our report includes Ford Motor Company, Honda, Dodge, BMTS Technology GmbH & Co. KG, Audi, Banks Power, General Motors, Chrysler, Garrett Motion Inc., BorgWarner, Continental AG, and Cummins Inc.

Frequently Asked Questions

How big is the automotive turbocharger market?

The automotive turbocharger market size was valued at USD 16.4 billion in 2023.

What is the CAGR of the global automotive turbocharger market from 2024 to 2032?

The CAGR of automotive turbocharger is 7.9% during the analysis period of 2024 to 2032.

Which are the key players in the automotive turbocharger market?

The key players operating in the global market are including Ford Motor Company, Honda, Dodge, BMTS Technology GmbH & Co. KG, Audi, Banks Power, General Motors, Chrysler, Garrett Motion Inc., BorgWarner, Continental AG, and Cummins Inc.

Which region dominated the global automotive turbocharger market share?

Asia-Pacific held the dominating position in automotive turbocharger industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

Asia-Pacific region exhibited fastest growing CAGR for market of automotive turbocharger during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive turbocharger industry?

The current trends and dynamics in the automotive turbocharger industry include global implementation of strict vehicle emission laws, growing automotive manufacturing and consumption, improvements in performance and safety at higher altitudes, and rising demand for gasoline-powered passenger automobiles.

Which technology held the maximum share in 2023?

The VGT/VNT technology the maximum share of the automotive turbocharger industry.