Automotive Transceivers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Transceivers Market Size - Global Industry, Share, Analysis, Trends and Forecast 2024 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

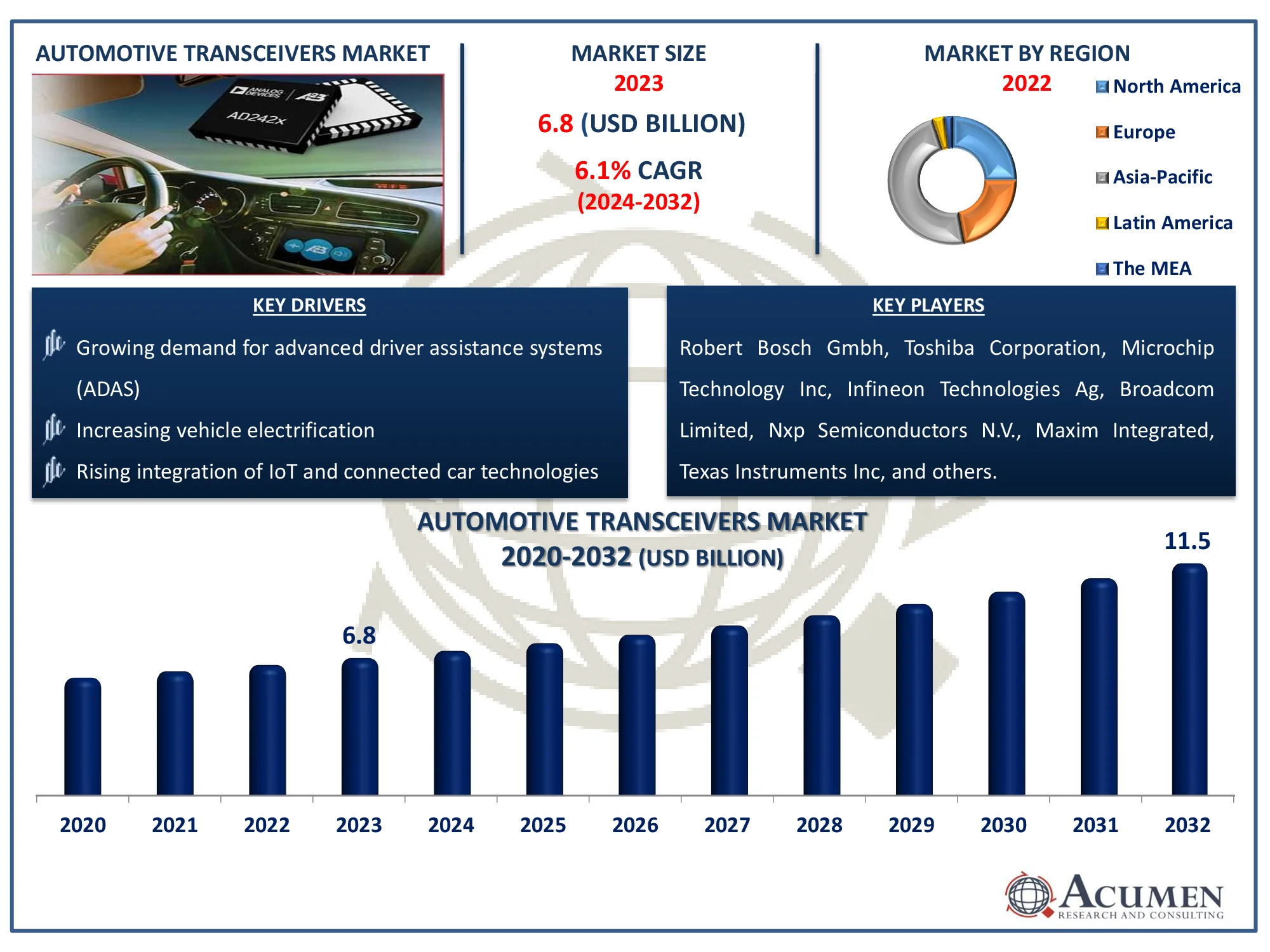

The Automotive Transceivers Market Size accounted for USD 6.8 Billion in 2023 and is estimated to achieve a market size of USD 11.5 Billion by 2032 growing at a CAGR of 6.1% from 2024 to 2032.

Automotive Transceivers Market Highlights

- Global automotive transceivers market revenue is poised to garner USD 11.5 billion by 2032 with a CAGR of 6.1% from 2024 to 2032

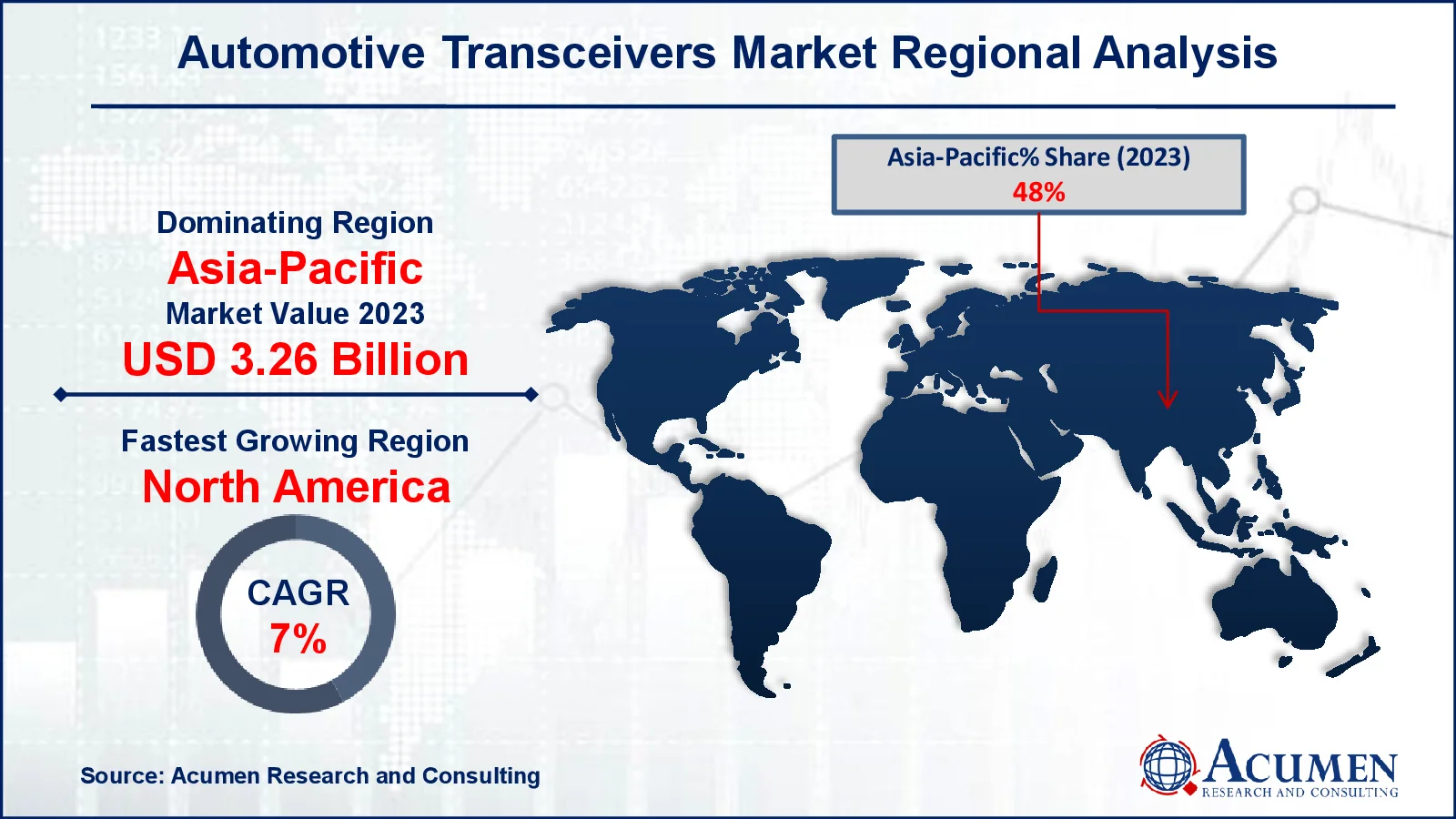

- Asia-Pacific automotive transceivers market value occupied around USD 3.26 billion in 2023

- North America automotive transceivers market growth will record a CAGR of more than 7% from 2024 to 2032

- Among protocol, the LIN sub-segment generated significant market share in 2023

- Based on application, the infotainment sub-segment generated 40% of market share in 2023

- Advancements in in-vehicle networking protocols like CAN FD and Ethernet is the automotive transceivers market trend that fuels the industry demand

The automotive business has changed dramatically during the previous 30 years. The earlier mechanical systems have been replaced by a combination of electrical and mechanical technologies. Growing safety technologies include air bags, seat belts, anti-lock braking systems (ABS), blind spot detection (BSD), electronic stability control (ECS), lane change assist (LCA), and adaptive cruise control (ACC), among others. Data communication networks are also being employed in automobiles due to the increasing amount of gadgets. Transceivers are mostly utilized to transmit and receive digital signals between various electronic equipment in order to communicate with the car's electronic control unit (ECU).

Global Automotive Transceivers Market Dynamics

Market Drivers

- Growing demand for advanced driver assistance systems (ADAS)

- Increasing vehicle electrification

- Rising integration of IoT and connected car technologies

Market Restraints

- High cost of advanced transceiver components

- Complexities in design and integration

- Regulatory challenges and standards variations

Market Opportunities

- Expansion of autonomous vehicle development

- Advancements in 5G technology for automotive communication

- Growing demand in emerging markets for connected and electric vehicles

Automotive Transceivers Market Report Coverage

| Market | Automotive Transceivers Market |

| Automotive Transceivers Market Size 2022 |

USD 6.8 Billion |

| Automotive Transceivers Market Forecast 2032 | USD 11.5 Billion |

| Automotive Transceivers Market CAGR During 2023 - 2032 | 6.1% |

| Automotive Transceivers Market Analysis Period | 2020 - 2032 |

| Automotive Transceivers Market Base Year |

2022 |

| Automotive Transceivers Market Forecast Data | 2023 - 2032 |

| Segments Covered | By Protocol, By Vehicle Type, By Application, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Robert Bosch Gmbh, Toshiba Corporation, Microchip Technology Inc, Infineon Technologies Ag, Broadcom Limited, Nxp Semiconductors N.V., Maxim Integrated, Texas Instruments Inc, Cypress Semiconductor Corporation, and Stmicroelectronics. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Automotive Transceivers Market Insights

Some of the fundamental factors driving the global automotive transceivers market growth include increased demand for transceivers in modern vehicles, a growing need for superior networking and communication, increased adoption of advanced driver assistance systems (ADAS), rising use of radar technologies in automotive applications, and ever-increasing safety regulations. The increased requirement for transceivers in modern automobiles is responsible for data interchange between the associated systems and control units.

The increasing deployment of electronic systems and ECUs in automobiles, driven by the growing need for improved networking and communication between these systems, is propelling the global automotive transceivers market forward. The rapidly expanding electric car industry is a primary driver driving global market growth.

Factors driving market expansion include enhanced vehicle safety to reduce road deaths, the growing adoption of connected and smart mobility solutions, and strict carbon dioxide emission rules. Furthermore, vehicle manufacturers are focusing on designing application-specific ECUs, which will increase demand for automotive transceivers. Market participants are largely focused on developing new innovative technologies to support the growth of the automotive transceiver market. However, the increasing complexity of electronic systems may stymie the growth of the global automotive transceivers market.

Automotive Transceivers Market Segmentation

The worldwide market for automotive transceivers is split based on protocol, vehicle type, application, and geography.

Automotive Transceiver Market By Protocol

- LIN

- CAN

- FlexRay

- Ethernet

- Others

According to the automotive transceivers industry analysis, the Local Interconnect Network (LIN) protocol is widely used in the automotive transceivers market because it is cost-effective and simple to implement. It is ideal for non-critical car functions like window controls, seat adjustments, and climate control, where high-speed data transfer isn't needed. LIN's simplicity and affordability make it a popular choice among automakers, especially for basic communication tasks in vehicles.

Automotive Transceiver Market By Vehicle Type

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

The passenger vehicles segment is the largest vehicle type category in the automotive transceivers market, due to the high volume of production and demand for advanced communication technologies in these vehicles. As passenger vehicles increasingly integrate sophisticated electronic systems, the need for reliable and efficient transceivers grows, driving market expansion. This segment benefits from the trend towards connected cars, autonomous driving, and enhanced safety features, which all rely heavily on robust in-vehicle communication networks.

Automotive Transceiver Market By Application

- Body Electronics

- Body Control Module

- HVAC

- Dashboard

- Others

- Infotainment

- Multimedia

- Navigation

- Telematics

- Others

- Powertrain

- Engine Management System

- Auto Transmission

- Chassis & Safety

- Electric Power Steering

- ADAS/Autonomous driving

According to the automotive transceivers industry forecast, infotainment systems serve as the major hub for a vehicle's entertainment and information demands, including navigation, music, and communication. Automotive transceivers play an important role in allowing these systems to transmit and receive data, guaranteeing smooth operation. As automobiles become more complex, there is a greater demand for improved infotainment systems, which raises the requirement for dependable transceivers.

Automotive Transceivers Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Transceivers Market Regional Analysis

The Asia-Pacific region leads the automotive transceivers market because it has a strong automotive industry with lots of vehicle production in countries like China, Japan, and South Korea. The need for better in-car communication systems and the rise in electric vehicle use are boosting market growth. For example, China is expected to sell over 10 billion electric vehicles in 2024, which will be about 45% of all cars sold there. Support from the government and major manufacturers in the region also helps its dominance.

North America is growing the fastest in this market because of a high demand for advanced driver assistance systems (ADAS) and connected cars. The region has a significant automotive manufacturing base and keeps up with new technologies, which drives its rapid growth.

Automotive Transceivers Market Players

Some of the top automotive transceivers companies offered in our report Include Robert Bosch Gmbh, Toshiba Corporation, Microchip Technology Inc, Infineon Technologies Ag, Broadcom Limited, Nxp Semiconductors N.V., Maxim Integrated, Texas Instruments Inc, Cypress Semiconductor Corporation, and Stmicroelectronics

Frequently Asked Questions

How big is the automotive transceivers market?

The automotive transceivers market size was valued at USD 6.8 billion in 2023.

What is the CAGR of the global automotive transceivers market from 2024 to 2032?

The CAGR of automotive transceivers is 6.1% during the analysis period of 2024 to 2032.

Which are the key players in the automotive transceivers market?

The key players operating in the global market are including Robert Bosch Gmbh, Toshiba Corporation, Microchip Technology Inc, Infineon Technologies Ag, Broadcom Limited, Nxp Semiconductors N.V., Maxim Integrated, Texas Instruments Inc, Cypress Semiconductor Corporation, and Stmicroelectronics.

Which region dominated the global automotive transceivers market share?

Asia-Pacific held the dominating position in automotive transceivers industry during the analysis period of 2024 to 2032.

Which region registered fastest CAGR from 2024 to 2032?

North America region exhibited fastest growing CAGR for market of automotive transceivers during the analysis period of 2024 to 2032.

What are the current trends and dynamics in the global automotive transceivers industry?

The current trends and dynamics in the automotive transceivers industry include growing demand for advanced driver assistance systems (ADAS), increasing vehicle electrification, and rising integration of IOT and connected car technologies.

Which protocol held the maximum share in 2023?

The LIN protocol held the maximum share of the automotive transceivers industry.