Automotive Suspension Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Published :

Report ID:

Pages :

Format :

Automotive Suspension Systems Market Size - Global Industry, Share, Analysis, Trends and Forecast 2023 - 2032

Report Coverage

- Industry Dynamics

- Market Size and Forecast Data

- Segment Analysis

- Competitive Landscape

- Regional Analysis with a Niche Focus on Country-Level Data

- High Level Analysis - Porter's, PESTEL, Value Chain, etc.

- Company Profiles of Key Players

- Option to Customize the Report As Per Your Specific Need

Request Sample Report

The Global Automotive Suspension Systems Market Size accounted for USD 46.6 Billion in 2022 and is projected to achieve a market size of USD 63.7 Billion by 2032 growing at a CAGR of 2.9% from 2023 to 2032.

Automotive Suspension Systems Market Report Key Highlights

- Global automotive suspension systems market revenue is expected to increase by USD 63.7 Billion by 2032, with a 2.9% CAGR from 2023 to 2032

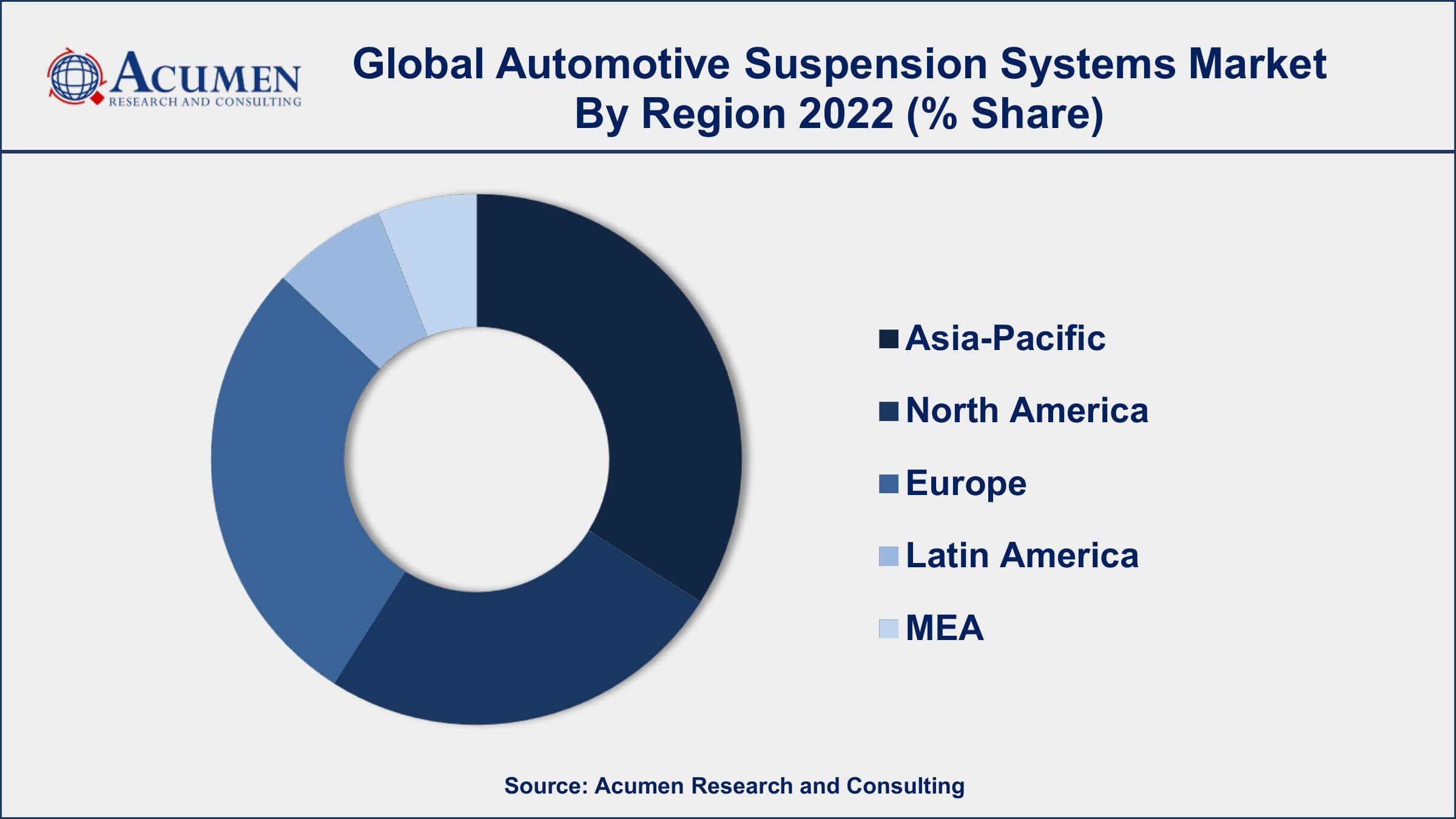

- Asia-Pacific region led with more than 34% of automotive suspension systems market share in 2022

- North America automotive suspension systems market growth will record a CAGR of over 3.5% from 2023 to 2032

- Air suspension is commonly found in luxury cars and SUVs, providing adjustable ride height and a smoother ride.

- According to a survey conducted by Consumer Reports, suspension problems are among the most commonly reported issues in vehicles, with about 14% of owners reporting such problems.

- Increasing demand for comfort and safety features in vehicles, drives the automotive suspension systems market size

Automotive suspension systems are an integral part of a vehicle's chassis that helps to support the weight of the vehicle, absorb shocks and vibrations, and provide a comfortable ride for passengers. They are designed to improve the handling and stability of a vehicle and to reduce the wear and tear on other parts of the vehicle, such as the tires and brakes. Suspension systems also help to maintain the stability of the vehicle during acceleration, braking, and cornering.

The global automotive suspension systems market has been experiencing steady growth in recent years, driven by factors such as increasing demand for passenger cars, growing focus on vehicle safety and comfort, and technological advancements in suspension systems. The market is expected to continue to grow in the coming years, with the increasing adoption of electric and hybrid vehicles, and the growing trend towards lightweight and fuel-efficient vehicles. The growth is attributed to the increasing demand for luxury and high-performance vehicles, rising demand for lightweight and durable suspension systems, and growing investments in research and development by leading players in the market.

Global Automotive Suspension Systems Market Trends

Market Drivers

- Increasing demand for passenger cars and commercial vehicles

- Growing focus on vehicle safety, comfort, and stability

- Technological advancements in suspension systems

- Rising demand for lightweight and durable suspension systems

- Increasing adoption of electric and hybrid vehicles

Market Restraints

- High cost of advanced suspension systems

- Volatility in raw material prices

Market Opportunities

- Rising demand for air suspension systems in commercial vehicles

- Increasing use of smart suspension systems for real-time monitoring and control

Automotive Suspension Systems Market Report Coverage

| Market | Automotive Suspension Systems Market |

| Automotive Suspension Systems Market Size 2022 | USD 46.6 Billion |

| Automotive Suspension Systems Market Forecast 2032 | USD 63.7 Billion |

| Automotive Suspension Systems Market CAGR During 2023 - 2032 | 2.9% |

| Automotive Suspension Systems Market Analysis Period | 2020 - 2032 |

| Automotive Suspension Systems Market Base Year | 2022 |

| Automotive Suspension Systems Market Forecast Data | 2023 - 2032 |

| Segments Covered | By System, By Component, By Suspension Type, By Vehicle Type, And By Geography |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled | Continental AG, Thyssenkrupp AG, Magneti Marelli S.p.A., Mando Corporation, Tenneco Inc., KYB Corporation, ZF Friedrichshafen AG, Benteler Automotive Corporation, Hitachi Automotive Systems Ltd., WABCO Holdings Inc., Infineon Technologies AG, and Schaeffler AG. |

| Report Coverage |

Market Trends, Drivers, Restraints, Competitive Analysis, Player Profiling, Covid-19 Analysis, Regulation Analysis |

Increasing emphasis on relatively better ride control and achieving smooth & safe rides with negligible vibrations are some of the key reasons changing the overall scenario in the global automotive suspension systems market. Automotive suspension systems are crucial for comfort, driving, and safety since the vehicle body is installed on the suspension and transfers all the force between the road and the body. The automotive suspension system comprises a spring, shock absorber, and wishbones to filter and transfer all the external force between the road and the body. It also provides better handling performance and enables the vehicle to respond favorably to the external forces generated by tires during acceleration and braking.

The introduction of automotive suspension systems has enabled negligible vibration in vehicles coupled with the optimal quality of ride and overall vehicle control. Automotive suspension systems aid in preventing additional wear and tear of components of the vehicle. A simple automotive suspension system includes shock absorbers, springs, struts, ball joints, and a control arm. Springs are a major part of automotive suspension systems. The main types of springs are coil springs, leaf springs, and torsion bars. Passenger vehicles generally use light coil springs whereas light commercial vehicles use leaf and coil springs and heavy commercial vehicles use air suspension. Three major types of automotive suspension systems include semi-active, active, and passive. In passive suspension systems, the wheel’s vertical movement depends on the surface whereas, in active and semi-active suspension systems, the wheel’s vertical movement totally depends on actively controlled vertical movement. Active suspension systems have high costs and require frequent maintenance.

Increasing demand for better suspension systems as well as the increasing number of technological advancements across the globe are some key factors accelerating the demand for lightweight, economical, and cheap automotive suspension systems. Strict emission norms laid by governments and other environmental organizations along with fuel efficiency standards have forced automotive suspension system manufacturers to opt for technologically advanced solutions. However, despite the significant growth of the overall automotive suspension market, various challenges such as high prices of independent suspension systems and lack of standardization are hampering the growth of the global automotive suspension systems market. In addition, advancements in technology in automotive suspension systems have led to the introduction of electrical generator suspension systems which acts as a power source for certain energy needs of the vehicle along with their actual purpose.

Automotive Suspension Systems Market Segmentation

The global automotive suspension systems market segmentation is based on system, component, suspension type, vehicle type, and geography.

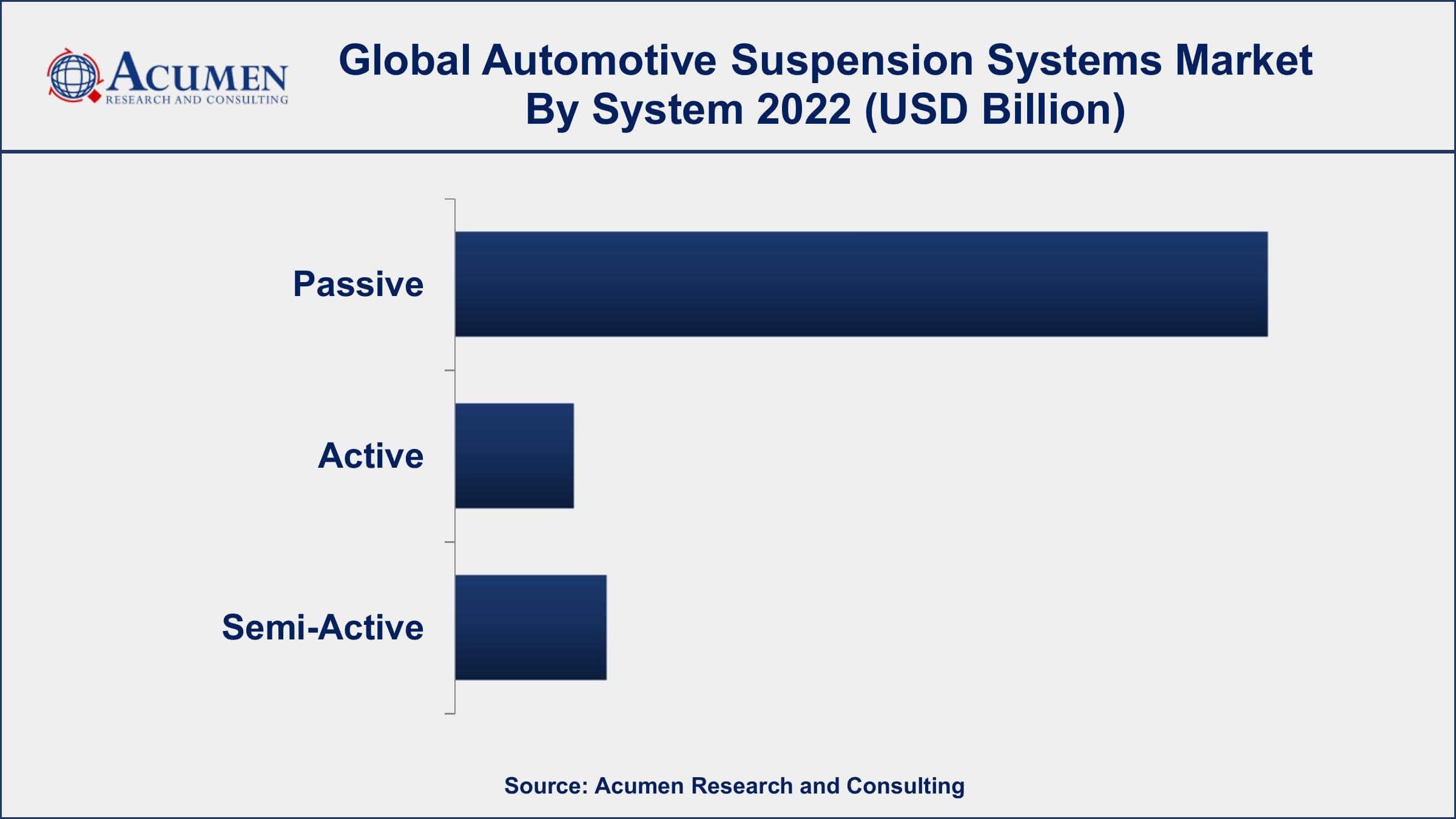

Automotive Suspension Systems Market By System

- Passive

- Semi-Active

- Active

According to our automotive suspension systems industry analysis, the passive segment held the largest market share in 2022. Passive suspension systems are widely used in mid-range and budget vehicles, where cost-effectiveness and durability are the primary considerations. The passive suspension systems consist of a combination of components such as coil springs, leaf springs, shock absorbers, and struts, among others. These components work together to provide a comfortable ride, reduce vibrations and noise, and improve handling and stability. Passive suspension systems are typically less expensive than their active counterparts and are relatively easier to maintain, making them a popular choice in many vehicles.

Automotive Suspension Systems Market By Component

- Shock Dampener

- Control Arm

- Struts

- Air Compressor

- Ball Joint

- Others

In terms of components, the shock dampener segment is predicted to grow significantly in the coming years. The demand for shock dampeners in the automotive industry is driven by various factors, such as growing vehicle production, increasing demand for comfortable and safe rides, and the need for better handling and stability. Shock dampeners are critical components in all types of vehicles, from passenger cars and light commercial vehicles to heavy-duty trucks and buses. The use of advanced materials, such as composites and lightweight alloys, is also expected to drive innovation and growth in the shock-dampener segment. The shock dampener segment in the automotive suspension systems market is highly competitive, with numerous global and regional players offering a range of products to cater to different vehicle types and applications.

Automotive Suspension Systems Market By Suspension Type

- Hydraulic Suspension

- Leaf Spring

- Air Suspension

According to the automotive suspension systems market forecast, the air suspension segment is expected to witness a considerable growth rate in the coming years. Air suspension systems are typically used in high-end luxury cars, commercial vehicles, and heavy-duty trucks, where the need for superior ride quality, stability, and load-carrying capacity is paramount. Air suspension systems can be adjusted to different ride heights and stiffness levels, making them highly customizable and versatile. The demand for air suspension systems in the automotive industry is driven by different factors, such as rising consumer demand for luxury and premium vehicles, growing awareness about ride comfort and safety, and the need for better load-carrying capacity and stability. Air suspension systems are also popular in commercial vehicles, such as buses and trucks, as they can improve fuel efficiency, reduce wear and tear on tires and other components, and improve driver comfort and safety.

Automotive Suspension Systems Market By Vehicle Type

- Two Wheelers

- Commercial Cars

- Passenger Cars

In terms of vehicle type, the passenger cars segment dominates the automotive suspension systems market in 2022. Passenger cars are the largest and most diverse segment of the automotive industry, and they require suspension systems that can provide a smooth and comfortable ride, improve handling and stability, and ensure optimal performance and safety. The demand for suspension systems in passenger cars is driven by factors, such as growing vehicle production, rising demand for luxury and premium vehicles, and the need for improved ride comfort and safety. Passenger cars are becoming increasingly sophisticated, with advanced features such as electric drivetrains, active safety systems, and advanced driver assistance systems (ADAS). As a result, suspension systems in passenger cars are also becoming more advanced, with features such as adaptive damping, air suspension, and active roll stabilization.

Automotive Suspension Systems Market Regional Outlook

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- France

- Spain

- Rest of Europe

Asia-Pacific

- India

- Japan

- China

- Australia

- South Korea

- Rest of Asia-Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

The Middle East & Africa

- South Africa

- GCC Countries

- Rest of the Middle East & Africa (ME&A)

Automotive Suspension Systems Market Regional Analysis

Asia-Pacific is dominating the automotive suspension systems market due to several factors such as the region's rapidly growing automotive industry, increasing disposable income, and rising demand for luxury and premium vehicles. The automotive industry in the Asia-Pacific region is one of the fastest-growing in the world, with countries such as China, Japan, India, and South Korea being major players. The region's large population and growing middle class have resulted in an increased demand for passenger cars, which has, in turn, driving the demand for suspension systems.

Moreover, many leading suspension system manufacturers are based in the Asia-Pacific region, which has given the region a competitive edge in the market. The region has a highly skilled workforce and advanced manufacturing infrastructure, which enables manufacturers to produce high-quality suspension systems at a lower cost. The governments of many countries in the region are also providing various incentives and subsidies to promote the growth of the automotive industry, which has further boosted the market's growth.

Automotive Suspension Systems Market Player

Some of the top automotive suspension systems market companies offered in the professional report include Continental AG, Thyssenkrupp AG, Magneti Marelli S.p.A., Mando Corporation, Tenneco Inc., KYB Corporation, ZF Friedrichshafen AG, Benteler Automotive Corporation, Hitachi Automotive Systems Ltd., WABCO Holdings Inc., Infineon Technologies AG, and Schaeffler AG.

Frequently Asked Questions

How big is the automotive suspension systems market?

The automotive suspension systems market size was USD 46.6 Billion in 2022.

What is the CAGR of the global automotive suspension systems market during forecast period of 2023 to 2032?

The CAGR of automotive suspension systems market is 2.9% during the analysis period of 2023 to 2032.

Which are the key players operating in the market?

The key players operating in the global automotive suspension systems market are Continental AG, Thyssenkrupp AG, Magneti Marelli S.p.A., Mando Corporation, Tenneco Inc., KYB Corporation, ZF Friedrichshafen AG, Benteler Automotive Corporation, Hitachi Automotive Systems Ltd., WABCO Holdings Inc., Infineon Technologies AG, and Schaeffler AG.

Which region held the dominating position in the global automotive suspension systems market?

Asia-Pacific held the dominating position in automotive suspension systems market during the analysis period of 2023 to 2032.

Which region registered the fastest growing CAGR for the forecast period of 2023 to 2032?

Europe region exhibited fastest growing CAGR for automotive suspension systems market during the analysis period of 2023 to 2032.

What are the current trends and dynamics in the global automotive suspension systems market?

The current trends and dynamics in the automotive suspension systems industry include the increasing demand for passenger cars and commercial vehicles, as well as growing focus on vehicle safety, comfort, and stability.

Which system held the maximum share in 2022?

The passive system held the maximum share of the automotive suspension systems market.